UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 31, 2014

THE MOSAIC COMPANY

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-32327 |

|

20-1026454 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 3033 Campus Drive

Suite E490 Plymouth,

Minnesota |

|

55441 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (800) 918-8270

Not applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02. Results of Operations and Financial Condition.

The following information is being “furnished” in accordance with General Instruction B.2. of Form 8-K and shall not be deemed

“filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in

any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as expressly set forth by specific reference in such filing:

On July 31, 2014, The Mosaic Company hosted a conference call discussing its financial results for the quarter ended June 30, 2014.

Furnished herewith as Exhibits 99.1 and 99.2 and incorporated by reference herein are copies of the transcript of the conference call and slides that were shown during the webcast of the conference call.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

Reference is made

to the Exhibit Index hereto with respect to the exhibits furnished herewith. The exhibits listed in the Exhibit Index hereto are being “furnished” in accordance with General Instruction B.2. of Form 8-K and shall not be deemed

“filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, nor shall they be deemed to be incorporated by reference in any filing under the Securities Act or the Exchange Act,

except as expressly set forth by specific reference in such filing.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

THE MOSAIC COMPANY |

|

|

|

| Date: August 4, 2014 |

|

By: |

|

/s/ Mark J. Isaacson |

|

|

Name: |

|

Mark J. Isaacson |

|

|

Title: |

|

Vice President, Acting General |

|

|

|

|

Counsel and Corporate Secretary |

EXHIBIT INDEX

|

|

|

| Exhibit No. |

|

Description |

|

|

| 99.1 |

|

Transcript of conference call of The Mosaic Company held on July 31, 2014 |

|

|

| 99.2 |

|

Slides shown during the webcast of the conference call of The Mosaic Company held on July 31, 2014 |

Exhibit 99.1

PARTICIPANTS

PARTICIPANTS

Corporate Participants

Laura C. Gagnon – Vice President Investor Relations, The Mosaic Company

Lawrence W. Stranghoener – Interim Chief Executive Officer, The Mosaic Company

Richard L. Mack – Executive Vice President and Chief Financial Officer, The Mosaic Company

James T. Prokopanko – President and Chief Executive Officer, The Mosaic Company

Richard N. McLellan – Senior Vice President-Commercial, The Mosaic Company

Mike Rahm – Vice President-Market Analysis & Strategic Planning, The Mosaic Company

James O’Rourke – Executive Vice President-Operations & Chief Operating Officer, The Mosaic Company

Other Participants

Vincent

Stephen Andrews – Analyst, Morgan Stanley & Co. LLC

Joel D. Jackson – Analyst, BMO Capital Markets (Canada)

Don D. Carson – Analyst, Susquehanna Financial Group LLLP

P.J. Juvekar – Analyst, Citigroup Global Markets Inc. (Broker)

Jeffrey Zekauskas – Analyst, JPMorgan Securities LLC

Christopher S. Parkinson – Analyst, Credit Suisse Securities (USA) LLC (Broker)

Mark W. Connelly – Analyst, CLSA Americas LLC

Michael L. Piken – Analyst, Cleveland Research Co. LLC

Carl Chen – Analyst, Scotia Capital Markets

Andrew D. Wong – Analyst, RBC Capital Markets Asset Management

Yonah Weisz – Analyst, HSBC Bank Plc (Tel Aviv Branch)

Matthew James Korn – Analyst, Barclays Capital, Inc.

Adam Samuelson – Analyst, Goldman Sachs & Co.

Kevin W. McCarthy – Analyst, Bank of America Merrill Lynch

MANAGEMENT DISCUSSION SECTION

MANAGEMENT DISCUSSION SECTION

Operator: Good morning, ladies and gentlemen, and welcome to The Mosaic

Company’s Second Quarter 2014 Earnings Conference Call. At this time, all participants have been placed in a listen-only mode. After the company completes their prepared remarks, the lines will be opened to take your questions. Your host for

today’s call is Laura Gagnon, Vice President—Investor Relations of The Mosaic Company. Ms. Gagnon, you may begin.

Laura C. Gagnon,

Vice President Investor Relations

Thank you, and welcome to our second quarter 2014 earnings call. Presenting today will be Larry

Stranghoener, Interim Chief Executive Officer, and Rich Mack, Executive Vice President & Chief Financial Officer. We also have members of the senior leadership team available to answer your questions after our prepared remarks.

After my introductory comments, Larry will review Mosaic’s accomplishments for the quarter and our views on current and future market

conditions. Rich will share his insights into our capital management philosophy and our future expectations. The presentation slides we are using during the call are available on our website at mosaicco.com.

|

|

|

| www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2014 CallStreet |

|

1 |

We will be making forward-looking statements during this conference call. The statements

include, but are not limited to, statements about future financial and operating results. They are based on management’s beliefs and expectations as of today’s date, July 31, 2014, and are subject to significant risks and

uncertainties. Actual results may differ materially from projected results. Factors that could cause actual results to differ materially from those in the forward-looking statements are included in our press release issued this morning and in our

reports filed with the Securities and Exchange Commission.

Now, I’d like to turn the call over to Larry.

Lawrence W. Stranghoener, Interim Chief Executive Officer

Good morning and thank you for joining our second quarter earnings discussion. I’ll start with an update on Jim. I’m delighted to

inform you that he will be returning to his duties full time on August 4, and he’s with us this morning. It has been an honor to fill in for him during his absence.

Now, let’s get to business. We have three key messages for you today. First, global demand for fertilizer was and is very strong. Second,

despite lower agricultural commodity prices, farmers around the world continue to have strong incentive to maximize their yields. And third, Mosaic continues to put its capital to use to grow the company and reward investors.

First, let’s discuss the demand picture. Demand for phosphate and potash was strong in all key agricultural areas of the world, so strong

in fact, that producers are struggling to keep up. For potash for example, we are fully committed through the third quarter. For several quarters, we have been predicting that volumes would rise first followed by prices, and indeed this is

happening. We have seen steady volume growth since the end of last year and prices eventually followed, first in phosphates and then in potash.

The second quarter played out as we expected. We saw strong sales volumes and an uptick in potash prices. Phosphate prices were solid around

the globe and the seasonal dip in phosphate shipments was limited as we predicted. The strength in phosphate prices without major market participation from India was somewhat unexpected with their total imports of phosphate at only 1.5 million

tonnes year-to-date. We continue to expect India to import 4.5 million tonnes to 5 million tonnes of DAP this year, which should further support prices in the second half.

Potash prices have risen as well with customers trying to lock in tonnes for the fall season. I say trying to lock in tonnes because supply is

limited. Rick McLellan and I recently traveled to visit customers in the Corn Belt, and we saw empty potash bin after empty potash bin; simply put, the cupboard was bare.

Customers are motivated to have tonnes in inventory for a good fall application season. They know producer inventories are very limited, and

they expect potential logistical issues this fall when an anticipated large harvest will be competing with other commodities for a limited number of railcars and barges.

Geopolitical issues in the Ukraine and Israel as well as typhoon damage in China are adding further uncertainty to near-term logistics

challenges. All these uncertainties are highlighting Mosaic’s strengths. Our customers value the security of supply we can provide thanks to our unique mix of assets, global reach, and talent.

In both phosphates and potash, we are maintaining our global shipment forecasts, which are 65 million tonnes to 66 million tonnes and

57 million tonnes to 58 million tonnes respectively. These forecasts for global shipments have not changed all year, and they were consistently above the rest of the market and now others have revised their numbers upward.

|

|

|

| www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2014 CallStreet |

|

2 |

While business conditions have improved, we are maintaining our focus on execution. We are

making good progress toward our goals to generate $0.5 billion in cost savings from our two business units and our corporate functions. Strong global demand and rising prices coupled with lower controllable operating expenses drove solid financial

results for the quarter.

