Consolidated Water Co. Ltd. Reports 2013 Operating Results

GEORGE TOWN, GRAND CAYMAN, CAYMAN ISLANDS--(Marketwired - Mar

17, 2014) - Consolidated Water Co. Ltd. (NASDAQ: CWCO), which

develops and operates seawater desalination plants and water

distribution systems in areas of the world where naturally

occurring supplies of potable water are scarce or nonexistent,

today reported its operating results for the year ended December

31, 2013. The Company will host an investor conference call on

Tuesday, March 18 2014, at 11:00 a.m. EDT (see details below) to

discuss its operating results and other topics of interest.

2013 Operating Results

Net income attributable to the Company's stockholders was

$8,594,519, or $0.58 per diluted share, for the year ended December

31, 2013, compared with net income attributable to CWCO

stockholders of $9,315,514, or $0.64 per diluted share, for the

year ended December 31, 2012. The decrease in net income from

2012 to 2013 was attributable to the earnings and profit sharing

derived from the Company's equity investment in its affiliate,

OC-BVI, which totaled $1,337,352 in 2013, compared with $2,464,773

in the previous year. OC-BVI's 2012 earnings included the

receipt of approximately $4.7 million of the amount awarded by the

Court in the Baughers Bay litigation, whereas its 2013 earnings

included the receipt of only $2.0 million on this award.

Total revenues for the year ended December 31, 2013 decreased

2.5% to approximately $63.8 million, compared with approximately

$65.5 million for 2012.

Retail water revenues declined 5% to approximately $23.0 million

(36% of total revenues) in the most recent year, versus

approximately $24.2 million (37% of total revenues) in

2012. The reduction in retail revenues was due to an

approximate 8% decrease in the number of gallons of water sold by

the Company's Cayman retail operation. Management is not

certain of the cause of this decrease in volume of retail water

sold, but believes the decrease could partially reflect the

adoption of water conservation measures by certain larger

customers. The impact of the reduction in the number of

gallons sold was exacerbated by a decrease in the Company's base

rates of approximately 0.22% due to movements in the consumer price

indices used to determine annual base rate adjustments that become

effective in the first quarter of each year.

Bulk water revenues decreased 2% to approximately $40.0 million

(63% of total revenues) in 2013, compared with approximately $40.8

million (62% of total revenues) in the previous year. The

January 2013 expiration of the Company's operating agreement with

the Water Authority - Cayman for the Lower Valley plant on Grand

Cayman Island resulted in a reduction in bulk water revenues for

the year ended December 31, 2013 when compared with the year ended

December 31, 2012. This decrease was partially offset by

increased sales from the other plants that the Company operates for

the Water Authority - Cayman. The total gallons of water sold

by the bulk segment in 2013 decreased by 2% relative to the number

of gallons sold in 2012.

Services revenues increased 80% to $843,413 in 2013, compared

with $469,625 in 2012, primarily due to an increase in the

management fees earned under the management services agreement with

OC-BVI.

Consolidated gross profit improved 7% to approximately $23.5

million (37% of total revenues) for the year ended December 31,

2013, versus approximately $22.0 million (34% of total revenues)

for the year ended December 31, 2012. Gross profit on retail

revenues declined 5% to approximately $12.0 million in 2013 (52% of

retail revenues), compared with approximately $12.7 million (52% of

retail revenues) in the previous year. Gross profit on bulk

revenues increased 29% to approximately $11.7 million (29% of bulk

revenues), compared with approximately $9.1 million (22% of bulk

revenues) in 2012. The increase in gross profit dollars for

the bulk segment reflected improved margins for bulk operations and

a reduction of approximately $2.2 million in depreciation expense,

as certain assets we continue to use reached the end of their

depreciable lives during the fourth quarter of 2012 and in early

2013. The services segment recorded a negative gross profit of

($236,847) in 2013, compared with a gross profit of $239,507 in

2012. The lower gross profit for 2013 reflects $307,000 in

incremental employee costs primarily due to the transfer of four

engineering employees from the retail segment to the services

segment, and a $173,000 increase in engineering-related consulting

expenses. The services segment's losses from operations of

approximately ($3.6 million) and ($1.7 million) for 2013 and 2012,

respectively, include the costs incurred by N.S.C. Agua, S.A. de

C.V. ("NSC"), the Company's Mexico subsidiary, to develop a 100

million gallon per day desalination plant in Rosarito,

Mexico.

