UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 27, 2014

LAMAR ADVERTISING COMPANY

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware

|

|

0-30242

|

|

72-1449411

|

| (State or other jurisdiction

of incorporation) |

|

(Commission File

Number) |

|

(IRS Employer

Identification No.) |

5321 Corporate Boulevard, Baton Rouge, Louisiana 70808

(Address of principal executive offices and zip code)

(225) 926-1000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any

of the following provisions (see General Instruction A.2. below):

| |

x |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 1.01 |

Entry into a Material Definitive Agreement. |

As previously disclosed, the board of directors of Lamar

Advertising Company (the “Company”) approved a plan to reorganize the Company to qualify as a real estate investment trust (“REIT”) for U.S. federal income tax purposes for the taxable year commencing January 1, 2014. As one

of the steps in the proposed conversion, on August 27, 2014, the Company entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Lamar Advertising REIT Company, a newly formed, wholly owned subsidiary of the Company

(“Lamar REIT”), providing for, among other things, the merger of the Company with and into Lamar REIT (the “Merger”), with Lamar REIT the surviving entity in the merger and succeeding to and continuing to operate the existing

business of the Company. Effective at the time of the Merger, Lamar REIT will be renamed “Lamar Advertising Company.” Pursuant to the Merger Agreement, the outstanding shares of the Company’s Class A common stock, Class B common

stock and Series AA preferred stock will be converted into the right to receive the same number of shares of Lamar REIT Class A common stock, Class B common stock and Series AA preferred stock, respectively.

Consummation of the Merger is subject to certain conditions, including approval by the Company’s stockholders, final approval of the REIT conversion by

the Company’s board of directors, and other customary closing conditions. While the Company anticipates electing REIT status for the taxable year beginning January 1, 2014, there is no certainty as to the timing of a REIT election or

whether the Company will ultimately make a REIT election.

The foregoing description of the Merger Agreement does not purport to be complete and is

qualified in its entirety by reference to the Merger Agreement, which is attached hereto as Exhibit 2.1.

Cautionary Note Regarding Forward-Looking

Statements

Certain information included in this current report is forward-looking in nature within the meaning of Section 27A of the Securities

Act of 1933 and Section 21E of the Securities Exchange Act of 1934. This report uses terminology such as “believes,” “plans,” “expects,” “intends,” “may,” “will,” “should,”

“potential,” and “continue” and similar expressions to identify forward-looking statements. Examples of forward-looking statements in this report include statements about the Company’s consideration of an election to REIT

status, the timing of any such REIT election and the Company’s ability to qualify as a REIT. Actual results may differ materially from those indicated in the Company’s forward-looking statements as a result of various factors, including

those factors set forth in Item 1A of its Annual Report on Form 10-K for the year ended December 31, 2013, under the caption “Risk Factors,” as updated by the Company’s subsequent filings with the SEC. The Company undertakes

no obligation to update the information contained in this current report to reflect subsequently occurring events or circumstances.

ADDITIONAL INFORMATION AND CAUTIONARY STATEMENT

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. Lamar

Advertising REIT Company has filed with the Securities and Exchange Commission (“SEC”) a registration statement on Form S-4 containing a proxy statement of Lamar Advertising Company and a prospectus of Lamar Advertising REIT Company with

respect to the proposed merger. The registration statement has not yet become effective. Notice of a special meeting of stockholders and a definitive proxy statement/prospectus will be mailed to stockholders who hold shares of capital stock of Lamar

Advertising Company on the record date to be determined by the board of directors of Lamar Advertising Company. INVESTORS ARE URGED TO READ THE FORM S-4 AND PROXY STATEMENT (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND ANY OTHER INFORMATION

ABOUT THE PROPOSED MERGER BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. You will be able to obtain documents free of charge at the website maintained by the SEC at www.sec.gov. In addition, you may obtain documents filed

with the SEC by Lamar Advertising Company free of charge by contacting Secretary, c/o Lamar Advertising Company, 5321 Corporate Blvd., Baton Rouge, LA 70808.

