UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________

FORM 8-K

_____________________________

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 24, 2014

|

| | |

Commission File Number | Exact Name of Registrant as Specified in its Charter, State of Incorporation, Address of Principal Executive Offices and Telephone Number |

IRS Employer Identification No. |

1-11607 | DTE Energy Company (a Michigan corporation) One Energy Plaza Detroit, Michigan 48226-1279 313-235-4000 | 38-3217752 |

1-2198 | DTE Electric Company (a Michigan corporation) One Energy Plaza Detroit, Michigan 48226-1279 313-235-4000 | 38-0478650 |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02. Results of Operations and Financial Condition.

DTE Energy Company (DTE Energy) is furnishing the Securities and Exchange Commission (SEC) with its earnings release issued October 24, 2014, announcing financial results for the quarter ended September 30, 2014. Copies of the earnings release and the financial information distributed for media and investor relations communications are furnished as Exhibits 99.1 and 99.2 and incorporated herein by reference. In its earnings release and the slide presentation discussed below, DTE Energy increased its 2014 operating earnings guidance range from $4.20-4.40 to $4.28-$4.42 per share.

Item 7.01. Regulation FD Disclosure.

DTE Energy is furnishing the SEC with its slide presentation issued October 24, 2014. A copy of the slide presentation is furnished as Exhibit 99.3 and incorporated herein by reference.

In its earnings release, slide presentation and this filing, DTE Energy discusses 2014 operating earnings guidance. It is likely that certain items that impact the company’s 2014 reported results will be excluded from operating results. Reconciliations to the comparable 2014 reported earnings guidance are not provided because it is not possible to provide a reliable forecast of specific line items. These items may fluctuate significantly from period to period and may have a significant impact on reported earnings.

In accordance with General Instruction B.2 of Form 8-K, the information in this Current Report on Form 8-K, including Exhibits 99.1 and 99.2 and 99.3, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

99.1 Earnings Release of DTE Energy Company dated October 24, 2014.

| |

99.2 | Financial Information Distributed for Media and Investor Relations Communications dated October 24, 2014. |

99.3 Slide Presentation of DTE Energy Company dated October 24, 2014.

Forward-Looking Statements:

This Form 8-K contains forward-looking statements that are subject to various assumptions, risks and uncertainties. It should be read in conjunction with the “Forward-Looking Statements” section in DTE Energy's and DTE Electric Company's (“DTE Electric”) 2013 Forms 10-K and 2014 Forms 10-Q (which sections are incorporated by reference herein), and in conjunction with other SEC reports filed by DTE Energy and DTE Electric that discuss important factors that could cause DTE Energy's and DTE Electric's actual results to differ materially. DTE Energy and DTE Electric expressly disclaim any current intention to update any forward-looking statements contained in this report as a result of new information or future events or developments.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrants have duly caused this report to be signed on their behalf by the undersigned hereunto duly authorized.

Date: October 24, 2014

DTE ENERGY COMPANY

(Registrant)

/s/PETER B. OLEKSIAK

Peter B. Oleksiak

Senior Vice President and Chief Financial Officer

DTE ELECTRIC COMPANY

(Registrant)

/s/PETER B. OLEKSIAK

Peter B. Oleksiak

Senior Vice President and Chief Financial Officer

EXHIBIT INDEX

Exhibit

Number Description

| |

99.1 | Earnings Release of DTE Energy Company dated October 24, 2014. |

| |

99.2 | Financial Information Distributed for Media and Investor Relations Communications dated October 24, 2014. |

| |

99.3 | Slide Presentation of DTE Energy Company dated October 24, 2014. |

EXHIBIT 99.1

October 24, 2014

DTE Energy reports third quarter 2014 results, increases guidance

DETROIT - DTE Energy (NYSE:DTE) today reported third quarter 2014 earnings of $156 million, or $0.88 per diluted share, compared with $198 million, or $1.13 per diluted share in 2013.

Operating earnings for the third quarter 2014 were $181 million, or $1.02 per diluted share, compared with 2013 operating earnings of $198 million, or $1.13 per diluted share. Operating earnings exclude non-recurring items, certain mark-to-market adjustments and discontinued operations. Reconciliations of reported earnings to operating earnings are at the end of this news release.

Reported earnings for the first nine months ended September 30, 2014 were $606 million or $3.42 per diluted share versus $537 million or $3.07 per diluted share in 2013. Year-to-date operating earnings were $609 million or $3.44 per diluted share, compared with $541 million or $3.09 per diluted share in 2013.

“We are on track to achieve our financial and operational goals for 2014” said Gerard M. Anderson, DTE Energy chairman and CEO. “In September, we learned that J.D. Power ranked DTE Energy ‘Highest in Customer Satisfaction With Residential Natural Gas Service in the Midwest Among Large Utilities.1’ We are gratified that our customers recognized us in this study, and we remain committed to our focus on improving customer satisfaction.”

“In our electric business, for the third year in a row, we experienced double the normal number of days with wind speeds above 40 MPH. This resulted in significant stress on our system - including the 4th largest storm outage event in our company’s history.” Anderson continued, “We intend to invest significantly to strengthen, harden and automate our system to address these trends and speed the restoration process for our customers.”

Noting that corporate citizenship is a factor in overall customer satisfaction, Anderson added that the company released a new Corporate Citizenship report in September. “The document summarizes DTE’s successes, challenges and progress in its aspiration to be a force for growth and prosperity in the communities where we live and serve. I am proud of the DTE employees who are working to make a difference in many aspects of our customers’ lives, both by the way we conduct our daily business and by participating in a broad range of civic organizations and community activities,” stated Anderson.

Also during the third quarter of 2014, DTE Energy’s Echo Wind Park began commercial operation. “DTE Energy is committed to provide 10 percent of its customers’ electricity needs from renewable energy sources by the end of 2015. The commissioning of Echo Wind Park brings us close to our goal with a renewable energy portfolio that is now 9.6 percent,” stated Anderson. “We expect renewables and natural gas to play a substantially expanded role in future electricity production. Recently proposed EPA carbon regulations would lead to replacement of a large portion of DTE’s coal generation plants over the next decade.” Anderson noted that DTE Energy is working with the EPA to achieve significant environmental progress while also ensuring that the state’s electric supply remains reliable and affordable.

Outlook for 2014

DTE Energy narrowed and increased its 2014 operating earnings guidance to $4.28 to $4.42 from $4.20 to $4.40 per diluted share.

“We are on solid financial footing after nine months of the year, despite third quarter weather that included cool temperatures and a challenging number of severe storms,” said Peter Oleksiak, DTE Energy senior vice president and CFO. “We are confident in raising operating earnings guidance from a mid-point of

$4.30 to $4.35 for 2014. Looking beyond 2014, we expect our corporate focus on continuous improvement in all aspects of our business to provide the platform upon which we will achieve future financial objectives.”

