UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): November 6, 2014

|

VAPOR CORP.

|

|

(Exact name of registrant as specified in its charter)

|

|

Delaware |

|

000-19001 |

|

84-1070932 |

| (State of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

3001

Griffin Road, Dania Beach, Florida |

|

33312 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (888) 766-5351

___________________________________________________

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

x Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

VAPOR CORP.

FORM 8-K

CURRENT REPORT

Item 1.01 Entry into Material Definitive Agreement

On November 6, 2014, Vapor Corp. (the “Registrant”)

entered into a binding term sheet (the “Term Sheet”) related to a proposed merger with Vaporin, Inc., a Delaware

corporation (“Vaporin”, and together with the Registrant, the “Parties”) and financing transaction

with certain other third parties.

By signing the Term Sheet, the Parties have agreed to negotiate

in good faith and to execute a definitive agreement as soon as possible, but in any event prior to December 21, 2014, and to otherwise

use best efforts to consummate the transactions contemplated by the Term Sheet on an expedited basis. Pursuant to the terms of

the Term Sheet, the merger agreement will provide for the acquisition of Vaporin by the Registrant through a statutory merger with

the Registrant being the surviving corporation upon consummation of the merger.

As consideration for the merger, the Term Sheet provides that the

stockholders of Vaporin would be entitled to receive the number of shares of the Registrant’s common stock such that the

former Vaporin stockholders would collectively own 45.0% of the issued and outstanding shares of common stock of the combined company

following consummation of the merger, subject to any adjustments to the exchange ratio which would be necessary to permit the respective

financial advisers of both the Registrant and Vaporin to make the determination that the merger consideration is fair from a financial

perspective. The Term Sheet provides that the shares of the Registrant’s common stock to be issued in upon consummation of

the proposed merger will be registered on a Form S-4 registration statement (the “Registration Statement”) to

be filed with the U.S. Securities and Exchange Commission (the “Commission”). The Term Sheet also prohibits

both the Registrant and Vaporin from entering into discussions or negotiations of any kind (written or oral) with any other entity

or person, perform any actions of any kind that are inconsistent in any way with the matters discussed in the Term Sheet, or entertain,

solicit, or consider any offers, terms, conditions, or provisions from any other entity or person regarding any transaction involving

a sale of all or substantially all of the assets of the Registrant or Vaporin, as applicable, a merger, consolidation, or recapitalization

of the Registrant or Vaporin, as applicable, or any similar transaction until March 31, 2015, subject to certain exceptions.

In addition to the proposed merger, the Term Sheet also

provides the material terms for a series of financing transactions. The first financing is expected to consist of a bridge

loan where Michael Brauser and Barry Honig (the “Investors”) or their affiliates will purchase $1.0 million

in senior secured convertible notes and warrants to purchase shares of

the Company’s common stock. The Investors are shareholders of Vaporin. Pursuant to the Term Sheet, a second

equity financing of $3.5 million is expected to close contingent on the closing of the merger with Vaporin. The Term Sheet

also contemplates that the Company may receive up to a total of $25.0 million in additional equity investments subject

to financial covenants and performance-based metrics still to be negotiated and documented in the final

definitive agreements.

The Parties are currently in the process of negotiating

definitive agreements, which are subject to approval of each of Vapor’s and Vaporin’s board of directors. The Term

Sheet further provides that the merger agreement and financings will include certain customary conditions to closing, including

that the consummation of the transactions contemplated by the merger agreement to be entered into shall be subject to, among other

things, (i) the receipt by each of the Registrant and Vaporin of an independent fairness issued by a separate independent investment

bank which provides a favorable opinion regarding the financial terms and conditions of the proposed merger; (ii) satisfactory

completion of due diligence by each of the Registrant and Vaporin; (iii) the Registration Statement being declared effective by

the Commission and no stop orders from any regulatory authority being in place; (iv) the receipt of approval by the stockholders

of the Registrant and Vaporin to the merger and merger agreement; and (v) the receipt by both Parties of all required regulatory

approvals, including from The NASDAQ Stock Market.

The foregoing summary of the Term Sheet is not complete and is qualified

in its entirety by reference to the full text of the Term Sheet, a copy of which is attached as Exhibit 10.1 to this Current Report

on Form 8-K and which is incorporated by reference herein.

