UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 6, 2014

Supernus Pharmaceuticals, Inc.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of

Incorporation)

|

0-50440 |

|

20-2590184 |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

|

|

1550 East Gude Drive, Rockville MD |

|

20850 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (301) 838-2500

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition.

On August 11, 2014, Supernus Pharmaceuticals, Inc. (“Supernus” or the “Company”) issued a press release regarding its financial results for the quarter ending June 30, 2014. A copy of this release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

As previously announced, Supernus will host a conference call at 9:00 a.m. Eastern Time (6:00 a.m. Pacific Time) on Tuesday, August 12, 2014 to review the financial results. A live webcast will be available at www.supernus.com. The webcast will be archived on the Company’s website for 30 business days following the live call. Callers should dial in approximately 10 minutes prior to the start of the call. The phone number to join the conference call is +1 (877) 288-1043 (U.S. and Canada) or +1 (970) 315-0267 (international and local). The access code for the live call is 75364090.

The information in this Item 2.02 (including Exhibit 99.1) is being “furnished” and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date of this report, except as shall be expressly set forth by specific reference in such filing.

This Current Report on Form 8-K contains “forward-looking statements” that do not convey historical information, but relate to predicted or potential future events, such as statements of our plans, strategies and intentions. These statements can often be identified by the use of forward-looking terminology such as “believe,” “expect,” “intend,” “may,” “will,” “should,” or “anticipate” or similar terminology. All statements other than statements of historical facts included in this Current Report on Form 8-K are forward-looking statements. All forward-looking statements speak only as of the date of this Current Report on Form 8-K. Except for Supernus’ ongoing obligations to disclose material information under the federal securities laws, Supernus undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. In addition to the risks and uncertainties of ordinary business operations and conditions in the general economy and the markets in which Supernus competes, the forward-looking statements of Supernus contained in this Current Report on Form 8-K are also subject various risks and uncertainties, including those set forth in Item 1A, “Risk Factors,” in Supernus’ Annual Report on Form 10-K for the fiscal year ended December 31, 2013, which the Company filed on March 21, 2014.

Item 5.02 Departure of Directors and Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On August 6, 2014, the Compensation Committee (the “Committee”) of the Board of Directors (the “Board”) of the Company approved, and the Board ratified, the adoption of certain termination and change of control practices, which practices are consistent with the Company’s industry peer group and were recommended to the Committee by Radford, its independent compensation consulting company. The Committee also approved and the Board ratified the form of Executive Retention Agreement (the “Agreement”), which provides for certain potential payments and other rights upon the termination of an executive officer of the Company, other than the Chief Executive Officer, and an amendment to the Chief Executive Officer’s employment agreement (the “Amendment”) to revise terms related to termination benefits upon a change in control.

Under the Agreement, upon termination of employment by the Company prior to a change in control without cause or by the executive officer for good reason, the executive officer will be entitled to receive his base salary and health benefits for a period of twelve months following the termination date. In the event of termination of employment by the Company on the date of, or within twelve months after, a change in control without cause or by the executive officer for good reason, the executive officer will be entitled to receive his base salary and health benefits for a period of twelve months following the termination date, a lump-sum payment equal to the most recent annual bonus received by the executive officer, and the executive officer’s stock-based compensation arrangements will be fully vested and nonforfeitable on the date of such termination and will continue to be exercisable and payable in accordance

2

with the terms that apply under such arrangements other than any vesting requirements. Under the Amendment, the Chief Executive Officer’s stock-based compensation arrangements will be fully vested and nonforfeitable on the date of such termination and will continue to be exercisable and payable in accordance with the terms that apply under such arrangements other than any vesting requirements. The Company has entered into the Amendment with the Chief Executive Officer and intends to enter into an Agreement with each executive officer promptly to give effect to these termination and change of control provisions. The severance provisions in the offer letters between the Company and each of W. Jones Bryan, Ph.D. and Padmanabh Bhatt, Ph.D. will be superseded by their respective Agreements.

The foregoing description of the Agreement and the Amendment do not purport to be complete and are qualified in their entirety by reference to the full text of the Agreement and the Amendment

Item 9.01 Financial Statements and Exhibits.

(d) Exhibit

The following documents are filed as an Exhibit pursuant to Item 5.02 hereof:

Exhibit 10.1 — Form of Executive Retention Agreement.

Exhibit 10.2 — Amendment to Amended and Restated Employment Agreement, dated August 8, 2014, by and between the Company and Jack Khattar.

The following document is furnished as an Exhibit pursuant to Item 2.02 hereof:

Exhibit 99.1 — Press Release dated August 11, 2014 of the Company announcing the quarter ending June 30, 2014 financial results.

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

SUPERNUS PHARMACEUTICALS, INC. |

|

|

|

|

DATED: August 11, 2014 |

By: |

/s/ Gregory S. Patrick |

|

|

Gregory S. Patrick |

|

|

Vice-President and Chief Financial Officer |

4

EXHIBIT INDEX

|

Number |

|

Description |

|

|

|

|

|

|

|

|

|

10.1 |

|

Form of Executive Retention Agreement. |

|

Attached |

|

|

|

|

|

|

|

10.2 |

|

Amendment to Amended and Restated Employment Agreement, dated August 8, 2014, by and between the Company and Jack Khattar. |

|

Attached |

|

|

|

|

|

|

|

99.1 |

|

Press Release dated August 11, 2014. |

|

Attached |

5

Exhibit 10.1

EXECUTIVE RETENTION AGREEMENT

THIS EXECUTIVE RETENTION AGREEMENT (this “Agreement”) is made and entered into this [DATE] day of [MONTH], 2014 (the “Effective Date”) by and between Supernus Pharmaceuticals, Inc., a Delaware corporation (the “Company”), and [EMPLOYEE NAME] (the “Executive”).

1. Definitions. Capitalized terms used in this Agreement shall have the meanings set forth either in this Section 1 or elsewhere in this Agreement.

(a) “Board” means the Board of Directors of the Company.

