- GAAP results: net loss of $0.8

million (attributable to Astrotech Corporation), or $(0.04) per

diluted share for the quarter ended June 30, 2014 and net loss of

$5.0 million (attributable to Astrotech Corporation), or $(0.25)

per diluted share, for the year ended June 30, 2014

- EBITDA loss of $0.4 million for the

quarter ended June 30, 2014 and $3.3 million for the year ended

June 30, 2014

- The sale of Astrotech Space

Operations (“ASO”) to Lockheed Martin was completed on August 22,

2014 for $61.0 million

- 1st Detect was awarded

a pivotal competitive contract for the Next Generation Chemical

Detector (NGCD) program

- 1st Detect was granted

four U.S. patents and filed nine U.S. patent applications during

the fiscal year. In total, 1st Detect owns six

key U.S. patents for its miniaturized mass spectrometer

technology

Astrotech Corporation (NASDAQ: ASTC), a leading provider of

commercial aerospace services and products and a manufacturer of

next generation chemical detection instrumentation, today announced

financial results for its fourth quarter and fiscal year ended June

30, 2014.

“With the successful completion of the sale of Astrotech Space

Operations (“ASO”), we find ourselves with a healthy balance sheet

and ideally positioned to execute the next phase of our corporate

strategy,” said Thomas B. Pickens III, Chairman and CEO of

Astrotech Corporation. "The recent award of the NGCD contract

further validated our technological breakthrough at 1st Detect and

we are eagerly pursuing additional opportunities."

The 1st Detect team continues to reinvent the industry with the

recent announcement of the strategic alliance with SparkCognition,

which will avail real-time predictive analytics to chemical

detection, an industry first. This will allow customers to use

cutting edge data analytics to solve complex problems by deriving

solutions from disparate data sets using sophisticated and

predictive algorithms.

“Our momentum is building and it is an exciting time to be part

of Astrotech,” Pickens added. “We continue to engage with key

industry partners to develop compelling solutions that address an

expanding variety of lucrative markets.”

Fourth Quarter Results

The Company posted fourth quarter fiscal year 2014 net loss of

$0.8 million, or $(0.04) per diluted share on revenue of

$5.6 million compared with a fourth quarter fiscal year 2013

net income of $2.2 million or $0.11 per diluted share on

revenue of $9.2 million.

Fiscal Year Results

The Company posted fiscal year 2014 net loss of

$5.0 million, or $(0.25) per diluted share on revenue of

$16.4 million compared with fiscal year 2013 net loss of

$0.2 million, or $(0.01) per diluted share on revenue of $24.0

million.

Financial Position and Liquidity

Working capital was $(4.4) million as of June 30, 2014,

which included $3.8 million in cash and cash equivalents and $1.3

million of accounts receivable.

About Astrotech Corporation

Astrotech is a leader in identifying and commercializing space

technology for terrestrial use. 1st Detect Corporation is

developing a breakthrough miniaturized mass spectrometer, the

MMS-1000™, while Astrogenetix, Inc. is a biotechnology company

utilizing microgravity as a research platform for drug discovery

and development. Both are wholly owned subsidiaries of the

parent.

This press release contains forward-looking statements that are

made pursuant to the Safe Harbor provisions of the Private

Securities Litigation Reform Act of 1995. Such forward-looking

statements are subject to risks, trends, and uncertainties that

could cause actual results to be materially different from the

forward-looking statement. These factors include, but are not

limited to, our ability to successfully develop our remaining

Spacetech business unit, our ability to develop and integrate our

miniaturized mass spectrometer, the MMS-1000™, continued government

support and funding for key space programs, product performance and

market acceptance of products and services, as well as other risk

factors and business considerations described in Astrotech’s

Securities and Exchange Commission filings including the annual

report on Form 10-K. Any forward-looking statements in this

document should be evaluated in light of these important risk

factors. Astrotech assumes no obligation to update these

forward-looking statements.

