UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16

OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of October, 2014

Commission File Number: 000-55232

Sphere 3D Corp.

(Translation of registrant's name into English)

240 Matheson Blvd. East

Mississauga, Ontario L4Z 1X1

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

[ ] Form 20-F [ x ] Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): [ ]

SUBMITTED HEREWITH

Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

| |

SPHERE 3D CORP. |

| |

(Registrant) |

| |

|

|

| Date: October 15, 2014 |

By: |

/s/ T. Scott Worthington |

| |

|

|

| |

|

T. Scott Worthington |

| |

Title: |

Chief Financial Officer |

SPHERE 3D CORPORATION

FORM 51-102F3

MATERIAL CHANGE REPORT

| Item 1 |

Name and Address of Company |

| |

|

| |

Sphere 3D Corporation (the “Corporation”)

|

| |

240 Matheson Boulevard East |

| |

Mississauga, Ontario |

| |

L4Z 1X1 |

| |

|

| Item 2 |

Date of Material Change |

| |

|

| |

October 14, 2014 |

| |

|

| Item 3 |

News Release |

| |

|

|

The news release attached hereto as Schedule “A” issued

by the Corporation and disseminated via Newsfile Corp. on October 14, 2014

and is available on the Corporation’s profile at

www.sedar.com. |

| |

|

| Item 4 |

Summary of Material Change |

| |

|

|

On October 14, 2014, the Corporation provided an update

of its proposed merger with Overland Storage, Inc. (“Overland”),

including: |

| |

|

|

|

• |

Overland entered into US$7.5 million loan (the

“Overland Financing”) with FBC Holdings S.á.r.l., an affiliated

company with Cyrus Capital Partners (“Cyrus Capital”), of which

US$2.5 million will be used to repay a portion of Overland’s outstanding

indebtedness to the Corporation. |

|

• |

The Corporation guaranteed US$2.5 million of the Overland

Financing, and upon closing of the merger transaction and subject to

regulatory approval, will repay such amount to Cyrus Capital in shares at

an ascribed price equal to the 20-day volume weighted average price ending

3 days before such conversion but in any event at a minimum of US$6.50. It

is expected that no more than 384,615 common shares of Sphere 3D will be

issued to Cyrus Capital in connection with such repayment. |

|

• |

Overland entered into a Memorandum of Understanding with

the plaintiffs in the consolidated class action cases referred to as “In

re Overland Storage Inc., Shareholders Litigation” that would, subject to

court approval and other standard conditions, provide for the settlement

of all outstanding claims in regard to Overland’s proposed merger

transaction with the Corporation. |

|

• |

In connection with the Overland Financing, the

Corporation and Overland have executed an amendment to the Agreement and

Plan of Merger Agreement dated May 15, 2014 to reduce the exchange ratio

from 0.510594 common shares of Sphere 3D for each share of Overland common

stock to 0.46385 common shares of Sphere 3D for each share of Overland

common stock. |

| |

|

|

| Item 5 |

Full Description of Material Change |

| |

|

|

The news release attached hereto as Schedule “A” provides

a full description of the material change. |

| |

|

| Item 6 |

Reliance on subsection 7.1(2) or (3) of National

Instrument 51-102 |

| |

|

| |

Not applicable. |

| |

|

| Item 7 |

Omitted Information |

| |

|

| |

None. |

| |

|

| Item 8 |

Executive Officer |

| |

|

|

The executive officer who is knowledgeable about this

material change report is Scott Worthington, Chief Financial Officer of

the Corporation, at (416) 749-5999. |

| |

|

| Item 9 |

Date of Report |

| |

|

| |

October 15, 2014 |

SCHEDULE “A”

Sphere 3D and Overland Merger Update

-Overland Completes Financing, Signs MOU for Settlement

of Class Action Litigation and Enters into Amended Merger Agreement with Sphere

3D-

Mississauga, ONTARIO – October 14, 2014 – Sphere 3D

Corporation (TSX-V: ANY; NASDAQ: ANY) (“Sphere 3D” or the “Company”) today

announced an update of its proposed merger with Overland Storage, Inc.

(“Overland”) (NASDAQ: OVRL).

Overland has entered into a financing arrangement (“Overland

Financing”) with FBC Holdings S.á.r.l., an affiliated company with Cyrus Capital

Partners (“Cyrus Capital”) and the majority shareholder of Overland.

The proceeds from the Overland Financing provide US $5 million

of working capital for Overland to complete various cost cutting initiatives

including streamlining of their manufacturing facilities, and the elimination of

redundant facilities, and an additional US $2.5 Million for repayment of a

portion of Overland’s outstanding indebtedness to Sphere 3D.

Sphere 3D has agreed that, immediately after the closing of the

merger transaction and subject to regulatory approval, it will issue common

shares to Cyrus Capital in repayment of $2.5 million of the principal amount of

the Overland Financing, at an ascribed price equal to the 20-day volume weighted

average price ending 3 days before such conversion but in any event at a minimum

of US$6.50. It is expected that no more than 384,615 common shares of Sphere 3D

will be issued to Cyrus Capital in connection with such repayment. These

securities are subject to a four-month hold period from the issuance date in

accordance with the policies of the TSXV and applicable securities laws.

