UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): October 2, 2014

Coeur Mining, Inc.

(Exact name of registrant as specified in its charter)

|

| | |

Delaware (State or other jurisdiction of incorporation or organization) | 1-8641 (Commission File Number) | 82-0109423 (IRS Employer Identification No.) |

104 S. Michigan Avenue

Suite 900

Chicago, Illinois 60603

(Address of Principal Executive Offices)

(312) 489-5800

(Registrant's telephone number, including area code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2 below):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.02. Termination of a Material Definitive Agreement.

On October 2, 2014, Coeur Mining, Inc., together with its subsidiaries Coeur Mexicana S.A. de C.V. (“Coeur Mexicana”), Ocampo Resources, Inc. and Ocampo Services, Inc., entered into a Termination Agreement (the “Termination Agreement”) with Franco-Nevada Corporation (“Franco-Nevada”) and Franco-Nevada Mexico Corporation S.A. de C.V. (“Franco-Nevada Mexico”), which provides for the termination of that certain Royalty Stream Agreement, effective January 20, 2009 by and between Coeur Mexicana and Franco-Nevada Mexico, as amended (the “Royalty Stream Agreement”), effective at such time as the minimum royalty amount under the Royalty Stream Agreement has been satisfied. In consideration for Franco-Nevada and Franco-Nevada Mexico agreeing to terminate the Royalty Stream Agreement, concurrent with the execution and delivery of the Termination Agreement Coeur Mexicana made a payment to Franco-Nevada Mexico in the amount of US$2 million.

Item 2.02. Results of Operations and Financial Condition.

On October 6, 2014, Coeur Mining, Inc. issued a press release announcing production for the quarter ended September 30, 2014. A copy of the press release is attached as Exhibit 99.1 to this Current Report and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) List of Exhibits

|

| |

Exhibit No. | Description |

Exhibit 99.1 | Press Release dated October 6, 2014 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| |

| COEUR MINING, INC. |

| |

Date: October 6, 2014 | By: /s/ Peter C. Mitchell |

| Name: Peter C. Mitchell Title: Senior Vice President and Chief Financial Officer

|

Exhibit Index

Exhibit No. Description

Exhibit 99.1 Press Release dated October 6, 2014

NEWS RELEASE

Coeur Reports Third Quarter Production Results

Raising Full-Year Gold Production Guidance Following 27% Increase in Rochester Gold Production

Chicago, Illinois - October 6, 2014 - Coeur Mining, Inc. (the "Company" or "Coeur") (NYSE:CDE) today announced preliminary third quarter production of 4.3 million ounces of silver and 64,989 ounces of gold, or 8.2 million silver equivalent ounces1.

Quarterly Production Results1

3Q 2014 Operational Results1

Third quarter operational highlights for each of the Company's mines are provided below.

|

| | | | | |

Palmarejo, Mexico | 3Q 2014 | 2Q 2014 | 1Q 2014 | 4Q 2013 | 3Q 2013 |

Underground Operations: | | | | | |

Tons mined | 169,656 | 177,359 | 209,854 | 237,384 | 219,909 |

Average silver grade (oz/t) | 4.92 | 6.15 | 5.95 | 6.00 | 4.73 |

Average gold grade (oz/t) | 0.10 | 0.11 | 0.11 | 0.14 | 0.11 |

Surface Operations: | | | | | |

Tons mined | 343,001 | 320,583 | 358,222 | 361,493 | 385,379 |

Average silver grade (oz/t) | 3.09 | 3.72 | 3.50 | 3.49 | 3.49 |

Average gold grade (oz/t) | 0.03 | 0.03 | 0.03 | 0.03 | 0.03 |

Processing: | | | | | |

Total tons milled | 518,212 | 534,718 | 571,345 | 595,803 | 583,365 |

Average recovery rate – Ag | 82.7% | 75.6% | 73.3% | 74.5% | 81.8% |

Average recovery rate – Au | 86.9% | 78.9% | 78.0% | 80.6% | 87.6% |

Silver production ounces (000's) | 1,533 | 1,761 | 1,820 | 1,994 | 1,918 |

Gold production ounces | 22,514 | 23,706 | 25,216 | 35,486 | 29,893 |

Silver equivalent production ounces (000's) | 2,884 | 3,183 | 3,333 | 4,123 | 3,712 |