(b) “Cause” means (i) the Executive’s willful refusal or failure to perform (other than by reason of Disability), or substantial negligence in the performance of, [his/her] duties and responsibilities to the Company or any of its affiliates, or [his/her] willful refusal or failure to follow or carry out any reasonable, lawful, written directive of the Board or of the Chief Executive Officer of the Company acting within the respective scopes of their authority; (ii) the Executive’s willful breach of any material provision of any agreement (including, without limitation, any non-competition, non-solicitation or confidentiality agreement) with the Company or any of its affiliates; (iii) the Executive’s act of dishonesty or fraud; (iv) the Executive’s breach of fiduciary duty of loyalty owed to the Company; (iii) the Executive’s willful breach of any material policy of the Company or an affiliate; or (iv) the Executive’s commission of a felony or of a crime involving moral turpitude.

(c) “Change in Control” means the occurrence of any of the following:

(1) any “person” (as such term is used in Sections 13(d) and 14(d) of the Securities Exchange Act of 1934, as amended), becomes the “beneficial owner” (as defined in Rule 13d-3 under the Securities Exchange Act of 1934, as amended), directly or indirectly, of securities of the Company representing more than 50% of the total voting power represented by the Company’s then outstanding voting securities (excluding for this purpose any such voting securities held by the Company, or any affiliate, parent or subsidiary of the Company or any employee benefit plan of the Company);

(2) a merger or consolidation of the Company which results in the holders of voting securities of the Company outstanding immediately prior thereto failing to continue to represent (either by remaining outstanding or by being converted into voting securities of the surviving entity) at least 50% of the combined voting power of the voting securities of the Company or such surviving entity outstanding immediately after such merger or consolidation;

(3) the sale or disposition of all or substantially all of the assets of the Company (or the consummation of any transaction having similar effect); or

(4) individuals who, as of the date hereof, constitute the Board (the “Incumbent Board”) cease for any reason to constitute at least a majority of the Board; provided, however, that any individual becoming a director subsequent to the date hereof whose election, or nomination for election, by the Company’s shareholders, was approved by a vote of at least a majority of the directors then comprising the Incumbent Board shall be considered as though such individual were a member of the Incumbent Board, but excluding, for this purpose, any such individual whose initial assumption of office occurs as a result of an actual or threatened election contest with respect to the election or removal of directors or other actual or threatened solicitation of proxies or consents by or on behalf of a Person other than the Board.

Notwithstanding anything to the contrary herein, an event (or series of events) that would otherwise meet the definition of “Change in Control” under this Section 1(c) will not be deemed to meet such definition unless it also constitutes a “change in control event” as defined in Treasury Regulation § 1.409A-3(i)(5)(i).

(d) “Covered Termination” means the termination of Executive’s Employment (1) by the Company without Cause (other than due to the Executive’s death or Disability), or (2) by the Executive for Good Reason.

(e) “Disabled” and correlative terms refers to the Executive’s inability to engage in any substantial gainful activity by reason of any medically determinable physical or mental impairment that can be expected to result in death or can be expected to last for a continuous period of not less than 12 months.

(f) “Employment” means the Executive’s employment with the Company and its subsidiaries and affiliates, as applicable. If the Executive’s employment is with a subsidiary and that entity ceases to be a subsidiary of the Company, the Executive’s Employment will be deemed to have terminated when the entity ceases to be a subsidiary of the Company unless the Executive transfers employment to the Company or one of its remaining subsidiaries. Notwithstanding the foregoing, in construing the provisions of this Agreement, references to termination or cessation of employment, separation from service, retirement or similar or correlative terms shall be construed to require a “separation from service” (as that term is defined in Section 1.409A-1(h) of the Treasury Regulations) from the Company and from all other corporations and trades or businesses, if any, that would be treated as a single “service recipient” with the Company under Section 1.409A-1(h)(3) of the Treasury Regulations. The Company may, but need not, elect in writing, subject to the applicable limitations under Section 409A, any of the special elective rules prescribed in Section 1.409A-1(h) of the Treasury Regulations for purposes of determining whether a “separation from service” has occurred. Any such written election shall be deemed a part of the Agreement.

(g) “Good Reason” means (1) a material reduction in the Executive’s base salary as in effect immediately prior to the Change in Control, or (2) a requirement

2

by the Company that the Executive relocate [his/her] primary place of Employment by more than fifty (50) miles from [his/her] primary place of Employment immediately prior to the Change in Control. A termination of Employment will not be considered a termination for Good Reason unless (i) the Executive, within ten (10) business days after the first occurrence of the condition giving rise to “Good Reason,” notifies the Company in writing of [his/her] intent to terminate; (ii) the Company fails to cure such condition within thirty (30) days after being so notified; and (iii) the Executive actually terminates Employment no later than ten (10) calendar days after the end of such thirty (30)-day cure period.

(h) “Intellectual Property” means any invention, formula, process, discovery, development, design, innovation or improvement (whether or not patentable or registrable under copyright statutes) made, conceived, or first actually reduced to practice by the Executive solely or jointly with others, during his Employment; provided, however, that, as used in this Agreement, the term “Intellectual Property” shall not apply to any invention that the Executive develops on his own time, without using the equipment, supplies, facilities or trade secret information of the Company or any of its subsidiaries or affiliates, unless such invention relates at the time of conception or reduction to practice of the invention (a) to the business of the Company or any of its subsidiaries or affiliates, (b) to the actual or demonstrably anticipated research or development of the Company or any of its subsidiaries or affiliates or (c) results from any work performed by the Executive for the Company or any of its subsidiaries or affiliates.

(i) “Person” means an individual, a corporation, a limited liability company, an association, a partnership, an estate, a trust and any other entity or organization, other than the Company or any of its subsidiaries or affiliates.

(j) “Termination Date” means the effective date of the Executive’s Covered Termination.

2. Severance Benefits.

(a) Covered Termination Prior to a Change in Control. Subject to Section 2(c), if the Executive experiences a Covered Termination prior to a Change in Control:

(1) The Company shall continue to pay Executive [his/her] base salary less required withholdings, payable in accordance with the Company’s regular payroll schedule, for a period of twelve (12) months following the Executive’s Termination Date; and

(2) Provided the Executive timely elects COBRA coverage, the Company shall pay Executive’s COBRA premiums at the same level of coverage (e.g., employee only or family coverage, and HMO or PPO)

3

Executive had in effect under the group health plans sponsored by the Employer immediately prior to the Termination Date. The Company shall pay such COBRA premiums until the earliest of (a) the close of the twelve (12)-month period following the Executive’s Termination Date (the “Maximum COBRA Payment Period”), (b) the COBRA coverage terminates or expires for the Executive and, if applicable, [his/her] spouse and dependents, and (c) the date the Executive becomes eligible for health insurance coverage in connection with new employment or self-employment. The amount of the Executive’s COBRA premiums paid by the Company shall be reduced appropriately as and when the COBRA coverage terminates or expires for each of the Executive and, if applicable, [his/her] spouse or dependents. Notwithstanding the foregoing, in the event the Company determines, in its sole discretion, that it cannot pay any such COBRA premiums without potentially causing the Company to incur penalties, excise taxes, or other expenses as a result of noncompliance with applicable law (including, without limitation, Section 2716 of the Public Health Service Act), then in lieu of paying such COBRA premiums the Company will pay Executive a taxable lump sum amount equal to the amount of monthly COBRA premiums being paid by the Company on Executive’s behalf at the time the Company makes such determination multiplied by the number of full calendar months that remain in the Maximum COBRA Payment Period at the time such lump sum payment is made.

