UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8‑K

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (date of earliest event reported): April 21, 2014

HALLIBURTON COMPANY

(Exact Name of Registrant as Specified in Its Charter)

Delaware

(State or Other Jurisdiction of Incorporation)

|

| |

001-03492 | No. 75-2677995 |

(Commission File Number) | (IRS Employer Identification No.) |

| |

3000 North Sam Houston Parkway East Houston, Texas | 77032 |

(Address of Principal Executive Offices) | (Zip Code) |

(281) 871-2699

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

INFORMATION TO BE INCLUDED IN REPORT

Item 2.02. Results of Operations and Financial Condition

On April 21, 2014, registrant issued a press release entitled “Halliburton Announces First Quarter Income From Continuing Operations of $0.73 Per Diluted Share."

The text of the Press Release is as follows:

HALLIBURTON ANNOUNCES FIRST QUARTER INCOME FROM

CONTINUING OPERATIONS OF $0.73 PER DILUTED SHARE

Repurchased $500 million of common stock during the first quarter

HOUSTON, Texas - Halliburton (NYSE:HAL) announced today that income from continuing operations for the first quarter of 2014 was $623 million, or $0.73 per diluted share. This compares to income from continuing operations for the first quarter of 2013 of $624 million, or $0.67 per diluted share, excluding a $637 million charge, after-tax, or $0.68 per diluted share, to increase a reserve related to the Macondo litigation. Reported loss from continuing operations for the first quarter of 2013 was $13 million, or $0.01 per diluted share.

Halliburton's total revenue in the first quarter of 2014 was $7.3 billion, compared to $7.0 billion in the first quarter of 2013. Operating income was $970 million in the first quarter of 2014, compared to adjusted operating income of $902 million in the first quarter of 2013. Reported operating loss was $98 million for the first quarter of 2013.

“I am pleased with total company revenue of $7.3 billion, which was a record first quarter for Halliburton,” commented Dave Lesar, chairman, president and chief executive officer.

“Operating income of $970 million was 8% higher than adjusted operating income in the first quarter of 2013, and was the result of our double-digit growth in the Eastern Hemisphere.

“In the Eastern Hemisphere, we continue to successfully execute our growth strategy. Relative to the first quarter of 2013, we grew revenue by 11% and operating income by 16%. We continue to forecast that full-year Eastern Hemisphere revenue growth will be in the low double digits, and average full year margins will be in the upper teens.

-more-

Halliburton/Page 2

“In the Middle East/Asia region, compared to the first quarter of the prior year, both revenue and operating income increased by 13%. Saudi Arabia led the improvement with growth across all product lines due to an increase in integrated project activity along with an overall higher rig count that is driving increased services.

“In Europe/Africa/CIS, relative to the first quarter of 2013, we saw revenue and operating income increase 9% and 21%, respectively. The improvement was led by higher completion tools sales and cementing activity throughout the region, and increased drilling and open hole wireline activity in Angola.

“In Latin America, revenue and operating income declined by 9% and 8%, respectively, compared to the same quarter last year, primarily due to a decline in drilling-related activity in Brazil and activity reductions in Mexico. For the full year, we expect Latin America revenue and operating income to be in line with 2013 levels.

“In North America, revenue increased 5% and operating income was flat compared to the first quarter of 2013. Results were negatively impacted by lower pressure pumping pricing and transitory issues related to weather disruption and higher logistics costs. We are optimistic about the potential for increased activity levels in the second half of the year, and expect North America margins to expand over the remainder of 2014. Service intensity levels are expanding across the United States, where we continue to see a trend to longer laterals, increased stage density, and rising volumes per stage. We continue to expect North America margins to approach 20% before the end of the year.

“Our strategy is working well and we intend to stay the course. I am optimistic about our ability to grow our North America revenue and margins, and to realize industry-leading revenue and margin growth in our international business, resulting in solid EPS growth and significantly higher cash generation. We expect earnings per share to grow approximately 25% in the second quarter, with further increases to follow. We remain focused on generating superior financial performance and providing industry-leading shareholder returns, as evidenced by our $500 million share repurchase this quarter.” concluded Lesar.

-more-

Halliburton/Page 3

2014 First Quarter Results

Completion and Production

Completion and Production (C&P) revenue in the first quarter of 2014 was $4.4 billion, an increase of $320 million, or 8%, from the first quarter of 2013. This increase was primarily driven by stronger stimulation activity in the United States land market, as well as higher completion tools sales in all regions.

