SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Act of 1934

Date of Report (Date of earliest event reported):

November 10, 2014

FONAR CORPORATION

______________________________________________________

(Exact name of registrant

as specified in its charter)

| Delaware |

|

0-10248 |

|

11-2464137 |

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

| |

|

110 Marcus Drive

Melville, New York 11747

(631) 694-2929 |

|

|

| |

|

(Address, including zip code, and telephone

number of registrant's principal executive office)

|

|

|

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

[ ] Written communications pursuant

to Rule 425 under the Securities Act 17 CFR 230.425)

[ ] Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)

Item 2.02(a) Results of Operations and Financial Condition.

We reported the results of operations

and financial condition of the Company for the fiscal quarter ended September 30, 2014 in a press release dated November 10,

2014.

Exhibits

99.1 Press Release dated November 10,

2014

SIGNATURES

Pursuant to the requirements of the Securities

and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

| |

FONAR CORPORATION |

| |

(Registrant) |

| |

By: /s/ Raymond Damadian |

| |

Raymond Damadian |

| |

President and Chairman |

|

Dated: November 10, 2014

|

|

| NEWS |

|

FONAR |

| For Immediate Release |

|

The Inventor of MR Scanning™ |

| Contact: Daniel Culver |

|

An ISO 9001 Company |

| Director of Communications |

|

Melville, New York 11747 |

| E-mail: investor@fonar.com |

|

Phone: (631) 694-2929 |

| www.fonar.com |

|

Fax: (631) 390-1709 |

FONAR Announces 1st

Quarter Fiscal 2015 Results

Net Revenues

for 1st Quarter Fiscal Year 2015 (F2015) Increased 7% to $18.0 million versus same period a year earlier.

Net Income

Available to Common Stockholders for 1st Quarter F2015 increased 4% to $2.4 million versus same period a year earlier.

Basic Net

Income Available to Common Stockholders for 1st Quarter F2015 increased 3% to $0.39 and Diluted Net Income Available

to Common Stockholders for 1st Quarter F2015 increased 3% to $0.38 versus same period a year earlier.

Revenues

from product sales for 1st Quarter F2015 increased to $1.3 million from $0.03 million during the same period a year

earlier.

MELVILLE, NEW

YORK, November 10, 2014 - FONAR Corporation (NASDAQ-FONR), The Inventor of MR Scanning™, reported its first quarter fiscal

2015 results for the quarter ended September 30, 2014. The Company’s two industry segments are: development, manufacturing

and servicing of the UPRIGHT® Multi-Position™ MRI, and management of Stand-Up® MRI (UPRIGHT® MRI) centers. The

Company is known as the first Company to invent and manufacture an MRI (Magnetic Resonance Imaging) scanner. Leading the list of

FONAR’s most recent patented inventions is its technology enabling full weight-bearing MRI imaging on all the gravity sensitive

regions of the human anatomy, e.g. the spine, brain, hip, knee, ankle, foot, shoulder, and pelvis. The FONAR UPRIGHT® Multi-Position™

MRI scanner is the world’s only MRI scanner licensed under FONAR’s multiple UPRIGHT® MRI patents to scan all the

patient’s body parts in their normal fully weight-bearing UPRIGHT® position.

Financial Highlights

The Company’s

total revenues increased 7% to $18.0 million for the quarter ended September 30, 2014 as compared to $16.8 million during the same

period a year earlier.

The acquisition

of Health Diagnostics in March 2013 added 14 MRI Centers under management to the original 11 MRI centers. One year ago, the Company

reported a 149% increase for this management of diagnostic imaging center segment to $14.3 million for the quarter ended September

30, 2013 as compared to $5.7 million for the quarter ended September 30, 2012. Now, one year later, revenues in this segment are

approximately $14.2 million for the quarter ended September 30, 2014.

Basic net income

available to common stockholders for the quarter ended September 30, 2014 increased 3% to $0.39 as compared to $0.38 during the

same quarter ended one year earlier. Diluted net income available to common stockholders for the quarter ended September 30, 2014

increased 3% to $0.38 as compared to $0.37 during the same quarter ended one year earlier. Net Income for the quarter ended September

30, 2014 was $3.3 million as compared to $3.6 million for the same quarter one year earlier.

Total assets at September 30, 2014 were

$78.8 million, as compared to $76.8 million at June 30, 2014. Total current assets at September 30, 2014 were $45.6 million, as

compared to $42.8 million at June 30, 2014.