This earnings announcement, as well as a package of slides and supplemental information, is available at www.dteenergy.com/investors.

DTE Energy plans to conduct a conference call with the investment community hosted by Oleksiak at 9:00 a.m. ET today, to discuss third quarter 2014 earnings results. Investors, the news media and the public may listen to a live internet broadcast of the call at www.dteenergy.com/investors. The telephone dial-in numbers are US and Canada toll free: (888) 778-8913 or International toll: (913) 312-1466. The passcode is 8660012. The internet broadcast will be archived on the company’s website. An audio replay of the call will be available from noon today to November 7. To access the replay, dial US and Canada toll free (888) 203-1112 or International toll (719) 457-0820 and enter passcode 5950191.

DTE Energy (NYSE:DTE) is a Detroit-based diversified energy company involved in the development and management of energy-related businesses and services nationwide. Its operating units include an electric utility serving 2.1 million customers in Southeastern Michigan and a natural gas utility serving 1.2 million customers in Michigan. The DTE Energy portfolio also includes non-utility energy businesses focused on power and industrial projects, natural gas pipelines, gathering and storage, and energy marketing and trading. Information about DTE Energy is available at dteenergy.com, twitter.com/dte_energy and facebook.com/dteenergy.

1Disclaimer: DTE Energy received the highest numerical score among large utilities in the Midwestern U.S. in the proprietary J.D. Power 2014 Gas Utility Residential Customer Satisfaction Study.SM Study based on 69,806 online interviews ranking 17 providers in the Midwestern U.S. (CO, IL, IN, IA, KS, KY, MI, MN, MO, NB, OH, WI). Proprietary study results are based on experiences and perceptions of consumers surveyed September 2013-July 2014. Your experiences may vary. Visit jdpower.com.

Use of Operating Earnings Information - DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors.

In this release, DTE Energy discusses 2014 operating earnings guidance. It is likely that certain items that impact the company's 2014 reported results will be excluded from operating results. Reconciliations to the comparable 2014 reported earnings guidance are not provided because it is not possible to provide a reliable forecast of specific line items. These items may fluctuate significantly from period to period and may have a significant impact on reported earnings.

The information contained herein is as of the date of this release. DTE Energy expressly disclaims any current intention to update any forward-looking statements contained in this release as a result of new information or future events or developments. Words such as “anticipate,” “believe,” “expect,” “projected,” “aspiration” and “goals” signify forward-looking statements. Forward-looking statements are not guarantees of future results and conditions but rather are subject to various assumptions, risks and uncertainties. This release contains forward-looking statements about DTE Energy’s financial results and estimates of future prospects, and actual results may differ materially.

Many factors may impact forward-looking statements including, but not limited to, the following: impact of regulation by the FERC, MPSC, NRC, CFTC and other applicable governmental proceedings and regulations, including any associated impact on rate structures; the amount and timing of cost recovery allowed as a result of regulatory proceedings, related appeals or new legislation, including legislative amendments and Customer Choice programs; economic conditions and population changes in our geographic area resulting in changes in demand, customer conservation and increased thefts of electricity and natural gas; environmental issues, laws, regulations, and the increased costs of remediation and compliance, including actual and potential new federal and state requirements; health, safety, financial, environmental and regulatory risks associated with ownership and operation of nuclear facilities; changes in the cost and availability of coal and other raw materials, purchased power and natural gas; the potential for losses on investments, including nuclear decommissioning and benefit plan assets and the related increases in future expense and contributions; volatility in the short-term natural gas storage markets impacting third-party storage revenues; volatility in commodity markets, deviations in weather and related risks impacting the results of our energy trading operations; access to capital markets and the results of other financing efforts which can be affected by credit agency ratings; instability in capital markets which could impact availability of short and long-term financing; the timing and extent of changes in interest rates; the level of borrowings the potential for increased costs or delays in completion of significant construction projects; changes in and application of federal, state and local tax laws and their interpretations, including the Internal Revenue Code, regulations, rulings, court proceedings and audits; the effects of weather and other natural phenomena on operations and sales to customers, and purchases from suppliers; unplanned outages; the cost of protecting assets against, or damage due to, terrorism or cyber attacks; employee relations and the impact of collective bargaining agreements; the availability, cost, coverage and terms of insurance and stability of insurance providers; cost reduction efforts and the maximization of plant and distribution system performance; the effects of competition; changes in and application of accounting standards and financial reporting regulations; changes in federal or state laws and their interpretation with respect to regulation, energy policy and other business issues; contract disputes, binding arbitration, litigation and related appeals; and the risks discussed in our public filings with the Securities and Exchange Commission. New factors emerge from time to time. We cannot predict what factors may arise

or how such factors may cause our results to differ materially from those contained in any forward-looking statement. Any forward-looking statements speak only as of the date on which such statements are made. We undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. This release should also be read in conjunction with the “Forward-Looking Statements” sections in each of DTE Energy’s and DTE Electric’s 2013 Forms 10-K and 2014 Forms 10-Q (which sections are incorporated herein by reference), and in conjunction with other SEC reports filed by DTE Energy and DTE Electric.

# # #

For further information, members of the media may call:

Scott Simons (313) 235-8808

Alejandro Bodipo-Memba (313) 235-3202

Analysts, for further information call:

Anastasia Minor (313) 235-8466

Joyce Leslie (313) 235-3209

|

| | | | | | | | | | | | | | | |

DTE Energy Company | | | | |

Consolidated Statements of Operations (Unaudited) | | | | |

|

| Three Months Ended | | Nine Months Ended |

| September 30, | | September 30, |

| 2014 | | 2013 | | 2014 | | 2013 |

| (In millions, except per share amounts) |

Operating Revenues | $ | 2,595 |

| | $ | 2,387 |

| | $ | 9,223 |

| | $ | 7,128 |

|

| | | | | | | |

Operating Expenses | | | | | |

| | |

|

Fuel, purchased power and gas | 1,119 |

| | 967 |

| | 4,550 |

| | 2,931 |

|

Operation and maintenance | 860 |

| | 728 |

| | 2,512 |

| | 2,168 |

|

Depreciation, depletion and amortization | 293 |

| | 284 |

| | 855 |

| | 811 |

|

Taxes other than income | 86 |

| | 84 |

| | 268 |

| | 262 |

|

Asset (gains) and losses, reserves and impairments, net | (2 | ) | | (5 | ) | | (10 | ) | | (6 | ) |