C&P operating income in the first quarter of 2014 was $661 million, an increase of $46 million, or 7%, from the first quarter of 2013. North America C&P operating income, improved by $14 million, or 3%, compared to the first quarter of 2013, due to increased stimulation activity in the United States land market, partially offset by pricing pressures associated with pressure pumping services. Latin America C&P operating income rose by $20 million, or 71%, compared to the first quarter of 2013, primarily due to improved profitability for pressure pumping in Argentina. Europe/Africa/CIS C&P operating income increased $14 million, or 22%, compared to the first quarter of 2013, driven by increased completion tools sales in Angola and Norway, and higher Boots and Coots activity in Algeria. Middle East/Asia C&P operating income was down $2 million, or 2%, compared to the first quarter of 2013, due to lower completion tools sales in Malaysia and decreased Boots and Coots activity in Australia and India, which were partially offset by increased completion tools sales in Saudi Arabia and China.

Drilling and Evaluation

Drilling and Evaluation (D&E) revenue in the first quarter of 2014 was $2.9 billion, an increase of $54 million, or 2%, from the first quarter of 2013. This increase was primarily driven by higher drilling activity in the Eastern Hemisphere and improved testing activity in all regions, which more than offset the decline in Latin America activity.

D&E operating income in the first quarter of 2014 was $398 million, a decrease of $9 million, or 2%, from the first quarter of 2013. North America D&E operating income decreased $17 million, or 10%, compared to the first quarter of 2013, due to decreased activity in Canada and decreased logging services in the United States land market, which were partially offset by increased testing services in the Gulf of Mexico. Latin America D&E operating income decreased $29 million, or 36%, compared to the first quarter of 2013, primarily due to lower drilling activity in Brazil. Europe/Africa/CIS D&E operating income improved by $11 million, or 19%, compared to the first quarter of 2013, due to increased drilling activity in the United Kingdom and Angola, which was partially offset by lower demand for fluid services in Norway. Middle East/Asia D&E operating income increased $26 million, or 27%, compared to the first quarter of 2013, due to increased drilling services in Thailand and Saudi Arabia, which were partially offset by a decline in logging sales in China.

-more-

Halliburton/Page 4

Corporate and Other

During the first quarter of 2014, Halliburton repurchased approximately 9 million shares of common stock at a total cost of $500 million. Since the inception of the stock repurchase program in February 2006, Halliburton has purchased 197 million shares at a total cost of approximately $8.1 billion. Approximately $1.2 billion of repurchases remain authorized under the program.

Also during the first quarter, Halliburton invested an additional $15 million, pre-tax, in strategic projects aimed at strengthening Halliburton's North America service delivery model and repositioning technology, supply chain, and manufacturing infrastructure to support projected international growth. Halliburton expects the cost of these strategic projects to continue to wind down during 2014.

Significant Recent Events and Achievements

| |

• | Halliburton announced the release of the RezConnect™ Well Testing System, a complete well testing solution for wireless control of downhole drill stem test (DST) tools and the measurement and analysis of well-test data in real time. The RezConnect Well Testing System uses Halliburton’s proprietary DynaLink® Telemetry System, a fully wireless downhole sensor and actuator network using acoustic energy in the tubing string. The RezConnect Well Testing System integrates all the DST tools and allows surface verification of their operational status. |

| |

• | Halliburton announced the signing of a partnership agreement with Gubkin Russian State University of Oil and Gas for the development of unconventional resources in Russia, including the Bazhenov shale. As part of the agreement, Halliburton will provide senior technical and management staff to serve on Gubkin's Industry Advisory Boards, as well as provide the foundation material for Gubkin's unconventional resources curriculum that will become the basis for student and industry training. |

| |

• | Halliburton expanded its line of DrillDOC® drilling optimization tools with the launch of 4 3/4-inch and 9 1/2-inch collars. The addition of the two new sizes is especially beneficial while drilling complex directional well trajectories and horizontal or extended reach wells. The new DrillDOC collars provide the measurements necessary to fully understand downhole drilling dynamics. |

| |

• | Halliburton announced its plans for a new Integrated Completions Center located in New Iberia, LA. This new facility will expand Halliburton’s resources and capabilities for deepwater completion tools while continuing to focus on service alignment, equipment maintenance, preparation, and job execution for Halliburton’s Gulf of Mexico customers. |

-more-

Halliburton/Page 5

Founded in 1919, Halliburton is one of the world's largest providers of products and services to the energy industry. With more than 75,000 employees, representing 140 nationalities in approximately 80 countries, the company serves the upstream oil and gas industry throughout the lifecycle of the reservoir - from locating hydrocarbons and managing geological data, to drilling and formation evaluation, well construction and completion, and optimizing production through the life of the field. Visit the company's website at www.halliburton.com.

