Current Report Filing (8-k)

May 14 2014 - 3:49PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): May 13, 2014

NETLIST, INC.

(Exact Name of Registrant as Specified in its Charter)

|

Delaware

(State or Other Jurisdiction of

Incorporation) |

|

001-33170

(Commission

File Number) |

|

95-4812784

(IRS Employer

Identification Number) |

175 Technology Drive, Suite 150

Irvine, California 92618

(Address of Principal Executive Offices)

(949) 435-0025

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02. Results of Operations and Financial Condition.

On May 13, 2014, Netlist, Inc. (the “Company”) issued a press release announcing the Company’s results of operations for the quarter ended March 29, 2014. The press release is attached hereto as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein in its entirety.

The information included in this Item 2.02 of Current Report on Form 8-K, including the attached Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit |

|

|

|

Number |

|

Description |

|

|

|

|

|

99.1 |

|

Press Release, dated May 13, 2014 |

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

NETLIST, INC. |

|

|

|

|

|

|

|

|

|

Date: May 14, 2014 |

By: |

/s/ Gail M. Sasaki |

|

|

|

Gail M. Sasaki |

|

|

|

Vice President and Chief Financial Officer |

3

Exhibit 99.1

NETLIST REPORTS FIRST QUARTER 2014 RESULTS

IRVINE, CALIFORNIA, May 13, 2014 - Netlist, Inc. (NASDAQ: NLST), a leading provider of high performance memory solutions for the cloud computing and storage markets, today reported financial results for the first quarter ended March 29, 2014.

Revenues for the first quarter ended March 29, 2014, were $7.0 million, compared to revenues of $6.0 million for the first quarter ended March 30, 2013. Gross profit for the first quarter ended March 29, 2014, was $2.0 million, or 28.4 percent of revenues, compared to a gross profit of $0.6 million, or 9.5 percent of revenues, for the first quarter ended March 30, 2013.

The adjusted EBITDA loss was ($0.8) million for the first quarter ended March 29, 2014, compared to an adjusted EBITDA loss of ($2.2) million for the prior year period.

Net loss for the first quarter ended March 29, 2014, was ($2.0) million, or ($0.05) loss per share, compared to a net loss in the prior year period of ($3.2) million, or ($0.10) loss per share. These results include stock-based compensation expense of $0.5 million for the first quarter ended March 29, 2014, compared to $0.4 million for the prior year period.

As of March 29, 2014, cash and cash equivalents and restricted cash were $19.1 million, total assets were $27.7 million, working capital was $20.5 million, total debt, net of debt discounts, was $5.4 million, and stockholders’ equity was $16.6 million.

“During the first quarter we made further progress in broadening our target market opportunity and expanding our portfolio of flagship products, specifically our NVvault™ and EVvault™ for the growing enterprise storage market,” said C.K. Hong, CEO of Netlist. “We also secured highly favorable rulings at the United States Patent and Trademark Office pertaining to our innovative patented technologies covering LRDIMM and hybrid memory. We are pleased with our financial results as well. We delivered year over year growth in revenues and gross profits and we significantly improved our cash position by effectively executing our public offering in February 2014.”

Conference Call Information

As previously announced, Netlist is conducting a conference call today at 5:00 pm Eastern Time to discuss and to review the financial results for the first quarter ended March 29, 2014. The dial-in number for the call is 1-412-858-4600. The live webcast and archived replay of the call can be accessed in the Investors section of Netlist’s website at www.netlist.com.

Note Regarding Use of Non-GAAP Financial Measures

Certain of the information set forth herein, including EBITDA and adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization), may be considered non-GAAP financial measures. Netlist believes this information is useful to investors because it provides a basis for measuring Netlist’s available capital resources, the operating performance of Netlist’s business and Netlist’s cash flow, excluding net interest expense, provisions for income taxes, depreciation,

amortization, stock-based compensation and net other expense that would normally be included in the most directly comparable measures calculated and presented in accordance with Generally Accepted Accounting Principles (“GAAP”). Netlist’s management uses these non-GAAP financial measures along with the most directly comparable GAAP financial measures in evaluating Netlist’s operating performance, capital resources and cash flow. Non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information presented in compliance with GAAP, and non-financial measures as reported by Netlist may not be comparable to similarly titled amounts reported by other companies.

