- Fourth Quarter Net Income of $55.4

Million and Net Income per Diluted Share of $0.06, Compared to

Prior Year’s Fourth Quarter Net Income of $123.1 Million and Net

Income per Diluted Share of $0.13

- Excluding LIFO and Losses on Debt

Retirement in Both Periods, Net Income was $99.5 Million or $0.10

Per Diluted Share This Year Compared to $70.4 Million or $0.07 Per

Diluted Share Last Year

- Full Year Net Income of $249.4

Million and Net Income per Diluted Share of $0.23, Compared to

Prior Year Net Income of $118.1 Million and Net Income per Diluted

Share of $0.12

- Record Fourth Quarter Adjusted

EBITDA of $356.3 Million Compared to Adjusted EBITDA of $340.3

Million in Prior Year’s Fourth Quarter

- Record Full Year Adjusted EBITDA of

$1,325.0 Million Compared to Adjusted EBITDA of $1,128.4 Million in

Prior Year, a 17.4 percent increase

- Rite Aid Provides Outlook for Fiscal

2015

Rite Aid Corporation (NYSE:RAD) today reported operating results

for its fourth quarter and fiscal year ended March 1, 2014.

For the fourth quarter, the company reported revenues of $6.6

billion, net income of $55.4 million or $0.06 per diluted share,

and Adjusted EBITDA of $356.3 million, or 5.4 percent of

revenues.

For the full year, the company reported revenues of $25.5

billion, net income of $249.4 million or $0.23 per diluted share,

and Adjusted EBITDA of $1,325.0 million, or 5.2 percent of

revenues.

“Thanks to the strong teamwork of our dedicated Rite Aid

associates, we delivered strong fourth-quarter and fiscal 2014

results, including new company records for fourth-quarter and

full-year Adjusted EBITDA,” said Rite Aid Chairman and CEO John

Standley. “These accomplishments reflect the significant progress

we’re making in executing key initiatives and delivering on our

promise to actively work with our customers to keep them well.”

“Our recent acquisitions of Health Dialog and RediClinic, our

expanded partnership with McKesson and our continued commitment to

investing in our store base have positioned us to transition our

strategy from turnaround to growth as we more aggressively pursue

opportunities to become a growing retail healthcare company.”

Fourth Quarter Summary

Revenues for the quarter were $6.6 billion versus revenues of

$6.5 billion in the prior year’s fourth quarter. Revenues increased

2.2 percent primarily as a result of an increase in pharmacy same

store sales.

Same store sales for the quarter increased 2.1 percent over the

prior year, consisting of a 3.5 percent increase in pharmacy sales,

partially offset by a 0.7 percent decrease in front end sales.

Pharmacy sales included an approximate 123 basis point negative

impact from new generic introductions. The number of prescriptions

filled in same stores decreased 1.8 percent over the prior year

period, with 1.3 percent of this decrease being driven by a

decrease in flu-related prescriptions and flu shots. Prescription

sales accounted for 67.5 percent of total drugstore sales, and

third party prescription revenue was 97.1 percent of pharmacy

sales.

Net income was $55.4 million or $0.06 per diluted share compared

to last year’s fourth quarter net income of $123.1 million or $0.13

per diluted share. Current year net income included a LIFO charge

of $44.1 million due to pharmacy inflation while prior year net

income included a LIFO credit of $175.4 million resulting from

significant generic deflation. The increase in LIFO expense was

partially offset by an increase in Adjusted EBITDA, no loss on debt

retirement in the current year compared to a $122.7 million loss on

debt retirement in the prior year and decreases in interest expense

and lease termination and impairment charges. Excluding the LIFO

charge, current year net income was $99.5 million or $.10 per

diluted share. Excluding the LIFO credit and loss on debt

retirement, prior year net income was $70.4 million or $.07 per

diluted share.