We generated net earnings of $248 million or $0.64 per share on net sales of $2.4 billion, compared with net

earnings of $430 million and net sales of $2.6 billion in the second calendar quarter of 2013. We continued to generate strong operating cash flow with nearly $800 million during the quarter. Even as we fund our capital commitments, we are

maintaining a solid cash cushion, with $2.4 billion of cash and cash equivalents on hand.

We continue to make important strategic progress

and we are successfully executing the many initiatives we announced over the past year. We have asked the organization to absorb a great deal of additional effort, from acquisition integration to balance sheet optimization to production capacity

expansion, and I am proud of the excellent and diligent work our team is producing. We are energized by the outcomes our strategic moves will provide and by the ever present long-term promise of our mission: to help the world grow the food at needs.

I would like to provide a few updates on our strategic accomplishments. First, our potash expansions remain on schedule and on budget. The

new south shaft at the Esterhazy K3 mine has reached a depth of more than 1,700 feet, and has moved through the Blairmore water formation, while the north shaft has reached 1,500 feet and will soon emerge from the Blairmore. Despite recent

volatility in potash demand, we have continued our steady and safe progress on these major projects.

New potash capacity does not come

cheap or easily, and it requires both a disciplined approach and conviction in the long-term demand story. While we have throttled back future expansion plans, our conviction persists in our ongoing projects, because we know the world is going to

need our additional production capacity.

Second, we expect to close the ADM distribution acquisition in Brazil and Paraguay near the end

of the year. We have received clearance from Brazilian antitrust authorities and we have teams working to prepare for integration of the ADM business and its 500 plus employees. Once the acquisition is completed, we expect to increase our

distribution in the world’s most promising agricultural area from 4 million tonnes to 6 million tonnes annually, and we expect to have a strong platform for future growth.

Third, the CF Industries phosphate integration has gone exceptionally well. Our cultures have fit well together, and the former CF employees

are enthusiastic about being part of the Mosaic team. The former CF facilities are meeting our production and cost expectations. Given current price and volume trends in the industry this deal was very well timed.

Fourth, expansion of our MicroEssentials® production capacity continues on schedule

and on budget. We are converting part of our New Wales facility in Florida to help us meet the growing demand for our phosphate based premium product which creates incremental value for growers, distributors, and Mosaic.

Fifth, the Ma’aden joint venture is also on track, and we reached an important milestone in June. We and our partners at Ma’aden and

SABIC secured $5 billion in financing for the project with 20 financial institutions participating. Once complete, the joint venture is expected to be the lowest cost phosphate operation in the world and it will have a logistical advantage to key

Asian geographies.

|

|

|

| www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2014 CallStreet |

|

3 |

Sixth, our portfolio improvements continued during the quarter. We sold our decommissioned

potash mine in Hersey, Michigan and its new owner will now operate it as a salt mine. We are also working toward a sale of our distribution business in Argentina and we will soon cease operations in Chile. In addition, we made the decision to stop

MOP production at our Carlsbad, New Mexico potash mine.

Production costs at Carlsbad were significantly higher than at our Canadian mines

in large part because of the problematic rock reserve in the Carlsbad basin. We will only produce K-Mag, our premium potash product, at Carlsbad going forward. These divestitures and production decisions have been difficult, but all of them were the

right call for the company and our shareholders. We expect enhanced profitability without sacrificing our ability to meet global demand for potash and phosphates.

Seventh and perhaps most important, we continue to generate strong and improving safety performance with our key measure of injuries improving

by 15% over last year’s record performance. Finally, we have continued to make great progress toward our goal of a more efficient balance sheet. We’ve done what we said we would do using our capital to create value. I will leave the

capital details to Rich Mack.

By my count, we have announced a dozen significant strategic decisions since the beginning of 2013 and all

of them are proceeding as planned. These are differentiating us from our peers as we are balancing significant internal and external investments with substantial shareholder distributions. It’s a track record we are proud of, and more

important, it signals our unwavering confidence in the future prospects for this business.

Now, before Jim provides some concluding

thoughts on the markets and the quarters ahead, I would like to welcome Rich Mack to the call. As you know, Rich is our new CFO. He has been a highly effective and influential leader at Mosaic since our founding and has made a successful transition

into his new role. Many of you have already spoken with Rich and I know he is eager to build relationships across the investment community in the months ahead. Rich?

Richard L. Mack, Executive Vice President and Chief Financial Officer

Thank you, Larry and good morning to everyone on the call. As some of you know, Larry and I have worked very closely together on material

decisions impacting Mosaic, since the company was formed in 2004. In fact, we were the very first employees of this company.

With

Larry’s announced retirement at the end of the calendar year, let me just say that I have a tremendous amount of respect for him and have been very fortunate to work with him for the past 10 years. He has been a remarkable mentor and I will

work diligently to continue his track record, highlighted by unwavering integrity and consistently transparent investor communications.

Turning now to the quarter. I am pleased that my first quarter in the CFO position was strong and the capital markets were relatively

uneventful, notwithstanding rising geopolitical uncertainty. The successful execution of our strategies at Mosaic continues to unfold. And I look forward to additional steady and measured progress in the future.

I’ll start with a brief discussion of our business segment financial results for the quarter, provide some insight on our capital

management philosophy and close by providing our guidance for the third quarter.

In phosphates, the price momentum that began last winter

resumed again this quarter with average selling prices reaching $465 per tonne. The price improvements were driven by strong demand in low producer pipeline inventories.

|

|

|

| www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2014 CallStreet |

|

4 |

We sold 3.4 million tonnes of finished phosphate products during the quarter, which was

at the top end of our guidance range with particularly strong demand for the North American spring planting season.

This quarter

represents the first full quarter of production and sales from our CF Phosphates acquisition, and as a result, it was a near record quarter in terms of volume. Our operating rate in phosphates was 85%, which was in line with prior guidance.

Our gross margin rate in phosphates was 17%, which was flat with last year, as margins were negatively impacted by about 3 percentage points as

a result of accounting impacts from the acquisition.

This $36 million non-cash impact will not continue. However, the acquisition will

drive higher ongoing depreciation, depletion, and amortization of about $8 million per quarter from the step-up in asset values.

Operating

earnings for the segment were $206 million, compared with $191 million a year ago. In our Potash business, prices continue to support our belief that we reached a floor earlier this year. Average selling prices for MOP were $267 per tonne for the

quarter. We shipped 2.5 million tonnes of potash, which was near the top end of our guidance range.

Our operating rate came in at

76%, negatively impacted by unplanned downtime at our Carlsbad mine and a longer than expected turnaround at Colonsay. The Potash segment generated operating earnings of $213 million, compared with $346 million in the second quarter of 2013, driven

by lower realized prices, a lower operating rate, higher depreciation, which was partially offset by an unrealized gain on derivatives, primarily FX in cost of goods sold.

Turning now to Mosaic’s capital management philosophy. As Mosaic’s new CFO, I’d like to spend a little time reviewing our

capital allocation, what we’ve done and what you can expect going forward. We’ve made nearly $9 billion in capital commitments over the past two years with the majority of this capital being invested in growth initiatives. We have long

believed that smart long-term capital allocation is essential to creating shareholder value in this industry. We’ve also optimized our asset portfolio through the divestitures and production decisions Larry highlighted earlier on this call. I

should note that we expect to record charges, largely non-cash, for the decommissioning of MOP production at Carlsbad in the third and fourth quarters.

In our view, Mosaic has been by far the most aggressive company in the industry during the weak part of the business cycle. And we have not

deviated from our often stated philosophy, which is to invest first in organic growth and maintenance of our assets, then in financially appealing acquisitions and joint ventures, followed by distributions of excess cash to shareholders.

