UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (date of earliest event reported) – July 31, 2014 (July 31, 2014)

COOPER-STANDARD HOLDINGS INC.

(Exact name of registrant as specified in its charter)

|

| | | | |

| | | | |

Delaware | | 000-54305 | | 20-1945088 |

(State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer Identification Number) |

|

| | | | |

| | | | |

39550 Orchard Hill Place Drive, Novi, Michigan | | 48375 |

(Address of principal executive offices) | | (Zip code) |

Registrant’s telephone number, including area code (248) 596-5900

Check the appropriate box below in the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (See General Instruction A.2 below):

|

| |

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4c)) |

Item 2.02 Results of Operations and Financial Condition.

On July 31, 2014, Cooper-Standard Holdings Inc. (the “Company”) issued a press release regarding its results of operations and financial condition for the second quarter ended June 30, 2014. The press release is attached hereto as Exhibit 99.1.

The information furnished pursuant to this Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

The following exhibit is furnished pursuant to Item 9.01 of Form 8-K:

99.1 Press release dated July 31, 2014.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

Cooper-Standard Holdings Inc.

|

| | |

| | |

| | /s/ Aleksandra A. Miziolek |

Name: | | Aleksandra A. Miziolek |

Title: | | Senior Vice President, General Counsel and Secretary |

Date:July 31, 2014

EXHIBIT INDEX

|

| | |

| | |

Exhibit

Number | | Exhibit Description |

| |

99.1 | | Press release dated July 31, 2014. |

| | |

Cooper Standard Reports Second Quarter 2014 Financial Results

- Sales Grew 9.3 Percent Year-Over-Year

- Adjusted EBITDA Margin Increased to 10.7 Percent

- Sale of Thermal and Emissions Product Line On Track

- 2014 Guidance Reaffirmed

NOVI, Mich., July 31, 2014 – Cooper-Standard Holdings Inc. (NYSE: CPS), the parent company of Cooper-Standard Automotive Inc. ("Cooper Standard" or "Company"), a leading global supplier of systems and components for the automotive industry, today announced financial results for the second quarter ended June 30, 2014. The Company also confirmed its previous financial guidance for the full year.

“We continue to successfully execute on our profitable growth strategy, as evidenced by delivering normalized financial performance and achieving double digit adjusted EBITDA margin,” said Jeffrey Edwards, chairman and CEO, Cooper Standard. “A key factor to our success this quarter was the team’s ability to address isolated operational challenges in North America and Europe. In addition to delivering strong financial results, we continue to establish our global footprint with manufacturing capacity in Eastern Europe and North America and opened a new Asia Pacific technical center and headquarters in Shanghai, China. Consistent with our commitment to focusing resources on our four core product groups in order to drive further ROIC improvements and grow long-term shareholder value, we are also on track to complete the sale of our Thermal and Emissions product line.”

Second Quarter and Six Months Ended June 30, 2014 Results

The Company reported revenue of $857.6 million for the second quarter of 2014, up 9.3% from $784.7 million for the second quarter of 2013. The increase in sales was favorably impacted by our increased volumes in North America, Europe and Asia Pacific, incremental sales related to the Jyco Sealing Technologies acquisition and favorable foreign exchange of $7.9 million. These items were partially offset by lower production volumes in South America and customer price concessions.

Gross profit for the quarter was $146.1 million, or 17.0 percent of sales, compared to $132.3 million, or 16.9 percent of sales, for the same period last year. The increase in gross profit was driven primarily by the favorable impact of continuous improvement savings and the increased volumes in North America, partially offset by customer price concessions, higher staffing costs and other operating expenses.

The Company reported net income of $13.2 million, or $0.72 per share on a fully diluted basis, in the second quarter of 2014, compared to $27.4 million, or $1.34 per share, in the second quarter of 2013. The current quarter included debt extinguishment costs of $18.8 million (after tax) related to the Company’s debt repurchase transactions that were completed in April. Adjusted for these debt extinguishment costs, Cooper Standard’s fully diluted earnings per share for the current quarter was $1.74. Net income for the six months ended June 30, 2014 was $32.9 million, or $51.8 million after adjustment for debt extinguishment costs of $18.9 million (after tax), compared to $48.1 million in the same prior year period.

Adjusted EBITDA for the second quarter was $91.8 million, or 10.7 percent of sales, compared to $82.5 million, or 10.5 percent of sales, in the same quarter last year.

