Report of Foreign Issuer (6-k)

October 01 2014 - 4:01PM

Edgar (US Regulatory)

FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of October 2014

Commission File Number: 033-97038

BROOKFIELD ASSET MANAGEMENT INC.

(Translation of registrant's name into English)

Brookfield Place

Suite 300

181 Bay Street, P.O. Box 762

Toronto, Ontario, Canada M5J 2T3

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by

Regulation S-T Rule 101(b)(1): ____

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by

Regulation S-T Rule 101(b)(7): ____

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby

furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- ____

INCORPORATION BY REFERENCE

The Form 6-K of Brookfield Asset Management Inc. dated October 1, 2014 and the exhibit thereto are hereby incorporated by reference as exhibits to Brookfield Asset Management Inc.’s registration statement on Form F-9 (File No. 333-112049).

EXHIBIT LIST

|

Exhibit

|

|

|

| |

|

|

|

|

|

BROOKFIELD INCREASES SIZE OF PREFERRED SHARE OFFERING TO C$300 MILLION

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

BROOKFIELD ASSET MANAGEMENT INC.

|

|

|

|

|

|

Date: October 1, 2014

|

By:

|

/s/ B. D. Lawson

|

| |

Name: B. D. Lawson

|

| |

Title: Senior Managing Partner & CFO

|

Exhibit 99.1

| Brookfield Asset Management Inc. |

|

BROOKFIELD INCREASES SIZE OF PREFERRED SHARE OFFERING TO C$300 MILLION

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR DISSEMINATION TO THE UNITED STATES

Toronto, Ontario, October 1, 2014 – Brookfield Asset Management Inc. (NYSE: BAM) (TSX: BAM.A) (Euronext: BAMA) today announced that as a result of strong investor demand for its previously announced offering it has agreed to increase the size of the offering to 12,000,000 Class A Preferred Shares, Series 42. The Preferred Shares, Series 42 will be issued at a price of C$25.00 per share, for gross proceeds of C$300,000,000. There will not be an underwriters’ option as was previously granted. The Preferred Shares, Series 42 are being offered on a bought deal basis by a syndicate of underwriters led by TD Securities Inc., RBC Capital Markets, CIBC and Scotiabank.

The Preferred Shares, Series 42 will be offered in all provinces of Canada by way of a supplement to Brookfield’s existing short form base shelf prospectus. The Preferred Shares, Series 42 may not be offered or sold in the United States or to U.S. persons absent registration or an applicable exemption from the registration requirements under the U.S. Securities Act.

The offering of Preferred Shares, Series 42 is expected to close on or about October 8, 2014.

Brookfield Asset Management Inc. is a global alternative asset manager with approximately $200 billion in assets under management. The company has over a 100-year history of owning and operating assets with a focus on property, renewable energy, infrastructure and private equity. Brookfield offers a range of public and private investment products and services, and is co-listed on the New York and Toronto Stock Exchanges under the symbol BAM and BAM.A, respectively. For more information, please visit our website at www.brookfield.com.

For more information, please visit our website at www.brookfield.com or contact:

|

Media:

Andrew Willis

Communications and Media

Tel: (416) 369-8236

Fax: (416) 363-2856

Email: andrew.willis@brookfield.com

|

|

Investors:

Amar Dhotar

Investor Relations

Tel: (416) 359-8629

Fax: (416) 363-2856

Email: amar.dhotar@brookfield.com

|

Forward-Looking Statements

Note: This news release contains “forward-looking information” within the meaning of Canadian provincial securities laws and “forward-looking statements” within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended, Section 21E of the U.S. Securities Exchange Act of 1934, as amended, “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995 and in any applicable Canadian securities regulations. The words “will”, “intends”, “expected” and derivations thereof and other expressions that are predictions of or indicate future events, trends or prospects and which do not relate to historical matters identify forward-looking statements.

Forward-looking statements in this news release include statements with respect to the issuance of the Preferred Shares, Series 42 and the use of proceeds from the issuance of the Preferred Shares, Series 42. Although Brookfield Asset Management believes that such forward-looking statements and information are based upon reasonable assumptions and expectations, the reader should not place undue reliance on forward-looking statements and information as such statements and information involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the company to differ materially from anticipated future results, performance or achievement expressed or implied by such forward-looking statements and information.

Factors that could cause actual results to differ materially from those contemplated or implied by forward-looking statements include: economic and financial conditions in the countries in which we do business; the behaviour of financial markets, including fluctuations in interest and exchange rates; availability of equity and debt financing; and other risks and factors detailed from time to time in the company’s Annual Report on Form 40-F filed with the Securities and Exchange Commission as well as other documents filed by the company with the securities regulators in Canada and the United States including the company’s most recent Management’s Discussion and Analysis of Financial Results under the heading “Business Environment and Risks.”

We caution that the foregoing list of important factors that may affect future results is not exhaustive. When relying on our forward-looking statements to make decisions with respect to Brookfield Asset Management, investors and others should carefully consider the foregoing factors and other uncertainties and potential events. Except as required by law, the company undertakes no obligation to publicly update or revise any forward-looking statements or information, whether written or oral, that may be as a result of new information, future events or otherwise.

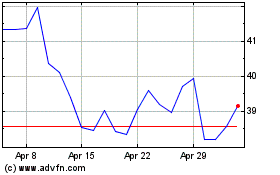

Brookfield Asset Managem... (NYSE:BAM)

Historical Stock Chart

From Aug 2024 to Sep 2024

Brookfield Asset Managem... (NYSE:BAM)

Historical Stock Chart

From Sep 2023 to Sep 2024