Lamar Advertising Company, its directors and executive officers and certain other members of management and employees may be deemed to be participants in the

solicitation of proxies from the company’s stockholders in connection with the merger. Information regarding the persons who may, under the rules of the SEC, be considered participants in the solicitation of proxies in connection with the

merger will be included in the Form S-4 and proxy statement when they become available. Information about the directors and executive officers of Lamar Advertising Company and their ownership of Lamar Advertising Company capital stock is set forth

in the proxy statement for Lamar Advertising Company’s 2014 Annual Meeting of Stockholders. Investors may obtain additional information regarding the interests of such participants by reading the Form S-4 and proxy statement for the merger when

they become available.

Investors should read the Form S-4 and proxy statement (including all amendments and supplements thereto) carefully before making

any voting or investment decisions.

| Item 9.01 |

Financial Statements and Exhibits. |

|

|

|

| Exhibit

No. |

|

Description |

| 2.1 |

|

Agreement and Plan of Merger by and between Lamar Advertising Company and Lamar Advertising REIT Company dated August 27, 2014. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

| Date: September 2, 2014 |

|

|

|

LAMAR ADVERTISING COMPANY |

|

|

|

|

|

By: |

|

/s/ Keith A. Istre |

|

|

|

|

Keith A. Istre |

|

|

|

|

Treasurer and Chief Financial Officer |

EXHIBIT INDEX

|

|

|

| Exhibit

No. |

|

Description |

| 2.1 |

|

Agreement and Plan of Merger by and between Lamar Advertising Company and Lamar Advertising REIT Company dated August 27, 2014. |

Exhibit 2.1

AGREEMENT AND PLAN OF MERGER

AGREEMENT AND PLAN OF MERGER (this “Agreement”), dated as of August 27, 2014, by and between Lamar

Advertising Company, a Delaware corporation (“LAMR”) and Lamar Advertising REIT Company, a Delaware corporation and a wholly owned subsidiary of LAMR (“LAMR REIT”).

RECITALS

WHEREAS,

LAMR has adopted an overall plan (the “REIT Conversion”) to restructure its business operations to allow it to qualify for U.S. federal income tax purposes as a “real estate investment trust”

(“REIT”);

WHEREAS, the REIT Conversion contemplates, among other things, the merger of LAMR with

and into LAMR REIT pursuant to this Agreement;

WHEREAS, as a result of the Merger (defined below) LAMR REIT will be renamed

“Lamar Advertising Company” and will succeed to and continue to operate the existing business of LAMR;

WHEREAS,

Section 251 of the General Corporation Law of the State of Delaware, 8 Del. C. § 101, et seq. (the “DGCL”), authorizes the merger of a Delaware corporation with and into another Delaware

corporation;

WHEREAS, for U.S. federal income tax purposes the Merger is intended to qualify as a reorganization within the

meaning of Section 368(a)(1)(F) of the Internal Revenue Code of 1986, as amended (the “Code”); and

WHEREAS, the Board of Directors of LAMR and the Board of Directors of LAMR REIT each has determined that the Merger and this Agreement

are advisable and in the best interests of each such corporation and its stockholders and each has approved this Agreement and the Merger on the terms and subject to the conditions set forth in this Agreement and directed that this Agreement be

submitted to a vote of their respective stockholders.

NOW, THEREFORE, in consideration of the foregoing, the parties hereto hereby

agree as follows:

ARTICLE I

THE MERGER; CLOSING; EFFECTIVE TIME; EFFECTS OF MERGER

1.1 The Merger. Subject to the terms and conditions of this Agreement, at the Effective Time (defined below) and in accordance with

Section 251 of the DGCL, LAMR shall be merged with and into LAMR REIT and the separate corporate existence of LAMR shall thereupon cease (the “Merger”) and LAMR REIT shall be the surviving corporation of the

Merger (sometimes hereinafter referred to as the “Surviving Corporation”) and the separate existence of the Surviving Corporation will continue unaffected by the Merger.

1.2 The Closing. Subject to the terms and conditions of this Agreement, the closing of the Merger (the

“Closing”) shall take place at such time, date and place as the parties may agree but in no event prior to the satisfaction or waiver, where permitted, of the conditions set forth in Section 4.1 hereof. The date

on which the Closing occurs is hereinafter referred to as the “Closing Date.”

1.3 Effective Time.

Subject to the terms and conditions of this Agreement, following the Closing, the parties hereto shall, at such time as they deem advisable, cause a certificate of merger (the “Certificate of Merger”) to be executed

and filed with the Secretary of State of the State of Delaware and make all other filings or recordings

1

required by Delaware law in connection with the Merger. The Merger shall become effective upon the filing of the Certificate of Merger with the Secretary of State of the State of Delaware or at

such later time as LAMR and LAMR REIT shall agree and specify in the Certificate of Merger in accordance with the DGCL (the “Effective Time”).

