CUSIP No. 381119106

Page 1 of 14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 13D/A-7

Under the Securities Exchange Act of 1934

Golden Minerals Company

(Name of Issuer)

Common Stock

(Title of Class of Securities)

381119106

(CUSIP Number)

Greg Link, Director

Sentient Executive GP IV, Limited, General Partner

Of Sentient GP IV, LP, General Partner of Sentient Global Resources Fund IV, L.P.,

Landmark Square, 1st Floor, 64 Earth Close, West Bay Beach South

P.O. Box 10795, George Town, Grand Cayman KY1-1007, Cayman Islands

345-946-0921

(Name, Address and Telephone Number of Person Authorized to

Receive Notices and Communications)

(with copy to)

Gregory A. Smith, Esq.

Quinn & Brooks LLP

P O Box 590

Larkspur CO 80118

303-298-8443

September 10, 2014

(Date of Event which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and if filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. [ ]

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule including all exhibits. See § 240.13d-7 for other parties to whom copies are to be sent.

*The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

CUSIP No. 381119106

Page 2 of 14

| | | |

1.

| NAMES OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

Sentient Global Resources Fund III, L.P.

|

2.

| CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions)

(a) x

(b) o

|

3.

| SEC USE ONLY

|

4.

|

SOURCE OF FUNDS (See Instructions)

OO

|

5.

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS

REQUIRED PURSUANT TO ITEM 2(d) or 2(e)

o

|

6.

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Cayman Islands

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH:

|

7.

|

SOLE VOTING POWER

3,582,746

|

8.

|

SHARED VOTING POWER

0

|

9.

|

SOLE DISPOSITIVE POWER

3,582,746

|

10.

|

SHARED DISPOSITIVE POWER

0

|

11.

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

3,582,746

|

12.

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨

|

13.

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

6.76%

|

14.

|

TYPE OF REPORTING PERSON

PN

|

CUSIP No. 381119106

Page 3 of 14

| | | |

1.

| NAMES OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

SGRF III Parallel I, L.P.

|

2.

| CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions)

(a) x

(b) o

|

3.

| SEC USE ONLY

|

4.

|

SOURCE OF FUNDS (See Instructions)

OO

|

5.

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS

REQUIRED PURSUANT TO ITEM 2(d) or 2(e)

o

|

6.

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Cayman Islands

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH:

|

7.

|

SOLE VOTING POWER

357,044

|

8.

|

SHARED VOTING POWER

0

|

9.

|

SOLE DISPOSITIVE POWER

357,044

|

10.

|

SHARED DISPOSITIVE POWER

0

|

11.

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

357,044

|

12.

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨

|

13.

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

0.67%

|

14.

|

TYPE OF REPORTING PERSON

PN

|

CUSIP No. 381119106

Page 4 of 14

| | | |

1.

| NAMES OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

Sentient Executive GP III, Limited

|

2.

| CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions)

(a) x

(b) o

|

3.

| SEC USE ONLY

|

4.

|

SOURCE OF FUNDS (See Instructions)

OO

|

5.

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS

REQUIRED PURSUANT TO ITEM 2(d) or 2(e)

o

|

6.

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Cayman Islands

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH:

|

7.

|

SOLE VOTING POWER

3,939,790

|

8.

|

SHARED VOTING POWER

0

|

9.

|

SOLE DISPOSITIVE POWER

3,939,790

|

10.

|

SHARED DISPOSITIVE POWER

0

|

11.

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

3,939,790

|

12.

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨

|

13.

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

7.43%

|

14.

|

TYPE OF REPORTING PERSON

CO

|

CUSIP No. 381119106

Page 5 of 14

| | | |

1.

| NAMES OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

Sentient GP III, Limited

|

2.

| CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions)

(a) x

(b) o

|

3.

| SEC USE ONLY

|

4.

|

SOURCE OF FUNDS (See Instructions)

OO

|

5.

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS

REQUIRED PURSUANT TO ITEM 2(d) or 2(e)

o

|

6.

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Cayman Islands

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH:

|

7.

|

SOLE VOTING POWER

3,939,790

|

8.

|

SHARED VOTING POWER

0

|

9.

|

SOLE DISPOSITIVE POWER

3,939,790

|

10.

|

SHARED DISPOSITIVE POWER

0

|

11.

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

3,939,790

|

12.

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨

|

13.

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

7.43%

|

14.

|

TYPE OF REPORTING PERSON

CO

|

CUSIP No. 381119106

Page 6 of 14

| | | |

1.

| NAMES OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

Sentient GP IV, Limited

|

2.

| CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions)

(a) x

(b) o

|

3.

| SEC USE ONLY

|

4.

|

SOURCE OF FUNDS (See Instructions)

OO

|

5.

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS

REQUIRED PURSUANT TO ITEM 2(d) or 2(e)

o

|

6.

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Cayman Islands

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH:

|

7.

|

SOLE VOTING POWER

13,986,193

|

8.

|

SHARED VOTING POWER

0

|

9.

|

SOLE DISPOSITIVE POWER

13,986,193

|

10.

|

SHARED DISPOSITIVE POWER

0

|

11.

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

13,986,193

|

12.

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨

|

13.

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

24.66%

|

14.

|

TYPE OF REPORTING PERSON

CO

|

CUSIP No. 381119106

Page 7 of 14

| | | |

1.

| NAMES OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

Sentient Global Resources Fund IV, L.P.

|

2.

| CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions)

(a) x

(b) o

|

3.

| SEC USE ONLY

|

4.

|

SOURCE OF FUNDS (See Instructions)

OO

|

5.

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS

REQUIRED PURSUANT TO ITEM 2(d) or 2(e)

o

|

6.

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Cayman Islands

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH:

|

7.

|

SOLE VOTING POWER

13,986,193

|

8.

|

SHARED VOTING POWER

0

|

9.

|

SOLE DISPOSITIVE POWER

13,986,193

|

10.

|

SHARED DISPOSITIVE POWER

0

|

11.

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

13,986,193

|

12.

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨

|

13.

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

24.66%

|

14.

|

TYPE OF REPORTING PERSON

PN

|

CUSIP No. 381119106

Page 8 of 14

| | | |

1.

| NAMES OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

Sentient Executive GP IV, Limited

|

2.

| CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (See Instructions)

(a) x

(b) o

|

3.

| SEC USE ONLY

|

4.

|

SOURCE OF FUNDS (See Instructions)

OO

|

5.

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS

REQUIRED PURSUANT TO ITEM 2(d) or 2(e)

o

|

6.

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Cayman Islands

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH:

|

7.

|

SOLE VOTING POWER

13,986,193

|

8.

|

SHARED VOTING POWER

0

|

9.

|

SOLE DISPOSITIVE POWER

13,986,193

|

10.

|

SHARED DISPOSITIVE POWER

0

|

11.

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

13,986,193

|

12.

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨

|

13.

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

24.66%

|

14.

|

TYPE OF REPORTING PERSON

CO

|

CUSIP No. 381119106

Page 9 of 14

Item 1.

Security and Issuer

This filing relates to the common stock (the “Common Stock”) of Golden Minerals Company (“Golden Minerals” or the “Issuer”), a Delaware corporation. The address of Golden Minerals’ principal office is 350 Indiana Street, Suite 800, Golden, Colorado 80401.

Item 2.

Identity and Background is amended to read as follows:

(a) – (c) This Schedule is being filed jointly by: (i) Sentient Global Resources Fund III, L.P. (“Fund III”), (ii) SGRF III, Parallel I, LP (“Parallel I”), (iii) Sentient Executive GP III, Limited (“Sentient Executive III”), (iv) Sentient GP III, Limited (“GP III); (v) Sentient Global Resources Fund IV, L.P. (“Fund IV”); (vi) Sentient GP IV, Limited (“GP IV”); and (vii) Sentient Executive GP IV, Limited (“Sentient Executive IV”) (the foregoing are collectively referred to herein as the “Reporting Persons”). Sentient Executive IV is the general partner of the general partner of Fund IV and makes the investment decisions for those entities.

