Current Report Filing (8-k)

October 31 2014 - 5:22PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 30, 2014

CLEAN ENERGY FUELS CORP.

(Exact Name of Registrant as Specified in Charter)

|

Delaware

(State or Other Jurisdiction of

Incorporation) |

|

001-33480

(Commission File Number) |

|

33-0968580

(IRS Employer Identification No.) |

|

4675 MacArthur Court, Suite 800, Newport Beach, California |

|

92660 |

|

(Address of Principal Executive Offices) |

|

Zip Code |

(949) 437-1000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On October 30, 2014, Richard R. Wheeler resigned from his position as Chief Financial Officer (and principal financial and accounting officer) of Clean Energy Fuels Corp. (the “Registrant”), effective November 3, 2014, to pursue other interests. The Registrant and Mr. Wheeler are finalizing the terms of a separation agreement, which is expected to include the Registrant’s agreement to pay Mr. Wheeler severance of $550,000, less applicable withholdings, in one lump sum payment after the effective date of the separation agreement, and a release of claims (subject to Mr. Wheeler’s statutory rights).

On October 31, 2014, the Registrant appointed Robert Vreeland, 53, as its Senior Vice President and Chief Financial Officer (and principal financial and accounting officer), effective immediately. From 2012 to 2014, Mr. Vreeland served as Vice President of Finance and Accounting of the Registrant. Before joining the Registrant, Mr. Vreeland was a consultant at RV CPA Services, PLLC, a provider of certified public accounting services. From 1997 to 2009, Mr. Vreeland held various finance and accounting positions at Hypercom, including Interim Chief Financial Officer, Senior Vice President and Corporate Controller, Senior Vice President, Operations, and Vice President of Financial Planning and Analysis. Prior to joining Hypercom, he spent twelve years at Coopers & Lybrand. Mr. Vreeland earned a B.S. from Northern Arizona University and is a certified public accountant.

In connection with Mr. Vreeland’s appointment, the Registrant and Mr. Vreeland have entered into an offer letter (the “Offer Letter”) governing the terms of his employment and his compensation. The Offer Letter provides, among other things, that (i) Mr. Vreeland will be entitled to receive a signing bonus of $50,000, less applicable withholdings, payable within 30 days after the effective date of his employment, (ii) Mr. Vreeland will be entitled to receive an annual base salary of $300,000, (iii) Mr. Vreeland will be eligible to receive a bonus for his performance during the remainder of the 2014 fiscal year and, beginning on January 1, 2015, a performance bonus at a rate of 30%, 50%, or 70% of his annual base salary, with the amount of any such bonus subject to the discretion of and approval by the Registrant’s Board of Directors or the Compensation Committee thereof, (iv) Mr. Vreeland will be eligible to participate in the Registrant’s standard benefit programs, and (v) subject to approval by the Registrant’s Board of Directors or the Compensation Committee thereof, Mr. Vreeland will be granted a stock option under the Company’s Amended and Restated 2006 Stock Incentive Plan (the “Plan”) to purchase up to 75,000 shares of the Company’s common stock, with such vesting provisions and other terms as the Registrant’s Board of Directors or the Compensation Committee thereof shall approve. The Offer Letter also provides that, upon successful completion of six months of employment as the Registrant’s Senior Vice President and Chief Financial Officer, Mr. Vreeland will be eligible (i) to enter into a senior executive employment agreement with the Registrant, with terms to be negotiated by the parties, (ii) to receive an increased annual base salary of $350,000, (iii) to receive an increased performance bonus, as established and approved by the Registrant’s Board of Directors or the Compensation Committee thereof, and (iv) subject to approval by the Registrant’s Board of Directors or the Compensation Committee thereof, to be granted an additional stock option under the Plan to purchase up to 25,000 shares of the Company’s common stock, with such vesting provisions and other terms as the Registrant’s Board of Directors or the Compensation Committee thereof shall approve. The Offer Letter further provides that (i) Mr. Vreeland’s employment may be terminated by the Registrant or by Mr. Vreeland at will at any time, and (ii) if Mr. Vreeland’s employment is terminated by the Registrant other than for cause, then Mr. Vreeland will be entitled to receive a payment of $50,000, less applicable withholdings, payable upon the effective date of such termination, where “for cause” is defined to mean any termination for: dishonesty; conviction of embezzlement, fraud or other conduct which would constitute a felony; willful unauthorized disclosure of confidential information; failure, neglect of or refusal to substantially perform the duties of employment; or any other act or omission which is a material breach of the Registrant’s policies regarding employment practices or applicable federal, state and local laws prohibiting discrimination or which is materially injurious to the financial condition or business reputation of the Registrant.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit No. |

