UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________________________

FORM 8-K

________________________________________________

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 30, 2014

________________________________________________

Advanced Energy Industries, Inc.

(Exact name of registrant as specified in its charter)

________________________________________________

|

| | | | |

Delaware | | 000-26966 | | 84-0846841 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

|

| | | | | |

1625 Sharp Point Drive, Fort Collins, Colorado | | 80525 | |

(Address of principal executive offices) | | (Zip Code) | |

|

| | | |

(970) 221-4670 |

(Registrant's telephone number, including area code) |

| | | |

Not applicable |

(Former name or former address, if changed since last report) |

________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(b) On September 30, 2014, Dr. Garry Rogerson resigned from his positions as Chief Executive Officer and Director of Advanced Energy Industries, Inc. (the “Company”), effective as of the end of business on September 30, 2014 in accordance with his Executive Transition and Separation Agreement dated May 31, 2014, a copy of which was attached as Exhibit 10.1 to the Company’s Current Report on Form 8-K filed on June 2, 2014.

(c) On September 30, 2014, the Company announced the promotion and appointment of Yuval Wasserman, age 59, as the Company’s Chief Executive Officer and as a Director of the Company, both effective October 1, 2014. Mr. Wasserman joined the Company in August 2007 as Senior Vice President, Sales, Marketing and Service. In October 2007 he was promoted to Executive Vice President, Sales, Marketing and Service. In April 2009 he was promoted to Executive Vice President and Chief Operating Officer of the Company and then in August 2011 he was promoted to President of the Thin Films Business Unit. Mr. Wasserman also serves on the board of directors of Syncroness, Inc., an outsourced engineering and product development company. Mr. Wasserman received a Bachelor of Science in Chemical Engineering from the Ben-Gurion University in Be'er Sheva, Israel.

The Company issued a press release on September 30, 2014, announcing the appointment of Mr. Wasserman as the Company’s President & Chief Executive Officer, a copy of which is attached to this Form 8-K as Exhibit 99.1.

Offer Letter to Mr. Yuval Wasserman

On September 28, 2014, the Company and Yuval Wasserman executed an offer letter (the “Offer Letter”), pursuant to which Mr. Wasserman was promoted to and accepted the Company’s offer to become the President & Chief Executive Officer of the Company. Mr. Wasserman will commence his new position with the Company on October 1, 2014. Pursuant to the Offer Letter, Mr. Wasserman will receive an annual base salary of $600,000. In addition to the above base salary, Mr. Wasserman is eligible for discretionary short- and long-term incentive compensation in accordance with the Company’s policies and applicable plans. The Company’s Short Term Incentive Plan (“STIP”) is an annual cash incentive plan with performance metrics set each year. Prior to his promotion, Mr. Wasserman participated in the STIP based on his position as President of the Thin Films Business Unit; and from this promotion date through the end of 2014, Mr. Wasserman shall participate in the STIP based on his position as Chief Executive Officer. Cash incentives will be paid to Mr. Wasserman under the STIP only if performance metrics related to revenue, non-GAAP operating income and cash in 2014, as previously established by the Board of Directors, are met. A threshold level of achievement for corporate non-GAAP operating income for the fiscal year must be met in order to trigger any payout of the revenue and non-GAAP operating income portions of the STIP. If the performance metrics in 2014 are not met, but the Company or the business unit, as the case may be, meets a specified minimum threshold of cash flow for the fiscal year, the terms of the STIP provide for an award of up to 40% of the pre-established target bonus to each participant, based on the formula set forth in the STIP. The pre-established target bonus under the STIP for Mr. Wasserman in his capacity as President of the Thin Films Business Unit is 75% of his base salary, and in his capacity as Chief Executive Officer is equal to 100% of his base salary. If the Company exceeds the performance metrics in 2014, a cash bonus greater than the target amount may become payable to Mr. Wasserman, up to a maximum of 200% of the target bonus. Any payout to Mr. Wasserman in respect of 2014 performance shall be based on his base salary as Chief Executive Officer. Pursuant to the Offer Letter, Mr. Wasserman will be granted options on October 1, 2014 to purchase common stock that have an estimated grant date value of $500,000 with a 3-year vesting period (1/3rd vests every year).

The exercise price for such options is equal to the fair market value of the underlying stock on the date of grant, as determined under the Company’s 2008 Omnibus Incentive Plan. The options are subject to the terms of the Company’s 2008 Omnibus Incentive Plan.

Mr. Wasserman will continue to receive medical and other benefits consistent with the Company’s standard policies and be eligible to participate in other Company plans, as applicable. In connection with his relocation to the Company’s headquarters in Fort Collins, Colorado, Mr. Wasserman will be reimbursed for customary out-of-pocket expenses he incurs, on the terms and subject to the conditions of the Company’s relocation policy.

The foregoing is a summary of the material terms of the Offer Letter and is qualified in its entirety by reference to the Offer Letter. A copy of the complete Offer Letter is attached to this Current Report on Form 8-K as Exhibit 10.1, and the terms of the Offer Letter are incorporated herein by this reference.

Change in Control Agreement with Mr. Wasserman

On September 30, 2014, the Company entered into an Executive Change in Control Agreement with Mr. Wasserman (the “CIC Agreement”), which became effective upon Mr. Wasserman commencing his service as President & Chief Executive Officer of

the Company on October 1, 2014. Mr. Wasserman’s prior Executive Change in Control Agreement dated March 29, 2008, as amended on March 4, 2013, was terminated and replaced by the CIC Agreement. The CIC Agreement provides Mr. Wasserman with severance payments and certain benefits in the event of his Involuntary Termination. An “Involuntary Termination” will be deemed to have occurred if Mr. Wasserman’s employment is terminated at the time of or following a Change in Control (as defined in the CIC Agreement) before the end of the CIC Period (as defined in the CIC Agreement) (i) by the Company without Cause (as defined in the CIC Agreement) or (ii) by Mr. Wasserman for Good Reason (as defined in the CIC Agreement). Any amounts payable to Mr. Wasserman pursuant to the CIC Agreement, except for any Accrued Compensation (as defined in the CIC Agreement), will be contingent on Mr. Wasserman provision to the Company of a release of claims.

