UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 1, 2014

BRADY CORPORATION

(Exact name of registrant as specified in its charter) Commission File Number 1-14959

|

| | |

| | |

Wisconsin | | 39-0971239 |

(State of Incorporation) | | (IRS Employer Identification No.) |

6555 West Good Hope Road

Milwaukee, Wisconsin 53223

(Address of Principal Executive Offices and Zip Code)

(414) 358-6600

(Registrant’s Telephone Number) Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

| |

Item 5.02 | DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN OFFICERS |

On August 1, 2014, Brady Corporation (the “Company”) entered into a Deed of Release (the “Severance Agreement”) with Stephen Millar, the Company’s Vice President, President - Die Cut, and President - Brady Asia Pacific, in connection with his departure from the Company effective September 30, 2014. Mr. Millar’s employment with the Company will terminate on September 30, 2014 with the elimination of his positions following completion of the second phase of the previously announced two-phase divestiture of the Company’s Die Cut business disclosed in item 8.01 hereto. Pursuant to the terms of the Severance Agreement, Mr. Millar will receive a severance package including, among other items, AUD $299,000 (currently approximately USD $277,921) as severance to be paid in equal installments throughout the 12 months following his separation from employment, a payment of AUD $100,000 (currently approximately USD $92,950) in recognition of his efforts in connection with the divestiture of the Company’s Die Cut-business, and outplacement assistance of up to AUD $10,000 (currently approximately USD $9,295). The Severance Agreement also contains 12-month non-competition and non-solicitation provisions, as well as confidentiality, waiver and non-disparagement provisions. The foregoing description of the Severance Agreement is qualified in its entirety by reference to the full text of such agreement, a copy of which is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

On August 1, 2014, Brady Corporation (the “Company”) completed the second phase of the previously announced two-phase divestiture of its European and Asian Die-Cut businesses to LTI Flexible Products, Inc. (d/b/a Boyd Corporation), a portfolio company of Snow Phipps Group, LLC, pursuant to the terms of the Share and Asset Purchase Agreement, dated as of February 24, 2014 (the “Purchase Agreement”). The second-phase closing involved the sale of the remainder of the Company’s Asian Die-Cut business, with operations in Langfang, Wuxi and Shenzhen in the People’s Republic of China and associated global sales support. In connection with the closing of both phases of the divestiture of its European and Asian Die-Cut businesses, the Company received aggregate cash proceeds of approximately $60 million, which amount remains subject to customary final working capital and net cash adjustments in accordance with the terms of the Purchase Agreement. The execution of the Purchase Agreement was previously reported by the Company on its Current Report on Form 8-K filed with the Securities and Exchange Commission on February 25, 2014, and the Purchase Agreement was filed as Exhibit 2.1 thereto. The closing of the first phase of the Company’s divestiture of its European and Asian Die-Cut businesses was previously reported by the Company on its Current Report on Form 8-K filed with the Securities and Exchange Commission on May 2, 2014. Attached as Exhibit 99.1 is the press release issued by the Company announcing the phase two closing.

|

| |

Item 9.01 | FINANCIAL STATEMENTS AND EXHIBITS |

(d) Exhibits

The following are filed as Exhibits to this Report.

|

| |

Exhibit No. | Description of Exhibit |

10.1 | Deed of Release between the Company and Mr. Millar, dated as of August 1, 2014. |

99.1 | Press Release of Brady Corporation, dated August 1, 2014, announcing Brady Corporation has closed on the second and final phase of the sale of its Die-Cut business.