Total liabilities at September 30, 2014

were $30.7 million, as compared to $30.9 million at June 30, 2014. Total current liabilities at September 30, 2014 were $22.0 million,

as compared to $21.2 million at June 30, 2014.

Stockholder’s equity at September

30, 2014 was $48.1 million, as compared to $45.9 million at June 30, 2014.

Cash

and cash equivalents increased 7% to $10.7 million at September 30, 2014, from $10.0 million at June 30, 2014.

Management Discussion

Raymond V. Damadian, president and

chairman of Fonar Corporation said, “Over the past year and a half we have accomplished much. We acquired a business which

allowed us to roughly double our size and successfully merged the companies allowing us to share capabilities and administrative

and technical expertise. This gave us a synergy of joint marketing strategies, and many other economies of scale.”

“Overall,” said Dr. Damadian,

“we have mitigated the increased pressure due to cuts in MRI reimbursements brought about by the Affordable Care Act. This

was because of the adherence to our ongoing business plan which has made the difference.”

“Perhaps, we can give some

credit to the uniqueness and practicality of our UPRIGHT® full weight-loaded MRI scanner, which is immensely popular with both

physician and patient. As Fonar’s customer, Medserena, pointed out on their purchase of their fifth scanner for Germany,

‘a large number of requests for the FONAR UPRIGHT® Multi-Position™ MRI are coming from physicians in Germany because

of the special medical need for FONAR’s unique technology. This is in spite of an intensely active MRI market in Germany

where there are already many conventional lie-down MRIs installed.’ Our German customer’s comments on the benefits

of the FONAR UPRIGHT® MRI technology are consistent with the success of our FONAR UPRIGHT® MRI scanners in the American

MRI marketplace,” said Dr. Damadian. “The treating physician in Germany quickly experiences the same result the treating

physician in America experiences: A “BETTER PATIENT OUTCOME” for his patient.”

The more accurate diagnosis

available from the fully weight-loaded Multi-Position™ MRI provided by the FONAR UPRIGHT® as compared to the

conventional weightless recumbent-only MRI examination enables a more complete and accurate diagnosis of the spine, which constitutes

up to 60% of all MRI examinations, thereby optimizing the specific surgical or medical treatment selected for the patient.

Since the PATIENT OUTCOME is the doctor’s number one PRIORITY for his patient,” said Dr. Damadian, “he quickly

learns from firsthand experience that the FONAR UPRIGHT® MRI and its power to “SEE IT ALL” becomes indispensable

towards his ultimate objective of optimizing the TREATMENT OUTCOMES OF HIS PATIENTS.”

Dr. Damadian concluded: “During

this quarter our MRI scanner product revenues increased and recently we reported sales to the UAE, Alaska, and Germany. Accordingly,

I am optimistic about future sales of our UPRIGHT® Multi-Position™ MRI scanner.”

About FONAR

FONAR (NASDAQ:FONR), Melville, NY, The

Inventor of MR Scanning™, was incorporated in 1978, and is the first, oldest and most experienced MRI company in the industry.

FONAR introduced the world’s first commercial MRI in 1980, and went public in 1981. Since its inception, nearly 300 recumbent-OPEN

MRIs and 157 UPRIGHT® Multi-Position™ MRI scanners have been installed worldwide. FONAR’s stellar product is the

UPRIGHT® MRI (also known as the Stand-Up® MRI), the only whole-body MRI that performs Position™ imaging (pMRI™)

and scans patients in numerous weight-bearing positions, i.e. standing, sitting, in flexion and extension, as well as the conventional

lie-down position. The FONAR UPRIGHT® MRI often sees the patient’s problem that other scanners cannot because they are

lie-down and ”weightless” only scanners. The patient-friendly UPRIGHT® MRI has a near-zero claustrophobic rejection

rate by patients. As a FONAR customer states, “If the patient is claustrophobic in this scanner, they’ll be claustrophobic

in my parking lot.” Approximately 85% of patients are scanned sitting while they watch a 42” flat screen TV. FONAR

is headquartered on Long Island, New York.

UPRIGHT® and STAND-UP®

are registered trademarks and The Inventor of MR Scanning™, Full Range of Motion™, Multi-Position™, Upright Radiology™,

The Proof is in the Picture™, True Flow™, pMRI™, Spondylography™, Dynamic™,Spondylometry™,

CSP™, and Landscape™, are trademarks of FONAR Corporation.

This release

may include forward-looking statements from the company that may or may not materialize. Additional information on factors that

could potentially affect the company's financial results may be found in the company's filings with the Securities and Exchange

Commission.