In the event of termination of Mr. Wasserman’s employment under circumstances constituting an Involuntary Termination, he will be entitled to receive: (a) all then accrued compensation and a pro-rata portion of executive’s target bonus for the year in which the termination is effected, (b) a lump sum payment equal to (i) 2 times his then current annual base salary plus (ii) his target bonus for the year in which the termination is effected, (c) continuation of benefits for 18 months following the period for revocation of the release, unless Mr. Wasserman commences employment with another employer, (d) an amount equal to the contributions that would have been made to the Company’s retirement plans on his behalf, if he had continued to be employed for 12 months following the period for revocation of the release, and (e) reimbursement, up to $15,000, for outplacement services.

Mr. Wasserman’s Options and RSUs (each as defined in the CIC Agreement) will also accelerate in full upon an Involuntary Termination following a Change in Control before the end of the CIC Period. The termination of Mr. Wasserman’s employment without Cause during a Pending Change in Control (as defined in the CIC Agreement) will not accelerate the vesting of Options or RSUs held by Mr. Wasserman, unless the Change in Control is effected within 3 months following the Date of Termination (as defined in the CIC Agreement), in which case Mr. Wasserman’s Options will vest in full.

The foregoing is a summary of the material terms of the CIC Agreement and is qualified in its entirety by reference to the CIC Agreement. A copy of the complete CIC Agreement is attached as Exhibit 10.2 to this Current Report on Form 8-K, and the terms the CIC Agreement are incorporated herein by this reference.

(d) Effective October 1, 2014, the Board of Directors of the Company appointed Mr. Wasserman as a Director, in accordance with the Offer Letter, to fill the vacancy created by Mr. Rogerson’s resignation. Information regarding Mr. Wasserman’s business experience is incorporated herein by reference to paragraph (c) of this Item 5.02. Mr. Wasserman brings years of executive and management experience in the semiconductor and electronics industries, and has significant knowledge of the Company’s history and operations.

Director Indemnification Agreement with Mr. Wasserman

Effective October 1, 2014, the Company entered into a Director Indemnification Agreement in the Company’s standard form (the “Indemnification Agreement”) with Mr. Wasserman.

The Indemnification Agreement provides that, to the fullest extent permitted by law and subject to exceptions specified in the Indemnification Agreement, the Company shall hold harmless and indemnify Mr. Wasserman and advance expenses incurred by Mr. Wasserman, including reasonable attorneys’ fees and court costs, in connection with any proceeding covered by the Indemnification Agreement. The Company’s obligations under the Indemnification Agreement shall continue following the time that Mr. Wasserman ceases to be a director of the Company, so long as Mr. Wasserman is subject to any proceeding covered by the Indemnification Agreement.

The rights of indemnification provided by the Indemnification Agreement are not exclusive and specifically supplement the rights to indemnification provided to the directors in the Company’s Certificate of Incorporation and By-laws and applicable law. To the extent that the Company maintains one or more insurance policies providing liability insurance for its directors, officers, employees, agents or fiduciaries, Mr. Wasserman shall be covered by such policy or policies in accordance with the terms thereof. In the event of any payment by the Company under the Indemnification Agreement, the Company shall be subrogated to the extent of such payment to all of the rights of recovery of Mr. Wasserman.

The form of Indemnification Agreement is attached as Exhibit 10.1 to the Company’s Current Report on Form 8-K filed December 14, 2009.

Item 9.01 Financial Statements and Exhibits.

|

| | |

Exhibit No. | | Description |

| | |

10.1 | | Offer Letter to Yuval Wasserman dated September 28, 2014 |

10.2 | | Executive Change in Control Agreement dated September 30, 2014 |

99.1 | | Press Release dated September 30, 2014 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

| | | |

| | /s/ Thomas. O. McGimpsey |

Date: October 1, 2014 | | Thomas O. McGimpsey |

| | Executive Vice President, General Counsel & Corporate Secretary |

EXHIBIT INDEX

|

| | |

Exhibit No. | | Description |

| | |

10.1 | | Offer Letter to Yuval Wasserman dated September 28, 2014 |

10.2 | | Executive Change in Control Agreement dated September 30, 2014 |

99.1 | | Press Release dated September 30, 2014 |

EXHIBIT 10.1

OFFER LETTER

|

| | |

| | 1625 Sharp Point Drive |

| | Fort Collins, Colorado 80525 USA |

| | Fax 970/221-5583 |

| | Main 970/221-4670 |

September 28, 2014

VIA ELECTRONIC MAIL

Yuval Wasserman

1110 Via Tornasol

Aptos, California 95003

Dear Yuval:

We are extremely pleased to offer you the position of President & Chief Executive Officer of Advanced Energy Industries, Inc. (the “Company” or “Advanced Energy”) on the terms set forth in this offer letter. Your promotion will be effective on October 1, 2014 (the “Effective Date”), with your office being re-located as of that date to the Company’s world headquarters located at 1625 Sharp Point Drive, Fort Collins, Colorado. In this capacity, you will have the complete support of the Board of Directors in your efforts to make certain that the Company achieves the goals set forth by the Board. You have also been nominated to serve as a member of the Board, commencing on the Effective Date.

Base Salary. Your salary will be increased as of the Effective Date to $600,000 on an annualized basis and will be paid semi-monthly, less applicable taxes, deductions and withholdings, and is subject to annual review.

Incentive Compensation. In addition to the above base salary, you will be eligible for discretionary short- and long-term incentive compensation in accordance with the following Company policies and applicable plans:

Short Term Incentive Plan (“STIP”). The STIP provides for a 2014 target cash incentive percentage for this position of 100% of the annual base salary. Payout will be dependent on the Company’s financial performance and your continued active employment with the Company in your position through the date that the incentive award is paid. Your current STIP opportunity at 75% will be applicable up through September 30, 2014 and will be based upon the Thin Films performance targets previously established. Your STIP opportunity as CEO will be increased to 100% for the time period commencing October 1, 2014 through December 31, 2014 and will be based upon Corporate performance targets previously established. Both STIP opportunities will be based on your salary as CEO. This means that should the respective performance targets be met, ¾ of your total STIP opportunity will be based on the STIP applicable to you as President of Thin Films (at target, $600,000 * 75% * ¾ of the year, or $337,500) and ¼ of your total STIP opportunity will be

based on the revised STIP applicable to you as CEO (at target, $600,000 * 100% * ¼ of a year, or $150,000).

The STIP incentive is usually paid in February after the fiscal year for which it is earned. Target incentives do not constitute a promise or guarantee of payment.