| 2,356 |

| | 2,058 |

| | 8,175 |

| | 6,166 |

|

Operating Income | 239 |

| | 329 |

| | 1,048 |

| | 962 |

|

| | | | | | | |

Other (Income) and Deductions | |

| | | | |

| | |

|

Interest expense | 107 |

| | 106 |

| | 323 |

| | 327 |

|

Interest income | (2 | ) | | (2 | ) | | (7 | ) | | (7 | ) |

Other income | (55 | ) | | (58 | ) | | (136 | ) | | (148 | ) |

Other expenses | 11 |

| | 7 |

| | 29 |

| | 23 |

|

| 61 |

| | 53 |

| | 209 |

| | 195 |

|

Income Before Income Taxes | 178 |

| | 276 |

| | 839 |

| | 767 |

|

| | | | | | | |

Income Tax Expense | 21 |

| | 76 |

| | 229 |

| | 225 |

|

| | | | | | | |

Net Income | 157 |

| | 200 |

| | 610 |

| | 542 |

|

| | | | | | | |

Less: Net Income Attributable to Noncontrolling Interest | 1 |

| | 2 |

| | 4 |

| | 5 |

|

| | | | | | | |

Net Income Attributable to DTE Energy Company | $ | 156 |

| | $ | 198 |

| | $ | 606 |

| | $ | 537 |

|

| | | | | | | |

Basic Earnings per Common Share | | | | | | | |

Net Income Attributable to DTE Energy Company | $ | 0.88 |

| | $ | 1.13 |

| | $ | 3.42 |

| | $ | 3.07 |

|

| | | | | | | |

Diluted Earnings per Common Share | | | | | | | |

Net Income Attributable to DTE Energy Company | $ | 0.88 |

| | $ | 1.13 |

| | $ | 3.42 |

| | $ | 3.07 |

|

| | | | | | | |

Weighted Average Common Shares Outstanding | | | | | |

| | |

|

Basic | 177 |

| | 175 |

| | 177 |

| | 174 |

|

Diluted | 177 |

| | 176 |

| | 177 |

| | 175 |

|

Dividends Declared per Common Share | $ | 0.69 |

| | $ | 0.66 |

| | $ | 2.00 |

| | $ | 1.93 |

|

| | | | | | | |

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

DTE Energy Company |

Segment Net Income (Unaudited) |

|

| Three Months Ended September 30, |

| 2014 | | 2013 |

(in Millions) | Reported

Earnings | | Adjustments | | Operating

Earnings | | Reported

Earnings | | Adjustments | | Operating

Earnings |

| | | | | | | | | | | | | |

DTE Electric | $ | 135 |

| | $ | — |

| | | $ | 135 |

| | $ | 179 |

| | $ | — |

| | | $ | 179 |

|

| | | | | | | | | | | | | |

DTE Gas | (16 | ) | | — |

| | | (16 | ) | | (13 | ) | | — |

| | | (13 | ) |

| | | | | | | | | | | | | |

Non-utility Operations | | | | | | | | | | | | | |

Gas Storage and Pipelines | 20 |

| | — |

| | | 20 |

| | 16 |

| | — |

| | | 16 |

|

| | | | | | | | | | | | | |

Power and Industrial Projects | 38 |

| | — |

| | | 38 |

| | 27 |

| | — |

| | | 27 |

|

| | | | | | | | | | | | | |

Energy Trading | (22 | ) | | 25 |

| A | | 3 |

| | (6 | ) | | — |

| | | (6 | ) |

|

|

| | | | | | | | | | | | |

Total Non-utility operations | 36 |

| | 25 |

| | | 61 |

| | 37 |

| | — |

| | | 37 |

|

|

|

| | | | | | | | | | | | |

Corporate and Other | 1 |

| | — |

| | | 1 |

| | (5 | ) | | — |

| | | (5 | ) |

|

|

| | | | | | | | | | | | |

Net Income Attributable to DTE Energy Company | $ | 156 |

| | $ | 25 |

| | | $ | 181 |

| | $ | 198 |

| | $ | — |

| | | $ | 198 |

|

| | | | | | | | | | | | | |

|

Adjustments key |

A) Energy Trading accounting timing of mark to market adjustment |

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

DTE Energy Company |

Segment Diluted Earnings Per Share (Unaudited) |

| |

| Three Months Ended September 30, |

| 2014 | | 2013 |

| Reported

Earnings | | Adjustments | | Operating

Earnings | | Reported

Earnings | | Adjustments | | Operating

Earnings |

| | | | | | | | | | | | | |

DTE Electric | $ | 0.76 |

| | $ | — |

| | | $ | 0.76 |

| | $ | 1.02 |

| | $ | — |

| | | $ | 1.02 |

|

| | | | | | | | | | | | | |

DTE Gas | (0.09 | ) | | — |

| | | (0.09 | ) | | (0.07 | ) | | — |

| | | (0.07 | ) |

| | | | | | | | | | | | | |

Non-utility Operations | | | | | | | | | | | | | |

Gas Storage and Pipelines | 0.11 |

| | — |

| | | 0.11 |

| | 0.09 |

| | — |

| | | 0.09 |

|

| | | | | | | | | | | | | |

Power and Industrial Projects | 0.21 |

| | — |

| | | 0.21 |

| | 0.15 |

| | — |

| | | 0.15 |

|

| | | | | | | | | | | | | |

Energy Trading | (0.12 | ) | | 0.14 |

| A | | 0.02 |

| | (0.03 | ) | | — |

| | | (0.03 | ) |

| | | | | | | | | | | | | |

Total Non-utility operations | 0.20 |

| | 0.14 |

| | | 0.34 |

| | 0.21 |

| | — |

| | | 0.21 |

|

| | | | | | | | | | | | | |

Corporate and Other | 0.01 |

| | — |

| | | 0.01 |

| | (0.03 | ) | | — |

| | | (0.03 | ) |

| | | | | | | | | | | | | |

Net Income Attributable to DTE Energy Company | $ | 0.88 |

| | $ | 0.14 |

| | | $ | 1.02 |

| | $ | 1.13 |

| | $ | — |

| | | $ | 1.13 |

|

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Adjustments key | |

A) Energy Trading accounting timing of mark to market adjustment | |

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

DTE Energy Company |

Segment Net Income (Unaudited) |

|

| Nine Months Ended September 30, |

| 2014 | | 2013 |

(in Millions) | Reported

Earnings | | Adjustments | | Operating

Earnings | | Reported

Earnings | | Adjustments | | Operating

Earnings |

| | | | | | | | | | | | | |

DTE Electric | $ | 400 |

| | $ | — |

| | | $ | 400 |

| | $ | 383 |

| | $ | — |

| | | $ | 383 |

|

| | | | | | | | | | | | | |

DTE Gas | 109 |

| | — |

| | | 109 |

| | 91 |

| | — |

| | | 91 |

|

| | | | | | | | | | | | | |

Non-utility Operations | | | | | | | | | | | | | |