Additional Information and Where to Find It

This communication does not constitute an offer to sell or the solicitation

of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed merger and upon

the execution of a definitive merger agreement, the Registrant intends to file a Registration Statement on Form S-4 that will include

a joint proxy statement of the Registrant and Vaporin and a prospectus of the Registrant with the Commission. Both the Registrant

and Vaporin may file other documents with the Commission regarding the proposed transaction. If a definitive merger agreement is

executed by the Parties, a definitive joint proxy statement will be mailed to the stockholders of the Registrant and Vaporin. INVESTORS

AND SECURITY HOLDERS ARE ADVISED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS WHEN IT BECOMES AVAILABLE, AND ANY OTHER RELEVANT

DOCUMENTS FILED WITH THE COMMISSION, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION. Investors and security holders may obtain a free copy of the registration statement (when available), including

the joint proxy statement/prospectus and other documents containing information about the Registrant and Vaporin at the Commission’s

website at www.sec.gov. These documents may be accessed and downloaded for free at Vapor’s website at www.vapor-corp.com

or by directing a request to Harlan Press, Chief Financial Officer, Vapor Corp., at 3001 Griffin Road, Dania Beach, Florida 33312,

telephone (888) 766-5351 or at www.vaporin.com or by directing a request to Jim Martin, Chief Financial Officer,

Vaporin, Inc. at 4400 Biscayne Boulevard, Miami, Florida 33137, telephone (305) 576-9298.

Participants in the Solicitation

This communication is not a solicitation of a proxy from any security

holder of the Registrant or Vaporin. However, the Registrant and Vaporin and their respective directors and executive officers

and other persons may be deemed to be participants in the solicitation of proxies from the Registrant’s and Vaporin’s

stockholders in respect of the proposed merger. Information regarding the directors and executive officers of the Registrant may

be found in its Annual Report on Form 10-K for the fiscal year ended December 31, 2013 (the “Registrant Form 10-K”),

which was filed with the Commission on February 26, 2014, and its Current Report on Form 8-K dated April 25, 2014 , as filed with

the Commission on April 28, 2014, both of which Reports can be obtained free of charge from the Registrant’s website. Information

regarding the directors and executive officers of Vaporin may be found in its Annual Report on Form 10-K for the fiscal year ended

December 31, 2013 (the “Vaporin Form 10-K”), which was filed with the Commission on March 27, 2014 and can be

obtained free of charge from Vaporin’s website. Other information regarding the participants in the proxy solicitation and

a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the Joint Proxy Statement/Prospectus

and other relevant materials to be filed with the Commission when they become available.

Forward Looking Statements

The foregoing contains forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995, including but not limited to those regarding the proposed merger and proposed

financing. Such statements are not historical facts and include expressions about management’s confidence and strategies

and management’s expectations about new and existing programs and products, relationships, opportunities, taxation, technology

and market conditions. These statements may be identified by such forward-looking terminology as “expect,” “believe,”

“view,” “opportunity,” “allow,” “continues,” “reflects,” “typically,”

“usually,” “anticipate,” or similar statements or variations of such terms. Such forward-looking statements

involve certain risks and uncertainties. Actual results may differ materially from such forward-looking statements. Factors that

may cause actual results to differ from those contemplated by such forward-looking statements include, but are not limited to,

the following: failure to enter into a definitive merger agreement; failure to enter into a potential financing transaction, reaction

to the proposed merger of the Registrant’s customers and employees; the diversion of management’s time on issues relating

to the merger; the inability to realize expected cost savings and synergies from the merger of the Registrant with Vaporin in the

amounts or in the timeframe anticipated; the Registrant’s operations and its ability to successfully execute its current

business strategy changes in the estimate of non-recurring charges; costs or difficulties relating to integration matters might

be greater than expected; changes in the stock price of the Registrant or Vaporin prior to closing; material adverse changes in

Vaporin’s or the Registrant’s operations or earnings; the inability to retain the Registrant’s customers and

employees; or a decline in the economy, as well as the risk factors set forth in the Registrant Form 10-K (and as supplemented

by Item 1.A. in the Registrant’s Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2014) and the Vaporin

Form 10-K. Neither the Registrant nor Vaporin assumes any obligation for updating any such forward-looking statement at any time.

Item 2.02 Results of Operations

and Financial Condition

On November

6, 2014, the Registrant issued a press release containing information related to certain preliminary results of its operations

for the quarter and nine months ended September 30, 2014. A copy of the press release is furnished herewith as Exhibit 99.1 and

is incorporated by reference herein.