Long Term Incentive Compensation. With regard to long term compensation, the Compensation Committee has approved (and the Board has ratified), effective October 1, 2014, a grant to you of options to purchase common stock that have an estimated grant date value of $500,000 with a 3-year vesting period (1/3rd vests every year). For the 2015 performance period, you would be eligible for a long term incentive opportunity with an anticipated grant date value of approximately $1.6 million. Grants for the 2015 performance period will be considered by the Compensation Committee and the Board in early 2015.

General Terms of Incentive Compensation. The exercise price of the options granted to you in accordance with this offer letter would be the fair market value of the underlying stock, which would be the closing price on the date of the grant. You must remain an active employee of the Company for the grant to be made and to vest (or continue to vest). Other terms are set forth in the 2008 Omnibus Incentive Plan and related award agreements that provide the grants. In the event of a conflict between the terms of this offer letter and the terms of the STIP plan document, the 2008 Omnibus Incentive Plan or related award agreements, the terms of the STIP plan document, the 2008 Omnibus Incentive Plan or the related award agreements, as applicable, will control. As a current participant in these incentive plans and programs, you have received copies of the plans, agreements and related documents; however, we would be pleased to provide you with additional copies at your request.

Stock Ownership Policy. Please be aware that you will continue to be subject to the Company’s Stock Ownership Policy at the CEO level which is described in our 2014 Annual Proxy Statement.

Executive Change in Control Severance Agreement. We will offer you the opportunity to replace your current executive change in control severance agreement with an agreement providing benefits consistent with your promotion to CEO, a copy of which will be provided to you separately.

Benefits. This offer will be in accordance with our standard Company agreements and policies applicable to executive officers, which agreements and policies cover such items as medical, moving, vacation, and disability benefits. We do not expect your promotion to CEO to result in material changes in such benefits.

The Company’s benefit programs are re-evaluated from time to time and are subject to change or cancellation at any time, at the discretion of the Company. This may include coverage offered and the cost of coverage.

As an executive of Advanced Energy you are expected to continue to manage your personal time off in an efficient manner. You will not accrue PTO but will be able to take time off at your own discretion. Advanced Energy also recognizes seven (7) company-sponsored holidays during each calendar year.

Conditions of Employment. As an employee of Advanced Energy, you will continue to be subject to all of its policies and procedures. The information in this letter is not intended to constitute a contract of employment, either express or implied. Your employment with Advanced Energy Industries, Inc. shall be at will, which means that either you or the Company may terminate the employment relationship at any time and for any reason, with or without advance notice.

Yuval, representing the full Board we are very excited that we have such an outstanding leader to take the Company to the next level of performance. I am looking forward to continuing to work with you and supporting your future successes.

|

| | | | | |

Regards, | | | | |

| | | | | |

/s/ Richard P. Beck | | | |

Richard P. Beck | | | |

Chairman of the Board | | | |

| | | | | |

Advanced Energy Industries, Inc. | | | |

| | | AGREED AND ACCEPTED: |

| | | By: | /s/ Yuval Wasserman |

| | | | Yuval Wasserman |

| | | | | |

EXHIBIT 10.2

EXECUTIVE CHANGE IN CONTROL AGREEMENT

This Executive Change in Control Agreement (this “Agreement”), is made as of the 30th day of September, 2014 to be effective on October 1, 2014 (the “Effective Date”), by and between Advanced Energy Industries, Inc., a Delaware corporation (the “Company”), and Yuval Wasserman (the “Executive”).

Recitals

A. The Executive has been promoted to President & Chief Executive Officer effective October 1, 2014.

B. The Board of Directors of the Company (the “Board”) acknowledges that consolidation within the industries in which the Company operates is likely to continue and the potential for a change in control of the Company, whether friendly or hostile, currently exists and from time to time in the future will exist, which potential can give rise to uncertainty among the senior executives of the Company. The Board considers it essential to the best interests of the Company to reduce the risk of the Executive’s departure and/or the inevitable distraction of the Executive’s attention from his duties to the Company, which are normally attendant to such uncertainties.

C. The Executive confirms that the terms of this Agreement reduce the risks of his departure and distraction of his attention from his duties to the Company and, accordingly, desires to enter into this Agreement.

D. Prior to the effectiveness of this Agreement, the Executive and the Company were party to that certain Executive Change in Control Agreement dated March 29, 2008, as amended on March 4, 2013 (the “Prior CIC Agreement”), which agreement is cancelled and fully superseded by this Agreement.

Agreement

In consideration of the foregoing and the mutual covenants contained herein, the Company and the Executive agree as follows:

1. Definitions. Capitalized terms used herein shall have the meanings given to them in Annex A attached hereto, except where the context requires otherwise.

2. Term of Agreement.

This Agreement shall be effective as of the Effective Date and shall continue in effect until September 30, 2015 (the “Initial Expiration Date”), provided, however, that the term of this Agreement automatically shall be extended for one additional year effective as of the Initial Expiration Date and each anniversary thereof (each, a “Scheduled Expiration Date”), unless either the Company or the Executive provides written notice to the other that the term of this Agreement shall terminate on the upcoming Scheduled Expiration Date, provided such notice is received by the receiving party not less than ninety (90) days prior to the applicable Scheduled Expiration Date, and provided further that the Company shall not be entitled to deliver to the Executive such notice in the event of a Change in Control or a Pending Change in Control. Notwithstanding the foregoing, this Agreement shall terminate immediately upon the termination of the Executive’s employment prior to a Change in Control.

Upon effectiveness of this Agreement, the Prior CIC Agreement is terminated and fully superseded by this Agreement. From and after the Effective Date, the Executive shall not be entitled to any rights or benefits under the Prior CIC Agreement.

3. At Will Employment; Reasons for Termination.

The Executive’s employment shall be at-will, as defined under applicable law. If the Executive’s employment terminates for any reason or no reason, the Executive shall not be entitled to any compensation, benefits, damages, awards or other payments in respect of such termination, except as provided in this Agreement or pursuant to the terms of any Applicable Benefit Plan. “Applicable Benefit Plan” means any written employee benefit plan in effect and in which the Executive participates as of the time of the termination of his employment.

4. Benefits Upon Separation.

(a) Compensation and Benefits Required by Law or Applicable Benefit Plan. Notwithstanding anything to the contrary herein, the Executive or his estate shall be entitled to any and all compensation, benefits, awards and other payments required by any Applicable Benefit Plan, the COBRA Act or other applicable law, after taking into account the agreements set forth herein.

