Amended Statement of Ownership (sc 13g/a)

February 07 2014 - 1:37PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Amendment No. 1

SCHEDULE 13G

Information

to be included in Statements filed

pursuant

to Rule

13d-1(b), (c) AND (d)

Netlist,

Inc.

(Name of Issuer)

COMMON

Stock, $0.001 par value

(Title of Class of Securities)

64118P109

(CUSIP Number)

December 31, 2013

(Date of event which requires filing of

this Statement)

Check the appropriate box to designate the

rule pursuant to which this Schedule is filed:

¨

Rule 13d-1(b)

x

Rule 13d-1(c)

¨

Rule 13d-1(d)

(Continued on following pages)

(Page 2 of 8 Pages)

|

1.

|

NAME OF REPORTING PERSON

S.S. OR I.R.S. IDENTIFICATION NO. OF ABOVE PERSON

Midsummer Small Cap Master, Ltd.

|

|

2.

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP

(a)

¨

(b)

¨

|

|

3.

|

SEC USE ONLY

|

|

4.

|

CITIZENSHIP OR PLACE OF ORGANIZATION:

Bermuda

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON WITH

|

5.

|

SOLE VOTING POWER

1,575,541 (see Item 4)

|

|

6.

|

SHARED VOTING POWER

None.

|

|

7.

|

SOLE DISPOSITIVE POWER

1,575,541 (see Item 4)

|

|

8.

|

SHARED DISPOSITIVE POWER

None.

|

|

9.

|

AGGREGATE AMOUNT BENEFICIALLY

OWNED BY EACH REPORTING PERSON

1,575,541 (see Item 4)

|

|

10.

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES

¨

|

|

11.

|

PERCENT OF CLASS REPRESENTED

BY AMOUNT IN ROW (9)

4.99% (1)

|

|

12.

|

TYPE OF REPORTING PERSON: OO

|

(1) The ownership percentage of the Reporting Person is based

upon 31,573,978 shares of Common Stock issued and outstanding as of October 31, 2013 (as reported in the Issuer’s most recently

filed quarterly report on Form 10-Q for the period ended September 28, 2013)

|

Item 1(a).

|

Name of Issuer.

|

|

|

|

|

|

Netlist, Inc. (the “

Issuer

”)

|

|

Item 1(b).

|

Address of Issuer’s Principal Executive Offices.

|

|

|

|

|

|

51 Discovery, Suite 150, Irvine, CA 92618

|

|

|

|

|

Item 2(a).

|

Names of Person Filing.

|

|

|

Midsummer Small Cap Master, Ltd. (“

Midsummer Small

Cap

”)

|

|

Item 2(b).

|

Address of Principal Business Office, or if none, Residence.

|

|

|

|

|

|

Midsummer Small Cap Master, Ltd.

c/o Midsummer Capital, LLC

733 Third Avenue, 19

th

Floor

New York, NY 10017

|

|

Item 2(c).

|

Citizenship.

|

|

|

Bermuda

|

|

Item 2(d).

|

Title of Class of Securities.

|

|

|

Common Stock, par value $0.001 per share (the “

Common

Stock

”)

|

|

Item 2(e).

|

CUSIP Number.

|

|

|

|

|

|

64118P109

|

|

Item 3.

|

If this statement is filed pursuant to Rules 13d-1(b) or 13d-2(b), check whether the person filing is a:

|

|

|

Not applicable.

|

|

Item 4.

|

Ownership.

|

This amendment No.

1 to Schedule 13G is being filed to disclose that Midsummer Small Cap is no longer required to file a Schedule 13G, as Midsummer

Small Cap beneficially owns less than 5% of the shares of Common Stock.

