Current Report Filing (8-k)

July 22 2014 - 5:17PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 22, 2014

|

|

|

(Exact name of registrant as specified in its charter)

|

| |

|

|

|

|

|

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

| |

|

|

477 Rosemary Ave. Ste. 219

West Palm Beach, FL

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: (561) 465-0030

|

|

|

(Former name or former address, if changed since last report.)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

x Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

On July 22, 2014, Forward Industries, Inc. (“Forward” or the “Company”) issued a press release announcing that it has filed a lawsuit against Terence Bernard Wise, a director of the Company, and his long-time business partner, Jenny P. Yu, alleging multiple violations of federal securities laws, including the filing of deceptive and deficient Schedules 13D and proxy solicitation materials with the Securities and Exchange Commission.

The press release also discusses the lawsuit filed by Mr. Wise in a New York State Court against the five members of the Board comprising the Special Committee, seeking a temporary restraining order and an injunction that would prevent a majority of the Board from voting on proposals to raise capital or engage in any extraordinary transactions. The Court declined to issue a restraining order, did not schedule a hearing on Mr. Wise’s proposed preliminary injunction, and expressed strong skepticism about the relief requested by Mr. Wise.

The foregoing description is qualified in its entirety by reference to the above-referenced press release, which is incorporated herein by reference.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits.

|

99.1

|

|

Press Release dated July 22, 2014 (filed herewith).

|

Forward Looking Statements

This Current Report on Form 8-K contains certain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that reflect the Company’s current expectations and projections about its future results, performance, prospects and opportunities. The Company has tried to identify these forward-looking statements by using words such as “may,” “should,” “expect,” “hope,” “anticipate,” “believe,” “intend,” “plan,” “estimate” and similar expressions. These forward-looking statements are based on information currently available to the Company and are subject to a number of risks, uncertainties and other factors that could cause its actual results, performance, prospects or opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. No assurance can be given that the actual results will be consistent with the forward-looking statements. Investors should read carefully the factors described in the “Risk Factors” section of the Company’s filings with the SEC, including the Company’s Form 10-K for the year ended September 30, 2013 for information regarding risk factors that could affect the Company’s results. Except as otherwise required by Federal securities laws, the Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changed circumstances or any other reason.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

FORWARD INDUSTRIES, INC |

|

|

Dated: July 22, 2014

|

By:

|

|

|

| |

|

Name:

|

Robert Garrett

|

|

| |

|

Title:

|

Chief Executive Officer

|

|

Exhibit 99.1

Forward Industries Files Lawsuit Against Terence Wise and Jenny Yu Seeking Declaratory and Injunctive Relief and Alleging Violations of U.S. Securities Laws

Court Rejects Baseless Wise Application for Temporary Restraining Order

WEST PALM BEACH, Fla., July 22, 2014 /PRNewswire/ -- Forward Industries, Inc. (NASDAQ: FORD), a designer and distributor of custom carry and protective solutions, announced today that it has filed a lawsuit in the U.S. District Court for the Southern District of New York against Terence Bernard Wise, a director of Forward, and his long-time business partner, Jenny P. Yu, alleging multiple violations of federal securities laws, including the filing of deceptive and deficient Schedules 13D and proxy solicitation materials with the Securities and Exchange Commission (“SEC”). In its complaint, Forward alleges that Mr. Wise and Ms. Yu have been acting as an undisclosed “group” in connection with their involvement in Mr. Wise’s bid to replace the Board of Directors of Forward (the “Board”) with his hand-picked designees. The suit alleges, among other things, that:

|

|

·

|

Mr. Wise and Ms. Yu each violated Section 13(d) of the Securities Exchange Act of 1934 (the “Exchange Act”) by improperly failing to report their beneficial ownership of Forward stock and plans and activities as a “group” in their respective Schedule 13D filings;

|

|

|

·

|

Mr. Wise violated Section 14(a) of the Exchange Act, including the anti-fraud provisions thereunder, by improperly failing to disclose in his proxy solicitation materials the identity of Ms. Yu, her ownership of Forward stock and that she and Mr. Wise are members of a “group” within the meaning of the securities laws;

|

|

|

·

|

Ms. Yu improperly acquired Forward stock while in possession of material non-public information about the Company that she obtained while attending Board meetings and in her capacity as Managing Director of the Company’s exclusive sourcing vendor; and

|

|

|

·

|

The purported notices of director nominations provided by Mr. Wise do not comply with the advance notice of nomination requirements contained in Forward’s bylaws as they do not disclose his arrangements and understandings with Ms. Yu with respect to their “group” activities or their beneficial ownership of Forward stock, and are therefore invalid.

|

As previously announced, on June 6, 2014, Mr. Wise chose to launch a costly and disruptive proxy contest to replace a majority of the entire Board at the 2014 Annual Meeting of Shareholders. Since then, Mr. Wise has stepped up his campaign to replace the Board with his hand-picked designees. On June 26, 2014, Mr. Wise submitted a second nomination letter purporting to nominate an additional three director candidates. Instead of seeking to elect a majority-slate, Mr. Wise now seeks to replace the entire Board with himself and his designees.

