SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 14, 2014 (September 30, 2014)

EBIX, INC.

(Exact name

of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

0-15946 |

|

77-0021975 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

file number) |

|

(I.R.S. Employer

Identification Number) |

5 Concourse Parkway, Suite 3200

Atlanta, GA 30328

(Address of principal executive offices)

(678) 281-2020

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

On September 30, 2014, the United States District Court for the Northern District of

Georgia (the “Court”) issued an order granting preliminarily approval of the agreement among the parties to settle all claims in the consolidated stockholder derivative action styled In re Ebix, Inc. Derivative Litigation, File

No. 1:13-CV-00062- RWS (N.D. Ga.) and in the stockholder derivative litigation pending in the Superior Court of Fulton County, Georgia styled In re Ebix, Inc. Shareholder Derivative Action, Case No. 2011-cv-205276 (the

“Settlement”). A hearing to determine whether the Court should issue an order granting final approval of the Settlement has been scheduled for December 2, 2014, at 9:30 a.m. in Courtroom 2105 at the United States District Court for

the Northern District of Georgia, Richard B. Russell Federal Building and Courthouse, 75 Spring Street, SW, Atlanta, Georgia 30303. Pursuant to the Court’s order, any objections to any aspects of the Settlement must be filed with the Clerk of

the Court no later than November 18, 2014. There can be no assurance that the Settlement will be approved by the Court.

Additional information

concerning the terms of the proposed Settlement, the December 2, 2014 hearing, and the requirements for objections can be found in the Notice of Proposed Settlement of Derivative Action (the “Notice”), which is attached hereto as

Exhibit 99.1. In addition, both the Notice and the Stipulation of Settlement dated as of September 23, 2014 are available for viewing on Ebix’s website at www.Ebix.com. The information on our website is not a part of this Current

Report and is not incorporated herein by reference.

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 99.1 |

|

Notice of Proposed Settlement of Derivative Action |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

| EBIX, INC. |

|

|

| By: |

|

/s/ Robert Kerris |

| Name: |

|

Robert Kerris |

| Title: |

|

EVP, Chief Financial Officer &

Corporate Secretary |

Dated: October 14, 2014

EXHIBIT INDEX

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 99.1 |

|

Notice of Proposed Settlement of Derivative Action |

Exhibit 99.1

UNITED STATES DISTRICT COURT

NORTHERN DISTRICT OF GEORGIA

ATLANTA DIVISION

|

|

|

|

|

| In re EBIX, INC. DERIVATIVE LITIGATION |

|

) )

) )

) )

) |

|

File No. 1:13-CV-62-RWS

NOTICE OF PROPOSED SETTLEMENT OF DERIVATIVE

ACTION |

| |

|

) |

|

|

| TO: |

ALL CURRENT RECORD HOLDERS AND BENEFICIAL OWNERS OF COMMON STOCK OF EBIX, INC. (“EBIX”) |

PLEASE READ THIS NOTICE CAREFULLY AND IN ITS ENTIRETY AS YOUR RIGHTS MAY BE AFFECTED BY PROCEEDINGS IN THE LITIGATION.

YOU ARE HEREBY NOTIFIED that the above-captioned consolidated stockholder derivative litigation (the “Federal Action”), as

well as the stockholder derivative litigation pending in the Fulton County, Georgia, Superior Court entitled In re Ebix. Inc. Shareholder Derivative Action, Case No. 2011CV205276 (the “State Action”) (collectively, the

“Actions”), are being settled on the terms set forth in the Stipulation of Settlement dated as of September 23, 2014 (the “Stipulation”). This Notice is provided by Order of the United States District Court for the Northern

District of Georgia (the “Federal Court”). It is not an expression of any opinion by the Federal Court with respect to the truth of the allegations in the litigation or the merits of the claims or defenses asserted by or against any party.

It is solely to notify you of the terms of the proposed Settlement, and your rights related thereto. The Federal Court has made no findings or determinations concerning the merits of the Actions. Capitalized terms not otherwise defined shall have

the definitions set forth in the Stipulation.