Adjusted EBITDA (which is reconciled to net income on the

attached table) was $356.3 million or 5.4 percent of revenues for

the fourth quarter compared to $340.3 million or 5.3 percent of

revenues for the like period last year. Adjusted EBITDA improved

due to an increase in pharmacy gross profit, driven by improvements

in pharmacy revenues and purchasing efficiencies, offset partially

by an increase in selling general and administrative expenses.

In the fourth quarter, the company relocated 2 stores, remodeled

94 stores and expanded 3 stores, bringing the total number of

wellness stores chainwide to 1,215. The company also closed 8

stores, resulting in a total store count of 4,587 at the end of the

fourth quarter.

Full Year Results

For the fiscal year ended March 1, 2014, Rite Aid had revenues

of $25.5 billion compared to $25.4 billion for the prior year.

Revenues increased 0.5 percent primarily as a result of an increase

in same store sales.

Same store sales for the year increased 0.7 percent consisting

of a 1.2 percent increase in pharmacy sales, partially offset by a

0.2 percent decrease in front end sales. Pharmacy sales included an

approximate 232 basis point negative impact from new generic

introductions. The number of prescriptions filled in same stores

decreased 0.3 percent over the prior year period. Prescription

sales accounted for 67.9 percent of total drugstore sales, and

third party prescription revenue was 97.0 percent of pharmacy

sales.

Net income for fiscal 2014 was $249.4 million or $0.23 per

diluted share compared to last year’s net income of $118.1 million

or $0.12 per diluted share. Contributing to the increase in net

income was an increase in Adjusted EBITDA and lower interest

expense, a loss on debt retirement of $62.4 million versus $140.5

million in the prior year, and lower lease termination and

impairment charges. Partially offsetting these improvements was a

LIFO charge of $104.1 million in the current year compared to a

LIFO credit of $147.9 million in the prior year.

As computed on the attached table, Adjusted EBITDA was $1,325.0

million or 5.2 percent of revenues for the year compared to

$1,128.4 million or 4.4 percent of revenues for last year. The

increase in Adjusted EBITDA was driven by increased pharmacy gross

profit due to the continued benefit of generic introductions on

pharmacy gross margin in the first half of the fiscal year,

purchasing efficiencies on generic drugs and strong cost

control.

For the year, the company relocated 11 stores, acquired 1 store,

remodeled 405 stores, expanded 4 stores, and closed 37 stores.

Outlook for Fiscal 2015

The company’s outlook for fiscal 2015 is based on the

anticipated benefits of its wellness remodels, customer loyalty

program, new pharmacy sourcing arrangement with McKesson and other

initiatives to grow sales and drive operational efficiencies. The

company’s outlook also considers planned wage and benefit

increases, the introduction of new generics in the second half of

Fiscal 2015, generic drug price increases and a challenging

reimbursement rate environment.

Rite Aid said it expects sales to be between $26.0 billion and

$26.5 billion in fiscal 2015 with same store sales expected to

range from an increase of 2.50 percent to an increase of 4.50

percent over fiscal 2014.

Adjusted EBITDA (which is reconciled to net income on the

attached table) is expected to be between $1.325 billion and $1.4

billion.

Net income for fiscal 2015 is expected to be between $313.0

million and $423.0 million or income per diluted share of $0.31 to

$0.42.

Capital expenditures are expected to be approximately $525

million. This number does not include the purchases of Health

Dialog or RediClinic.

Conference Call Broadcast

Rite Aid will hold an analyst call at 8:30 a.m. Eastern Time

today with remarks by Rite Aid's management team. The call will be

simulcast via the internet and can be accessed through the websites

www.riteaid.com in the conference call section of investor

information and www.StreetEvents.com. Slides related to materials

discussed on the call will be available on both sites. A playback

of the call will be available on both sites starting at 12 p.m.

Eastern Daylight Time today. A playback of the call will also be

available by telephone beginning at 12 p.m. Eastern Daylight Time

today until 11:59 p.m. Eastern Time on April 12, 2014. The playback

number is 1-855-859-2056 from within the U.S. and Canada or

1-404-537-3406 from outside the U.S. and Canada with the

eight-digit reservation number 17821795.