1.4 Certificate of Incorporation and Bylaws.

(a) The amended and restated certificate of incorporation of the Surviving Corporation in effect immediately prior to the Effective Time, shall

be and remain the certificate of incorporation of the Surviving Corporation as of the Effective Time, until altered, amended or repealed as provided therein or by applicable law, except that Article First shall be amended to read as follows:

“FIRST: The name of the corporation (hereinafter the “Corporation”) is Lamar Advertising

Company.”

(b) The amended and restated bylaws of the Surviving Corporation in effect immediately prior to the Effective Time shall be

and remain the bylaws of the Surviving Corporation immediately as of the Effective Time, until altered, amended or repealed as provided therein or by applicable law, except that the name of the corporation therein shall be amended to Lamar

Advertising Company.

1.5 Directors of the Surviving

Corporation. At the Effective time, the number of directors of the Surviving Corporation in effect immediately prior to the Effective Time shall be the same as the number of directors of LAMR immediately prior to the Effective time. The

directors of LAMR immediately prior to the Effective Time shall, at the Effective Time, become the directors of the Surviving Corporation until expiration of their then-current terms as directors, or prior resignation, death or removal.

1.6 Officers of the Surviving Corporation. The officers of LAMR immediately prior to the Effective Time shall, at the Effective Time,

become the officers of the Surviving Corporation, with the same offices and titles, and shall hold office at the pleasure of the Board of Directors of the Surviving Corporation and subject to the bylaws of the Surviving Corporation.

1.7 Effects of Merger. The Merger shall have the effects specified in the DGCL and this Agreement.

ARTICLE II

EFFECT ON

CAPITAL STOCK; EXCHANGE OF CERTIFICATES

2.1 Effect on Capital Stock. At the Effective Time, by virtue of the Merger and

without any further action on the part of LAMR, LAMR REIT or the stockholders of such corporations, the following shall occur:

(a) The

outstanding shares of Class A Common Stock, par value $0.001 per share, of LAMR (“LAMR Class A Common Stock”) issued and outstanding immediately prior to the Effective Time shall be converted into the right

to receive the same number of validly issued, fully paid and nonassessable shares of Class A common stock, par value $0.001 per share, of the Surviving Corporation (“Surviving Corporation Class A Common

Stock”).

(b) The outstanding shares of Class B Common Stock, par value $0.001 per share, of LAMR (the “LAMR

Class B Common Stock”, and together with the LAMR Class A Common Stock, the “LAMR Common Stock”) issued and outstanding immediately prior to the Effective Time shall be converted into the right to

receive the same number of validly issued, fully paid and nonassessable shares of Class B common stock, par value $0.001 per share, of the Surviving Corporation (“Surviving Corporation Class B Common Stock”, and

together with the Surviving Corporation Class A Common Stock, “Surviving Corporation Common Stock”).

2

(c) The outstanding shares of Series AA Preferred Stock, par value $0.001 per share, of LAMR

(“LAMR Series AA Preferred Stock”, and collectively with LAMR Common Stock, “LAMR Stock”) issued and outstanding immediately prior to the Effective Time shall be converted into the right

to receive the same number of validly issued, fully paid and nonassessable shares of Series AA preferred stock, par value $0.001 per share, of the Surviving Corporation (“Surviving Corporation Series AA Preferred

Stock”).

(d) All shares of LAMR Common Stock and LAMR Series AA Preferred Stock shall no longer be outstanding and shall

be canceled and shall cease to exist. At the Effective Time, each certificate (“Certificate”) formerly representing shares of LAMR Stock shall thereafter only represent the right to receive (i) the consideration

payable in respect of such shares under Sections 2.1(a), (b), and (c) and (ii) an amount equal to any dividend or other distribution pursuant to Section 2.2 and Section 2.3(c).

(e) Each share of LAMR Stock held in LAMR’s treasury at the Effective Time shall, by virtue of the Merger and without any action on the

part of the holder thereof, cease to be outstanding, shall be canceled without payment of any consideration therefor and shall cease to exist.

