SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C INFORMATION

Information statement pursuant to Section 14(c) of the Securities Exchange Act of 1934

Check the appropriate box:

|

x

|

Preliminary Information Statement

|

|

|

|

|

o

|

Definitive Information Statement

|

|

o

|

Confidential, for Use of the Commission Only (as permitted by Rule 14c-5 (d)(2))

|

Legend Oil and Gas, Ltd.

(Exact Name of Registrant as Specified in Charter)

Payment of Filing Fee (Check the appropriate box):

|

o

|

No fee required.

|

|

|

|

|

o

|

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

|

|

|

|

|

|

|

1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

5)

|

Total fee paid:

|

|

o

|

Fee paid previously with preliminary materials.

|

|

|

|

|

o

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

2)

|

Form, Schedule or Registration Statement No:

|

|

|

|

|

|

|

3)

|

Filing Party:

|

|

|

|

|

|

|

4)

|

Date Filed:

|

Legend Oil & Gas, Ltd.

555 Northpoint Center East, Suite 400

Alpharetta, GA 30022

678-366-4400

July 22, 2014

This Information Statement is furnished by the Board of Directors of Legend Oil & Gas, Ltd., a Colorado corporation (the “Company”), to holders of record as of the close of business on June 23, 2014 (the “Stockholders”) of the Company’s common stock, $0.001 par value per share (the “Common Stock), pursuant to Section 14(c) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The purpose of this Information Statement is to inform our Stockholders that on July 25, 2014, the Company obtained the written consent of stockholders representing 53% of the voting rights of the Company common stock and preferred stock (the “Majority Stockholders”) approving an amendment to the Company’s Articles of Incorporation to effect an increase in the amount of authorized shares of Common Stock from 500,000,000 to 1,100,000,000 (the “Authorized Capital Increase”). Pursuant to Rule 14c-2 under the Exchange Act, the actions will not be effective, and a Certificate of Amendment to our Articles of Incorporation effectuating the Authorized Capital Increase, a copy of which is attached hereto as Exhibit A will not be filed with the Secretary of State for the State of Colorado, until at least twenty (20) days after the initial mailing of this Information Statement to the Stockholders

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

THIS IS NOT A NOTICE OF A SPECIAL MEETING OF STOCKHOLDERS AND NO STOCKHOLDER MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN. WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY

PLEASE NOTE THAT THE COMPANY’S CONTROLLING STOCKHOLDERS HAVE VOTED TO APPROVE THE AUTHORIZED CAPITAL INCREASE. THE NUMBER OF VOTES HELD BY THE STOCKHOLDERS EXECUTING THE WRITTEN CONSENT IS SUFFICIENT TO SATISFY THE STOCKHOLDER VOTE REQUIREMENT FOR THIS MATTER UNDER APPLICABLE LAW AND THE COMPANY’S CHARTER, SO NO ADDITIONAL VOTES WILL CONSEQUENTLY BE NEEDED TO APPROVE THESE ACTIONS.

No action is required by you. The accompanying information statement is furnished only to inform our stockholders of the actions described above before they take place in accordance with the requirements of United States federal securities laws. This Information Statement is being mailed on or about August 4, 2014, to all of the Company's stockholders of record as of the close of business on June 23, 2014.

By Order of the Board of Directors,

/s/ Marshall Diamond-Goldber

g

Marshall Diamond-Goldberg

Chairman of the Board of Directors

LEGEND OIL & GAS, LTD.

INFORMATION STATEMENT

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY

This Information Statement is furnished by the Board of Directors Legend Oil & Gas, Ltd., a Colorado (the “Company,” “we” or “us”) to the holders of record at the close of business on June 23, 2014 (the “Record Date”) of the Company’s outstanding common stock, par value $0.001 per share, pursuant to Rule 14c-2 of the Securities Exchange Act of 1934, as amended (the “Exchange Act” ), and pursuant Section 7-107 of the Colorado Corporation and Association Act.

