Filed by GTECH S.p.A.

pursuant to Rule 425 under the Securities Act of 1933

and deemed to be filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: GTECH S.p.A.; International Game Technology

Filer’s SEC File No.: 333-146050

Date: October 23, 2014

The following is a transcript from a presentation given by GTECH’s CFO, Alberto Fornaro, on October 23, 2014.

Thank you for joining us for GTECH’s net roadshow regarding our bond consent solicitation process. I am Alberto Fornaro, the CFO of GTECH. We will begin our presentation on slide 6.

Slide 6 - New Global Leader in End-to-End Gaming

On 16 July, we entered into a definitive merger agreement with IGT. By entering into this transaction, we will be joining two iconic gaming companies that are leaders in their categories and have literally driven the growth and innovation of the government sponsored and commercial segments since their beginnings.

Once this transaction is concluded, we will have created the world’s leading end-to-end gaming company. We will have the most diversified product portfolio in the gaming industry with an unmatched global footprint.

With this transaction we will be able to provide to our customers premium products and services for any channel or market segment they choose to enter.

We will also have the kind of scale that can make a real difference in delivering powerful and innovative revenue-generating gaming programs and products driven by our industry-leading R&D efforts.

The transaction also creates immediate financial value as we expect it to be accretive to cashflow. To that end, we expect to achieve $280 million of EBITDA synergies within three years.

Turning to Slide 7…

Slide 7 - Best-in-Class Offerings Across Client Spectrum

Combined, we are the leader in all major gaming markets segments — lottery, gaming machines, interactive wagering and social gaming. The combination will create an unparalleled portfolio of products and services for our customers.

Slide 8 - Enhanced Geographical Diversity

On slide 8, the combination brings greater diversity and balance to our geographical sources of revenue. By 2013 pro forma revenues, Italy would have contributed about 36% of our revenues while North America would have provided 46%, with the remainder from international jurisdictions. That also provides a natural hedge for fluctuations in worldwide economies and their currencies.

Turning to Slide 9…

Slide 9 — Product Diversification

The transaction also diversifies our sources of revenue by products. In the combined company, gaming equipment would have made up 51% of 2013 pro forma revenues and 43% for lotteries and interactive. The profile is more balanced and much less concentrated in any one product segment.

And, most importantly, we are the leader in key segments of the gaming industry. Lottery, casino and distributed gaming machines and interactive products are expected to grow over the next five years.

Turning to Slide 10…

Slide 10 - Achievable Synergies Driving Value

We expect EBITDA synergies of $280m to be driven by $230m related to cost savings and $50m of revenue enhancements. Based on our extensive experience and capability in the area, we are confident that they are achievable.

Slide 11 - Transaction Snapshot

On slide 11, we’ll review some of the transaction details.

Under the terms of the merger, GTECH will acquire all outstanding shares of IGT for $13.69 in cash and 0.1819 shares of HoldCo for a total of $18.25 per IGT share. This represents a 75% cash and 25% stock transaction.

The transaction value represents an aggregate consideration of $4.7 billion and an implied enterprise value of $6.4 billion, including the assumption of $1.7 billion in debt. This also reflects an implied multiple of 8.7x, or 6.3x assuming pro forma run-rate synergies.

GTECH and IGT will combine under the HoldCo structure which will be solely listed on the New York Stock Exchange and will be a U.S. registered company.

Our pro forma ownership will be split 80% GTECH and 20% IGT (assuming no withdrawal rights are exercised).

From a governance perspective, Marco Sala, GTECH’s Chief Executive Officer, will serve as the Chief Executive Officer of HoldCo. The initial HoldCo board will be comprised of 13 directors.

Turning to Slide 12…

Slide 12 - Transaction Structure Overview

The newly formed holding company “HoldCo” was created for this transaction and will be domiciled in the United Kingdom.

IGT will merge into a wholly-owned U.S. subsidiary of HoldCo for the 75% cash and 25% stock consideration.

GTECH will merge into HoldCo and GTECH shareholders will receive HoldCo shares on a 1-for-1 basis. Italian assets will be transferred to two Italian HoldCo subsidiaries with no impact on operations.

According to Italian law, GTECH shareholders have the right to withdraw their shares. The transaction maximum is 20%.

Turning to Slide 13…

Slide 13 - Expected Financing, Capital Structure and Dividend Policy

We expect to finance the cash portion of the consideration with cash on hand and new financing. We have a $10.7 billion bridge loan to finance the transaction, including refinancing certain existing indebtedness. The main uses of the $10.7 billion financing include:

$3.7B cash consideration

$1.3B IGT notes backstop

€2.8B GTECH notes backstop

$0.6B drawn credit facilities backstop

At or before closing, we plan to replace the bridge facility with bond issuances in Euro, in US $ and with new revolving credit facilities.

Net debt/EBITDA at closing is expected to be 4.5/4.9x excluding synergies. The synergy run rate would reduce leverage by 0.5x to 0.6x. We believe significant cash generation and improved cash conversion ratio will help bring the net leverage ratio down to 4.0x or below depending on the initial level.