(f) Each share of LAMR REIT Common Stock issued and outstanding immediately prior to the Effective Time shall, by virtue of the Merger and

without any action on the part of LAMR REIT or the holder of such shares, cease to be outstanding, shall be canceled without payment of any consideration therefor and shall cease to exist.

(g) Each option to purchase shares of Class A LAMR Common Stock outstanding immediately prior to the Effective Time shall, by virtue of

the Merger and without any action on the part of the holder thereof, be converted into and become an option to purchase, upon the same terms and conditions, the number of shares of Surviving Corporation Class A Common Stock which is equal to

the number and type of shares of Class A LAMR Common Stock subject to such option. The exercise price per share of Surviving Corporation Class A Common Stock under each of said options shall be equal to the exercise price per share of

Class A LAMR Common Stock under such option immediately prior to the Effective Time. For the avoidance of doubt, any options subject to vesting and/or other restrictions shall remain subject to the same terms and conditions, including as to

vesting, exercisability and/or other restrictions, which shall not be affected by the Merger.

(h) Each restricted stock award, restricted

stock unit, stock appreciation right, or any other stock-based award, stock purchase right or other right with respect to Class A LAMR Common Stock that is outstanding immediately prior to the Effective Time shall be converted into and become,

upon the same terms and conditions, a restricted stock award, restricted stock unit, stock appreciation right, or other stock-based award, stock purchase right or other right with respect to shares of Surviving Corporation Class A Common Stock,

giving each holder the same rights, with respect to the same class and same number of shares of such stock of the Surviving Corporation, as such holder had with respect to the stock of LAMR under such outstanding restricted stock award, restricted

stock unit, stock appreciation right, or other stock-based award, stock purchase right or other right. All obligations in respect of such outstanding restricted stock awards, restricted stock units, stock appreciation rights, or other stock-based

awards, stock purchase rights or other rights shall, as of the Effective Time, be assumed by the Surviving Corporation. For the avoidance of doubt, any restricted stock award, restricted stock unit, stock appreciation right or other stock-based

award, stock purchase right or other right subject to vesting and/or other restrictions shall remain subject to the same terms and conditions, including as to vesting, exercisability and/or other restrictions, which shall not be affected by the

Merger.

2.2 Dividends Declared Prior to the Effective Time. LAMR’s obligations with respect to any dividends or other

distributions to the stockholders of LAMR that have been declared by LAMR but not paid prior to the Effective Time will be assumed by the Surviving Corporation in accordance with the terms thereof.

2.3 Exchange of Certificates.

(a) As of the Effective Time, the Surviving Corporation shall deposit, or shall cause to be deposited, (i) with American Stock Transfer

and Trust Company, the transfer agent and registrar for the shares of the Surviving Corporation Class A Common Stock and one of the exchange agents for purposes of the Merger,

3

(“ATS”), for exchange in accordance with this Article II, certificates evidencing shares of Surviving Corporation Class A Common Stock to be issued pursuant to

Section 2.1 and delivered pursuant to this Section 2.3 in exchange for outstanding shares of LAMR Class A Stock, (ii) with LAMR REIT, the transfer agent and registrar for the shares of the Surviving Corporation Class B Common

Stock and one of the exchange agents for purposes of the Merger, (together with ATS, the “Exchange Agents”), for exchange in accordance with this Article II, certificates evidencing shares of Surviving Corporation

Class B Common Stock to be issued pursuant to Section 2.1 and delivered pursuant to this Section 2.3 in exchange for outstanding shares of LAMR Class B Common Stock, and (iii) with LAMR REIT, the transfer agent and registrar for the shares

of the Surviving Corporation Series AA Preferred Stock, for exchange in accordance with this Article II, certificates evidencing shares of Surviving Corporation Series AA Preferred Stock to be issued pursuant to Section 2.1 and delivered

pursuant to this Section 2.3 in exchange for outstanding shares of LAMR Series AA Preferred Stock. In addition, the Surviving Corporation shall deposit, or shall cause to be deposited, with the Exchange Agents, for the benefit of holders of

Certificates as necessary from time to time after the Effective Time, any dividends or other distributions payable pursuant to Section 2.2 and Section 2.3(c).

