Focus Graphite Inc. (TSX VENTURE:FMS)(OTCQX:FCSMF)(FRANKFURT:FKC) ("Focus" or

the "Company") is very pleased to announce an update of its National Instrument

43-101 ("NI 43-101") mineral resource estimate for its 100%-owned Lac Knife

graphite project, in northeastern Quebec.

The resource estimate is based on both the 2012 and 2013 additional exploration

and definition drilling programs for a total of 92 holes, and 9,103 meters that

successfully achieved the designed goal to upgrade the quality of existing

Indicated and Inferred resources to the Measured and Indicated categories. This

is in addition to 105 previous drill holes that totalled 9,217 meters.

Measured and Indicated resources are now estimated at 9.6 million tonnes grading

14.77% Cg at a 3% Cg cut-off grade. Additionally there are 3.1 million tonnes of

Inferred resources at 13.25% Cg using a 3% cut-off in this updated resource

estimate presented in Table 1 below.

Table 1. Lac Knife Mineral Resource Estimate

@ 3.0% graphitic carbon ("Cg") cut-off

--------------------------------------------------------------------------

Tonnage Cg In situ Graphite

(t) (%) (t)

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Measured 432,000 23.66 102,000

--------------------------------------------------------------------------

Indicated 9,144,000 14.35 1,312,000

--------------------------------------------------------------------------

Measured + Indicated 9,576,000 14.77 1,414,000

--------------------------------------------------------------------------

Inferred 3,102,000 13.25 411,000

--------------------------------------------------------------------------

Mineral resources are not mineral reserves and do not have demonstrated

economic viability

Highlights

-- Measured and Indicated mineral resources reported at a cut-off of 3.0%

Cg increased in tonnage by 92% to 9.6 million tonnes grading 14.77% Cg

compared to the previous estimate of 4.9 million tonnes grading 15.76%

Cg reported at a cut-off of 5.0% Cg.

-- Upgraded 432,000 thousand tonnes of Indicated resources to the Measured

resource category grading an average of 23.66% Cg using a 3% cut-off

grade.

-- The updated resource estimate increased the in-situ Graphite content by

81%.

-- The bulk of the 3.0 million tonnes previously classified as Inferred

resource was successfully upgraded to the Measured and Indicated

categories.

-- Delineation of an additional 3.1 million tonnes of Inferred resources

that is located within the southwest extension of the Lac Knife deposit.

As shown in Table 2 below, when comparing at the 5% Preliminary Economic

Assessment (PEA) cut-off, the resource tonnage increased by 92% in the Measured

and Indicated categories from 4.9 million tonnes grading 15.76% Cg in the PEA

study to 9.5 million tonnes grading 14.86% Cg in this new update. This

translated to an increase of 81% of in-situ graphite from 778,000 tonnes to 1.4

million tonnes in the Measured and Indicated categories.

In the Inferred resource category, the tonnage decreased by 2.0% from 3.0

million tonnes in the PEA study to 2.9 million tonnes in this resource update.

The Inferred resource category average grade was reduced from 15.58% Cg to

13.75% Cg resulting in a reduction of 13.5% of in-situ graphite in this category

from 467,000 tonnes down to 404,000 tonnes. These changes resulted from

converting most of the 3.0 million tonnes of Inferred resources in the PEA study

pit to the Measured and Indicated categories, and also by significantly

extending the deposit to the south adding an additional 3.1 million tonnes of

Inferred resources in the newly delineated South Central Zone which is still

considered open in this direction by Focus (See Figure 1).

Another contributing factor was the reduction of the cut-off grade from 5% Cg in

the PEA study down to 3% Cg in this update. The reduction in cut-off was driven

by a higher selling price and higher concentrate grade.

