UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 Or 15(d) Of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 28, 2014

U.S. GLOBAL INVESTORS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Texas |

|

0-13928 |

|

74-1598370 |

| (State of other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

IRS Employer

Identification No.) |

|

|

| 7900 Callaghan Road, San Antonio, Texas |

|

78229 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: 210-308-1234

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition.

On August 27, 2014, U.S. Global Investors, Inc. issued a press release reporting earnings and other financial results for its fiscal

year ended June 30, 2014. A copy of the press release is attached and being furnished as Exhibit 99.1.

Item 9.01 Financial Statements

and Exhibits.

Exhibit 99.1 – Press Release issued by U.S. Global Investors, Inc. dated August 27, 2014, reporting

earnings and other financial results for the fourth quarter and fiscal year ended June 30, 2014.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

|

| U.S. Global Investors, Inc. |

|

|

| By: |

|

/s/ Lisa Callicotte |

|

|

Lisa Callicotte |

|

|

Chief Financial Officer |

Dated: August 28, 2014

Exhibit 99.1

|

|

|

| Contact: Susan Filyk

Investor Relations 210.308.1286

sfilyk@usfunds.com |

|

|

For Immediate Release

U.S. Global Investors, Inc. Reports Results for Fiscal Year 2014

Increases Investment in Galileo Global Equity Advisors, Streamlines Products and Operations

************************************************************************

SAN ANTONIO–August 27, 2014–U.S. Global Investors, Inc. (NASDAQ: GROW), a boutique registered investment advisory firm

specializing in natural resources and emerging markets, today reported a net loss of $970,000, or (0.06) cents per share, on revenues of $11.4 million for the fiscal year ended June 30, 2014. For the fiscal year 2013, U.S. Global Investors

recorded a net loss of $194,000, or (0.01) cents per share, on operating revenues of $17.3 million.

In the fourth quarter of fiscal year 2014, the

company had net income of $260,000, or 0.02 cents per share, on operating revenues of $2.9 million.

On June 30, 2014, total assets under management

as of period end were $1.23 billion compared to $1.16 billion on June 30, 2013, an increase of 6 percent. The increase in total assets under management was a positive outcome of the June 1, 2014, acquisition of a controlling interest in

Galileo Global Equity Advisors, Inc. and the inclusion of Galileo’s $267 million in assets under management, as of June 30, 2014. During fiscal 2014, U.S. Global Investors’ average assets under management were $1.08 billion, compared

to $1.55 billion in fiscal 2013.

A Transitional Year

“Fiscal year 2014 was a challenging transitional year for U.S. Global Investors,” says Frank Holmes, CEO of U.S. Global Investors, Inc. “The

company accomplished strategic objectives in simplifying our operations and product lineup during a difficult environment for resources and emerging markets. The streamlining changes required expensive and time-consuming legal and regulatory

processes but those one-time costs are behind us. Our organization is substantially leaner and nimbler, our product line is streamlined and our focus is on our core competency of money management.”

Simultaneously, the company pursued growth strategies by increasing its investment in Galileo, a high-performing Canadian-based investment advisor, and laying

the groundwork for launching exchange traded funds (ETFs).

FY14 earnings, Page 2

August 27, 2014

Emerging markets, gold and natural resources experienced a challenging three-year decline which negatively

affected investor sentiment, shifted investors from longer-term actively managed strategies to short-term ETF trading and impacted GROW’s revenues. While the company has always maintained a lean and reflexive cost structure, during fiscal year

2014, the company put in place a series of additional positive changes to control costs and improve competitiveness in the future.

In December 2013, U.S.

Global Investors exited the expensive money market fund business by closing its Treasury money market fund and successfully converting its government money market fund to a higher yielding, ultra-short government bond fund. Over the past five years,

bearing the expense of subsidizing yields and protecting the integrity of the $1 NAV has cost the money market fund industry nearly $24 billion in waived expenses, according to the Investment Company Institute. U.S. Global Investors’ move away

from money market funds reduced the company’s cash drain from continuing these costly products.

Without economies of scale, the costs of maintaining

mutual funds have become exceedingly expensive as regulatory and distribution costs have risen dramatically over the past decade. As a result, U. S. Global made the decision to merge or liquidate several of the company’s small funds that were

unprofitable. As a result, as of January 2014, the company has a simplified product line with nine actively managed mutual funds in the United States.