(b) Covered Termination After Change in Control. Subject to Section 2(c), if the Executive experiences a Covered Termination on the date of, or within twelve (12) months after, a Change in Control:

(1) The Company shall continue to pay Executive [his/her] base salary less required withholdings, payable in accordance with the Company’s regular payroll schedule, for a period of twelve months following the date of Executive’s Covered Termination;

(2) The Company shall pay the Executive a lump-sum payment equal to the most recent annual bonus received by the Executive;

(3) The Executive’s stock-based compensation arrangements shall be fully vested and nonforfeitable on the date of the Covered Termination and shall continue to be exercisable and payable in accordance with terms that apply under such arrangements other than any vesting requirements; provided that in no event will the time and form of payment of any such arrangement that is subject to Section 409A of the Internal Revenue of 1986, as amended (“Code”) be modified as result of such vesting; and

4

(4) Provided the Executive timely elects COBRA coverage, the Company shall pay Executive’s COBRA premiums at the same level of coverage (e.g., employee only or family coverage, and HMO or PPO) Executive had in effect the group health plans sponsored by the Employer immediately prior to the Termination Date. The Company shall pay such COBRA premiums until the earliest of (a) the close of the Maximum COBRA Payment Period, (b) the COBRA coverage terminates or expires for the Executive and, if applicable, [his/her] spouse and dependents, and (c) the date the Executive becomes eligible for health insurance coverage in connection with new employment or self-employment. The amount of the Executive’s COBRA premiums paid by the Company shall be reduced appropriately as and when the COBRA coverage terminates or expires for each of the Executive and, if applicable, [his/her] spouse or dependents. Notwithstanding the foregoing, in the event the Company determines, in its sole discretion, that it cannot pay any such COBRA premiums without potentially causing the Company to incur penalties, excise taxes, or other expenses as a result of noncompliance with applicable law (including, without limitation, Section 2716 of the Public Health Service Act), then in lieu of paying such COBRA premiums the Company will pay Executive a taxable lump sum amount equal to the amount of monthly COBRA premiums being paid by the Company on Executive’s behalf at the time the Company makes such determination multiplied by the number of full calendar months that remain in the Maximum COBRA Payment Period at the time such lump sum payment is made.

(c) Release Required. The obligation of the Company to make any payments described in this Section 2 is conditioned on the Executive’s execution and delivery to the Company not later than the forty-fifth (45th) calendar day following the Termination Date a release of claims in substantially the same form as Exhibit B attached hereto and not revoking such release within seven (7) days after such execution and delivery (the “Release of Claims”). To the extent any payments described in this Section 2 are subject to Code Section 409A, such payments will, except as provided in Section 2(d) and provided that the Executive complies with this Section 2(c), first become payable on the first regular payroll date for Company executives that occurs on or after the 60th day after the Termination Date, and the first installment of payments described in Section 2(a) or Sections 2(b)(1) and (4), whichever is applicable, shall include such amounts as would have been paid to or on behalf of the Executive had such payments begun with the first payroll date for Company executives following the Termination Date. In no event will the Executive be entitled to duplicate compensation or benefits under Sections 2(a) and 2(b).

(d) Timing of Payments; 409A. To the extent that any portion of the payments described in Section 2(a) constitutes nonqualified deferred compensation subject to Section 409A, and if at the Termination Date the Executive is a “specified

5

employee” as that term is defined in Section 409A, such portion shall be paid no earlier than six (6) months and one day following the Termination Date. This Agreement shall be interpreted and administered in a manner so that any amount or benefit payable hereunder shall be paid or provided in a manner that is either exempt from or compliant with the requirements Section 409A of the Code and applicable Internal Revenue Service guidance and Treasury Regulations issued thereunder. Nonetheless, the tax treatment of the benefits provided under the Agreement is not warranted or guaranteed. Neither Company nor its directors, officers, employees or advisers shall be held liable for any taxes, interest, penalties or other monetary amounts owed by Executive as a result of the application of Section 409A or any other provision of the Code.

3. Restrictive Covenants.

(a) Confidentiality. From the date hereof, and during any period of the Executive’s Employment and following any termination thereof, without the prior written consent of the Board or its authorized representative, except to the extent required by law or an order of a court having jurisdiction or under subpoena from an appropriate government agency, in which event the Executive shall use the Executive’s best efforts to consult with the Board prior to responding to any such order or subpoena, and except as required in the performance of his duties hereunder, the Executive shall not disclose any confidential or proprietary trade secrets, customer lists, referral sources, drawings, designs, information regarding product development, marketing plans, sales plans, manufacturing plans, management organization information (including but not limited to data and other information relating to members of the Board, the Company or any of its subsidiaries or affiliates or to the management of the Company or any its subsidiaries or affiliates), operating policies or manuals, business plans, financial records, packaging design or other financial, commercial, business or technical information (a) relating to the Company or any of its subsidiaries or affiliates or (b) that the Company or any of its subsidiaries or affiliates may receive belonging to suppliers, customers, referral sources or others who do business with the Company or any of its affiliates (collectively, “Confidential Information”) to any third Person unless such Confidential Information has been previously disclosed to the public or is in the public domain (in each case, other than by reason of the Executive’s breach of this Section 3(a) or the wrongful act of any other Person having any obligation of confidentiality to the Company or any of its subsidiaries or affiliates). In the event of the termination of the Executive’s Employment for any reason, the Executive shall deliver to the Company all of (a) the property of each of the Company and its subsidiaries and affiliates and (b) the documents and data of any nature and in whatever medium of each of the Company and its subsidiaries and affiliates, and the Executive shall not take with the Executive any such property, documents or data or any reproduction thereof, or any documents containing or pertaining to any Confidential Information other than those documents to which he is legally entitled, including, as the case may be, the Executive’s personnel file.