Fund III and Parallel I are both Cayman Islands limited partnerships. The sole general partner of each is Sentient GP III, LP which is a Cayman Islands limited partnership (“GP III”). The sole general partner of GP III is Sentient Executive III which is a Cayman Islands exempted company. Fund IV is a Cayman Islands limited partnership. The sole general partner is Sentient GP IV, LP which is a Cayman Islands limited partnership (“GP IV”). The sole general partner of GP IV is Sentient Executive IV which is a Cayman Islands exempted company. The principal business of Fund III, Parallel I, and Fund IV is making investments in public and private companies engaged in mining and other natural resources activities. The principal business of GP III is performing the functions of and serving as the sole general partner of Fund III, Parallel I and other similar funds and the principal business of Sentient Executive III is performing the functions of and serving as the sole general partner of GP III. Investment decisions related to investments of Fund III and Parallel I are made by Sentient Executive with the approval of Fund III and Parallel I, as appropriate. The principal business of GP IV is performing the functions of and serving as the sole general partner of Fund IV, and other similar funds and the principal business of Sentient Executive IV is performing the functions of and serving as the sole general partner of GP IV. Investment decisions related to investments of Fund IV are made by Sentient Executive IV with the approval of Fund IV.

The principal offices of each of the Reporting Persons is: Landmark Square, 1st Floor, 64 Earth Close, West Bay Beach South, P.O. Box 10795, George Town, Grand Cayman KY1-1007, Cayman Islands.

(d)

During the past 5 years, none of the Reporting Persons, and to the best knowledge of the Reporting Persons, none of the Schedule A Persons has been convicted in a criminal proceeding (excluding traffic violations and similar misdemeanors).

(e)

During the past 5 years, none of the Reporting Persons, and to the best knowledge of the Reporting persons, none of the Schedule A Persons a party to a civil proceeding of a judicial or administrative body of competent jurisdiction that resulted in a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws, or a party to a civil proceeding of a judicial or administrative body of competent jurisdiction that resulted in a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

(f)

The citizenship of the Schedule A Persons who are natural persons is set forth on Schedule A and incorporated herein by this reference.

Item 3.

Source and Amount of Funds or Other Consideration

The funds used by Fund IV to purchase the Units of Golden Minerals are funds held by it for investment.

Item 4.

Purpose of Transaction is amended to read as follows:

(a) The acquisition of additional securities of the Issuer, or the disposition of securities of the Issuer.

CUSIP No. 381119106

Page 10 of 14

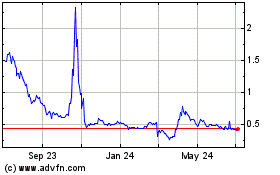

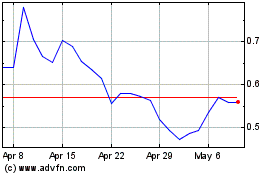

On September 5, 2014, Golden Minerals Company (the “Company”) entered into an underwriting agreement (the “Underwriting Agreement”) with Roth Capital Partners, LLC, as representative of the underwriters named in Schedule I thereto (the “Underwriters”) relating to the issuance and sale (the “2014 Public Offering”) of 3,692,000 shares (the “Shares”) of the Company’s common stock, par value $0.01 per share (“Common Stock”), and warrants (the “Warrants”) to purchase 1,846,000 shares of Common Stock. The Shares and Warrants were sold in units (“Units”), with each Unit consisting of one share of Common Stock and a Warrant to purchase one-half of a share of Common Stock, at a price of $0.86 per Unit, before underwriting discounts. The 2014 Public Offering, including issuance of the 3,692,000 Units, closed on September 10, 2014.

2014 Fund IV Private Placement

On September 10, 2014, Golden Minerals entered into a subscription agreement (the “2014 Fund IV Subscription Agreement”) with Fund IV.

Pursuant to the 2014 Fund IV Subscription Agreement, the Company agreed to sell to Fund IV a total of 5,800,000 shares of Common Stock (the “2014 Fund IV Shares ”) and warrants to purchase 2,900,000 shares of Common Stock (the “2014 Fund IV Warrants ”) in a private placement (the “2014 Fund IV Private Placement”). The 2014 Fund IV Warrants have the same terms as the Warrants issued in the 2014 Public Offering. The 2014 Fund IV Shares and 2014 Fund IV Warrants were sold in units, with each unit consisting of one share of Common Stock and a warrant to purchase one-half of a share of Common Stock. The price to Fund IV in the 2014 Fund IV Private Placement was $0.817 per unit, the same price paid by the Underwriters in the 2014 Public Offering. Following the consummation of the 2014 Fund IV Private Placement and the 2014 Public Offering, Fund IV owns approximately 25% (with Sentient’s combined ownership being approximately 32.1%) of the Company’s outstanding common stock (excluding restricted common stock held by the Company’s employees).

In connection with the closing of the 2014 Fund IV Private Placement, the Company entered into a Registration Rights Agreement, dated September 10, 2014 (the “2014 Fund IV Registration Rights Agreement”), with Fund IV pursuant to which the Company agreed to register with the SEC the resale of the 2014 Fund IV Shares and the shares issuable upon exercise of the 2014 Fund IV Warrants. The agreement requires that the Company file a registration statement with the SEC no later than June 30, 2015 and cause such registration statement to be declared effective no later than September 30, 2015. If the Company is unable to meet these deadlines, it may be subject to a penalty equal to 1.0% of the aggregate purchase price paid by Fund IV for the 2014 Fund IV Shares and 2014 Fund IV Warrants and amounts paid (or deemed paid, in the event of a cashless exercise), if any, for shares underlying the 2014 Fund IV Warrants upon exercise of such warrant for every thirty (30) days following the applicable deadline, up to a maximum amount of 3.0% of the aggregate purchase price.

The 2014 Fund IV Private Placement closed on September 10, 2014 concurrently with the closing of the 2014 Public Offering.

The 2014 Fund IV Private Placement was conducted outside the United States pursuant to Regulation S under the Securities Act of 1933, as amended.

The foregoing description of the 2014 Fund IV Subscription Agreement, 2014 Fund IV Warrant and 2014 Fund IV Registration Rights Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the 2014 Fund IV Subscription Agreement, 2014 Fund IV Warrant Agreement and 2014 Fund IV Registration Rights Agreement, which are attached hereto as Items 7.A., B. and C, respectively.

Additional Issuance of Warrants Resulting from the 2014 Public Offering and 2014 Fund IV Private Placement

In September 2012, the Company closed on a public offering and concurrent private placement with Fund IV in which the Company sold units, consisting of one share of common stock and a five-year warrant to acquire one half of a share of common stock at an exercise price of $8.42 per share (the “September 2012 Warrants”). Fund IV is the owner of 682,897 of the September 2012 Warrants. Pursuant to certain adjustment provisions in the warrant agreement governing the September 2012 Warrants, as a result of the 2014 Public Offering, the number of shares of common stock issuable upon exercise of the September 2012 Warrants were required to be increased from 3,431,649 shares to 4,031,409 shares (599,760 increase) and the September 2012 Warrants

CUSIP No. 381119106

Page 11 of 14

exercise price adjusted from $8.42 per share to $7.17 per share pursuant to a weighted average dilution calculation based on the pricing in the 2014 Public Offering and the 2014 Fund IV Private Placement.

As a result of the above adjustments, Fund IV was issued an additional 119,352 September 2012 Warrants as part of the anti-dilution adjustment at an exercise price of $7.17.

The following table shows the number of shares of the Issuer’s common stock owned prior to and after the purchase pursuant to the 2014 Fund IV Subscription Agreement as well as the purchase price paid by Fund IV and the percentage ownership of Fund III, Parallel I, and Fund IV.

| | | | | | |

| Number of Shares owned prior to September 10, 2014

|

Number of Shares Purchased September 10, 2014

|

Number of Warrants previously owned and acquired as a result of anti-dilution

|

Number of

Warrants

Purchased September 10, 2014

| Price (in US $) of Units* purchased September 10, 2014

|

Total ownership as a % of outstanding shares

|

Fund III

| 3,582,746

| 0

| 0

| 0

| $ 0

| 6.8%

|

Parallel I

| 357,044

| 0

| 0

| 0

| $ 0

| 0.7%

|

Fund IV

| 4,483,944

| 5,800,000

| 802,249

| 2,900,000

| $ 4,738,600

| 24.7%

|

Total

| 8,423,734

| 5,800,000

| 802,249

| 2,900,000

| $ 4,738,600

| 32.1%

|

* Each Unit consists of one share of common stock plus one warrant to purchase one-half share of common stock.