As a result, we are in excellent position for the stronger parts of this cycle while continuing to maintain a very solid financial foundation.

In addition to the business initiatives Larry mentioned, the $9 billion shown on this slide includes more than $1 billion allocated to our maintenance and reliability programs, which results in greater productivity levels and helps ensure the safety

of our employees.

Notably, we have also allocated over $3 billion in capital distributions to shareholders. We’ve paid over $800

million in dividends and funded $2.4 billion in share repurchases including the Class A share repurchase agreement, which coincidently was completed yesterday. We have a remaining authorization of $600 million for additional share repurchases.

This is a heavy list of accomplishments in a short period of time. We don’t believe you’ll find any other company in our space

that’s committed to capital stewardship and leveraging it to create value for our shareholders. Larry and I also worked closely on the development of our financial targets in early 2013 and I remain committed to our financial philosophy.

We’ve deployed significant capital and we continue to make progress in optimizing our balance sheet, while maintaining a cushion appropriate for the cyclicality of our business.

|

|

|

| www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2014 CallStreet |

|

5 |

That said, we’re growing. We’ve invested for growth, and we expect to review our

options to redeploy the excess cash flow we generate from that growth. Our targeted cash liquidity buffer is $2.25 billion, which is comprised of $750 million on balance sheet and our unused credit revolver. As of June 30, we had on balance

sheet cash and cash equivalents of $2.4 billion. Subsequent to the quarter, we repurchased approximately $300 million of stock from the Margaret A. Cargill Trusts.

In addition, we have committed $350 million for our pending Brazil acquisition and expect to set aside about $625 million for our asset

retirement obligations under RCRA. This leaves us near-term resources of about $400 million in excess cash. Our targeted adjusted debt-to-EBITDA is 1.5 times to 2 times and we are in this range now. Remember, our primary objectives for these metrics

are to optimize our balance sheet while maintaining our credit rating.

So where are we today? We are comfortable with our stated liquidity

and debt targets as of now, but we expect to review uses of excess cash as our business grows. We are mindful of our strong cash position, and we expect to generate strong cash flow from operations going forward. If we are not able to find adequate

uses for this cash whether internally or through strategic investments, you can expect that we will return excess amounts to shareholders. Going forward, the amount and timing of shareholder distributions will be dependent on the investment

opportunities we see including Mosaic’s stock. I would also note that as of today I have been in this role for about two months and I am very excited about the great hand I have been dealt in terms of our current and future financial

capabilities. I look forward to sharing more information with you on this topic in the months ahead.

Finally, I will discuss our guidance

for the third quarter of 2014. Our outlook remains positive with the expectation of a strong third quarter followed by the traditional seasonal slowdown in the fourth quarter. In the near term, we expect stable margins and high operating rates in

phosphates. And with strong potash sales expectations, we anticipate that our potash mines will operate at full capacity rates following scheduled maintenance downtime. Of course many unknowns will influence the environment including U.S. crop

progress as well as demand from India, exports from China, and the developing geopolitical unrest around the world.

Global demand

prospects continue to look very promising despite the lower prevailing agricultural commodity prices. We continue to project that global shipments of the main finished phosphate products will increase nearly 4% to a record 65 million tonnes to

66 million tonnes this year, and that global potash shipments will rise by 7% or nearly 4 million tonnes to 57 million tonnes to 58 million tonnes in 2014.

In phosphates, sales volumes are expected to range from 3.3 million tonnes to 3.6 million tonnes for the third quarter and our

inventories are expected to remain limited. This compares to 2.7 million tonnes in last year’s period. We expect our realized prices for DAP to range from $440 per tonne to $470 per tonne. Mosaic’s phosphate operating rate is expected

to approach 90% during the third quarter, while the Phosphate segment gross margin rate is expected to be in the middle to high teens.

On

the potash side, we expect sales volumes to be in the range of 1.8 million tonnes to 2 million tonnes during the third quarter, compared with actual volumes of 1.4 million tonnes in the same period last year. We expect average

realized potash prices to be in the range of $275 per tonne to $295 per tonne. The gross margin rate for the potash segment is expected to be in the high 20% to low 30% range. With strong global demand, we are fully committed for the third quarter.

Our operating rate in potash will reflect required maintenance downtime and is expected to be in the low 70% range.

|

|

|

| www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2014 CallStreet |

|

6 |

Our 2014 Canadian resource taxes and royalties increased to a range of $170 million to $210

million due to higher income in Canada. And full-year brine management expenses are expected to remain around $200 million with slightly higher spending in the second half of 2014 compared to the first six months.

We estimate SG&A expenses to be approximately $390 million to $410 million in calendar 2014, which is lower than prior guidance due to the

accelerated impact of our expense savings initiatives. These expenses include charges related to cost savings initiatives and our phosphate acquisition.

For the year, we estimate an effective tax rate excluding discrete items, continuing in the mid-to-high 20% range. The tax rate is being driven

higher by our decision to repatriate cash from Canada, which resulted in higher non-cash expenses. All else equal, it is reasonable to expect our tax rate to return to the low-to-mid 20% range for 2015.

And finally, our expectations for capital expenditures and equity investments declined to the range of $1 billion to $1.2 billion, including

investments in the Ma’aden joint venture, reflecting about $200 million of investments shifting into 2015. With that, I look forward to getting to meet many of you over the next several months.

And now, I am very pleased to welcome Jim to the call for his concluding comments.

James T. Prokopanko, President and Chief Executive Officer, The Mosaic Company

Thank you, Rich. Your initiation as CFO is now complete. Before I begin, I would like to thank Larry for so capably taking the helm while I was

out for the last couple of months. An interim role brings some unusual challenges and I know that Larry has handled everything the job threw at him with his usual grace and integrity.

I’m pleased to report that I will resume my full-time duties next week. At that time, Larry will assume the previously announced role of

Executive Vice President of Strategy and Business Development for the duration of 2014. As our presentation today makes clear, we’re feeling very good about the crop nutrition industry and Mosaic’s future prospects.

We’ve seen the business improvements we expected, and we believe demand will remain solid at least through the fall season here in North

America. Fertilizer inventories all over the world are reaching very low levels, particularly in India where farmers are continuing to buy as little as possible, as they await evidence of the new government subsidy and other agricultural intentions.

As always, there were several factors to watch, including the Indian monsoon, China phosphate exports, the impacts of geopolitical conflicts, logistical issues, and of course, agricultural commodity prices.

Before we take your questions, I’d like to address the declines in corn and soybean prices, because I think it’s important that we

put this short-term commodity price weakness in perspective. Agriculture in 2014 is a vastly different and vastly more resilient business than it was even a decade ago. Today’s farmers in all of the key agricultural regions of the world are

using highly sophisticated technology. They’ve learned that they have to understand a wide range of global markets and they manage their acreage and their herds for maximum economic yield. We believe that this period of lower grain and oilseed

prices will be short lived and that the modern farmer, as well as Mosaic, will weather it well. We have ample evidence for this belief.

|

|

|

| www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2014 CallStreet |

|

7 |

First, farmers are more concerned about revenue per acre than they are about price per

bushel. They can increase their yields and thus their revenues per acre through the proper application of fertilizers. Second, prudent farmers have very strong balance sheets following the long run of high grain and oilseed prices. Farmers know that

agriculture is cyclical and they plan for and expect periods of lower prices. Third, for fertilizer producers, successive bumper crops are good news. Big crops deplete the soil of nutrients which must be replenished to drive future big crops.

Farmers are not going to pay for expensive seed traits, equipment, and other inputs, then skimp on fertilizer. That would be like buying a Ferrari and then not buying the gas to put in it.