(b) No Payments Without Release. The Executive shall not be entitled to any of the compensation (other than Accrued Compensation), benefits or other payments provided herein in respect of the termination of his employment, unless and until he has provided to the Company a full release of claims, substantially in the form of Appendix I attached hereto, which release shall be dated not earlier than the date of the termination of his employment, which release shall be executed within 30 days of Executive’s termination of employment.

(c) Voluntary Resignation or Termination for Cause.

(i) In the event of the Executive’s Voluntary Resignation or termination of his employment by the Company for Cause, the Executive shall not be entitled to any compensation, benefits, awards or other payments in connection with such termination of his employment, except as provided in paragraph (a) of this Section 4.

(ii) The Executive shall not be deemed to have been terminated for Cause under this Agreement, unless the following procedures have been observed: To terminate the Executive for Cause, the Board must deliver to the Executive notice of such termination in writing, which notice must specify the facts purportedly constituting Cause in reasonable detail. The Executive will have the right, within 10 calendar days of receipt of such notice, to submit a written request for review by the Board. If such request is timely made, within a reasonable time thereafter, the Board (with all directors attending in person or by telephone) shall give the Executive the opportunity to be heard (personally or by counsel). Following such hearing, unless a majority of the directors then in office confirm that the Executive’s termination was for Cause, the Executive’s termination shall be deemed to have been made by the Company without Cause for purposes of this Agreement.

(d) Death or Long-Term Disability. In the event of the Executive’s death or Long-Term Disability, the Executive (or his estate or personal representative) shall be entitled to receive (i) the proceeds of any life insurance policy carried by the Company with respect to the Executive, or (ii) payments pursuant to any long-term disability insurance policy carried by the Company with respect to the Executive, as applicable.

(e) Involuntary Termination. In the event Executive’s employment is terminated under circumstances constituting an Involuntary Termination, the Executive shall be entitled to receive:

(i) within fifteen (15) calendar days after the Date of Termination, the Executive’s Accrued Compensation and Pro-Rata Bonus through the Date of Termination; and

(ii) within fifteen (15) calendar days after the period for revocation of the release has elapsed, the amount in cash equal to the sum of (x) two (2) times the Executive’s annual Base Salary and (y) the Executive’s Target Bonus in effect as of the Date of Termination; and

(iii) for eighteen (18) months after the period for revocation of the release has elapsed continuation of the Benefits, as if the Executive’s employment had not been terminated; provided, however, that if the Executive commences employment with another employer during such eighteen (18) month period and is eligible to receive medical benefits under the new employer’s plan(s), the Benefits shall terminate as of the date the Executive becomes eligible to receive such benefits;

(iv) within fifteen (15) calendar days after the after the period for revocation of the release has elapsed, an amount equal to the contributions to the Company’s retirement plans on behalf of the Executive that would have been made for the benefit of the Executive if the Executive’s employment had continued for twelve (12) months after the Date of Termination, assuming for this purpose that all benefits under any such retirement plans were fully vested and that the Executive’s compensation during such twelve (12) months were the same as it had been immediately prior to the Date of Termination; and

(v) reimbursement, up to $15,000, for outplacement services reasonably selected by the Executive incurred by the end of the second calendar year after termination of employment such reimbursement to occur by the

end of the following calendar year.

5. Effect on Option and Restricted Unit Agreements.

(a) In the event Options held by the Executive are assumed by the surviving entity in connection with a Change in Control, if an Involuntary Termination of Executive’s employment occurs following the Change of Control before the end of the CIC Period, vesting of any and all assumed Options held by the Executive shall be accelerated so that all unexpired Options then held by the Executive shall be fully vested and exercisable immediately upon the Involuntary Termination.

(b) In the event RSUs held by the Executive are assumed by the surviving entity in connection with a Change in Control, if an Involuntary Termination of Executive’s employment occurs following the Change of Control before the end of the CIC Period, vesting of any and all assumed RSUs held by the Executive shall be accelerated so that all RSUs then held by the Executive shall be fully vested and exercisable immediately upon the Involuntary Termination.

(c) The termination of the Executive’s employment by the Company without Cause during a Pending Change in Control shall have no effect on the vesting of the Options or RSUs then held by the Executive, and no shares of Common Stock or common stock of any subsidiary of the Company shall be delivered to the Executive in connection with the RSUs held by the Executive at the time of the termination of his employment unless the Change in Control is effected within three (3) months following the Date of Termination. If the Change in Control is effected, then the Options and RSUs held by the Executive as of the Date of Termination shall be treated as if the Executive’s employment had not been terminated and the Executive shall have rights as set forth under Section 5(a) above. If the Change in Control is not effected within three (3) months following the Date of Termination, then the Options and RSUs held by the Executive as of the Date of Termination shall be treated as if the Executive’s employment had been terminated as of such three-month anniversary of the Date of Termination.

(d) In the event the Executive’s employment is terminated by the Company under any circumstances other than those described in paragraphs (a) through (c) of this Section 5, the effect of such termination of employment on the Options and/or RSUs then held by the Executive shall be as set forth in the agreements representing such Options and/or RSUs.

6. Mitigation. In no event shall the Executive be obligated to seek other employment or take any other action by way of mitigation of the amounts payable to the Executive under any of the provisions of this Agreement, and except as set forth in Section 4, such amounts shall not be reduced whether or not the Executive obtains other employment.

7. Successors.

(a) This Agreement is personal to the Executive, and, without the prior written consent of the Company, shall not be assignable by the Executive other than by will or the laws of descent and distribution. This Agreement shall inure to the benefit of and be enforceable by the Executive’s legal representatives.

(b) This Agreement shall inure to the benefit of and be binding upon the Company and its successors and assigns.

(c) The Company shall require any successor (whether direct or indirect, by purchase, merger, consolidation or otherwise) to all or substantially all of the business and/or assets of the Company to assume expressly and agree to perform this Agreement in the same manner and to the same extent that the Company would be required to perform it if no such succession had taken place.

8. Miscellaneous.

(a) The captions of this Agreement are not part of the provisions hereof and shall have no force or effect. This Agreement constitutes the entire agreement and understanding of the parties in respect of the subject matter hereof and supersedes all prior understanding, agreements, or representations by or among the parties, written or oral, to the extent they relate in any away to the subject matter hereof; provided, however, this Agreement shall have no effect on any confidentiality agreements or assignment of inventions agreements between the parties. This Agreement may not be amended or modified other than by a written agreement executed by the parties hereto or their respective successors and legal representatives.