|

Description |

|

99.1 |

|

Press Release issued by Clean Energy Fuels Corp. dated October 31, 2014 |

1

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: October 31, 2014 |

|

Clean Energy Fuels Corp. |

|

|

|

|

|

|

By: |

/s/ Andrew J. Littlefair |

|

|

|

Name: Andrew J. Littlefair |

|

|

|

Title: Chief Executive Officer |

2

Exhibit 99.1

Clean Energy Names Robert Vreeland as Chief Financial Officer

NEWPORT BEACH, CALIF. — October 31, 2014 — Clean Energy Fuels Corp. (NASDAQ: CLNE) announced today that Robert Vreeland has been appointed Chief Financial Officer effective immediately.

“Bob brings a wealth of financial planning, analytics and accounting experience to the position of CFO as well as having gained a deep knowledge of Clean Energy and the overall natural gas fueling industry over the last few years,” said Andrew J. Littlefair, President and CEO of Clean Energy. “I look forward to partnering with Bob as we keep Clean Energy on the path of continued strong growth with sound financial practices that are taking us closer to profitability.”

Mr. Vreeland served as Vice President of Finance and Accounting at Clean Energy from 2012 to 2014. Before joining Clean Energy, he was a consultant at RV CPA Services, PLLC, a provider of certified public accounting services. From January 1997 to May 2009, Mr. Vreeland held various finance and accounting positions at Hypercom, including Interim CFO; Senior Vice President and Corporate Controller; Senior Vice President, Operations; and Vice President of Financial Planning and Analysis. Prior to joining Hypercom, he spent twelve years at Coopers & Lybrand. Mr. Vreeland earned a B.S. from Northern Arizona University and is a certified public accountant.

Mr. Vreeland is replacing Richard Wheeler who served as Clean Energy’s CFO from 2002 to 2014. Mr. Wheeler resigned his position with Clean Energy effective November 3, 2014 and plans to pursue other interests.

“Rick has been a valuable part of Clean Energy’s rapid growth which has resulted in us becoming the leader in the country’s natural gas vehicle fuel market,” said Mr. Littlefair. “I will miss his sound financial counsel and his ability to make complex transactions seem simple. We wish Rick the very best.”

|

Media Contact: |

Investor Contact: |

|

Gary Foster |

Tony Kritzer |

|

949-437-1113 |

949-437-1403 |

|

gfoster@cleanenergyfuels.com |

tkritzer@cleanenergyfuels.com |

About Clean Energy Fuels Corp.

Clean Energy Fuels Corp. (Nasdaq: CLNE) is the leading provider of natural gas for transportation in North America. We build and operate compressed natural gas (CNG) and liquefied natural gas (LNG) fueling stations; manufacture CNG and LNG equipment and technologies for ourselves and other companies; develop renewable natural gas (RNG) production facilities; and deliver more CNG, LNG and Redeem RNG fuel than any other company in the U.S. For more information, visit www.cleanenergyfuels.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 that involve risks, uncertainties and assumptions, including without limitation statements about Clean Energy’s anticipated future growth and financial results and the integration and fit of newly hired personnel. Actual results and the timing of events could differ materially from those anticipated in these forward-looking statements as a result of several factors, including, without limitation, market acceptance and growth of natural gas as a vehicle fuel, prices of natural gas, general economic conditions and other factors that may affect the Clean Energy’s future performance and financial results, and the ability of new personnel to work efficiently and effectively with the Clean Energy’s management team. The forward-looking statements made herein speak only as of the date of this press release and, unless otherwise required by law, Clean Energy undertakes no obligation to publicly update such forward-looking statements to reflect subsequent events or circumstances. Additionally, the reports and other documents Clean Energy files with the Securities and Exchange Commission (available at www.sec.gov) describe risk factors that may cause actual results to differ materially from the forward-looking statements contained in this press release.

# # #

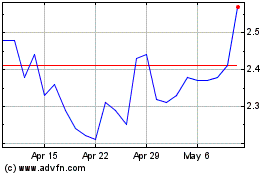

Clean Energy Fuels (NASDAQ:CLNE)

Historical Stock Chart

From Mar 2024 to Apr 2024

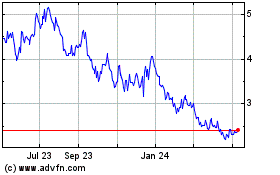

Clean Energy Fuels (NASDAQ:CLNE)

Historical Stock Chart

From Apr 2023 to Apr 2024