Consolidated general and administrative expenses ("G&A")

increased 9% to approximately $15.8 million in 2013, compared with

approximately $14.5 million in the previous year. Project

development expenses incurred by NSC increased by approximately

$1.5 million, employee costs rose approximately $206,000 due to

base salary increases, directors' fees and expenses increased

approximately $218,000, and fees and license expenses increased

approximately $146,000. These cost increases were partially

offset by a reduction of approximately $584,000 in business

development expenses not related to NSC, a decrease of

approximately $186,000 in research and development costs, a decline

of approximately $178,000 in professional fees, and a reduction in

depreciation expense of approximately $131,000.

Interest income decreased slightly to $826,570 in 2013, versus

$835,941 in 2012 as a result of the declining principal balances on

our loans receivable. Interest expense decreased 45% to

$484,057 for the year ended December 31, 2013, versus $876,971 in

the previous year, as a result of the repayment in March 2012 of

the remaining $8.5 million of CW-Bahamas' Series A bonds payable

and the declining principal balances on the Company's remaining

bonds payable.

Management Comments

"I am pleased that we were able to increase the Company's

consolidated gross profit dollars by 7% during 2013, in spite of a

2.5% decline in consolidated revenues," commented Chief Executive

Officer Rick McTaggart. "This demonstrates our expertise in

operating and maintaining seawater desalination plants and our

ability to maximize the production of our facilities while

controlling costs, which ultimately benefits our customers and

shareholders."

"The erosion over the past three years of our retail sales

volumes in Grand Cayman is somewhat confounding, given that

economic conditions and tourist numbers continue to

improve. We are currently speaking with some of our larger

customers to determine what factors may be contributing to this

phenomenon."

"Development activities involving our Rosarito desalination

plant and conveyance pipeline project in northern Baja California,

Mexico continue to progress," continued Mr. McTaggart. "Over

the last three months, we have held technical and financial

meetings with officials from the Government of Baja California and

the public water utility in Tijuana, Mexico, Comisión Estatal de

Servicios Públicos de Tijuana ("CESPT"), and we expect to reach

certain important project milestones shortly. In addition, we

continue to work closely with the Otay Water District in San Diego

County, California, and expect to soon deploy additional water

sampling and piloting programs in support of Otay's efforts to

obtain necessary regulatory approvals in California."

"We continue to believe that the northern Baja California and

southern California region desperately needs new drinking water

sources and that the Rosarito project provides an economical and

practical solution to meet this need. Recent press coverage of

the extreme drought conditions affecting the region supports our

views," concluded Mr. McTaggart.

Cash Dividends

On January 31, 2014, the Company paid a quarterly cash dividend

of $0.075 per share for the 19th consecutive quarter. The

Company has paid cash dividends to shareholders since 1985.

Investor Conference Call

The Company will host a conference call at 11:00 a.m. Eastern

Time (EDT) on Tuesday, March 18, 2014. Shareholders and other

interested parties may participate in the conference call by

dialing 877-374-8416 (international/local participants dial

412-317-6716) and requesting participation in the "Consolidated

Water Conference Call" a few minutes before 11:00 a.m. EDT on March

18, 2014.

A replay of the conference call will be available one hour after

the call through Tuesday, March 25, 2014 by dialing 877-344-7529

(international/local participants dial 412-317-0088) and entering

the conference ID # 10042472, and on the Company's website at

www.cwco.com.

CWCO-E

About Consolidated Water Co. Ltd.

Consolidated Water Co. Ltd. develops and operates seawater

desalination plants and water distribution systems in areas of the

world where naturally occurring supplies of potable water are

scarce or nonexistent. The Company operates water production and/or

distribution facilities in the Cayman Islands, Belize, the British

Virgin Islands, The Commonwealth of The Bahamas, and Bali,

Indonesia.