1

1. Silver equivalence calculated using a 60:1 silver to gold ratio.

| |

• | Tons milled continued to decrease in line with the previously announced strategy to gradually reduce open-pit and underground mining at Palmarejo over the next year and begin higher-margin underground production at Guadalupe. |

| |

• | Silver and gold recoveries improved as a result of process improvements and better management of the sources of ore in the process plant. |

| |

• | Production from lower-grade areas of the mine caused a decline in the average silver grade, particularly underground, however higher silver grades are expected in the fourth quarter. |

|

| | | | | |

Rochester, Nevada | 3Q 2014 | 2Q 2014 | 1Q 2014 | 4Q 2013 | 3Q 2013 |

Tons placed | 3,892,421 | 3,329,582 | 3,640,861 | 4,569,588 | 2,678,906 |

Average silver grade (oz/t) | 0.51 | 0.58 | 0.59 | 0.57 | 0.53 |

Average gold grade (oz/t) | 0.005 | 0.003 | 0.003 | 0.002 | 0.003 |

Silver production ounces (000's) | 1,156 | 1,112 | 750 | 712 | 595 |

Gold production ounces | 11,702 | 9,230 | 8,192 | 7,890 | 4,824 |

Silver equivalent production ounces (000's) | 1,858 | 1,666 | 1,242 | 1,185 | 884 |

| |

• | Silver production increased 4% and gold production increased 27% compared to the second quarter at Rochester. On a silver-equivalent basis, production increased 12% from the second quarter and 110% compared to the third quarter of 2013. |

| |

• | Average silver grade declined in the third quarter, however the average gold grade increased to the highest level in more than a year. |

| |

• | Coeur has increased its 2014 gold production guidance for Rochester to 38,000 - 42,000 ounces due to the strong gold production. |

|

| | | | | |

Kensington, Alaska | 3Q 2014 | 2Q 2014 | 1Q 2014 | 4Q 2013 | 3Q 2013 |

Tons milled | 145,097 | 163,749 | 159,697 | 149,246 | 147,427 |

Average gold grade (oz/t) | 0.23 | 0.18 | 0.17 | 0.26 | 0.20 |

Average recovery rate | 93.0% | 94.5% | 94.5% | 96.0% | 96.5% |

Gold production ounces | 30,773 | 28,089 | 25,428 | 36,469 | 28,323 |

| |

• | Significantly higher average gold grade drove a 10% sequential increase in gold production at Kensington in the third quarter, despite an 11% decline in tons milled due to maintenance downtime. |

|

| | | | | |

San Bartolomé, Bolivia | 3Q 2014 | 2Q 2014 | 1Q 2014 | 4Q 2013 | 3Q 2013 |

Tons milled | 471,938 | 437,975 | 385,375 | 451,660 | 428,884 |

Average silver grade (oz/t) | 3.70 | 3.86 | 3.88 | 3.79 | 3.89 |

Average recovery rate | 86.5% | 87.5% | 90.5% | 87.6% | 91.5% |

Silver production ounces (000's) | 1,509 | 1,481 | 1,355 | 1,498 | 1,528 |

| |

• | Third quarter production results were consistent with prior quarters. |

|

| | | | | |

Endeavor, Australia | 3Q 2014 | 2Q 2014 | 1Q 2014 | 4Q 2013 | 3Q 2013 |

Silver production ounces (000's) | 141 | 111 | 147 | 115 | 142 |

| |

• | Silver production received from the Company’s silver stream from the Endeavor mine in Australia increased by 27% in the third quarter. |

2014 Production Outlook

Coeur's 2014 total silver and gold production guidance is shown below. The Company has increased the production range for gold due to stronger gold production from Rochester.

|

| | | |

(silver and silver equivalent ounces in thousands) | Silver | Gold | Silver Equivalent1 |

Palmarejo, Mexico | 6,700 - 7,000 | 84,000 - 90,000 | 11,740 - 12,400 |

San Bartolomé, Bolivia | 5,700 - 6,000 | — | 5,700 - 6,000 |

Rochester, Nevada | 4,100 - 4,400 | 38,000 - 42,000 | 6,380 - 6,920 |

Endeavor, Australia | 500 - 600 | — | 500 - 600 |

Kensington, Alaska | — | 107,000 - 112,000 | 6,420 - 6,720 |

Total | 17,000 - 18,000 | 229,000 - 244,000 | 30,740 - 32,640 |

Financial Results and Conference Call

Coeur will report its full operational and financial results for the third quarter on November 5, 2014 after the New York Stock Exchange closes for trading. There will be a conference call on November 6, 2014 at 11:00 a.m. Eastern time.

Dial-In Numbers: (877) 768-0708 (US and Canada)

(660) 422-4718 (International)

Conference ID: 716 78 102

The conference call and presentation will also be webcast on the Company’s website coeur.com.