Gas Storage and Pipelines | 59 |

| | — |

| | | 59 |

| | 49 |

| | — |

| | | 49 |

|

| | | | | | | | | | | | | |

Power and Industrial Projects | 66 |

| | — |

| | | 66 |

| | 46 |

| | 4 |

| C | | 50 |

|

| | | | | | | | | | | | | |

Energy Trading | 6 |

| | (5 | ) | A | | 1 |

| | (1 | ) | | — |

| | | (1 | ) |

| | | | | | | | | | | | | |

Total Non-utility operations | 131 |

| | (5 | ) | | | 126 |

| | 94 |

| | 4 |

| | | 98 |

|

| | | | | | | | | | | | | |

Corporate and Other | (34 | ) | | 8 |

| B | | (26 | ) | | (31 | ) | | — |

| | | (31 | ) |

| | | | | | | | | | | | | |

Net Income Attributable to DTE Energy Company | $ | 606 |

| | $ | 3 |

| | | $ | 609 |

| | $ | 537 |

| | $ | 4 |

| | | $ | 541 |

|

| | | | | | | | | | | | | |

|

Adjustments key |

A) Energy Trading accounting timing of mark to market adjustment |

B) New York state tax law change |

C) Asset impairment |

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

DTE Energy Company |

Segment Diluted Earnings Per Share (Unaudited) |

| |

| Nine Months Ended September 30, |

| 2014 | | 2013 |

| Reported

Earnings | | Adjustments | | Operating

Earnings | | Reported

Earnings | | Adjustments | | Operating

Earnings |

| | | | | | | | | | | | | |

DTE Electric | $ | 2.26 |

| | $ | — |

| | | $ | 2.26 |

| | $ | 2.19 |

| | $ | — |

| | | $ | 2.19 |

|

| | | | | | | | | | | | | |

DTE Gas | 0.62 |

| | — |

| | | 0.62 |

| | 0.52 |

| | — |

| | | 0.52 |

|

| | | | | | | | | | | | | |

Non-utility Operations | | | | | | | | | | | | | |

Gas Storage and Pipelines | 0.33 |

| | — |

| | | 0.33 |

| | 0.28 |

| | — |

| | | 0.28 |

|

| | | | | | | | | | | | | |

Power and Industrial Projects | 0.37 |

| | — |

| | | 0.37 |

| | 0.27 |

| | 0.02 |

| C | | 0.29 |

|

| | | | | | | | | | | | | |

Energy Trading | 0.03 |

| | (0.02 | ) | A | | 0.01 |

| | (0.01 | ) | | — |

| | | (0.01 | ) |

| | | | | | | | | | | | | |

Total Non-utility operations | 0.73 |

| | (0.02 | ) | | | 0.71 |

| | 0.54 |

| | 0.02 |

| | | 0.56 |

|

| | | | | | | | | | | | | |

Corporate and Other | (0.19 | ) | | 0.04 |

| B | | (0.15 | ) | | (0.18 | ) | | — |

| | | (0.18 | ) |

| | | | | | | | | | | | | |

Net Income Attributable to DTE Energy Company | $ | 3.42 |

| | $ | 0.02 |

| | | $ | 3.44 |

| | $ | 3.07 |

| | $ | 0.02 |

| | | $ | 3.09 |

|

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Adjustments key | |

A) Energy Trading accounting timing of mark to market adjustment | |

B) New York state tax law change | |

C) Asset impairment | |

DTE Energy Debt/Equity Calculation

As of September 30, 2014

($ millions)

|

| | | |

Short-term borrowings | $ | 653 |

|

Current portion of long-term debt, including capital leases | 274 |

|

Mortgage bonds, notes and other | 7,426 |

|

Capital lease obligations | 3 |

|

Other adjustments | 48 |

|

less Securitization bonds, including current portion | (105 | ) |

50% Junior Subordinated Debentures | 240 |

|

Total debt | 8,539 |

|

| |

50% Junior Subordinated Debentures | 240 |

|

Common equity | 8,186 |

|

Total adjusted equity | 8,426 |

|

| |

Total capitalization | $ | 16,965 |

|

| |

Debt | 50.3 | % |

Adjusted equity | 49.7 | % |

| |

Total | 100 | % |

|

| | | | | | | | | | | | | | | | | | | | |

Sales Analysis - 3Q 2014 |

| | |

Electric Sales - DTE Electric Service Area (GWh) | | Electric Billings - DTE Electric Service Area (000s) |

| | | | | | | | | | | | |

| 3Q 2014 | | 3Q 2013 | | % Change | | | 3Q 2014 | | 3Q 2013 | | % Change |

Residential | 3,932 |

| | 4,401 |

| | (11 | )% | | Residential | $ | 574,555 |

| | $ | 672,902 |

| | (15 | )% |

Commercial | 4,541 |

| | 4,504 |

| | 1 | % | | Commercial | 473,190 |

| | 508,522 |

| | (7 | )% |

Industrial | 2,710 |

| | 2,635 |

| | 3 | % | | Industrial | 195,796 |

| | 203,606 |

| | (4 | )% |

Other | 62 |

| | 233 |

| | (73 | )% | | Other | 13,891 |

| | 27,685 |

| | (50 | )% |

| 11,245 |

| | 11,773 |

| | (4 | )% | | | $ | 1,257,432 |

| | $ | 1,412,715 |

| | (11 | )% |

Choice | 1,334 |

| | 1,393 |

| | (4 | )% | | Choice | 23,846 |

| | 25,789 |

| | (8 | )% |

TOTAL SALES | 12,579 |

| | 13,166 |

| | (4 | )% | | TOTAL BILLINGS | $ | 1,281,278 |

| | $ | 1,438,504 |

| | (11 | )% |

|

| | | | | | | | | | | | | | | | | | | | |

Gas Sales - DTE Gas Service Area (MMcf) | | Gas Billings - DTE Gas Service Area (000s) |

| | | | | | | | | | | | |

| 3Q 2014 | | 3Q 2013 | | % Change | | | 3Q 2014 | | 3Q 2013 | | % Change |

Residential | 7,646 |

| | 8,671 |

| | (12 | )% | | Residential | $ | 89,088 |

| | $ | 86,918 |

| | 2 | % |

Commercial | 1,581 |

| | 1,297 |

| | 22 | % | | Commercial | 17,988 |

| | 14,625 |

| | 23 | % |

Industrial | 56 |

| | 113 |

| | (50 | )% | | Industrial | 466 |

| | 817 |

| | (43 | )% |

| 9,283 |

| | 10,081 |

| | (8 | )% | | | $ | 107,542 |

| | $ | 102,360 |

| | 5 | % |

End User Transportation* | 27,575 |

| | 23,924 |

| | 15 | % | | End User Transportation* | 32,192 |

| | 31,865 |

| | 1 | % |

TOTAL SALES | 36,858 |

| | 34,005 |

| | 8 | % | | TOTAL BILLINGS | $ | 139,734 |

| | $ | 134,225 |

| | 4 | % |

________________ | | | | | | | ________________ | | | | | |

* Includes choice customers | | | | | | | * Includes choice customers | | | | | |