The information

in this Item 2.02 of this Report including the Exhibit, is being furnished pursuant to Item 2.02 of Form 8-K and General Instruction

B.2 thereunder. Such information shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall

it be deemed to be incorporated by reference in any filing of the Company under the Securities Act of 1933, as amended, or the

Exchange Act.

|

Item 9.01.

|

Financial Statements and Exhibits

|

| (d) |

|

Exhibits |

| |

|

|

|

10.1

|

|

Binding Term Sheet for Proposed Merger and Financing Transactions, dated as of November 6, 2014.

|

| |

|

|

|

99.1

|

|

Press Release, dated November 6, 2014.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

VAPOR

CORP.

|

|

| |

|

|

|

| |

|

|

|

| Date: November 6, 2014 |

By:

|

/s/

Jeffrey E. Holman |

|

| |

|

Jeffrey E. Holman

|

|

| |

|

Chief

Executive Officer

|

|

|

|

|

|

|

EXHIBIT INDEX

|

Exhibit

Number

|

|

Description

|

| |

|

|

|

10.1

|

|

Binding Term Sheet for Proposed Merger and Financing Transactions, dated as of November 6, 2014.

|

| |

|

|

|

99.1

|

|

Press Release, dated November 6, 2014.

|

| |

|

|

| |

|

|

VAPOR CORP.

BINDING TERM SHEET FOR PROPOSED MERGER AND FINANCING TRANSACTIONS

This binding term sheet (this “Term Sheet”) summarizes the principal terms of (a) a proposed merger transaction (the “Merger”) between Vapor Corp., a Delaware corporation (“Vapor”), and Vaporin, Inc., a Delaware corporation (“Vaporin”), and (b) three related Financings (as defined herein) for Vapor. The Merger and these Financings are sometimes collectively referred to herein as the “Transactions”. Vapor and Vaporin are each sometimes referred to as a “Party” and collectively as the “Parties”.

| |

Structure of the Merger; Surviving Corporation

|

|

Vapor and Vaporin would consummate a statutory merger in accordance with the laws of the state of incorporation of each corporation. Vapor would be the surviving corporation in the Merger.

|

|

| |

Merger Consideration

|

|

Upon the consummation of the Merger, the shareholders of Vaporin will receive shares of the common stock of Vapor sufficient to give Vaporin shareholders ownership of a percentage of the total outstanding capital stock of Vapor equal to 45.0% of the combined company, subject to adjustment based on the Fairness Opinions (as defined herein).

|

|

| |

Fairness Opinions

|

|

The consummation of the Merger shall be conditioned on, among other things, the receipt by each of Vapor and Vaporin of an independent fairness opinion (each, a “Fairness Opinion”) issued by a separate independent investment bank which provides a favorable opinion regarding the financial terms and conditions of the Merger. These investment bankers shall be chosen by Vapor and Vaporin, respectively, and the interpretation of the results of each Fairness Opinion shall be determined by the Party that engaged the respective investment banker in that Party’s sole discretion. Each Party shall be responsible for all of the fees and expenses incurred in connection with the preparation of a Fairness Opinion.

|

|

| |

|

|

|

|

|

|

| |

Registration Statement

|

|

The Parties anticipate that a Registration Statement (the “Registration Statement”) on Form S-4 will be required in connection with the Merger. Each Party shall cooperate with and shall promptly perform all actions and provide all information and documents to the other Party as required or desired by such other Party in connection with the preparation, filing, and effectiveness of this Registration Statement. The consummation of the Merger would be conditioned on this Registration Statement being declared effective by the Securities and Exchange Commission and no stop orders from any regulatory authority being in place.

|

|

| |

Financing Transactions

|

|

Subject to the limitations contained in this Section, the following amounts of financing will be made available to Vapor:

|

|

| |

|

|

|

■ |

A bridge financing (the “Bridge Financing”) of $1,000,000 to be funded by Michael Brauser and Barry Honig (or their affiliates) within five (5) days after the execution of this Term Sheet on the terms described on the Financing Term Sheet included as Exhibit A. .

|

|

| |

|

|

|

|

|

|

| |

|

|

|

■ |

A total of $3,500,000 (the “Closing Financing”) to be funded contemporaneously with the consummation of the Merger. This Closing Financing will consist of common stock (with 100% warrant coverage) at a share price (“Per Share Price”) equal to the lesser of: (i) 80% of Vapor’s Volume Weighted Average Price (“VWAP”) on the five trading days after the announcement of Vapor’s preliminary third quarter results or (ii) 80% of Vapor’s VWAP on the five trading days prior to the closing of the Merger (beginning with the day prior to the Merger closing). The warrants will be exercisable at 125% of the Per Share Price, have cashless exercise rights and will be exercisable for a five year period. The holders of the common stock and warrants will have full-ratchet rights. Messrs. Brauser and Honig (or their affiliates) will lead the Closing Financing. The funds for the Closing Financing will be placed into an escrow account with an escrow agent satisfactory to all parties at least ten (10) days prior to the closing date of the Merger, and such funds will be released to Vapor at the same time as the consummation of the Merger. |