The percentage of outstanding shares is based upon the Issuer having a total of 53,022,833 shares issued and outstanding after giving effect to the 2014 Public Offering and concurrent 2014 Fund IV Private Placement, including those owned by Fund III, Parallel I, and Fund IV.

The Reporting Persons reserve the right to acquire beneficial ownership or control over additional securities of the Issuer.

(b) Any extraordinary corporate transaction, such as a merger, reorganization or liquidation, involving the Issuer or any of its subsidiaries.

None.

(c) A sale or transfer of a material amount of assets of the Issuer or any of its subsidiaries.

None.

(d) Any change in the present board or directors or management of the Issuer, including plans or proposals to change the number of term of directors or to fill any existing vacancies on the board.

None.

(e) Any material change in the present capitalization or dividend policy of the Issuer.

None.

(f) Any other material change in the Issuer’s business or corporate structure. None, except as set forth herein.

None.

CUSIP No. 381119106

Page 12 of 14

(g) Changes to the Issuer’s charter, bylaws or instruments corresponding thereto or other actions which may impede the acquisition of control of the Issuer by any person.

None.

(h) Causing a class of securities of the Issuer to be delisted form a national securities exchange or to cease to be authorized to be quoted in an inter-dealer quotation system of a registered national securities association.

None.

(i) Causing a class of equity securities of the Issuer becoming eligible for termination of registration pursuant to Section 12(g)(4) of the Act.

None.

(j) Any action similar to any of those enumerated above.

None.

Item 5.

Interest in Securities of the Issuer is amended to read as follows:

Fund IV owns 10,283,944 shares of the Issuer’s common stock and warrants to acquire an additional 3,702,249 shares of the Issuer’s common stock.

Item 6.

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer

None, except as previously reported.

Item 7.

Material to be Filed as Exhibits

The following additional exhibits are filed herewith:

(A)

Subscription Agreement dated September 10, 2014.

(B)

Registration Rights Agreement dated September 10, 2014 incorporated herein by reference to Form 8-K of Golden Minerals dated September 10, 2014 and filed with the Commission effective September 10, 2014.

(C)

Warrant Agreement dated September 10, 2014.

(D)

Filing Agreement dated September 17, 2014 by and among Sentient Global Resources Fund III, LP; SGRF III Parallel I, L.P.; Sentient Executive GP III, Limited; Sentient GP III, LP; Sentient Global Resources Fund IV, LP, Sentient GP IV, LP, its General Partner and Sentient Executive GP IV, Limited, General Partner.

CUSIP No. 381119106

Page 13 of 14

Signatures

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

| |

Sentient Global Resources Fund III, L.P.

By: Sentient GP III, LP, General Partner

By: Sentient Executive GP III, Limited,

General Partner

By: _/s/ Greg Link_________

Greg Link, Director

Date: September 17, 2014

| SGRF III Parallel I, L.P.

By: Sentient GP III, LP, General Partner

By: Sentient Executive GP III, Limited,

General Partner

By: _/s/ Greg Link_________

Greg Link, Director

Date: September 17, 2014

|

Sentient GP III, LP

By: _/s/ Greg Link_________

Greg Link, Director

Date: September 17, 2014

Sentient Executive GP III, Limited

By: _/s/ Greg Link_________

Greg Link, Director

Date: September 17, 2014

|

Sentient Global Resources Fund IV, L.P.

By: Sentient GP IV, LP, General Partner

By: Sentient Executive GP IV, Limited,

General Partner

By: _/s/ Greg Link_________

Greg Link, Director

Date: September 17, 2014

|

Sentient GP IV, LP

By: _/s/ Greg Link_________

Greg Link, Director

Date: September 17, 2014

Sentient Executive GP IV, Limited

By: _/s/ Greg Link_________

Greg Link, Director

Date: September 17, 2014

| |

CUSIP No. 381119106

Page 14 of 14

SCHEDULE A

The (i) name, (ii) title, (iii) citizenship, (iv) principal occupation and (v) business address of each director of Sentient Executive GP III, Limited and Sentient Executive GP IV, Limited are as follows. Neither Sentient Executive GP III, Limited nor Sentient Executive GP IV, Limited has any executive officers.

| | | | | | | | |

Name

| | Title

| | Citizenship

| | Principal Occupation

| | Business Address

|

| | | | | | | | |

Peter Cassidy

| | Director

| | Australia

| | Investment Manager

| | Level 44, Grosvenor Place

225 George Street

Sydney NSW 2000

Australia

|

| | | | | | | | |

Greg Link

| | Director

| | New Zealand

| | Investment Manager

| | Landmark Square

1st Floor, 64 Earth Close

West Bay Beach South

P.O. Box 10795

George Town, Grand Cayman KY1-1007

Cayman Islands

|

| | | | | | | | |

Peter Weidmann

| | Director

| | Germany

| | Investor Relations Manager

| | Schellingstrasse 76

80799 Munich

Germany

|

Andrew Pullar

| | Director

| | Australian

U.K.

| | Investment Manager

| | Landmark Square

1st Floor, 64 Earth Close

West Bay Beach South

P.O. Box 10795

George Town, Grand Cayman KY1-1007Cayman Islands

|

SUBSCRIPTION AGREEMENT

THIS SUBSCRIPTION AGREEMENT (this “Agreement”) is made as of September 10, 2014, by and between GOLDEN MINERALS COMPANY, a Delaware corporation (the “Company”), and SENTIENT GLOBAL RESOURCES FUND IV, L.P., a Cayman Islands exempted limited partnership (the “Buyer”).

RECITALS

A.

SENTIENT GLOBAL RESOURCES FUND III, L.P. (“FUND III”), a Cayman Islands exempted limited partnership, SGRF III PARALLEL I, L.P. (“SGRF III”), a Cayman Islands exempted limited partnership, and the Buyer (Fund III, SGRF III and the Buyer, collectively, “Sentient”) currently hold an aggregate of 8,423,734 shares of the Company’s common stock, par value $0.01 per share (“Common Stock”), representing approximately 19.4% of the total outstanding shares of Common Stock.

B.

The Company has informed Sentient that it intends to undertake a public offering of units (the “Units”) in the United States, with each unit consisting of one share of the Company’s Common Stock and a warrant (the “Warrant”) to purchase a half of a share of the Company’s Common Stock. On September 5, 2014, the Company executed an underwriting agreement (the “Underwriting Agreement”) with Roth Capital Partners with respect to the issuance and sale of 3,692,000 Units (the “Offering”).

C.

The Buyer has advised the Company that it desires to purchase Units concurrent with the Offering in order to permit Sentient to have an aggregate ownership interest up to approximately 26.8% of the issued and outstanding Common Stock of the Company (excluding outstanding restricted common shares held by employees). The purchase and sale of the Units pursuant to this Agreement will occur on a private placement basis as an offering outside of the United States pursuant to Regulation S under the U.S. Securities Act of 1933 (the “Securities Act”), as amended.

NOW, THEREFORE, in consideration of the recitals and the mutual promises, representations, warranties, and covenants set forth in this Agreement and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties agree as follows:

AGREEMENT

1.

Subscription. In consideration of and in reliance on the representations, warranties, covenants and agreements of the Company in this Agreement, subject to the sale of Units in the Offering, the Buyer hereby agrees to purchase 5,800,000 Units at a purchase price of US$0.817 per Unit (the “Offering Price”). The form of Warrant that will be issued to the Buyer is attached hereto as Exhibit A.

2.

Acceptance of Subscription. The Company, in consideration of and in reliance on the representations and warranties, covenants and agreements of the Buyer in this Agreement,

- 1 -

= "FIRST PAGE ONLY" = "1" 1, = "1" 1) 1 = 1 3392716.5 3392716.5

hereby accepts the subscription of the Buyer, subject to the terms and conditions of this Agreement, and agrees to issue the Units to the Buyer.

3.

Reserved.

4.