NOTE: The statements in this press release that are not historical statements, including statements regarding future financial performance, are forward-looking statements within the meaning of the federal securities laws. These statements are subject to numerous risks and uncertainties, many of which are beyond the company's control, which could cause actual results to differ materially from the results expressed or implied by the statements. These risks and uncertainties include, but are not limited to: results of litigation, settlements, and investigations; actions by third parties, including governmental agencies; whether a settlement relating to the Macondo multi-district litigation will be reached at the amounts contemplated by our reserve or at all; settlement discussions relating to the Macondo incident do not cover all possible parties and claims, and there are additional reasonably possible losses relating to the Macondo incident that we cannot reasonably estimate at this time; with respect to repurchases of Halliburton common stock, the continuation or suspension of the repurchase program, the amount, the timing and the trading prices of Halliburton common stock and the availability and alternative uses of cash; changes in the demand for or price of oil and/or natural gas can be significantly impacted by weakness in the worldwide economy; consequences of audits and investigations by domestic and foreign government agencies and legislative bodies and related publicity and potential adverse proceedings by such agencies; indemnification and insurance matters; protection of intellectual property rights and against cyber attacks; compliance with environmental laws; changes in government regulations and regulatory requirements, particularly those related to offshore oil and natural gas exploration, radioactive sources, explosives, chemicals, hydraulic fracturing services, and climate-related initiatives; compliance with laws related to income taxes and assumptions regarding the generation of future taxable income; risks of international operations, including risks relating to unsettled political conditions, war, the effects of terrorism, foreign exchange rates and controls, international trade and regulatory controls, and doing business with national oil companies; weather-related issues, including the effects of hurricanes and tropical storms; changes in capital spending by customers; delays or failures by customers to make payments owed to us; execution of long-term, fixed-price contracts; impairment of oil and natural gas properties; structural changes in the oil and natural gas industry; maintaining a highly skilled workforce; availability and cost of raw materials; and integration of acquired businesses and operations of joint ventures. Halliburton's Form 10-K for the year ended December 31, 2013, recent Current Reports on Form 8-K, and other Securities and Exchange Commission filings discuss some of the important risk factors identified that may affect Halliburton's business, results of operations, and financial condition. Halliburton undertakes no obligation to revise or update publicly any forward-looking statements for any reason.

-more-

HALLIBURTON COMPANY

Condensed Consolidated Statements of Operations

(Millions of dollars and shares except per share data)

(Unaudited)

