Provectus Biopharmaceuticals, Inc. (NYSE MKT:PVCT)

(http://www.pvct.com), a development-stage oncology and dermatology

biopharmaceutical company (“Provectus”), today announced financial

results for the third quarter of 2014.

Third Quarter Results and Balance Sheet Highlights

At September 30, 2014, cash and cash equivalents were

$17,773,680 compared to $15,696,243 at December 31, 2013. The

increase of approximately $2.1 million was due primarily to $4.3

million cash received from warrant and stock option exercises and

$7.5 million net proceeds from the sale of our common stock in the

nine months ended September 30, 2014, offset by $9.7 million of

operating cash expenses.

Therefore, our ability to continue as a going concern is

reasonably assured due to our cash and cash equivalents on hand at

September 30, 2014. Given our current rate of expenditures and our

ability to curtail or defer certain controllable expenditures, we

do not anticipate needing to raise additional capital to further

develop PV-10 on our own to treat locally advanced cutaneous

melanoma, cancers of the liver, recurrent breast cancer, pancreatic

cancer and other indications because we plan to strategically

monetize PV-10 through appropriate regional license transactions,

co-development partnerships, and license PH-10 for psoriasis and

other related indications described as inflammatory dermatoses.

Shareholders’ equity at September 30, 2014 was $19,539,425. This

compares to shareholders’ equity at December 31, 2013 of

$6,628,666.

PROVECTUS

BIOPHARMACEUTICALS, INC. CONDENSED CONSOLIDATED BALANCE

SHEETS

September 30,2014(Unaudited)

December 31, 2013(Audited) Assets Current Assets Cash

and cash equivalents $ 17,773,680 $ 15,696,243 Total Current Assets

17,773,680 15,696,243

Equipment and furnishings, less

accumulated depreciation of $434,479

and $429,331, respectively

95,555 30,113 Patents, net of amortization of $7,963,957 and

$7,460,617, respectively 3,751,488 4,254,828 Other assets 27,000

27,000 $ 21,647,723 $ 20,008,184 Liabilities and

Stockholders’ Equity Current Liabilities Accounts payable — trade $

478,200 $ 348,869 Accrued consulting expense 91,282 61,282 Other

accrued expenses 311,579 102,795 Total Current Liabilities 881,061

512,946 Warrant liability 1,227,237 12,866,572 Total Liabilities

2,108,298 13,379,518 Stockholders’ Equity

Preferred stock; par value $.001 per

share; 25,000,000 shares

authorized; Series A 8% convertible

preferred stock, 0 and

33,334 shares issued and outstanding,

respectively, liquidation

preference $0.75 (for 2013 in aggregate

$25,001)

— 33 Common stock; par value $.001 per share; 300,000,000

authorized; 180,299,739 and 159,751,724 shares issued and

outstanding, respectively 180,300 159,752 Paid-in capital

176,469,175 152,519,701 Accumulated deficit (157,110,050 )

(146,050,820 ) Total Stockholders’ Equity 19,539,425

6,628,666 $ 21,647,723 $ 20,008,184

About Provectus Biopharmaceuticals, Inc.

Provectus Biopharmaceuticals, Inc., specializes in developing

oncology and dermatology therapies. PV-10, its novel

investigational drug for cancer, is designed for injection into

solid tumors (intralesional administration), thereby reducing

potential for systemic side effects. Its oncology focus is on

melanoma, breast cancer and cancers of the liver. The Company has

received orphan drug designations from the FDA for its melanoma and

hepatocellular carcinoma indications. PH-10, its topical

investigational drug for dermatology, is undergoing clinical

testing for psoriasis and atopic dermatitis. Provectus has

completed phase 2 trials of PV-10 as a therapy for metastatic

melanoma, and of PH-10 as a topical treatment for atopic dermatitis

and psoriasis. Information about these and the Company’s other

clinical trials can be found at the NIH registry,

www.clinicaltrials.gov. For additional information about Provectus,

please visit the Company’s website at www.pvct.com or contact

Porter, LeVay & Rose, Inc.

FORWARD-LOOKING STATEMENTS: This release contains

“forward-looking statements” as defined under U.S. federal

securities laws. These statements reflect management’s current

knowledge, assumptions, beliefs, estimates, and expectations and

express management’s current views of future performance, results,

and trends and may be identified by their use of terms such as

“anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,”

“may,” “plan,” “predict,” “project,” “will,” and other similar

terms. Forward-looking statements are subject to a number of risks

and uncertainties that could cause our actual results to materially

differ from those described in the forward-looking statements.

Readers should not place undue reliance on forward-looking

statements. Such statements are made as of the date hereof, and we

undertake no obligation to update such statements after this

date.

Risks and uncertainties that could cause our actual results to

materially differ from those described in forward-looking

statements include those discussed in our filings with the

Securities and Exchange Commission (including those described in

Item 1A of our Annual Report on Form 10-K for the year ended

December 31, 2013, and in our Quarterly Reports on Form 10-Q for

the quarters ended March 31, 2014, June 30, 2014, and September 30,

2014), and the following:

• our determination, based on guidance from the FDA, whether

to proceed with or without a partner with a phase 3 trial of PV-10

to treat locally advanced cutaneous melanoma and the costs

associated with such a trial if it is necessary; • our

determination whether to license PV-10, our melanoma drug product

candidate, and other solid tumors such as liver cancer, if such

licensure is appropriate considering the timing and structure of

such a license, or to commercialize PV-10 on our own to treat

melanoma and other solid tumors such as liver cancer; • our ability

to license our dermatology drug product candidate, PH-10, on the

basis of our phase 2 atopic dermatitis and psoriasis results, which

are in the process of being further developed in conjunction with

mechanism of action studies; and • our ability to raise additional

capital if we determine to commercialize PV-10 and/or PH-10 on our

own, although our expectation is to be acquired by a prospective

pharmaceutical or biotech concern prior to commercialization.

Provectus Biopharmaceuticals, Inc.Peter R. Culpepper, CFO, COO,

866-594-5999 #30orPorter, LeVay & Rose, Inc.Investor

RelationsMarlon Nurse, DM, SVP, 212-564-4700orMedia RelationsBill

Gordon, 212-724-6312

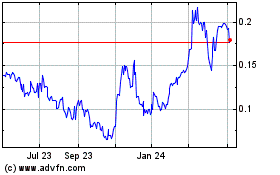

Provectus Biopharmaceuti... (QB) (USOTC:PVCT)

Historical Stock Chart

From Mar 2024 to Apr 2024

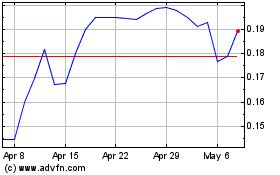

Provectus Biopharmaceuti... (QB) (USOTC:PVCT)

Historical Stock Chart

From Apr 2023 to Apr 2024