The cost of furnishing this Information Statement will be borne by us. We will mail this Information Statement to registered stockholders and certain beneficial stockholders where requested by brokerage houses, nominees, custodians, fiduciaries and other like parties.

This Information Statement informs stockholders of the action taken and approved on June 23, 2014, by the Company’s Board of Directors and by the Company’s stockholders representing the voting rights of 53% of the Company’s common stock and preferred stock issued and outstanding on June 24, 2014 (the “Majority Stockholders”). The Company’s Board of Directors and the Majority Stockholders approved an amendment of the Company’s Articles of Incorporation to increase the number of authorized shares of capital stock of the Company from 500,000,000 shares of capital stock, par value $0.001 per share, to 1,100,000,000 shares of capital stock, par value $0.001 per share (the “Authorized Capital Increase”), of which 1,000,000,000 will be designated as common stock and 100,000,000 will be designated as blank check preferred stock.

Accordingly, all necessary corporate approvals in connection with the amendment to the Company’s Articles of Incorporation to effect the Authorized Capital Increase have been obtained. This Information Statement is furnished solely for the purpose of informing the Company’s stockholders, in the manner required under the Exchange Act of these corporate actions. Pursuant to Rule 14c-2 under the Exchange Act, the actions will not be effective and a Certificate of Amendment to our Articles of Incorporation effectuating the Authorized Capital Increase will not be filed with the Secretary of State for the State of Colorado, until at least twenty (20) days after the initial mailing of this Information Statement to the Company’s stockholders. Therefore, this Information Statement is being sent to you for informational purposes only.

THIS IS NOT A NOTICE OF A SPECIAL MEETING OF STOCKHOLDERS AND NO STOCKHOLDER MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN. WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY

The Company’s stockholders as of the Record Date will be furnished copies of this Information Statement. This Information Statement is first being mailed or furnished to our stockholders on or about August 4, 2014.

We have asked brokers and other custodians, nominees and fiduciaries to forward this Information Statement to the beneficial owners of our capital stock held of record and will reimburse such persons for out-of-pocket expenses incurred in forwarding such material.

INFORMATION STATEMENT COSTS

The entire cost of furnishing this Information Statement will be borne by the Company. We will request brokerage houses, nominees, custodians, fiduciaries and other like parties to forward this Information Statement to the beneficial owners of the Company’s common stock held of record by them and will reimburse such persons for their reasonable charges and expenses in connection therewith.

PLEASE NOTE THAT THE COMPANY’S CONTROLLING STOCKHOLDERS HAVE VOTED TO APPROVE THE AUTHORIZED CAPITAL INCREASE. THE NUMBER OF VOTES HELD BY THE STOCKHOLDERS EXECUTING THE CONSENT IS SUFFICIENT TO SATISFY THE STOCKHOLDER VOTE REQUIREMENT FOR SUCH MATTER UNDER APPLICABLE LAW AND THE COMPANY’S CHARTER, SO NO ADDITIONAL VOTES WILL BE NEEDED TO APPROVE THIS ACTION.

FORWARD-LOOKING STATEMENTS

Certain statements included in this Information Statement regarding the Company are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Exchange Act. This information may involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from the future results, performance or achievements expressed or implied by any forward-looking statements. Forward-looking statements, which involve assumptions and describe our future plans, strategies and expectations, are generally identifiable by use of the words “may,” “will,” “should,” “expect,” “anticipate,” “estimate,” “believe,” “intend” or “project” or the negative of these words or other variations on these words or comparable terminology. Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this Information Statement will in fact occur. We are not under any obligation, and we expressly disclaim any obligation, to update or alter any forward-looking statements, whether as a result of new information, future events or otherwise.

NOTICE OF ACTIONS TO BE TAKEN PURSUANT TO THE WRITTEN CONSENT OF STOCKHOLDERS HOLDING A MAJORITY OF THE OUTSTANDING SHARES OF COMMON STOCK OF THE COMPANY IN LIEU OF A SPECIAL MEETING OF THE STOCKHOLDERS, DATED JUNE 25, 2014.

