Current Report Filing (8-k)

June 18 2014 - 8:01AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event

reported): June 15, 2014

NEKTAR THERAPEUTICS

(Exact Name of Registrant as Specified

in Charter)

| Delaware |

0-24006 |

94-3134940 |

| (State or Other Jurisdiction |

(Commission |

(IRS Employer |

| of Incorporation) |

File Number) |

Identification No.) |

455 Mission Bay Boulevard South

San Francisco, California 94158

(Address of Principal Executive Offices

and Zip Code)

Registrant’s telephone number, including

area code: (415) 482-5300

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

On June 15, 2014, Nektar Therapeutics (“Nektar”)

received a $19.75 million payment pursuant to the License, Manufacturing and Supply Agreement, dated September 30, 2006 (the “Nektar

Agreement”), by and between Nektar and Ophthotech Corporation (“Ophthotech,” which is a successor party to (OSI)

Eyetech, Inc.). Under the Nektar Agreement, Ophthotech received a worldwide, exclusive license to certain of Nektar’s proprietary

PEGylation technology to develop, manufacture and sell Fovista®. On May 19, 2014, Ophthotech entered into a Licensing

and Commercialization Agreement (the “Novartis Agreement”) with Novartis Pharma AG for Fovista®. Novartis paid

Ophthotech a $200 million upfront fee pursuant to the Novartis Agreement. Under the Nektar Agreement, Ophthotech paid Nektar the

$19.75 million payment based on the upfront fee received by Ophthotech. Nektar is entitled to up to $9.5 million in additional

payments based upon Ophthotech’s potential achievement of certain regulatory and sales milestones. Nektar is also entitled

to low- to mid- single-digit royalties on net sales of Fovista® that vary based on sales levels. Nektar’s right to receive

royalties in any particular country will expire upon the later of ten years after first commercial sale of Fovista® or expiration

of patent rights in the particular country. Under the Nektar Agreement, Nektar is the exclusive supplier of all of Ophthotech’s

clinical and commercial requirements of Nektar’s proprietary PEGylation reagent used in Fovista®.

SIGNATURES

Pursuant to the requirement of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

By: |

/s/ Gil M. Labrucherie |

| |

|

Gil M. Labrucherie |

| |

|

General Counsel and Secretary |

| |

|

|

| |

Date: |

June 17, 2014 |

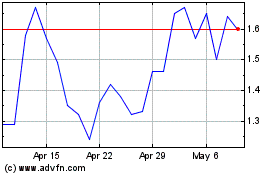

Nektar Therapeutics (NASDAQ:NKTR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nektar Therapeutics (NASDAQ:NKTR)

Historical Stock Chart

From Apr 2023 to Apr 2024