Fourth, a likely early harvest will give farmers ample time to complete their fertilizer application in the fall, giving them a head start

coming out of winter. This is another reason why we expect and are seeing strong demand for fall fertilizer application in North America.

Finally and most important, the tug of war between yields and demand will continue. Stocks to use ratios remain low, which is one reason why

farmers planted 92 million acres of corn in the U.S. this year. They know the world is hungry, and that it is getting hungrier every day. Volatility is a fact of life in agriculture, but so is the long upward trend of demand for food. This

industry requires a long-term view and the long-term remains undoubtedly appealing.

Mosaic is in excellent position to outperform over the

long-term. Our company has been public for nearly 10 years now, and in that time, we’ve accomplished a great deal. We’ve built a resilient franchise that has demonstrated its ability to earn solid profits across the business cycle. And in

recent times, we have taken advantage of numerous opportunities to accelerate our progress.

I’m thrilled to be back, primarily

because I’m so enthusiastic about the years ahead for Mosaic and all our stakeholders.

With that, I’ll turn the call back to

Larry to moderate the Q&A session. Operator?

|

|

|

| www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2014 CallStreet |

|

8 |

QUESTION AND ANSWER SECTION

QUESTION AND ANSWER SECTION

Operator: Absolutely. [Operator Instructions] Thank you. And your first

question comes from the line of Vincent Andrews with Morgan Stanley. Your line is open.

<Q – Vincent Andrews – Morgan

Stanley & Co. LLC>: Thank you. Good morning and welcome back, Jim, it’s great to hear you. Could you talk a little bit about the composition of shipments in potash in the third quarter, just in terms of where they’re going

to go geographically? I presume it’s a big North American mix, probably less Brazil, less China, more India and Southeast Asia. Is that the right way to think about it?

<A – Larry Stranghoener – The Mosaic Company>: Good morning, Vincent. Yes, you’re thinking about it the right way.

I’ll let Rick McLellan amplify.

<A – Rick McLellan – The Mosaic Company>: Yeah. I think, Vincent, you’ve

pretty much outlined what we expect to happen. The demand in North America is very strong and it’s really driven by the fact that after a really good spring application season, the pipeline is completely emptied out of product and so

there’s going to be a big push to get those tonnes into this marketplace. As well that you’re hitting into Brazil planting season, so they’re going to continue to pull tonnes despite being on a very solid pace. And then, yes,

you’re right, mostly going to Southeast Asia and probably not very much into China until we get into the fourth quarter.

Operator:

Thank you. Your next question comes from the line of Joel Jackson with BMO Capital Markets. Your line is open.

<Q – Joel

Jackson – BMO Capital Markets (Canada)>: Hi, thank you. Your rock cost went up in the quarter looking where it’s been only maybe a couple years ago. Could you talk about what happened there and how you see that playing out, those

costs playing out for the next few quarters? Thanks.

<A – Larry Stranghoener – The Mosaic Company>: Joel, good

morning. Yes, rock costs were up in the quarter. It’s directly a function of the accounting impacts for the CF acquisition where we had to write up the acquired inventory and those costs will go back to a more normal level in the third quarter

and fourth quarter of the year.

Operator: Thank you. Your next question comes from the line of the Don Carson with Susquehanna Financial.

Your line is open.

<Q – Don Carson – Susquehanna Financial Group LLLP>: Yes, thank you. I want to go back to potash

demand, really two parts. One in the domestic markets, Larry, you commented on how you saw lots of empty bins. So I’m wondering how much of this demand is pipeline filling versus pounds in the ground. Maybe Mike Rahm can comment on what he

thought consumption increased by in the most recent fertilizer here. And the standard markets seem much looser. I’m wondering why Canpotex decided to keep shipping optional tonnes to China at low first half prices. And why you wouldn’t

seek a contract at higher prices.

<A – Larry Stranghoener – The Mosaic Company>: Good morning. Don, thank you for

those questions. Again, I’ll ask Rick to answer coupled with the responses from Mike Rahm as well.

<A – Rick McLellan

– The Mosaic Company>: Yeah. Good morning, Don. I’ll start with the domestic market. And frankly, from our perspective, we see that the product that’s going to go into North America, we’re going to have to point it to the

right markets, the markets that are going to use it this fall. And we don’t look to see much pipeline growth during this period. So the product that was in storage and was sold went to the market in the spring and what’s going to get

shipped in between now, and in the end of fall, which, by the way, probably will have a long tail because you’re going to get an early start to harvest, will get used up. We don’t see the pipeline fill.

|

|

|

| www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2014 CallStreet |

|

9 |

Mike, do you want to talk about disappearance maybe?

<A – Mike Rahm – The Mosaic Company>: Sure. Good morning, Don. Just to refresh, we’re projecting global shipments

of potash at 57.4 million tonnes this year. That’s up 3.8 million tonnes from last year. If you look at a price chart of potash, potash prices trended down and bottomed early this year. And we think over the last couple of years,

pipelines around the globe have been pulled down to very low levels. So of this 57.4 million tonnes, we think that most of that is virtually all use. And then, another way to think of it, if you look at global grain and oilseed production, we

had a huge step-up in 2013. We’re going to continue to produce at that very high level, probably more. And if you look at a 100 million metric tonne increase in global grain and oilseed use, that pulls a lot of incremental nutrients out of

the ground. So short answer, we think most of these shipments around the world, and especially in North America, are going to the ground.

<A – Larry Stranghoener – The Mosaic Company>: Don, just to reiterate the key message, demand is strong around the world

for both P and K and inventory levels are very low.

<A – Rick McLellan – The Mosaic Company>: I think, Don, there

was another part to your question, it’s Rick, about the China contract. The agreement with China was on optional tonnage; it was a jointly agreed upon option. Frankly, when we agreed to move forward with that, the market pricing on standard

hadn’t improved that much. The fact that we now are in a position where we’re well sold on standard is allowing those spot markets to move up.

Operator: Thank you. Your next question comes from the line of P.J. Juvekar with Citi. Your line is open.

<Q – P.J. Juvekar – Citigroup Global Markets Inc. (Broker)>: Yes, thank you. So where do you see DAP inventories in

China and India today? I think Mike Rahm had talked about low phosphate inventories almost a year ago. Wondering can you compare today’s inventory to that point and also discuss phosphate exports from China this year, which I believe are

tracking much higher than last year. Thank you.

<A – Larry Stranghoener – The Mosaic Company>: Good morning, P.J.

Thank you. I’ll turn again to Rick and Mike, starting with Mike.

<A – Mike Rahm – The Mosaic Company>: Well,

Rick, you had a comment, why don’t you go ahead first.

<A – Rick McLellan – The Mosaic Company>: No, it just,

last year at this time, while Mike’s getting his numbers together, I’ll just talk about we said that there was a build of in-country inventory. And it was getting chewed through. Well, this year we see the impact of that being is we expect

between 4.5 million tonnes and 5 million tonnes of imports into India of DAP. There’s a million and a half been brought forward today. We believe between now and the first of November, they need arrivals of close to 3 million

tonnes of DAP. Minimal amounts of those tonnes have been booked. So they have – getting that we’re going to be the first of August tomorrow, they’ve got to get some buying shoes on pretty quickly. Mike, do you want to take.