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| | BRADY CORPORATION |

| | |

| | |

Date: August 1, 2014 | | /s/ Thomas J. Felmer |

| | Thomas J. Felmer |

| | Interim President & Chief Executive Officer and Chief Financial Officer |

EXHIBIT INDEX

|

| |

EXHIBIT NUMBER | DESCRIPTION |

10.1 | Deed of Release between the Company and Mr. Millar, dated as of August 1, 2014. |

99.1 | Press Release of Brady Corporation, dated August 1, 2014, announcing Brady Corporation has closed on the second and final phase of the sale of its Die-Cut business.

|

EXHIBIT 10.1

DATE: August 1, 2014

|

|

BETWEEN Brady Australia Pty Ltd ACN 000 788 447 AND Brady Corporation AND Stephen Millar |

|

DEED OF RELEASE |

|

|

|

Level 11 |

100 George Street |

PARRAMATTA NSW 2150 |

DX 8226 PARRAMATTA NSW |

Tel: (02) 9895 9200 |

Fax: (02) 9895 9290 |

Dir: (02) 9895 9222 |

Ref: SJB140396 |

Email: sbooth@colemangreig.com.au |

Deed of Release

THIS Deed is made this 1st day of August 2014

Parties:

|

| |

Brady Australia Pty Ltd, ACN 000 788 447 | |

of 2 Bellevue Circuit, Greystanes NSW 2145 | (“Brady Australia”) |

AND:

|

| |

Brady Corporation (a United States Corporation) | |

of 6555 Good Hope Road, Milwaukee, WI 53223 | (“Brady Corporation”) |

AND:

|

| |

Stephen Millar | |

of 1/50 Rutherford Ave BURRANEER NSW 2230 Australia | (“Stephen”) |

Background

| |

A. | References to Brady Australia and to Brady Corporation incorporate all subsidiary companies of those companies respectively. |

| |

B. | Stephen has been employed by Brady Australia since 1999, and most recently held the positions of Vice President Brady Corporation, President/Asia Pacific and President/Die Cut (“the employment”). |

| |

C. | Brady Australia, Brady Corporation and Stephen have agreed that Stephen’s employment will terminate (“the termination”) on the terms set out in this Deed on the grounds of redundancy, in view of the impending divestiture of Die Cut from Brady ownership. |

| |

D. | While working for Brady Australia and Brady Corporation and their subsidiary and affiliated companies, Stephen has had access to confidential information and commercially sensitive business information of Brady Australia and Brady Corporation and their subsidiaries and affiliates. |

| |

E. | The parties have agreed, without admissions, to finalise all claims and issues arising out of the employment and the termination as stated in this deed. |

Operative Part

The parties agree as follows:

| |

1 | Termination of employment and consequences of termination |

| |

1.1 | Brady and Stephen acknowledge and agree that Stephen’s employment in the positions as Vice President of Brady Corporation, President/Asia Pacific, and President/Die-Cut and his employment with Brady, shall terminate on September 30, 2014 (“the Termination Date”). |

| |

1.2 | Stephen hereby provides notice of his resignation from all officer and director positions of Brady Australia, Brady Corporation and all related corporate entities as of that date. |

| |

1.3 | Stephen’s employment will terminate at 11:59 p.m. on the Termination Date. |

| |

1.4 | All of Stephen’s balances, including Company stock, within any Company plan will be paid out in accordance with the provisions of each plan and Stephen’s valid elections under such plans. In addition, Stephen shall have all of his pre-existing rights with respect to stock options and restricted |

stock in accordance with the equity plans and granting agreements governing such equity. Following the Termination Date, Stephen will be provided with a summary of outstanding grants and post-termination exercise periods under those equity agreements.

1.5 Brady Australia will pay to Stephen:

| |

(a) | payment of $299,000/AUD, being 12 months of base salary with respect to redundancy, payable over the 12 months following the Termination Date in accordance with the usual payroll practices of Brady Australia, with the first such payment to be made on the first pay date after the Termination Date; |

| |

(b) | a payment of $100,000/AUD in recognition of Stephen’s work in connection with the divestiture of the Die Cut business; and, |

| |

(c) | all accrued annual and long service leave; |

in each case, subject to deduction of tax as an employment termination payment, and in the case of (a) on the basis applicable to redundancy.