(b) All notices and other communications hereunder shall be in writing and shall be given by hand

delivery to the other party or by registered or certified mail, return receipt requested, postage prepaid, addressed as follows:

if to the Executive, to the address set forth as his principal residence in the records of the Company; and

if to the Company:

Advanced Energy Industries, Inc.

1625 Sharp Point Drive

Fort Collins, CO 80525

Attention: General Counsel

or to such other address as either party shall have furnished to the other in writing in accordance herewith. Notice and communications shall be effective when actually received by the addressee.

(c) The invalidity or unenforceability of any provision of this Agreement shall not affect the validity or enforceability of any other provision of this Agreement.

(d) The Company may withhold from any amounts payable under this Agreement such United States federal, state or local or foreign taxes as shall be required to be withheld pursuant to any applicable law or regulation.

(e) The Executive’s or the Company’s failure to insist upon strict compliance with any provision of this Agreement or the failure to assert any right the Executive or the Company may have hereunder shall not be deemed to be a waiver of such provision or right or any other provision or right of this Agreement.

(f) All claims by the Executive for payments or benefits under this Agreement shall be promptly forwarded to and addressed by the Compensation Committee and shall be in writing. Any denial by the Compensation Committee of a claim for benefits under this Agreement shall be delivered to the Executive in writing and shall set forth the specific reasons for the denial and the specific provisions of this Agreement relied upon. The Compensation Committee shall afford the Executive a reasonable opportunity for a review of the decision denying a claim and shall further allow the Executive make a written demand upon the Company to submit the disputed matter to arbitration in accordance with the provisions of paragraph (g) below. The Company shall pay all expenses of the Executive, including reasonable attorneys and expert fees, in connection with any such arbitration. If for any reason the arbitrator has not made his award within one hundred eighty (180) days from the date of Executive’s demand for arbitration, such arbitration proceedings shall be immediately suspended and the Company shall be deemed to have agreed to Executive’s position. Thereafter, the Company shall, as soon as practicable and in any event within 10 business days after the expiration of such 180-day period, pay Executive his reasonable expenses and all amounts reasonably claimed by him that were the subject of such dispute and arbitration proceedings.

(g) Subject to the terms of paragraph (f) above, any dispute arising from, or relating to, this Agreement shall be resolved at the request of either party through binding arbitration in accordance with this paragraph (g). Within 10 business days after demand for arbitration has been made by either party, the parties, and/or their counsel, shall meet to discuss the issues involved, to discuss a suitable arbitrator and arbitration procedure, and to agree on arbitration rules particularly tailored to the matter in dispute, with a view to the dispute’s prompt, efficient, and just resolution. Upon the failure of the parties to agree upon arbitration rules and procedures within a reasonable time (not longer than 15 business days from the demand), the Commercial Arbitration Rules of the American Arbitration Association shall be applicable. Likewise, upon the failure of the parties to agree upon an arbitrator within a reasonable time (not longer than 15 business days from demand), there shall be a panel comprised of three arbitrators, one to be appointed by each party and the third one to be selected by the two arbitrators jointly, or by the American Arbitration Association, if the two arbitrators cannot decide on a third arbitrator. At least 30 days before the arbitration hearing (which shall be set for a date no later than 60 days from the demand), the parties shall allow each other reasonable written discovery including the inspection and copying of documents and other tangible items relevant to the issues that are to be presented at the arbitration hearing. The arbitrator(s) shall be empowered to decide any disputes regarding the scope of discovery. The award rendered by the arbitrator(s) shall be final and binding upon both parties. The arbitration shall be conducted in Larimer County in the State of Colorado. The Colorado District Court located in Larimer County shall have exclusive jurisdiction over disputes between the parties in connection with such arbitration and the enforcement thereof, and the parties consent to the jurisdiction and venue of such court for such purpose.

(h) This Agreement shall be governed by the laws of the State of Colorado, without giving effect to any choice of law provision or rule (whether of the State of Colorado or any other jurisdiction) that would cause the application of

the laws of any jurisdiction other than the State of Colorado.

9. Other Terms Relating to Section 409A

(a) Except as provided in Section 9(b), amounts payable under this Agreement following Executive’s termination of employment, other than those expressly payable on a deferred or installment basis or as reimbursement of expenses, will be paid as promptly as practicable after such a termination of employment and, in any event, within 2 1/2 months after the end of the year in which employment terminates and amounts payable as reimbursements of expenses to the Executive must be made on or before the last day of the calendar year following the calendar year in which such expense was incurred.

(b) Anything in this Agreement to the contrary notwithstanding, if (A) on the date of termination of Executive’s employment with the Company or a subsidiary, any of the Company’s stock is publicly traded on an established securities market or otherwise (within the meaning of Section 409A(a)(2)(B)(i) of the Internal Revenue Code, as amended (the “Code”)), (B) if Executive is determined to be a “specified employee” within the meaning of Section 409A(a)(2)(B) of the Code, (C) the payments exceed the amounts permitted to be paid pursuant to Treasury Regulations section 1.409A-1(b)(9)(iii) and (D) such delay is required to avoid the imposition of the tax set forth in Section 409A(a)(1) of the Code, as a result of such termination, the Executive would receive any payment that, absent the application of this Section 9(b), would be subject to interest and additional tax imposed pursuant to Section 409A(a) of the Code as a result of the application of Section 409A(2)(B)(i) of the Code, then no such payment shall be payable prior to the date that is the earliest of (1) six (6) months after the Executive’s termination date, (2) the Executive’s death or (3) such other date as will cause such payment not to be subject to such interest and additional tax (with a catch-up payment equal to the sum of all amounts that have been delayed to be made as of the date of the initial payment).

(c) It is the intention of the parties that payments or benefits payable under this Agreement not be subject to the additional tax imposed pursuant to Section 409A of the Code. To the extent such potential payments or benefits could become subject to such Section, the parties shall cooperate to amend this Agreement with the goal of giving the Executive the economic benefits described herein in a manner that does not result in such tax being imposed.

(d) A termination of employment under this Agreement shall be deemed to occur only in circumstances that would constitute a separation from service for purposes of Treasury Regulations section 1.409A-1(h)(1)(ii).

(e) Wherever payments under this Agreement are to be made in installments, each such installment shall be deemed to be a separate payment for purposes of Section 409A.