Table 2. Sensitivity to cut-off change and comparison to previous estimate

-----------------------------------------------------------

October 30th,

Updated 2012

Mineral Resource PEA Mineral

Estimate Resource Estimate

(3.0% Cg Cut-off (5.0% Cg Cut-off Percent

base case) base case) Change

-------------- -------------------------- -------------------- -------------

Cut- Cg Cg Tonn- Grap-

off Tonnes Cg% Tonnes Tonnes Cg% Tonnes age hite

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Meas- grea- 428,000 23.81 102,000 0 0

ured ter

than

10.0

---------------------------------------------------------------------

grea- 432,000 23.66 102,000 0 0

ter

than

5.0

---------------------------------------------------------------------

grea- 432,000 23.66 102,000

ter

than

3.0

---------------------------------------------------------------------

grea- 432,000 23.66 102,000

ter

than

2.0

----------------------------------------------------------------------------

Indic- grea- 7,466,000 15.77 1,177,000 4,533,000 16.43 745,000 64.7% 58.0%

ated ter

than

10.0

---------------------------------------------------------------------

grea- 9,065,000 14.44 1,309,000 4,938,000 15.76 778,000 83.6% 68.3%

ter

than

5.0

---------------------------------------------------------------------

grea- 9,144,000 14.35 1,312,000

ter

than

3.0

---------------------------------------------------------------------

grea- 9,146,000 14.35 1,312,000

ter

than

2.0

----------------------------------------------------------------------------

Meas- grea- 7,894,000 16.21 1,279,000 4,533,000 16.43 745,000 74.1% 71.7%

ured ter

+ than

Indic- 10.0

ated ---------------------------------------------------------------------

grea- 9,497,000 14.86 1,411,000 4,938,000 15.76 778,000 92.3% 81.4%

ter

than

5.0

---------------------------------------------------------------------

grea- 9,576,000 14.77 1,414,000

ter

than

3.0

---------------------------------------------------------------------

grea- 9,578,000 14.77 1,415,000

ter

than

2.0

----------------------------------------------------------------------------

Infer- grea- 2,196,000 15.81 347,000 2,861,000 15.92 455,000 -23.2% -23.7%

red ter

than

10.0

---------------------------------------------------------------------

grea- 2,941,000 13.75 404,000 3,000,000 15.58 467,000 -2.0% -13.5%

ter

than

5.0

---------------------------------------------------------------------

grea- 3,102,000 13.25 411,000

ter

than

3.0

---------------------------------------------------------------------

grea- 3,116,000 13.20 411,000

ter

than

2.0

----------------------------------------------------------------------------

The rounding of tonnes as required by NI43-101 reporting guidelines may

result in apparent differences between tonnes, grade and contained graphite.

To view Figure 1 please click on the following link:

http://media3.marketwire.com/docs/FMS0128.pdf

Focus Graphite President and Chief Operating Officer Don Baxter stated: "We are

very pleased to have further de-risked the Lac Knife project by increasing the

quality and tonnage of the resource. This updated resource will be incorporated

into a mineral reserve estimate in the feasibility study currently underway with

Met-Chem.

"This announcement comes on the heels of our historic announcement of the

signing of a 10-year off-take agreement with a Chinese industrial conglomerate,

just as China announced it was shutting down approximately 20% of its flake

graphite production in Shandong Province. This further illustrates the need for

reliable, low cost, high quality graphite flake production outside of China,"

Mr. Baxter said.

"Again, Focus is showing that it has strong potential to meet these growing

needs, and the updated resource indicates the Lac Knife project could

potentially produce high quality graphite flake over a significant mine life,"

he added.

The updated mineral resource is based on 197 diamond drill holes totaling 18,320

metres of historic and recent drilling. This includes 104 surface diamond drill

holes totaling 10,337 metres completed by Focus Graphite since 2010.

Mineral Resources have been reported within a constraining pit shell at a

cut-off grade of 3.0% graphitic carbon ("Cg"). Details on the mineral resource

estimation procedures are given in the notes below.

Notes on Mineral Resource Estimation Methodology

-- Mineral resources are estimated in conformance with the CIM Mineral

Resource definitions referred to in NI 43-101 Standards of Disclosure

for Mineral Projects. Pierre Desautels, P.Geo. Principal Resource

Geologist of AGP Mining Consultants Inc. Qualified Person under NI 43-

101 who is an independent of the Company, has prepared and authorized

the release of the mineral resource estimates presented herein. Jeffrey

Cassoff, Eng. Lead Mining Engineer of Met-Chem Canada Inc. and Qualified

Person under NI 43-101 has reviewed the technical content of this News

Release. This mineral resource estimate is an update of the resource

estimated by Roche Limited Consulting Group effective December 5th, 2011

and later accepted (with a resource classification update) by RPA

Consulting as part of a Preliminary Economic Assessment study dated

October 30th, 2012.