6

(b) Non-Competition. During the period commencing on the date hereof and ending twelve (12) months after the termination of the Executive’s Employment with the Company and its subsidiaries and affiliates (the “Restriction Period”), the Executive shall not, except with the prior written consent of the Board, directly or indirectly, own any interest in, operate, join, control or participate as a partner, director, principal, officer, or agent of, enter into the employment of, act as a consultant to, or perform any services for any entity which has material operations which competes with the business of the Company and its subsidiaries and affiliates or in which the Company or any of its subsidiaries or affiliates was, or had documented plans to become, materially involved during the Executive’s Employment, in each case in any jurisdiction in which the Company or any of its subsidiaries or affiliates is engaged, or in which any of the foregoing has documented plans to become engaged of which the Executive has knowledge at the time of Executive’s termination of Employment. Notwithstanding anything herein to the contrary, the foregoing shall not prevent the Executive from acquiring as an investment securities representing not more than two percent (2%) of the outstanding voting securities of any publicly held corporation.

(c) Non-Solicitation. Acknowledging the strong interest of the Company and its subsidiaries and affiliates in an undisrupted workplace, during the Restriction Period, the Executive shall not, and shall not assist any Person to, (a) hire or solicit for hiring any employee or former employee of the Company or its subsidiaries or affiliates or seek to persuade any employee of the Company or subsidiaries or affiliates to discontinue employment or (b) solicit or encourage any independent contractor providing services to the Company or its subsidiaries or affiliates to terminate or diminish its relationship with the Company or any of its subsidiaries or affiliates. Executive acknowledges that his access to Confidential Information and to the Company’s and its subsidiaries’ and affiliates’ referral sources and customers and his development of goodwill on behalf of the Company and its subsidiaries and affiliates with their referral sources and customers during his Employment would give him an unfair competitive advantage were he to leave employment and begin competing with the Company or any of its subsidiaries or affiliates for their existing referral sources and customers and that he is therefore being granted access to Confidential Information and to the referral sources and customers of the Company and its subsidiaries and affiliates in reliance on his agreement hereunder. The Executive therefore agrees that, during the Restriction Period, he will not solicit or encourage any referral source or customer of the Company or its subsidiaries or affiliates to terminate or diminish its relationship with the Company, or any of its subsidiaries or affiliates and he will not seek to persuade any such referral source or customer to conduct with any Person any business or activity which such referral source or customer conducts or could conduct with the Company or any of its subsidiaries or affiliates; provided, however, that these restrictions shall apply only with respect to those Persons who are referral sources or customers of the Company or any of its subsidiaries and affiliates at any time during his Employment or whose business has been solicited on behalf of the Company or any of its subsidiaries or affiliates by any of

7

their employees or agents, other than by form letter, blanket mailing or published advertisement, within one year prior to the date his employment ends.

(d) Works for Hire. The Executive agrees to maintain accurate and complete contemporaneous records of, and shall immediately and fully disclose and deliver to the Company, all Intellectual Property. Executive hereby assigns and agrees to assign to the Company (or as otherwise directed by the Company) his full right, title and interest in and to all Intellectual Property. Executive agrees to execute any and all applications for domestic and foreign patents, copyrights and other proprietary rights and do such other acts (including, among others, the execution and delivery of instruments of further assurance or confirmation) requested by the Company to assign the Intellectual Property to the Company (or one of its subsidiaries or affiliates, as directed) and to permit the Company to enforce any patents, copyrights and other proprietary rights in the Intellectual Property. The Executive will not charge the Company or any of its subsidiaries or affiliates for time spent in complying with these obligations. All copyrightable works that the Executive creates, including without limitation computer programs and documentation, shall be considered “work made for hire” and shall, upon creation, be owned exclusively by the Company.

4. Withholding. All payments made by the Company under this Agreement shall be reduced by any tax or other amounts required to be withheld by the Company under applicable law.

5. Assignment. The Company shall require any corporation, entity, individual or other person who is the successor (whether direct or indirect by purchase, merger, consolidation, reorganization or otherwise) to all or substantially all the business or assets of the Company to assume, whether expressly or by operation of law, all of the obligations of the Company under this Agreement. The Executive may not transfer or assign [his/her] rights under this Agreement, except as permitted by the laws of descent and distribution.

6. Severability. If any portion or provision of this Agreement shall to any extent be declared illegal or unenforceable by a court of competent jurisdiction, then the remainder of this Agreement, or the application of such portion or provision in circumstances other than those as to which it is so declared illegal or unenforceable, shall not be affected thereby, and each portion and provision of this Agreement shall be valid and enforceable to the fullest extent permitted by law.

7. Waiver. No waiver of any provision hereof shall be effective unless made in writing and signed by the waiving party. The failure of either party to require the performance of any term or obligation of this Agreement, or the waiver by either party of any breach of this Agreement, shall not prevent any subsequent enforcement of such term or obligation or be deemed a waiver of any subsequent breach.

8

8. Sections 280G/ 4999. In the event it is determined that the Executive is entitled to payments and/or benefits under this Agreement or any other amounts in the “nature of compensation” (whether pursuant to this Agreement or any other plan, arrangement, or agreement with the Company or any affiliate, any person whose actions result in a change of ownership or effective control of the Company covered by Section 280G(b)(2) of the Code or any person affiliated with the Company or such person) as a result of such change of ownership or effective control of the Company (“Payments”) would be subject to the excise tax imposed by Section 4999 of the Code (the “280G Excise Tax”), notwithstanding anything in this Agreement to the contrary, the Company shall cause to be determined, before any amounts of the Payments are paid to the Executive, which of the two following alternative forms of payment would maximize the Executive’s after-tax proceeds: (i) the payment in full of the entire amount of the Payments, or (ii) payment of only a part of the Payments such that the Executive receives the largest possible payment without the imposition of the 280G Excise Tax (the “Reduced Amount”). If it is determined that the Reduced Amount will maximize the Executive’s after-tax proceeds, the Payments shall be reduced to equal the Reduced Amount in the following order: (i) first, by reducing the Severance Payment to the extent necessary, (ii) second, if necessary, by reducing other Payments that are not subject to the rule described in Treasury Regulation Section 1.280G-1 Q&A 24(c), and (iii) third, if necessary, by reducing other Payments that are subject to the rule described in Treasury Regulation Section 1.280G-1 Q&A 24(c); provided, however, that in each case where amounts are paid in more than one installment, each installment shall be reduced proportionally; and provided, further, that in each case Payments are reduced starting with any Payments that shall be exempt from Section 409A and proceeding to other Payments that are not exempt from Section 409A. Unless the Executive consents in writing to a different methodology, all determinations under this Section 8 shall be made at the Company’s expense by a nationally recognized accounting or consulting firm that is reasonably acceptable to the Executive.