|

| | | | | | | | | | | | |

| Three Months Ended |

| March 31 | | December 31 |

| 2014 | | 2013 | | 2013 |

Revenue: | | | | | |

Completion and Production | $ | 4,420 |

| | $ | 4,100 |

| | $ | 4,542 |

|

Drilling and Evaluation | 2,928 |

| | 2,874 |

| | 3,097 |

|

Total revenue | $ | 7,348 |

| | $ | 6,974 |

| | $ | 7,639 |

|

Operating income: | | | | | |

Completion and Production | $ | 661 |

| | $ | 615 |

| | $ | 765 |

|

Drilling and Evaluation | 398 |

| | 407 |

| | 498 |

|

Corporate and other (a) | (89 | ) | | (1,120 | ) | | (119 | ) |

Total operating income (loss) | 970 |

| | (98 | ) | | 1,144 |

|

Interest expense, net | (93 | ) | | (71 | ) | | (98 | ) |

Other, net | (31 | ) | | (14 | ) | | (6 | ) |

Income (loss) from continuing operations before income taxes | 846 |

| | (183 | ) | | 1,040 |

|

Income tax (provision) benefit (b) | (229 | ) | | 172 |

| | (268 | ) |

Income (loss) from continuing operations | 617 |

| | (11 | ) | | 772 |

|

Income (loss) from discontinued operations, net | (1 | ) | | (5 | ) | | 23 |

|

Net income (loss) | $ | 616 |

| | $ | (16 | ) | | $ | 795 |

|

Noncontrolling interest in net (income) loss of subsidiaries | 6 |

| | (2 | ) | | (2 | ) |

Net income (loss) attributable to company | $ | 622 |

| | $ | (18 | ) | | $ | 793 |

|

Amounts attributable to company shareholders: | | | | | |

Income (loss) from continuing operations | $ | 623 |

| | $ | (13 | ) | | $ | 770 |

|

Income (loss) from discontinued operations, net | (1 | ) | | (5 | ) | | 23 |

|

Net income (loss) attributable to company | $ | 622 |

| | $ | (18 | ) | | $ | 793 |

|

Basic income (loss) per share attributable to company shareholders: | | | | | |

Income (loss) from continuing operations | $ | 0.73 |

| | $ | (0.01 | ) | | $ | 0.91 |

|

Income (loss) from discontinued operations, net | — |

| | (0.01 | ) | | 0.02 |

|

Net income (loss) per share | $ | 0.73 |

| | $ | (0.02 | ) | | $ | 0.93 |

|

Diluted income (loss) per share attributable to company shareholders: | | | | | |

Income (loss) from continuing operations | $ | 0.73 |

| | $ | (0.01 | ) | | $ | 0.90 |

|

Income (loss) from discontinued operations, net | — |

| | (0.01 | ) | | 0.03 |

|

Net income (loss) per share | $ | 0.73 |

| | $ | (0.02 | ) | | $ | 0.93 |

|

Basic weighted average common shares outstanding | 849 |

| | 931 |

| | 849 |

|

Diluted weighted average common shares outstanding | 853 |

| | 931 |

| | 854 |

|

| | |

(a) | Includes a $1 billion, pre-tax, charge in the three months ended March 31, 2013 related to the Macondo well incident. |

(b) | Includes $50 million in federal tax benefits in the three months ended March 31, 2013. |

See Footnote Table 1 for certain items included in operating income (loss). |

See Footnote Table 2 for operating income (loss) adjusted for certain items. |

See Footnote Table 3 for a reconciliation of as-reported income (loss) from continuing operations to adjusted income from continuing operations. |

-more-

HALLIBURTON COMPANY

Condensed Consolidated Balance Sheets

(Millions of dollars)

|

| | | | | | | | |

| | (Unaudited) | | |

| March 31 | | December 31 |

| 2014 | | 2013 |

Assets |

Current assets: | | | |

Cash and equivalents | $ | 2,123 |

| | $ | 2,356 |

|

Receivables, net | 6,314 |

| | 6,181 |

|

Inventories | 3,415 |

| | 3,305 |

|

Other current assets (a) | 1,634 |

| | 1,862 |

|

Total current assets | 13,486 |

| | 13,704 |

|

| | | |

Property, plant, and equipment, net | 11,463 |

| | 11,322 |

|

Goodwill | 2,193 |

| | 2,168 |

|

Other assets (b) | 2,114 |

| | 2,029 |

|

Total assets | $ | 29,256 |

| | $ | 29,223 |

|

| | | |

Liabilities and Shareholders’ Equity |

Current liabilities: | | | |

Accounts payable | $ | 2,525 |

| | $ | 2,365 |

|

Accrued employee compensation and benefits | 823 |

| | 1,029 |

|

Loss contingency for Macondo well incident | 278 |

| | 278 |

|

Other current liabilities | 1,306 |

| | 1,354 |

|

Total current liabilities | 4,932 |

| | 5,026 |

|

| | | |

Long-term debt | 7,816 |

| | 7,816 |

|

Loss contingency for Macondo well incident | 1,022 |

| | 1,022 |

|

Other liabilities | 1,734 |

| | 1,744 |

|

Total liabilities | 15,504 |

| | 15,608 |

|

| | | |

Company shareholders’ equity | 13,725 |

| | 13,581 |

|

Noncontrolling interest in consolidated subsidiaries | 27 |

| | 34 |

|

Total shareholders’ equity | 13,752 |

| | 13,615 |

|

Total liabilities and shareholders’ equity | $ | 29,256 |

| | $ | 29,223 |

|

| | | | |

(a) | Includes $238 million of investments in fixed income securities at March 31, 2014, and $239 million of investments in fixed income securities at December 31, 2013. |

(b) | Includes $140 million of investments in fixed income securities at March 31, 2014, and $134 million of investments in fixed income securities at December 31, 2013. |

