UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 6, 2014

PROVECTUS BIOPHARMACEUTICALS, INC.

(Exact name of registrant as specified in charter)

|

|

|

|

|

| Delaware |

|

001-36457 |

|

90-0031917 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

7327 Oak Ridge Hwy., Knoxville, Tennessee 37931

(Address of Principal Executive Offices)

(866) 594-5999

(Registrant’s Telephone Number, Including Area Code)

(Former Name or Former Address, If Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 1.01. |

Entry Into a Material Definitive Agreement. |

On June 6, 2014, Provectus

Biopharmaceuticals, Inc. (the “Company”), in its capacity as a nominal defendant, entered into a Stipulated Settlement Agreement and Mutual Release (the “Settlement”) in the shareholder derivative action filed in the Circuit

Court for the State of Tennessee, Knox County (the “Court”), against H. Craig Dees, Timothy C. Scott, Eric A. Wachter, and Peter R. Culpepper (collectively, the “Executives”), Stuart Fuchs, Kelly M. McMasters, and

Alfred E. Smith, IV (collectively, together with the Executives, the “Individual Defendants”), and against the Company as a nominal defendant (the “Shareholder Derivative Lawsuit”). In addition to the Company and the Individual

Defendants, plaintiffs Glenn Kleba and Don B. Dale are parties to the Settlement.

By entering into the Settlement, the settling parties

have resolved the derivative claims to their mutual satisfaction. The Individual Defendants have not admitted the validity of any claims or allegations and the settling plaintiffs have not admitted that any claims or allegations lack merit or

foundation. Under the terms of the Settlement, (i) the Executives each agreed (A) to re-pay to the Company $2.24 Million of the cash bonuses they each received in 2010 and 2011, which amount equals 70% of such bonuses or an estimate of the

after-tax net proceeds to each Executive; provided, however, that subject to certain terms and conditions set forth in the Settlement, the Executives are entitled to a 2:1 credit such that total actual repayment may be $1.12 Million each;

(B) to reimburse the Company for 25% of the actual costs, net of recovery from any other source, incurred by the Company as a result of the Shareholder Derivative Lawsuit; and (C) to grant to the Company a first priority security interest

in 1,000,000 shares of the Company’s common stock owned by each such Executive to serve as collateral for the amounts due to the Company under the Settlement; (ii) Drs. Dees and Scott and Mr. Culpepper agreed to retain incentive stock

options for 100,000 shares but shall forfeit 50% of the nonqualified stock options granted to each such Executive in both 2010 and 2011. The Settlement also requires that each of the Executives enter into new employment agreements with the Company,

which were entered into on April 28, 2014, and that the Company adhere to certain corporate governance principles and processes in the future. Under the Settlement, Messrs. Fuchs and Smith and Dr. McMasters have each agreed to pay the

Company $25,000 in cash, subject to reduction by such amount that the Company’s insurance carrier pays to the Company on behalf of such defendant pursuant to such defendant’s directors and officers liability insurance policy. The

Settlement also provides for an award to plaintiffs’ counsel of attorneys’ fees and reimbursement of expenses in connection with their role in this litigation, subject to Court approval.

The Settlement remains subject to approval by the Court and a settlement hearing. The hearing on the terms of the proposed Settlement will be

held on July 24, 2014 at 1:30 P.M. Eastern Time to determine whether: (1) if the terms and conditions of the Settlement are fair, reasonable and adequate and in the best interest of the Company and its shareholders, (2) if the

judgment, as provided for in the Settlement, should be entered, and (3) if the request of plaintiff’s counsel for an award of attorneys’ fees and reimbursement of expenses should be granted and, if so, in what amount or, if any

agreement reached regarding the amount of such fees and expenses should be approved.

| Item 7.01. |

Regulation FD Disclosure. |

On June 12, 2014, Provectus Biopharmaceuticals, Inc.

(the “Company”) issued a press release announcing that it would hold a conference call on Thursday, June 19, 2014 to discuss the outline of the Company’s proposed Phase 3 study of the Company’s oncology drug candidate PV-10

in the treatment of melanoma as well as developments in the use of PV-10 in other cancer indications and to discuss the Company’s dermatological drug candidate PH-10. A copy of the Company’s press release is attached hereto as Exhibit 99.1

and is incorporated herein by reference.

| Item 9.01. |

Financial Statements and Exhibits. |

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 99.1 |

|

Press Release, dated June 12, 2014 |

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date: June 12, 2014

|

|

|

| PROVECTUS BIOPHARMACEUTICALS, INC. |

|

|

| By: |

|

/s/ Peter R. Culpepper |

|

|

Peter R. Culpepper Chief Financial Officer

and Chief Operating Officer |

3

Exhibit 99.1

|

|

|

| Contact: Provectus Biopharmaceuticals, Inc.

Peter R. Culpepper, CFO, COO Phone: 866-594-5999 #30 |

|

Porter, LeVay & Rose, Inc.