Consolidated Water Co. Ltd. is headquartered in George Town,

Grand Cayman, in the Cayman Islands. The Company's ordinary

(common) stock is traded on the NASDAQ Global Select Market under

the symbol "CWCO". Additional information on the Company is

available on its website at http://www.cwco.com.

This press release includes statements that may constitute

"forward-looking" statements, usually containing the words

"believe", "estimate", "project", "intend", "expect", "should" or

similar expressions. These statements are made pursuant to the

safe harbor provisions of the Private Securities Litigation Reform

Act of 1995. Forward-looking statements inherently involve

risks and uncertainties that could cause actual results to differ

materially from the forward-looking statements. Factors that

would cause or contribute to such differences include, but are not

limited to, continued acceptance of the Company's products and

services in the marketplace, changes in its relationships with the

governments of the jurisdictions in which it operates, the outcome

of its negotiations with the Cayman government regarding a new

retail license agreement, its ability to successfully secure

contracts for water projects, including the projects under

development in Baja California, Mexico and Bali, Indonesia, its

ability to develop and operate such projects profitably, and its

ability to manage growth and other risks detailed in the Company's

periodic report filings with the Securities and Exchange Commission

("SEC").

By making these forward-looking statements, the Company

undertakes no obligation to update these statements for revisions

or changes after the date of this release.

(Financial Highlights Follow)