Buyer Representations and Warranties. Buyer hereby represents and warrants to the Company as follows:

4.1

Organization; Authorization; Validity of Agreement. The Buyer is a limited partnership duly organized, validly existing and in good standing under the laws of the Cayman Islands and has full limited partnership power and authority to execute and deliver this Agreement and the Registration Rights Agreement and to consummate the transactions contemplated hereby and thereby. The execution, delivery and performance by Buyer of this Agreement and the Registration Rights Agreement and the consummation of the transactions contemplated hereby and thereby have been duly authorized by Buyer, and no other action on the part of Buyer is necessary to authorize the execution and delivery by Buyer of this Agreement or the consummation of the transactions contemplated hereby and thereby. No vote of, or consent by, the limited partners of Buyer is necessary to authorize the execution and delivery by Buyer of this Agreement and the Registration Rights Agreement or the consummation by it of the purchase and sale of the Units.

4.2

Execution; Validity of Agreement. This Agreement has been duly executed and delivered by Buyer, and assuming due and valid authorization, execution and delivery hereof by the Company, is a valid and binding obligation of Buyer, enforceable against Buyer in accordance with its terms, except as such enforceability may be limited by the effects of bankruptcy, insolvency, fraudulent transfer, reorganization, moratorium, and other laws relating to or affecting creditors’ rights, and the general principles of equity.

4.3

Consents and Approvals; No Violations. None of the execution, delivery or performance of this Agreement or the Registration Rights Agreement by Buyer and the consummation by Buyer of the purchase and sale of the Units or compliance by Buyer with any of the provisions hereof or thereof will (1) conflict with or result in any breach of any provision of the certificate of limited partnership and agreement of limited partnership of Buyer, (2) require any filing with (except for filings with the Securities and Exchange Commission (the “SEC”), the Ontario Securities Commission, the Toronto Stock Exchange (“TSX”), NYSE MKT, and other regulatory authorities advising them of the issuance and sale of the Units), or permit, authorization, consent or approval of, any governmental entity, except for approval of the listing of the Common Stock by the TSX and the NYSE MKT, (3) result in a violation or breach of, or constitute (with or without due notice or lapse of time or both) a default (or give rise to any right of termination, cancellation or acceleration) under, any of the terms, conditions or provisions of any note, bond, mortgage, indenture, lease, license, contract, agreement or other instrument or obligation to which Buyer is a party or to which its assets are subject, or (4) violate any order, writ, injunction, decree, statute, rule or regulation applicable to Buyer.

4.4

Report of Trade. Buyer acknowledges that the Company may be required to file a report of trade with the Ontario Securities Commission containing personal information about the Buyer. This report of trade will include the full name, address and telephone number

- 2 -

= "1" 0, = "1" 1) 0 = 1 = "FIRST PAGE ONLY" = "1" 0, = "1" 1) 0 = 1

of the Buyer, the number and type of securities purchased, the total purchase price paid for the Units, the date of the Closing and the exemption relied upon under applicable securities laws to complete such purchase.

4.5

Anti-Money Laundering. None of the funds being used to purchase the Units are to the Buyer’s knowledge proceeds obtained or derived directly or indirectly as a result of illegal activities. The funds being used to purchase the Units which will be advanced by the Buyer to the Company hereunder will not represent proceeds of crime for the purposes of the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (Canada) (the “PCMLTFA”) and the Buyer acknowledges that the Company may in the future be required by law to disclose the Buyer's name and other information relating to this Agreement and the Buyer's subscription hereunder, on a confidential basis, pursuant to the PCMLTFA. To the best knowledge of Buyer: (i) none of the funds to be provided by or on behalf of the Buyer are being tendered on behalf of a person or entity who has not been identified to the Buyer; and (ii) the Buyer shall promptly notify the Company if Buyer discovers that any of such representations cease to be true, and to provide the Company with appropriate information in connection therewith.

4.6

Investment Representations.

(a)

Buyer is acquiring the Units as principal for investment and not with a view toward, or for sale in connection with, any distribution thereof, nor with any present intention of distributing or selling the Units.

(b)

Buyer is an “accredited investor” as defined in Regulation D under the Securities Act and in National Instrument 45-106 - Prospectus and Registration Exemptions of the Canadian Securities Administrators, and is able to bear the economic risk of holding the Units for an indefinite period, and has knowledge and experience in financial and business matters such that it is capable of evaluating the risks of the investment in the Units. Buyer was not created or used solely to purchase or hold Units as an “accredited investor.”

(c)

Buyer’s principal address is as set out in Section 7.2 of this Agreement and is outside the United States and Buyer is not a “U.S. person” as defined in Rule 902 under the Securities Act (a “Non-U.S. Person”). Buyer is acquiring the Units outside of the United States in accordance with Regulation S under the Securities Act. The purchase of the Units by Buyer is for Buyer’s own account or for the account of one or more affiliates of Buyer who are Non-U.S. Persons located outside the United States.

(d)

Buyer acknowledges that it has reviewed the Public Reports (as defined in Section 5.8) and that it has had the right to ask questions of and receive answers from the Company and its officers and directors, and to obtain such information as Buyer deems necessary to verify the accuracy (a) of the information referred to in the Public Reports and (b) of any other information relevant to making an investment decision with respect to the Units.

(e)

Buyer acknowledges that

(i) the Units are being offered in a transaction not involving any public offering within the United States within the meaning of the Securities Act and that the shares of Common

- 3 -

= "1" 0, = "1" 1) 0 = 1 = "FIRST PAGE ONLY" = "1" 0, = "1" 1) 0 = 1

Stock, including the shares of Common Stock underlying the Warrants (the “Warrant Shares”), have not been registered under the Securities Act,

(ii) the Units are not being qualified pursuant to a prospectus for distribution to the public in Canada under applicable Canadian Securities Laws (as defined in section 5.8 of this Agreement) and are not freely tradeable,

(iii) the certificates representing the shares of Common Stock will bear the legend set forth below (provided that the legends set forth in the second and third paragraphs below may be removed from, and will not be set forth on, any certificates representing the shares of Common Stock from and after January 11, 2015):

THE SECURITIES REPRESENTED HEREBY HAVE NOT BEEN REGISTERED UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS AMENDED (THE “U.S. SECURITIES ACT”) OR ANY STATE SECURITIES LAWS, AND MAY BE OFFERED, SOLD OR OTHERWISE TRANSFERRED ONLY (A) TO THE COMPANY, (B) PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE U.S. SECURITIES ACT, (C) OUTSIDE THE UNITED STATES IN COMPLIANCE WITH REGULATION S UNDER THE U.S. SECURITIES ACT, (D) IN COMPLIANCE WITH THE EXEMPTION FROM REGISTRATION UNDER THE U.S. SECURITIES ACT PROVIDED BY RULE 144 THEREUNDER, IF AVAILABLE, AND IN COMPLIANCE WITH ANY APPLICABLE STATE SECURITIES LAWS, OR (E) IN A TRANSACTION THAT DOES NOT REQUIRE REGISTRATION UNDER THE U.S. SECURITIES ACT OR ANY APPLICABLE STATE LAWS AND REGULATIONS GOVERNING THE OFFER AND SALE OF SECURITIES, AND, IN THE CASE OF (C), (D) OR (E), THE HOLDER HAS PRIOR TO SUCH TRANSFER FURNISHED TO THE COMPANY AN OPINION OF COUNSEL OF RECOGNIZED STANDING IN FORM AND SUBSTANCE SATISFACTORY TO THE COMPANY.

THE SECURITIES REPRESENTED BY THIS CERTIFICATE ARE LISTED ON THE TORONTO STOCK EXCHANGE (“TSX”); HOWEVER, SUCH SECURITIES CANNOT BE TRADED THROUGH THE FACILITIES OF TSX SINCE THEY ARE NOT FREELY TRANSFERABLE, AND CONSEQUENTLY ANY CERTIFICATE REPRESENTING SUCH SECURITIES IS NOT “GOOD DELIVERY” IN SETTLEMENT OF TRANSACTIONS ON THE TSX.

UNLESS PERMITTED UNDER SECURITIES LEGISLATION, THE HOLDER OF THIS SECURITY MUST NOT TRADE THE SECURITY IN CANADA BEFORE JANUARY 11, 2015.