-more-

HALLIBURTON COMPANY

Condensed Consolidated Statements of Cash Flows

(Millions of dollars)

(Unaudited)

|

| | | | | | | |

| Three Months Ended

March 31 |

| 2014 | | 2013 |

Cash flows from operating activities: | | | |

Net income (loss) | $ | 616 |

| | $ | (16 | ) |

Adjustments to reconcile net income (loss) to net cash flows from operating activities: | | | |

Depreciation, depletion, and amortization | 510 |

| | 448 |

|

Loss contingency for Macondo well incident | — |

| | 1,000 |

|

Payment of Barracuda-Caratinga obligation | — |

| | (219 | ) |

Other, primarily working capital | (172 | ) | | (864 | ) |

Total cash flows from operating activities | 954 |

| | 349 |

|

| | | |

Cash flows from investing activities: | | | |

Capital expenditures | (643 | ) | | (685 | ) |

Purchase of investment securities | (55 | ) | | (28 | ) |

Sales of investment securities | 50 |

| | 9 |

|

Other | (26 | ) | | 53 |

|

Total cash flows from investing activities | (674 | ) | | (651 | ) |

| | | |

Cash flows from financing activities: | | | |

Payments to reacquire common stock | (500 | ) | | (50 | ) |

Dividends to shareholders | (127 | ) | | (116 | ) |

Other | 113 |

| | 21 |

|

Total cash flows from financing activities | (514 | ) | | (145 | ) |

| | | |

Effect of exchange rate changes on cash | 1 |

| | (8 | ) |

Decrease in cash and equivalents | (233 | ) | | (455 | ) |

Cash and equivalents at beginning of period | 2,356 |

| | 2,484 |

|

Cash and equivalents at end of period | $ | 2,123 |

| | $ | 2,029 |

|

-more-

HALLIBURTON COMPANY

Revenue and Operating Income Comparison

By Segment and Geographic Region

(Millions of dollars)

(Unaudited)