|

| |

|

|

|

|

|

|

| |

|

|

|

■ |

A total of $20,000,000 to $25,000,000 (the “Subsequent Financing”) to be funded after the consummation of the Merger. This investment shall be made pursuant to a disbursement schedule and shall be subject to Vapor’s compliance with certain financial covenants and restrictions and Vapor’s achievement of certain performance-based metrics. This disbursement schedule, these financial covenants and restrictions, and these performance-based metrics will be negotiated and finalized prior to the consummation of the Merger and will be reflected in an agreement (“Financing Agreement”) which will be executed contemporaneously with the signing of the definitive Merger Agreement. The Financing Agreement for the Subsequent Financing will provide that certain Vaporin stockholders will be subject to certain penalties if the Subsequent Financing is not consistent with the terms of the Financing Agreement. These penalties could include the return of some of the shares of Vapor common stock received in the Merger.

|

|

| |

|

|

|

|

|

|

| |

|

|

|

■ |

The terms and conditions of the Subsequent Financing, including the share purchase price and any other economic terms, shall be no less favorable to Vapor than the equivalent terms and conditions of the Bridge Financing and/or the Closing Financing (whichever is more favorable to investors).

|

|

| |

|

|

|

|

|

|

| |

|

|

|

■ |

In partial consideration of the role of Messrs. Brauser and Honig in the successful consummation of the Bridge and Closing Financings, one or more of them shall have the right to collectively appoint a total of two members of Vapor’s Board of Directors; provided, however, that all such appointees shall be reasonably acceptable to Vapor. Vapor’s Board of Directors shall consist of a total of five members. If in the future the Board of directors is increased, such party or parties shall have the right to appoint one less than a majority of the number of directors. Vapor agrees to nominate the designees at its next annual meeting of stockholders and recommend to its stockholders the election of such designees at any subsequent stockholders’ meetings at which directors are elected through December 31, 2015. If any aspect of the Subsequent Financing does not occur for any reason other than Vapor’s failure to comply with the financial covenants or restrictions or the performance-based metrics or Vapor choosing not to proceed with a Subsequent Financing for any reason, this right to appoint Vapor Board of Directors members shall immediately terminate in all respects.

|

|

| |

|

|

|

|

|

|

| |

|

|

|

■ |

The Bridge Financing, the Closing Financing, and the Subsequent Financing are collectively referred to herein as the “Financings”.

|

|

| |

|

|

|

|

|

|

| |

|

|

|

■ |

Any shares of Vapor stock issued in connection with any Financing shall be unregistered but shall be subject to standard “piggyback” registration rights.

|

|

| |

|

|

|

|

|

|

| |

|

|

|

■ |

As a condition to the purchase of any Vapor stock purchased or received in any of the Financings, the recipient of such stock shall enter into standard stockholder or voting agreements which shall be agreed to in form and substance by both Vaporin and Vapor at the time of executing the Merger Agreement. |

|

| |

|

|

|

|

|

|

| |

|

|

|

■ |

The decision to accept the terms and conditions of and to proceed with the Subsequent Financing shall be in Vapor’s sole discretion.

|

|

| |

|

|

|

|

|

|

| |

Transaction Documents

|

|

The proposed Merger will be completed in accordance with terms and conditions to be set forth in a definitive merger agreement (the “Merger Agreement”) which shall be mutually satisfactory in form and substance and all of which shall include closing conditions, representations and warranties, and covenants of the parties customary in transactions of this type. The definitive Merger Agreement shall be signed within forty-five (45) days after the execution of this Term Sheet by both parties. If this definitive Merger Agreement is not signed by all parties by the end of this forty-five (45) day period, then either party may terminate this Term Sheet by written notice to the other party and not be obligated to proceed with the Merger. Without limiting the generality of the foregoing, the Merger Agreement would provide for the following:

(i) Representations and Warranties. The Merger Agreement shall contain standard parallel representations and warranties of the Parties, including, without limitation, due authorization, capitalization, corporate power, ownership of intellectual property, no brokers, and taxation.