TO OUR STOCKHOLDERS:

NOTICE IS HEREBY GIVEN that, on June 23, 2014, Legend Oil & Gas, Ltd., a Colorado corporation (the “Company”) obtained the unanimous written consent of its board of directors (“Board of Directors”) and, on June 25, 2014, the written consent of 5 stockholders representing 53% of the voting rights of the Company’s issued and outstanding common stock and preferred stock as of June 23, 2014 (the “Majority Stockholders”), approving an amendment of the Company’s Articles of Incorporation (the “Articles of Incorporation”) to increase the number of authorized shares of capital stock of the Company from 500,000,000 shares of capital stock, par value $0.001 per share, to 1,100,000,000 shares of capital stock, par value $0.001 per share (the “Authorized Capital Increase”).

OUTSTANDING SHARES AND VOTING RIGHTS

As of June 23, 2014 (the “Record Date”), the Company's authorized capitalization consisted of 400,000,000 shares of common stock, par value $0.001, of which 165,311,844 shares were issued and outstanding, and 100,000,000 shares of preferred stock, par value $0.001, of which 0 shares were issued and outstanding.

Each share of common stock of the Company entitles its holder to one vote on each matter submitted to the Company’s stockholders. As the Majority Stockholders have consented to the foregoing actions by resolution dated June 25, 2014, in lieu of a special meeting in accordance with Section 7-107-104 of the Colorado Corporation and Association Act and because the Majority Stockholders have sufficient voting power to approve such actions through their ownership of common stock and voting rights designated by ownership of preferred stock, no other stockholder vote will be solicited in connection with this Information Statement.

AMENDMENT TO THE COMPANY’S ARTICLES OF INCORPORATION

The Board of Directors and Majority Stockholders have approved an amendment to the Company’s Articles of Incorporation to effect the Authorized Capital Increase.

We intend to file a Certificate of Amendment (“Amendment”), a copy of which is attached hereto as Exhibit A, to our Articles of Incorporation with the Secretary of State for the State of Colorado effectuating the above action. Pursuant to Rule 14c-2 under the Exchange Act, the actions will not be effective, and the Amendment will not be filed, until at least twenty (20) days after the initial mailing date of this Information Statement to the Company’s stockholders. It is presently contemplated that such mailing will be made on or about August 4, 2014.

The Authorized Capital Increase

The purpose of the Authorized Capital Increase is to increase the number of shares of the Company’s common stock available for issuance to investors, or held in reserve for investors for potential future issuance, who agree to provide the Company with the funding it requires to continue its operations, and/or to persons in connection with potential acquisition transactions, warrant or option exercises and other transactions under which the Company’s Board of Directors may determine is in the best interest of the Company and its stockholder to issue shares of common stock.

As of the date of this Information Statement, the Company has identified certain investors who have or would be willing to enter into agreements relating to actual or potential investment in the Company. Futhermore, the Company has contractual obligations to maintain certain reserve levels for specific investments, which obligations we may not be able to meet if we don’t undertake the Authorized Capital Increase. In particular, existing investors may require an increase in existing reserves upon the completion of the Authorized Capital Increase. This does not necessarily mean that any or all of shares will be issued, but rather that such shares are held aside in the event they are required to satisfy obligations under their debt structures.

As of the date of this Information Statement, the Company has not entered into any agreements relating to an acquisition of another specified company or specific assets of another specified company, pursuant to which the Company will issue shares of its common stock.

The Authorized Capital Increase will not have any immediate effect on the rights of existing stockholders, but may have a dilutive effect on the Company’s existing stockholders when additional shares are issued.

