UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event

reported): August 6, 2014

NOVAVAX, INC.

(Exact name of registrant as specified

in charter)

| |

|

|

|

|

| Delaware |

|

0-26770 |

|

22-2816046 |

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.)

|

20 Firstfield Road

Gaithersburg, Maryland 20878

(Address of Principal Executive Offices,

including Zip Code)

(240) 268-2000

(Registrant’s telephone number,

including area code)

(Former name or former

address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| ¨ | Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02. Results of Operations and Financial

Condition.

Second Quarter Financial Results

On August 6, 2014,

Novavax, Inc. (the “Company”) issued a press release announcing the Company’s financial results for the quarter

ended June 30, 2014. A copy of this press release is attached as Exhibit 99.1 to this Current Report on Form 8-K.

The information

in Items 2.02 and 9.01 of this Form 8-K (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section

18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section,

nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act except as expressly

set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

| Exhibit No. |

|

Description |

|

| |

|

|

| 99.1 |

|

Press release, dated August 6, 2014, regarding the Company’s financial results for the quarter ended June 30, 2014. |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

|

Novavax, Inc.

(Registrant) |

|

| |

|

|

|

| Date: August 7, 2014 |

|

By: |

|

/s/ John A. Herrmann III |

|

| |

|

|

|

Name: |

|

John A. Herrmann III |

|

| |

|

|

|

Title: |

|

Senior Vice President, General Counsel and Corporate Secretary |

|

EXHIBIT INDEX

| Exhibit No. |

|

Description |

|

| |

|

|

| 99.1 |

|

Press release, dated August 6, 2014, regarding the Company’s financial results for the quarter ended June 30, 2014. |

Exhibit 99.1

Novavax Reports Second-Quarter 2014 Financial

Results

Gaithersburg, MD (August 6, 2014) -

Novavax, Inc. (Nasdaq: NVAX), a clinical-stage biopharmaceutical company focused on the discovery, development and commercialization

of recombinant nanoparticle vaccines and adjuvants, today reported its financial results for the second quarter and six months

ended June 30, 2014.

Novavax Corporate Highlights

Second Quarter Achievements:

| - | Delivered positive top-line data from a dose-confirmatory Phase 2 clinical trial of its RSV F-protein

vaccine candidate in 720 women of childbearing age, including a key finding that the highest levels of Palivizumab-competing antibodies

(PCA) observed in any of its previous trials was achieved with only one dose of its vaccine candidate; |

| - | Reported follow-up data from its dose-ranging Phase 1 clinical trial of its RSV F-protein vaccine

candidate in 220 elderly subjects, showing sustained levels of RSV F antibody and PCA responses were demonstrated over a four to

six month period; and |

| - | Raised total net-proceeds of $108 million, after deducting underwriters discount and offering expenses,

in an underwritten public offering. |

2014 Anticipated Events:

| - | Release of top-line data from recently initiated Phase 1/2 clinical trial of H7N9 avian influenza

VLP vaccine candidate with its Matrix-M adjuvant in the third quarter of 2014; |

| - | Initiate Phase 2 clinical trial of its RSV F-protein vaccine candidate for protection of infants

via maternal immunization in pregnant women in fourth quarter of 2014; |

| - | Initiate Phase 1 clinical trial of its RSV F-protein vaccine candidate for protection of pediatrics

in fourth quarter of 2014; |

| - | Initiate Phase 2 clinical trial of its RSV F-protein vaccine candidate for protection of elderly

in fourth quarter of 2014; |

| - | Initiate Phase 2 clinical trial of its quadrivalent VLP seasonal influenza vaccine in the fourth

quarter of 2014; |

| - | Novavax, Inc. 2014 Analyst and Investor Meeting to be held on Tuesday, September 23, 2014 in New

York City; and |

| - | Novavax will present the following pre-clinical data at the upcoming ICAAC conference to be held

in Washington, DC between September 5 –

9, 2014: |

| o | Presentation # I-649: “Immunization of Pregnant Baboons with the RSV Nanoparticle Vaccine

Protects Infant Baboons Challenged with Respiratory Syncytial Virus in a Comparable Manner to Infants Prophylaxed with Palivizumab;”

and |

| o | Presentation # I-314B: “Development and Characterization of Recombinant RSV Nanoparticle

Vaccine Induced Monoclonal Antibody.” |

“Progress in the second quarter maintained

the momentum built in both the first quarter of the year and in 2013. We continue to make progress in our RSV and influenza vaccine

development programs,” said Stanley C. Erck, President and CEO of Novavax. “The second half of 2014 will be the most

productive period in the company’s history. We plan to initiate 4 clinical studies before the end of 2014; RSV maternal immunization,

pediatric and elderly, as well as a seasonal influenza clinical trial. We also plan to initiate a combination RSV/seasonal influenza

clinical trial in early 2015. In addition, we plan to present pre-clinical and clinical data at several important medical meetings

later this year.”