I. WHY THE FEDERAL COURT HAS ISSUED THIS NOTICE

Your rights may be affected by the Settlement of the Actions. The parties to the Actions have agreed upon terms to settle the Actions and have

signed the Stipulation setting forth those Settlement terms.

II. SUMMARY OF THE ACTIONS

On January 7, 2013, Federal Plaintiff Gilbert Spagnola filed a stockholder derivative complaint in the Federal Court on behalf of Ebix and

against the Individual Defendants for alleged violations of state and federal law. Spagnola v. Bhalla, et al., Civil Action No. 1:13-CV-00062-RWS (N.D. Ga.). On January 23, 2013, Federal Plaintiff Hotel Trades Council and Hotel

Association of New York City, Inc. Pension Fund filed a similar stockholder derivative complaint in the Federal Court on behalf of Ebix and against the Individual Defendants for alleged violations of state law. Hotel Trades Council and Hotel

Association of New York City, Inc. Pension Fund v. Raina, et al., Civil Action No. 1:13-CV-00246-RWS (N.D. Ga.). On April 12, 2013, the Federal Court entered an order consolidating the two actions and appointing lead derivative

plaintiff and liaison counsel for the matter. On May 20, 2013, lead derivative plaintiff filed its Consolidated Shareholder Derivative and Class Action Complaint. The action asserts various derivative claims on behalf of Ebix against the

Individual Defendants related to purported breaches of fiduciary duties, abuse of control, gross mismanagement, waste of corporate assets, negligence, and unjust enrichment. On June 4, 2013, the Federal Court entered a consent order that

largely stayed the action.

2

On September 1, 2011, State Plaintiff filed a stockholder derivative complaint in the State

Court on behalf of Ebix and against the Individual Defendants for alleged violations of state law. This action also was based on similar allegations regarding the Individual Defendants’ breaches of fiduciary duties and related claims that were

subsequently asserted in the Federal Derivative Action. Pursuant to a stipulation and order dated November 2, 2012, an amended consolidated complaint was filed on January 14, 2013, and the action was stayed pending the completion of expert

discovery in the now settled Securities Class Action.

Over the past few months, the Settling Parties have discussed ways to resolve this

dispute. As a result of that process, and subject to the approval of the Federal Court, the Settling Parties have reached an agreement to settle the Actions upon the terms and subject to the conditions set forth in this Stipulation.

3

III. TERMS OF THE PROPOSED DERIVATIVE SETTLEMENT

The principal terms, conditions, and other matters that are part of the Settlement are subject to approval by the Federal Court and a number of

other conditions. This summary should be read in conjunction with, and is qualified in its entirety by reference to, the text of the Stipulation, which has been filed with the Federal Court and may be viewed at www.Ebix.com. As set forth therein,

the terms of the Settlement include the adoption, implementation, and/or maintenance of the following corporate governance measures:

| |

• |

|

the appointment of an independent director as either Chairman or “Lead Independent Director” separate and in addition to the board chairman; |

| |

• |

|

increasing the number of directors on the Corporate Governance Committee to three (3) independent directors; |

| |

• |

|

retaining an independent auditor in India that is approved by the Public Company Accounting Oversight Board or affiliated with a member firm; |

4

| |

• |

|

creating a “Director of Internal Audit” and separately a “Director of Internal Tax” positions both of whom shall report directly to the Audit

Committee;1 |

| |

• |

|

appointing a Trading and Compliance Officer to evaluate and monitor the Company’s insider trading policies and practices.2 |

IV. DISMISSAL OF ACTIONS AND RELEASE OF CLAIMS

The Stipulation also provides for the entry of judgment dismissing the Actions on the merits with prejudice, and certain releases as detailed

in the Stipulation.

