Play a Rising Dollar with These ETFs - ETF News And Commentary

January 14 2014 - 10:00AM

Zacks

2013 was successful for both the U.S. stock markets and the dollar.

Generally, most of the time when the dollar surges, U.S. stocks

struggle but this was not the case in 2013. Both the dollar and the

stocks moved up for most of the year.

This trend is likely to continue in 2014 as investors continue to

flock to both equities and the U.S. dollar, given an improving

economy and Fed tapering plans. As the Fed will purchase $10

billion less in securities from the market this month, interest

rates will rise at a slower pace but will lead to a surge in the

dollar.

Why Will the Dollar Rise?

Activity is picking up faster in the U.S. economy, building up

momentum for 2014. The labor market is showing clear signs of

healing with falling jobless claims, the housing market is on the

path to recovery, and oil prices are at moderate levels.

U.S. manufacturing index (PMI) rose to 55 in December from 54.7 in

November, indicating the fastest growth in 11 months, while factory

activity was at a two and half year high in December (read: 3 ETFs

to Profit from the Manufacturing Upswing).

The recent consumer sentiment survey has also been extremely

positive, with the latest reading surpassing expectations and being

the strongest year-end reading since 2007. The Consumer Confidence

Index, measured by the Conference Board, climbed to 78.1 in

December from a revised 72 in November.

Further, the U.S. trade deficit narrowed to a four-year low in

November buoyed by the booming U.S. energy market and rising

external demand (read: Play the U.S. Oil Boom with These Energy

ETFs).

This has boosted the dollar and will further lead to appreciation

on the belief that the U.S. economy will continue to show strong

growth, prompting speculation that the Fed will continue to pare

its stimulus throughout the year.

On the political front, the U.S. is now on much stronger footing

with the two-year bipartisan budget deal, which eases spending cuts

and political dysfunction. This move has cleared the path for a

stronger 2014. Moreover, the IMF is expected to raise its 2014

growth outlook for the U.S. given the continued upbeat data and the

reduction of economic uncertainty.

Given the strengthening economic fundamentals, the bullish trend in

the greenback is expected to continue at least for the short term.

Investors seeking to make a play on U.S. dollar could consider any

of the following ETFs (see: all the Currency ETFs here):

PowerShares DB US Dollar Bullish Fund (UUP)

This fund could be the prime beneficiary of the rising dollar as it

offers exposure against a basket of world currencies. These include

the euro, Japanese yen, British pound, Canadian dollar, Swedish

krona and Swiss franc.

This is done by tracking the Deutsche Bank Long US Dollar Index

Futures Index Excess Return plus the interest income from the

fund’s holdings of U.S. Treasury securities.

In terms of holdings, UUP allocates nearly 58% in euros while 25%

collectively in Japanese yen and British pound. The fund has so far

managed an asset base of $673 million while sees heavy daily volume

of more than 1.1 million shares. It charges 80 bps in total fees

and expenses.

This dollar ETF added 1% since the start of the New Year and has

the potential to move higher heading into the year. This is

especially true as UUP currently has a Zacks ETF Rank of 2 or ‘Buy’

rating.

WisdomTree Bloomberg U.S. Dollar Bullish Fund

(USDU)

This ETF is the newest play in the dollar space and has amassed

$32.8 million since its debut last month. Volume is also solid, as

it exchanges nearly 112,000 shares a day on average. The fund

charges 0.50% in expenses (read: WisdomTree Launches Dollar Bullish

Fund).

The product offers exposure to the U.S. dollar against a basket of

10 developed and emerging market currencies by tracking the

Bloomberg Dollar Total Return Index. The fund allocates higher to

the euro currency at 31.17%, closely followed by Japanese Yen

(19.31%) and Canadian dollars (11.43%).

Other currencies like the Mexican Peso, British Pound, Australian

dollar, Swiss franc, South Korean Won, Chinese Yuan and Brazilian

Real receive single-digit allocations in the fund’s basket. USDU

was up 0.5% in the first few trading sessions of 2014.

Bottom Line

A stronger domestic economy, bullish global fundamentals, and

increasing consumer confidence may propel the U.S. dollar higher in

the coming months (read: Where Will Global Currency ETFs Go in

2014?). Investors could ride this surge in dollar with less risk by

going long in the above two unleveraged products.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

WISDMTR-BB USDB (USDU): ETF Research Reports

PWRSH-DB US$ BU (UUP): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

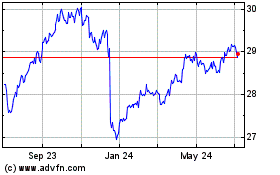

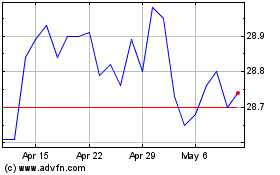

Invesco DB US Dollar Ind... (AMEX:UUP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Invesco DB US Dollar Ind... (AMEX:UUP)

Historical Stock Chart

From Apr 2023 to Apr 2024