Potential Anti-Takeover Aspects and Possible Disadvantages of Shareholder Approval of the Increase

The increase in the authorized number of shares of Common Stock could have possible anti-takeover effects. These authorized but unissued shares could (within the limits imposed by applicable law) be issued in one or more transactions that could make a change of control of the Company more difficult, and therefore more unlikely. The additional authorized shares could be used to discourage persons from attempting to gain control of the Company by diluting the voting power of shares then outstanding or increasing the voting power of persons that would support the Board of Directors in a potential takeover situation, including by preventing or delaying a proposed business combination that is opposed by the Board of Directors although perceived to be desirable by some shareholders. The Board of Directors does not have any current knowledge of any credible effort by any third party to accumulate our securities or obtain control of the Company by means of a merger, tender offer, solicitation in opposition to management or otherwise.

While the Authorized Capital Increase may have anti-takeover ramifications, our Board of Directors believes that the financial flexibility offered by the Authorized Capital Increase outweighs any disadvantages. To the extent that the Authorized Capital Increase may have anti-takeover effects, the Authorized Capital Increase may encourage persons seeking to acquire our Company to negotiate directly with the Board of Directors enabling the Board of Directors to consider the proposed transaction in a manner that best serves the shareholders’ interests.

Effective Date of Amendment

Pursuant to Rule 14c-2 under the Exchange Act, the Authorized Capital Increase will not be effective, until at least twenty (20) days after initial date on which this Information Statement is mailed to

the Company’s stockholders. The Company anticipates that this Information Statement will be mailed to our stockholders on or about August 4, 2014. Therefore, the Company anticipates that the Authorized Capital Increase will be effective, and the Amendment to our Articles of Incorporation will be filed with the Secretary of State for the State of Colorado, on or about August 25, 2014.

The Company has asked brokers and other custodians, nominees and fiduciaries to forward this Information Statement to the beneficial owners of the Company’s common stock and will reimburse such persons for out-of-pocket expenses incurred in forwarding such material.

No Dissenter’s Rights

Under the Colorado Corporation and Association Act, our dissenting shareholders are not entitled to appraisal rights with respect to the Authorized Capital Increase, and we will not independently provide our shareholders with such right.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following tables set forth information with respect to the beneficial ownership of our Common Shares as of June 23, 2014 by our directors, named executive officers, and directors and executive officers as a group, as well as each person (or group of affiliated persons) who is known by us to beneficially own 5% or more of our Common Shares. As of the latest practical date before filing this annual report, there were 165,311,844 Common Shares issued and outstanding.

The percentages of Common Shares beneficially owned are reported on the basis of regulations of the Securities and Exchange Commission governing the determination of beneficial ownership of securities. Under the rules of the Securities and Exchange Commission, a person is deemed to be a beneficial owner of a security if that person has or shares voting power, which includes the power to vote or to direct the voting of the security, or investment power, which includes the power to dispose of or to direct the disposition of the security. To our knowledge, unless indicated in the footnotes to the table, each beneficial owner named in the tables below has sole voting and sole investment power with respect to all shares beneficially owned.

|

Title of Class

|

|

Name of Beneficial Owner

|

|

Amount and Nature of Beneficial Ownership

|

|

|

Percent of Class

|

|

|

Common stock, par value $0.001

|

|

Marshall Diamond-Goldberg (1)

Director and Chief Executive Officer

555 Northpoint Center East, Suite 400

Alpharetta, GA 30022

|

|

|

28,653,245

|

|

|

|

33

|

%

|

|

Common stock, par value $0.001

|

|

Hillair Capital Investments, LP (2)

c/o Hillair Capital Management LLC

330 Primrose Rd, Ste. 660

Burlingame, CA 94010

|

|

|

4,155,998

|

|

|

|

5

|

%

|

|

Common stock, par value $0.001

|

|

Wi2Wi Corporation (2)

132 Simonston Blvd.

Thomhill Ontario, Canada

L3T 4L8

|

|

|

21,350,247

|

|

|

|

24

|

%

|

|

Common stock, par value $0.001

|

|

Northpoint Energy Partners, LLC (2), (3)