1.6 Brady Australia will also provide to Stephen:

| |

(a) | 12 months of outplacement services not to exceed $10,000.00/AUD at an outplacement firm selected by Stephen and approved by Company ; and, |

| |

(a) | the option to retain his company computer/mobile phone/iPad fully wiped of all company-related data and information. |

| |

2 | Confidentiality and return of company property |

| |

2.1 | The parties specifically agree that the benefits provided under clause 1 fully satisfy any obligation Brady Australia or Brady Corporation may have to provide salary payments to Stephen under any Confidential Information or Non-Compete Agreement he may have signed. All Confidentiality, Non-Solicitation and Non-Compete restrictions and responsibilities to which Stephen will be subject after execution of this Agreement are set forth in this clause 2. |

| |

2.2 | In addition, and as further consideration for this Agreement, Stephen agrees to, understands and acknowledges the following: |

| |

(a) | during his employment with Brady Australia and Brady Corporation, he was provided with Confidential Information relating to the companies and their subsidiary and affiliated companies, and the business and clients of Brady Australia and Brady Corporation and their subsidiary and affiliated companies, the disclosure or misuse of which would cause severe and irreparable harm to them. |

| |

(b) | Stephen agrees that all Confidential Information is and will remain the sole and absolute property of Brady Australia and Brady Corporation respectively. |

| |

(c) | Upon the Termination Date, Stephen must immediately return to Brady Australia and Brady Corporation all documents and materials that contain or constitute Confidential Information, in any form whatsoever, including but not limited to, all copies, abstracts, electronic versions, and summaries thereof. |

| |

(d) | Stephen further agrees that, without the written approval of either Brady Australia or Brady Corporation, he will not disclose, use, copy or duplicate, or otherwise permit the use, disclosure, copying or duplication of any Confidential Information. Stephen agrees to take all reasonable steps and precautions to prevent any unauthorized disclosure, use, copying or duplication of Confidential Information. |

| |

(e) | For the purposes of this Deed, Confidential Information means any and all financial, technical, commercial or other information concerning the business and affairs of Brady Australia and Brady Corporation, or any of their subsidiary and affiliated companies, that is confidential and proprietary to Brady Australia or Brady Corporation, or any of their subsidiary and affiliated companies, including without limitation, |

(i) information relating to the past and existing customers and vendors and development of prospective customers and vendors, including specific customer product requirements, pricing arrangements, payments terms, customer lists and other similar information;

(ii) inventions, designs, methods, discoveries, works of authorship, creations, improvements or ideas developed or otherwise produced, acquired or used by either Brady Australia or Brady Corporation or any of their subsidiary or affiliated companies;

(iii) the proprietary programs, processes or software, including but not limited to, computer programs in source or object code and all related documentation and training materials, including all upgrades, updates, improvements, derivatives and modifications thereof and including programs and documentation in incomplete stages of design or research and development;

(iv) the subject matter of the patents, design patents, copyrights, trade secrets, trademarks, service marks, trade names, trade dress, manuals, operating instructions, training materials, and other industrial property, including such information in incomplete stages of design or research and development; and

(v) other confidential and proprietary information or documents relating to the products, business and marketing plans and techniques, sales and distribution networks and any other information or documents which Brady Australia or Brady Corporation or any of their subsidiary or affiliated companies protect as being confidential.

| |

(f) | Stephen further agrees that, without the written approval of the Board of Directors of either Brady Australia or Brady Corporation, he will not engage in any of the conduct described in subsection (i) below, either directly or indirectly, or as an employee, contractor, consultant, partner, officer, director or stockholder, other than a stockholder of less than 5% of the equities of a publicly traded corporation, or in any other capacity for any person, firm, partnership or corporation: |

(i) for a period of 12 months following the Termination Date, Stephen will not:

(A) perform duties as or for a Competitor that are the same as or similar to the duties performed by him for either Brady Australia or Brady Corporation at any time during any part of the 24 month period preceding the Termination Date; or

(B) participate in the inducement of or otherwise encourage employees, clients, or vendors of either Brady Australia or Brady Corporation or any of their subsidiary or affiliated companies to currently and/or prospectively breach, modify, or terminate any agreement or relationship they have or had with either of those companies during any part of the 24 month period preceding the Termination Date.