(iv) the certificates representing the Warrants will bear the legend set forth below:

- 4 -

= "1" 0, = "1" 1) 0 = 1 = "FIRST PAGE ONLY" = "1" 0, = "1" 1) 0 = 1

THE SECURITIES REPRESENTED HEREBY HAVE NOT BEEN REGISTERED UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS AMENDED (THE “U.S. SECURITIES ACT”) OR ANY STATE SECURITIES LAWS, AND MAY BE OFFERED, SOLD OR OTHERWISE TRANSFERRED ONLY (A) TO THE COMPANY, (B) PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE U.S. SECURITIES ACT, (C) OUTSIDE THE UNITED STATES IN COMPLIANCE WITH REGULATION S UNDER THE U.S. SECURITIES ACT, (D) IN COMPLIANCE WITH THE EXEMPTION FROM REGISTRATION UNDER THE U.S. SECURITIES ACT PROVIDED BY RULE 144 THEREUNDER, IF AVAILABLE, AND IN COMPLIANCE WITH ANY APPLICABLE STATE SECURITIES LAWS, OR (E) IN A TRANSACTION THAT DOES NOT REQUIRE REGISTRATION UNDER THE U.S. SECURITIES ACT OR ANY APPLICABLE STATE LAWS AND REGULATIONS GOVERNING THE OFFER AND SALE OF SECURITIES, AND, IN THE CASE OF (C), (D) OR (E), THE HOLDER HAS PRIOR TO SUCH TRANSFER FURNISHED TO THE COMPANY AN OPINION OF COUNSEL OF RECOGNIZED STANDING IN FORM AND SUBSTANCE SATISFACTORY TO THE COMPANY.

UNLESS PERMITTED UNDER SECURITIES LEGISLATION, THE HOLDER OF THIS SECURITY MUST NOT TRADE THE SECURITY IN CANADA BEFORE JANUARY 11, 2015.

(v) the certificates representing the Warrant Shares will bear the legend set forth below:

THE SECURITIES REPRESENTED HEREBY HAVE NOT BEEN REGISTERED UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS AMENDED (THE “U.S. SECURITIES ACT”) OR ANY STATE SECURITIES LAWS, AND MAY BE OFFERED, SOLD OR OTHERWISE TRANSFERRED ONLY (A) TO THE COMPANY, (B) PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE U.S. SECURITIES ACT, (C) OUTSIDE THE UNITED STATES IN COMPLIANCE WITH REGULATION S UNDER THE U.S. SECURITIES ACT, (D) IN COMPLIANCE WITH THE EXEMPTION FROM REGISTRATION UNDER THE U.S. SECURITIES ACT PROVIDED BY RULE 144 THEREUNDER, IF AVAILABLE, AND IN COMPLIANCE WITH ANY APPLICABLE STATE SECURITIES LAWS, OR (E) IN A TRANSACTION THAT DOES NOT REQUIRE REGISTRATION UNDER THE U.S. SECURITIES ACT OR ANY APPLICABLE STATE LAWS AND REGULATIONS GOVERNING THE OFFER AND SALE OF SECURITIES, AND, IN THE CASE OF (C), (D) OR (E), THE HOLDER HAS PRIOR TO SUCH TRANSFER FURNISHED TO THE COMPANY AN OPINION OF COUNSEL OF

- 5 -

= "1" 0, = "1" 1) 0 = 1 = "FIRST PAGE ONLY" = "1" 0, = "1" 1) 0 = 1

RECOGNIZED STANDING IN FORM AND SUBSTANCE SATISFACTORY TO THE COMPANY.

(vi) the shares of Common Stock and the Warrants comprising the Units are subject to “hold period” resale restrictions under applicable Canadian Securities Laws and that, absent an exemption from the prospectus requirements of Canadian Securities Laws, such securities must not be traded or resold in or to a resident of Canada until four months and a day after the closing of the transaction contemplated herein. The Buyer shall comply with all resale restrictions applicable to the Units, shares of Common Stock, Warrants and Warrant Shares in Canada and the United States under applicable securities laws.

(f)

Golden Minerals Shares. As of the date hereof, Buyer is the beneficial owner (as defined in Rule 13d-3 under the Exchange Act) of 5,166,841 shares of Common Stock, and Sentient (Fund III, SGRF III and the Buyer, collectively) is the beneficial owner (as defined in Rule 13d-3 under the Exchange Act) of 9,106,631 shares of Common Stock.

(g)

Brokers or Finders. Buyer has not entered into any agreement or arrangement entitling any agent, broker, investment banker, financial advisor or other firm or person to any broker’s or finder’s fee or any other commission or similar fee in connection with any of the transactions contemplated by this Agreement.

(h)

Non-Reliance of Buyer. Except for the specific representations and warranties expressly made by the Company in Section 5 of this Agreement, Buyer acknowledges that (a) neither the Company, its affiliates nor any other Person has made any representation or warranty, express or implied, as to the Company, the Company’s business, assets, liabilities, operations, prospects, condition (financial or otherwise), including with respect to the effectiveness or success of the Company’s operations, exploration activities or future capital raising activities, and (b) no officer, agent, representative or employee of the Company has any authority, express or implied, to make any representations, warranties or agreements not specifically set forth in this Agreement. Buyer has not received an “offering memorandum” (as defined in Ontario Securities Commission Rule 14-501 – Definitions) or any other similar document describing or purporting to describe the business and affairs of the Company. Buyer specifically disclaims that it is relying upon or has relied upon any representations or warranties that may have been made by any Person except for the specific representations and warranties expressly made by the Company in Section 5. Any inspection, investigation or review performed by Buyer in connection with this Agreement will not affect or negate the representations and warranties of the Company contained herein.

5.

Representations and Warranties of the Company. The Company hereby represents and warrants to Buyer as follows:

5.1

Organization. The Company is a corporation, duly organized, validly existing and in good standing under the laws of the State of Delaware. The Company has the requisite corporate power and authority to own, lease and operate its assets and properties and to carry on its business as it is now being conducted. The Company is qualified to transact business and is in good standing in each jurisdiction in which the properties owned, leased or operated by

- 6 -

= "1" 0, = "1" 1) 0 = 1 = "FIRST PAGE ONLY" = "1" 0, = "1" 1) 0 = 1

it or the nature of the business conducted by it makes such qualification necessary, except where the failure to be so qualified and in good standing would not reasonably be expected to have a Material Adverse Effect.

5.2

Authorization; Validity of Agreement. The Company has full corporate power and authority to execute and deliver this Agreement and the Registration Rights Agreement and to consummate the transactions contemplated hereby and thereby. The execution, delivery and performance by the Company of this Agreement and the Registration Rights Agreement and the consummation of the transactions contemplated hereby and thereby have been duly authorized by the Company’s Board of Directors, and no other corporate action on the part of the Company is necessary to authorize the execution and delivery by the Company of this Agreement or the consummation of the purchase and sale of the Units.

5.3

Subsidiaries. Each direct and indirect Subsidiary of the Company is duly organized, validly existing and in good standing under the laws of its jurisdiction of formation and has the requisite power and authority to own, lease and operate its assets and properties and to carry on its business as it is now being conducted and each Subsidiary of the Company is qualified to transact business, and is in good standing, in each jurisdiction in which the properties owned, leased or operated by it or the nature of the business conducted by it makes such qualification necessary; except, in all cases, where the failure to be so organized, existing, qualified and in good standing would not reasonably be expected to have a Material Adverse Effect.

5.4

Execution; Validity of Agreement. This Agreement has been duly executed and delivered by the Company and, assuming due and valid authorization, execution and delivery hereof by Buyer, is a valid and binding obligation of the Company, enforceable against the Company in accordance with its terms, except as such enforceability may be limited by the effects of bankruptcy, insolvency, fraudulent transfer, reorganization, moratorium, and other laws relating to or affecting creditors’ rights, and the general principles of equity.