Going forward and with the exception of year one, we expect the Board to implement a dividend policy that returns at maximum 50% of levered free cash flow. This is consistent with GTECH’s past dividend policy.

All in all, HoldCo will generate significant cash flow from operations and will materially enhance our cash flow conversion.

Turning to Slide 14…

Slide 14 - Indicative Timetable

This is a long dated transaction that is expected to close in the first half of 2015.

Turning to Slide 15…

Slide 15 - Key Consent Terms

We are requesting consents on the €500,000,000 5.375% bonds due 2018 and €500,000,000 3.50% bonds due 2020. By providing your consent, Noteholders will:

· Approve the transaction

· Waive all Events of Default and potential events of Default related to the transaction between GTECH and IGT and the related steps; and

· Waive the put right that could otherwise be triggered by the merger and the related steps

This guarantee will be effective within one month after the merger, and it will be effected through an amendment that is independent of the consent process. This guarantee will mean that the holders of the Notes will benefit from the same credit support that is given to the holders of IGT’s notes.

The consent fees that we are offering are 2.50% on the 2018 bonds and 4.50% on the 2020 bonds. 0.50% will be paid shortly after the resolution is passed, while the remainder of the fees will be paid shortly after the closing of the mergers.

…Turning to Slide 16…

Slide 16 - Key Dates

This slide captures the key dates related to the bond consent process.

Please note the Early Voting Deadline is the 6th November at 5:00 p.m. Central European Time. In order to receive the consent fee payments, you need to submit your consent by that deadline.

The bondholder meeting is scheduled for the 24th of November.

Turning to Slide 17…

Slide 17 - Consent Process and Contact Information

This slide provides detailed information regarding the consent process.

If you need any additional information on the process, please contact the Information Agent, who will also be able to provide with copies of the Consent Solicitation Memorandum and any other related documentation.

We appreciate your commitment to GTECH, and we look forward to continuing our relationship with you in this exciting new chapter in the company’s history.

If you have any questions, please contact one of the Solicitation Agents or the GTECH team.

Thank you for your time today.

Cautionary Statement Regarding Forward-Looking Statements

This communication contains forward-looking statements (including within the meaning of the Private Securities Litigation Reform Act of 1995) concerning IGT, GTECH, Georgia Worldwide PLC (“NewCo”), the proposed transactions and other matters. These statements may discuss goals, intentions and expectations as to future plans, trends, events, results of operations or financial condition, or otherwise, based on current beliefs of the management of NewCo, IGT and GTECH as well as assumptions made by, and information currently available to, such management. Forward-looking statements may be accompanied by words such as “aim,” “anticipate,” “believe,” “plan,” “could,” “would,” “should,”, “shall”, “continue”, “estimate,” “expect,” “forecast,” “future,” “guidance,” “intend,” “may,” “will,” “possible,” “potential,” “predict,” “project” or the negative or other variations of them. Should one or more of these risks or uncertainties materialize, or should any of the underlying assumptions prove incorrect, actual results may differ materially from those predicted in GTECH’s forward-looking statements and from past results, performance or achievements. These forward-looking statements are subject to various risks and uncertainties, many of which are outside the parties’ control. Therefore, you should not place undue reliance on such statements. Factors that could cause actual results to differ materially from those in the forward-looking statements include (but are not limited to) failure to obtain applicable regulatory or shareholder approvals in a timely manner or otherwise; failure to satisfy other closing conditions to the proposed transactions; risks that the new businesses will not be integrated successfully or that the combined companies will not realize estimated cost savings, value of certain tax assets, synergies and growth or that such benefits may take longer to realize than expected; failure to realize anticipated benefits of the combined operations; risks relating to unanticipated costs of integration; reductions in customer spending, a slowdown in customer payments and changes in customer demand for products and services; unanticipated changes relating to competitive factors in the industries in which the companies operate; ability to hire and retain key personnel; the potential impact of announcement or consummation of the proposed transactions on relationships with third parties, including customers, employees and competitors; ability to attract new customers and retain existing customers in the manner anticipated; reliance on and integration of information technology systems; changes in legislation or governmental regulations affecting the companies; international, national or local economic, social or political conditions that could adversely affect the companies or their customers; conditions in the credit markets; risks associated with assumptions the parties make in connection with the parties’ critical accounting estimates and legal proceedings; and the parties’ international operations, which are subject to the risks of currency fluctuations and foreign exchange controls. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties that affect

the parties’ businesses, including those described in NewCo’s Form F-4 and other documents filed from time to time with the Securities and Exchange Commission (the “SEC”) and those described in GTECH’s annual reports, registration documents and other documents filed from time to time with the Italian financial market regulator (CONSOB), as well as those included in IGT’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K. Except as required under applicable law, the parties do not assume any obligation to update these forward-looking statements. Nothing in this announcement is intended, or is to be construed, as a profit forecast or to be interpreted to mean that earnings per GTECH share or IGT share for the current or any future financial years or those of the combined group, will necessarily match or exceed the historical published earnings per GTECH share or IGT share, as applicable. All forward-looking statements contained in this communication are qualified in their entirety by this cautionary statement. All subsequent written or oral forward-looking statements attributable to GTECH, or persons acting on its behalf, are expressly qualified in its entirety by the cautionary statements contained throughout this communication. As a result of these risks, uncertainties and assumptions, you should not place undue reliance on these forward-looking statements.