For purposes of this Agreement, a Competitor shall mean any corporation, person, firm or organization (or division or part thereof) engaged in or about to become engaged in research and development work on, or the production and/or sale of, any product or service anywhere in the world which is directly competitive with one with respect to which Stephen acquired Confidential Information by reason of his work with Brady Australia or Brady Corporation or any of their subsidiary or affiliated companies.

| |

(g) | Stephen acknowledges and agrees that compliance with this clause 2 is necessary to protect Brady Australia and Brady Corporation, and that a breach of any portion of this clause 2 will result in irreparable and continuing damage to Brady Australia and Brady Corporation for which there will be no adequate remedy at law, as the confidentiality of the information of which Stephen is aware is substantially indistinguishable from the personal skills, knowledge and ability he has developed in the course of his employment, and can be protected only by these restraints. In the event of a breach of this clause 2, or any part thereof, either Brady Australia or Brady Corporation, and their successors and assigns will be entitled to seek injunctive relief and to such other and further relief as is proper under the circumstances. Either Brady Australia or Brady Corporation may institute and prosecute proceedings in any Court of competent jurisdiction either in law or in equity to obtain damages for any such breach of this clause 2, or to enjoin Stephen from performing services in breach of this clause 2 during the term of employment and for a period of 12 months following the Termination Date. Stephen hereby agrees to submit to the jurisdiction of any Court of competent jurisdiction in any disputes that arise under this Agreement. If any such dispute is before a Court of competent jurisdiction in Australia, the law of New South Wales shall apply. |

| |

(h) | Stephen further agrees that, in the event of a breach of this paragraph 9, Brady Australia and Brady Corporation shall also be entitled to recover the value of any amounts previously paid or payable under this Agreement. |

| |

(i) | In case any one or more of the provisions of this clause 2 is found to be invalid, illegal or unenforceable in any respect, the validity, legality and enforceability of the remaining provisions will not be affected or impaired in any way. |

| |

(j) | STEPHEN HAS READ THIS CLAUSE 2 AND AGREES THAT THE CONSIDERATION PROVIDED IS FAIR AND REASONABLE AND FURTHER AGREES THAT GIVEN THE IMPORTANCE TO BRADY AUSTRALIA OR BRADY CORPORATION OF THEIR CONFIDENTIAL AND PROPRIETARY INFORMATION, THE FOREGOING RESTRICTIONS ON HIS ACTIVITIES ARE LIKEWISE FAIR AND REASONABLE. |

| |

3.1 | Stephen releases Brady Australia and Brady Corporation from all claims and liabilities related to the employment and the termination and this deed may be pleaded in bar to all such claims or liabilities, other than workers compensation claims or claims with respect to superannuation, or any action to enforce this deed. |

| |

4 | Confidentiality of this deed |

| |

4.1 | The parties agree that the terms of this deed and the negotiations which preceded it, are confidential and not to be disclosed to any other person without written agreement of the other party, other than for purposes of enforcement of this deed, or as required by law or for the purpose of obtaining professional legal or financial advice. |

| |

5.1 | Brady Australia and Brady Corporation each agrees that it will not make, nor knowingly authorise or allow its directors, officers, employees or agents to make, disparaging statements about Stephen to any other person. |

| |

5.2 | Stephen agrees that he will not make any disparaging statement about Brady Australia, Brady Corporation or their directors, officers, employees or agents to any other person. |