Adjusted EBITDA loss is a non-GAAP measure in which the net interest expense, provision for income taxes, depreciation, amortization, stock-based compensation and net other expense are added back to the GAAP basis loss. The non-GAAP measures are described above and are reconciled to the corresponding GAAP measure in the condensed consolidated financial statements portion of this release under the heading “Unaudited Schedule Reconciling GAAP Net Loss to Non-GAAP EBITDA and Adjusted EBITDA.”

About Netlist:

Netlist, Inc. designs and manufactures high-performance, logic-based memory subsystems for server and storage applications for cloud computing. Netlist’s flagship products include HyperCloud®, a patented memory technology that breaks traditional performance barriers, NVvault™ and EXPRESSvault™ family of products that significantly accelerate system performance and provide mission critical fault tolerance, and a broad portfolio of industrial Flash and specialty memory subsystems including VLP (very low profile) DIMMs and Planar-X RDIMMs. Netlist has steadily invested in and grown its IP portfolio, which now includes 43 issued patents and more than 30 U.S. and foreign pending patent applications in the areas of high performance memory and hybrid memory technologies.

Netlist develops technology solutions for customer applications in which high-speed, high-capacity, small form factor and efficient heat dissipation are key requirements for system memory. These customers include OEMs that design and build tower, rack-mounted, and blade servers, high-performance computing clusters, engineering workstations and telecommunications equipment. Founded in 2000, Netlist is headquartered in Irvine, CA with manufacturing facilities in Suzhou, People’s Republic of China. Learn more at www.netlist.com.

Safe Harbor Statement:

This news release contains forward-looking statements regarding future events and the future performance of Netlist. These forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those expected or projected. These risks and uncertainties include, but are not limited to, risks associated with the launch and commercial success of our products, programs and technologies; the success of product partnerships; continuing development, qualification and volume production of EXPRESSvault™, NVvault™, HyperCloud® and VLP Planar-X RDIMM; the timing and magnitude of the anticipated decrease in sales to our key customer; our ability to leverage our NVvault™ technology in a more diverse customer base; the rapidly-changing nature of technology; risks associated with intellectual property, including patent infringement litigation against us as well as the costs and unpredictability of litigation over infringement of our intellectual property and the possibility of our patents being reexamined by the United States Patent and Trademark office; volatility in the pricing of DRAM ICs and NAND; changes in and uncertainty of customer acceptance of, and demand for, our existing products and products under development, including uncertainty of and/or delays in product orders and product qualifications; delays in the Company’s and its customers’ product releases and development; introductions of new products by competitors; changes in end-user demand for technology solutions; the Company’s ability to attract and retain skilled personnel; the Company’s reliance on suppliers of critical components and vendors in the supply chain; fluctuations in the market price of critical components; evolving industry standards; and the political and regulatory environment in the People’s Republic of China. Other risks and uncertainties are described in the Company’s annual report on Form 10-K filed on March 18, 2014, and subsequent filings with the U.S. Securities and Exchange Commission made by the Company from time to time. Except as required by law, Netlist undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

(Tables Follow)

For more information, please contact:

|

Brainerd Communicators, Inc. |

|

Netlist, Inc. |

|

Mike Smargiassi or Corey Kinger |

|

Gail M. Sasaki |

|

NLST@braincomm.com |

|

Chief Financial Officer |

|

(212) 986-6667 |

|

(949) 435-0025 |

2

Netlist, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

(in thousands, except par value)

|

|

|

unaudited |

|

audited |

|

|

|

|

March 29, |

|

December 28, |

|

|

|

|

2014 |

|

2013 |

|

|

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

17,974 |

|

$ |

6,701 |

|

|

Restricted cash |

|

1,100 |

|

1,100 |

|

|

Accounts receivable, net |

|

4,219 |

|

4,866 |

|

|

Inventories |

|

2,428 |

|

2,620 |

|

|

Prepaid expenses and other current assets |

|

811 |

|

823 |

|

|

Total current assets |

|

26,532 |

|

16,110 |

|

|

|

|

|

|

|

|

|

Property and equipment, net |

|

891 |

|

1,143 |

|

|

Other assets |

|

323 |

|

422 |

|

|

Total assets |

|

$ |

27,746 |

|

$ |

17,675 |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

3,881 |

|

$ |

3,795 |

|

|

Accrued payroll and related liabilities |

|

771 |

|

635 |

|

|

Accrued expenses and other current liabilities |

|

543 |

|

533 |

|

|

Accrued engineering charges |

|

500 |

|

500 |

|

|

Current portion of long-term debt and debt discount |

|

298 |

|

— |

|

|

Total current liabilities |

|

5,993 |

|

5,463 |

|

|

Long-term debt, net of current portion and debt discount |

|

5,056 |

|

5,099 |

|

|

Other liabilities |

|

104 |

|

100 |

|

|

Total liabilities |

|

11,153 |

|

10,662 |

|

|

|

|

|

|

|

|

|

Commitments and contingencies |

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

|

Common stock, $0.001 par value - 90,000 shares authorized; 41,480 (2014) and 31,776 (2013) shares issued and outstanding |