|

| | | | | | | | | | | | | | | | | | |

Weather |

| | | | | | | | | | | | |

Cooling Degree Days | | | | | | | Heating Degree Days | | | | | |

DTE Electric service territory | | | | | | | DTE Gas service territory | | | | | |

| 3Q 2014 | | 3Q 2013 | | % Change | | | 3Q 2014 | | 3Q 2013 | | % Change |

Actuals** | 408 |

| | 583 |

| | (30 | )% | | Actuals | 159 |

| | 143 |

| | 11 | % |

Normal | 580 |

| | 580 |

| | — | % | | Normal | 130 |

| | 122 |

| | 7 | % |

Deviation from normal | (30 | )% | | 1 | % | | | | Deviation from normal | 22 | % | | 17 | % | | |

|

| | | | | | | | |

Earnings Impact of Weather | |

Variance from normal weather ($ millions, after-tax) | |

| 3Q 2014 | | 3Q 2013 | |

DTE Electric | $ | (33 | ) | | $ | — |

| |

DTE Gas | 1 |

| | 1 |

| |

|

| | | | | | | | | | | | | | | | | | | | |

Sales Analysis - YTD September 30, 2014 |

| | |

Electric Sales - DTE Electric Service Area (GWh) | | Electric Billings - DTE Electric Service Area (000s) |

| | | | | | | | | | | | |

| YTD 2014 | | YTD 2013 | | % Change | | | YTD 2014 | | YTD 2013 | | % Change |

Residential | 11,362 |

| | 11,600 |

| | (2 | )% | | Residential | $ | 1,653,392 |

| | $ | 1,784,071 |

| | (7 | )% |

Commercial | 12,757 |

| | 12,585 |

| | 1 | % | | Commercial | 1,338,593 |

| | 1,427,270 |

| | (6 | )% |

Industrial | 7,765 |

| | 7,746 |

| | — | % | | Industrial | 587,350 |

| | 600,844 |

| | (2 | )% |

Other | 438 |

| | 701 |

| | (38 | )% | | Other | 59,647 |

| | 81,019 |

| | (26 | )% |

| 32,322 |

| | 32,632 |

| | (1 | )% | | | $ | 3,638,982 |

| | $ | 3,893,204 |

| | (7 | )% |

Choice | 3,838 |

| | 3,940 |

| | (3 | )% | | Choice | 70,344 |

| | 73,031 |

| | (4 | )% |

TOTAL SALES | 36,160 |

| | 36,572 |

| | (1 | )% | | TOTAL BILLINGS | $ | 3,709,326 |

| | $ | 3,966,235 |

| | (6 | )% |

|

| | | | | | | | | | | | | | | | | | | | |

Gas Sales - DTE Gas Service Area (MMcf) | | Gas Billings - DTE Gas Service Area (000s) |

| | | | | | | | | | | | |

| YTD 2014 | | YTD 2013 | | % Change | | | YTD 2014 | | YTD 2013 | | % Change |

Residential | 76,663 |

| | 68,420 |

| | 12 | % | | Residential | $ | 654,251 |

| | $ | 594,449 |

| | 10 | % |

Commercial | 18,031 |

| | 14,980 |

| | 20 | % | | Commercial | 148,735 |

| | 127,767 |

| | 16 | % |

Industrial | 676 |

| | 415 |

| | 63 | % | | Industrial | 7,555 |

| | 3,092 |

| | 144 | % |

| 95,370 |

| | 83,815 |

| | 14 | % | | | $ | 810,541 |

| | $ | 725,308 |

| | 12 | % |

End User Transportation* | 121,561 |

| | 111,531 |

| | 9 | % | | End User Transportation* | 172,348 |

| | 161,663 |

| | 7 | % |

TOTAL SALES | 216,931 |

| | 195,346 |

| | 11 | % | | TOTAL BILLINGS | $ | 982,889 |

| | $ | 886,971 |

| | 11 | % |

________________ | | | | | | | ________________ | | | | | |

* Includes choice customers | | | | | | | * Includes choice customers | | | | | |

|

| | | | | | | | | | | | | | | | | | |

Weather |

| | | | | | | | | | | | |

Cooling Degree Days | | | | | | | Heating Degree Days | | | | | |

DTE Electric service territory | | | | | | | DTE Gas service territory | | | | | |

| YTD 2014 | | YTD 2013 | | % Change | | | YTD 2014 | | YTD 2013 | | % Change |

Actuals | 648 |

| | 846 |

| | (23 | )% | | Actuals | 4,916 |

| | 4,189 |

| | 17 | % |

Normal | 795 |

| | 795 |

| | — | % | | Normal | 4,079 |

| | 4,020 |

| | 1 | % |

Deviation from normal | (18 | )% | | 6 | % | | | | Deviation from normal | 21 | % | | 4 | % | | |

|

| | | | | | | | |

Earnings Impact of Weather | |

Variance from normal weather ($ millions, after-tax) | |

| YTD 2014 | | YTD 2013 | |

DTE Electric | $ | (17 | ) | | $ | (1 | ) | |

DTE Gas | 32 |

| | 8 |

| |

|

| | | | | | | | |

DTE Electric Weather Normal Sales* Analysis - YTD September 30, 2014 |

|

Weather Normal Electric Sales - DTE Electric Service Area (GWh) |

| | | | | |

| YTD 2014 | | YTD 2013 | | % Change |

Residential | 11,558 |

| | 11,666 |

| | (1 | )% |

Commercial | 12,807 |

| | 12,610 |

| | 2 | % |

Industrial | 7,792 |

| | 7,747 |

| | 1 | % |

Other | 439 |

| | 702 |

| | (37 | )% |

| 32,596 |

| | 32,725 |

| | (1 | )% |

Choice | 3,848 |

| | 3,943 |

| | (2 | )% |

TOTAL SALES | 36,444 |

| | 36,668 |

| | (1 | )% |

|

| | | | | | | | |

Weather Normal Electric Sales - DTE Electric Service Area (Includes Electric Choice) (GWh) |