<A – Mike Rahm – The Mosaic Company>: Sure, P.J., let me answer the last question first in terms of China’s

exports. Yeah, they are tracking higher, and in our projection for their total DAP/MAP/Triple exports this year is a little – a whisker shy of 6 million tonnes, and that compares to about 5.3 million tonnes last year. Most of that

increase is in the form of DAP. But there is kind of a symbiotic relationship between China and India, so India’s imports of DAP, as Rick mentioned, we think they’ll be in that 4.5 million tonnes to 5 million tonnes with

3 million tonnes left to ship between now and November.

|

|

|

| www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2014 CallStreet |

|

10 |

Just in terms of phosphate pipeline inventories, we think in the case of India, that

inventory or pipeline is pretty much dry and they’re playing a very close game of supplying the phosphate that Indian farmers need. So I think it’s a very similar story to potash. The pipeline is very low, and in the case of India, the

recent regeneration of the monsoon is extremely good news. The last official report from the Meteorological Group in India was that rainfall was 25% less than normal, and the most recent information we have from our team there is, we think the

report tomorrow will indicate that rainfall is only 8% or so below normal. So it started late, but it’s been a very, very good – delivering very good rainfall here recently.

Operator: Thank you. Your next question comes from the line of Jeff Zekauskas with JPMorgan. Your line is open.

<Q – Jeff Zekauskas – JPMorgan Securities LLC>: Hi, good morning. You have a $500 million cost-cutting program. How much

in costs do you think you’ll take out in 2015? And secondly, do you expect global potash demand and global phosphate demand to grow in 2015?

<A – Larry Stranghoener – The Mosaic Company>: Jeff, good morning. Starting with the cost-cutting program, we’ve

described, starting I think since last year, our program to reduce costs at our operating units by some $200 million each coupled with extensive cost reductions in our corporate support functions. We are well down the path of defining the road to

get there and have begun to implement the actions. You’ve seen some evidence of that already. I think you’re starting to see evidence of it in our results. I’ll ask Joc to give some more color on what we are doing.

<A – Joc O’Rourke – The Mosaic Company>: Yeah, Jeff, so just to give a little bit of color on our cost cutting.

Certainly – or productivity improvements, certainly what we’ve done so far, if you look at the evidence of Hersey and Carlsbad, the shutting down of MOP at Carlsbad, those take significant costs out of our system to produce the same number

of tonnes of potash, so that’s the first step. We’re right sizing our other operations, and we’re getting into a real hard look at what the productivity is. So if you’re asking how we’re – how we’re going in terms

of timing, I would say, we’re front end loaded, but we do expect to take the whole five years to get that $400 million.

<A

– Larry Stranghoener – The Mosaic Company>: With respect to your second question, Jeff on P&K volumes in 2015, note that 2014 is a year of record shipments and Mike, why don’t you unveil our thoughts about 2015.

<A – Mike Rahm – The Mosaic Company>: Sure. We’ve asked our geographies to provide some input in terms of how they

see 2015 shaping up. We expect further increases in 2015. Maybe not quite as robust as 2014, but in terms of specific ranges, we think 2015 global phosphate shipments will be in that 65.5 to 67.5 million tonne range and our point estimate is

kind of right in the middle. And that follows the 1.6 million tonne increase this year. So from point-to-point, we’re estimating almost 1 million tonne increase, about 1.3%, little bit lower growth rate, but still growth in the

current environment.

Case of potash, the numbers come in for 2015 around 58 million tonnes to 60 million tonnes. And frankly,

our point estimate is at the high end of that range. So we think there’ll be a pretty decent follow-through to the 7% increase that we’ve seen in potash shipments this year. That translates into about 3.8 million tonne increase in

2014, probably a 2 million tonne to 2.5 million tonne increase in 2015.

Operator: Thank you. Your next question comes from the

line of Chris Parkinson with Credit Suisse. Your line is open.

|

|

|

| www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2014 CallStreet |

|

11 |

<Q – Chris Parkinson – Credit Suisse Securities (USA) LLC (Broker)>:

Perfect. Thank you. You mentioned your goal of growing ADM’s fertilizer tonnes in Brazil from about 4 million to 6 million. Can you just remind us of your initiatives in MicroEssentials in the region and also your expectations going

forward the next couple of years? Thank you.

<A – Larry Stranghoener – The Mosaic Company>: Yeah. Chris, just to be

sure, the acquisition of the ADM business in Brazil and Paraguay brings with it that incremental 2 million tonnes. So we’re not talking about growing their business. We’re talking about adding their 2 million tonnes of volume to

our current 4 million tonnes of volume to get to 6 million tonnes in total, in again, what is a large and still a very fast growing marketplace.

The MicroEssentials story is a key part of the value of this acquisition. Rick, would you just shed a little bit of light on our thinking

there?

<A – Rick McLellan – The Mosaic Company>: Yeah. Thanks, Larry. Chris, we’ve been talking about the

success of MicroEssentials in North America a lot. We haven’t spent as much time talking about that success in Brazil. And frankly, again, it’s a yield story. It’s a yield story on soybeans where we’re getting anywhere from 4% to

6% increase in soybean yield. That’s the first value that it creates. The second is you’re sending, in a very costly market environment for freight, the same nutrients in less tonnes. And so there’s a value that the farmer sees for

that. They can get the product there in a more cost effective manner. And they run less product through their own equipment. So for those two reasons, we’ve seen pretty consistent growth. And right now, we’re at about 6% of the Brazil

market is delivered – phosphates are delivered as MicroEssentials.

Operator: Thank you. Your next question comes from the line of

Mark Connelly with CLSA. Your line is open.

<Q – Mark Connelly – CLSA Americas LLC>: Thank you. I was hoping that

Rick would share his perspective on Ma’aden, how the project’s progressing, what the biggest issues are and then an update on production and ramp up?

<A – Larry Stranghoener – The Mosaic Company>: Yeah, Mark. That would actually be Rich Mack who has been our

representative on the board at Ma’aden as one the architects of the deal. So Rich, would you address that please?

<A –

Rich Mack – The Mosaic Company>: Sure. Thanks, Larry. And, Mark, I guess the way I would characterize it is progress on Ma’aden is advancing very well. The stages that we’re at right now would be in advanced engineering on

virtually all packages that we need to construct this very large $7.5 billion project. As was noted in the prepared comments, this is a big project finance deal and we had a very successful project financing of $5 billion close in the last 45 days

or so at very favorable pricing, so that’s also another milestone. In areas up north and by Ras Al Khair in the eastern part of Saudi Arabia, there are spades in the ground and there is infrastructure emerging from the ground and advancing as

expected.

And so lots of work to do, good progress, and as we previously communicated, we expect this 3 million tonnes to

3.5 million tonnes come online in the last quarter of 2016.

Operator: Your next question comes from the line of Michael Piken with

Cleveland Research. Your line is open.

<Q – Michael Piken – Cleveland Research Company LLC>: Yeah. Hi. Good morning

and welcome back, Jim. Just wanted to circle back here in terms of North America, and if you could just sort of talk about kind of the logistical challenges and how you guys are sort of thinking about warehousing versus doing consignment agreements

versus your partners versus just making more spot sales? And how you’re managing the various aspects of that business? Thanks.

|

|

|

| www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2014 CallStreet |

|

12 |

<A – Larry Stranghoener – The Mosaic Company>: Thank you, Mike. Good

morning to you. That’s a timely topic. Joc, why don’t you take the first stab at it. Rick, you might have something to add.

<A – Joc O’Rourke – The Mosaic Company>: Yeah. I’ll take the first step and then hand it over to Rick. Of

course, our warehousing strategy includes both our own warehouses and customer warehouses. And Rick can mention some of the customer warehouses. We look at this as being something that probably will continue as an issue. North American rail

logistics is going to be a problem. We’re probably looking at increasing our own railcar fleet for that reason. The availability of systems’ fleet cars is lower than probably it would’ve been. And we’ve got to expect that there

could be another winter ahead of us. As such, we’re looking at all of the things we can do to move product in a more measured way through the whole season. And with that, I’ll hand it over to Rick to just talk about our.

