|

|

|

|

|

Prospectus Supplement No. 16

(to

Prospectus dated May 30, 2013)

|

|

Filed pursuant to Rule 424 (b)(4)

Registration No. 333-187508

|

125,000 Shares of Series A Convertible Preferred Stock

12,500,000 Shares of Common Stock Underlying the Preferred Stock

Warrants to Purchase up to 6,250,000 Shares of Common Stock and

6,250,000 Shares of Common Stock Underlying the Warrants

ARCA biopharma, Inc.

This prospectus supplement supplements the prospectus dated May 30, 2013 (the “Prospectus”), as supplemented by that certain

Prospectus Supplement No. 1 dated July 17, 2013 (“Supplement No. 1”), by that certain Prospectus Supplement No. 2 dated July 19, 2013 (“Supplement No. 2”), by that certain Prospectus Supplement

No. 3 dated July 24, 2013 (“Supplement No. 3”), by that certain Prospectus Supplement No. 4 dated July 30, 2013 (“Supplement No. 4”), by that certain Prospectus Supplement No. 5 dated

August 6, 2013 (“Supplement No. 5”), by that certain Prospectus Supplement No. 6 dated September 4, 2013 (“Supplement No. 6”), by that certain Prospectus Supplement No. 7 dated September 23,

2013 (“Supplement No. 7”), by that certain Prospectus Supplement No. 8 dated October 29, 2013 (“Supplement No. 8”), by that certain Prospectus Supplement No. 9 dated November 6, 2013

(“Supplement No. 9”), by that certain Prospectus Supplement No. 10 dated November 13, 2013 (“Supplement No. 10”), by that certain Prospectus Supplement No. 11 dated November 21, 2013

(“Supplement No. 11”), by that certain Prospectus Supplement No. 12 dated December 5, 2013 (“Supplement No. 12”), by that certain Prospectus Supplement No. 13 dated January 8, 2014 (“Supplement

No. 13”), by that certain Prospectus Supplement No. 14 dated February 10, 2014 (“Supplement No. 14”), and by that certain Prospectus Supplement No. 15 dated February 12, 2014 (“Supplement

No. 15”, and together with Supplement No. 1, Supplement No. 2, Supplement No. 3, Supplement No. 4, Supplement No. 5, Supplement No. 6, Supplement No. 7, Supplement No. 8, Supplement No. 9,

Supplement No. 10, Supplement No. 11, Supplement No. 12, Supplement No. 13, and Supplement No. 14, the “Supplements”), which form a part of our Registration Statement on Form S-1 (Registration No. 333-187508).

This prospectus supplement is being filed to update and supplement the information in the Prospectus and the Supplements with the information contained in our current report on Form 8-K, filed with the Securities and Exchange Commission (the

“Commission”) on February 18, 2014 (the “Current Report”). Accordingly, we have attached the Current Report to this prospectus supplement.

The Prospectus, the Supplements and this prospectus supplement relate to the offer and sale of up to 125,000 shares of Series A Convertible

Preferred Stock (“Preferred Stock”) which are convertible into 12,500,000 shares of Common Stock, warrants to purchase up to 6,250,000 shares of our Common Stock and 6,250,000 shares of Common Stock underlying the warrants.

This prospectus supplement should be read in conjunction with the Prospectus and the Supplements. This prospectus supplement updates and

supplements the information in the Prospectus and the Supplements. If there is any inconsistency between the information in the Prospectus, the Supplements and this prospectus supplement, you should rely on the information in this prospectus

supplement.

Our common stock is traded on the Nasdaq Global Market under the trading symbol “ABIO.” On February 18, 2014,

the last reported sale price of our common stock was $1.79 per share.