Frank LaGrange Johnson, Chairman of the Board of Forward and a member of the Special Committee of the Board that is evaluating Mr. Wise’s purported nominations, commented: “The Special Committee believes Mr. Wise and Ms. Yu have been misleading in their filings with the SEC and in Mr. Wise’s communications with shareholders. We are fully committed to aggressively pursuing this legal action in order to protect the interests of all Forward shareholders.”

Forward’s lawsuit seeks injunctive and declaratory relief, among other things, directing Mr. Wise and Ms. Yu to comply with the federal securities laws.

Groundless Wise Lawsuit

Forward also commented today on the lawsuit filed by Mr. Wise in a New York State Court against the five members of the Board comprising the Special Committee, seeking a temporary restraining order (“TRO”) and an injunction that would prevent a majority of the Board from voting on proposals to raise capital or engage in any extraordinary transactions. The Special Committee believes that Mr. Wise’s lawsuit is a frivolous and ill-advised effort to usurp the Board’s authority without a shareholder vote.

Last week, Forward’s lawyers appeared in court in opposition to Mr. Wise’s request for a TRO. The Court declined to issue a restraining order, did not schedule a hearing on Mr. Wise’s proposed preliminary injunction, and expressed strong skepticism about the relief requested by Mr. Wise. Yesterday, the members of the Special Committee filed with the Court an Answer denying Mr. Wise’s claims.

Mr. Johnson commented on behalf of the Special Committee: “We are extremely disappointed that Mr. Wise has chosen to resort to meritless litigation. We believe Mr. Wise’s lawsuit is not in the best interests of shareholders and serves no purpose other than to perpetuate his scorched-earth campaign to elect his dissident slate. While Mr. Wise claims to be suing on behalf of the Company, he is really representing his own interests and those of his company, which enjoys a multi-million dollar sourcing contract with Forward, and not those of the shareholders. The Section 13(d) disclosure laws were specifically designed to protect shareholders from undisclosed ‘groups’ surreptitiously accumulating significant positions in companies without disclosing their true intent.”

The members of the Special Committee intend to vigorously defend themselves and to continue their efforts to maximize value for all shareholders, including but not exclusively Mr. Wise and Ms. Yu, through Forward’s carefully planned growth strategy that balances organic and merger related opportunities.

Note Regarding Forward-Looking Statements

In addition to the historical information contained herein, this press release contains certain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that reflect the Company’s current expectations and projections about its future results, performance, prospects and opportunities. The Company has tried to identify these forward-looking statements by using words such as “may,” “should,” “expect,” “hope,” “anticipate,” “believe,” “intend,” “plan,” “estimate” and similar expressions. These forward-looking statements are based on information currently available to the Company and are subject to a number of risks, uncertainties and other factors that could cause its actual results, performance, prospects or opportunities to differ materially from those expressed in, or implied by, these forward-looking statements. No assurance can be given that the actual results will be consistent with the forward-looking statements. Investors should read carefully the factors described in the “Risk Factors” section of the Company’s filings with the SEC, including the Company’s Form 10-K for the year ended September 30, 2013 for information regarding risk factors that could affect the Company’s results. Except as otherwise required by Federal securities laws, the Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changed circumstances or any other reason.

About Forward Industries

Incorporated in 1962, and headquartered in West Palm Beach, Florida, Forward Industries is a global designer and distributor of mobile device cases and accessories. Forward’s products can be viewed online at www.forwardindustries.com.

Additional Information and Where To Find It

In connection with the proxy contest initiated by Mr. Wise, the Company will be filing documents with the SEC, including the filing by the Company of a Proxy Statement. Shareholders are urged to read the Proxy Statement for the 2014 Annual Meeting of Shareholders when it becomes available, as well as other documents filed with the SEC, because they will contain important information. The final Proxy Statement will be mailed to shareholders of the Company. Shareholders may obtain free copies of these documents (when they are available) and other documents filed with the SEC at (www.sec.gov) or by contacting the Company at (561) 465-0030.

Participants in the Solicitation of Proxies

The following directors and executive officers of Forward Industries may be deemed to be participants in the solicitation of proxies from shareholders in connection with the Company’s 2014 Annual Meeting of Shareholders (each individual’s beneficial ownership of shares of Common Stock of the Company is set forth in the parenthetical opposite his name): Robert Garrett, Jr. (401,157 shares), James O. McKenna III (176,953 shares), Frank LaGrange Johnson (202,855 shares), Owen P.J. King (45,000 shares), John F. Chiste (45,000 shares) and Timothy Gordon (113,427 shares). Shareholders are advised to read the Company’s Proxy Statement for the 2014 Annual Meeting of Shareholders and other relevant documents when they become available, because they will contain important information. You can obtain free copies of these documents from the Company as described above.

Contact:

MacKenzie Partners, Inc.

Larry Dennedy

Laurie Connell

(212) 929-5500

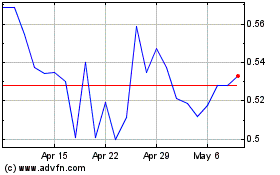

Forward Industries (NASDAQ:FORD)

Historical Stock Chart

From Mar 2024 to Apr 2024

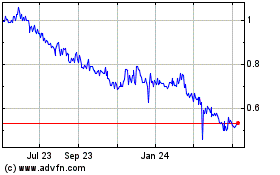

Forward Industries (NASDAQ:FORD)

Historical Stock Chart

From Apr 2023 to Apr 2024