CONDENSED CONSOLIDATED BALANCE SHEETS

(AMOUNTS AND SHARES IN THOUSANDS)

(UNAUDITED)

ASSETS

| | |

September 30,

2014 | |

June 30,

2014 * |

| Current Assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 10,662 | | |

$ | 9,952 | |

| Accounts receivable – net | |

| 5,186 | | |

| 4,450 | |

| Accounts receivable - related party | |

| 90 | | |

| — | |

| Medical receivable – net | |

| 8,779 | | |

| 8,808 | |

| Management and other fees receivable - net | |

| 12,952 | | |

| 11,970 | |

| Management and other fees receivable – related medical practices – net | |

| 3,253 | | |

| 3,427 | |

| Costs and estimated earnings in excess of billings on uncompleted contracts | |

| 1,620 | | |

| 760 | |

| Inventories | |

| 2,422 | | |

| 2,444 | |

| Prepaid expenses and other current assets | |

| 669 | | |

| 1,011 | |

| Total Current Assets | |

| 45,633 | | |

| 42,822 | |

| Deferred income tax asset | |

| 5,740 | | |

| 5,740 | |

| Property and equipment – net | |

| 14,489 | | |

| 15,030 | |

| Goodwill | |

| 1,767 | | |

| 1,767 | |

| Other intangible assets – net | |

| 10,233 | | |

| 10,509 | |

| Other assets | |

| 905 | | |

| 922 | |

| Total Assets | |

$ | 78,767 | | |

$ | 76,790 | |

LIABILITIES

| Current Liabilities: | |

| | | |

| | |

| Current portion of long-term debt and capital leases | |

$ | 2,892 | | |

$ | 2,891 | |

| Accounts payable | |

| 2,805 | | |

| 2,482 | |

| Other current liabilities | |

| 9,242 | | |

| 9,024 | |

| Unearned revenue on service contracts | |

| 5,296 | | |

| 4,731 | |

| Unearned revenue on service contracts – related party | |

| 83 | | |

| — | |

| Customer deposits | |

| 1,570 | | |

| 1,927 | |

| Billings in excess of costs and estimated earnings on uncompleted contracts | |

| 142 | | |

| 142 | |

| Total Current Liabilities | |

| 22,030 | | |

| 21,197 | |

| Long-Term Liabilities: | |

| | | |

| | |

| Deferred income tax liability | |

| 584 | | |

| 584 | |

| Due to related medical practices | |

| 228 | | |

| 234 | |

| Long-term debt and capital leases, less current portion | |

| 7,559 | | |

| 8,482 | |

| Other liabilities | |

| 263 | | |

| 386 | |

| Total Long-Term Liabilities | |

| 8,634 | | |

| 9,686 | |

| Total Liabilities | |

| 30,664 | | |

| 30,883 | |

* Condensed from audited financial

statements

CONDENSED CONSOLIDATED BALANCE SHEETS

(AMOUNTS AND SHARES IN THOUSANDS)

(UNAUDITED)

STOCKHOLDERS’ EQUITY

| STOCKHOLDERS' EQUITY: | |

September 30, 2014 | |

June 30,

2014 * |

Class A non-voting preferred stock $.0001 par value; 453 shares authorized at September 30, 2014 and June 30, 2014, 313 issued and outstanding at September 30, 2014 and June 30, 2014 | |

$ | — | | |

$ | — | |

Preferred stock $.001 par value; 567 shares authorized at September 30, 2014 and June 30, 2014, issued and outstanding – none | |

| — | | |

| — | |

Common Stock $.0001 par value; 8,500 shares authorized at September 30, 2014 and June 30, 2014, 6,062 and 6,057 issued at September 30, 2014 and June 30, 2014, respectively; 6,051 and 6,046 outstanding at September 30, 2014 and June 30, 2014, respectively | |

| 1 | | |

| 1 | |

Class B Common Stock (10 votes per share) $.0001 par value; 227 shares authorized at September 30, 2014 and June 30, 2014; .146 issued and outstanding at September 30, 2014 and June 30, 2014 | |

| — | | |

| — | |

Class C Common Stock (25 votes per share) $.0001 par value; 567 shares authorized at September 30, 2014 and June 30, 2014, 383 issued and outstanding at September 30, 2014 and June 30, 2014 | |

| — | | |

| — | |

| Paid-in capital in excess of par value | |

| 175,413 | | |

| 175,284 | |

| Accumulated deficit | |

| (146,724 | ) | |

| (149,259 | ) |

| Notes receivable from employee stockholders | |

| (37 | ) | |

| (39 | ) |

| Treasury stock, at cost - 12 shares of common stock at September 30, 2014 and June 30, 2014 | |

| (675 | ) | |

| (675 | ) |

| Total Fonar Corporation Stockholder Equity | |

| 27,978 | | |

| 25,312 | |

| Noncontrolling interests | |

| 20,125 | | |

| 20,595 | |

| Total Stockholders' Equity | |

| 48,103 | | |

| 45,907 | |

| Total Liabilities and Stockholders' Equity | |

$ | 78,767 | | |

$ | 76,790 | |

* Condensed from audited financial

statements

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(Amounts and shares in thousands, except per

share amounts)

