Sysco Misses on Q3 Earnings & Rev - Analyst Blog

May 05 2014 - 1:00PM

Zacks

Global food products maker and distributor Sysco

Corporation (SYY) reported third-quarter fiscal 2014

adjusted earnings of 38 cents. Earnings lagged the Zacks Consensus

Estimate of 39 cents by 2.6% and declined from the prior-year

quarter earnings of 40 cents by 5.0% due to modest sales growth and

cost pressure. Sales were also dampened by a sluggish

macro-economic scenario and weather related headwinds, which in

turn led to lower consumer spending. However, March sales were

significantly stronger compared to January and February as improved

weather rebounded demand and locally-managed sales

strengthened.

Quarter in Detail

Sysco's sales grew 3.2% on a year-over-year basis to $11.277

billion in the third quarter of fiscal 2014, driven by 3.0% volume

growth (including acquisitions). Acquisitions contributed 0.8% to

sales growth, while currency translation decreased sales by 0.9%.

Third-quarter sales marginally lagged the Zacks Consensus Estimate

of $11.393 billion. Growth was weaker than 4.1% growth in the

second quarter and 5.7% growth in the first quarter owing to a

difficult consumer spending environment.

Gross profit improved 2.7% to $2.0 billion in the quarter, while

gross margin was flat at 17.7% due to ongoing cost pressure.

Adjusted operating income increased only 0.3% in the quarter to

$388.3 million due to a 3.3% increase in adjusted operating

expenses. Adjusted operating margin declined 10 basis points to

3.4% in the quarter.

Other Financial Updates

Cash and cash equivalents were $341.1 million at the end of Mar

29, 2014 compared with $449.9 million at the end of Dec 28, 2013.

Long-term debt was $2.99 billion at the end of the third quarter as

against $2.94 billion at the end of the second quarter.

Overall, we appreciate the company’s growth strategy and its

efforts to reduce costs and improve efficiency. However, we are

concerned about rising costs due to fuel price hikes and other

inputs, which hurt margins. Sysco holds a Zacks Rank #3 (Hold).

Other better-ranked food companies in the industry include

B&G Foods Inc (BGS), BRF-Brasil

Food (BRFS) and McCormick & Co. Inc.

(MKC). While B&G Foods and BRF sport a Zacks Rank#1 (Strong

Buy), McCormick holds a Zacks Rank #2 (Buy).

B&G FOODS CL-A (BGS): Free Stock Analysis Report

BRF-BRASIL FOOD (BRFS): Free Stock Analysis Report

MCCORMICK & CO (MKC): Free Stock Analysis Report

SYSCO CORP (SYY): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

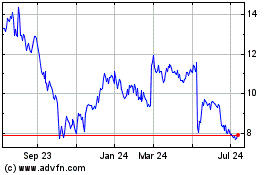

B and G Foods (NYSE:BGS)

Historical Stock Chart

From Mar 2024 to Apr 2024

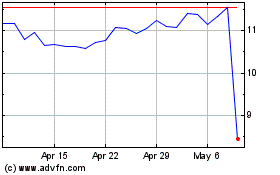

B and G Foods (NYSE:BGS)

Historical Stock Chart

From Apr 2023 to Apr 2024