Important Information for Investors and Shareholders

This communication is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities or the solicitation of any vote in any jurisdiction pursuant to the proposed transactions or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and applicable European regulations. Subject to certain exceptions to be approved by the relevant regulators or certain facts to be ascertained, the public offer will not be made directly or indirectly, in or into any jurisdiction where to do so would constitute a violation of the laws of such jurisdiction, or by use of the mails or by any means or instrumentality (including without limitation, facsimile transmission, telephone and the internet) of interstate or foreign commerce, or any facility of a national securities exchange, of any such jurisdiction. On October 1, 2014, NewCo has filed with the SEC a registration statement on Form F-4, file number 333-199096, which includes the proxy statement of IGT that also constitutes a prospectus of NewCo (the “proxy statement/prospectus”). The registration statement on Form F-4 is available at www.sec.gov under the name “Georgia Worldwide”. INVESTORS AND SHAREHOLDERS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS, AND OTHER RELEVANT DOCUMENTS TO BE FILED WITH THE SEC, IN THEIR ENTIRETY CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT IGT, GTECH, NEWCO, THE PROPOSED TRANSACTIONS AND RELATED MATTERS. Investors and shareholders will be able to obtain free copies of the proxy statement/prospectus and other documents filed with the SEC by the parties through the website maintained by the SEC at www.sec.gov. In addition, investors and shareholders will be able to obtain free copies of the proxy statement/prospectus and other documents filed with the SEC by the parties by contacting Investor Relations, IGT (for documents filed with the SEC by IGT) or Investor Relations, GTECH (for documents filed with the SEC by NewCo).

Italian CONSOB Regulation No. 17221

Pursuant to Article 6 of the CONSOB Regulation no. 17221 of March 12, 2010 (as amended, the “CONSOB Regulation”), NewCo is a related party of GTECH, being a wholly owned subsidiary of GTECH.

The merger agreement providing for the GTECH-NewCo merger — which exceeds the thresholds for “significant transactions” pursuant to the Regulation — was approved unanimously by the GTECH board of directors.

The merger agreement and the GTECH-NewCo merger are subject to the exemption set forth in Article 14 of the CONSOB Regulation and Article 3.2 of the “Disposizioni in materia di operazioni con parti correlate” (“Procedures for transactions with related parties”) adopted by GTECH on July 31, 2014 and published on its

website (www.gtech.com). Pursuant to this exemption, GTECH will not publish an information document (documento informativo) for related party transactions as provided by Article 5 of the CONSOB Regulation. In connection with the meeting of GTECH shareholders scheduled for November 4, 2014 to approve the GTECH-NewCo merger, GTECH has published an information document pursuant to Article 70, paragraph 6, of the CONSOB Regulation on Issuers (CONSOB Regulation no. 11971 of May 24, 1999, as amended), in accordance with applicable terms.

Participants in the Distribution

IGT, GTECH and NewCo and their respective directors, executive officers and certain other member of management and employees may be deemed to be participants in the solicitation of proxies from the shareholders of IGT in respect of the proposed transactions contemplated by the proxy statement/prospectus. Information regarding the persons who may, under the rules of the SEC, be participants in the solicitation of the shareholders of IGT in connection with the proposed transactions, including a description of their direct or indirect interests, by security holdings or otherwise, are set forth in the proxy statement/prospectus filed with the SEC. Information regarding IGT’s directors and executive officers is contained in IGT’s Annual Report on Form 10-K for the year ended September 28, 2013 and its Proxy Statement on Schedule 14A, dated January 24, 2014, which are filed with the SEC.

***

GTECH S.p.A. is a leading commercial operator and provider of technology in the regulated worldwide gaming markets, delivering best-in-class products and services, with a commitment to the highest levels of integrity, responsibility, and shareholder value creation. The Company is listed on the FTSE MIB at the Italian Stock Exchange under the trading symbol “GTK” and is majority owned by De Agostini S.p.A. In 2013, GTECH had approximately €3.1 billion in revenues and 8,600 employees with operations in approximately 100 countries on six continents. For more information, please visit www.gtech.com.

For further information:

|

|

Robert K. Vincent |

Simone Cantagallo |

|

|

GTECH S.p.A. |

GTECH S.p.A. |

|

|

Corporate Communications |

Media Communications |

|

|

T. (+1) 401 392 7452 |

T. (+39) 06 51899030 |

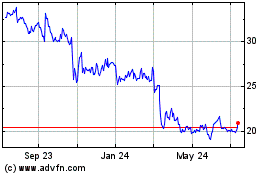

International Game Techn... (NYSE:IGT)

Historical Stock Chart

From Mar 2024 to Apr 2024

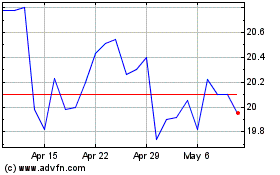

International Game Techn... (NYSE:IGT)

Historical Stock Chart

From Apr 2023 to Apr 2024