<A – Rick McLellan – The Mosaic Company>: Yeah. Thanks, Joc. Good morning, Mike. I think you were at the Southwest, we

talked for a moment. But there, all of the talk was about logistics challenges, whether it be barges, whether it would be rail or impending changes to trucking. This is something we’re going to deal with. So separating purchasing from the time

of shipment is why we got into having these programs and they will continue.

The one thing you have to remember is with the warehouses

empty and product going to the field, there won’t be product that’ll get filled – warehouses won’t get filled up before this fall for those extra few tonnes that people might expect. Everything that goes between now and in the

start of the third quarter and into the fourth quarter is going to go to the ground.

Operator: Thank you. Your next question comes from

the line of Ben Isaacson with Scotiabank. Your line is now open.

<Q – Carl Chen – Scotia Capital Markets>: Thank

you very much. Hi, this is Carl Chen stepping in for Ben. I was wondering if you could please remind us of how we should think about margins and EBITDA on the distribution business in Brazil. And are you still looking to expand in the country or are

you satisfied with your post ADM acquisition position for now?

<A – Larry Stranghoener – The Mosaic Company>: Carl,

good morning. We’ve made it very clear that we like the outlook for Brazil. We’re pleased with the presence we have there today, but are very anxious to build on that. We’re doing so of course through the ADM acquisition, which we

hope will close by the end of this year. And we’re looking at other expansion, internal expansion opportunities as well.

This is

important largely as a way to ensure we’ve got access to markets for our production. And that’s really what this is all about. It’s not to be in distribution for the sake of distribution. And because we see Brazil as such a large and

growing market, we want to make sure that we can funnel product there for many years to come, and having control over more distribution is a sure way of doing that. The distribution business itself is typically a 5% to 6% sort of operating margin,

with very good returns on capital, though I might add. So all told, we think this is a very good business proposition for us. And we look forward to executing this growth plan in Brazil.

Operator: Thank you. Your next question comes from the line of Andrew Wong with RBC Capital Markets. Your line is open.

<Q – Andrew Wong – RBC Capital Markets Asset Management>: Hi. Thanks for taking my question. I just want to talk about

the phosphate sales volume guidance. It’s sequentially higher, a bit higher. Can you talk about what’s driving third quarter sales? Is it domestic, international, is it blended volumes? Just trying to understand the mix. And then, it was

mentioned earlier this year that the phosphate segment reporting was subject to a bit of a review. Any updated thoughts on that? Thanks.

|

|

|

| www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2014 CallStreet |

|

13 |

<A – Larry Stranghoener – The Mosaic Company>: Andrew, I’ll ask

Rick to address the first question about our sales volume guidance for phosphate in the third quarter, and then Rich Mack can address the segment question that you raised. Rick?

<A – Rick McLellan – The Mosaic Company>: Yeah. Good morning, Andrew. As we think about sales for the third quarter, it

is the – we expect the distribution or the blend sales to be up as part of this. So that in itself will give the segment some margin compression as we go through it. But we also are seeing very good volumes for the domestic market and into

international marketplaces. We have focused on the Americas, and right now, we don’t have very many tonnes going to India where if you think about it, at this time two years ago we were shipping a large share of what we were producing. And so

we’re going to have higher volumes driven by our expansion and distribution and the addition of CF tonnes. Rich?

<A – Rich

Mack – The Mosaic Company>: Thanks, Rick. Andrew, I guess there’s two things I would say on segment reporting. One, I’m just moving into this role and two, we have the ADM acquisition, which is going to significantly increase

the size of our international distribution business. I’m well aware of the challenges that many of you have had in terms of modeling our current segment composition where we have international distribution and our phosphate upstream business in

the same segment. And so I simply would ask you to stay patient and stay tuned. It’s under review.

Operator: Thank you. Your next

question comes from the line of Yonah Weisz with HSBC Bank. Your line is open.

<Q – Yonah Weisz – HSBC Bank Plc (Tel Aviv

Branch)>: Hi there. Good afternoon. And thank you for the call. If I can ask about American phosphate dynamics from a volume side OCP has a greater presence this year than in the past. I also believe China is delivering a significant amount

of volume of DAP into North America for the first time in some time. How is the market reacting to this? How are you reacting to this in terms of volume production or place in perspective? From pricing last year lower Indian prices did have a

probable influence on global pricing for DAP also in North America. This year it doesn’t seem to be happening so much. I’m wondering how you see that business ship as well. Thank you.

<A – Larry Stranghoener – The Mosaic Company>: Yonah, good morning. Thank you for the questions. I think again Rick

McLellan would be the appropriate person to address those. Rick?

<A – Rick McLellan – The Mosaic Company>: Yeah.

Good morning, Yonah. If we think about imports into North America, the North American market requires imports to meet the total demand. There is not the capability for domestic producers to be the sole supplier to the marketplace.

So we’ve seen seeing product come from OCP, product from Morocco into the marketplace. Those frankly have to come. Your question about

China, there were several Chinese vessels supposed to be heading to the U.S. To-date nothing has arrived and the market continues to be very tight for supply into the third quarter.

And as far as – the second question was on pricing on what we see in India versus North America. I think that what we see happening is the

North American price, or the price out of producers ex-China, has continued to strengthen over the last six-week period. In the meantime, the price that Indian buyers are having to pay to get those tonnes out of China has increased dramatically. I

think at the start of their programs, they had a $450 number that they were able to buy for; the latest they’re hearing is between $485 and $490.

|

|

|

| www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2014 CallStreet |

|

14 |

So we’ve seen significant price pull-up in India and given the demand picture into the

Americas for the next 6 week to 8 week period, we see the impact of India being minimal.

<A – Larry Stranghoener – The

Mosaic Company>: Yeah. And I would just reiterate, Yonah, the supply demand picture for phosphate in particular is, well, for both nutrients, is just very solid through the rest of this year. There’s a lot of demand. I hope we’ve

made that very clear. There’s strong demand this year; we see demand growth continuing next year. We find our customers are far more concerned about logistics issues and the challenge of getting product into the market this fall and much less

concerned about price. So it’s a good time to be in this business.

Operator: And your next question comes from the line of Matthew

Korn with Barclays. Your line is open.

<Q – Matthew Korn – Barclays Capital, Inc.>: Hi. Good morning, everybody,

and again, welcome back Jim. So for potash, inventories are low, bins are empty, you’ve had a steady stream of updates really over the last several months indicating how tight the granular market is. And it seems that your demand outlook is

clearly improving. Is it fair to ask in this environment why prices aren’t moving up even higher? Have you had signals from your customers that you’ve got elasticity that could kick in if you went to a higher price level? Is there

anticipation that maybe some of the transportation premium that’s embedded in pricing today could decline over second half? Just curious your thoughts there.

<A – Larry Stranghoener – The Mosaic Company>: Yeah, thank you, Matthew. Good morning. Rick, you want to address that

please?

<A – Rick McLellan – The Mosaic Company>: I think the – I’ll go back to what we’ve been

saying since the start of the year. First, we needed to see demand growth. That demand growth is occurring. Our expectations are close to 4 million tonne increase in global potash demand in this year and prices have moved higher. We expect that

the Brazil business on a global basis will get done in the $360 range and there are chances for opportunities for it to go to $380. We put a price increase before we booked tonnes into North America that was up $20. Those are being realized and will

be realized in the third quarter.

And so, first, we need to get the demand underneath us which we’re getting, and then there are

chances for prices to go higher.

Operator: Thank you. Your next question comes from the line of Adam Samuelson with Goldman Sachs. Your

line is open.

<Q – Adam Samuelson – Goldman Sachs & Company>: Yeah. Thanks. Good morning, everyone. And,

Jim, I’d like to echo the comments. Good to hear you again. Question, I guess, for Mike Rahm, taking that demand outlook that you gave for next year both in potash and phosphate, the expectations internally on industry capacity utilization. And

maybe, Mike, if you could give a little more color on the breakdown of the demand growth in potash and the key regions that are driving it, particularly expected demand growth in North America and Brazil?