Hosting the call will be Mitchell J. Krebs, President and Chief Executive Officer of Coeur, who will be joined by Peter C. Mitchell, Senior Vice President and Chief Financial Officer; Frank L. Hanagarne, Jr., Senior Vice President and Chief Operating Officer; Hans Rasmussen, Vice President, Exploration; Joe Phillips, Senior Vice President and Chief Development Officer; and other members of management.

A replay of the call will be available through November 20, 2014.

Replay Numbers: (855) 859-2056 (US and Canada)

(404) 537-3406 (International)

About Coeur

Coeur Mining is the largest U.S.-based primary silver producer and a significant gold producer with four precious metals mines in the Americas employing nearly 2,000 people. Coeur produces from its wholly owned operations: the Palmarejo silver-gold mine in Mexico, the San Bartolomé silver mine in Bolivia, the Rochester silver-gold mine in Nevada and the Kensington gold mine in Alaska. The Company also has a non-operating interest in the Endeavor mine in Australia in addition to net smelter royalties on the Cerro Bayo mine in Chile, the El Gallo mine in Mexico, and the Zaruma mine in Ecuador. In addition, the Company owns strategic investment positions in several silver and gold development companies with projects in North and South America and has two silver-gold feasibility stage projects - the La Preciosa project in Mexico and the Joaquin project in Argentina. The Company conducts ongoing exploration activities in Alaska, Argentina, Bolivia, Mexico, and Nevada.

For Additional Information:

Bridget Freas, Director, Investor Relations

(312) 489-5819

Donna Mirandola, Director, Corporate Communications

(312) 489-5842

coeur.com

Cautionary Statement

This news release contains forward-looking statements within the meaning of securities legislation in the United States and Canada, including statements regarding anticipated production, grades, margins, recovery rates, the re-scoped mine plan for Palmarejo, and future performance. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause Coeur's actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include, among others, the risks and hazards inherent in the mining business (including risks inherent in developing large-scale mining projects, environmental hazards, industrial accidents, weather or geologically related conditions), changes in the market prices of gold and silver and a sustained lower price environment, the uncertainties inherent in Coeur's production, exploratory and developmental activities, including risks relating to permitting and regulatory delays, ground conditions, grade variability, any future labor disputes or work stoppages, the uncertainties inherent in the estimation of gold and silver ore reserves, changes that could result from Coeur's future acquisition of new mining properties or businesses, reliance on third parties to operate certain mines where Coeur owns silver production and reserves and the absence of control over mining operations in which Coeur or its subsidiaries hold royalty or streaming interests

and risks related to these mining operations including results of mining and exploration activities, environmental, economic and political risks of the jurisdiction in which the mining operations are located, the loss of any third-party smelter to which Coeur markets silver and gold, the effects of environmental and other governmental regulations, the risks inherent in the ownership or operation of or investment in mining properties or businesses in foreign countries, Coeur's ability to raise additional financing necessary to conduct its business, make payments or refinance its debt, as well as other uncertainties and risk factors set out in filings made from time to time with the United States Securities and Exchange Commission, and the Canadian securities regulators, including, without limitation, Coeur's most recent reports on Form 10-K and Form 10-Q. Actual results, developments and timetables could vary significantly from the estimates presented. Readers are cautioned not to put undue reliance on forward-looking statements. Coeur disclaims any intent or obligation to update publicly such forward-looking statements, whether as a result of new information, future events or otherwise. Additionally, Coeur undertakes no obligation to comment on analyses, expectations or statements made by third parties in respect of Coeur, its financial or operating results or its securities.

W. David Tyler, Coeur's Vice President, Technical Services and a qualified person under Canadian National Instrument 43-101, supervised the preparation of the scientific and technical information concerning Coeur's mineral projects in this news release. For a description of the key assumptions, parameters and methods used to estimate mineral reserves and resources, as well as data verification procedures and a general discussion of the extent to which the estimates may be affected by any known environmental, permitting, legal, title, taxation, socio-political, marketing or other relevant factors, please see the Technical Reports for each of Coeur's properties as filed on SEDAR at sedar.com.

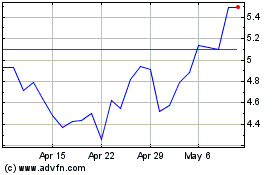

Coeur Mining (NYSE:CDE)

Historical Stock Chart

From Mar 2024 to Apr 2024

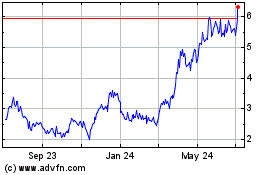

Coeur Mining (NYSE:CDE)

Historical Stock Chart

From Apr 2023 to Apr 2024