Additionally, the Company is pleased to report that Overland

has entered into a Memorandum of Understanding with the Plaintiffs in the

consolidated class action cases referred to as “In re Overland Storage Inc.,

Shareholders Litigation” that would, subject to court approval and other

standard conditions, provide for the settlement of all outstanding claims in

regard to Overland’s proposed merger transaction with Sphere 3D.

In connection with the Overland Financing, Sphere 3D and

Overland have executed an amendment to the Agreement and Plan of Merger

Agreement dated May 15, 2014 (the “Merger Agreement”) to reduce the exchange

ratio from 0.510594 common shares of Sphere 3D for each share of Overland common

stock to 0.46385 common shares of Sphere 3D for each share of Overland common

stock.

Sphere 3D and Overland today filed an amended Registration

Statement on Form F-4/A with the United States Securities and Exchange

Commission (the “SEC”) to include additional disclosures in relation to: the

financing, amended Agreement and Plan of Merger, the MOU regarding the

settlement of the outstanding class action litigation, and to address

outstanding comments with the SEC. Upon effectiveness of the Form F-4/A, Overland will be in a position to set its shareholder meeting

date for a date that is expected to be 20 calendar days following

effectiveness.

Peter Tassiopoulos, Sphere 3D’s CEO stated: “Significant

progress has been made for us to be in a position to not only consummate this

transaction, but to begin combined operations from a solid foundation

post-closing. Overland has successfully been able to exceed their stated goal of

$20 million in annualized operating savings since their Tandberg acquisition

while gaining efficiency throughout their organization. With the Overland

Financing in place now to support these measures, and the filing of the

additional disclosures earlier today, we believe that we are well on our way to

finalizing the merger transaction and moving forward with growth and

profitability as our primary focus.”

About Sphere 3D Corporation

Sphere 3D Corporation (TSX-V: ANY, NASDAQ:ANY) is a

virtualization technology solution provider. Sphere 3D's Glassware 2.0™ platform

delivers virtualization of some of the most demanding applications in the

marketplace today; making it easy to move applications from a physical PC or

workstation to a virtual environment either on premise and/or from the cloud.

Sphere 3D’s V3 Systems division supplies the industry’s first purpose built

appliance for virtualization as well as the Desktop Cloud Orchestrator

management software for VDI. Sphere 3D recently announced its proposed merger

with Overland Storage (NASDAQ: OVRL). This alliance is intended to bring

together next generation technologies for virtualization and cloud coupled with

end-to-end scalable storage offerings enabling the introduction of a number of

converged solutions. Sphere 3D maintains offices in Mississauga, Ontario, Canada

and in Salt Lake City, Utah, U.S. For additional information visit www.sphere3d.com or access the Company's public filings

at www.sedar.com or www.sec.gov

Forward-Looking Statements

Certain statements contained in this press release include

“forward-looking statements” that involve a number of risks and uncertainties,

and actual results or events may differ materially from those projected or

implied in those statements. Examples include the parties’ ability to consummate

the proposed Transaction and timing thereof, the benefits and impact of the

proposed Transaction, including tax effects to shareholders, the combined

company’s ability to achieve synergies and value creation that are contemplated

by the parties, Sphere 3D’s ability to promptly and effectively integrate

Overland’s business and the diversion of management time on Transaction-related

issues.

Forward-looking statements, without limitation, may contain the

words believes, expects, anticipates, estimates, intends, plans, or similar

expressions. Forward-looking statements are not guarantees of future

performance. They involve risks, uncertainties and assumptions and actual

results could differ materially from those anticipated. Forward-looking

statements are based on the opinions and estimates of management at the date the

statements are made, and are subject to a variety of risks and uncertainties and

other factors that could cause actual events or results to differ

materially from those projected in the forward-looking statements.

Sphere 3D cautions you that you should not rely unduly on these

forward-looking statements, which reflect their current beliefs and are based on

information currently available. Except as required by applicable laws, Sphere

3D does not undertake any obligation to update or revise any forward-looking

statements as of any future date. Additional information concerning these

statements and other factors can be found in Sphere 3D’s filings with securities

regulatory authorities at www.sedar.com or www.edgar.gov.

Sphere 3D Contact:

Sphere 3D Corporation

Peter Tassiopoulos

Chief

Executive Officer

416-749-5999

Peter.Tassiopoulos@Sphere3D.com

Neither TSXV nor its Regulation Services Provider (as that

term is defined in policies of the TSXV) accepts responsibility for the adequacy

or accuracy of this release.

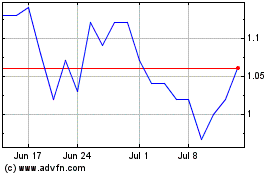

Sphere 3D (NASDAQ:ANY)

Historical Stock Chart

From Aug 2024 to Sep 2024

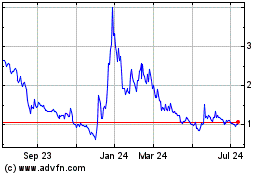

Sphere 3D (NASDAQ:ANY)

Historical Stock Chart

From Sep 2023 to Sep 2024