|

| | | | | | | | | | | |

| Three Months Ended |

| March 31 | | December 31 |

Revenue by geographic region: | 2014 | | 2013 | | 2013 |

Completion and Production: | | | | | |

North America | $ | 2,927 |

| | $ | 2,745 |

| | $ | 2,871 |

|

Latin America | 355 |

| | 355 |

| | 428 |

|

Europe/Africa/CIS | 607 |

| | 532 |

| | 647 |

|

Middle East/Asia | 531 |

| | 468 |

| | 596 |

|

Total | 4,420 |

| | 4,100 |

| | 4,542 |

|

Drilling and Evaluation: | | | | | |

North America | 974 |

| | 961 |

| | 952 |

|

Latin America | 504 |

| | 590 |

| | 590 |

|

Europe/Africa/CIS | 692 |

| | 655 |

| | 752 |

|

Middle East/Asia | 758 |

| | 668 |

| | 803 |

|

Total | 2,928 |

| | 2,874 |

| | 3,097 |

|

Total revenue by region: | | | | | |

North America | 3,901 |

| | 3,706 |

| | 3,823 |

|

Latin America | 859 |

| | 945 |

| | 1,018 |

|

Europe/Africa/CIS | 1,299 |

| | 1,187 |

| | 1,399 |

|

Middle East/Asia | 1,289 |

| | 1,136 |

| | 1,399 |

|

Total revenue | $ | 7,348 |

| | $ | 6,974 |

| | $ | 7,639 |

|

| | | | | |

Operating income by geographic region: | | | | | |

Completion and Production: | | | | | |

North America | $ | 446 |

| | $ | 432 |

| | $ | 478 |

|

Latin America | 48 |

| | 28 |

| | 72 |

|

Europe/Africa/CIS | 78 |

| | 64 |

| | 99 |

|

Middle East/Asia | 89 |

| | 91 |

| | 116 |

|

Total | 661 |

| | 615 |

| | 765 |

|

Drilling and Evaluation: | | | | | |

North America | 156 |

| | 173 |

| | 166 |

|

Latin America | 52 |

| | 81 |

| | 81 |

|

Europe/Africa/CIS | 68 |

| | 57 |

| | 108 |

|

Middle East/Asia | 122 |

| | 96 |

| | 143 |

|

Total | 398 |

| | 407 |

| | 498 |

|

Total operating income by region: | | | | | |

North America | 602 |

| | 605 |

| | 644 |

|

Latin America | 100 |

| | 109 |

| | 153 |

|

Europe/Africa/CIS | 146 |

| | 121 |

| | 207 |

|

Middle East/Asia | 211 |

| | 187 |

| | 259 |

|

Corporate and other | (89 | ) | | (1,120 | ) | | (119 | ) |

Total operating income (loss) | $ | 970 |

| | $ | (98 | ) | | $ | 1,144 |

|

| | | | | |

See Footnote Table 1 for certain items included in operating income (loss). |

See Footnote Table 2 for operating income (loss) adjusted for certain Items. |

See Footnote Table 3 for a reconciliation of as-reported income (loss) from continuing operations to adjusted income from continuing operations. |

-more-

FOOTNOTE TABLE 1

HALLIBURTON COMPANY

Items Included in Operating Income (Loss)

(Millions of dollars except per share data)

(Unaudited)

|

| | | | | | | | | |

| Three Months Ended March 31, 2013 | | Three Months Ended December 31, 2013 |

| Operating Income | After Tax Per Share | | Operating Income | After Tax Per Share |

Completion and Production: | | | | | |

North America | | | | | |

Restructuring charges | — |

| — |

| | (5 | ) | (0.01 | ) |

Latin America | | | | | |

Restructuring charges | — |

| — |

| | (1 | ) | — |

|

Europe/Africa/CIS | | | | | |

Restructuring charges | — |

| — |

| | (1 | ) | — |

|

Middle East/Asia | | | | | |

Restructuring charges | — |

| — |

| | (3 | ) | — |

|

Drilling and Evaluation: | | | | | |

North America | | | | | |

Restructuring charges | — |

| — |

| | (2 | ) | — |

|

Latin America | | | | | |

Restructuring charges | — |

| — |

| | (3 | ) | — |

|

Europe/Africa/CIS | | | | | |

Restructuring charges | — |

| — |

| | (1 | ) | — |

|

Middle East/Asia | | | | | |

Restructuring charges | — |

| — |

| | (2 | ) | — |

|

Corporate and other: | | | | | |

Macondo-related charge | (1,000 | ) | (0.68 | ) | | — |

| — |

|

Restructuring charges | — |

| — |

| | (20 | ) | (0.02 | ) |

| | | | | |

-more-

FOOTNOTE TABLE 2

HALLIBURTON COMPANY

Adjusted Operating Income Excluding Certain Items

By Segment and Geographic Region

(Millions of dollars)

(Unaudited)

|

| | | | | | | | | | | | | |

| | | Three Months Ended |

| | | March 31 | | December 31 |

Adjusted operating income by geographic region: (a)(b) | 2014 | | 2013 | | 2013 |

| Completion and Production: | | | | | |

| North America | $ | 446 |

| | $ | 432 |

| | $ | 483 |

|

| Latin America | 48 |

| | 28 |

| | 73 |

|

| Europe/Africa/CIS | 78 |

| | 64 |

| | 100 |

|

| Middle East/Asia | 89 |

| | 91 |

| | 119 |

|

| Total | 661 |

| | 615 |

| | 775 |

|

| Drilling and Evaluation: | | | | | |

| North America | 156 |

| | 173 |

| | 168 |

|

| Latin America | 52 |

| | 81 |

| | 84 |

|

| Europe/Africa/CIS | 68 |

| | 57 |

| | 109 |

|

| Middle East/Asia | 122 |

| | 96 |

| | 145 |

|

| Total | 398 |

| | 407 |

| | 506 |

|

| Adjusted operating income by region: | | | | | |

| North America | 602 |

| | 605 |

| | 651 |

|

| Latin America | 100 |

| | 109 |

| | 157 |

|

| Europe/Africa/CIS | 146 |

| | 121 |

| | 209 |

|

| Middle East/Asia | 211 |

| | 187 |

| | 264 |

|

| Corporate and other | (89 | ) | | (120 | ) | | (99 | ) |

| Adjusted total operating income | $ | 970 |

| | $ | 902 |

| | $ | 1,182 |

|

| |

(a) | Management believes that operating income adjusted for the Macondo-related charge for the quarter ended March 31, 2013 and restructuring charges for the quarter ended December 31, 2013 is useful to investors to assess and understand operating performance, especially when comparing those results with previous and subsequent periods or forecasting performance for future periods, primarily because management views the excluded items to be outside of the company's normal operating results. Management analyzes operating income without the impact of these items as an indicator of performance, to identify underlying trends in the business, and to establish operational goals. The adjustments remove the effects of these expenses. |