9. Injunctive Relief; Breach of Restrictive Covenants; Blue Pencil.

(a) Injunctive Relief. The Executive acknowledges and agrees that the covenants, obligations and agreements of Executive contained in Section 3 relate to special, unique and extraordinary matters and that a violation of any of the terms of such covenants, obligations or agreements will cause the Company irreparable injury for which adequate remedies are not available at law. Therefore, the Executive agrees that the Company shall be entitled to an injunction, restraining order or such other equitable relief (without the requirement to post bond) as a court of competent jurisdiction may deem necessary or appropriate to restrain the Executive from committing any violation of such covenants, obligations or agreements, and shall additionally be entitled to an award of reasonable attorneys’ fees. These injunctive remedies are cumulative and in addition to any other rights and remedies the Company may have.

9

(b) Breach of Restrictive Covenants. The Executive agrees that in the event the Executive breaches any provision of Section 3 hereof in any material respect, the Executive shall (i) not be entitled to receive, if not already paid, any amount otherwise payable under this Agreement, and (ii) return to the Company any and all payments previously made by the Company pursuant to this Agreement within 15 days after written demand for such repayment is made to the Executive by the Company.

(c) Blue Pencil. The Executive and the Company agree that the covenants contained in Section 3 hereof are reasonable covenants under the circumstances, and further agree that if, in the opinion of any court of competent jurisdiction such covenants are not reasonable in any respect, such court shall have the right, power and authority to (and it is the intent of the Executive and the Company that such court shall) excise or modify such provision or provisions of these covenants that to the court appear not reasonable and to enforce the remainder of these covenants as so amended.

10. Entire Agreement. This Agreement constitutes the entire agreement between the parties with respect to the subject matter herein and supersedes and terminates all prior communications, agreements and understandings, written or oral, with respect thereto including, without limitation, the severance provisions, if any, of any offer letter the Executive may have previously received from the Company.

11. Effect on Employment. Nothing contained herein will give the Executive any right to Employment with the Company or any of its affiliates or affect the right of the Company or any of its affiliates to discharge or discipline the Executive at any time.

12. Amendment. This Agreement may be amended or modified only by a written instrument signed by the Executive and by an expressly authorized representative of the Company.

13. Headings. The headings and captions in this Agreement are for convenience only and in no way define or describe the scope or content of any provision of this Agreement.

14. Counterparts. This Agreement may be executed in two or more counterparts, each of which shall be an original and all of which together shall constitute one and the same instrument.

15. Governing Law. This Agreement and all claims or disputes arising out of or based upon this Agreement or relating to the subject matter hereof will be governed by and construed in accordance with the domestic substantive laws of the State of Maryland without giving effect to any choice or conflict of laws provision or rule that would cause the application of the domestic substantive laws of any other jurisdiction.

10

[The remainder of this page has been left blank intentionally.]

11

IN WITNESS WHEREOF, this Agreement has been executed as a sealed instrument by the Company, by its duly authorized representative, and by the Executive, as of the date first above written.

|

THE EXECUTIVE: |

|

THE COMPANY: |

|

|

|

|

|

|

|

|

|

|

|

By: |

|

|

|

|

|

|

|

|

|

Title: |

|

12

Exhibit B

Release of Claims

FOR AND IN CONSIDERATION OF the benefits to be provided me in connection with the termination of my employment, as set forth in the Executive Retention Agreement, dated as of [ ] (the “Agreement”), which are conditioned on my signing this Release of Claims and to which I am not otherwise entitled, and for other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, I, on my own behalf and on behalf of my heirs, executives, administrators, beneficiaries, representatives and assigns, and all others connected with me, hereby release and forever discharge SUPERNUS PHARMACEUTICALS, INC. (the “Company”), its subsidiaries and other affiliates and all of their respective past, present and future officers, directors, trustees, shareholders, employees, agents, plans and plan fiduciaries, insurers, general and limited partners, members, managers, joint venturers, representatives, successors and assigns, and all others connected with any of them, both individually and in their official capacities, from any and all causes of action, rights and claims of any type or description, known or unknown, which I have had in the past, now have, or might now have, through the date of my signing of this Release of Claims, in any way resulting from, arising out of or connected with my employment by the Company or any of its subsidiaries or other affiliates or the termination of that employment or pursuant to any federal, state or local law, regulation or other requirement (including without limitation the Civil Rights Act of 1964 (including Title VII of that Act), the Equal Pay Act of 1963, the Age Discrimination in Employment Act of 1967 (ADEA), the Americans with Disabilities Act of 1990 (ADA), the Fair Labor Standards Act of 1938 (FLSA), the Family and Medical Leave Act of 1993 (FMLA), the Worker Adjustment and Retraining Notification Act (WARN), the Employee Retirement Income Security Act of 1974 (ERISA), the National Labor Relations Act (NLRA), and the fair employment practices laws of the state or states in which I have been employed by the Company or any of the subsidiaries or other affiliates, each as amended from time to time).

Excluded from the scope of this Release of Claims is (i) any amount owed to me pursuant to the Agreement; (ii) any claim arising under the terms of the Agreement after the effective date of this Release of Claims, (iii) any right of indemnification or contribution that I have pursuant to the Articles of Incorporation or By-Laws of the Company or any of its subsidiaries or other affiliates and (iv) any non-forfeitable rights to accrued benefits, if any, arising under any applicable employee benefit plans.

I agree that I have no right to obtain or receive any monetary damages or other relief of any kind as a result of any action or proceeding by me or by anyone else on my behalf regarding any claims covered by the above general release and, to the extent permitted by law, I agree that I will not seek or accept any monetary damages or other relief of any kind in any such action or proceeding. In addition, without limiting the scope of the foregoing, I expressly (i) agree not to be a class representative or be part of a class

13

regarding any action under ERISA, or otherwise to bring an action under ERISA on behalf of a plan or trust for relief for such plan or trust under ERISA, and (ii) to the extent permitted by law, agree not to retain the benefits of any decision, judgment or settlement in any such action.

