Siebert Financial Corp. Announces a Letter of Intent with Siebert Brandford Shank & Co.

September 08 2014 - 10:03AM

Business Wire

Siebert Financial Corp. (NASDAQ: SIEB) today announced a letter

of intent for the sale of its Capital Markets division to

top-ranked municipal finance firm Siebert Brandford Shank &

Co., L.L.C. Terms of the preliminary agreement were not

disclosed.

The Siebert Capital Markets Group offers Institutional clients

equity execution services on an agency basis, as well as equity and

fixed income underwriting and investment banking services.

“We are pleased to execute the letter of intent with Siebert

Brandford Shank & Co.,” said Jane H. Macon, Chairwoman of the

Board of Directors of Siebert Financial Corp. “Importantly, it

builds upon the strong legacy of integrity and devotion to client

services established by our founder, Muriel F. Siebert, the First

Woman to own a seat on the New York Stock Exchange. Mickie was a

staunch supporter of equality in the world of business, and this

agreement positions the Capital Markets Group to utilize key

synergies at SBSCO.”

Muriel Siebert & Co., Inc. owns 49% of Siebert Brandford

Shank & Co., L.L.C., which was founded in 1996.

Siebert Brandford Shank has had aggressive growth since its

inception, managing deals for state and local governments across

the country totaling over $1 trillion in municipal transactions.

The firm is the top-ranked minority- and women-owned municipal bond

underwriting firm in the country and is the only minority and

women-owned firm ever nationally ranked in the top 10 among all

such firms in the country.

About Siebert Financial Corp.

Siebert Financial Corp. is a holding company which conducts all

of its brokerage operations through Muriel Siebert & Co., Inc.

The firm became a member of the New York Stock Exchange in 1967,

when Ms. Siebert became the first woman to own a seat on the

Exchange. Siebert Financial is based in New York City with

additional retail branches in Boca Raton, FL, Beverly Hills, CA and

Jersey City, NJ.

Siebert does not provide investment, tax or legal advice.

Statements in this press release concerning the Company’s business

outlook or future economic performance, anticipated profitability,

revenues, expenses or other financial items, together with other

statements that are not historical facts, are “forward-looking

statements” as that term is defined under the Federal Securities

Laws. Forward-looking statements are subject to risks,

uncertainties and other factors which could cause actual results to

differ materially from those stated in such statements. Such risks,

uncertainties and other factors include, changes in general

economic and market conditions, fluctuations in volume and prices

of securities, changes and prospects for changes in interest rates

and demand for brokerage and investment banking services, increases

in competition within and without the discount brokerage business

through broader service offerings or otherwise, competition from

electronic discount brokerage firms offering greater discounts on

commissions than Siebert, prevalence of a flat fee environment,

decline in participation in equity or municipal finance

underwriting, decreased ticket volume in the discount brokerage

division, limited trading opportunities, increases in expenses,

changes in net capital or other regulatory requirements. As a

result of these and other factors, Siebert may experience material

fluctuations in its operating results on a quarterly or annual

basis, which could materially and adversely affect its business,

financial condition, operating results, and stock price, as well as

other risks detailed in the Company’s filings with the Securities

and Exchange Commission. Although the Company believes that the

expectations reflected in “forward-looking statements” are

reasonable, it cannot guarantee future results, levels of activity,

performance or achievements. Accordingly, investors are cautioned

not to place undue reliance on any such “forward-looking

statements,” and the Company disclaims any obligation to update the

information contained herein or to publicly announce the result of

any revisions to such “forward-looking statements” to reflect

future events or developments. An investment in Siebert involves

various risks, including those mentioned above and those, which are

detailed from time to time in Siebert’s Securities and Exchange

Commission filings. Copies of the company’s SEC filings may be

obtained by contacting the company or the SEC.

Rubenstein AssociatesPublic RelationsLaura Hynes-KellerW:

212-843-8095M: 646-797-6992E: lhynes@rubenstein.com

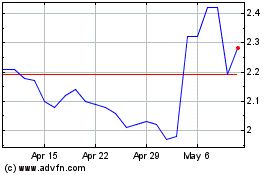

Siebert Financial (NASDAQ:SIEB)

Historical Stock Chart

From Mar 2024 to Apr 2024

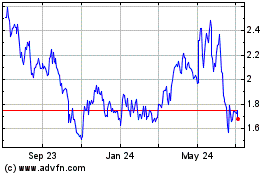

Siebert Financial (NASDAQ:SIEB)

Historical Stock Chart

From Apr 2023 to Apr 2024