555 Northpoint Center East, Suite 400

Alpharetta, GA 30022

|

|

|

16,263,333

|

|

|

|

19

|

%

|

|

Common stock, par value $0.001

|

|

James Vandeberg

Former Officer and Director

1218 Third Avenue, Suite 505

Seattle, WA 98101

|

|

|

17,516,679

|

|

|

|

20

|

%

|

|

TOTAL:

|

|

|

|

|

87,939,502

|

|

|

|

|

|

|

(1)

|

Mr. Diamond-Goldberg beneficially owns these shares through Marlin Consulting Corp., of which he is the sole shareholder.

|

|

(2)

|

The information for such shareholders are based on the list of record holders maintained by our stock transfer agent. Such shareholder has not filed a Schedule 13D with the SEC disclosing its greater than five percent ownership.

|

(3) Mr. Andrew Reckles, our Chief Restructuring Officer, is a member of Northpoint Energy Partners, LLC and may have voting power of these shares in accordance with Section 16 of the Securities Act of 1934.

We know of no arrangements, including pledges, by or among any of the forgoing persons, the operation of which could result in a change of control.

VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF

As of June 23, 2014, there were 165,311,844

shares of the Company’s common stock issued and outstanding and 0 shares of the Company’s preferred stock outstanding. Each holder of common stock is entitled to one vote per share.

The Majority Stockholders, as stockholders holding in the aggregate 87,939,502 shares of common stock of the Company and 0 shares of the preferred stock of the Company, which combined represents 53% of the voting power of our outstanding shares of common stock, have approved the Authorized Capital Increase by written consent dated June 25, 2014.

VOTING PROCEDURES

Pursuant to the Colorado Corporation and Association Act, and our Articles of Incorporation, the affirmative vote of the holders of a majority of the Company’s voting power is sufficient to amend our Articles of Incorporation, which vote was obtained by the written consent of the Majority Stockholders as described herein. As a result, the amendment to our Articles of Incorporation has been approved and no further votes will be needed.

INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON

The Company currently has one director, Chief Executive Officer, Mr. Marshall Diamond-Goldberg. As of the latest practical date before this filing, Mr. Diamond-Goldberg, through Marlin Consulting Corp., of which he is the sole shareholder, owns 28,653,245 shares of common stock. Mr. Diamond-Goldberg’s business address is that of the Company. He has not been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors) during the past ten years.

Mr. James Vandeberg served as Director and Chief Financial Officer of the Company from May 2010 and May 2013, respectively, until his resignation from both positions on July 2, 2014. As of the latest practical date before this filing, Mr. Vandeberg owns 17,516,679 shares of common stock. Mr. Vandeberg’s business address is 1218 Third Avenue, Suite 505, Seattle, WA 98101. He has not been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors) during the past ten years.

Mr. Andrew Reckles was appointed Chief Restructuring Officer of the Company on May 20, 2014. As of the latest practical date before this filing, Mr. Reckles, through Northpoint Energy Partners, LLC (“Northpoint”), of which he a member, owns 16,263,333

shares of common stock. Mr. Reckles’s business address is that of the Company. He has not been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors) during the past ten years.

On October 7, 2013, the Company entered into a consulting agreement with Northpoint for financial consulting services in respect to certain developments and ad hoc projects of the Company. In connection with this agreement, the Company has issued Northpoint approximately 4,763,333 shares of restricted common stock of the Company and, to date, has paid them fees based on (i) a temporary 2.0% non-operating overriding royalty interest in the Piqua region of the state of Kansas (property currently owned by the Company) and (ii) a financing consulting fee equal to 2% of the gross amount of capital raised by the Company for any financing which the Company undertakes and completes during the term of the Northpoint engagement in connection with the SPA and July and November 2013 Agreements referenced above under Item 3.02. Northpoint will also receive a 1.5% non-operating, overriding royalty on any asset or property that the Company acquires during the term of the Northpoint engagement that they advise on, performs diligence, and/or introduces to the Company.