In signing this Release of Claims, I acknowledge my understanding that I may not sign it prior to the termination of my employment, but that I may consider the terms of this Release of Claims for up to 21 days (or such longer period as the Company may specify) from the later of the date my employment with the Company terminates or the date I receive this Release of Claims. I also acknowledge that I am advised by the Company and its subsidiaries and other affiliates to seek the advice of an attorney prior to signing this Release of Claims; that I have had sufficient time to consider this Release of Claims and to consult with an attorney, if I wished to do so, or to consult with any other person of my choosing before signing; and that I am signing this Release of Claims voluntarily and with a full understanding of its terms.

I further acknowledge that, in signing this Release of Claims, I have not relied on any promises or representations, express or implied, that are not set forth expressly in the Plan. I understand that I may revoke this Release of Claims at any time within seven days of the date of my signing by written notice to the Chief Financial Officer of the Company and that this Release of Claims will take effect only upon the expiration of such seven-day revocation period and only if I have not timely revoked it.

Intending to be legally bound, I have signed this Release of Claims under seal as of the date written below.

|

Signature: |

|

|

|

|

|

|

|

Name (please print): |

|

|

|

|

|

|

|

Date Signed: |

|

|

|

|

|

|

|

14

Exhibit 10.2

SUPERNUS PHARMACEUTICALS, INC.

AMENDMENT TO AMENDED AND RESTATED EMPLOYMENT AGREEMENT

This AMENDMENT (“Amendment”) is made this 8th day of August, 2014 to the Amended and Restated Employment Agreement (“Agreement”) by and between Supernus Pharmaceuticals, Inc. a Delaware corporation (the “Employer”), and Jack Khattar (the “Executive”).

WHEREAS, the Executive and Employer originally entered into an employment agreement dated December 22, 2005;

WHEREAS, on February 29, 2012, the Executive and Employer most recently amended and restated such employment agreement effective January 1, 2012;

WHEREAS, the parties hereto wish to amend such employment agreement as provided herein;

WHEREAS, Section 16 of the Agreement provides that the Agreement may be amended or modified only by a written instrument signed by the Executive and by a duly authorized representative of the Employer;

NOW THEREFORE, in consideration of the foregoing premises and other consideration, the receipt and sufficiency of which are hereby acknowledge, the parties hereto, intending to be bound hereby, agree that the Agreement shall be amended as follows:

AMENDMENT

1. Section 6(a)(ii) of the Agreement is hereby amended by adding “and” to the end thereof.

2. Section 6(a) of the Agreement is hereby amended by adding the following new Section 6(a)(iii) to the end thereof:

(iii) if, and only if, on the date of, or within 12 months after, a Change in Control, the Executive’s employment is terminated by the Executive for Good Reason or by the Employer without Cause, then the Executive’s stock-based compensation arrangements shall be fully vested and nonforfeitable on the date of such termination of employment and shall continue to be exercisable and payable in accordance with terms that apply under such arrangements other than any vesting requirements; provided that in no event will the time and form of payment of any such arrangement that is subject to Section 409A of the Code (as defined in Section 6(b) below) be modified as result of such vesting.

3. The last paragraph of Section 6(a) of the Agreement is hereby amended to replace the term “Termination Benefits,” in both places such term appears in such paragraph, with the phrase “the Termination Benefits described in Sections 6(a)(i) – (ii) above.”

4. Except as expressly provided herein, the remaining terms of the Agreement shall continue in full force and effect.

|

|

SUPERNUS PHARMACEUTICALS, INC. |

|

|

|

|

|

By: |

/s/ Greg S. Patrick |

|

|

|

Name: |

Greg Patrick |

|

|

|

Title: |

Chief Financial Officer |

|

|

|

|

|

|

|

|

/s/ Jack Khattar |

|

|

|

Jack Khattar |

2

Exhibit 99.1

Supernus Announces

Second Quarter 2014 Results

· Second quarter combined net product revenue for Oxtellar XR® and Trokendi XR® was $27.6 million. Total Revenue for the first half of 2014 was a record, $38.7 million.

· Raising guidance for annual revenues to approximately $105 million, and expecting to be profitable for the full year.

· Trokendi XR revenue for the second quarter, $22.6 million, includes prescriptions filled during the first and second quarters, as well as product in the distribution channel as of June 30. Going forward, revenue for Trokendi XR will be recorded based on shipments to wholesalers.

· Net income in the second quarter was $3.2 million, compared to a net loss of ($15.5) million in the first quarter.

· Cash burn for the second quarter totaled $8 million, as compared to $20 million for the first quarter.

Rockville, MD, August 12, 2014 - Supernus Pharmaceuticals, Inc. (NASDAQ: SUPN), a specialty pharmaceutical company focused on developing and commercializing products for the treatment of central nervous system diseases, today reported financial results for the second quarter 2014 and discussed key company developments.

Business Update

Second quarter product prescriptions, as reported by IMS for Trokendi XR and Oxtellar XR combined, totaled 43,207, increasing by 12,999, or 43%, as compared to first quarter 2014. Trokendi XR prescriptions for the second quarter totaled 28,773, representing a 53.6% increase over the 18,727 prescriptions in the first quarter of 2014. Prescriptions for Oxtellar XR during the second quarter totaled 14,434, a 25.7% increase over the 11,481 prescriptions filled during the first quarter of 2014.

Managed care coverage continues to improve for both products. Oxtellar XR now has 159.9 million lives covered and Trokendi XR has 145.3 million lives covered.

“Our solid second quarter reflects our continued success with the launch of Trokendi XR and Oxtellar XR. We continue to show significant increase in the adoption of our products in the marketplace,” said Jack Khattar, President and CEO of Supernus Pharmaceuticals, Inc. “Our sales force and commercial team continued their excellent execution and delivery of robust prescription growth for both products.”

“We closed the first half of the year with record revenues of $38.7 million reflecting the strength of our business and the strong foundation we are building at Supernus. We are looking forward to having a banner year in Supernus history, achieving profitability for the full year and approximately $105 million in revenue.”