ASTROTECH CORPORATION AND SUBSIDIARIES

Condensed Consolidated Statements of Operations

(In thousands, except per share data)

Three Months

Ended June 30,

Twelve Months

Ended June 30,

2014 2013

2014 2013 Revenue $ 5,640

$ 9,180 $ 16,423 $ 23,995 Cost of revenue 2,629

5,102 10,705 15,684

Gross profit 3,011 4,078

5,718 8,311

Operating expenses: Selling, general and administrative 3,352 1,449

8,893 6,790 Research and development 704 586

2,505 2,080 Total operating

expenses 4,056 2,035 11,398

8,870

Income (loss) from operations

(1,045 ) 2,043 (5,680 )

(559 ) Interest and other expense, net (5 )

(44 ) (182 ) (164 )

Income (loss) before

income taxes

(1,050

) 1,999 (5,862 )

(723 ) Income tax benefit (expense) 2

— (6 ) —

Net income

(loss) (1,048 ) 1,999

(5,868 ) (723 ) Less: Net

loss attributable to noncontrolling interest* (226 )

(156 ) (908 ) (538 )

Net income (loss)

attributable to Astrotech Corporation $ (822

) $ 2,155 $ (4,960

) $ (185 ) Net income (loss) per

share attributable to Astrotech Corporation, basic and diluted $

(0.04 ) $ 0.11 $ (0.25 ) $ (0.01 )

* Noncontrolling interest resulted from grants of restricted

stock in 1st Detect and Astrogenetix to certain employees, officers

and directors. Please refer to the June 30, 2014 10-K filed

with the Securities and Exchange Commission for further detail.

ASTROTECH CORPORATION AND SUBSIDIARIES Condensed

Consolidated Balance Sheets

(In thousands)

June 30, 2014 2013

Assets Cash and cash equivalents $ 3,831 $ 5,096 Accounts

receivable, net of allowance 1,279 5,317 Prepaid expenses and other

current assets 574 503

Total current assets

5,684 10,916 Property, plant, and

equipment, net 35,069 37,035 Other assets, net 29 51

Total assets $ 40,782 $ 48,002

Liabilities and stockholders’ equity Current

liabilities $

10,093

$ 6,609 Long-term liabilities

389

5,913 Stockholders’ equity 30,300 35,480

Total

liabilities and stockholders’ equity $ 40,782

$ 48,002 ASTROTECH CORPORATION AND

SUBSIDIARIES Unaudited Reconciliation of Non-GAAP

Measures Earnings Before Interest, Taxes, Depreciation and

Amortization (In thousands) Three Months

Ended June 30,

Twelve Months

Ended June 30,

2014 2013

2014 2013 EBITDA

$

(405

) $ 2,623 $

(3,273

) $ 1,642 Depreciation &

amortization

589

563

2,356

2,115 Interest expense 56 61 233 250

Income tax benefit (expense)

2

—

(6

)

—

Net income (loss) (1,048 )

1,999 (5,868 )

(723 ) Net loss attributable to noncontrolling

interest (226 ) (156 ) (908 ) (538 )

Net income (loss) attributable to Astrotech Corporation

$ (822 ) $ 2,155 $

(4,960 ) $ (185 )

EBITDA (earnings before interest, taxes, depreciation and

amortization) is a non-U.S. GAAP financial measure. We included

information concerning EBITDA because we use such information when

evaluating operating earnings (loss) to better evaluate the

underlying performance of the Company. EBITDA does not represent,

and should not be considered an alternative to, net income (loss),

operating earnings (loss), or cash flow from operations as those

terms are defined by U.S. GAAP and does not necessarily indicate

whether cash flows will be sufficient to fund cash needs. While

EBITDA is frequently used as measures of operations and the ability

to meet debt service requirements by other companies, our use of

this financial measure is not necessarily comparable to such other

similarly titled captions of other companies.

Astrotech CorporationEric Stober, 512-485-9530Chief Financial

Officer

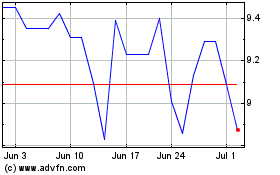

Astrotech (NASDAQ:ASTC)

Historical Stock Chart

From Aug 2024 to Sep 2024

Astrotech (NASDAQ:ASTC)

Historical Stock Chart

From Sep 2023 to Sep 2024