-- All drill holes are composed of diamond drill core that was sampled and

assayed over the entire length of mineralized zones by sampling

approximately 1.5 meter intervals. A QA/QC program was introduced during

the 2010 drill program and was expanded during the 2012 and 2013 drill

program to include the insertion of standards, duplicates, and blanks

and check assays at a secondary laboratory.

-- Specific gravities were determined at the IOS laboratory, located in

Chicoutimi Quebec. A total of 5,133 specific gravity results exist in

the database that was collected by IOS since the 2010 drill program. Due

to the strong correlation between sulphur and the bulk density

estimates, a density model was interpolated with the same parameters

used for the sulphur model. The interpolated density model ranges from

2.64 g/cm3to 3.05 g/cm3averaging 2.81 g/cm3

-- Detailed geological logging and sectional interpretations by Focus

Graphite led to the development of a three-dimensional (3D) domain model

based on lithology and grade boundaries. The wireframe modelling

resulted in outlining three major mineralized zones with eight minor

accessory zones. Grade is typically above 3% within the wireframes but

was as low as 1% in local lower grade zones within high grade domains

that were utilized in the variography studies, and in the grade

interpolation constraints.

-- For the treatment of outliers, each statistical domain was evaluated

separately and no top cut was necessary. However, a search restriction

of 30 x 30 x 30 meters was imposed on threshold values of 38% Cg in

order to restrict the influence of the highest values during the

interpolation process.

-- The composite intervals selected were 3.0 metres in length.

-- A 3D geological block model was generated using GEMS(C) software. The

block model matrix size is 6 x 6 x 5 metres. Ordinary kriging was used

for all domains with inverse distance and nearest neighbour check

models. The interpolation was carried out in multiple passes with

increasing search ellipsoid dimensions. Classification for all models

was based primarily on the pass number, distance to the closest

composite and the krige variance. The Measured classification was only

retained in the area, in proximity to, the bulk sample pits. No

adjustment to the classification was made for blocks interpolated

primarily with historical holes since these were found to be adequate

for resource modelling.

-- The reported mineral resources are considered to have reasonable

prospects of economic extraction. Met-Chem created a pit shell using the

Lerchs-Grossman pit optimization algorithm and design parameters

including costs, sales price, and the open pit mine, and concentrator

operating parameters that were derived from the Updated Preliminary

Economic Assessment (see News Release dated November 7th, 2013) as well

as typical regional cost estimates;

-- Selling Price: 2,000 $/t (FOB Sept-Iles);

-- Mill Recovery: 91.089%;

-- Concentrate Grade: 96.6% Ct;

-- Pit Slope: 45 degrees;

-- Mining Cost: 6 $/t mined;

-- Processing Cost: 40.61 $/t milled;

-- Transportation Cost: 25 $/t of concentrate;

-- Administration and Infrastructure Cost: 15 $/t milled.

-- The resulting pit shell encompasses most of the estimated Measured,

Indicated and Inferred Resources. The rounding of tonnes as required by

NI 43-101 reporting guidelines may result in apparent differences

between tonnes, grade and contained graphite.

-- Mineral resources are not mineral reserves and do not have demonstrated

economic viability. The estimate of mineral resources may be materially

affected by environmental, permitting, legal, title, taxation,

sociopolitical, marketing, or other relevant issues.

-- The quantity and grade of reported Inferred mineral resources in this

estimation are uncertain in nature and there has been insufficient

exploration to define these Inferred mineral resources as Indicated or

Measured mineral resources and it is uncertain if further exploration

will result in upgrading them to the Indicated or Measured mineral

resource categories.

Lac Knife Project

The Lac Knife project comprises 57 map-designated claims covering 2,986.31 ha

located in Esmanville Township (NTS map sheet 23B/11), 27 km south-southwest of

the iron-mining town of Fermont, in the Cote-Nord administrative district of

Quebec. Focus acquired a 100% interest in the project in October 2010. A map

showing the location of the Lac Knife project is available on the company's

website at www.focusgraphite.com.

