Definitive Materials Filed by Investment Companies. (497)

February 28 2014 - 9:50AM

Edgar (US Regulatory)

|

|

|

|

|

|

|

|

Summary Prospectus

|

|

February 28, 2014

|

|

Madison Cash Reserves Fund

|

|

Share Class/Ticker: Class A - MFAXX

Ÿ

Class B - MFBXX

|

|

|

|

|

|

Before you invest, you may want to review the Fund's prospectus, which contains more information about the Fund and its risks. You can find the Fund's prospectus, Statement of Additional Information (SAI) and other information about the Fund online at madisonfunds.com/ProspectusReports. You can also obtain this information at no cost by calling 800.877.6089 or by sending an email request to madisonlitrequests@madisonadv.com. The current prospectus and SAI dated February 28, 2014, are incorporated by reference into this Summary Prospectus.

|

Investment Objective

The Madison Cash Reserves Fund seeks high current income from money market instruments consistent with the preservation of capital and liquidity.

Fees and Expenses

This table describes the fees and expenses that you may pay if you buy and hold shares of the fund. You may qualify for sales charge discounts if you and your immediate family invest, or agree to invest in the future, at least $25,000 in Madison Funds. More information about these and other discounts is available from your financial professional, in the “Your Account - Sales Charges and Fees” section on page 88 of this prospectus and in the “More About Purchasing and Selling Shares” section on page 57 of the statement of additional information.

|

|

|

|

|

|

|

Shareholder Fees:

(fees paid directly from your investment)

|

Class A

|

Class B

|

|

Maximum Sales Charge (Load)Imposed on Purchases (as a percentage of offering price)

|

None

|

None

|

|

Maximum Deferred Sales Charge (Load) (as a percentage of amount redeemed)

|

None

|

4.50%

1

|

|

Redemption Fee Within 30 days of Purchase (as a percentage of amount redeemed)

|

None

|

None

|

|

|

|

|

|

Annual Fund Operating Expenses:

(expenses that you pay each year as a percentage of the value of your investment)

|

Class A

|

Class B

|

|

Management Fees

|

0.40%

|

0.40%

|

|

Distribution and/or Service (Rule 12b-1) Fees

|

None

|

0.75%

|

|

Other Expenses

|

0.15%

|

0.15%

|

|

Total Annual Fund Operating Expenses

|

0.55%

|

1.30%

|

|

Less: Fee waivers and/or expense reimbursements

2

|

-0.46%

|

-1.20%

|

|

Total Net Annual Fund Operating Expenses (after fee waivers/expense reimbursements)

|

0.09%

|

0.10%

|

1

The CDSC is reduced after 12 months and eliminated after six years following purchase.

|

|

|

|

2

|

Madison Asset Management, LLC (“Madison”), the investment adviser of the fund, and MFD Distributor, LLC (“MFD”), the fund’s principal distributor, contractually agreed until

|

at least March 1, 2015 to waive fees and reimburse fund expenses to the extent necessary to prevent a negative fund yield. The fee waiver agreement may be terminated by

the Board of Trustees of the fund at any time and for any reason; however, the Board has no intention of terminating this agreement in the next year. Not included in the fee

waiver are (i) any fees and expenses relating to portfolio holdings (e.g., brokerage commissions, interest on loans, etc.); or (ii) extraordinary and non-recurring fees and expenses (e.g., costs relating to any line of credit the fund maintains with its custodian or another entity for investment purposes). Neither Madison nor MFD has the right to recoup any waived fees.

Example

:

The following example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds. The example assumes you invest $10,000

in the fund for the time periods indicated and then either redeem or not redeem your shares at the end of the period. The example also assumes that your investment has a 5% return each year and that the fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Redemption

|

No Redemption

|

|

|

A

|

|

B

|

|

|

A

|

|

B

|

|

|

1 Year

|

$

|

9

|

|

$

|

460

|

|

|

$

|

9

|

|

$

|

10

|

|

|

3 Years

|

130

|

|

643

|

|

|

130

|

|

293

|

|

|

5 Years

|

261

|

|

797

|

|

|

261

|

|

597

|

|

|

10 Years

|

645

|

|

1,253

|

|

|

645

|

|

1,253

|

|

Principal Investment Strategies

The fund invests exclusively in U.S. dollar-denominated money market securities maturing in 13 months or less from the date of purchase. These securities will be obligations of the U.S. Government and its agencies and instrumentalities, but may also include securities issued by U.S. and foreign financial institutions, corporations, municipalities, foreign governments, and multi-national organizations, such as the World Bank. At least 95% of the fund’s assets must be rated in the highest short-term category (or its unrated equivalent), and 100% of the fund’s assets must be invested in securities rated in the two highest rating categories.

Madison Cash Reserves Fund |

1

MF-CRSPRO 0214

The fund may invest in U.S. dollar-denominated foreign money market securities, although no more than 25% of the fund’s assets may be invested in these securities unless they are backed by a U.S. parent financial institution. In addition, the fund may enter into repurchase agreements, engage in short-term trading and purchase securities on a when-issued or forward commitment basis. The fund maintains a dollar-weighted average portfolio maturity of 60 days or less.