<A – Larry Stranghoener – The Mosaic Company>: Adam, good morning. We’ll take one more question after this, by the

way. And as you suggest, I’ll turn this one over to Mike to respond to.

<A – Mike Rahm – The Mosaic Company>:

All right. Good morning, Adam. Yeah. I’m glad you asked the question. Because people, I think, are questioning demand growth in this commodity price environment. And I think one of the things you need to look at is the affordability index.

We publish that each week on our website, last week. And let me just say the affordability index is simply a ratio of ag commodity prices and crop nutrient prices. Last week that was 0.88.

|

|

|

| www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2014 CallStreet |

|

15 |

And I think many people are looking back to the 2008 period and saying, my gosh, we’re

going to be in the same soup here given the drop-off in ag commodity prices. But just to contrast today with 2008, if you go back to the peak of that affordability index, that peaked at 1.55 back in the first week of August in 2008. And at that

time, the price of urea, I think was $780, the price of DAP was $1,078, the price of MOP was $918. And interestingly, if you look at the price of ag commodities at that time, price of corn was $5.22, a little bit higher than the $3.62 today, and the

price of soybeans was $12.43, not a heck of lot difference than the $12.21 that we see today.

So affordability, when we got our input from

the geographies, our guidance was, think in terms of an affordability index similar to where we’re at today. So that’s kind of the background in terms of how the forecasts were put together in the guidance. In terms of where the increases

are coming from, in the case of phosphate, we expect growth in India and a little bit further growth in Brazil with most of the other regions remaining about flat, and in a few regions maybe a small decline. And particularly in North America, if we

see corn acres drop down into the 90 million acre range next year, we could see slightly lower shipments. In the case of potash, generally, we see pretty positive growth across the board, again led by rebounds in India; also further growth we

think in Brazil and China.

So as I said before, in the case of potash, we’re projecting another 2 million tonne increase in

shipments or about a 4% increase. So hopefully, that I think covers the bases in terms of that question about what does 2015 look like at this point.

Operator: Thank you. Your next question comes from the line of Kevin McCarthy with Bank of America Merrill Lynch. Your line is open.

<Q – Kevin McCarthy – Bank of America Merrill Lynch>: Yes. Good morning and thanks for squeezing me in. Two potash

questions if I may. First would you discuss your Canpotex allocation in the back half of the year and beyond? Some of your competitors have proved out capacity and so I’m wondering if you think your mix will skew further to North America over

the next year or so. And then second, maybe a simple question but I thought I heard you say your potash volumes were committed entirely for the third quarter and yet we have a shipment range of 1.8 million tonnes to 2.0 million tonnes. And

so I was just wondering if you could address maybe some of the variables that would conceivably skew to the higher end or the lower end there. Thanks.

<A – Larry Stranghoener – The Mosaic Company>: Thank you, Kevin. Good morning. One final question for Rick. Rick?

<A – Rick McLellan – The Mosaic Company>: Yeah. Frankly our Canpotex allocation is going to ebb and flow as our partners

have brought on production or we bring on production. So we are expecting where we don’t see a skew to more North America in the longer-term. I think as we went in, we will come out after all of the expansions are proven. So that we don’t

see a long-term difference there.

Frankly, Kevin, good question on why you would have a range if you have everything sold. It’s what

I ask our own people and I think frankly it’s all about the logistics systems. Right now we’re assuming that the product that we produce is going to get into the marketplace. And that the barge systems, the rail systems, and the truck

systems will perform. But there’s a lot of competing commodities moving on those same logistics systems. So that’s the reason for the range.

Lawrence W. Stranghoener, Interim Chief Executive Officer

Thank you, Rick, Thanks Kevin. Thanks all for your patience this morning. We’ve run a little bit late. Before we close, I just want to

repeat how delighted the team here is to have Jim back with us. Jim is looking fit and energetic. He’s newly svelte. He’s got a new haircut that reminds us all a bit of George Clooney. And he’s here to give you some concluding

comments. Jim?

|

|

|

| www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2014 CallStreet |

|

16 |

James T. Prokopanko, President and Chief Executive Officer, The Mosaic Company

Thanks very much, Larry. With that, I’m going to just reinforce what the key messages are that we left you in the last hour. First, the

global demand for fertilizer is exceptionally strong, and I think you can pick that up just through the enthusiasm and our outlook for the quarters ahead.

Second, farmers around the world continue to have to produce and they have a strong incentive to maximize their yields. Even in a period of

lower agricultural prices, they can’t earn more money by producing less; they need to use fertilizer.

And third, as Rich clearly

described, Mosaic continues to put its capital to use to grow the company and to reward our investors. We feel great about our positioning and about Mosaic’s future. Thank you all for joining our call. It’s great to be back and everybody

have a great day. Thank you.

Operator: This concludes today’s conference call. You may now disconnect.

Disclaimer

The

information herein is based on sources we believe to be reliable but is not guaranteed by us and does not purport to be a complete or error-free statement or summary of the available data. As such, we do not warrant, endorse or guarantee the

completeness, accuracy, integrity, or timeliness of the information. You must evaluate, and bear all risks associated with, the use of any information provided hereunder, including any reliance on the accuracy, completeness, safety or usefulness of

such information. This information is not intended to be used as the primary basis of investment decisions. It should not be construed as advice designed to meet the particular investment needs of any investor. This report is published solely for

information purposes, and is not to be construed as financial or other advice or as an offer to sell or the solicitation of an offer to buy any security in any state where such an offer or solicitation would be illegal. Any information expressed

herein on this date is subject to change without notice. Any opinions or assertions contained in this information do not represent the opinions or beliefs of FactSet CallStreet, LLC. FactSet CallStreet, LLC, or one or more of its employees,

including the writer of this report, may have a position in any of the securities discussed herein.

THE INFORMATION PROVIDED TO YOU

HEREUNDER IS PROVIDED “AS IS,” AND TO THE MAXIMUM EXTENT PERMITTED BY APPLICABLE LAW, FactSet CallStreet, LLC AND ITS LICENSORS, BUSINESS ASSOCIATES AND SUPPLIERS DISCLAIM ALL WARRANTIES WITH RESPECT TO THE SAME, EXPRESS, IMPLIED AND

STATUTORY, INCLUDING WITHOUT LIMITATION ANY IMPLIED WARRANTIES OF MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE, ACCURACY, COMPLETENESS, AND NON-INFRINGEMENT. TO THE MAXIMUM EXTENT PERMITTED BY APPLICABLE LAW, NEITHER FACTSET CALLSTREET, LLC NOR

ITS OFFICERS, MEMBERS, DIRECTORS, PARTNERS, AFFILIATES, BUSINESS ASSOCIATES, LICENSORS OR SUPPLIERS WILL BE LIABLE FOR ANY INDIRECT, INCIDENTAL, SPECIAL, CONSEQUENTIAL OR PUNITIVE DAMAGES, INCLUDING WITHOUT LIMITATION DAMAGES FOR LOST PROFITS OR

REVENUES, GOODWILL, WORK STOPPAGE, SECURITY BREACHES, VIRUSES, COMPUTER FAILURE OR MALFUNCTION, USE, DATA OR OTHER INTANGIBLE LOSSES OR COMMERCIAL DAMAGES, EVEN IF ANY OF SUCH PARTIES IS ADVISED OF THE POSSIBILITY OF SUCH LOSSES, ARISING UNDER OR IN

CONNECTION WITH THE INFORMATION PROVIDED HEREIN OR ANY OTHER SUBJECT MATTER HEREOF.