V. PLAINTIFFS’ ATTORNEY FEES AND EXPENSES

The maximum amount of aggregate fees and expenses that will be sought by Plaintiffs’ Counsel to resolve the Actions is six hundred ninety

thousand dollars ($690,000.00). To date, Plaintiffs’ Counsel have not received any payments for their efforts on behalf of Ebix stockholders. Any fee awarded by the Federal Court is designed to compensate Plaintiffs’ Counsel for the

results achieved in the Actions and the risks of undertaking the prosecution of the Actions on a contingent basis.

| 1 |

Notwithstanding the foregoing, the Director of Internal Audit and the Director of Internal Tax may have additional responsibilities and functions within Ebix. |

| 2 |

Notwithstanding the foregoing, the Trading Compliance Officer may have additional responsibilities and functions within Ebix. |

5

VI. REASONS FOR THE SETTLEMENT

The Settling Parties have determined that it is desirable and beneficial that the Actions, and all of their disputes related thereto, be fully

and finally settled in the manner and upon the terms and conditions set forth in the Stipulation.

A. Why Did Plaintiffs Agree to

Settle?

Plaintiffs’ Counsel conducted an extensive investigation relating to the claims and the underlying events and

transactions alleged in the Actions. Plaintiffs and Plaintiffs’ Counsel recognize and acknowledge the significant risk, expense, and length of continued proceedings necessary to prosecute the Actions against the Individual Defendants through

trial and through possible appeals. Plaintiffs’ Counsel also have taken into account the uncertain outcome and the risk of any litigation, especially in complex cases such as the Actions, as well as the difficulties and delays inherent in such

litigation. Plaintiffs’ Counsel are also mindful of the inherent problems of establishing demand futility, and the possible defenses to the claims alleged in the Actions.

6

B. Why Did the Defendants Agree to Settle?

Defendants have denied and continue to deny each and all of the claims and allegations of wrongdoing made by Plaintiffs in the Actions and

maintain furthermore that they have meritorious defenses. Defendants expressly have denied and continue to deny all charges of wrongdoing or liability against them arising out of any of the conduct, statements, acts, or omissions alleged, or that

could have been alleged, in the Actions, and Defendants contend that many of the allegations in the Complaint are materially inaccurate. The Defendants also have denied and continue to deny, among other allegations, the allegations that Plaintiffs,

Ebix, or its stockholders have suffered damage or that Plaintiffs, Ebix, or its stockholders were harmed in any way by the conduct alleged in the Actions or otherwise. The Defendants have further asserted and continue to assert that at all times

they acted in good faith and in a manner they reasonably believed to be and that was in the best interests of Ebix and its stockholders. Nonetheless, Defendants have concluded that further conduct of the Actions would be protracted and expensive,

and that it is desirable that the Actions be fully and finally settled in the manner and upon the terms and conditions set forth in this Stipulation. Defendants also have taken into account the uncertainty and risks inherent in any litigation,

especially in complex cases like the Actions.

7

VII. SETTLEMENT HEARING

Pursuant to an Order of the United States District Court for the Northern District of Georgia, a hearing (the “Settlement Hearing”)

shall be held before this Court on December 2, 2014, at 9:30 a.m., at the United States District Court for the Northern District of Georgia, Atlanta Division, Courtroom 2105, Richard B. Russell Federal Building and United States Courthouse, 75

Spring Street, SW, Atlanta, Georgia 30303-3309, to determine whether the proposed Settlement of the Actions on the terms and conditions provided for in the Stipulation is fair, reasonable, and adequate to Plaintiffs and Ebix and should be approved

by the Court; whether the Final Order and Judgment as provided in ¶1.12 of the Stipulation should be entered; and to determine the amount of fees and expenses that should be awarded to Plaintiffs’ Counsel. The Court may adjourn the

Settlement Hearing without further notice to current or former Ebix stockholders. If the Settlement is approved, you will be subject to and bound by the provisions of the Stipulation, the releases contained therein, and by all orders,

determinations, and judgments, including the Final Order and Judgment, in the Actions concerning the Settlement, whether favorable or unfavorable to you or Ebix.

8

Pending final determination of whether the Settlement should be approved, no Ebix stockholder,

either directly, representatively, derivatively, or in any other capacity, shall commence or prosecute against any of the Released Persons, an action or proceeding in any court, administrative agency, or other tribunal asserting any of the Released

Claims.