5.5

Consents and Approvals; No Violations. Except for approval of the listing of the Common Stock and Warrant Shares by the TSX and the NYSE MKT, none of the execution, delivery or performance of this Agreement or the Registration Rights Agreement by the Company, the consummation by the Company of the issuance and sale of the Units in accordance herewith or compliance by the Company with any of the provisions hereof will (1) conflict with or result in any breach of any provision of the certificate of incorporation or bylaws of the Company or any of its Subsidiaries, (2) require any filing with (except for filings with the SEC, the Ontario Securities Commission, the TSX, the NYSE MKT, and other regulatory authorities advising them of the issuance and sale of the Units), or permit, authorization, consent or approval of, any governmental entity or any other Person, (3) result in a violation or breach of, or constitute (with or without due notice or lapse of time or both) a default (or give rise to any right of termination, cancellation or acceleration) under, any of the terms, conditions or provisions of any note, bond, mortgage, indenture, lease, license, contract, agreement or other instrument or obligation to which the Company or any of its Subsidiaries is a party, other than such violation, breach or default as would not reasonably be expected to have a Material Adverse Effect, or (4) violate any order, writ, injunction, decree, statute, rule or regulation applicable to

- 7 -

= "1" 0, = "1" 1) 0 = 1 = "FIRST PAGE ONLY" = "1" 0, = "1" 1) 0 = 1

the Company or any of its Subsidiaries, other than such violation as would not reasonably be expected to have a Material Adverse Effect.

5.6

Good Title Conveyed. At the time of issuance, the Units will be duly authorized, validly issued, fully paid and nonassessable and not subject to any preemptive rights. The Units, when issued, will be free and clear of all Encumbrances, except for any restrictions on transfer arising under the lock-up agreement to be executed by the Buyer concurrent with the closing of the Offering, the Securities Act or any applicable state or Canadian provincial securities laws.

5.7

Capitalization. The authorized capital of the Company consists of (i) 100,000,000 shares of Common Stock, of which 43,530,833 are issued and outstanding as of the date of this Agreement, including 797,304 shares of restricted stock which are subject to forfeiture conditions, and (ii) 10,000 shares of preferred stock, par value $0.01 per share, none of which are issued and outstanding. Except for (a) the Common Stock and Warrant Shares included in the Units, (b) shares of Common Stock, including Warrant Shares, issued in connection with the anticipated Offering, (c) shares of Common Stock to be issued to directors of the Company pursuant to outstanding restricted stock units, (d) shares of Common Stock issuable upon exercise of options issued under the Company’s Amended and Restated 2009 Equity Incentive Plan, (e) shares of Common Stock which may be issued in the ordinary course pursuant to the Company’s Amended and Restated 2009 Equity Incentive Plan, and (f) shares of Common Stock issuable upon the exercise of options issued in connection with the Company’s business combination with ECU Silver Mining Inc., the Company has not issued or committed to issue any shares of Common Stock or preferred stock or any rights, warrants, options to acquire any shares of any class of capital stock of the Company.

5.8

Filings. The Company is a reporting issuer in the Province of Ontario and is not in default in any material respect of any of the requirements of the Securities Act (Ontario) and the rules and regulations adopted thereunder together with applicable policy statements of the Ontario Securities Commission and rules of the TSX (collectively, the “Canadian Securities Laws”). The Company has made all filings with the SEC that it has been required to make under the Securities Act and the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”) and all filings that it has been required to make pursuant to the Canadian Securities Laws (collectively, but not including any report prepared pursuant to Canadian National Instrument 43-101- Standards of Disclosure for Mineral Projects, the “Public Reports”). The Company prepared the Public Reports in good faith, and to the Company’s knowledge (after reasonably prudent inquiry), none of the Public Reports, as of their respective dates, contained any untrue statement of a material fact or omitted to state a material fact necessary in order to make the statements made therein, in light of the circumstances under which they were made, not misleading. The Company is a domestic issuer, as defined in Rule 902 under the Securities Act.

5.9

Financial Statements. The financial statements included in the Public Reports (including the related notes and schedules) (the “Financial Statements”) have been prepared in accordance with United States generally accepted accounting principles applied on a consistent basis throughout the periods covered thereby and fairly present in all material respects the financial condition of the Company as of the indicated dates and the results of operations of

- 8 -

= "1" 0, = "1" 1) 0 = 1 = "FIRST PAGE ONLY" = "1" 0, = "1" 1) 0 = 1

the Company for the indicated periods, subject, in the case of unaudited consolidated financial statements, to normal year-end adjustments.

5.10

Absence of Changes. Since June 30, 2014, except as disclosed in the Public Reports, (i) no event has occurred which has caused or constitutes a Material Adverse Effect, and (ii) neither the Company nor any of its Subsidiaries has entered into any agreement that was material to the Company and was required to be disclosed pursuant to Form 8-K under the Exchange Act that has not been disclosed.

5.11

Litigation. There are no claims, suits, actions or proceedings pending or, to the knowledge of the Company, threatened against, relating to or affecting the Company or any of its Subsidiaries, before any court, governmental department, commission, agency, instrumentality or authority, or any arbitrator that would reasonably be expected, individually or in the aggregate, to have a Material Adverse Effect. Neither the Company nor any of its Subsidiaries is subject to any judgment, decree, injunction, rule or order of any court, governmental department, commission, agency, instrumentality or authority, or any arbitrator which prohibits the consummation of the transactions contemplated hereby or would reasonably be expected, individually or in the aggregate, to have a Material Adverse Effect.

5.12

Brokers or Finders. Except as set forth in the Underwriting Agreement, the Company has not entered into any agreement or arrangement entitling any agent, broker, investment banker, financial advisor or other firm or Person to any broker’s or finder’s fee or any other commission or similar fee in connection with any of the transactions contemplated by this Agreement.

6.

Closing Conditions. The purchase and sale of the Units is expected to be completed on or about September 10, 2014, concurrent with the closing of the Offering, upon satisfaction of the closing conditions set forth in this Section 6 (the date on which such closing occurs, the “Closing Date”).

6.1

Conditions to Buyer’s Obligation to Close. The obligations of Buyer to consummate the purchase and sale of the Units shall be subject to the satisfaction or waiver on or prior to the Closing Date of each of the following conditions:

(a)

Statutes; Court Orders. No statute, rule or regulation shall have been enacted or promulgated by any governmental entity which prohibits the consummation of the purchase and sale of the Units; and there shall be no order or injunction of a court of competent jurisdiction in effect precluding or prohibiting consummation of the purchase and sale of the Units.

(b)

Government Action. There shall not be threatened or pending any suit, action or proceeding by any governmental entity seeking to restrain or prohibit the consummation of the purchase and sale of the Units or seeking to impose material limitations on the ability of Buyer effectively to exercise full rights of ownership of the Units, including the right to vote the shares of Common Stock, including the Warrant Shares.

(c)

Representations and Warranties. The representations and warranties of the Company set forth in this Agreement shall be true and correct as of the Closing

- 9 -

= "1" 0, = "1" 1) 0 = 1 = "FIRST PAGE ONLY" = "1" 0, = "1" 1) 0 = 1

Date as though made on and as of such date, except where the failure to do so would not have a Material Adverse Effect, provided that if any fact or condition occurs after the date of this Agreement and such fact or condition causes any representation or warranty in this Agreement to be untrue, misleading or inaccurate in any material respect, the Company will deliver to Buyer a certificate describing the exceptions to the applicable representation (a “Representation Update Certificate”), and such Representation Update Certificate will be deemed to modify automatically the applicable representation or warranty; provided, however, that if such Representation Update Certificate reflects an occurrence which could reasonably be expected to have a Material Adverse Effect, Buyer shall be entitled to reject the Representation Update Certificate and the condition set forth in this Section 6.1(c) shall not be met.

(d)

Covenants. The Company shall have complied in all material respects with all covenants, agreements and obligations of the Company contained in this Agreement.

(e)

Consents and Approvals. The Company shall have received conditional approval from the TSX and approval from the NYSE MKT with respect to the listing of the Common Stock and Warrant Shares included in the Units.

(f)

Offering. With respect to the Units, the Company shall have issued (or concurrent with the Units, will issue) the Units sold in the Offering.