The mineralization at Lac Knife is hosted in biotite-quartz-feldspar paragneiss

and schist of the Nault Formation, in association with iron formations of the

Wabush Formation. These are equivalent to the lower Proterozoic Labrador Trough

rocks affected by the late Proterozoic Grenvillian orogeny. High grade

metamorphism and folding associated with the Grenvillian orogeny has resulted in

the formation of important concentrations of graphite dominated by

value-enhanced large flakes.

Sampling, Assaying and QA/QC

The entire drill cores were logged at the Lac Knife camp and shipped to the IOS

facilities in Chicoutimi for sample preparation. Two slabs of about 1/4 of the 4

inch diameter PQ core were sawed parallel on each side of the central axis of

the core. One of the slabs was earmarked for geochemical analysis while the

other slab was kept as a witness sample. Center parts of the core are kept for

possible subsequent uses. The samples are mostly 1.5 m in length with variances

from 0.5 m to 1.8 m). Slab samples were dried before processing for density

measurement, crushing and grinding at the IOS sample preparation laboratory.

Once prepared, the samples were sent to the Consortium de Recherche Appliquee en

Traitement et Transformation des Substances Minerales ("COREM"), an ISO/IEC

17025:2005 certified facility in Quebec-City, for graphitic carbon (Cg) analysis

using LECO high frequency combustion method with infrared measurement (internal

analytical code LSA-M-B10 for graphitic carbon; ISO 9686:2004). For the

measurement of graphitic carbon, the sample is pre-treated with nitric acid,

placed in a LECO capsule and introduced in the furnace (1,380 degrees C) in an

oxygen atmosphere. Carbon is oxidized to CO2. After the removal of moisture, gas

(CO2) is measured by an infrared detector and a computerized system calculates

the concentration of graphitic carbon (% Cg). Total sulphur was also analyzed by

LECO (code LSA-M-B41) (Table 1). For sulphur determinations, the sample is

placed in a LECO capsule and introduced in the furnace (1,380 degrees C) until

sulphur is oxidized to SO2. After the removal of moisture, gas (SO2) is measured

by an infrared detector and a computerized system calculates the concentration

of total sulphur (% S).

Under the QA/QC program, about 10% of the samples were analyzed by COREM for

total (code LSA-M-B45), organic (code LSA-M-B58), inorganic (code LSA-M-B11) and

graphitic (code LSA-M-B10) carbon as well as for total sulphur. Duplicates of

these samples were also sent to ACTLABS Laboratories in Ancaster, Ontario

(ISO/IEC 17025:2005 with CAN-P-1579) for graphitic carbon (code 5D - C

Graphitic) and total sulphur (code 4F - S Combustion infrared detection)

determinations and for 35 multi-element analysis using ICP methods (code 1E2 -

Aqua Regia). IOS introduced standards, duplicates (sawing, crushing or grinding

duplicates) and blank samples into each batch of core samples as part of the

QA/QC program.

Qualified Persons

Benoit Lafrance, Ph.D., geo (Quebec), Focus Vice-President of Exploration and

Don Baxter, P. Eng., Focus President & Chief Operating Officer, both Qualified

Persons as defined by NI 43-101 guidelines, have reviewed and approved the

technical content of this news release. Pierre Desautels, P.Geo. Principal

Resource Geologist of AGP Mining Consultants Inc. Qualified Person under NI

43-101 who is independent of the Company, has prepared and authorized the

release of the mineral resource estimates presented herein. Jeffrey Cassoff,

Eng., Lead Mining Engineer of Met-Chem Canada Inc. and Qualified Person under NI

43-101 guidelines has reviewed the technical content of the News Release.

About Focus Graphite

Focus Graphite Inc. is an emerging mid-tier junior mining development company, a

technology solutions supplier and a business innovator. Focus is the owner of

the Lac Knife graphite deposit located in the Cote-Nord region of northeastern

Quebec. The Lac Knife project hosts a NI 43-101 compliant Measured and Indicated

Mineral Resource Estimate(i) of 9.6 million tons grading 14.77% graphitic carbon

(Cg) as crystalline graphite with an additional Inferred Mineral Resource

Estimate(i) of 3.1 million tons grading 13.25% Cg of crystalline graphite.