(ii) Conditions to Closing. The Merger Agreement shall contain standard conditions to closing, including, without limitation, the execution of a Financing Agreement for the Subsequent Financing, the receipt of all required stockholder votes (including any “majority of the minority” vote if applicable), the effectiveness of the Registration Statement, the presence of no stop orders, the consummation of the Closing Financing contemporaneously with the consummation of the Merger, the completion of due diligence investigations satisfactory to each party, and the receipt by both parties of all required regulatory approvals, including any required approvals from NASDAQ.

|

|

| |

Due Diligence Reviews

|

|

Each Party to the Merger shall promptly conduct a full due diligence review of the other Party, including, without limitation, business, legal, accounting, tax, and technology due diligence items. Any due diligence review conducted by Vaporin shall be coordinated through one designated representative. All due diligence reviews shall be completed within thirty (30) days after the execution of this Term Sheet by both Parties.

|

|

| |

Miscellaneous:

|

|

Confidentiality: Each of the Parties covenants and agrees that for a term beginning on the date of signing of this Term Sheet and ending on the second anniversary of such signing not to disclose the terms of this Term Sheet to any person other than the respective parties’ representatives and advisors who have a need to know, without the written consent of all of the other Parties. The Parties will enter into separate Confidentiality Agreements promptly after the execution of this Term Sheet.

No Announcements: No Party shall make any public announcement of any kind (oral or written and including any press releases) regarding this Term Sheet or any of the components or provisions of the proposed Transactions discussed herein without the prior written consent of all Parties; provided, however, that any Party can take any actions required to comply with applicable laws and regulations.

|

|

| |

|

|

No Shop Provision: Until March 31, 2015, neither Vapor nor Vaporin shall enter into any discussions or negotiations of any kind (written or oral) with any entity or person other than the other Party, perform any actions of any kind that are inconsistent in any way with the matters discussed in this Term Sheet, or entertain, solicit, or consider any offers, terms, conditions, or provisions from any entity or person other than the Parties hereto regarding any transaction involving a sale of all or substantially all of the assets of the Parties, a merger, consolidation, or recapitalization of the Parties, or any similar transaction; provided, however, that if Vapor or Vaporin receives any communications from a third party about a merger, consolidation or sale of all or substantially all of its assets (any, an “Acquisition Proposal”) and it is advised by its counsel that its Board of Directors is required under the Delaware General Corporation Law to consider such Acquisition Proposal, it may consider such Acquisition Proposal and take actions in furtherance of it without breaching this No Shop provision. Vapor or Vaporin, as the case may be, shall promptly notify the other Party orally and in writing in the event that it receives any Acquisition Proposal or inquiry related thereto. Nothing contained herein shall preclude a party from complying with Rule 14e-2 promulgated under the Securities Exchange Act of 1934.

Expenses: Each Party to the Transactions will pay its own fees and expenses associated with the Transactions, including all legal and accounting fees and any fees and costs associated with its respective Fairness Opinion.

Due Authorization for Execution. The execution of this Term Sheet on behalf of both Vapor and Vaporin has been duly authorized by all required corporate actions and procedures.

|

|

| |

|

|

No Hiring or Solicitation of Employees or Consultants. If the Transactions are not consummated for any reason, neither Vaporin nor Vapor shall, for a period ending on March 31, 2016 (the “Termination Date”), hire, engage as a consultant (directly or indirectly), or solicit for employment or engagement as a consultant (directly or indirectly) any employee or consultant of the other Party who is employed or engaged as a consultant by such other Party or who was employed or engaged as a consultant by such other Party at any time within the six months immediately preceding the date of the proposed hiring or engagement of such employee or consultant.

Governing Law: This Term Sheet shall be interpreted and enforced under the laws of the State of Florida without giving effect to its conflicts of law principles.

Counterparts: This Term Sheet may be executed in separate counterparts, and all such executed counterparts together shall be deemed to be fully effective and to be one and the same document.

|

|

[Signature Page Follows]

IN WITNESS WHEREOF, The undersigned parties have caused this Term Sheet for Proposed Merger and Financing Transactions to be executed on November 6, 2014.

| |

|

|

|

| |

VAPOR CORP.

|

|

| |

|

|

|

|

|

By

|

/s/ Jeffrey Holman |

|

| |

Name: |

Jeffrey Holman |

|

| |

Title: |

Chief Executive Officer |

|

| |

|

|

|

| |

VAPORIN, INC. |

|

| |

|

|

|

| |

By

|

/s/ Greg Brauser |

|

| |

Name: |

Greg Brauser |

|

| |

Title: |

Chief Operating Officer |

|

EXHIBIT A

The terms and conditions presented below do not constitute any form of binding contract but rather are solely for the purpose of outlining those terms pursuant to which a definitive agreement may ultimately be entered into. This Term Sheet does not purport to summarize all the terms, conditions, covenants, representations, warranties and other provisions which would be contained in the definitive legal documentation for the financing contemplated herein. Closing is contingent upon completion of due diligence and final negotiation and execution of satisfactory documentation containing customary closing conditions, representations, warranties, etc.