(g)

Deliveries at Closing. Buyer shall have received from the Company each of the deliveries set forth below:

(i)

At the Closing, certificates representing the shares of Common Stock and Warrants, comprising the Units, duly and validly issued in favor of Buyer and otherwise sufficient to vest in Buyer good title to the shares of Common Stock and Warrants comprising the Units;

(ii)

At the Closing, a certificate issued by the secretary or an assistant secretary of the Company, dated the Closing Date, in form and substance reasonably satisfactory to Buyer, certifying on behalf of the Company (i) the resolutions of the board of directors of the Company authorizing the execution, delivery and performance of this Agreement and the issuance of the Units, (ii) the incumbency and signature of the authorized signatory of the Company executing this Agreement, (iii) the amended and restated certificate of incorporation and bylaws of the Company, as in effect on the Closing Date, and (iv) that the condition to closing set forth in Section 6.1(c) has been met;

(iii)

At the Closing, the Registration Rights Agreement, duly executed by the Company;

(iv)

An opinion of U.S. counsel to the Company addressed to the Buyer, providing that the issuance, sale and delivery to the Buyer of the Units have been duly authorized by all necessary corporate action and (i) upon issuance against payment therefor and delivery to the Buyer, (A) the Common Stock included in such Units will be validly issued, fully paid and non-assessable and (B) the Warrants will be

- 10 -

= "1" 0, = "1" 1) 0 = 1 = "FIRST PAGE ONLY" = "1" 0, = "1" 1) 0 = 1

valid and binding obligations of the Company and (ii) assuming issuance of the Warrant Shares upon the exercise of the Warrant in accordance with the terms of the Warrant, the Warrant Shares will be validly issued, fully paid and non-assessable; and

(v)

An opinion of Canadian counsel to the Company addressed to the Buyer, providing that the issuance of the Units is exempt from the prospectus requirements under Ontario securities laws, that such securities are subject to restrictions on transfer under Ontario securities law and that the Common Stock included in such Units and the Warrant Shares are conditionally approved for listing on the TSX.

6.2

Conditions to the Company’s Obligation to Close. The obligations of the Company to consummate the purchase and sale of the Units shall be subject to the satisfaction on or prior to the applicable Closing Date of each of the following conditions:

(a)

Statutes; Court Orders. No statute, rule or regulation shall have been enacted or promulgated by any governmental entity which prohibits the consummation of the purchase and sale of the Units; and there shall be no order or injunction of a court of competent jurisdiction in effect precluding or prohibiting consummation of the purchase and sale of the Units.

(b)

Government Action. There shall not be threatened or pending any suit, action or proceeding by any governmental entity seeking to restrain or prohibit the consummation of the purchase and sale of the Units.

(c)

Representations and Warranties. The representations and warranties of Buyer set forth in this Agreement shall be true and correct in all material respects as though made on and as of the Closing Date, except when the failure to do so would not have a material adverse effect on the ability of Buyer to perform its obligations under this Agreement or the availability of an exemption from registration pursuant to Regulation S under the Securities Act.

(d)

Covenants. Buyer shall have complied in all material respects with all covenants, agreements and obligations of Buyer contained in this Agreement.

(e)

Consents and Approvals. The Company shall have received conditional approval from the TSX and approval from the NYSE MKT with respect to the listing of the Common Stock and Warrant Shares included in the Units.

(f)

Offering. The Company shall have issued (or concurrent with the Units, will issue) the Units sold in the Offering.

(g)

Deliveries at Closing. The Company shall have received from Buyer the following:

(i)

By wire transfer of immediately available funds, the amount of the purchase price for the securities to an account designated by the Company prior to the applicable Closing;

- 11 -

= "1" 0, = "1" 1) 0 = 1 = "FIRST PAGE ONLY" = "1" 0, = "1" 1) 0 = 1

(ii)

The Registration Rights Agreement, duly executed by the Buyer.

7.

Miscellaneous.

7.1

Successors and Assigns. Neither this Agreement nor any of the rights, interests or obligations hereunder shall be assigned by any of the parties hereto without the prior written consent of the other parties. Subject to the preceding sentence, this Agreement shall be binding upon, inure to the benefit of, and be enforceable by, the parties and their respective permitted successors and assigns. Nothing in this Agreement is intended to confer upon any party other than the parties hereto or their respective permitted successors and assigns any rights, remedies, obligations, or liabilities under or by reason of this Agreement, except as expressly provided in this Agreement.

7.2

Notices. Unless otherwise provided herein, any notice, request, waiver, instruction, consent or document or other communication required or permitted to be given by this Agreement shall be effective only if it is in writing and (i) delivered by hand or sent by certified mail, return receipt requested, (ii) if sent by a nationally-recognized overnight delivery service with delivery confirmed, or (iii) if sent by facsimile (or other similar electronic means), with receipt confirmed as follows:

| |

Company:

| Golden Minerals Company

350 Indiana Street, Suite 800

Golden, Colorado 80401

Attn: President

Fax: (303) 839-5907

|

with a copy (which shall not constitute notice) to:

| Davis Graham & Stubbs LLP

1550 17th Street, Suite 500

Denver, Colorado 80202

Attn: Deborah J. Friedman

Fax: (303) 893-1379

|

- 12 -

= "1" 0, = "1" 1) 0 = 1 = "FIRST PAGE ONLY" = "1" 0, = "1" 1) 0 = 1

| |

Buyer:

| Sentient Global Resources Fund IV, L.P.

Landmark Square, 1st Floor, 64 Earth Close, West Bay Beach South

PO Box 10795

George Town, Grand Cayman KY1-1007

CAYMAN ISLANDS

Attention: Sue Bjuro – Office Manager

Fax: (345) 946-0921

|

with a copy (which shall not constitute notice) to:

| Quinn & Brooks, LLP

c/o Gregory A. Smith

P.O. Box 590

Larkspur, Colorado 80118

Fax: (720) 294-8374

|

The parties shall promptly notify each other of any change in their respective addresses or facsimile numbers or of the individual or entity or office to receive notices, requests or other communications under this Section 7.2. All notices shall be deemed to have been given (i) if personally delivered or sent by certified mail, as of the date when so delivered, (ii) if sent by nationally-recognized overnight delivery service, two days after mailing, or (iii) if sent by facsimile (or other similar electronic means) as of the date sent, if during normal business hours of the recipient, and otherwise on the next business day.

7.3

Amendments and Waivers. This Agreement may not be amended or supplemented, unless set forth in a writing signed by each party hereto. Except as otherwise permitted in this Agreement, the terms or conditions of this Agreement may not be waived unless set forth in a writing signed by the party entitled to the benefits thereof. No waiver of any of the provisions of this Agreement shall be deemed or shall constitute a waiver of such provision at any time in the future or a waiver of any other provision hereof. The rights and remedies of the parties hereto are cumulative and not alternative. Except as otherwise provided in this Agreement, neither the failure nor any delay by any party hereto in exercising any right, power or privilege under this Agreement will operate as a waiver of such right, power or privilege, and no single or partial exercise of any such right, power or privilege will preclude any other or further exercise of such right, power or privilege or the exercise of any other right, power or privilege.

7.4

Severability. Any term or provision of this Agreement that is held by a court of competent jurisdiction or other authority to be invalid, void or unenforceable in any situation in any jurisdiction shall not affect the validity or enforceability of the remaining terms and provisions hereof or the validity or enforceability of the offending term or provision in any other situation or in any other jurisdiction. If the final judgment of a court of competent jurisdiction or other authority declares that any term or provision hereof is invalid, void or unenforceable, the parties agree that the court making such determination shall have the power to reduce the scope, duration, area or applicability of the term or provision, to delete specific words or phrases, or to replace any invalid, void or unenforceable term or provision with a term or provision that is valid and enforceable and that comes closest to expressing the intention of the invalid or unenforceable term or provision.

- 13 -

= "1" 0, = "1" 1) 0 = 1 = "FIRST PAGE ONLY" = "1" 0, = "1" 1) 0 = 1

7.5

Governing Law. This Agreement shall be governed by and construed in accordance with the internal laws (as opposed to the conflicts of law provisions) of the State of Colorado.

7.6

Submission to Jurisdiction. The parties hereby submit to the non-exclusive jurisdiction of any court of the State of Colorado or the United States District Court for the District of Colorado for the purpose of any suit, action, or other proceeding arising out of this Agreement, and waive any and all objections to jurisdiction that they may have under the laws of the State of Colorado or the United States and any claim or objection that any such court is an inconvenient forum.

7.7

Entire Agreement. This Agreement constitutes the full and entire understanding and agreement between the parties with regard to the subjects hereof and thereof.

7.8

Counterparts. This Agreement may be executed in two or more counterparts (including by facsimile or similar means of electronic communication), each of which shall be deemed an original, but all of which together shall constitute one and the same instrument.