Financial Results for the Three and

Six Months Ended June 30, 2014

Novavax reported a net loss of $17.9 million,

or $0.08 per share, for the second quarter of 2014, compared to a net loss of $12.6 million, or $0.08 per share, for the second

quarter of 2013. For the six months ended June 30, 2014, the net loss was $31.7 million, or $0.15 per share, compared to a net

loss of $22.6 million, or $0.15 per share, for the same period in 2013.

Novavax revenue in the second quarter of

2014 increased 134% to $8.3 million as compared to $3.5 million for the same period in 2013. The increase in revenue was primarily

due to the higher level of activity in the second quarter of 2014 associated with the company’s Phase 1/2 clinical trial

using its H7N9 pandemic influenza candidate and Matrix-M adjuvant and preliminary manufacturing work for its Phase 2 seasonal influenza

clinical trial, both under the HHS BARDA contract, and with the company’s Phase 2 clinical trial in women of childbearing

age under its amended collaboration with PATH. In conjunction with the increase in revenue, the cost of government contracts revenue

in the second quarter of 2014 increased 213% to $5.1 million as compared to $1.6 million for the same period in 2013. This increase

was primarily related to higher level of activity associated with the company’s previously mentioned pandemic and seasonal

influenza activities.

Research and development expenses increased

41% to $15.2 million in the second quarter of 2014, compared to $10.8 million for the same period in 2013, primarily as a result

of higher employee-related costs tied to continued growth in support of the company’s RSV and influenza vaccine programs,

as well as Novavax AB research and development expenses. General and administrative expenses increased 45% to $5.8 million in the

second quarter of 2014 as compared to $4.0 million for the same period in 2013, resulting from higher employee-related costs, as

well as Novavax AB general and administrative expenses, partially offset by lower professional fees.

As of June 30, 2014, the company had $208.8

million in cash and cash equivalents and investments compared to $133.1 million as of December 31, 2013. In June 2014, the company

raised net proceeds of approximately $108 million through the sale of its common stock. Net cash used in operating activities for

the six months of 2014 was $31.4 million compared to $18.2 million for the same period in 2013. The factors contributing to the

increase in cash usage are as described above.

Conference Call

| Date: |

August 6, 2014 |

| Time: |

4:30 PM US eastern time |

| Dial-in number: |

1 (877) 212-6076 (domestic) or 1 (707) 287-9331 (international) |

| Via Web: |

www.novavax.com |

Conference call Replay:

| Dates: |

Starting at 6:31 PM on August 6, 2014 until midnight October 6, 2014 |

| Dial-in number: |

1 (855) 859-2056 (domestic) or 1 (404) 537-3406 (international) |

| Passcode: |

82216889 |

| Via-Web: |

www.novavax.com, “Investor Info”/“Events” |

About Novavax

Novavax, Inc. (Nasdaq: NVAX) is a clinical-stage

biopharmaceutical company creating novel vaccines and vaccine adjuvants to address a broad range of infectious diseases worldwide.

Using innovative proprietary recombinant nanoparticle vaccine technology, the company produces vaccine candidates to efficiently

and effectively respond to both known and newly emergent diseases. Additional information about Novavax is available on the company’s

website, novavax.com.

Novavax Inc., Forward-Looking Statements

Statements herein relating to the future

of Novavax and the ongoing development of its vaccine and adjuvant products are forward-looking statements. Novavax cautions that

these forward looking statements are subject to numerous risks and uncertainties, which could cause actual results to differ materially

from those expressed or implied by such statements. These risks and uncertainties include those identified under the heading “Risk

Factors” in the Novavax Annual Report on Form 10-K for the year ended December 31, 2013, filed with the Securities and Exchange

Commission (SEC). We caution investors not to place considerable reliance on the forward-looking statements contained in this press

release. You are encouraged to read our filings with the SEC, available at sec.gov, for a discussion of these and other risks and

uncertainties. The forward-looking statements in this press release speak only as of the date of this document, and we undertake

no obligation to update or revise any of the statements. Our business is subject to substantial risks and uncertainties, including

those referenced above. Investors, potential investors, and others should give careful consideration to these risks and uncertainties.