[Signature Page Follows]

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date set forth in the Preamble hereto.

|

| | | | |

| | ADVANCED ENERGY INDUSTRIES, INC. |

| | | | |

| By: | /s/ Thomas. O. McGimpsey |

| Name: | Thomas O. McGimpsey |

| Title: | Executive Vice President, General Counsel & Corporate Secretary |

| | | | |

| | |

| | | Yuval Wasserman | |

| | | /s/ Yuval Wasserman |

ANNEX A

DEFINITIONS

(a) “Accrued Compensation” means an amount including all amounts earned or accrued through the Date of Termination but not paid as of the Date of Termination including (i) Base Salary, (ii) reimbursement for reasonable and necessary expenses incurred by the Executive on behalf of the Company during the period ending on the Date of Termination, (iii) vacation and sick leave pay (to the extent provided by Company policy or applicable law), and (iv) incentive compensation (if any) earned in respect of any period ended prior to the Date of Termination. It is expressly understood that incentive compensation shall have been “earned” as of the time that the conditions to such incentive compensation have been met, even if not calculated or payable at such time.

(b) “Agreement” means this Executive Change in Control Agreement, as set forth in the Preamble hereto.

(c) “Applicable Benefit Plan” means any written employee benefit plan in effect and in which the Executive participates as of the time of the termination of his employment.

(d) “Base Salary” means the Executive’s annual base salary at the rate in effect during the last regularly scheduled payroll period immediately preceding the occurrence of the Change in Control or termination of employment and does not include, for example, bonuses, overtime compensation, incentive pay, fringe benefits, sales commissions or expense allowances.

(e) “Board” means the Board of Directors of the Company, as set forth in the Recitals hereto.

(f) “Capital Stock” means capital stock of the Company or any of its subsidiaries.

(g) “Cause” means any of the following:

(i) the Executive’s (A) conviction of a felony; (B) commission of any other material act or omission involving dishonesty or fraud with respect to the Company or any of its Affiliates or any of the customers, vendors or suppliers of the Company or its Affiliates; (C) misappropriation of material funds or assets of the Company for personal use; or (D) engagement in unlawful harassment or unlawful discrimination with respect to any employee of the Company or any of its subsidiaries;

(ii) the Executive’s continued substantial and repeated neglect of his duties, after written notice thereof from the Board, and such neglect has not been cured within 30 days after the Executive receives notice thereof from the Board;

(iii) the Executive’s gross negligence or willful misconduct in the performance of his duties hereunder that is materially and demonstrably injurious to the Company; or

(iv) the Executive’s engaging in conduct constituting a breach of his written obligations to the Company in respect of confidentiality and/or the use or ownership of proprietary information.

(h) “Change in Control” shall be deemed to occur upon the consummation of any of the following transactions, unless the only parties to the transaction are the Company and/or one or more of its direct or indirect majority-owned subsidiaries and/or one or more companies directly or indirectly owning a majority interest in the Company immediately prior to the transaction:

(i) a merger or consolidation in which the Company is not the surviving entity, except for a transaction the principal purpose of which is to change the state of the Company’s incorporation or a transaction in which 50% or more of the surviving entity’s outstanding voting stock following the transaction is held by holders who held 50% or more of the Company’s outstanding voting stock prior to such transaction; or

(ii) the sale, transfer or other disposition of all or substantially all of the assets of the Company; or

(iii) any reverse merger in which the Company is the surviving entity, but in which 50% or more of the Company’s outstanding voting stock is transferred to holders different from those who held the stock immediately prior to such merger; or

(iv) the acquisition by any person (or entity), other than Douglas Schatz and/or any of his affiliates or members of his immediate family, directly or indirectly of 50% or more of the combined voting power of the outstanding

shares of Common Stock.

(i) “CIC Period” means the twelve (12) month period following the effective date of a Change in Control.

(j) “Code” means the Internal Revenue Code of 1986, as amended.

(k) “Common Stock” means common stock, par value $0.001, of the Company.

(l) “Company” means Advanced Energy Industries, Inc., a Delaware corporation, as set forth in the Preamble hereto.

(m) “Date of Termination” means (i) if the Executive’s employment is terminated for Cause, the date of receipt by the Executive of written notice from the Board or the Chief Executive Officer that the Executive has been terminated, or any later date specified therein, as the case may be, (ii) if the Executive’s employment is terminated by the Company other than for Cause, death or Long-Term Disability, the date specified in the Company’s written notice to the Executive of such termination, (iii) if the Executive’s employment is terminated by reason of the Executive’s death or Long-Term Disability, the date of such death or the effective date of such Long-Term Disability, (iv) if the Executive’s employment is terminated by Executive’s resignation that constitutes Involuntary Termination under this Agreement, the date of the Company’s receipt of the Executive’s notice of termination or any later date specified therein.

(n) “Effective Date” means the date set forth in the Preamble hereto.

(o) “Executive” means the individual identified in the Preamble hereto.

(p) “Good Reason” means any of the following:

(i) a material reduction in the Executive’s duties, level of responsibility or authority, other than (A) a change in title only, or (B) isolated incidents that are promptly remedied by the Company; or

(ii) a material reduction in the Executive’s Base Salary, without (A) the Executive’s express written consent or (B) an increase in the Executive’s benefits, perquisites and/or guaranteed bonus, which increase(s) have a value reasonably equivalent to the reduction in Base Salary; or

(iii) a material reduction in the Executive’s Target Bonus, without (A) the Executive’s express written consent or (B) an corresponding increase in the Executive’s Base Salary; or

(iv) the relocation of the Executive’s principal place of business to a location more than thirty-five (35) miles from the Executive’s principal place of business immediately prior to the Change in Control, without the Executive’s express written consent; or

(v) the Company’s (or its successor’s) material breach of this Agreement.

(q) “Involuntary Termination” means the termination of Executive’s employment with the Company at the time of or following a Change in Control before the end of the CIC Period:

(i) by the Company without Cause, or

(ii) by the Executive for Good Reason.

(r) “Long-Term Disability” is defined according to the Company’s insurance policy regarding long-term disability for its employees.

(s) “Option” means options to purchase Capital Stock granted by the Company or any of its subsidiaries under a compensation plan adopted or approved by the Company.

(t) A “Payment” means any payment or distribution in the nature of compensation (within the meaning of Section 280G(b)(2) of the Code) to or for the benefit of the Executive, whether paid or payable pursuant to this Agreement or otherwise.