| | | | | |

| YTD 2014 | | YTD 2013 | | % Change |

Residential | 11,558 |

| | 11,666 |

| | (1 | )% |

Commercial | 15,117 |

| | 14,945 |

| | 1 | % |

Industrial | 9,330 |

| | 9,355 |

| | — | % |

Other | 439 |

| | 702 |

| | (37 | )% |

TOTAL SALES | 36,444 |

| | 36,668 |

| | (1 | )% |

* Includes adjustments for temperature normalization and, beginning in 2014, customer

outages due to weather

3rd Quarter 2014 Earnings Conference Call October 24, 2014

Safe Harbor Statement 2 The information contained herein is as of the date of this presentation. Many factors may impact forward-looking statements including, but not limited to, the following: impact of regulation by the FERC, MPSC, NRC, CFTC and other applicable governmental proceedings and regulations, including any associated impact on rate structures; the amount and timing of cost recovery allowed as a result of regulatory proceedings, related appeals or new legislation, including legislative amendments and Customer Choice programs; economic conditions and population changes in our geographic area resulting in changes in demand, customer conservation and increased thefts of electricity and natural gas; environmental issues, laws, regulations, and the increased costs of remediation and compliance, including actual and potential new federal and state requirements; health, safety, financial, environmental and regulatory risks associated with ownership and operation of nuclear facilities; changes in the cost and availability of coal and other raw materials, purchased power and natural gas; the potential for losses on investments, including nuclear decommissioning and benefit plan assets and the related increases in future expense and contributions; volatility in the short-term natural gas storage markets impacting third-party storage revenues; volatility in commodity markets; deviations in weather and related risks impacting the results of our energy trading operations; access to capital markets and the results of other financing efforts which can be affected by credit agency ratings; instability in capital markets which could impact availability of short and long-term financing; the timing and extent of changes in interest rates; the level of borrowings; the potential for increased costs or delays in completion of significant construction projects; changes in and application of federal, state and local tax laws and their interpretations, including the Internal Revenue Code, regulations, rulings, court proceedings and audits; the effects of weather and other natural phenomena on operations and sales to customers, and purchases from suppliers; unplanned outages; the cost of protecting assets against, or damage due to, terrorism or cyber attacks; employee relations and the impact of collective bargaining agreements; the availability, cost, coverage and terms of insurance and stability of insurance providers; cost reduction efforts and the maximization of plant and distribution system performance; the effects of competition; changes in and application of accounting standards and financial reporting regulations; changes in federal or state laws and their interpretation with respect to regulation, energy policy and other business issues; contract disputes; binding arbitration, litigation and related appeals; and the risks discussed in our public filings with the Securities and Exchange Commission. New factors emerge from time to time. We cannot predict what factors may arise or how such factors may cause our results to differ materially from those contained in any forward-looking statement. Any forward-looking statements speak only as of the date on which such statements are made. We undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. This presentation should also be read in conjunction with the “Forward-Looking Statements” sections in each of DTE Energy’s and DTE Electric’s 2013 Forms 10-K and 2014 Forms 10-Q (which sections are incorporated herein by reference), and in conjunction with other SEC reports filed by DTE Energy and DTE Electric.

Participants • Peter Oleksiak – Senior Vice President and CFO • Jeff Jewell – Vice President and Controller • Mark Rolling – Vice President and Treasurer • Anastasia Minor – Executive Director, Investor Relations 3

• Overview • Third Quarter 2014 Earnings Results • Cash Flow and Balance Sheet Metrics • Summary 4

Our business strategy is fundamental to how we create value for our investors Utility growth plan driven by infrastructure investments Strategic, transparent, low-risk growth opportunities in non-utility businesses provide diversity in earnings and geography Constructive regulatory structure and continued cost savings enable utilities to earn their authorized returns Operational excellence and customer satisfaction that are distinctive in our industry 60% – 70% dividend payout target and strong BBB credit rating 5% - 6% Annual EPS Growth Attractive Dividend Strong Balance Sheet 5

New electric cost of service rates related to Michigan PA169 filed Electric generation RFP submittals complete and in final negotiations Open season initiated by Vector Pipeline for potential expansion Successful open season for NEXUS capacity; FERC pre-filing on track for year end We achieved several important milestones with key projects during 3Q 2014 6

Michigan economy continues to improve Michigan most improved Pro-Business state AMERICAN ECONOMIC DEVELOPMENT INSTITUTE with Pollina Corp. Real Estate Michigan leads nation in manufacturing job growth Top 10 Competitive States of 2013 Rank State 1 Georgia 2 Tennessee 3 Texas 4 Louisiana 5 North Carolina 6 Michigan 2013 7 South Carolina 8 Kentucky Michigan 2012 rank #8 9 Utah 10 South Carolina Michigan 2011 rank #16 Michigan is moving up in ranking of competitive states… …and continues to receive positive recognition 7

2008A 2009A 2010A 2011A 2012A 2013A 2014E 2015E 2016E 2017E 2018E $3.33 $4.09 $3.75 $3.64 $2.12 $2.24 $2.35 $2.48 $2.12 * Reconciliation to GAAP reported earnings included in the appendix We remain committed to delivering on our growth targets, and we have increased our 2014 operating EPS* guidance midpoint to $4.35 (dollars) Operating EPS* 7.4% CAGR 2008-2014 Dividend per share 5.4% CAGR 2009-2014 (Annualized) $2.83 $3.94 $4.35 Guidance Midpoint Aspiration of over $1 billion in operating earnings* by 2018 $2.62 8 $2.76 $4.30

• Overview • Third Quarter 2014 Earnings Results • Cash Flow and Balance Sheet Metrics • Summary 9

3Q 2013 3Q 2014 Change DTE Electric 179$ 135$ (44)$ DTE Gas (13) (16) (3) Gas Storage & Pipelines 16 20 4 Power & Industrial Projects 27 38 11 Corporate & Other (5) 1 6 Growth segments** 204$ 178$ (26)$ Growth segments operating EPS 1.16$ 1.00$ (0.16)$ Energy Trading (6)$ 3$ 9$ DTE Energy 198$ 181$ (17)$ Operating EPS 1.13$ 1.02$ (0.11)$ Avg. Shares Outstanding 175 177 DTE Energy Third Quarter 2014 Operating Earnings* Variance Operating Earnings* (millions, except EPS) DTE Electric • Cooler weather and higher storm expense, partially offset by O&M lean initiatives DTE Gas • Higher O&M expense related to reinvestment Non-Utility • Gas Storage & Pipelines driven by higher pipeline and gathering earnings, partially offset by pipeline investment accounting change • Power & Industrial Projects higher due to Renewables and Reduced Emissions Fuel earnings Corporate & Other • Timing Energy Trading • Improved power portfolio performance Drivers 10 * Reconciliation to GAAP reported earnings included in the appendix ** Total DTE Energy excluding Energy Trading