Revenue and Gross Margin

Beginning in the second quarter 2014, revenue recognition for Trokendi XR is based on contemporaneous shipments to wholesalers. Revenue increased to $22.6 million for the quarter, including 47,500 prescriptions filled during the first and second quarters, as well as product in the distribution channel as of June 30. This compares to $4.1 million recorded during the first quarter of 2014, based on 11,244 prescriptions filled during the fourth quarter of 2013. Consequently, net deferred product revenue on the balance sheet has been recognized, and the balance eliminated.

Oxtellar XR revenue for the second quarter of 2014, based on shipments to wholesalers, was $5.0 million.

Licensing revenue for the quarter was $2.1 million due to a milestone payment triggered by the May 2014 launch of Orenitram (treprostinil) Extended-Release Tablets by our partner, United Therapeutics, for the treatment of pulmonary arterial hypertension.

Operating Expenses

Selling, general and administrative expenses for the second quarter 2014 were $19.6 million, as compared to $12.2 million in the second quarter of 2013. The higher expense reflected expansion of the sales force coupled with increased promotional and marketing related activities in support of Trokendi XR and Oxtellar XR.

Research and development expenses during the second quarter 2014 were $4.7 million, as compared to $3.5 million in the second quarter of 2013. This increase was due to preclinical and clinical trials for our pipeline products.

Net Income and Earnings Per Share

The Company reported net income for the second quarter 2014 of $3.2 million, or $0.08 per diluted share, as compared to a net loss of ($27.4) million, or ($0.89) per diluted share for the second quarter 2013. This increase, $30.6 million year-over-year, is primarily due to the year-over-year growth in product revenue coupled with the impact of issuing our convertible debt.

Weighted average diluted common shares outstanding in the second quarter 2014 were approximately 42.4 million, as compared to approximately 30.9 million during the second quarter 2013.

As of June 30, 2014, approximately $50.2 million of the Company’s six year $90 million notes, bearing interest at 7.5% per annum, had been converted to common stock.

Capital Resources

As of June 30, 2014, the Company had $62.7 million in cash, cash equivalents, marketable securities, and long term marketable securities compared to approximately $70.5 million as of March 31, 2014. Cash burn for the three and six months ending June 30, 2014 was approximately $8 million and $28 million, respectively.

On July 8, 2014 the Company received $30 million in cash as part of a royalty interest acquisition agreement with HealthCare Royalty Partners.

Financial Guidance

With the recognition of royalty revenues of $30 million in July, the Company is raising its 2014 revenue guidance to approximately $105 million. The Company is also reducing its cash burn guidance for the year to $5 million to $10 million, and raising its guidance for year-end cash and marketable securities to $75 million to $85 million. The Company anticipates achieving profitability for the full year and being cash flow positive in 2015.

Progress of Product Candidates

The Company’s product candidates currently in development, SPN-810 for impulsive aggression in patients with ADHD and SPN-812 for ADHD, continue to progress on schedule. SPN-810 is being developed in cooperation with the FDA as a first-in-class product for an indication with a significant unmet medical need. The Company is progressing toward full-scale production of SPN-810, and is scheduled to start Phase III patient dosing in 2015.

In the second quarter, the Company initiated and completed a pharmacokinetics study for extended release formulations for SPN-812. The study was successful and the Company has selected an extended release formulation that will be the basis of the product tested later in a Phase IIb trial in 2015. In addition, both pipeline programs continue to move forward with animal toxicology studies, including carcinogenicity programs.

Conference Call Details

The Company will hold a conference call hosted by Jack Khattar, President and Chief Executive Officer, and Greg Patrick, Vice President and Chief Financial Officer, to discuss these results at 9:00am ET, on Tuesday, August 12, 2014. An accompanying webcast will also be provided. Please refer to the information below for conference call dial-in information and webcast registration. Callers should dial in approximately 10 minutes prior to the start of the call.

|

Conference dial-in: |

877-288-1043 |

|

International dial-in: |

970-315-0267 |

|

Conference ID: |

75364090 |

|

Conference Call Name: |

Supernus Pharmaceuticals 2Q 2014 Earnings Conference Call |

Following the live call, a replay will be available on the Company’s website, www.supernus.com, under “Investor Info”.

About Supernus Pharmaceuticals, Inc.

Supernus Pharmaceuticals, Inc. is a specialty pharmaceutical company focused on developing and commercializing products for the treatment of central nervous system, or CNS, diseases. The Company has two marketed products for epilepsy, Oxtellar XR® (extended-release oxcarbazepine) and Trokendi XR® (extended-release topiramate). The Company is also developing several product candidates in psychiatry to address large market opportunities in ADHD, including ADHD patients with impulsive aggression. These product candidates include SPN-810 for impulsive aggression in ADHD and SPN-812 for ADHD.

Forward-Looking Statements:

This press release includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements do not convey historical information, but relate to predicted or potential future events that are based upon management’s current expectations. These statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. In addition to the

factors mentioned in this press release, such risks and uncertainties include, but are not limited to, the Company’s ability to achieve profitability; the Company’s ability to raise sufficient capital to fully implement its corporate strategy; the implementation of the Company’s corporate strategy; the Company’s future financial performance and projected expenditures; the Company’s ability to increase the number of prescriptions written for each of its products; the Company’s ability to increase its net revenue; the Company’s ability to enter into future collaborations with pharmaceutical companies and academic institutions or to obtain funding from government agencies; the Company’s product research and development activities, including the timing and progress of the Company’s clinical trials, and projected expenditures; the Company’s ability to receive, and the timing of any receipt of, regulatory approvals to develop and commercialize the Company’s product candidates; the Company’s ability to protect its intellectual property and operate its business without infringing upon the intellectual property rights of others; the Company’s expectations regarding federal, state and foreign regulatory requirements; the therapeutic benefits, effectiveness and safety of the Company’s product candidates; the accuracy of the Company’s estimates of the size and characteristics of the markets that may be addressed by its product candidates; the Company’s ability to increase its manufacturing capabilities for its products and product candidates; the Company’s projected markets and growth in markets; the Company’s product formulations and patient needs and potential funding sources; the Company’s staffing needs; and other risk factors set forth from time to time in the Company’s SEC filings made pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended. The Company undertakes no obligation to update the information in this press release to reflect events or circumstances after the date hereof or to reflect the occurrence of anticipated or unanticipated events.