(u) “Pending Change in Control” means that one or more of the following events has occurred and a Change in

Control pursuant thereto is reasonably expected to be effected within 90 days of the date as of the determination as to whether there is a Pending Change in Control: (i) the Company executes a letter of intent, term sheet or similar instrument with respect to a transaction or series of transactions, the consummation of which transaction(s) would result in a Change in Control; (ii) the Board approves a transaction or series of transactions, the consummation of which transaction(s) would result in a Change in Control; or (iii) a person makes a public announcement of tender offer for the Common Stock, the completion of which would result in a Change in Control. A Pending Change in Control shall cease to exist upon a Change in Control.

(v) “Pro Rata Bonus” means an amount equal to 100% of the Target Bonus that the Executive would have been eligible to receive for the Company’s fiscal year in which the Executive’s employment terminates following a Change in Control, multiplied by a fraction, the numerator of which is the number of days in such fiscal year through the Termination Date and the denominator of which is 365.

(w) “RSUs” means restricted stock units granted by the Company or any of its subsidiaries under a compensation plan adopted or approved by the Company, pursuant to which the Executive has the right to receive Capital Stock upon the satisfaction of vesting and other conditions.

(x) “Target Bonus” means the bonus which would have been paid to the Executive for achievement of specific performance objectives pertaining to the business of the Company or any of its specific business units or divisions, or to individual performance criteria applicable to the Executive or his position, which objectives have been established by the Board of Directors (or the Compensation Committee thereof) for the Executive relating to such plan or budget for the year in question. “Target Bonus ” shall not mean the “maximum bonus” which the Executive might have been paid for overachievement of such plan.

(y) “Value” of a Payment means the economic present value of a Payment as of the date of the change of control for purposes of Section 280G of the Code, as determined by the Accounting Firm using the discount rate required by Section 280G(d)(4) of the Code.

(z) “Voluntary Resignation” means the termination of the Executive’s employment upon his voluntary resignation, which includes retirement, as set forth in Section 3 hereof.

APPENDIX I

Legal Release

This Legal Release (“Release”) is between Advanced Energy Industries, Inc. (the “Company”) and Yuval Wasserman (“Executive ”) (each a “ Party ,” and together, the “ Parties ”).

Recitals

A. Executive and the Company are parties to an Executive Change In Control Agreement dated as of October 1, 2014 (the “ CIC Agreement ”).

B. Executive wishes to receive the compensation, benefits, awards and/or other payments described in the CIC Agreement.

C. Executive and the Company wish to resolve, except as specifically set forth herein, all claims between them arising from or relating to any act or omission predating the Final Separation Date of [ ].

Agreement

The Parties agree as follows:

Confirmation of CIC Agreement Obligations. The Company shall pay or provide to Executive the payments and benefits, as, when and on the terms and conditions specified in the CIC Agreement.

Legal Releases

(a) Executive, on behalf of Executive and Executive’s heirs, personal representatives and assigns, and any other person or entity that could or might act on behalf of Executive, including, without limitation, Executive’s counsel (all of whom are collectively referred to as “Executive Releasers”), hereby fully and forever releases and discharges the Company, its present and future affiliates and subsidiaries, and each of their past, present and future officers, directors, employees, shareholders, independent contractors, attorneys, insurers and any and all other persons or entities that are now or may become liable to any Releaser due to any Releasee’s act or omission, (all of whom are collectively referred to as “Executive Releasees”) of and from any and all actions, causes of action, claims, demands, costs and expenses, including attorneys’ fees, of every kind and nature whatsoever, in law or in equity, whether now known or unknown, that Executive Releasers, or any person acting under any of them, may now have, or claim at any future time to have, based in whole or in part upon any act or omission occurring on or before the Final Separation Date, without regard to present actual knowledge of such acts or omissions, including specifically, but not by way of limitation, matters which may arise at common law, such as breach of contract, express or implied, promissory estoppel, wrongful discharge, tortious interference with contractual rights, infliction of emotional distress, defamation, or under federal, state or local laws, such as the Fair Labor Standards Act, the Employee Retirement Income Security Act, the National Labor Relations Act, Title VII of the Civil Rights Act of 1964, the Age Discrimination in Employment Act, the Rehabilitation Act of 1973, the Equal Pay Act, the Americans with Disabilities Act, the Family and Medical Leave Act, and any civil rights law of any state or other governmental body; PROVIDED, HOWEVER, that notwithstanding the foregoing or anything else contained in this Agreement, the release set forth in this Section shall not extend to: (i) any rights arising under this Agreement; or; (ii) any vested rights under any pension, retirement, profit sharing or similar plan; (iii) Executive’s rights, if any, to indemnification, and/or defense under any Company certificate of incorporation, bylaw and/or policy or procedure, or under any insurance contract, in connection with Executive’s acts and omissions within the course and scope of Executive’s employment with the Company; or (iv) any rights or remedies that cannot by law be waived by private agreement. Executive hereby warrants that Executive has not assigned or transferred to any person any portion of any claim which is released, waived and discharged above. Executive further states and agrees that Executive has not experienced any illness, injury, or disability that is compensable or recoverable under the worker’s compensation laws of any state that was not reported to the Company by Executive before the Final Separation Date. Executive has specifically consulted with counsel with respect to the agreements, representations, and declarations set forth in the previous sentence. Executive understands and agrees that by signing this Agreement Executive is giving up any right to bring any legal claim against the Company concerning, directly or indirectly, Executive’s employment relationship with the Company, including Executive’s separation from employment. Executive agrees that this legal release is intended to be interpreted in the broadest possible manner in favor of the Company, to include all actual or potential legal claims that Executive may have against the Company, except as specifically provided otherwise in this Agreement.

(b) In order to provide a full and complete release, Executive understands and agrees that this Agreement is intended to include all claims, if any, covered under this Section 2 that Executive may have and not now know or suspect to exist in Executive’s favor against any Executive Releasee and that this Agreement extinguishes such claims. Thus, Executive expressly waives all rights under any statute or common law principle in any jurisdiction that provides, in effect, that a general release does not extend to claims which the releasing party does not know or suspect to exist in Executive’s favor at the time of executing the release, which if known by Executive must have materially affected Executive’s settlement with the party being released. Notwithstanding any other provision of this Section 2, however, nothing in this Section 2 is intended or shall be construed to limit or otherwise affect in any way Executive’s rights under this Agreement.