To the extent permitted by law and available in the market, the fund may invest in mortgage-backed and asset-backed securities, including those representing pools of mortgage, commercial, or consumer loans originated by financial institutions.

Principal Risks

As with any money market fund, the yield paid by the fund will vary with changes in interest rates. Generally, if interest rates rise, the market value of income bearing securities will decline.

During unusual periods of credit market illiquidity, it is possible that the fund’s holdings of commercial paper could be subject to principal loss in the event the fund needs to raise cash to meet redemptions.

An investment in the fund is neither insured nor guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the fund attempts to maintain a stable price of $1.00 per share, there is no assurance that it will be able to do so and it is possible to lose money by investing in the fund.

Performance

The following bar chart and table provide some indication of the risks of investing in the fund. The bar chart shows how the fund’s investment results have varied from year to year. The table shows the fund’s average annual total returns for various periods compared to different broad measures of market performance. The fund’s past performance (before and after taxes) is not necessarily an indication of its future performance. Updated performance information current to the most recent month-end is available at no cost by visiting www.madisonfunds.com or by calling 1-800-877-6089.

Calendar Year Total Returns for Class A Shares

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Highest/Lowest quarter end results during this period were:

|

|

|

|

|

Highest:

|

3Q 2006

|

1.19

|

%

|

|

|

Lowest:

|

2009-2013

(all quarters)

|

0.00

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average Annual Total Returns

For Periods Ended December 31, 2013

|

|

|

|

|

|

|

|

|

1 Year

|

5 Years

|

10 Years

|

|

Class A Shares

|

0.00%

|

0.00%

|

1.41%

|

|

Class B Shares

|

-4.50%

|

-0.40%

|

1.05%

|

|

90-Day U.S. Treasury Bill

(reflects no deduction for sales charges, account fees, expenses or taxes)

|

0.05%

|

0.10%

|

1.59%

|

Portfolio Management

The investment adviser to the fund is Madison Asset Management, LLC.

Madison Cash Reserves Fund |

2

Purchase and Sale of Fund Shares

Class A and B Shares

. The minimum investment amounts are as follows for Class A and B shares:

|

|

|

|

|

|

|

|

|

Type of Account

|

To Open an Account

1

|

To Add to an Account

1

|

|

Non-retirement accounts:

|

$1,000 ($1,000 per fund)

|

$150 ($50 per fund)

|

|

Retirement accounts:

|

$500 ($500 per fund)

|

$150 ($50 per fund)

|

|

Systematic investment programs:

2

|

|

|

|

|

Twice Monthly or Biweekly

3

|

$25

|

$25

|

|

|

|

Monthly

|

$50

|

$50

|

|

|

|

Bimonthly (every other month)

|

$100

|

$100

|

|

|

|

Quarterly

|

$150

|

$150

|

|

1

The fund reserves the right to accept purchase amounts below the minimum for accounts that are funded with pre-tax or salary

reduction contributions which include SEPs, 401(k) plans, non-qualified deferred compensation plans, and other pension and profit

sharing plans, as well as for investment for accounts opened through institutional relationships like “managed account” programs.

2

Regardless of frequency, the minimum investment allowed is $50 per fund per month.

3

Only one fund can be opened under the twice monthly or biweekly options and all purchases need to be directed to that fund.

You may generally purchase, exchange or redeem shares of the fund on any day the New York Stock Exchange (NYSE) is open for business by written request (Madison Funds, P.O. Box 8390, Boston, MA 02266-8390), by telephone (1-800-877-6089), by contacting your financial professional, by wire (purchases only) or, with respect to purchases and exchanges, online at madisonfunds.com. Requests must be received in good order by the fund or its agent prior to the close of regular trading of the NYSE in order to receive that day's net asset value. Investors wishing to purchase or redeem shares through a broker-dealer or other financial intermediary should contact the intermediary to learn how to place an order.

Tax Information

Dividends you receive from the fund are subject to federal income taxes and may also be subject to state and local taxes, unless you are tax-exempt or your account is tax-exempt or tax-deferred (in which case, such distributions may be taxable upon withdrawal). Distributions from the fund are expected to be taxed as ordinary income.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase shares of the fund through a broker-dealer or other financial intermediary (such as a financial advisor), the fund, the fund’s investment adviser and/or the fund’s principal distributor may pay the intermediary for the sale of fund shares and related services. Currently, the fund has such an arrangement with CUNA Brokerage Services, Inc., the former principal distributor of the fund’s shares, as well as certain other financial intermediaries. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary and your financial advisor to recommend the fund over another investment. Ask your financial advisor or visit your financial intermediary’s website for more information.

Madison Cash Reserves Fund |

3

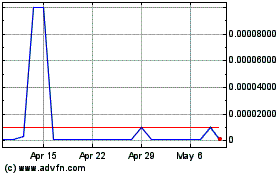

MultiCell Technologies (CE) (USOTC:MCET)

Historical Stock Chart

From Mar 2024 to Apr 2024

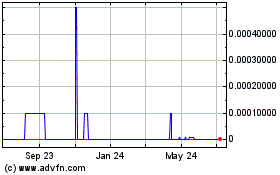

MultiCell Technologies (CE) (USOTC:MCET)

Historical Stock Chart

From Apr 2023 to Apr 2024