In

December 2013, the company completed the outsourcing of its fund transfer agency services to U.S. Bancorp, a leading provider of mutual fund shareholder services. This change streamlined U.S. Global Investors’ operations, created economies of

scale for fund shareholders, reduced internal regulatory and compliance costs, and created a leaner professional staff focused on money management and marketing.

Increased Investment in Galileo

In June 2014, U.S.

Global Investors completed its purchase of an additional 15 percent in Galileo Global Equity Advisors, based in Toronto. This strategic partnership brought U.S. Global Investors’ ownership, through its wholly owned subsidiary U.S. Global

Investors (Canada) Ltd., to approximately 65 percent of the issued and outstanding shares of Galileo. “Galileo has received numerous awards for outstanding fund performance and we believe it is well positioned for continued success and growth

in Canada,” says Holmes.

This relationship empowers Galileo’s management team to build the business with U.S. Global’s additional

investment capital and marketing support while U.S. Global benefits from Galileo’s proven track record in fund management and a platform for potentially expanding product offerings in Canada.

Planning to Enter ETF Market

U.S. Global Investors has

been granted exemptive relief by the Securities and Exchange Commission, allowing the company to begin the process of bringing ETF products to market. “These investment vehicles are in high demand by investors, and we are excited to soon expand

our fund offerings with innovative and dynamic ETF products,” say Holmes.

FY14 earnings, Page 3

August 27, 2014

Share Repurchase Program

During this transition year, U.S. Global Investors continued purchasing outstanding stock. Since the program began in January 2013, the company has purchased

shares totaling 148,403 class A shares using cash of approximately $463,000. The company used an algorithm to purchase shares on down days, following the rules and regulations that restrict the amounts and times when shares can be purchased on any

given day. The share repurchase plan expires at the end of the calendar year 2014 but may be suspended or discontinued at any time.

Continued Strong

Balance Sheet

The company had net working capital of approximately $24.7 million at the end of fiscal year 2014. With approximately $5.9 million in

cash and cash equivalents and $24 million in securities recorded at fair value, which together comprise approximately 79 percent of total assets, U.S. Global Investors has adequate liquidity and is in a position to pursue potential investment

opportunities. The company has had no long-term debt since 2004 and owns its headquarters building.

U.S. Global Continues GROW Dividends

The company has continued to pay monthly dividends for more than six years and will continue its dividend payments in the fourth calendar quarter of 2014.

The company’s board of directors approved payment of the $0.005 per share per month dividend beginning in October 2014 and continuing through December

2014. The record dates are October 13, November 10 and December 15, and the payment dates will be October 27, November 24 and December 29.

At the end of this period, the company will have paid monthly dividends for more than seven years. At the August 15, 2014, closing price of $3.52, the

$0.005 monthly dividend equals a 1.7 percent yield on an annualized basis.

The continuation of future cash dividends will be determined by U.S.

Global’s board of directors, at its sole discretion, after review of the company’s financial performance and other factors, and is dependent on earnings, operations, capital requirements, general financial condition of the company and

general business conditions.

Earnings Webcast Information

The company has scheduled a webcast for 7:30 a.m. Central time on Thursday, August 28, 2014, to discuss the company’s key financial results for the

fiscal year. Frank Holmes, CEO and chief investment officer, will be accompanied on the webcast by Susan McGee, president and general counsel, and Lisa Callicotte, chief financial officer. Click here to register or visit

www.usfunds.com. Please log in at least 5 minutes prior to the start of the webcast.

FY14 earnings, Page 4

August 27, 2014

Selected financial data (unaudited): (dollars in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended |

|

| |

|

6/30/2014 |

|

|

3/31/2014 |

|

|

6/30/2013 |

|

| Operating Revenues |

|

$ |

2,905 |

|

|

$ |

2,742 |

|

|

$ |

3,459 |

|

| Operating Expenses |

|

|

3,350 |

|

|

|

3,157 |

|

|

|

3,983 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating Loss |

|

|

(445 |

) |

|

|

(415 |

) |

|

|

(524 |

) |

| Total Other Income (Loss) |

|

|

667 |

|

|

|

403 |

|

|

|

(84 |

) |

| Tax Expense (Benefit) |

|

|

(51 |

) |

|

|

14 |

|

|

|

(193 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income (Loss) from Continuing Operations |

|

|

273 |

|

|

|

(26 |

) |

|

|

(415 |

) |

| Net Loss from Discontinued Operations |

|

|

(6 |

) |

|

|

(2 |

) |

|

|

(35 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income (Loss) |

|

$ |

267 |

|

|

$ |

(28 |

) |

|

$ |

(450 |

) |

| Less: Net Income Attributable to Non-Controlling Interest |

|

|

7 |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income (Loss) Attributable to U.S. Global Investors |