(b) As soon as reasonably practicable after the Effective Time, the Surviving Corporation shall cause the Exchange Agents to mail to each

holder of record of a Certificate (i) a letter of transmittal which shall specify that delivery shall be effected, and risk of loss and title to the Certificate shall pass, only upon delivery of the Certificate to the Exchange Agents and shall

be in such form and have such other provisions as the Surviving Corporation may reasonably specify, and (ii) instructions for use in effecting the surrender of the Certificates in exchange for a certificates of Surviving Corporation Common

Stock. Upon surrender of a Certificate for cancellation to the Exchange Agents together with such letter of transmittal, duly executed and completed in accordance with the instructions thereto, the Certificate so surrendered shall forthwith be

cancelled, and the holder of such Certificate shall be entitled to receive in exchange therefor (A) the number and class of shares of Surviving Corporation Common Stock which such holder has the right to receive in respect of the Certificate

surrendered pursuant to the provisions of this Article II and (B) the payment of any of dividends and other distributions that such holder has the right to receive pursuant to Section 2.3(c). No interest shall be paid or accrued on any

Merger consideration or on unpaid dividends and distributions payable to holders of Certificates. In the event of a surrender of a Certificate representing shares of LAMR Stock in exchange for certificates evidencing shares of Surviving Corporation

Stock in the name of a person other than the person in whose name such shares of LAMR Stock are registered, the proper number of shares of Surviving Corporation Stock may be issued to such a transferee in book-entry form for such transferee if the

Certificate evidencing such securities is presented to the Exchange Agents, accompanied by all documents required by the Exchange Agents or the Surviving Corporation to evidence and effect such transfer and to evidence that any applicable transfer

taxes have been paid.

(c) No dividends or other distributions declared by the Surviving Corporation in respect of Surviving Corporation

Common Stock, the record date for which is at or after the Effective Time, shall be paid by the Exchange Agents to any holder of any unsurrendered Certificate until such Certificate is surrendered for exchange in accordance with this Article II.

Subject to the effect of applicable laws, following surrender of any such Certificate, the Exchange Agents shall release to the holder of the certificates representing shares of Surviving Corporation Common Stock issued in exchange therefor, without

interest, (A) at the time of such surrender, the previously reserved amount equal to the dividends or other distributions with a record date after the Effective Time theretofore payable with respect to such shares of Surviving Corporation

Common Stock that had been held by the Exchange Agents for the benefit of such holder, and (B) at the appropriate payment date, the dividends or other distributions payable with respect to such shares of Surviving Corporation Common Stock with

a record date after the Effective Time but with a payment date subsequent to surrender.

(d) At and after the Effective Time, there shall

be no transfers on the stock transfer books of LAMR of shares of LAMR Common Stock which were outstanding immediately prior to the Effective Time. If, after the Effective Time, Certificates are presented to the Surviving Corporation, they shall be

canceled and exchanged for shares of Surviving Corporation Common Stock in accordance with the procedures set forth in this Article II.

4

(e) Fractional shares of Surviving Corporation Common Stock and Series AA Preferred Stock shall

be issued pursuant hereto.

(f) Any former stockholders of LAMR who have not complied with this Article II within one year after the

Effective Time shall thereafter look only to the Surviving Corporation for release of (A) their previously reserved shares of Surviving Corporation Common Stock deliverable in respect of each share of LAMR Common Stock such stockholder holds as

determined pursuant to this Agreement and (B) any dividends or other distributions paid on such shares for the benefit of such stockholders, without any interest thereon.

(g) In the event any Certificate shall have been lost, stolen or destroyed, upon the making of an affidavit of that fact by the person claiming

such Certificate to be lost, stolen or destroyed and, if required by the Surviving Corporation, the posting by such person of a bond in such reasonable amount as the Surviving Corporation may direct as indemnity against any claim that may be made

against it with respect to such Certificate, the Exchange Agents or the Surviving Corporation will issue in exchange for such lost, stolen or destroyed Certificate the shares of Surviving Corporation Common Stock deliverable in certificated or

book-entry form in respect thereof pursuant to this Agreement.

(h) None of LAMR, the Surviving Corporation, the Exchange Agents or any

other person shall be liable to any former holder of shares or securities of LAMR for any amount properly delivered to a public official pursuant to any applicable abandoned property, escheat or similar laws.