###

| NOVAVAX, INC. |

| CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS |

| (in thousands, except per share information) |

| | |

Three Months Ended | | |

Six Months Ended |

|

| | |

June 30, | | |

June 30, |

|

| | |

2014 | | |

2013 | | |

2014 | | |

2013 | |

| | |

(unaudited) | | |

(unaudited) |

|

| Revenue | |

$ | 8,259 | | |

$ | 3,531 | | |

$ | 15,721 | | |

$ | 7,365 | |

| | |

| | | |

| | | |

| | | |

| | |

| Costs and expenses: | |

| | | |

| | | |

| | | |

| | |

| Cost of government contracts revenue | |

| 5,102 | | |

| 1,632 | | |

| 8,123 | | |

| 3,344 | |

| Research and development | |

| 15,202 | | |

| 10,785 | | |

| 29,720 | | |

| 20,041 | |

| General and administrative | |

| 5,806 | | |

| 4,012 | | |

| 10,114 | | |

| 6,882 | |

| Total costs and expenses | |

| 26,110 | | |

| 16,429 | | |

| 47,957 | | |

| 30,267 | |

| Loss from operations | |

| (17,851 | ) | |

| (12,898 | ) | |

| (32,236 | ) | |

| (22,902 | ) |

| Interest income (expense), net | |

| (31 | ) | |

| 3 | | |

| (71 | ) | |

| 27 | |

| Other income | |

| 18 | | |

| ― | | |

| 18 | | |

| ― | |

| Change in fair value of warrant liability | |

| ― | | |

| 267 | | |

| ― | | |

| 267 | |

| Realized gains on investments | |

| ― | | |

| ― | | |

| 615 | | |

| ― | |

| Loss from operations before income tax expense | |

| (17,864 | ) | |

| (12,628 | ) | |

| (31,674 | ) | |

| (22,608 | ) |

| Income tax expense | |

| ― | | |

| 5 | | |

| ― | | |

| 22 | |

| Net loss | |

$ | (17,864 | ) | |

$ | (12,633 | ) | |

$ | (31,674 | ) | |

$ | (22,630 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted net loss per share | |

$ | (0.08 | ) | |

$ | (0.08 | ) | |

$ | (0.15 | ) | |

$ | (0.15 | ) |

| Basic and diluted weighted average | |

| | | |

| | | |

| | | |

| | |

| number of common shares outstanding | |

| 217,178 | | |

| 152,312 | | |

| 213,075 | | |

| 150,391 | |

SELECTED CONSOLIDATED BALANCE SHEET

DATA

(in thousands)

| | |

June 30,

2014 | | |

December 31,

2013 | |

| | |

(unaudited) | | |

| |

| Cash and cash equivalents | |

$ | 103,857 | | |

$ | 119,471 | |

| Investments | |

| 104,951 | | |

| 13,597 | |

| Total current assets | |

| 166,602 | | |

| 145,001 | |

| Working capital | |

| 149,123 | | |

| 126,879 | |

| Total assets | |

| 311,991 | | |

| 235,125 | |

| Total notes payable and capital lease obligations | |

| 1,808 | | |

| 2,184 | |

| Total stockholders’ equity | |

| 281,731 | | |

| 203,234 | |

###

| Contact: | Barclay A. Phillips |

| | SVP, Chief Financial Officer and Treasurer |

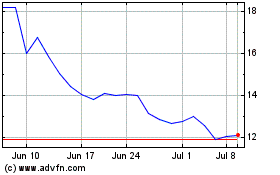

Novavax (NASDAQ:NVAX)

Historical Stock Chart

From Aug 2024 to Sep 2024

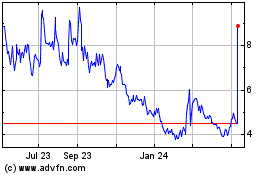

Novavax (NASDAQ:NVAX)

Historical Stock Chart

From Sep 2023 to Sep 2024