Rite Aid is one of the nation’s leading drugstore chains with

nearly 4,600 stores in 31 states and the District of Columbia.

Information about Rite Aid, including corporate background and

press releases, is available through Rite Aid’s website at

www.riteaid.com.

Statements, including guidance, in this release that are not

historical are forward-looking statements made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995. Words such as “anticipate,” “believe,” “continue,”

“could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,”

“project,” “should,” and “will” and variations of such words and

similar expressions are intended to identify such forward-looking

statements. These forward-looking statements are not guarantees of

future performance and involve risks, assumptions and

uncertainties, including, but not limited to, our high level of

indebtedness and our ability to make interest and principal

payments on our debt and satisfy the other covenants contained in

our debt agreements, general economic, market and competitive

conditions, our ability to improve the operating performance of our

stores in accordance with our long term strategy, the impact of

private and public third-party payers continued reduction in

prescription drug reimbursements and efforts to encourage mail

order, our ability to manage expenses and our investments in

working capital, outcomes of legal and regulatory matters and

changes in legislation or regulations, including healthcare reform.

These and other risks, assumptions and uncertainties are described

in Item 1A (Risk Factors) of our most recent Annual Report on Form

10-K and in other documents that we file or furnish with the

Securities and Exchange Commission, which you are encouraged to

read. Should one or more of these risks or uncertainties

materialize, or should underlying assumptions prove incorrect,

actual results may vary materially from those indicated or

anticipated by such forward-looking statements. Accordingly, you

are cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date they are made. Rite Aid

expressly disclaims any current intention to update publicly any

forward-looking statement after the distribution of this release,

whether as a result of new information, future events, changes in

assumptions or otherwise.

See the attached table for a reconciliation of a non-GAAP

financial measure, Adjusted EBITDA to net income (loss), the most

comparable GAAP financial measure. We define Adjusted EBITDA as net

income (loss) excluding the impact of income taxes (and any

corresponding adjustments to tax indemnification asset), interest

expense, depreciation and amortization, LIFO adjustments, charges

or credits for facility closing and impairment, inventory

write-downs related to store closings, stock-based compensation

expense, debt retirements, sale of assets and investments, revenue

deferrals related to our customer loyalty program and other

items.

RITE AID CORPORATION AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS (Dollars in thousands) (unaudited)

March 1, 2014 March 2, 2013 ASSETS Current assets: Cash and

cash equivalents $ 146,406 $ 129,452 Accounts receivable, net

949,062 929,476 Inventories, net of LIFO reserve of $1,018,581 and

$915,241 2,993,948

3,154,742

Prepaid expenses and other current assets 195,709

195,377 Total current assets 4,285,125 4,409,047

Property, plant and equipment, net 1,957,329 1,895,650 Other

intangibles, net 431,227 464,404 Other assets 271,190

309,618 Total assets $ 6,944,871 $ 7,078,719

LIABILITIES AND STOCKHOLDERS' DEFICIT Current

liabilities: Current maturities of long-term debt and lease

financing obligations $

49,174

$ 37,311 Accounts payable 1,292,419 1,384,644 Accrued salaries,

wages and other current liabilities 1,165,859

1,156,315 Total current liabilities 2,507,452 2,578,270

Long-term debt, less current maturities 5,632,798 5,904,370 Lease

financing obligations, less current maturities

75,171

91,850 Other noncurrent liabilities 843,152

963,663 Total liabilities 9,058,573 9,538,153

Commitments and contingencies - - Stockholders' deficit: Preferred

stock - Series G - 1 Preferred stock - Series H - 182,097 Common

stock 971,331 904,268 Additional paid-in capital 4,468,149

4,280,831 Accumulated deficit (7,515,848 ) (7,765,262 ) Accumulated

other comprehensive loss (37,334 ) (61,369 ) Total

stockholders' deficit (2,113,702 ) (2,459,434 ) Total

liabilities and stockholders' deficit $ 6,944,871 $

7,078,719 RITE AID CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS (Dollars in

thousands, except per share amounts) (unaudited)