ARTICLE III

SPECIFIC

UNDERTAKINGS

3.1 Stock Incentive Plan and Employee Stock Purchase Plan. At the Effective Time, the rights and obligations of

LAMR under the Lamar Advertising Company Amended and Restated 1996 Equity Incentive Plan and the Lamar Advertising Company 2009 Employee Stock Purchase Plan, as amended (collectively, the “Plans”) and related agreements will

be assumed by the Surviving Corporation in accordance with the terms thereof, and all rights of the parties thereto and the participants therein to acquire shares of LAMR Class A Common Stock on the terms and conditions of the Plans and such

agreements will be converted into rights to acquire shares of Surviving Corporation Class A Common Stock, in each case, to the extent set forth in, and in accordance with, the terms of such Plans and related other agreements. The number of

shares available for grant under each Plan is set forth in Schedule 3.1.

3.2 Other Employee Benefit Plans. Following the Effective

Time, the Surviving Corporation shall honor, or cause to be honored, all obligations under employment agreements, employee retention or consulting agreements and all employee benefit plans, programs, policies and arrangements of LAMR in accordance

with the terms thereof. Nothing herein shall be construed to prohibit the Surviving Corporation from amending or terminating such agreements, programs, policies and arrangements after the Merger in accordance with the terms thereof and with

applicable law.

3.3 Indemnification. The Surviving Corporation and LAMR agree that all rights to indemnification and exculpation

from liability for acts or omissions occurring at or prior to the Effective Time and rights to advancement of expenses relating thereto existing prior to the Effective Time in favor of current or former directors or officers of LAMR as provided in

LAMR’s certificate of incorporation, bylaws, under law or by any existing indemnification agreements or arrangements of LAMR shall survive the Merger and become the obligations of the Surviving Corporation.

5

ARTICLE IV

CONDITIONS

4.1

Conditions as to Each Party’s Obligation to Effect the Merger. The respective obligations of each party to consummate the transactions contemplated by this Agreement are subject to the satisfaction or waiver (to the extent not prohibited

by law), of the following conditions at or prior to the Closing Date:

(a) This Agreement shall have been duly adopted by the requisite

vote of the stockholders of LAMR and LAMR REIT.

(b) LAMR’s Board of Directors shall not have determined that the transactions

constituting the REIT Conversion that impact the Surviving Corporation’s qualification as a REIT have not occurred or are not reasonably likely to occur.

(c) LAMR REIT shall have amended and restated its certificate of incorporation to read substantially in the form attached hereto as Exhibit A.

(d) LAMR REIT shall have amended and restated its bylaws to read substantially in the form attached hereto as Exhibit B.

(e) LAMR shall have received from its tax counsel an opinion to the effect that the Merger qualifies as a reorganization within the meaning of

Section 368(a)(1)(F) of the Code, and that each of LAMR and LAMR REIT is a party to a reorganization within the meaning of Section 368(b) of the Code.

(f) The shares of Surviving Corporation Class A Common Stock issuable to stockholders of LAMR pursuant to this Agreement shall have been

approved for listing on the NASDAQ Stock Market, subject to official notice of issuance.

(g) The Registration Statement on Form S-4 filed

with the Securities and Exchange Commission by LAMR REIT in connection with the Merger shall have become effective under the Securities Act of 1933, as amended, and shall not be the subject of any stop order or proceeding seeking a stop order.

(h) LAMR’s Board of Directors shall have determined, in its sole discretion, that no legislation, or proposed legislation with a

reasonable possibility of being enacted, would have the effect of substantially (i) impairing the ability of the Surviving Corporation to qualify as a REIT, (ii) increasing the federal tax liabilities of LAMR or the Surviving Corporation

resulting from the REIT Conversion, or (iii) reducing the expected benefits to the Surviving Corporation resulting from the REIT Conversion.

(i) LAMR shall have received all governmental approvals and third party consents required to be obtained by LAMR or its subsidiaries in

connection with the Merger and the transactions constituting the REIT Conversion, except where the failure to obtain such approvals or consents would not reasonably be expected to materially and adversely affect the business, financial condition or

results of operations of the Surviving Corporation and its subsidiaries taken as a whole.

ARTICLE V

DEFERRAL AND TERMINATION

5.1 Deferral. Consummation of the Merger may be deferred by the Board of Directors of LAMR or any authorized officer of LAMR following

the special meeting of the stockholders of LAMR if said Board of Directors or authorized officer determines that such deferral would be advisable and in the best interests of LAMR and its stockholders.

5.2 Termination of Agreement. This Agreement may be terminated and the Merger may be abandoned at any time prior to the Effective Time,

before or after the adoption of this Agreement by the stockholders of LAMR, by the Board of Directors of LAMR in its sole discretion.