Dated: November 6, 2014

| |

|

|

Company

|

Vapor Corp., a Delaware corporation (the “Company”)

|

|

Securities:

|

$1,000,000 senior secured convertible notes (the “Notes”) and warrants (the “Warrants”) to purchase shares of the Company’s common stock (the “Common Stock”)

|

|

Investors:

|

Michael Bruaser or his affiliates (the “Investors”)

|

|

Closing Date:

|

Within 5 Days of the execution of this Term Sheet

|

|

Maturity Date

|

Unless earlier converted or redeemed, the Notes will mature on the one (1) year anniversary of the Closing Date (“Maturity Date”).

|

|

Interest

|

The Notes bear interest at a rate of 7% per annum, subject to increase to 15% per annum upon the occurrence and continuance of an event of default (as described below). Interest on the Notes is payable monthly in shares of Common Stock or cash, at the Company’s option. Interest on the Notes is computed on the basis of a 360-day year and twelve 30-day months and is payable in arrears monthly and is compounded monthly.

|

|

Conversion

|

The Notes shall be convertible into shares of Common Stock at a per share price of equal to the lesser of (i) $2.00, or (ii) 80% of the average VWAP over the three trading day period immediately prior to the Closing Date (the “Conversion Price”).

|

| |

|

|

|

| |

Warrants:

|

|

100% Warrant coverage. The Warrants will be exercisable on the issuance date through the fifth anniversary of the issuance date.

|

| |

|

|

|

| |

|

|

The Warrants will be exercisable at an initial exercise price equal to $2.75 per share. The exercise price of the Warrants is subject to adjustment for stock splits, stock dividends, combinations or similar events. .

|

| |

Placement Agent:

|

|

Palladium Capital Advisors LLC (“Palladium”) on a best efforts basis. Palladium shall be paid 5% of the gross proceeds from the sale of the Note payable on the Closing Date. In addition, Palladium shall receive a warrant on equivalent terms to the Warrants in an amount equal to 5% of the shares sold or issuable upon conversion of the Notes.

|

| |

Legal Fees:

|

|

The Company shall be responsible for all legal fees of outside counsel and disbursements up to $25,000.

|

| |

Binding Effect:

|

|

This Term Sheet is intended to be binding on the parties, including the Investors, of their mutual intent on proceeding with a financing transaction pursuant to a definitive agreement and related transaction documents prior to the Closing Date. The financing shall be completed in accordance with terms and conditions set forth in the Note transaction documents, all of which shall be mutually satisfactory in form and substance and all of which shall include representations and warranties and covenants of the parties customary in transactions of this this type.

|

| |

Effect of Termination

|

|

In the event that, following the execution and delivery of the final transaction documents, the Company or the Investors (the “Defaulting Party”) terminates the transaction not in accordance with the terms set forth herein, the Defaulting Party shall be obliged to pay to all of the non-terminating party’s actual deal related expenses.

|

| |

Counterparts

|

|

This term sheet may be executed in any number of counterparts and by facsimile or email transmission, each of which shall be deemed to be an original instrument, but all of which taken together shall constitute one and the same agreement. Facsimile or email signatures shall be deemed to be original signatures for all purposes.

|

| |

|

|

|

|

Accepted and Acknowledged

|

|

|

|

| |

|

|

|

|

VAPOR CORP.

|

|

|

|

| |

|

|

|

|

By:

|

/s/ Jeffrey Holman

|

|

|

|

|

Name: Jeffrey Holman

|

|

|

|

|

Title: CEO

|

|

|

|

| |

|

|

|

|

PALLADIUM CAPITAL ADVISORS LLC

|

|

|

|

| |

|

|

|

|

By:

|

/s/ Joel Padowitz

|

|

|

|

|

Name: Joel Padowitz

|

|

|

|

|

Title: CEO

|

|

|

|

| |

|

|

|

|

BY THE INVESTORS:

| |

|

|

MICHAEL BRUASER

|

|

| |

|

|

By:

|

/s/ Michael Brauser

|

|

| Name: |

Michael Brauser |

|

| |

|

|

BARRY HONIG

|

|

| |

|

|

By:

|

/s/

Barry Honig

|

|

| Name: |

Barry Honig |

|

| |

This Term Sheet is intended to be a binding obligation of the Investor’s and the Company only. The failure of any party to consummate a transaction shall not represent a breach of any obligation by the Placement Agent or its representatives.

|

|

EXHIBIT 99.1

Vapor Corp. Announces Execution

of a Term Sheet to Merge with Vaporin, Inc.

and Releases Certain Preliminary Third Quarter Financial Results

DANIA BEACH, Fla., November 6, 2014 – Vapor Corp. (NASDAQCM:

VPCO) (“Vapor” or the “Company”), a U.S.-based vaporizer

and electronic cigarette company, announced today, that it has executed a binding term sheet (“Term Sheet”)

to enter into a merger with Vaporin, Inc. (OTCQB: VAPO) (“Vaporin”), a company whose primary focus is in vaporizers

and eliquids.