Thirteen weeks ended Thirteen weeks ended March 1, 2014 March 2,

2013 Revenues $ 6,597,459 $ 6,455,245 Costs and expenses: Cost of

goods sold 4,711,743 4,407,482 Selling, general and administrative

expenses 1,716,671 1,682,332 Lease termination and impairment

charges 17,270 36,567 Interest expense 101,992 127,408 Loss on debt

retirements, net - 122,660 Loss on sale of assets, net 412

2,491 6,548,088

6,378,940 Income before income taxes 49,371 76,305

Income tax benefit (6,006 ) (46,782 ) Net income $

55,377 $ 123,087 Basic and diluted earnings

per share: Numerator for earnings per share: Net income $

55,377 $ 123,087 Accretion of redeemable preferred stock - (25 )

Cumulative preferred stock dividends - (2,691

) Income attributable to common stockholders - basic 55,377 120,371

Add back - Interest on convertible notes 1,364 1,364 Add back -

Cumulative preferred stock dividends - 2,691

Income attributable to common stockholders - diluted $

56,741 $ 124,426 Denominator:

Basic weighted average shares 956,925 891,303 Outstanding options

and restricted shares, net 35,304 19,608 Convertible preferred

stock - 33,109 Convertible notes 24,800 24,800

Diluted weighted average shares 1,017,029

968,820 Basic income per share $ 0.06 $

0.14 Diluted income per share $ 0.06 $ 0.13 RITE AID

CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS

OF OPERATIONS (Dollars in thousands, except per share amounts)

(unaudited) Fifty-two weeks ended Fifty-two weeks

ended March 1, 2014 March 2, 2013 Revenues $ 25,526,413 $

25,392,263 Costs and expenses: Cost of goods sold 18,202,679

18,073,987 Selling, general and administrative expenses 6,561,162

6,600,765 Lease termination and impairment charges 41,304 70,859

Interest expense 424,591 515,421 Loss on debt retirements, net

62,443 140,502 Gain on sale of assets, net (15,984 )

(16,776 ) 25,276,195 25,384,758

Income before income taxes 250,218 7,505 Income tax expense

(benefit) 804 (110,600 ) Net income $ 249,414

$ 118,105 Basic and diluted earnings per

share: Numerator for earnings per share: Net income $

249,414 $ 118,105 Accretion of redeemable preferred stock (77 )

(102 ) Cumulative preferred stock dividends (8,318 ) (10,528 )

Conversion of Series G and H preferred stock (25,603 )

- Income attributable to common stockholders - basic

215,416 107,475 Add back - Interest on convertible notes

5,456 - Income attributable to common

stockholders - diluted $ 220,872 $ 107,475

Denominator: Basic weighted average shares 922,199

889,562 Outstanding options and restricted shares, net 32,093

17,697 Convertible notes 24,800 -

Diluted weighted average shares 979,092

907,259 Basic income per share $ 0.23 $ 0.12 Diluted

income per share $ 0.23 $ 0.12 RITE AID CORPORATION AND

SUBSIDIARIES CONSOLIDATED STATEMENTS OF COMPREHENSIVE

INCOME (In thousands) (unaudited) Thirteen weeks

ended Thirteen weeks ended March 1, 2014 March 2, 2013 Net income $

55,377 $ 123,087 Other comprehensive income (loss): Defined benefit

pension plans: Amortization of prior service cost, net transition

obligation and net actuarial losses included in net periodic

pension cost 20,247 (11,794 ) Total other

comprehensive income (loss) 20,247 (11,794 )

Comprehensive income $ 75,624 $ 111,293 RITE

AID CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF

COMPREHENSIVE INCOME (In thousands) (unaudited)

Fifty-two weeks ended Fifty-two weeks ended March 1, 2014 March 2,

2013 Net income $ 249,414 $ 118,105 Other comprehensive income

(loss): Defined benefit pension plans:

Amortization of prior service cost, net

transition obligation and net actuarial losses included in net

periodic pension cost

24,035 (8,735 ) Total other comprehensive income

(loss) 24,035 (8,735 ) Comprehensive income $ 273,449

$ 109,370 RITE AID CORPORATION AND SUBSIDIARIES

SUPPLEMENTAL OPERATING AND CASH FLOW INFORMATION

(Dollars in thousands, except per share amounts) (unaudited)

Thirteen weeks ended Thirteen weeks ended March 1, 2014

March 2, 2013

SUPPLEMENTAL OPERATING INFORMATION

Revenues $ 6,597,459 $ 6,455,245 Cost of goods sold

4,711,743 4,407,482 Gross profit 1,885,716

2,047,763 LIFO charge (credit) 44,142 (175,384

) FIFO gross profit 1,929,858 1,872,379 Gross profit as a

percentage of revenues 28.58 % 31.72 % LIFO charge (credit) as a

percentage of revenues 0.67 % -2.72 % FIFO gross profit as a

percentage of revenues 29.25 % 29.01 % Selling, general and

administrative expenses 1,716,671 1,682,332 Selling, general and

administrative expenses as a percentage of revenues 26.02 % 26.06 %

Cash interest expense 98,015 119,497 Non-cash interest

expense 3,977 7,911 Total interest

expense 101,992 127,408 Adjusted EBITDA 356,330

340,277 Adjusted EBITDA as a percentage of revenues 5.40 % 5.27 %

Net income 55,377 123,087 Net income as a percentage of

revenues 0.84 % 1.91 % Total debt 5,757,143 6,033,531

Invested cash 2,484 16,127 Total debt

net of invested cash 5,754,659 6,017,404

SUPPLEMENTAL CASH FLOW INFORMATION Payments for

property, plant and equipment 78,601 82,651 Intangible assets

acquired 22,748 21,475 Total cash

capital expenditures 101,349 104,126 Equipment received for noncash

consideration 1,237 649 Equipment financed under capital leases

3,042 655 Gross capital expenditures $

105,628 $ 105,430 RITE AID CORPORATION AND

SUBSIDIARIES SUPPLEMENTAL OPERATING AND CASH FLOW

INFORMATION (Dollars in thousands, except per share amounts)

(unaudited) Fifty-two weeks ended Fifty-two weeks

ended March 1, 2014 March 2, 2013

SUPPLEMENTAL OPERATING

INFORMATION Revenues $ 25,526,413 $ 25,392,263 Cost of

goods sold 18,202,679 18,073,987 Gross

profit 7,323,734 7,318,276 LIFO charge (credit) 104,142

(147,882 ) FIFO gross profit 7,427,876 7,170,394

Gross profit as a percentage of revenues 28.69 % 28.82 %

LIFO charge (credit) as a percentage of revenues 0.41 % -0.58 %

FIFO gross profit as a percentage of revenues 29.10 % 28.24 %

Selling, general and administrative expenses 6,561,162

6,600,765 Selling, general and administrative expenses as a

percentage of revenues 25.70 % 26.00 % Cash interest expense

407,957 484,426 Non-cash interest expense 16,634

30,995 Total interest expense 424,591 515,421

Adjusted EBITDA 1,324,959 1,128,379 Adjusted EBITDA as a

percentage of revenues 5.19 % 4.44 % Net income 249,414

118,105 Net income as a percentage of revenues 0.98 % 0.47 %

Total debt 5,757,143 6,033,531 Invested cash 2,484

16,127 Total debt net of invested cash 5,754,659

6,017,404

SUPPLEMENTAL CASH FLOW INFORMATION

Payments for property, plant and equipment 333,870 315,846

Intangible assets acquired 87,353 67,134

Total cash capital expenditures 421,223 382,980 Equipment

received for noncash consideration 2,825 3,285 Equipment financed

under capital leases 18,065 7,906 Gross

capital expenditures $ 442,113 $ 394,171 RITE

AID CORPORATION AND SUBSIDIARIES SUPPLEMENTAL INFORMATION

RECONCILIATION OF NET INCOME TO ADJUSTED EBITDA (In thousands)