6

5.3 Effect of Termination and Abandonment. In the event of termination of this Agreement

and abandonment of the Merger pursuant to this Article V, this Agreement shall forthwith become null and void and have no effect and no party hereto (or any of its affiliates, directors, partners, officers or stockholders) shall have any liability

or further obligation to any other party to this Agreement.

ARTICLE VI

GENERAL PROVISIONS

6.1

Appraisal Rights. The holders of shares of LAMR Class A Common Stock are not entitled under applicable law to dissenters’ or appraisal rights as a result of the Merger or REIT Conversion. The holders of LAMR Class B Common Stock and

LAMR Series AA Preferred Stock are entitled to dissenters’ rights pursuant to Section 262 of the DGCL.

6.2 Entire

Agreement. This Agreement, the Exhibits hereto, and any documents delivered by the parties in connection herewith constitute the entire agreement among the parties with respect to the subject matter hereof and supersede all prior agreements and

understandings among the parties with respect thereto. No addition to or modification of any provision of this Agreement shall be binding upon any party hereto unless made in writing and signed by all parties hereto.

6.3 Amendment. This Agreement may be amended by the parties hereto at any time before or after adoption of this Agreement by the

stockholders of LAMR, but after such stockholder adoption, no amendment shall be made which by law requires the further approval of such stockholders without obtaining such further approval. This Agreement may not be amended except by an instrument

in writing signed on behalf of each of the parties hereto.

6.4 Governing Law and Jurisdiction. This Agreement shall be governed by

and construed in accordance with the laws of the State of Delaware. Each of the parties hereby submits to the non-exclusive jurisdiction of the state and federal courts located in the State of Delaware.

6.5 Counterparts. This Agreement may be executed by the parties hereto in separate counterparts, each of which when so executed and

delivered shall be an original, but all such counterparts shall together constitute one and the same instrument. Each counterpart may consist of a number of copies hereof, each signed by less than all, but together signed by all of the parties

hereto.

6.6 Severability. Any term or provision of this Agreement which is invalid or unenforceable in any jurisdiction shall, as

to that jurisdiction, be ineffective to the extent of such invalidity or unenforceability without rendering invalid or unenforceable the remaining terms and provisions of this Agreement or affecting the validity or enforceability of any of the terms

or provisions of this Agreement in any other jurisdiction. If any provision of this Agreement is so broad as to be unenforceable, the provision shall be interpreted to be only so broad as is enforceable.

6.7 Waiver of Conditions. The conditions to each of the parties’ obligations to consummate the Merger are for the sole benefit of

such party and may be waived by such party in whole or in part to the extent permitted by applicable law.

6.8 No Third-Party

Beneficiaries. This Agreement is not intended to confer upon any person other than the parties hereto any rights or remedies hereunder.

[Signature Page Follows]

7

IN WITNESS WHEREOF, the parties have executed this Agreement and caused the same to be

duly delivered on their behalf on the day and year first written above.

|

|

|

| LAMAR ADVERTISING COMPANY |

|

|

| By: |

|

/s/ Keith A. Istre |

|

|

Name: Keith A. Istre |

|

|

Title: Chief Financial Officer |

|

| LAMAR ADVERTISING REIT COMPANY |

|

|

| By: |

|

/s/ Sean. E. Reilly |

|

|

Name: Sean E. Reilly |

|

|

Title: Chief Executive Officer |

[Signature Page to Merger Agreement]

8

Schedule 3.1

LAMR Stock Incentive Plans

|

|

|

| Plan |

|

Shares Available for Grant |

| Lamar Advertising Company Amended and Restated 1996 Equity Incentive Plan |

|

2,637,628,000 |

| 2009 Employee Stock Purchase Plan, as amended |

|

356,853 |

9

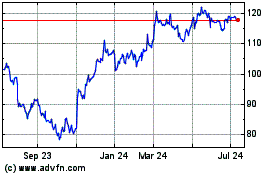

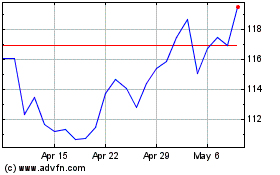

Lamar Advertising (NASDAQ:LAMR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lamar Advertising (NASDAQ:LAMR)

Historical Stock Chart

From Apr 2023 to Apr 2024