Marlon Nurse, DM, SVP – Investor Relations Phone:

212-564-4700 Bill Gordon – Media Relations Phone:

212-724-6312 |

PROVECTUS BIOPHARMACEUTICALS TO DISCUSS OUTLINE OF PHASE 3 CLINICAL TRIAL OF PV-10 TO TREAT MELANOMA ON

CONFERENCE CALL

Management Will Also Discuss Access to ASCO-Presented Phase 2 Melanoma Data, Developments in Other Cancer

Indications and in PH-10 Use

Call Scheduled for Thursday, June 19, 2014 at 4 pm Eastern Daylight Time

KNOXVILLE, TN, June 12, 2014— Provectus Biopharmaceuticals, Inc. (NYSE MKT: PVCT), (http://www.pvct.com), a development-stage oncology and

dermatology biopharmaceutical company, announced today that it will hold a conference call on Thursday, June 19, 2014, at 4 pm Eastern Daylight Time.

Management will discuss the outline of the Company’s proposed Phase 3 study of PV-10 in the treatment of melanoma, developments in the use of PV-10 in

other cancer indications, as well as PH-10 and news regarding its use. Management will also discuss its potential plans to monetize its PV-10 and PH-10 assets with various contemplated license and co-development transactions.

In addition, summary data from the PV-10 Phase 2 melanoma study is expected to be available on clinicaltrials.gov prior to the conference call.

Conference Call Thursday, June 19, 2014, at 4 PM EDT

The management of Provectus Biopharmaceuticals, Inc. will host a conference call Thursday, June 19, 2014 at 4 PM Eastern. Those who wish to participate in

the conference call may telephone 877-407-4019 from the U.S. International callers may telephone 201-689-8337 approximately 15 minutes before the call. A webcast will also be available at www.pvct.com.

A digital replay will be available by telephone approximately two hours after the completion of the call until August 19, 2014, and may be accessed by

dialing 877-660-6853 from the U.S. or 201-612-7415 for International callers, and using the Conference ID#13584727.

About Provectus Biopharmaceuticals, Inc.

Provectus Biopharmaceuticals specializes in developing oncology and dermatology therapies. Its novel oncology drug PV-10 is designed to selectively target and

destroy cancer cells through intralesional administration, significantly reducing potential for systemic side effects. Its oncology focus is on melanoma, breast cancer and cancers of the liver. The Company has received orphan drug designations from

the FDA for its melanoma and hepatocellular carcinoma indications. Its dermatological drug PH-10 also targets abnormal or diseased cells, with the current focus on psoriasis and atopic dermatitis. Provectus has recently completed Phase 2 trials of

PV-10 as a therapy for metastatic melanoma, and of PH-10 as a topical treatment for atopic dermatitis and psoriasis. Information about these and the Company’s other clinical trials can be found at the NIH registry, www.clinicaltrials.gov. For

additional information about Provectus please visit the Company’s website at www.pvct.com or contact Porter, LeVay & Rose, Inc.

FORWARD-LOOKING STATEMENTS: This press release contains “forward-looking statements” as defined under U.S. federal securities laws. These

statements reflect management’s current knowledge, assumptions, beliefs, estimates, and expectations and express management’s current views of future performance, results, and trends and may be identified by their use of terms such as

“anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “will,” and other similar terms.

Forward-looking statements are subject to a number of risks and uncertainties that could cause our actual results to materially differ from those described in the forward-looking statements. Readers should not place undue reliance on forward-looking

statements. Such statements are made as of the date hereof, and we undertake no obligation to update such statements after this date.

Risks and

uncertainties that could cause our actual results to materially differ from those described in forward-looking statements include those discussed in our filings with the Securities and Exchange Commission (including those described in Item 1A

of our Annual Report on Form 10-K for the year ended December 31, 2013, and in our Quarterly Report on Form 10-Q for the quarter ended March 31, 2014), and the following:

| |

• |

|

our determination, based on guidance from the FDA, whether to proceed with or without a partner with a phase 3 trial of PV-10 to treat locally advanced cutaneous melanoma and the costs associated with such a trial if it

is necessary; |

| |

• |

|

our determination whether to license PV-10, our melanoma drug product candidate, and other solid tumors such as liver cancer, if such licensure is appropriate considering the timing and structure of such a license, or

to commercialize PV-10 on our own to treat melanoma and other solid tumors such as liver cancer; |

| |

• |

|

our ability to license our dermatology drug product candidate, PH-10, on the basis of our phase 2 atopic dermatitis and psoriasis results, which are in the process of being further developed in conjunction with

mechanism of action studies; and |

| |

• |

|

our ability to raise additional capital in the event we determine to commercialize PV-10 and/or PH-10 on our own, although our expectation is to be acquired by a prospective pharmaceutical or biotech concern prior to

commercialization. |

###

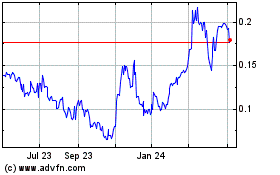

Provectus Biopharmaceuti... (QB) (USOTC:PVCT)

Historical Stock Chart

From Mar 2024 to Apr 2024

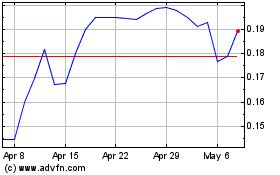

Provectus Biopharmaceuti... (QB) (USOTC:PVCT)

Historical Stock Chart

From Apr 2023 to Apr 2024