|

$ |

260 |

|

|

$ |

(28 |

) |

|

$ |

(450 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings (Loss) per share (basic and diluted) |

|

$ |

0.02 |

|

|

$ |

0.00 |

|

|

$ |

(0.02 |

) |

| Avg. common shares outstanding (basic) |

|

|

15,437,165 |

|

|

|

15,454,932 |

|

|

|

15,477,333 |

|

| Avg. common shares outstanding (diluted) |

|

|

15,437,165 |

|

|

|

15,454,932 |

|

|

|

15,477,333 |

|

| Avg. assets under management (billions) |

|

$ |

1.0 |

|

|

$ |

1.0 |

|

|

$ |

1.3 |

|

Selected financial data for fiscal year: (dollars in thousands, except per share data)

|

|

|

|

|

|

|

|

|

| |

|

2014 |

|

|

2013 |

|

| Operating Revenues |

|

$ |

11,439 |

|

|

$ |

17,318 |

|

| Operating Expenses |

|

|

14,841 |

|

|

|

17,509 |

|

|

|

|

|

|

|

|

|

|

| Operating Loss |

|

|

(3,402 |

) |

|

|

(191 |

) |

| Total Other Income |

|

|

2,165 |

|

|

|

262 |

|

| Income Tax Expense (Benefit) |

|

|

(517 |

) |

|

|

100 |

|

|

|

|

|

|

|

|

|

|

| Loss from Continuing Operations |

|

|

(720 |

) |

|

|

(29 |

) |

| Loss from Discontinued Operations |

|

|

(243 |

) |

|

|

(165 |

) |

|

|

|

|

|

|

|

|

|

| Net Loss |

|

|

(963 |

) |

|

|

(194 |

) |

| Less: Net Income Attributable to Non-Controlling Interest |

|

|

7 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

| Net Loss Attributable to U.S. Global Investors |

|

$ |

(970 |

) |

|

$ |

(194 |

) |

|

|

|

|

|

|

|

|

|

| Loss per share (basic and diluted) |

|

$ |

(0.06 |

) |

|

$ |

(0.01 |

) |

| Avg. common shares outstanding (basic) |

|

|

15,459,022 |

|

|

|

15,482,612 |

|

| Avg. common shares outstanding (diluted) |

|

|

15,459,022 |

|

|

|

15,482,612 |

|

| Avg. assets under management (billions) |

|

$ |

1.1 |

|

|

$ |

1.6 |

|

####

FY14 earnings, Page 5

August 27, 2014

About U.S. Global Investors, Inc.

The story of U.S. Global Investors goes back more than 40 years when it began as an investment club. Today, U.S. Global Investors, Inc.

(www.usfunds.com) is a registered investment advisor that focuses on profitable niche markets around the world. Headquartered in San Antonio, Texas, the company provides money management and other services to U.S. Global Investors Funds and

other international clients.

Forward-Looking Statements and Disclosure

This news release and other statements by U.S. Global Investors may include certain “forward-looking statements” including statements relating to

revenues, expenses and expectations regarding market conditions. You can identify these forward-looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,”

“opportunity,” “seeks,” “anticipates” or other comparable words. Such statements involve certain risks and uncertainties and should be read with corporate filings and other important information on the company’s

website, www.usfunds.com, or the Securities and Exchange Commission’s website at www.sec.gov.

These filings, such as the

company’s annual report and Form 10-K, should be read in conjunction with the other cautionary statements that are included in this release. Future events could differ materially from those anticipated in such statements and there can be no

assurance that such statements will prove accurate and actual results. The company undertakes no obligation to publicly update or review any forward-looking statements, whether as a result of new information, future developments or otherwise.

The Galileo Funds are not offered for sale in the United States.

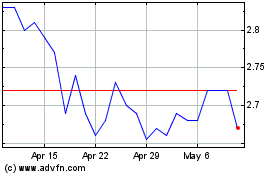

US Global Investors (NASDAQ:GROW)

Historical Stock Chart

From Mar 2024 to Apr 2024

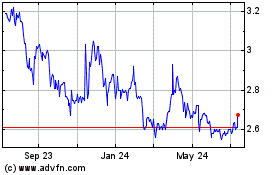

US Global Investors (NASDAQ:GROW)

Historical Stock Chart

From Apr 2023 to Apr 2024