|

41 |

|

31 |

|

|

Additional paid-in capital |

|

116,057 |

|

104,469 |

|

|

Accumulated deficit |

|

(99,505 |

) |

(97,487 |

) |

|

Total stockholders’ equity |

|

16,593 |

|

7,013 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

27,746 |

|

$ |

17,675 |

|

3

Netlist, Inc. and Subsidiaries

Unaudited Condensed Consolidated Statements of Operations

(in thousands, except per share amounts)

|

|

|

Three Months Ended |

|

|

|

|

March 29, |

|

March 30, |

|

|

|

|

2014 |

|

2013 |

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

7,001 |

|

$ |

5,963 |

|

|

Cost of sales(1) |

|

5,016 |

|

5,397 |

|

|

Gross profit |

|

1,985 |

|

566 |

|

|

Operating expenses: |

|

|

|

|

|

|

Research and development(1) |

|

1,975 |

|

1,842 |

|

|

Selling, general and administrative(1) |

|

1,622 |

|

1,756 |

|

|

Total operating expenses |

|

3,597 |

|

3,598 |

|

|

Operating loss |

|

(1,612 |

) |

(3,032 |

) |

|

Other expense, net: |

|

|

|

|

|

|

Interest expense, net |

|

(395 |

) |

(130 |

) |

|

Other expense, net |

|

(11 |

) |

(6 |

) |

|

Total other expense, net |

|

(406 |

) |

(136 |

) |

|

Loss before provision for income taxes |

|

(2,018 |

) |

(3,168 |

) |

|

Provision for income taxes |

|

— |

|

2 |

|

|

Net loss |

|

$ |

(2,018 |

) |

$ |

(3,170 |

) |

|

Net loss per common share: |

|

|

|

|

|

|

Basic and diluted |

|

$ |

(0.05 |

) |

$ |

(0.10 |

) |

|

|

|

|

|

|

|

|

Weighted-average common shares outstanding: |

|

|

|

|

|

|

Basic and diluted |

|

36,881 |

|

30,205 |

|

(1) Amounts include stock-based compensation expense as follows:

|

Cost of sales |

|

$ |

15 |

|

$ |

12 |

|

|

Research and development |

|

188 |

|

160 |

|

|

Selling, general and administrative |

|

328 |

|

262 |

|

4

Netlist, Inc. and Subsidiaries

Unaudited Schedule Reconciling GAAP Net Loss to Non-GAAP EBITDA and Adjusted EBITDA

(in thousands)

|

|

|

Three Months Ended |

|

|

|

|

March 29, |

|

March 30, |

|

|

|

|

2014 |

|

2013 |

|

|

|

|

|

|

|

|

|

GAAP net loss |

|

$ |

(2,018 |

) |

$ |

(3,170 |

) |

|

|

|

|

|

|

|

|

Interest expense, net |

|

395 |

|

130 |

|

|

Provision for income taxes |

|

— |

|

2 |

|

|

Depreciation and amortization |

|

282 |

|

418 |

|

|

EBITDA |

|

(1,341 |

) |

(2,620 |

) |

|

|

|

|

|

|

|

|

Stock-based compensation |

|

531 |

|

434 |

|

|

Other expense, net |

|

11 |

|

6 |

|

|

Adjusted EBITDA |

|

$ |

(799 |

) |

$ |

(2,180 |

) |

5

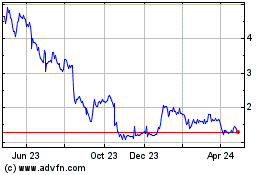

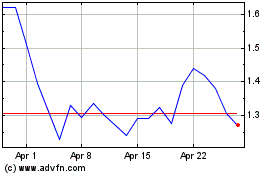

Netlist (QB) (USOTC:NLST)

Historical Stock Chart

From Mar 2024 to Apr 2024

Netlist (QB) (USOTC:NLST)

Historical Stock Chart

From Apr 2023 to Apr 2024