Investing in

our securities involves a high degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors” beginning on page 5 of the Prospectus and beginning on page 23 of our quarterly report on

Form 10-Q for the quarterly period ended September 30, 2013 before you decide whether to invest in shares of our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

determined if the Prospectus or this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The date of

this prospectus supplement is February 18, 2014

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 18, 2014 (February 11, 2014)

ARCA biopharma, Inc.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

Delaware

|

|

000-22873

|

|

36-3855489

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

11080 CirclePoint Road, Suite 140, Westminster, CO 80020

(Address of Principal Executive Offices) (Zip Code)

(720) 940-2200

(Registrant’s telephone number, including area code)

Not Applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain

Officers; Compensatory Arrangements of Certain Officers.

On February 11, 2014, the Board of Directors (the “Board”) of

ARCA biopharma, Inc. (the “Company”) elected Daniel J. Mitchell as a director of the Company to fill a vacancy on the Board.

In

connection with Mr. Mitchell’s appointment, and pursuant to the Company’s previously adopted director compensation policy, the Company granted Mr. Mitchell options to purchase (i) 7,079 shares of common stock (“Grant

1”) and (ii) 16,000 shares of common stock (“Grant 2”), each at an exercise price of $1.80 per share, the closing price of the Company’s common stock on February 11, 2014. The options are subject to the terms and

conditions of the Company’s 2013 Equity Incentive Plan, as amended (the “Plan”), and the Company’s standard forms of Stock Option Agreement and Option Grant Notice for the Plan, copies of which were filed as Exhibit 10.4 to the

Company’s Current Report on Form 8-K filed on September 23, 2013. The Grant 1 options vest in equal monthly installments over an eleven month period beginning February 1, 2014, and the Grant 2 options vest in equal monthly

installments over a three year period beginning on the date of grant, in each case assuming Mr. Mitchell’s continued service on the Board for such periods. On the same date, the Company also approved paying compensation to its existing

non-employee directors by granting to Dr. Linda Grais, Mr. Robert Conway and Dr. Raymond Woosley options to purchase 8,000 shares of common stock at an exercise price of $1.80 per share, the closing price of the Company’s common

stock on February 11, 2014. The options are subject to the terms and conditions of the Plan and the Company’s standard forms of Stock Option Agreement and Option Grant Notice for the Plan. The options vest in equal monthly installments and

will be fully vested as of December 31, 2014, assuming Dr. Grais’, Mr. Conway’s and Dr. Woosley’s continued service on the Board for such periods.

Item 5.08. Shareholder Director Nominations.

On February 11, 2014, the Board approved June 5, 2014 as the date of the Company’s Annual Meeting of Stockholders (the

“Annual Meeting”). The Board also approved April 7, 2014 as the record date for stockholders entitled to notice of and to vote at the Annual Meeting.

Because the Annual Meeting will be held more than 30 calendar days from the date of the Company’s 2013 Annual Meeting of Stockholders,

the due dates for the provision of any qualified stockholder proposal or qualified stockholder nominations under the rules of the Securities and Exchange Commission (the “SEC”) and the bylaws of the Company listed in the Company’s

2013 Proxy Statement on Schedule 14A as filed with the SEC on August 1, 2013 are no longer applicable. Such nominations or proposals, including any notice on Schedule 14N, are now due to the Company no earlier than March 7, 2014 and no

later than April 6, 2014. The Company currently intends to make its proxy materials available beginning on or about April 15, 2014.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Dated: February 18, 2014

|

|

|

|

|

ARCA biopharma, Inc.

(Registrant)

|

|

|

|

|

By:

|

|

/s/ Christopher D. Ozeroff

|

|

|

|

Name: Christopher D. Ozeroff

|

|

|

|

Title: SVP and General Counsel

|

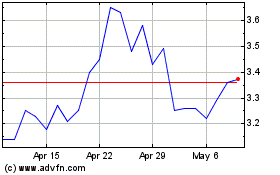

ARCA Biopharma (NASDAQ:ABIO)

Historical Stock Chart

From Apr 2024 to May 2024

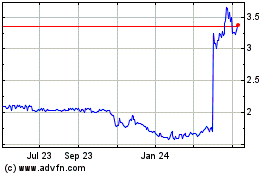

ARCA Biopharma (NASDAQ:ABIO)

Historical Stock Chart

From May 2023 to May 2024