| |

6 | Independent legal advice |

| |

6.1 | Stephen acknowledges that he has had sufficient time to consider the terms of this deed, and the opportunity to obtain independent advice (legal, financial or otherwise) with respect to this deed. |

| |

7.1 | This deed and the rights and obligations of the parties are to be construed in accordance with the laws of the Commonwealth of Australia and the State of New South Wales. |

| |

8.1 | The provisions of this deed contain the entire agreement between the parties as to the subject matter of this deed. |

| |

9.1 | If any provision of this deed is found to be invalid or of no force or effect, then this deed is to be construed as if that provision is not in this deed but remainder of this instrument retains its full force and effect. |

10.1 This deed may be executed in counterparts and all counterparts taken together to constitute one document.

EXECUTED as a Deed

|

| | |

SIGNED, SEALED & DELIVERED by STEPHEN MILLAR in the presence of: |

| | |

/s/ G.D. Millar | | /s/ Stephen Millar |

Witness | | Stephen Millar |

|

| | |

SIGNED, SEALED & DELIVERED by Brady Australia Pty Ltd ACN 000 788 447 in accordance with the provisions of section 127 of the Corporations Act 2001: |

| | |

/s/ Esther Savvas | | /s/ Thomas J. Felmer |

Director/Secretary: Esther Savvas | | Director: Thomas Felmer |

|

| | |

SIGNED, SEALED & DELIVERED by Brady Corporation (a United States Corporation): |

| | |

/s/ Thomas J. Felmer | | |

Authorized Representative: Thomas Felmer | | |

EXHIBIT 99.1

For More Information:

Investor contact: Aaron Pearce 414-438-6895

Media contact: Carole Herbstreit 414-438-6882

Brady Corporation closes the second and final phase of the sale of its Die-Cut Business

MILWAUKEE (August 1, 2014)--Brady Corporation (NYSE: BRC) (“Brady”), a world leader in identification solutions, today announced that it has completed the second phase of the previously announced two-step divestiture of its European and Asian Die-Cut businesses to Boyd Corporation, a leading global provider of highly engineered, specialty material-based energy management and sealing solutions.

On February 24, 2014, Brady announced that it reached an agreement to sell its Die-Cut business to Boyd Corporation in a two-step process. The first step, which closed on May 1, 2014, involved the sale of the Die-Cut business with operations in Germany, Thailand, Korea, and Malaysia. The second step, which closed on August 1, 2014, involved the sale of the remaining portion of the Die-Cut business, with operations in the People’s Republic of China and associated global sales support. Aggregate cash proceeds received by the Company in connection with the sale of its Die-Cut business were approximately $60 million and are subject to customary final working capital and net cash adjustments.

About Brady Corporation

Brady Corporation is an international manufacturer and marketer of complete solutions that identify and protect premises, products and people. Brady’s products help customers increase safety, security, productivity and performance and include high-performance labels, signs, safety devices, printing systems and software. Founded in 1914, the company has a diverse customer base in electronics, telecommunications, manufacturing, electrical, construction, medical and a variety of other industries. Brady is headquartered in Milwaukee, Wisconsin and as of July 31, 2013, employed approximately 7,400 people in its worldwide businesses. Brady’s fiscal 2013 sales were approximately $1.15 billion. Brady stock trades on the New York Stock Exchange under the symbol BRC. More information is available on the Internet at www.bradycorp.com.

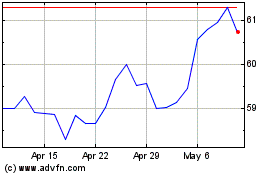

Brady (NYSE:BRC)

Historical Stock Chart

From Mar 2024 to Apr 2024

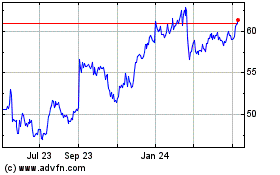

Brady (NYSE:BRC)

Historical Stock Chart

From Apr 2023 to Apr 2024