(c) Executive agrees and acknowledges that Executive: (i) understands the language used in this Agreement and the Agreement’s legal effect; (ii) is specifically releasing all claims and rights under the Age Discrimination in Employment Act, as amended, 29 U.S.C. Section 621 et seq.; (iii) will receive compensation under this Agreement to which Executive would not have been entitled without signing this Agreement; (iv) has been advised by the Company to consult with an attorney before signing this Agreement; and (v) will be given up to twenty one (21) calendar days to consider whether to sign this Agreement. For a period of seven days after Executive signs this Agreement, Executive may, in Executive’s sole discretion, rescind this Agreement by delivering a written notice of rescission to the Company’s General Counsel. If Executive rescinds this Agreement within seven calendar days after Executive signs the Agreement, or if Executive does not sign this Agreement within the twenty-one day consideration period, this Agreement shall be void, all actions taken pursuant to this Agreement shall be reversed, and neither this Agreement nor the fact of or circumstances surrounding its execution shall be admissible for any purpose whatsoever in any proceeding between the Parties, except in connection with a claim or defense involving the validity or effective rescission of this Agreement. If Executive does not rescind this Agreement within seven calendar days after the day Executive signs this Agreement, this Agreement shall become final and binding and shall be irrevocable.

Executive acknowledges that Executive has received all compensation to which Executive is entitled for Executive’s work up to Executive’s last day of employment with the Company, and that Executive is not entitled to any further pay or benefit of any kind, for services rendered or any other reason, other than the payments and benefits, to the extent not already paid, described in the CIC Agreement.

Executive agrees that the only thing of value that Executive will receive by signing this Supplemental Release is the payments and benefits described in the CIC Agreement.

The Parties agree that their respective rights and obligations under the CIC Agreement shall survive the execution of this Release.

NOTE: DO NOT SIGN THIS LEGAL RELEASE UNTIL AFTER EXECUTIVE’S FINAL DAY OF EMPLOYMENT.

|

| | | | | |

YUVAL WASSERMAN | | ADVANCED ENERGY INDUSTRIES |

| | | | | |

| | By: | |

Date: | | Title: | |

| | Date: | |

|

| | | |

CONTACT: | | | |

Danny Herron | | Annie Leschin | |

Advanced Energy Industries, Inc. | | Advanced Energy Industries, Inc. | |

970.407.6570 | | 970.407.6555 | |

danny.herron@aei.com | | ir@aei.com | |

ADVANCED ENERGY ANNOUNCES YUVAL WASSERMAN AS PRESIDENT AND CEO

Fort Collins, Colo., September 30, 2014 - Advanced Energy Industries, Inc. (Nasdaq GM: AEIS) today announced the appointment and promotion of company president, Yuval Wasserman, to the position of president and chief executive officer and board member, effective October 1, 2014. Yuval succeeds Garry Rogerson who has been in the role since August 2011.

“Since joining Advanced Energy, Yuval has been instrumental in enabling the company to become one of the most efficient and productive organizations in the industry,” said Dick Beck, Chairman of the Board of Directors. “His passion and decades of management and industry experience have afforded him an unparalleled understanding of the opportunities and challenges Advanced Energy faces. He has earned the respect of the entire organization as well as the Board of Directors, making him ideally suited to lead the company into its next stage of growth and return value to shareholders.”

“Yuval is an outstanding choice to lead the Company forward and ensure a smooth, well-organized transition,” said Garry Rogerson, CEO of Advanced Energy. “Having worked closely with Yuval for the last three years to build a stronger, more focused company, I have seen firsthand his ability to manage a global and diversified business. I am confident that his strong performance as president and his leadership skills will serve our customers and shareholders well.”

“I am honored and excited to lead such a dynamic company driven by a strong sense of commitment to achieve excellence in everything it pursues,” said Yuval Wasserman, “I am very proud of the work we have done as an organization to transform into one of the most competitive power conversion companies in the industry and I plan to capitalize on that success as we focus on achieving the Company’s key objectives.”

A 30 year veteran of semiconductor and electronics industries, Yuval has been with Advanced Energy since August 2007. Having joined as senior vice president of Sales, Marketing & Service, he was promoted several times, most recently to president. Under his leadership during the last four years, the precision power products business has diversified and grown significantly, through a variety of strategic new products and the addition of four acquisitions in the last two years. Previously, Yuval served as president and chief executive officer of Tevet Process Control

Technologies Ltd., a semiconductor metrology company. Prior to that, he held senior executive and management positions at Boxer Cross Inc., a metrology company that was acquired by Applied Materials, Fusion Systems, a plasma strip company that was a division of Axcelis Technologies, and AG Associates, a semiconductor capital equipment company focused on rapid thermal processing. Mr. Wasserman started his career at National Semiconductors where he held various engineering and management positions. He currently serves as a director of Syncroness, Inc. Mr. Wasserman has a Bachelor of Science degree in chemical engineering from Ben Gurion University in Israel, and studied business at the AeA/Stanford University Executive Institute.

About Advanced Energy

Advanced Energy (NASDAQ: AEIS - News) is a global leader in innovative power and control technologies for thin-film manufacturing and high-growth solar-power generation. Advanced Energy is headquartered in Fort Collins, Colorado, with dedicated support and service locations around the world. For more information, go to www.advanced-energy.com.

Forward-Looking Language

Advanced Energy’s expectations with respect to statements that are not historical information are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These include statements regarding the expected future performance of the Company and leadership transition. Forward-looking statements are subject to known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. Risks associated with Advanced Energy’s business, industry and stock are described in Advanced Energy's Form 10-K, Forms 10-Q and other reports and statements filed with the Securities and Exchange Commission. These reports and statements are available on the SEC's website at www.sec.gov. Copies may also be obtained from Advanced Energy's website at www.advancedenergy.com or by contacting Advanced Energy's investor relations at 970-407-6555. Forward-looking statements are made and based on information available to the company on the date of this press release. Advanced Energy assumes no obligation to update the information in this press release.

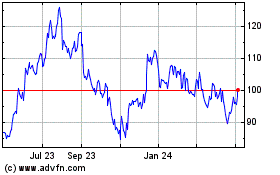

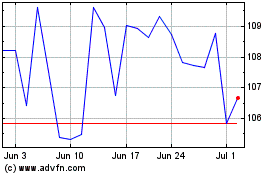

Advanced Energy Industries (NASDAQ:AEIS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Advanced Energy Industries (NASDAQ:AEIS)

Historical Stock Chart

From Apr 2023 to Apr 2024