(UNAUDITED)

| | |

FOR THE THREE MONTHS ENDED SEPTEMBER 30, |

| REVENUES | |

2014 | |

2013 |

| Product sales – net | |

$ | 1,271 | | |

$ | 28 | |

| Service and repair fees – net | |

| 2,491 | | |

| 2,512 | |

| Service and repair fees - related parties – net | |

| 28 | | |

| 28 | |

| Patient fee revenue, net of contractual allowances and discounts | |

| 6,787 | | |

| 5,827 | |

| Provision for bad debts for patient fee | |

| (3,146 | ) | |

| (2,040 | ) |

| Management and other fees – net | |

| 8,738 | | |

| 8,511 | |

| Management and other fees - related medical practices – net | |

| 1,816 | | |

| 1,965 | |

| Total Revenues – Net | |

| 17,985 | | |

| 16,831 | |

| COSTS AND EXPENSES | |

| | | |

| | |

| Costs related to product sales | |

| 1,085 | | |

| 48 | |

| Costs related to service and repair fees | |

| 507 | | |

| 544 | |

| Costs related to service and repair fees - related parties | |

| 6 | | |

| 6 | |

| Costs related to patient fee revenue | |

| 1,899 | | |

| 1,848 | |

| Costs related to management and other fees | |

| 5,199 | | |

| 5,075 | |

| Costs related to management and other fees – related medical practices | |

| 1,370 | | |

| 1,219 | |

| Research and development | |

| 397 | | |

| 395 | |

| Selling, general and administrative | |

| 3,578 | | |

| 3,737 | |

| Provision for bad debts | |

| 506 | | |

| (94 | ) |

| Total Costs and Expenses | |

| 14,547 | | |

| 12,778 | |

| Income From Operations | |

| 3,438 | | |

| 4,053 | |

| Interest Expense | |

| (204 | ) | |

| (243 | ) |

| Investment Income | |

| 62 | | |

| 61 | |

| Other Expense | |

| — | | |

| (151 | ) |

| Income Before Provision for Income Taxes and noncontrolling Interests | |

| 3,296 | | |

| 3,720 | |

| Provision for Income Taxes | |

| 40 | | |

| 100 | |

| Net Income | |

| 3,256 | | |

| 3,620 | |

| Net Income - Noncontrolling Interests | |

| (721 | ) | |

| (1,183 | ) |

| Net Income - Controlling Interests | |

$ | 2,535 | | |

$ | 2,437 | |

| Net Income Available to Common Stockholders | |

$ | 2,370 | | |

$ | 2,277 | |

| Net Income Available to Class A Non-Voting Preferred Stockholders | |

$ | 123 | | |

$ | 119 | |

| Net Income Available to Class C Common Stockholders | |

$ | 42 | | |

$ | 41 | |

| Basic Net Income Per Common Share Available to Common Stockholders | |

$ | 0.39 | | |

$ | 0.38 | |

| Diluted Net Income Per Common Share Available to Common Stockholders | |

$ | 0.38 | | |

$ | 0.37 | |

| Basic and Diluted Income Per Share - Common C | |

$ | 0.11 | | |

$ | 0.11 | |

| Weighted Average Basic Shares Outstanding – Common Stockholders | |

| 6,050 | | |

| 5,978 | |

| Weighted Average Diluted Shares Outstanding - Common Stockholders | |

| 6,178 | | |

| 6,106 | |

| Weighted Average Basic Shares Outstanding – Class C Common | |

| 383 | | |

| 383 | |

| Weighted Average Diluted Shares Outstanding – Class C Common | |

| 383 | | |

| 383 | |

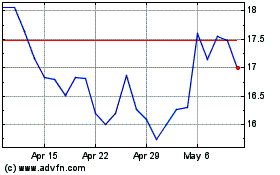

Fonar (NASDAQ:FONR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Fonar (NASDAQ:FONR)

Historical Stock Chart

From Apr 2023 to Apr 2024