Focus' goal is to assume an industry leadership position by becoming a low-cost

producer of technology-grade graphite. On November 7, 2013 the Company released

the results of an updated Preliminary Economic Assessment ("PEA") of the Lac

Knife Project which indicated that the project has very good potential to become

a graphite producer. As a technology-oriented enterprise with a view to building

long-term, sustainable shareholder value, Focus also invests in the development

of graphene applications and patents through Grafoid Inc.

Forward Looking Statement

This News Release contains "forward-looking information" within the meaning of

Canadian securities legislation. All information contained herein that is not

clearly historical in nature may constitute forward-looking information.

Generally, such forward-looking information can be identified by the use of

forward-looking terminology such as "plans", "expects" or "does not expect", "is

expected", "budget", "scheduled", "estimates", "forecasts", "intends",

"anticipates" or "does not anticipate", or "believes", or variations of such

words and phrases or state that certain actions, events or results "may",

"could", "would", "might" or "will be taken", "occur" or "be achieved".

Forward-looking information is subject to known and unknown risks, uncertainties

and other factors that may cause the actual results, level of activity,

performance or achievements of the Company to be materially different from those

expressed or implied by such forward-looking information, including but not

limited to: (i) volatile stock price; (ii) the general global markets and

economic conditions; (iii) the possibility of write-downs and impairments; (iv)

the risk associated with exploration, development and operations of mineral

deposits; (v) the risk associated with establishing title to mineral properties

and assets; (vi)the risks associated with entering into joint ventures; (vii)

fluctuations in commodity prices; (viii) the risks associated with uninsurable

risks arising during the course of exploration, development and production; (ix)

competition faced by the resulting issuer in securing experienced personnel and

financing; (x) access to adequate infrastructure to support mining, processing,

development and exploration activities; (xi) the risks associated with changes

in the mining regulatory regime governing the resulting issuer; (xii) the risks

associated with the various environmental regulations the resulting issuer is

subject to; (xiii) risks related to regulatory and permitting delays; (xiv)

risks related to potential conflicts of interest; (xv) the reliance on key

personnel;

(xvi) liquidity risks; (xvii) the risk of potential dilution through the issue

of common shares; (xviii) the Company does not anticipate declaring dividends in

the near term; (xix) the risk of litigation; and (xx) risk management.

Forward-looking information is based on assumptions management believes to be

reasonable at the time such statements are made, including but not limited to,

continued exploration activities, no material adverse change in metal prices,

exploration and development plans proceeding in accordance with plans and such

plans achieving their stated expected outcomes, receipt of required regulatory

approvals, and such other assumptions and factors as set out herein. Although

the Company has attempted to identify important factors that could cause actual

results to differ materially from those contained in the forward-looking

information, there may be other factors that cause results not to be as

anticipated, estimated or intended. There can be no assurance that such

forward-looking information will prove to be accurate, as actual results and

future events could differ materially from those anticipated in such

forward-looking information. Such forward-looking information has been provided

for the purpose of assisting investors in understanding the Company's business,

operations and exploration plans and may not be appropriate for other purposes.

Accordingly, readers should not place undue reliance on forward-looking

information. Forward-looking information is made as of the date of this News

Release, and the Company does not undertake to update such forward-looking

information except in accordance with applicable securities laws.

FOR FURTHER INFORMATION PLEASE CONTACT:

Focus Graphite Inc.

Mr. Don Baxter, P.Eng

President and Chief Operating Officer

705-789-9706

dbaxter@focusgraphite.com

www.focusgraphite.com

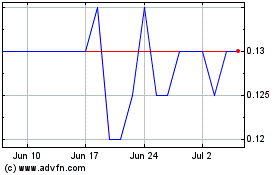

Focus Graphite (TSXV:FMS)

Historical Stock Chart

From Apr 2024 to May 2024

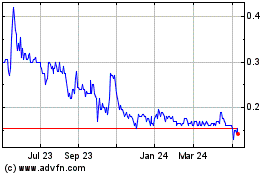

Focus Graphite (TSXV:FMS)

Historical Stock Chart

From May 2023 to May 2024