Mr. Warren Binderman was appointed as Chief Financial Officer of the Company on July 2, 2014. As of the latest practical date before this filing, Mr. Binderman owns 0 shares of common stock. He has not been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors) during the past ten years.

During the past year, Messrs. Diamond-Goldberg, Vandeberg, Reckles and Binderman have not been a party to any contract, arrangements or understandings with any person with respect to any securities of the registrant, including, but not limited to joint ventures, loan or option arrangements, puts or calls, guarantees against loss or guarantees of profit, division of losses or profits, or the giving or withholding of proxies. Furthermore, Messrs. Diamond-Goldberg, Vandeberg, Reckles and Binderman do not have any arrangements or understandings with any person with respect to any future employment by the registrant or its affiliates; or with respect to any future transactions to which the registrant or any of its affiliates will or may be a party.

Mr. Kyle Severson served as Chief Financial Officer of the Company from July 2012, until his resignation in May 2013. As of the latest practical date before this filing, Mr. Severson owns 0 shares of common stock.

WHERE YOU CAN OBTAIN ADDITIONAL INFORMATION

The Company is subject to the informational requirements of the Exchange Act, and in accordance therewith files reports, proxy statements and other information including annual and quarterly reports on Form 10-K and 10-Q with the Commission. Reports and other information filed by the Company can be inspected and copied at the public reference facilities maintained at the Commission at 100 F Street NW, Washington, D.C. 20549. Copies of such material can be obtained upon written request addressed to the Commission, Public Reference Section, 100 F Street NW, Washington D.C. 20549, at prescribed rates. The Commission maintains a website on the Internet (http://www.sec.gov) that contains the filings of issuers that file electronically with the Commission through the EDGAR system. Copies of such filings may also be obtained by writing to the Company at Legend Oil & Gas, Ltd., 555 Northpoint Center East, Suite 400, Alpharetta, GA 30022.

STOCKHOLDERS SHARING AN ADDRESS

Unless we have received contrary instructions from a stockholder, we are delivering only one Information Statement to multiple stockholders sharing an address. We will, upon request, promptly deliver a separate copy of this Information Statement to a stockholder who shares an address with another stockholder. A stockholder who wishes to receive a separate copy of the Information Statement may make such a request in writing to the Company at Legend Oil & Gas, Ltd., 555 Northpoint Center East, Suite 400, Alpharetta, GA 30022.

On behalf of the Board of Directors,

/s/ Marshall Diamond-Goldber

g

Marshall Diamond-Goldberg

Chairman of the Board of Directors

July 22, 2014

Exhibit A

Certificate of Amendment to Articles of Incorporation

The Capital Stock section of the Articles of Incorporation is hereby amended by deleting in its entirety and inserting in lieu thereof the following:

“The aggregate number of shares which this Corporation shall have the authority to issue is: 1,100,000,000 shares of $0.001 par value each, which shares are designated “Common Stock”; and 100,000,000 shares of $0.001 par value each, which shares are designated “Preferred Stock” and which may be issued in one or more classes or series, which such rights, preferences, privileges and restrictions as will be fixed at the discretion of the Board of Directors.”

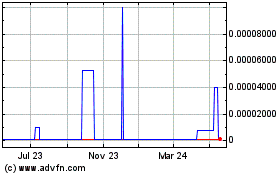

Legend Oil and Gas (CE) (USOTC:LOGL)

Historical Stock Chart

From Mar 2024 to Apr 2024

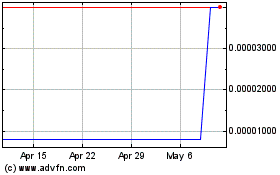

Legend Oil and Gas (CE) (USOTC:LOGL)

Historical Stock Chart

From Apr 2023 to Apr 2024