Thirteen weeks ended Thirteen weeks ended

March 1, 2014 March 2, 2013 Reconciliation of net

income to adjusted EBITDA: Net income $ 55,377 $ 123,087

Adjustments: Interest expense 101,992 127,408 Income tax benefit

(6,006 ) (46,782 )

Adjustments to tax indemnification

asset

32,356 31,077 Depreciation and amortization 102,060 102,951 LIFO

charge (credit) 44,142 (175,384 ) Lease termination and impairment

charges 17,270 36,567 Stock-based compensation expense 4,000 4,845

Loss on sale of assets, net 412 2,491 Loss on debt retirements, net

- 122,660 Closed facility liquidation expense 1,001 1,009 Customer

loyalty card program revenue deferral 3,501 10,317 Other 225

31 Adjusted EBITDA $ 356,330 $ 340,277

Percent of revenues 5.40 % 5.27 % RITE AID

CORPORATION AND SUBSIDIARIES SUPPLEMENTAL INFORMATION

RECONCILIATION OF NET INCOME TO ADJUSTED EBITDA (In thousands)

Fifty-two weeks ended Fifty-two weeks ended

March 1, 2014 March 2, 2013 Reconciliation of net

income to adjusted EBITDA: Net income $ 249,414 $ 118,105

Adjustments: Interest expense 424,591 515,421 Income tax expense

(benefit) 804 (110,600 )

Adjustments to tax indemnification

asset

30,516 91,314 Depreciation and amortization 403,741 414,111 LIFO

charge (credit) 104,142 (147,882 ) Lease termination and impairment

charges 41,304 70,859 Stock-based compensation expense 16,194

17,717 Gain on sale of assets, net (15,984 ) (16,776 ) Loss on debt

retirements, net 62,443 140,502 Closed facility liquidation expense

3,849 5,272 Severance costs - (72 ) Customer loyalty card program

revenue deferral 2,679 26,564 Other 1,266

3,844 Adjusted EBITDA $ 1,324,959 $ 1,128,379

Percent of revenues 5.19 % 4.44 % RITE AID CORPORATION AND

SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS

(Dollars in thousands) (unaudited) Thirteen

weeks ended Thirteen weeks ended March 1, 2014 March 2, 2013

OPERATING ACTIVITIES: Net income $ 55,377 $ 123,087

Adjustments to reconcile to net cash provided by operating

activities: Depreciation and amortization 102,060 102,951 Lease

termination and impairment charges 17,270 36,567 LIFO charge

(credit) 44,142 (175,384 ) Loss on sale of assets, net 412 2,491

Stock-based compensation expense 4,000 4,845 Loss on debt

retirements, net - 122,660 Excess tax benefit on stock options

(26,665 ) - Changes in operating assets and liabilities: Accounts

receivable (107,946 ) (13,011 ) Inventories 262,965 117,045

Accounts payable (125,934 ) (55,566 ) Other assets and liabilities,

net (31,553 ) (45,334 )

Net cash provided by operating

activities

194,128 220,351 INVESTING ACTIVITIES: Payments for property, plant

and equipment (78,601 ) (82,651 ) Intangible assets acquired

(22,748 ) (21,475 ) Proceeds from dispositions of assets and

investments 14,259 2,576 Proceeds from insured loss 9,006

- Net cash used in investing activities

(78,084 ) (101,550 ) FINANCING ACTIVITIES: Proceeds from issuance

of long-term debt - 1,631,000 Net (payments to) proceeds from

revolver (190,000 ) 665,000 Principal payments on long-term debt

(7,907 ) (2,441,062 ) Change in zero balance cash accounts 10,066

(152 ) Net proceeds from the issuance of common stock 8,336 543

Financing fees paid for early debt redemption - (64,305 ) Excess

tax benefit on stock options 26,665 - Deferred financing costs paid

(10 ) (44,014 ) Net cash used in financing activities

(152,850 ) (252,990 ) Decrease in cash and cash

equivalents (36,806 ) (134,189 ) Cash and cash equivalents,

beginning of period 183,212 263,641

Cash and cash equivalents, end of period $ 146,406 $ 129,452

RITE AID CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS (Dollars in thousands)