The Term Sheet contemplates a proposed merger with Vaporin to be

structured as a merger of equals with Vapor as the surviving party in the transaction. As consideration for the merger, the Term

Sheet provides that the stockholders of Vaporin would be entitled to receive the number of shares of the Company’s common

stock such that the former Vaporin stockholders would collectively own 45.0% of the issued and outstanding shares of common stock

of the combined company following consummation of the merger, subject to any adjustments to the exchange ratio which would be necessary

to permit the respective financial advisers of both the Company and Vaporin to make the determination that the merger consideration

is fair from a financial perspective.

The Term Sheet further contemplates, in connection with

the proposed merger, a series of financing transactions. The first financing is expected to consist of a bridge loan

where Michael Brauser and Barry Honig (the “Investors”) or their affiliates will purchase $1.0 million in senior

secured convertible notes and warrants to purchase shares of the Company’s common stock. The Investors are

shareholders of Vaporin. Pursuant to the Term Sheet, a second equity financing of $3.5 million is expected to close

contingent on the closing of the merger with Vaporin. The Term Sheet also contemplates that the Company may receive up to a

total of $25.0 million in additional equity investments subject to financial covenants and performance-based metrics still to

be negotiated and documented in the final definitive agreements.

The Company believes the potential financings, if consummated, would

allow the Company to continue to execute its strategy to attempt to capture an increased share of the rapidly expanding vaporizer

market.

By signing the Term Sheet, the parties have agreed to negotiate

in good faith and to execute definitive agreements as soon as possible, but in any event prior to December 21, 2014, and to otherwise

use best efforts to consummate the transactions contemplated by the Term Sheet on an expedited basis. The parties are currently

in the process of negotiating such definitive agreements, which are subject to approval of each party’s board of directors.

The proposed merger and financings remain subject to receipt of fairness opinions, due diligence, stockholder votes, and other

customary closing conditions.

Financial Results

The Company will release

its financial results for the third quarter and nine months of 2014 after the market closes on Friday, November 14, 2014.

Highlights will include six (6) new retail kiosk locations opened in major U.S. shopping malls, since November 1, 2014, and

reported net sales of $2,673,926 and $13,547,792

for the three and nine months ended September 30, 2014, respectively, which represent decreases of 58.3%

and 28.5%, respectively compared to the prior year periods. The decrease in sales is primarily attributable to

decreased sales of the Company’s television direct marketing campaign for the Company’s Alternacig® and

VaporX® branded campaigns, decreases in sales from our on-line stores, distributor inventory build leveling off in 2014

and continued pipeline load in the e-cigarette category in 2013, and the increasing prevalence of vaporizers, tanks and open

system vapor products that are marginalizing the e-cigarette category. Sales were also negatively impacted by new national

competitors’ launches of their own branded products during 2014. The Company

expects to report net losses of $4.8 million and $7.3 million for the three and nine months ended September 30, 2014,

respectively, compared to net income of $0.3 million and $0.3 million for the three and nine months ended September 30, 2013,

respectively.

About Vapor Corp. Vapor

Corp., a NASDAQ listed company, is a U.S. based vaporizer and electronic cigarette company, whose brands include emagine vaporTM,

Krave®, VaporX®, Hookah Stix®, Alternacig® and Fifty-One®. We also design and develop private label brands

for some of our distribution customers. “Electronic cigarettes” or “e-cigarettes,” and “Vaporizers,”

are battery-powered products that enable users to inhale nicotine vapor without smoke, tar, ash or carbon monoxide. Vapor’s

electronic cigarettes, vaporizers and accessories are available online, through our company owned stores under the emagine

vaporTM brand, through direct response to our television advertisements and through

retail locations throughout the United States. For more information on Vapor Corp. and its e-cigarette and vaporizer brands, please

visit us at www.vapor-corp.com.