2014 Guidance

The Company reaffirmed its full year guidance as previously provided on May 5, 2014. Assuming North American vehicle production volume of 17.0 million units, European vehicle production volume of 19.9 million units and an average full year exchange rate of 1 Euro = $1.37 and 1 Canadian dollar = $0.92, the Company expects:

| |

• | Consolidated Sales: $3.25 billion - $3.35 billion |

| |

• | Capital Expenditures: $195 million - $205 million |

| |

• | Cash Restructuring Expenses: $20 million - $30 million |

| |

• | Cash Taxes: $25 million - $35 million. |

Net Income to Adjusted EBITDA Reconciliation

The following table provides a reconciliation of EBITDA and adjusted EBITDA to net income, which is the most comparable U.S. GAAP financial measure:

Management considers EBITDA and adjusted EBITDA as key indicators of the Company's operating performance and believes that these and similar measures are widely used by investors, securities analysts and other interested parties in evaluating the Company's performance. Adjusted EBITDA is defined as net income adjusted to reflect income tax expense, interest expense net of interest income, depreciation and amortization, and certain non-recurring items that management does not consider to be reflective of the Company's core operating performance.

When analyzing the Company's operating performance, investors should use EBITDA and adjusted EBITDA in addition to, and not as alternatives for, net income, operating income, or any other performance measure derived in accordance with GAAP, or as an alternative to cash flow from operating activities as a measure of the Company's performance. EBITDA and adjusted EBITDA have limitations as analytical tools and should not be considered in isolation or as substitutes for analysis of the Company's results of operations as reported

under GAAP. Other companies may report EBITDA and adjusted EBITDA differently and therefore Cooper Standard's results may not be comparable to other similarly titled measures of other companies. In addition, in evaluating adjusted EBITDA, it should be noted that in the future Cooper Standard may incur expenses similar to or in excess of the adjustments in the above presentation. This presentation of adjusted EBITDA should not be construed as an inference that Cooper Standard's future results will be unaffected by unusual or non-recurring items.

Conference Call Details

Cooper Standard's will host a conference call and webcast on Friday, August 1 at 9 a.m. ET to discuss its second quarter 2014 results, provide a general business update and respond to investor questions.

An interactive webcast will also be available by clicking here.

To participate in the live question-and-answer session, callers in the United States and Canada should dial toll-free 800-949-4315 (international callers dial 678-825-8315) and provide the conference ID 63216159 or ask to be connected to the Cooper Standard teleconference. Callers should dial in at least five minutes prior to the start of the call. Financial and automotive analysts are invited to ask questions after the presentations are made.

Individuals unable to participate during the live teleconference or webcast may visit the investors' portion of the Cooper Standard website (http://www.ir.cooperstandard.com) for a webcast or podcast replay of the presentation.

About Cooper Standard

Cooper Standard, headquartered in Novi, Mich., is a leading global supplier of systems and components for the automotive industry. Products include sealing and trim, fuel and brake delivery, fluid transfer and anti-vibration systems. Cooper Standard employs more than 25,000 people globally and operates in 19 countries around the world. For more information, please visit www.cooperstandard.com.

Forward Looking Statements

This press release includes forward-looking statements as contemplated by the 1995 Private Securities Litigation Reform Act, reflecting management's current analysis and expectations, based on what are believed to be reasonable assumptions. The words "estimates," "expects," "anticipates," "projects," "plans," "intends," "believes," "forecasts" or future or conditional verbs, such as "will," "should," "could" or "may" and variations of such words or similar expressions are intended to identify forward-looking statements. Forward-looking statements are not guarantees of future results and may involve known and unknown risks and uncertainties that may cause actual results to differ materially from those projected, including, without limitation, the risks and uncertainties set forth in the Company's most recent Annual Report on the Form 10-K, subsequent Quarterly Reports on Form 10Q and other Securities and Exchange Commission filings. The forward-looking statements in this press release are made as of the date hereof and the Company does not assume any obligation to update, amend or clarify them to reflect events, new information or circumstances occurring after the date hereof.

CPS_F

Contact for Analysts:

Glenn Dong

Cooper Standard

(248) 596-6031

investorrelations@cooperstandard.com

Contact for Media:

Sharon Wenzl

Cooper Standard

(248) 596-6211

sswenzl@cooperstandard.com

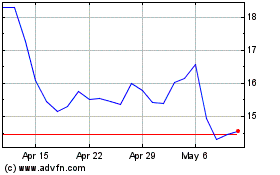

Cooper Standard (NYSE:CPS)

Historical Stock Chart

From Mar 2024 to Apr 2024

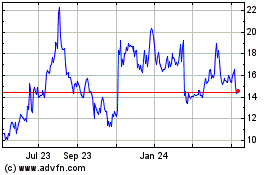

Cooper Standard (NYSE:CPS)

Historical Stock Chart

From Apr 2023 to Apr 2024