7.9

Announcements. Publicity and other general releases of information to the public through the media concerning the transaction contemplated by this Agreement shall be jointly planned and coordinated between the Company and Buyer. Neither party shall act unilaterally in this regard without the prior approval of the other party provided, however, that such approval shall not be unreasonably withheld. Nothing in this Section 7.9 shall prevent either party from furnishing information to any governmental entity or from furnishing information to comply with applicable laws or rules of any applicable stock exchange.

7.10

Definitions. The following terms shall have the meanings set forth below:

(a)

“Encumbrances” means any and all liens, charges, security interests, options, claims, mortgages, pledges, proxies, voting trusts or agreements, obligations, understandings or arrangements, defects or imperfections of title or other restrictions on title or transfer of any nature whatsoever.

(b)

“Material Adverse Effect” means a material adverse effect on the business, assets, liabilities, financial condition or results of operations of the Company and its subsidiaries taken as a whole, or a material adverse effect on the ability of the Company to perform its obligations under this Agreement; provided however, that none of the following individually or in the aggregate, will be deemed to have a Material Adverse Effect: (x) fluctuations in the market price of the Common Stock; or (y) fluctuations in the prices of precious or base metals, or (z) any change or effect arising out of general economic conditions or conditions generally affecting the mining industries.

(c)

“Person” means a natural person, partnership, corporation, limited liability company, business trust, joint stock company, trust, unincorporated association, joint venture, governmental entity or other entity or organization.

- 14 -

= "1" 0, = "1" 1) 0 = 1 = "FIRST PAGE ONLY" = "1" 0, = "1" 1) 0 = 1

(d)

“Registration Rights Agreement” means the Registration Rights Agreement in the form attached hereto Exhibit B.

(e)

“Subsidiary” means any corporation or other entity with respect to which a specified Person (or a Subsidiary thereof) owns a majority of the common stock or other appropriate equity interest, or has the power to vote or direct the voting of sufficient securities to elect a majority of the directors, managers or members (as appropriate) of its board of directors or other governing body.

7.11

Expenses. All reasonable, documented out-of-pocket costs and expenses incurred by the parties in connection with the negotiation, preparation, execution and delivery of this Agreement and the Registration Rights Agreement, including fees, expenses and disbursements of legal counsel, shall be paid by the Company; provided that the fees, expenses and disbursements of legal counsel to Buyer shall not exceed $15,000.

* * * * *

- 15 -

= "1" 0, = "1" 1) 0 = 1 = "FIRST PAGE ONLY" = "1" 0, = "1" 1) 0 = 1

IN WITNESS WHEREOF, the parties have executed this SUBSCRIPTION AGREEMENT as of the date first written above.

| |

GOLDEN MINERALS COMPANY

|

| |

| |

By:

| /s/ Robert P. Vogels

|

Name:

| Robert P. Vogels

|

Title:

| Sr. Vice President and Chief Financial Officer

|

| | | |

SENTIENT GLOBAL RESOURCES FUND IV, L.P.

|

|

By:

|

Sentient GP IV, L.P., General Partner

|

By:

| Sentient Executive GP IV, Limited, General Partner

|

| |

| |

By:

| /s/ Gregory Link

|

Name:

| Gregory Link

|

Title:

| Director

|

Exhibit A

FORM OF WARRANT

Exhibit A

FORM OF REGISTRATION RIGHTS AGREEMENT

THE SECURITIES REPRESENTED HEREBY HAVE NOT BEEN REGISTERED UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS AMENDED (THE “U.S. SECURITIES ACT”) OR ANY STATE SECURITIES LAWS, AND MAY BE OFFERED, SOLD OR OTHERWISE TRANSFERRED ONLY (A) TO THE COMPANY, (B) PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE U.S. SECURITIES ACT, (C) OUTSIDE THE UNITED STATES IN COMPLIANCE WITH REGULATION S UNDER THE U.S. SECURITIES ACT, (D) IN COMPLIANCE WITH THE EXEMPTION FROM REGISTRATION UNDER THE U.S. SECURITIES ACT PROVIDED BY RULE 144 THEREUNDER, IF AVAILABLE, AND IN COMPLIANCE WITH ANY APPLICABLE STATE SECURITIES LAWS, OR (E) IN A TRANSACTION THAT DOES NOT REQUIRE REGISTRATION UNDER THE U.S. SECURITIES ACT OR ANY APPLICABLE STATE LAWS AND REGULATIONS GOVERNING THE OFFER AND SALE OF SECURITIES, AND, IN THE CASE OF (C), (D) OR (E), THE HOLDER HAS PRIOR TO SUCH TRANSFER FURNISHED TO THE COMPANY AN OPINION OF COUNSEL OF RECOGNIZED STANDING IN FORM AND SUBSTANCE SATISFACTORY TO THE COMPANY.

UNLESS PERMITTED UNDER SECURITIES LEGISLATION, THE HOLDER OF THIS SECURITY MUST NOT TRADE THE SECURITY BEFORE JANUARY 11, 2015.

WARRANT AGREEMENT

THIS WARRANT AGREEMENT is dated September 10, 2014, among Golden Minerals Company, a Delaware corporation (the “Company”), Computershare Inc., a Delaware corporation, and its wholly-owned subsidiary, Computershare Trust Company, N.A., a federally chartered trust company, collectively as warrant agent (the “Warrant Agent”), for the benefit of Sentient Global Resources Fund IV, L.P., as the initial holder (the “Holder”).

RECITALS

A.

The Company proposes to issue to the Holder a warrant (the “Warrant”) to acquire up to 2,900,000 shares of common stock, $0.01 par value (“Common Stock”), of the Company, subject to adjustment as provided herein (the “Warrant Shares”), at an initial price of $1.21 per share (the “Exercise Price”); and

B.

The Warrant Agent is willing to serve as warrant agent in connection with the issuance of the Warrant, maintaining its book-entry system or, in the alternative, issuing a certificate evidencing the Warrant (the “Warrant Certificate”), and the other matters as provided herein subject to the express terms and conditions set forth herein.

NOW, THEREFORE, in consideration of the foregoing and for the purpose of defining the terms and provisions of the Warrant and the respective rights and obligations thereunder of the Company, the Warrant Agent and the Holder, the parties hereby agree as follows:

1.

Definitions. For the purposes of this Warrant Agreement, the following terms shall have the following meanings:

= "1" 1, = "1" 1) 1 = 1 3397012.9

“Adjustment Right” means any right granted with respect to any securities issued in connection with, or with respect to, any issuance or sale (or deemed issuance or sale in accordance with Section 8(c)) of shares of Common Stock (other than rights of the type described in Section 8(a) or 8(b) hereof) that could result in a decrease in the net consideration received by the Company in connection with, or with respect to, such securities (including, without limitation, any cash settlement rights, cash adjustment or other similar rights).

“Approved Stock Plan” means any employee benefit plan which has been approved by the board of directors of the Company prior to or subsequent to the date hereof pursuant to which shares of Common Stock, restricted stock, standard options, stock appreciation and similar and customary employee incentive rights to purchase Common Stock may be issued to any employee, officer, director or consultant for services provided to the Company in their capacity as such.

“Black Scholes Consideration Value” means the value of the applicable Option or Convertible Security (as the case may be) based on the Black Scholes Option Pricing Model obtained from the “OV” function on Bloomberg determined as of the close of business on the Trading Day immediately following the public announcement of the execution of definitive documents with respect to the issuance of such Option or Convertible Security (as the case may be) and reflecting (i) a risk-free interest rate corresponding to the U.S. Treasury rate for a period equal to the remaining term of such Option or Convertible Security (as the case may be) as of the date of issuance of such Option or Convertible Security (as the case may be), (ii) an expected volatility equal to the greater of 50% and the 100-day volatility obtained from the HVT function on Bloomberg and (iii) the underlying price per share used in such calculation shall be the highest Closing Sale Price for any Trading Day during the ten (10) Trading Day period ending on and including the Trading Day immediately preceding the public announcement of the execution of definitive documents with respect to the issuance of such Option or Convertible Security (as the case may be).

“Business Day” means any day except Saturday, Sunday and any day which shall be a federal legal holiday in the United States or a day on which banking institutions in the City of New York or the State of New Jersey are authorized or required by law or other government action to close.