(unaudited) Fifty-two weeks ended Fifty-two

weeks ended March 1, 2014 March 2, 2013 OPERATING

ACTIVITIES: Net income $ 249,414 $ 118,105 Adjustments to reconcile

to net cash provided by operating activities: Depreciation and

amortization 403,741 414,111 Lease termination and impairment

charges 41,304 70,859 Gain from lease termination (8,750 ) - LIFO

charge (credit) 104,142 (147,882 ) Gain on sale of assets, net

(15,984 ) (16,776 ) Stock-based compensation expense 16,194 17,717

Loss on debt retirements, net 62,443 140,502 Excess tax benefit on

stock options (26,665 ) - Changes in operating assets and

liabilities: Accounts receivable (28,051 ) 82,721 Inventories

56,557 130,100 Accounts payable (100,774 ) (68 ) Other assets and

liabilities, net (51,525 ) 10,199 Net cash

provided by operating activities 702,046 819,588 INVESTING

ACTIVITIES: Payments for property, plant and equipment (333,870 )

(315,846 ) Intangible assets acquired (87,353 ) (67,134 ) Proceeds

from sale-leaseback transactions 3,989 6,355 Proceeds from

dispositions of assets and investments 28,416 30,320 Proceeds from

lease termination 8,750 - Proceeds from insured loss 15,144

- Net cash used in investing activities

(364,924 ) (346,305 ) FINANCING ACTIVITIES: Proceeds from issuance

of long-term debt 1,310,000 2,057,263 Net (payments to) proceeds

from revolver (265,000 ) 529,000 Principal payments on long-term

debt (1,340,435 ) (2,920,209 ) Change in zero balance cash accounts

(95 ) (43,659 ) Net proceeds from the issuance of common stock

33,217 1,646 Payments for the repurchase of preferred stock (21,034

) - Financing fees paid for early debt redemption (45,636 ) (75,374

) Excess tax benefit on stock options 26,665 - Deferred financing

costs paid (17,850 ) (54,783 ) Net cash used in

financing activities (320,168 ) (506,116 ) Increase

(decrease) in cash and cash equivalents 16,954 (32,833 ) Cash and

cash equivalents, beginning of period 129,452

162,285 Cash and cash equivalents, end of period $ 146,406

$ 129,452 RITE AID CORPORATION AND

SUBSIDIARIES SUPPLEMENTAL INFORMATION RECONCILIATION OF NET INCOME

GUIDANCE TO ADJUSTED EBITDA GUIDANCE YEAR ENDING FEBRUARY 28, 2015

(In thousands, except per share amounts)

Guidance Range Low High Sales $

26,000,000 $ 26,500,000 Same store sales 2.50 % 4.50 %

Gross capital expenditures $ 525,000 $ 525,000

Reconciliation of net income to adjusted EBITDA: Net income $

313,000 $ 423,000 Adjustments: Interest expense 390,000

390,000 Income tax expense 70,000 60,000 Depreciation and

amortization 411,000 409,000 LIFO charge 50,000 35,000 Store

closing and impairment charges 55,000 50,000 Loss on debt

retirement 17,000 17,000 Other 19,000 16,000

Adjusted EBITDA $ 1,325,000 $ 1,400,000

Diluted income per share $ 0.31 $ 0.42

Rite Aid CorporationInvestors:Matt Schroeder,

717-214-8867investor@riteaid.comorMedia:Susan Henderson,

717-730-7766

Rite Aid (NYSE:RAD)

Historical Stock Chart

From Aug 2024 to Sep 2024

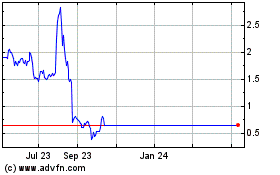

Rite Aid (NYSE:RAD)

Historical Stock Chart

From Sep 2023 to Sep 2024