Current Report Filing (8-k)

May 09 2014 - 2:06PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): May 6, 2014

Communication Intelligence Corporation

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

000-19301

|

|

94-2790442

|

|

(State or other

|

|

(Commission File Number)

|

|

(I.R.S. Employer

|

|

jurisdiction of

|

|

|

|

Identification No.)

|

|

incorporation)

|

|

|

|

|

275 Shoreline Drive, Suite 500

Redwood Shores, CA 94065

(Address of principal executive offices)

(650) 802-7888

Registrant’s telephone number, including area code

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 1.01 Entry into a Material Definitive Agreement

On May 6, 2014, Communication Intelligence Corporation (the “Company”) entered into a Credit Agreement with Venture Champion Asia Limited, an affiliate of ICG Global Limited (the “Lender”). Under the terms of the Credit Agreement, for a period of 18 months, the Company is permitted to borrow up to $2 million in unsecured indebtedness from the Lender in individual draws of $500,000 (or greater amounts with the consent of the Lender). Each draw is subject to a 15% original issue discount, such that, if the Company borrowed $2 million under the terms of the Credit Agreement, those draws would result in an aggregate of $2.352 million in unsecured indebtedness. Any indebtedness incurred under the Credit Agreement matures 18 months from the date of the Credit Agreement. Any outstanding indebtedness incurred under the Credit Agreement may be converted at the Lender’s option at any time prior to the maturity date into shares of the Company’s Common Stock at a conversion price of $0.0275 per share.

In connection with the Company’s entry into the Credit Agreement, the Company issued the Lender a warrant to purchase approximately 10.909 million shares of Common Stock. This warrant is exercisable for a period of three years and has an exercise price of $0.0275 per share. In addition to the warrant described in the preceding sentences, the Lender is entitled to receive additional warrants to purchase additional shares of Common Stock in connection with draws under the Credit Agreement. Any such additional warrants issued will be exercisable for a number of shares equal to 50% of the principal amount of the draw divided by the lesser of (a) $0.0275 or (b) 80% of the volume weighted average trading price of the Company’s Common Stock for the period of ten (10) trading days immediately prior to the issuance of such draw, will have an exercise price equal to the lesser of (a) $0.0275 or (b) 80% of the volume weighted average trading price of the Company’s Common Stock for the period of ten (10) trading days immediately prior to the issuance of such draw, and will be exercisable through the date that is three years after the date of the first draw.

In the event that the Company borrows $1 million or more from Lender, the Credit Agreement requires the Company to employ reasonable best efforts to conduct a registered offering and up-listing of shares of the Company’s Common Stock within six months thereafter. In the event of such an offering, Lender is permitted to convert outstanding indebtedness into shares of Common Stock at a conversion price equal to the lesser of (a) $0.0275 or (b) 80% of the price of the shares issued in the offering.

Item 7.01 Regulation FD Disclosure

On May 7, 2014, the Company issued a press release announcing the Company’s entry into the Credit Agreement. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and incorporated by reference herein. In accordance with General Instruction B.2 of Form 8-K, Exhibit 99.1 hereto shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

99.1 Press Release dated May 7, 2014

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Communication Intelligence Corporation

|

|

Date: May 8, 2014

|

|

| |

By:

|

/s/ Andrea Goren

|

|

| |

|

|

| |

|

Andrea Goren

|

| |

|

Chief Financial Officer

|

Exhibit Index

| |

|

|

|

Exhibit

|

|

Description

|

|

99.1

|

|

Press Release dated May 7, 2014

|

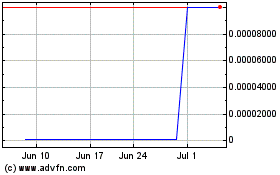

iSign Solutions (CE) (USOTC:ISGN)

Historical Stock Chart

From Mar 2024 to Apr 2024

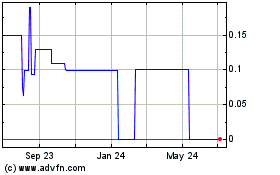

iSign Solutions (CE) (USOTC:ISGN)

Historical Stock Chart

From Apr 2023 to Apr 2024