| |

|

| CONSOLIDATED WATER CO. LTD. |

|

| |

|

| CONSOLIDATED BALANCE SHEETS |

|

| |

|

| |

|

December 31, |

|

| |

|

2013 |

|

|

2012 |

|

| ASSETS |

|

|

|

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

|

|

| |

Cash

and cash equivalents |

|

$ |

33,626,516 |

|

|

$ |

33,892,655 |

|

| |

Marketable securities |

|

|

8,587,475 |

|

|

|

8,570,338 |

|

| |

Accounts receivable, net |

|

|

18,859,560 |

|

|

|

12,516,466 |

|

| |

Inventory |

|

|

1,383,135 |

|

|

|

1,757,601 |

|

| |

Prepaid expenses and other current assets |

|

|

3,435,127 |

|

|

|

2,709,185 |

|

| |

Current portion of loans receivable |

|

|

1,691,102 |

|

|

|

1,812,532 |

|

| Total current assets |

|

|

67,582,915 |

|

|

|

61,258,777 |

|

| Property, plant and equipment, net |

|

|

58,602,886 |

|

|

|

58,993,406 |

|

| Construction in progress |

|

|

1,450,417 |

|

|

|

2,612,800 |

|

| Inventory, non-current |

|

|

4,204,089 |

|

|

|

3,970,241 |

|

| Loans receivable |

|

|

7,337,177 |

|

|

|

9,028,279 |

|

| Investment in OC-BVI |

|

|

6,623,448 |

|

|

|

6,925,346 |

|

| Intangible assets, net |

|

|

1,096,488 |

|

|

|

1,455,015 |

|

| Goodwill |

|

|

3,499,037 |

|

|

|

3,499,037 |

|

| Investment in land |

|

|

12,175,566 |

|

|

|

- |

|

| Other assets |

|

|

2,792,831 |

|

|

|

2,706,185 |

|

| Total assets |

|

$ |

165,364,854 |

|

|

$ |

150,449,086 |

|

| |

|

|

|

|

|

|

|

|

| LIABILITIES AND EQUITY |

|

|

|

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

|

|

| |

Accounts payable and other current liabilities |

|

$ |

7,157,896 |

|

|

$ |

5,883,666 |

|

| |

Dividends payable |

|

|

1,164,026 |

|

|

|

1,158,967 |

|

| |

Current portion of long term debt |

|

|

5,205,167 |

|

|

|

1,647,493 |

|

| |

Land

purchase obligation |

|

|

10,050,000 |

|

|

|

- |

|

| Total current liabilities |

|

|

23,577,089 |

|

|

|

8,690,126 |

|

| Long term debt |

|

|

- |

|

|

|

5,205,167 |

|

| Other liabilities |

|

|

289,392 |

|

|

|

435,413 |

|

| Total liabilities |

|

|

23,866,481 |

|

|

|

14,330,706 |

|

| Commitments and contingencies |

|

|

|

|

|

|

|

|

| Equity |

|

|

|

|

|

|

|

|

| Consolidated Water Co. Ltd. stockholders' equity |

|

|

|

|

|

|

|

|

| |

Redeemable preferred stock, $0.60 par value. Authorized 200,000

shares; issued and outstanding 37,408 and 30,265 shares,

respectively |

|

|

22,445 |

|

|

|

18,159 |

|

| |

Class

A common stock, $0.60 par value. Authorized 24,655,000 shares;

issued and outstanding 14,686,197 and 14,593,011 shares,

respectively |

|

|

8,811,718 |

|

|

|

8,755,807 |

|

| |

Class

B common stock, $0.60 par value. Authorized 145,000 shares; none

issued or outstanding |

|

|

- |

|

|

|

- |

|

| |

Additional paid-in capital |

|

|

83,381,387 |

|

|

|

82,467,421 |

|

| |

Retained earnings |

|

|

47,155,548 |

|

|

|

42,965,179 |

|

| |

Cumulative translation adjustment |

|

|

(471,983 |

) |

|

|

(15,400 |

) |

| Total Consolidated Water Co. Ltd. stockholders'

equity |

|

|

138,899,115 |

|

|

|

134,191,166 |

|

| Non-controlling interests |

|

|

2,599,258 |

|

|

|

1,927,214 |

|

| Total equity |

|

|

141,498,373 |

|

|

|

136,118,380 |

|

| Total liabilities and equity |

|

$ |

165,364,854 |

|

|

$ |

150,449,086 |

|

| |

|

|

|

|

|

|

|

|

| |

|

| CONSOLIDATED WATER CO. LTD. |

|

| |

|

| CONSOLIDATED STATEMENTS OF INCOME |

|

| |

|

| |

|

Year Ended December 31, |

|

| |

|

2013 |

|

|

2012 |

|

|

2011 |

|

| Retail water revenues |

|

$ |

23,018,498 |

|

|

$ |

24,222,895 |

|

|

$ |

23,356,338 |

|

| Bulk water revenues |

|

|

39,960,220 |

|

|

|

40,758,182 |

|

|

|

30,757,874 |

|

| Services revenues |

|

|

843,413 |

|

|

|

469,625 |

|

|

|

1,040,280 |

|

| |

Total

revenues |

|

|

63,822,131 |

|

|

|

65,450,702 |

|

|

|

55,154,492 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of retail revenues |

|

|

11,023,096 |

|

|

|

11,548,255 |

|

|

|

11,496,598 |

|

| Cost of bulk revenues |

|

|

28,212,896 |

|

|

|

31,679,887 |

|

|

|

24,127,488 |

|

| Cost of services revenues |

|

|

1,080,260 |

|

|

|

230,118 |

|

|

|

508,339 |

|

| |

Total

cost of revenues |

|

|

40,316,252 |

|

|

|

43,458,260 |

|

|

|

36,132,425 |

|

| Gross profit |

|

|

23,505,879 |

|

|

|

21,992,442 |

|

|

|

19,022,067 |

|

| General and administrative expenses |

|

|

15,844,303 |

|

|

|

14,542,817 |

|

|

|

13,651,650 |

|

| Impairment losses |

|

|

- |

|

|

|

521,444 |

|

|

|

- |

|

| Income from operations |

|

|

7,661,576 |

|

|

|

6,928,181 |

|

|

|

5,370,417 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Other income (expense) |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Interest income |