CONTACTS:

Jack A. Khattar, President and CEO

Gregory S. Patrick, Vice President and CFO

Supernus Pharmaceuticals, Inc.

301-838-2591

or

INVESTOR CONTACT:

COCKRELL GROUP

877-889-1972

investorrelations@thecockrellgroup.com

cockrellgroup.com

Supernus Pharmaceuticals, Inc.

Condensed Consolidated Balance Sheets

(in thousands)

|

|

|

June 30, 2014 |

|

December 31, 2013 |

|

|

|

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

Cash, cash equivalents and marketable securities |

|

$ |

47,270 |

|

$ |

82,191 |

|

|

Accounts receivable, net |

|

10,854 |

|

5,054 |

|

|

Inventories |

|

10,101 |

|

7,152 |

|

|

Other current assets |

|

3,756 |

|

2,764 |

|

|

Total Current Assets |

|

71,981 |

|

97,161 |

|

|

|

|

|

|

|

|

|

Property and equipment, net |

|

2,590 |

|

2,554 |

|

|

Long term marketable securities |

|

15,462 |

|

8,756 |

|

|

Deferred financing costs |

|

713 |

|

1,005 |

|

|

Other long-term assets |

|

3,444 |

|

1,519 |

|

|

Total Assets |

|

$ |

94,190 |

|

$ |

110,995 |

|

|

|

|

|

|

|

|

|

Accounts payable and accrued expenses |

|

$ |

19,044 |

|

$ |

18,314 |

|

|

Deferred product revenue, net |

|

— |

|

7,882 |

|

|

Deferred licensing revenue |

|

143 |

|

204 |

|

|

Total Current Liabilities |

|

19,187 |

|

26,400 |

|

|

|

|

|

|

|

|

|

Deferred licensing revenue, net of current portion |

|

1,345 |

|

1,417 |

|

|

Convertible notes, net of discount |

|

28,671 |

|

34,393 |

|

|

Other non-current liabilities |

|

2,784 |

|

2,677 |

|

|

Derivative liabilities |

|

8,834 |

|

12,644 |

|

|

Total Liabilities |

|

60,821 |

|

77,531 |

|

|

|

|

|

|

|

|

|

Total Stockholders’ Equity |

|

33,369 |

|

33,464 |

|

|

Total Liabilities & Stockholders Equity |

|

$ |

94,190 |

|

$ |

110,995 |

|

Supernus Pharmaceuticals, Inc.

Consolidated Statements of Operations

(in thousands, except share and per share data)

|

|

|

Three Months ended June 30, |

|

Six Months ended June 30, |

|

|

|

|

2014 |

|

2013 |

|

2014 |

|

2013 |

|

|

|

|

(unaudited) |

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

|

|

|

|

|

|

|

|

|

Net product sales |

|

$ |

27,609 |

|

$ |

154 |

|

$ |

36,604 |

|

$ |

154 |

|

|

Licensing revenue |

|

2,066 |

|

127 |

|

2,152 |

|

274 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenue |

|

29,675 |

|

281 |

|

38,756 |

|

428 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs and expenses |

|

|

|

|

|

|

|

|

|

|

Cost of product sales |

|

1,661 |

|

4 |

|

2,155 |

|

4 |

|

|

Research and development |

|

4,677 |

|

3,542 |

|

9,159 |

|

8,065 |

|

|

Selling, general and administrative |

|

19,581 |

|

12,214 |

|

37,109 |

|

25,747 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total costs and expenses |

|

25,919 |

|

15,760 |

|

48,423 |

|

33,816 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income (loss) |

|

3,756 |

|

(15,479 |

) |

(9,667 |

) |

(33,388 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense) |

|

|

|

|

|

|

|

|

|

|

Interest income and other income (expense), net |

|

85 |

|

47 |

|

187 |

|

191 |

|

|

Interest expense |

|

(1,278 |

) |

(2,144 |

) |

(2,485 |

) |

(2,872 |

) |

|

Changes in fair value of derivative liabilities |

|

678 |

|

(8,619 |

) |

1,355 |

|

(8,540 |

) |

|

Loss on extinguishment of debt |

|

(39 |

) |

(1,162 |

) |

(1,732 |

) |

(1,162 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Total other expense |

|

(554 |

) |

(11,878 |

) |

(2,675 |

) |

(12,383 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

|

$ |

3,202 |

|

$ |

(27,357 |

) |

$ |

(12,342 |

) |

$ |

(45,771 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) per common share: |

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.08 |

|

$ |

(0.89 |

) |

$ |

(0.30 |

) |

$ |

(1.48 |

) |

|

Diluted |

|

$ |

0.08 |

|

$ |

(0.89 |

) |

$ |

(0.30 |

) |

$ |

(1.48 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average number of common shares: |

|

|

|

|

|

|

|

|

|

|

Basic |

|

42,056,285 |

|

30,897,075 |

|

41,595,232 |

|

30,886,309 |

|

|

Diluted |

|

42,372,137 |

|

30,897,075 |

|

41,595,232 |

|

30,886,309 |

|

Supernus Pharmaceuticals, Inc.

Reconciliation of Non-GAAP Net Income (Loss)

(in thousands)

|

|

|

Three Months ended

June 30, |

|

Six Months ended June

30, |

|

|

|

|

2014 |

|

2014 |

|

|

|

|

(unaudited) |

|

|

Net Income (Loss) - GAAP |

|

$ |

3,202 |

|

$ |

(12,342 |

) |

|

|

|

|

|

|

|

|

Changes in fair value of derivative liabilities |

|

678 |

|

1,355 |

|

|

Loss on extinguishment of debt |

|

(39 |

) |

(1,732 |

) |

|

|

|

|

|

|

|

|

Adjusted Net Income (Loss) - non-GAAP |

|

$ |

2,563 |

|

$ |

(11,965 |

) |

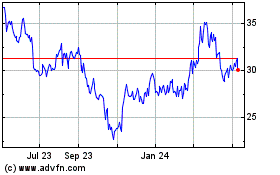

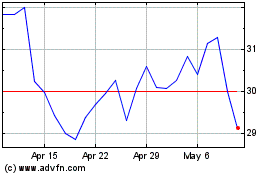

Supernus Pharmaceuticals (NASDAQ:SUPN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Supernus Pharmaceuticals (NASDAQ:SUPN)

Historical Stock Chart

From Apr 2023 to Apr 2024