DTE Electric Variance Analysis * Reconciliation to GAAP reported earnings included in the appendix (millions) • Cooler weather in 3Q 2014 Variance to normal weather - 3Q 2013: $0 - 3Q 2014: ($33) • Higher storm expenses • Lean and reinvestment - 3Q 2013: reinvestment $5 - 3Q 2014: lean initiatives $7 11 Drivers Operating Earnings* Variance $179 ($33) ($20) $135 ($3) $12

DTE Electric $400 $520 - $530 $505 - $515 DTE Gas 109 120 - 126 134 - 139 Gas Storage & Pipelines 59 78 - 86 80 Power & Industrial Projects 66 75 - 85 90 - 95 Corporate & Other (26) (49) - (45) (49) - (45) Growth segments** $608 $744 - $782 $760 - $784 Growth segments operating EPS $3.44 $4.20 - $4.40 $4.28 - $4.42 Energy Trading $1 $0 $0 DTE Energy $609 $744 - $782 $760 - $784 Operating EPS $3.44 $4.20 - $4.40 $4.28 - $4.42 Avg. Shares Outstanding 177 177 177 We are increasing and narrowing our 2014 operating earnings* guidance, supported by strength in DTE Gas and Power & Industrial Projects (millions, except EPS) Prior Guidance Revised Guidance * Reconciliation to GAAP reported earnings included in the appendix ** Total DTE Energy excluding Energy Trading • DTE Electric: Storms and cool summer weather • DTE Gas: Cold winter weather • Gas Storage & Pipelines: Business growth and winter weather favorability, offset by pipeline investment accounting change • Power & Industrial Projects: Reduced Emissions Fuel performance 12 2014 YTD Actuals* Guidance Drivers

• Overview • Third Quarter 2014 Earnings Results • Cash Flow and Balance Sheet Metrics • Summary 13

YTD 2013 YTD 2014 Cash From Operations* $1.7 $1.2 Capital Spending (1.4) (1.5) Free Cash Flow $0.3 ($0.3) Asset Sales 0 0 Dividends (0.3) (0.3) Net Cash ($0.0) ($0.6) Debt Financing: Issuances $0.8 $1.8 Redemptions (0.8) (1.2) Change in Debt $0.0 $0.6 DTE Energy YTD 2014 Cash Flow Cash Flow Summary (billions) Drivers 14 * Includes ~$150 million and $0 of equity issued for employee benefit programs in YTD 2013 and YTD 2014, respectively • Cash from operations decrease - DTE Electric: higher fuel and purchased power costs and lower surcharge collections - DTE Gas: higher weather related gas purchases • Capital expenditures higher - DTE Electric: increased spending

We are revising our 2014 cash flow guidance Cash Flow Summary (billions) Capital Expenditures Summary (millions) 15 DTE Electric Operational $1,080 $1,160 Environmental 280 200 Renewable Energy 240 240 $1,600 $1,600 DTE Gas Operational $150 $150 Main Renewal / Meter Move-out / Pipeline Integrity 90 90 $240 $240 Non-Utility $490 $330 Total $2,330 $2,170 Revised Guidance Prior Guidance Prior Guidance Revised Guidance Cash From Operations $1.6 $1.6 Capital Spending (2.3) (2.2) Free Cash Flow ($0.7) ($0.6) Asset Sales 0 0 Dividends (0.5) (0.5) Net Cash ($1.2) ($1.1) Debt Financing: Issuances $2.1 $2.3 Redemptions (0.9) (1.2) Change in Debt $1.2 $1.1

2013 2014E * Debt excludes securitization, a portion of DTE Gas’ short-term debt, and considers 50% of the Junior Subordinated Notes as equity Leverage* Funds from Operations / Debt* 2013 2014E 49% 52% Target 50% - 52% 23% 22% Target 20% - 22% Strong balance sheet remains a key priority and supports growth • Targeting zero equity issuances in 2014 • $1.2 billion of available liquidity as of September 30, 2014 • Refinanced over $1.0 billion of long-term debt – Annualized pre-tax interest savings of nearly $25 million 16

• Overview • Third Quarter 2014 Earnings Results • Cash Flow and Balance Sheet Metrics • Summary 17

• Our third quarter operating earnings* reflect cooler weather and storms at DTE Electric, partially offset by strong results in our non-utility segments • We are confident in this year’s performance and are increasing our operating EPS* guidance midpoint to $4.35 • Our balance sheet and cash flow metrics remain strong • We reiterate our commitment to provide 5% - 6% operating EPS growth and an attractive dividend Summary 18 EEI conference presentation is November 13 at 11:15 AM CT with Gerry Anderson – Chairman & CEO Webcast access: www.dteenergy.com/investors * Reconciliation to GAAP reported earnings included in the appendix

Contact Us DTE Energy Investor Relations www.dteenergy.com/investors (313) 235-8030 19

Appendix

DTE Energy Third Quarter 2014 Operating Earnings Per Share* Gas Storage & Pipelines $0.11 Power & Industrial Projects $0.21 * Reconciliation to GAAP reported earnings included in the appendix Energy Trading $0.02 Corporate & Other $0.01 DTE Gas ($0.09) Non-Utility $0.34 DTE Electric $0.76 $1.02 21

22 Capital Expenditures DTE Energy YTD 2014 Capital Expenditures Drivers (millions) YTD 2013 YTD 2014 DTE Electric Operational $682 $845 Environmental 125 119 Renewable Energy 139 179 $946 $1,143 DTE Gas Operational $99 $99 Main Renewal / Meter Move Out / Pipeline Integrity 56 53 $155 $152 Non-Utility $286 $238 Total $1,387 $1,533 • DTE Electric capital higher due to timing of infrastructure investments and higher storm restoration costs • Non-Utility capital is lower due to timing of gathering investments

Third Quarter DTE Energy Trading Reconciliation of Operating Earnings* to Economic Net Income ** Consists of 1) the income statement effect of not recognizing changes in the fair market value of certain non- derivative contracts including physical inventory and capacity contracts for transportation, transmission and storage. These contracts are not MTM, instead are recognized for accounting purposes on an accrual basis; and 2) Operating Adjustments for unrealized mark-to-market changes of certain derivative contracts 3Q 2014 Economic Net Income Accounting Adjustments** 3Q 2014 Operating Earnings* ($6) $8 • Economic net income equals economic gross margin*** minus O&M expenses and taxes • DTE Energy management uses economic net income as one of the performance measures for external communications with analysts and investors • Internally, DTE Energy uses economic net income as one of the measures to review performance against financial targets and budget * Reconciliation to GAAP reported earnings included in the appendix *** Economic gross margin is the change in net fair value of realized and unrealized purchase and sale contracts including certain non-derivative contract costs Operating Earnings* Realized Unrealized O&M / Other 3Q 2013 3Q 2014 $15 $4 11 (8) (13) (12) (millions, after-tax) ($6) $3 3Q 2013 Operating Earnings* 3Q 2013 Economic Net Income Accounting Adjustments** $14 $3 $11 $14 23 (millions)