The contents and appearance of this report are

Copyrighted FactSet CallStreet, LLC 2014. CallStreet and FactSet CallStreet, LLC are trademarks and service marks of FactSet CallStreet, LLC. All other trademarks mentioned are trademarks of their respective companies. All rights reserved.

|

|

|

| www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2014 CallStreet |

|

17 |

|

|

| The

Mosaic Company Earnings Conference Call –

Second Quarter 2014

July 31, 2014

Jim Prokopanko, President and Chief Executive Officer

Larry Stranghoener, Interim Chief Executive Officer

Rich Mack, Executive Vice President and Chief Financial Officer

Laura Gagnon, Vice President Investor Relations

Exhibit 99.2 |

|

|

|

2

Safe Harbor Statement

This document contains forward-looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995. Such statements include, but are not limited to, statements

about the Northern Promise Joint Venture, the acquisition and assumption of certain related liabilities of

the Florida phosphate assets of CF Industries, Inc. (“CF”) and Mosaic’s ammonia supply

agreements with CF; repurchases of stock; other proposed or pending future transactions or

strategic plans and other statements about future financial and operating results. Such statements are

based upon the current beliefs and expectations of The Mosaic Company’s management and are

subject to significant risks and uncertainties. These risks and uncertainties include but are

not limited to risks and uncertainties arising from the ability of the Northern Promise Joint Venture to

obtain additional planned funding in acceptable amounts and upon acceptable terms, the future success

of current plans for the Northern Promise Joint Venture and any future changes in those plans;

difficulties with realization of the benefits of the transactions with CF, including the risks that

the acquired assets may not be integrated successfully or that the cost or capital savings from the

transactions may not be fully realized or may take longer to realize than expected, or the

price of natural gas or ammonia changes to a level at which the natural gas based pricing under one of

the long term ammonia supply agreements with CF becomes disadvantageous to Mosaic; customer defaults;

the effects of Mosaic’s decisions to exit business operations or locations; the

predictability and volatility of, and customer expectations about, agriculture, fertilizer, raw material,

energy and transportation markets that are subject to competitive and other pressures and economic

and credit market conditions; the level of inventories in the distribution channels for crop

nutrients; changes in foreign currency and exchange rates; international trade risks and other risks

associated with Mosaic’s international operations and those of joint ventures in which Mosaic

participates, including the risk that protests against natural resource companies in Peru

extend to or impact the Miski Mayo mine; changes in government policy; changes in environmental and other

governmental regulation, including greenhouse gas regulation, implementation of numeric water quality

standards for the discharge of nutrients into Florida waterways or possible efforts to reduce

the flow of excess nutrients into the Mississippi River basin or the Gulf of Mexico; further

developments in judicial or administrative proceedings, or complaints that Mosaic’s operations

are adversely impacting nearby farms, business operations or properties; difficulties or

delays in receiving, increased costs of or challenges to necessary governmental permits or approvals or

increased financial assurance requirements; resolution of global tax audit activity; the

effectiveness of Mosaic’s processes for managing its strategic priorities; adverse

weather conditions affecting operations in Central Florida, the Mississippi River basin or the Gulf Coast of the United

States, or Canada, and including potential hurricanes, excess heat, cold snow, rainfall or drought;

actual costs of various items differing from management’s current estimates, including,

among others, asset retirement, environmental remediation, reclamation or other environmental

regulation, Canadian resources taxes and royalties, the liabilities Mosaic assumed in the Florida

phosphate assets acquisition, or the costs of the Northern Promise Joint Venture, its existing

or future funding and Mosaic’s commitments in support of such funding; reduction of Mosaic’s

available cash and liquidity, and increased leverage, due to its use of cash and/or available debt

capacity to fund share repurchases, financial assurance requirements and strategic

investments; brine inflows at Mosaic’s Esterhazy, Saskatchewan, potash mine or other potash shaft mines;

other accidents and disruptions involving Mosaic’s operations, including potential mine fires,

floods, explosions, seismic events or releases of hazardous or volatile chemicals, as well as

other risks and uncertainties reported from time to time in The Mosaic Company’s reports filed with the

Securities and Exchange Commission. Actual results may differ from those set forth in the

forward-looking statements.

|

|

|

|

3

1.

Strong global phosphate and potash

demand.

2.

Farmers continue to be incented to

maximize yield.

3.

Mosaic executing well against strategic

priorities to create shareholder value.

Key Messages |

|

|

|

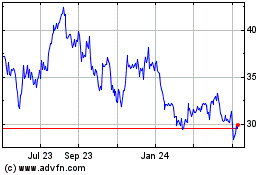

•

Seasonal price

weakness shorter

and less

pronounced.

•

Well positioned into

Q3.

•

Expect 2014

shipments to be at

high end of 65-66

million tonnes.

Volume First, Then Price and Margin

As Expected: Market Conditions Tightened

* Excluding impact of CF phosphate acquisition accounting. See

reconciliation on slide 22. Source: Mosaic

4

Phosphates |

|

|

|

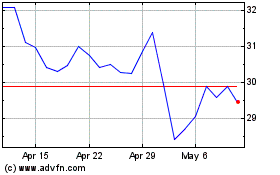

Expect producer inventories to decline further in H2 2014

Potash

Volume First, Then Price and Margin

•

As expected,

volume momentum

came first, pricing

followed.

•

Good demand at

current $390/short

ton warehouse

price.

•

On track to achieve

2014 shipments of

57-58 million tonnes

Source: Mosaic

5 |

|

|

|

6

Second Quarter Financial Highlights

$0.64 diluted earnings per share

Includes $0.06 negative impact of notable items

$796 million in cash from operations

$2.4 billion

$403 million

$206

$213

Operating Earnings

$1,672

$762

Net Sales

Phosphates

Potash |

|

|

|

7

Strategic Accomplishments

Potash expansions continue to be on time and on budget.

Received Brazil antitrust clearance for ADM acquisition.

Made significant progress on CF Industries phosphates

integration:

High confidence in announced $40-50 million in annual pre-tax

synergies Executing

well

on

MicroEssentials®

expansion

at

New

Wales.

Finalized $5 billion project financing for Ma’aden phosphate

joint venture.

Sold decommissioned potash mine in Hersey, Michigan.

Announced decision to close Carlsbad MOP production.

Continued strong safety performance. |

|

|

|

9

Phosphates Segment Highlights

$ In millions, except DAP price

Q2 2014

Q1 2014

Q2 2013

Net sales

$1,672

$1,254

$1,646

Gross Margin

$284

$207

$279

Percent of net sales

17%

17%

17%

Operating earnings

$206

$138

$191

Sales volumes

3.4

2.7

2.9

NA

production

volume

(a)

2.5

2.0

2.1

Finished product operating rate

85%

79%

84%

Avg DAP selling price

$465

$414

$477

(a)

Includes crop nutrient dry concentrates and animal feed ingredients

Second quarter highlights:

•

The year-over-year increase in net sales is driven by higher sales volumes, partially

offset by lower finished product pricing.

•

The year-over-year increase in gross margin dollars reflects higher sales volumes, lower raw

material costs, partially offset by lower finished product pricing.

o

Three percentage point impact from acquisition accounting of CF Industries phosphates business.

|

|

|

|

10

Potash Segment Highlights

$ In millions, except MOP price

Q2 2014

Q1 2014

Q2 2013

Net sales

$762

$733

$974

Gross Margin

$250

$212

$389

Percent of net sales

33%

29%

40%

Operating earnings

$213

$166

$346

Sales volumes

2.5

2.4

2.5

Production volume

2.0

1.9

2.2

Production operating rate

76%

70%

81%

Avg MOP selling price

$267

$267

$366

Second quarter highlights:

•