VIII. RIGHT TO ATTEND FINAL HEARING

You may enter an appearance in the Litigation, at your own expense, individually or through counsel of your choice. If you do not enter an

appearance, you will be represented by Plaintiffs’ Counsel. If you want to object at the Final Hearing, then you must first comply with the procedures for objecting, which are set forth below. The Federal Court has the right to change the

hearing dates or times without further notice. Thus, if you are planning to attend the Final Hearing, you should confirm the date and time before going to the Federal Court. If you have no objection to the Settlement, you do not need to appear at

the Settlement Hearing or take any other action.

9

IX. THE PROCEDURES FOR OBJECTING TO THE SETTLEMENT

Any current Ebix stockholder may appear and show cause, if he, she, or it has any, why the proposed Settlement of the Actions should or should

not be approved as fair, reasonable, and adequate, why a judgment should or should not be entered thereon, why attorneys’ fees and expenses should or should not be awarded to Plaintiffs’ Counsel; provided, however, that no current Ebix

stockholder or any other Person shall be heard or entitled to contest such matters, unless that Person has filed said objections, papers, and briefs on or before November 18, 2014, with the Clerk of the United States District Court for the

Northern District of Georgia at the following address:

Clerk of the Court

United States District Court

Northern District of Georgia

75

Spring Street, SW

Atlanta, Georgia 30303-3309

Any current Ebix stockholder who does not make his, her, or its objection in the manner provided shall be deemed to have waived such objection and shall

forever be foreclosed from making any objection to the fairness, reasonableness, or adequacy of the proposed Settlement as set forth in the Stipulation and to the award of attorneys’ fees and expenses to Plaintiffs’ Counsel, unless

otherwise ordered by the Federal Court, but shall be bound by the Final Order and Judgment to be entered and the releases to be given.

All opening briefs and supporting documents in support of the Settlement, and any application by Plaintiffs’ Counsel for attorneys’

fees and expenses shall be filed and served by November 4, 2014, fourteen (14) calendar days prior to the deadline for objections set forth herein. Any reply briefs and supporting documents shall be filed and served by November 25,

2014, seven (7) calendar days prior to the Settlement Hearing.

10

Any objection to any aspect of the Settlement must be filed with the Clerk of the Federal Court

no later than November 18, 2014, at the following address:

Clerk of the Court

United States District Court

Northern District of Georgia

75

Spring Street, SW

Atlanta, Georgia 30303-3309

X. HOW TO OBTAIN ADDITIONAL INFORMATION

This Notice summarizes the Stipulation. It is not a complete statement of the events of the Actions or the terms of the Settlement contained in

the Stipulation.

You may inspect the Stipulation and other papers in the Federal Action at the United States District Court’s

Clerk’s office at any time during regular business hours of each business day. The Clerk’s office will not mail copies to you. In addition, this Notice and the Stipulation can be viewed on the Company’s website at www.Ebix.com.

Inquiries regarding the proposed Settlement also may be made to counsel for the Federal Plaintiffs: David A. Bain, Law offices of David A. Bain, LLC, 1050 Promenade II, 1230 Peachtree Street, NE, Atlanta, Georgia 30309, Tel: (404) 724-9990,

Fax: (404) 724-9986; or Richard A. Speirs, Cohen Milstein Sellers & Toll PLLC, 88 Pine Street, 14th Floor, New York, New York 10005, Tel: (212) 838-7797, Fax: (212) 838-7745.

11

PLEASE DO NOT CONTACT THE FEDERAL COURT OR THE CLERK’S OFFICE REGARDING THIS NOTICE.

|

|

|

| DATED: October 14, 2014 |

|

BY ORDER OF THE COURT UNITED STATES DISTRICT

COURT NORTHERN DISTRICT OF GEORGIA |

12

Ebix (NASDAQ:EBIX)

Historical Stock Chart

From Aug 2024 to Sep 2024

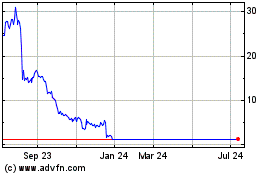

Ebix (NASDAQ:EBIX)

Historical Stock Chart

From Sep 2023 to Sep 2024