Current Report Filing (8-k)

August 08 2014 - 4:11PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 8, 2014

|

|

|

(Exact name of registrant as specified in its charter)

|

| |

|

|

|

|

|

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

| |

|

|

17802 IH 10 West, Suite 400

San Antonio, Texas

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: (210) 344-3400

|

|

|

(Former name or former address, if changed since last report.)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 2.02.

|

Results of Operations and Financial Condition.

|

On August 8, 2014, Biglari Holdings Inc. (the “Company”) issued a press release announcing its financial results for its third fiscal quarter, which ended July 2, 2014. The Company’s press release is attached hereto as Exhibit 99.1 and the information set forth therein is incorporated herein by reference and constitutes a part of this report.

The information in this Current Report, including the exhibit attached hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of such section. The information in this Current Report, including the exhibit, shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any incorporation by reference language in any such filing, unless the Company expressly sets forth in such future filing that such information is to be considered “filed” or incorporated by reference therein.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits.

|

|

|

|

|

99.1

|

|

Press Release issued by the Company on August 8, 2014.

|

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Current Report on Form 8-K to be signed on its behalf by the undersigned hereunto duly authorized.

|

August 8, 2014

|

BIGLARI HOLDINGS INC.

|

| |

|

| |

|

| |

|

| |

|

| |

By:

|

|

| |

|

Name:

|

Bruce Lewis

|

| |

|

Title:

|

Controller

|

Exhibit Index

|

|

|

|

|

99.1

|

|

Press Release issued by the Company on August 8, 2014.

|

Exhibit 99.1

BIGLARI HOLDINGS INC.

NEWS RELEASE

San Antonio, TX, August 8 – Biglari Holdings Inc. (NYSE: BH) announces its results for the fiscal third quarter of 2014.

Biglari Holdings Inc.’s earnings for the twelve and forty weeks that ended July 2, 2014 and July 3, 2013 are summarized below. To become fully apprised of our results, shareholders should carefully study our 10-Q, which has been posted at www.biglariholdings.com.

|

(In thousands)

|

|

| |

|

|

|

|

|

|

| |

|

July 2,

|

|

|

July 3,

|

|

|

July 2,

|

|

|

July 3,

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Pre-tax operating earnings

|

|

$ |

796 |

|

|

$ |

4,806 |

|

|

$ |

10,949 |

|

|

$ |

14,374 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Biglari Holdings investment gains/losses

|

|

|

57 |

|

|

|

— |

|

|

|

57 |

|

|

|

(569 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gain on contribution to investment partnerships

|

|

|

— |

|

|

|

162,869 |

|

|

|

29,524 |

|

|

|

162,869 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gain on sale of subsidiary

|

|

|

— |

|

|

|

1,597 |

|

|

|

— |

|

|

|

1,597 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment partnership gains/losses

|

|

|

15,305 |

|

|

|

— |

|

|

|

(7,044 |

) |

|

|

— |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

|

(2,791 |

) |

|

|

(1,173 |

) |

|

|

(6,385 |

) |

|

|

(4,969 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax expense

|

|

|

(3,773 |

) |

|

|

(62,259 |

) |

|

|

(5,686 |

) |

|

|

(61,837 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other

|

|

|

— |

|

|

|

864 |

|

|

|

(1,133 |

) |

|

|

1,981 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net earnings attributable to Biglari Holdings Inc.

|

|

$ |

9,594 |

|

|

$ |

106,704 |

|

|

$ |

20,282 |

|

|

$ |

113,446 |

|

Analysis of Results:

Investments held through investment partnerships affect our reported quarterly earnings based on their carrying value. We do not regard the quarterly or annual fluctuations in the partnerships’ carrying values to be meaningful. Therefore, we believe our operating businesses are best analyzed before the impact of investment gains/losses. As a consequence, in the preceding table we separate earnings of our operating businesses from our investment gains/losses.

Furthermore, in the fiscal second quarter of 2014, Biglari Holdings contributed securities to an investment partnership and recognized a non-cash pre-tax gain of $29.5 million. We do not find the gain to be meaningful from an economic perspective. The transaction had no material effect on our consolidated shareholders’ equity because the gain included in earnings was accompanied by a corresponding reduction in unrealized investment gains included in a separate component of shareholders’ equity.

About Biglari Holdings Inc.

Biglari Holdings Inc. is a holding company owning subsidiaries engaged in a number of diverse business activities, including media, property and casualty insurance, as well as restaurants. The Company’s largest operating subsidiaries are involved in the franchising and operating of restaurants. All major operating, investment, and capital allocation decisions are made for the Company and its subsidiaries by Sardar Biglari, Chairman and Chief Executive Officer.

Comment on Regulation G

This press release contains certain non-GAAP financial measures. In addition to the GAAP presentations of net earnings, Biglari Holdings defines pre-tax operating earnings outside of the investment gains/losses of the Company and the investment partnerships, gains on contributions to the investment partnerships, and interest expense.

Risks Associated with Forward-Looking Statements

This news release may include "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. These statements are based on current expectations and are subject to a number of risks and uncertainties that could cause actual results to differ markedly from those projected or discussed here. Biglari Holdings cautions readers not to place undue reliance upon any such forward-looking statements, for actual results may differ materially from expectations. Biglari Holdings does not update publicly or revise any forward-looking statements even if experience or future changes make it clear that any projected results expressed or implied therein will not be realized. Further information on the types of factors that could affect Biglari Holdings and its business can be found in the company's filings with the SEC.

***

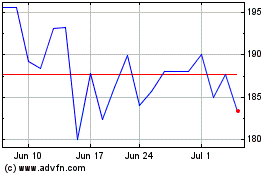

Biglari (NYSE:BH)

Historical Stock Chart

From Aug 2024 to Sep 2024

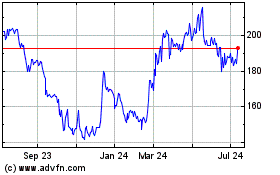

Biglari (NYSE:BH)

Historical Stock Chart

From Sep 2023 to Sep 2024