Forward Looking Statements

The foregoing contains forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995, including but not limited to those regarding the proposed merger and proposed

financing. Such statements are not historical facts and include expressions about management’s confidence and strategies

and management’s expectations about new and existing programs and products, relationships, opportunities, taxation, technology

and market conditions. These statements may be identified by such forward-looking terminology as “expect,” “believe,”

“view,” “opportunity,” “allow,” “continues,” “reflects,” “typically,”

“usually,” “anticipate,” or similar statements or variations of such terms. Such forward-looking statements

involve certain risks and uncertainties. Actual results may differ materially from such forward-looking statements. Factors that

may cause actual results to differ from those contemplated by such forward-looking statements include, but are not limited to,

the following: failure to enter into a definitive merger agreement; failure to enter into a potential financing transaction, reaction

to the proposed merger of Vapor’s customers and employees; the diversion of management’s time on issues relating to

the merger; the inability to realize expected cost savings and synergies from the merger of Vapor with Vaporin in the amounts or

in the timeframe anticipated; Vapor’s operations and its ability to successfully execute its current business strategy changes

in the estimate of non-recurring charges; costs or difficulties relating to integration matters might be greater than expected;

changes in the stock price of Vapor or Vaporin prior to closing; material adverse changes in Vaporin’s or Vapor’s operations

or earnings; the inability to retain Vapor’s customers and employees; or a decline in the economy, as well as the risk factors

set forth in Vapor Form 10-K (and as supplemented by Item 1.A. in Vapor’s Quarterly Report on Form 10-Q for the quarterly

period ended March 31, 2014) and the Vaporin Form 10-K. Neither Vapor nor Vaporin assumes any obligation for updating any such

forward-looking statement at any time.

Additional Information and Where to Find It

This communication does not constitute an offer to sell or the solicitation

of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed merger and upon

the execution of a definitive merger agreement, Vapor intends to file a Registration Statement on Form S-4 that will include a

joint proxy statement of Vapor and Vaporin and a prospectus of Vapor with the Securities and Exchange Commission (the “Commission”).

Both Vapor and Vaporin may file other documents with the Commission regarding the proposed transaction. If a definitive merger

agreement is executed by the parties, a definitive joint proxy statement will be mailed to the stockholders of Vapor and Vaporin.

INVESTORS AND SECURITY HOLDERS ARE ADVISED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS WHEN IT BECOMES AVAILABLE, AND ANY OTHER

RELEVANT DOCUMENTS FILED WITH THE COMMISSION, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THE DOCUMENTS, BECAUSE THEY WILL CONTAIN

IMPORTANT INFORMATION. Investors and security holders may obtain a free copy of the registration statement (when available),

including the joint proxy statement/prospectus and other documents containing information about Vapor and Vaporin at the Commission’s

website at www.sec.gov. These documents may be accessed and downloaded for free at Vapor’s website at www.vapor-corp.com

or by directing a request to Harlan Press, Chief Financial Officer, Vapor Corp., at 3001 Griffin Road, Dania Beach, Florida 33312,

telephone (888) 766-5351 or at www.vaporin.com or by directing a request to Jim Martin, Chief Financial Officer,

Vaporin, Inc. at 4400 Biscayne Boulevard, Miami, Florida 33137, telephone (305) 576-9298.

Participants in the Solicitation

This communication is not a solicitation of a proxy from any security

holder of Vapor or Vaporin. However, Vapor and Vaporin and their respective directors and executive officers and other persons

may be deemed to be participants in the solicitation of proxies from Vapor’s and Vaporin’s stockholders in respect

of the proposed merger. Information regarding the directors and executive officers of Vapor may be found in its Annual Report on

Form 10-K for the fiscal year ended December 31, 2013 (the “Registrant Form 10-K”), which was filed with the

Commission on February 26, 2014, and its Current Report on Form 8-K dated April 25, 2014 , as filed with the Commission on April

28, 2014, both of which Reports can be obtained free of charge from Vapor’s website. Information regarding the directors

and executive officers of Vaporin may be found in its Annual Report on Form 10-K for the fiscal year ended December 31, 2013 (the

“Vaporin Form 10-K”), which was filed with the Commission on March 27, 2014 and can be obtained free of charge

from Vaporin’s website. Other information regarding the participants in the proxy solicitation and a description of their

direct and indirect interests, by security holdings or otherwise, will be contained in the Joint Proxy Statement/Prospectus and

other relevant materials to be filed with the Commission when they become available.

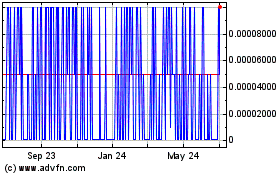

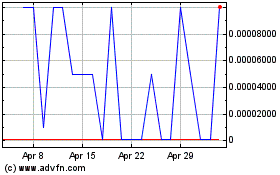

Healthier Choices Manage... (PK) (USOTC:HCMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Healthier Choices Manage... (PK) (USOTC:HCMC)

Historical Stock Chart

From Apr 2023 to Apr 2024