Current Report Filing (8-k)

May 27 2014 - 4:16PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 20, 2014

RIGEL PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation)

|

0-29889 |

|

94-3248524 |

|

(Commission File No.) |

|

(IRS Employer Identification No.) |

1180 Veterans Boulevard

South San Francisco, CA 94080

(Address of principal executive offices)

94080

(Zip Code)

Registrant’s telephone number, including area code: (650) 624-1100

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(e)

2014 Cash Incentive Plan

On May 20, 2014, the Board of Directors (the “Board”) of Rigel Pharmaceuticals, Inc. (the “Company”) approved the 2014 Cash Incentive Plan (the “Incentive Plan”), pursuant to which the Company’s named executive officers and other employees may become entitled to cash bonus payments based on attainment of specified corporate performance goals. A copy of the Incentive Plan is attached as Exhibit 10.29 hereto and is incorporated herein by reference.

Item 5.07. Submission of Matters to a Vote of Security Holders.

The 2014 Annual Meeting of Stockholders (the “Annual Meeting”) of the Company was held on May 20, 2014. The following is a brief description of each matter voted upon at the Annual Meeting, as well as the number of votes cast for or against each matter and the number of abstentions and broker non-votes with respect to each matter. A more complete description of each matter is set forth in the Company’s definitive proxy statement for the Annual Meeting filed with the Securities and Exchange Commission on April 8, 2014.

· Each of the two directors proposed by the Company for re-election was elected by the following votes to serve until the Company’s 2017 Annual Meeting of Stockholders or until his respective successor have been elected and qualified. The tabulation of votes on this matter was as follows:

|

Nominee |

|

Shares

Voted For |

|

Shares

Withheld |

|

|

Walter H. Moos, Ph.D. |

|

55,660,863 |

|

891,143 |

|

|

Stephen A. Sherwin, M.D. |

|

51,360,708 |

|

5,191,298 |

|

There were 19,559,364 broker non-votes for this matter.

· The Company’s stockholders approved amendments to the Company’s 2000 Employee Stock Purchase Plan.

The tabulation of votes on this matter was as follows: shares voted for: 55,861,362; shares voted against: 685,859; shares abstaining: 4,785; and broker non-votes: 19,559,364.

· The Company’s stockholders approved, on an advisory basis, the compensation of the Company’s named executive officers.

The tabulation of votes on this matter was as follows: shares voted for: 56,107,515; shares voted against: 437,668; shares abstaining: 6,823; and broker non-votes: 19,559,364.

· The Company’s stockholders ratified the selection of Ernst & Young LLP as the independent registered public accounting firm of the Company for its fiscal year ending December 31, 2014.

The tabulation of votes on this matter was as follows: shares voted for: 73,469,296; shares voted against: 2,317,826; and shares abstaining: 324,248.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit |

|

Description |

|

10.29 |

|

2014 Cash Incentive Plan |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Dated: May 27, 2014 |

|

RIGEL PHARMACEUTICALS, INC. |

|

|

|

|

|

|

By: |

/s/ Dolly A. Vance |

|

|

|

Dolly A. Vance |

|

|

|

Executive Vice President, General Counsel and Corporate Secretary |

3

EXHIBIT INDEX

|

Exhibit |

|

Description |

|

|

|

|

|

10.29 |

|

2014 Cash Incentive Plan |

4

Exhibit 10.29

2014 CASH INCENTIVE PLAN

Purpose:

The terms of the 2014 Cash Incentive Plan (the “Plan”) have been established to reward the executives and other employees of Rigel Pharmaceuticals, Inc. (the “Company”) for assisting the Company in achieving its operational goals through exemplary performance. Under the Plan, cash bonuses, if any, will be based on both the achievement of corporate goals and a review of personal performance, which is determined at the discretion of the Compensation Committee of the Board of Directors (the “Compensation Committee”) and/or the Board of Directors (the “Board”). The overarching intent in setting and achieving the goals is to build long-term shareholder value.

Determination of 2014 Cash Bonuses:

Target bonuses for participants in the Plan will range from 5% to 60% of such recipient’s 2014 base salary, with a range for executives of 40% to 60% of such executive’s 2014 base salary. The maximum bonus that a participant will be eligible to receive is 120% of such participant’s 2014 base salary and in no event will a bonus be paid later than March 15 of the year following the year in which the bonus was earned. The objective Company performance goals for each participant will be based on meeting certain goals with respect to the Company’s financial and operational performance, expanding the clinical development pipeline (weighted at 10%), advancing multiple product candidates in multiple indications in clinical development (weighted at 30%), initiating and advancing a late-stage clinical candidate (weighted at 25%), obtaining positive efficacy results in a clinical study (weighted at 25%), and maintaining a viable cash position for the Company at December 31, 2014 (weighted at 10%), as well as other Company performance goals to be determined by the Compensation Committee, including consideration of shareholder return compared to peer companies. The Board and Compensation Committee reserve the right to modify these goals and criteria at any time or to grant bonuses to the participants even if the performance goals are not met, as well as to withhold bonuses if a minimum threshold of 40% of the goals are not met.

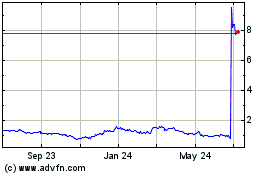

Rigel Pharmaceuticals (NASDAQ:RIGL)

Historical Stock Chart

From Mar 2024 to Apr 2024

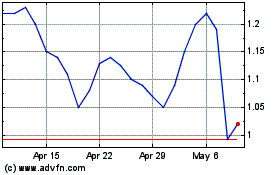

Rigel Pharmaceuticals (NASDAQ:RIGL)

Historical Stock Chart

From Apr 2023 to Apr 2024