(b) | Adjusted operating income for each segment and region is calculated as: "Operating income (loss)" less "Items Included in Operating Income (Loss)." |

-more-

FOOTNOTE TABLE 3

HALLIBURTON COMPANY

Reconciliation of As-Reported Income (Loss) from Continuing Operations to

Adjusted Income from Continuing Operations

(Millions of dollars except per share data)

(Unaudited)

|

| | | | | | | |

| | Three Months Ended March 31 2013 | Three Months Ended December 31, 2013 |

As-reported income (loss) from continuing operations attributable to company | $ | (13 | ) | $ | 770 |

|

Macondo-related charge, net of tax (a) | 637 |

| — |

|

Restructuring charges, net of tax (a) | — |

| 28 |

|

Adjusted income from continuing operations attributable to company (a) | $ | 624 |

| $ | 798 |

|

| | | |

As-reported diluted weighted average common shares outstanding (b) | 931 |

| 854 |

|

Adjusted diluted weighted average common shares outstanding (b) | 935 |

| 854 |

|

| | | |

As-reported income (loss) from continuing operations per diluted share (c) | $ | (0.01 | ) | $ | 0.90 |

|

Adjusted income from continuing operations per diluted share (c) | $ | 0.67 |

| $ | 0.93 |

|

| | | |

(a) | Management believes that income (loss) from continuing operations adjusted for the Macondo-related charge for the quarter ended March 31, 2013 and restructuring charges for the quarter ended December 31, 2013 is useful to investors to assess and understand operating performance, especially when comparing those results with previous and subsequent periods or forecasting performance for future periods, primarily because management views the excluded item to be outside of the company's normal operating results. Management analyzes income from continuing operations without the impact of this item as an indicator of performance, to identify underlying trends in the business, and to establish operational goals. The adjustment removes the effect of this expense. Adjusted income from continuing operations attributable to company is calculated as: “As-reported income (loss) from continuing operations attributable to company” plus "Macondo-related charge, net of tax" for the quarter ended March 31, 2013 and "Restructuring charges, net of tax" for the quarter ended December 31, 2013. |

(b) | As-reported diluted weighted average common shares outstanding excludes four million shares of common stock associated with awards granted under employee stock plans for the quarter ended March 31, 2013, as their impact would be antidilutive since our reported continuing operations attributable to company was in a loss position. When adjusting income from continuing operations attributable to company for the Macondo-related charge, these four million shares become dilutive.

|

(c) | As-reported income (loss) from continuing operations per diluted share is calculated as: "As-reported income (loss) from continuing operations attributable to company" divided by "As-reported diluted weighted average common shares outstanding." Adjusted income from continuing operations per diluted share is calculated as: "Adjusted income from continuing operations attributable to company" divided by "Adjusted diluted weighted average common shares outstanding." |

-more-

Conference Call Details

Halliburton (NYSE:HAL) will host a conference call on Monday, April 21, 2014, to discuss the first quarter 2014 financial results. The call will begin at 8:00 AM Central Time (9:00 AM Eastern Time).

Halliburton’s first quarter press release will be posted on the Halliburton website at www.halliburton.com. Please visit the website to listen to the call live via webcast. In addition, you may participate in the call by telephone at (703) 639-1127. A passcode is not required. Attendees should log in to the webcast or dial in approximately 15 minutes prior to the call’s start time.

A replay of the conference call will be available on Halliburton’s website for seven days following the call. Also, a replay may be accessed by telephone at (703) 925-2533, passcode 1631885.

-more-

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

| | | HALLIBURTON COMPANY |

| | | |

| | | |

Date: | April 21, 2014 | By: | /s/ Bruce A. Metzinger |

| | | Bruce A. Metzinger |

| | | Assistant Secretary |

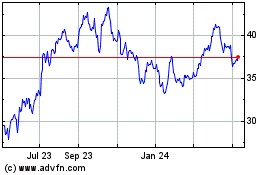

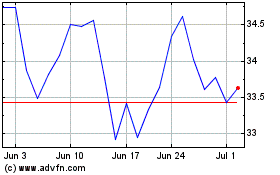

Halliburton (NYSE:HAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Halliburton (NYSE:HAL)

Historical Stock Chart

From Apr 2023 to Apr 2024