Midsummer Small Cap

beneficially owns 1,575,541 shares of Common Stock as of the date hereof (217,987 shares of Common Stock and 1,357,555 shares of

Common Stock issuable upon exercise of Common Stock Purchase Warrants). Additionally, Midsummer Small Cap holds Common Stock Purchase

Warrants previously purchased and originally exercisable into 2,016,627 shares of Common Stock, in the aggregate. However, the

aggregate number of shares of Common Stock into which such warrants are exercisable, and which Midsummer Small Cap has the right

to acquire beneficial ownership, is limited to the number of shares of Common Stock that, together with all other shares of Common

Stock beneficially owned by Midsummer Small Cap, including the shares of Common Stock subject to this Schedule 13, does not exceed

4.99% of the total outstanding shares of Common Stock. Accordingly, such warrants are not exercisable into Common Stock unless

and until the actual shares of Common Stock held by any of Midsummer Small Cap or Midsummer Capital is less than 4.99% of the total

outstanding shares of Common Stock.

Midsummer Capital,

LLC (“

Midsummer Capital

”) is the investment advisor to Midsummer Small Cap. By virtue of such relationship,

Midsummer Capital may be deemed to have dispositive power over the shares owned by Midsummer Small Cap. Midsummer Capital disclaims

beneficial ownership of such shares. Mr. Alan Benaim and Mr. Joshua Thomas have delegated authority from the members of Midsummer

Capital with respect to the shares of Common Stock owned by Midsummer Small Cap. Messrs. Benaim and Thomas may be deemed to share

dispositive power over the shares of common stock held by Midsummer Small Cap. Messrs. Benaim and Thomas disclaim beneficial ownership

of such shares of Common Stock, and neither person has any legal right to maintain such delegated authority

Accordingly,

for the purpose of this Statement:

|

|

(a)

|

Amount beneficially owned by Midsummer Small Cap: 1,575,541 shares of Common Stock of the Issuer.

|

|

|

(b)

|

Percent of Class: Midsummer Small Cap beneficially holds 4.99% of the Issuer’s issued and

outstanding Common Stock.

|

|

|

(c)

|

Number of shares as to which Midsummer Small Cap has:

|

|

|

(i)

|

Sole power to direct the vote: 1,575,541 shares of Common Stock of the Issuer.

|

|

|

(ii)

|

Shared power to vote or to direct the vote: None.

|

|

|

(iii)

|

Sole power to dispose or direct the disposition of the Common Stock: 1,575,541 shares of Common

Stock of the Issuer.

|

|

|

(iv)

|

Shared power to dispose or direct the disposition of the Common Stock: None.

|

|

Item 5.

|

Ownership of Five Percent or Less of a Class.

|

|

|

Not applicable.

|

|

Item 6.

|

Ownership of More than Five Percent on Behalf of Another Person.

|

|

|

Not applicable.

|

|

Item 7.

|

Identification and Classification of the Subsidiary Which Acquired the Security Being Reported on By the Parent Holding Company.

|

|

|

Not applicable.

|

|

Item 8.

|

Identification and Classification of Members of the Group.

|

|

|

Not applicable.

|

|

Item 9.

|

Notice of Dissolution of Group.

|

|

|

Not applicable.

|

|

Item 10.

|

Certification.

|

|

|

|

|

|

By signing below, I certify that, to the

best of my knowledge and belief, the securities referred to above were not acquired and are not held for the purpose of or with

the effect of changing or influencing the control of the issuer of the securities and were not acquired and are not held in connection

with or as a participant in any transaction which could have that purpose or effect.

|

SIGNATURE

After reasonable inquiry

and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

|

Date: February 7, 2014

|

|

|

MIDSUMMER SMALL CAP MASTER,

LTD.

|

|

|

By:

|

/s/ Alan Benaim

|

|

|

|

|

Name: Alan Benaim

|

|

|

|

Title: Authorized Signatory

|

|

|

|

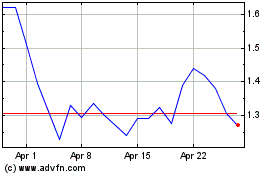

Netlist (QB) (USOTC:NLST)

Historical Stock Chart

From Mar 2024 to Apr 2024

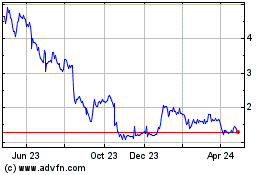

Netlist (QB) (USOTC:NLST)

Historical Stock Chart

From Apr 2023 to Apr 2024