Year to Date DTE Energy Trading Reconciliation of Operating Earnings* to Economic Net Income ** Consists of 1) the income statement effect of not recognizing changes in the fair market value of certain non- derivative contracts including physical inventory and capacity contracts for transportation, transmission and storage. These contracts are not MTM, instead are recognized for accounting purposes on an accrual basis; and 2) Operating Adjustments for unrealized mark-to-market changes of certain derivative contracts YTD 2014 Economic Net Income Accounting Adjustments** YTD 2014 Operating Earnings* ($1) $22 • Economic net income equals economic gross margin*** minus O&M expenses and taxes • DTE Energy management uses economic net income as one of the performance measures for external communications with analysts and investors • Internally, DTE Energy uses economic net income as one of the measures to review performance against financial targets and budget * Reconciliation to GAAP reported earnings included in the appendix *** Economic gross margin is the change in net fair value of realized and unrealized purchase and sale contracts including certain non-derivative contract costs Operating Earnings* Realized Unrealized O&M / Other YTD 2013 YTD 2014 $46 $25 11 (6) (41) (35) (millions, after-tax) ($1) $1 YTD 2013 Operating Earnings* YTD 2013 Economic Net Income Accounting Adjustments** $23 $1 $35 $36 24 (millions)

Third Quarter and September Year To Date Reconciliation of Reported to Operating Earnings Use of Operating Earnings Information – DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. Operating earnings are presented both with and without Energy Trading. The term “Growth Segments” refers to DTE Energy without Energy Trading and represents the business segments that management expects to generate earnings growth going forward. 25 3Q'14 3Q'13 YTD '14 YTD '13 3Q'14 3Q'13 YTD '14 YTD '13 DTE Energy Reported Earnings 156$ 198$ 606$ 537$ 0.88$ 1.13$ 3.42$ 3.07$ DTE Electric - - - - - - - - DTE Gas - - - - - - - - Gas Storage & Pipelines - - - - Power & Industrial Projects Asset Impairment - - - 4 - - - 0.02 Corporate & Other NY State Tax Law Change - - 8 - - - 0.04 - DT E rgy Growth Segments Operating Earnings 156$ 198$ 614$ 541$ 0.88$ 1.13$ 3.46$ 3.09$ Energy Trading Certain Mark to Market Transactions 25 - (5) - 0.14 - (0.02) - DTE Energy Operating Earnings 181$ 198$ 609$ 541$ 1.02$ 1.13$ 3.44$ 3.09$ Net Income (millions) EPS

Use of Operating Earnings Information – DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. 2008 – 2013 Full Year Reconciliation of Reported to Operating Earnings 26 2008 2009 2010 2011 2012 2013 2008 2009 2010 2011 2012 2013 DTE Energy Report Earnings 546$ 532$ 630$ 711$ 610$ 661$ 3.34$ 3.24$ 3.74$ 4.18$ 3.55$ 3.76$ DTE Electric Chrysler Bad Debt - 4 - - - - - 0.02 - - - - Settlement with Detroit Thermal - - (3) - - - - - (0.02) - - - Fermi 1 Asset Retirement Obligation - - - 9 - - - - - 0.05 - - DTE Gas Performance Excellence Process 4 - (20) - - - 0.03 - (0.12) - - - Gas Storage & Pipelines - - - - - - - - - - - - Power & Industrial Projects Performance Excellence Process 1 - - - - - 0.01 - - - - - Chrysler Bad Debt - 1 - - - - - 0.01 - - - - General Motors Bad Debt - 3 - - - - - 0.02 - - - - Coke Oven Gas Settlement - - - - 7 - - - - - 0.04 - Chicago Fuels Terminal Sale - - - - 2 - - - - - 0.01 - Pet Coke Mill Impairment - - - - 1 - - - - - 0.01 - Asset Impairment - - - - - 4 - - - - - 0.02 Energy Trading Performance Excellence Process 1 - - - - - 0.01 - - - - - Certain Mark to Market Transactions - - - - - 55 - - - - - 0.31 Corporate & Other Antrim Hedge 13 3 - - - - 0.08 0.01 - - - - Crete Sale - Tax True-up 2 - - - - - 0.01 - - - - - Michigan Corporate Income Tax Adj. - - - (87) - - - - - (0.50) - - Unconventional Gas Core Barnett Sale (81) - - - - - (0.50) - - - - - Barnett Lease Impairment 5 - - - - - 0.03 - - - - - Disc tinued Operations (11) 6 8 3 56 - (0.06) 0.03 0.04 0.02 0.33 - Synfuel Discontinued Operations (20) - - - - - (0.12) - - - - - DTE Energy Operating Earnings 460$ 549$ 615$ 636$ 676$ 720$ 2.83$ 3.33$ 3.64$ 3.75$ 3.94$ 4.09$ Net Income (millions) EPS

Reconciliation of Other Reported to Operating Earnings Use of Operating Earnings Information – DTE Energy management believes that operating earnings provide a more meaningful representation of the company’s earnings from ongoing operations and uses operating earnings as the primary performance measurement for external communications with analysts and investors. Internally, DTE Energy uses operating earnings to measure performance against budget and to report to the Board of Directors. The term “Growth segments” refers to DTE Energy without Energy Trading and represents the business segments that management expects to generate earnings growth going forward. In this presentation, DTE Energy provides guidance for future period operating earnings. It is likely that certain items that impact the company’s future period reported results will be excluded from operating results. A reconciliation to the comparable future period reported earnings is not provided because it is not possible to provide a reliable forecast of specific line items. These items may fluctuate significantly from period to period and may have a significant impact on reported earnings. For comparative purposes, 2008 through 2012 operating earnings exclude the Unconventional Gas Production segment that was classified as a discontinued operation on 12/31/2012. 27

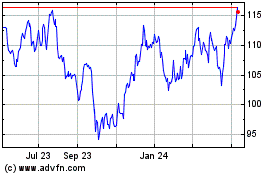

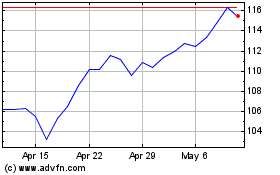

DTE Energy (NYSE:DTE)

Historical Stock Chart

From Mar 2024 to Apr 2024

DTE Energy (NYSE:DTE)

Historical Stock Chart

From Apr 2023 to Apr 2024