|

|

826,570 |

|

|

|

835,941 |

|

|

|

1,200,999 |

|

| |

Interest expense |

|

|

(484,057 |

) |

|

|

(876,971 |

) |

|

|

(1,141,744 |

) |

| |

Profit sharing income from OC-BVI |

|

|

357,636 |

|

|

|

343,454 |

|

|

|

- |

|

| |

Equity in earnings of OC-BVI |

|

|

979,716 |

|

|

|

2,121,319 |

|

|

|

838,652 |

|

| |

Impairment of investment in OC-BVI |

|

|

(200,000 |

) |

|

|

- |

|

|

|

- |

|

| |

Other |

|

|

7,048 |

|

|

|

272,085 |

|

|

|

283,656 |

|

| |

Other

income (expense), net |

|

|

1,486,913 |

|

|

|

2,695,828 |

|

|

|

1,181,563 |

|

| Net income |

|

|

9,148,489 |

|

|

|

9,624,009 |

|

|

|

6,551,980 |

|

| Income attributable to non-controlling interests |

|

|

553,970 |

|

|

|

308,495 |

|

|

|

438,762 |

|

| Net income attributable to Consolidated Water Co. Ltd.

stockholders |

|

$ |

8,594,519 |

|

|

$ |

9,315,514 |

|

|

$ |

6,113,218 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic earnings per common share attributable to

Consolidated Water Co. Ltd. common stockholders |

|

$ |

0.59 |

|

|

$ |

0.64 |

|

|

$ |

0.42 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted earnings per common share attributable to

Consolidated Water Co. Ltd. common stockholders |

|

$ |

0.58 |

|

|

$ |

0.64 |

|

|

$ |

0.42 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Dividends declared per common share |

|

$ |

0.30 |

|

|

$ |

0.30 |

|

|

$ |

0.30 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average number of common shares used in the

determination of: |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Basic

earnings per share |

|

|

14,633,884 |

|

|

|

14,578,518 |

|

|

|

14,560,259 |

|

| |

Diluted earnings per share |

|

|

14,703,880 |

|

|

|

14,606,148 |

|

|

|

14,596,013 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| CONSOLIDATED WATER CO. LTD. |

| CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(LOSS) |

| |

| |

|

Year Ended December 31, |

| |

|

2013 |

|

|

2012 |

|

|

2011 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Net Income |

|

$ |

9,148,489 |

|

|

$ |

9,624,009 |

|

|

$ |

6,551,980 |

| Other comprehensive income (loss) |

|

|

|

|

|

|

|

|

|

|

|

| |

|

Foreign currency translation adjustment |

|

|

(480,614 |

) |

|

|

(16,210 |

) |

|

|

- |

| |

Total other comprehensive income (loss) |

|

|

(480,614 |

) |

|

|

(16,210 |

) |

|

|

- |

| Comprehensive income |

|

|

8,667,875 |

|

|

|

9,607,799 |

|

|

|

6,551,980 |

| Comprehensive income attributable to the

non-controlling interest |

|

|

529,939 |

|

|

|

307,685 |

|

|

|

438,762 |

| Comprehensive income attributable to Consolidated Water

Co. Ltd. stockholders |

|

$ |

8,137,936 |

|

|

$ |

9,300,114 |

|

|

$ |

6,113,218 |

| |

|

|

|

|

|

|

|

|

|

|

|

For further information, please contact: Frederick W. McTaggart

President and CEO (345) 945-4277 David W. Sasnett Executive Vice

President and CFO (954) 509-8200 info@cwco.com or RJ Falkner &

Company, Inc. Investor Relations Counsel (800) 377-9893

info@rjfalkner.com

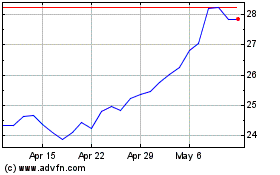

Consolidated Water (NASDAQ:CWCO)

Historical Stock Chart

From Aug 2024 to Sep 2024

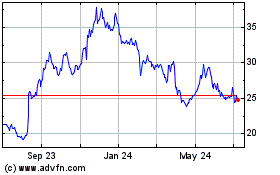

Consolidated Water (NASDAQ:CWCO)

Historical Stock Chart

From Sep 2023 to Sep 2024