Immune checkpoint related achievements

include first collaboration agreement for cancer immunotherapy and

experimental results supporting additional candidates

Scientific Advisory Board for Oncology and

Immunology formed

Compugen Ltd. (NASDAQ: CGEN) today reported financial

results for the third quarter and nine months ending September 30,

2013.

Anat Cohen-Dayag, Ph.D., President and CEO of Compugen, stated,

“After more than a decade of focused research and infrastructure

building, we are now demonstrating significant progress in the

first, of what we hope to be, a number of new and exciting product

oriented chapters in the evolution of Compugen. This first chapter

relates to our ongoing activities in the field of immune checkpoint

proteins, a field of great promise and interest.

Dr. Cohen-Dayag continued, “During the past quarter we entered

with Bayer Pharma AG our first immune checkpoint related

collaboration agreement. In addition, we disclosed experimental

results supporting a third immune checkpoint related product

candidate for oncology and results supporting additional potential

indications for a previously disclosed candidate. We also formed a

Scientific Advisory Board of world experts to provide insight and

guidance in this area, and more generally in the Company’s focus

areas of immunology and oncology.”

Dr. Cohen-Dayag concluded, “The field of immune checkpoint based

therapies was selected for the first focused use of Compugen’s

predictive discovery capabilities. Therefore, it is extremely

gratifying to see how our continuing achievements in this field are

now providing the potential to establish Compugen as a significant

contributor in the worldwide fight against cancer and the treatment

of autoimmune diseases through therapies based on immune

checkpoints, while at the same time, demonstrating the value of the

unique predictive discovery infrastructure that we have

established.”

Revenues for the third quarter of 2013 and the nine months

ending September 30, 2013 were $1.6 million and $1.8 million,

respectively, compared with $108,000 for both comparable periods in

2012. Revenues reported for the most recent periods included the

portion of the non-refundable upfront payment received under the

August 2013 collaboration and license agreement with Bayer Pharma

AG (“Bayer Agreement”) that was recognizable during such periods in

accordance with U.S. GAAP revenue recognition accounting.

Cost of revenues for the third quarter of 2013 and the nine

months ending September 30, 2013 were $1.5 million and $1.7 million

respectively, compared with $33,000 for both comparable periods in

2012. The increase reflects the certain research and development

expenses attributed to the Bayer Agreement and royalties to the

Israeli Chief Scientist Office, in accordance with Israeli research

grants rules. In addition, cost of revenues for the third quarter

of 2013 and the nine months ending September 30, 2013 also include

certain payments we made pursuant to the research and development

funding arrangements related to the Bayer Agreement’s upfront

payment.

Net loss after taxes for the most recent quarter was $4.7

million (after reflecting a non-cash expense of $1.0 million

related to stock-based compensation and non-cash financial loss of

$2.1 million related to the accounting for certain research and

development funding arrangements as further described below), or

$0.12 per share, compared with a net loss of $3.5 million (after

reflecting a non-cash expense of $708,000 related to stock-based

compensation and a non-cash financial income of $58,000 related to

the research and development funding arrangements), or $0.10 per

share, for the corresponding quarter of 2012.

Net loss after taxes for the first nine months of 2013 was $11.2

million (after reflecting non-cash expense of $2.4 million related

to stock-based compensation and a non-cash financial loss of $1.7

million related to the research and development funding

arrangements), or $0.29 per share, compared with net loss of $8.3

million (after reflecting a non-cash expense of $1.8 million

related to stock-based compensation and non-cash financial income

of $1.3 million related to the research and development funding

arrangements), or $0.23 per share, for the same nine-month period

in 2012. The increase in net loss for the first nine months of 2013

compared with the same nine-month period in 2012, resulted in large

part from increased cost of revenues and research and development

expenses, net, as further discussed below.

Research and development expenses, net, were $2.8 million for

both the third quarter of 2013 and 2012, and remain the Company’s

largest expense. Research and development expenses, net, were $9.0

million for the first nine months of 2013, compared with $6.8

million for the first nine months of 2012. The growth in research

and development expenses, net, for the first nine months of 2013

reflects establishment and initiation of activities at the South

San Francisco operation as well as increasing levels of activity in

support of the Company’s Pipeline Program.

As of September 30, 2013 and December 31, 2012, the liability

related to the "Research and development funding arrangements"

amounted to $14.1 million and $7.9 million, respectively, resulting

from the accounting for the Baize research and development funding

arrangements signed in December 2010 and December 2011, and as

amended in April 2013. The liability balances do not reflect future

cash payment obligations and are primarily related to the estimated

fair values of the derivative instruments resulting from the right

of Baize to waive its right to receive potential future payments in

exchange for Compugen ordinary shares. Therefore such liability

balances will reflect changes in the market value of Compugen

ordinary shares.

As of September 30, 2013, cash and cash related accounts totaled

$44 million, which includes net proceeds from the at-the-market

sale during the third quarter of 2013 by the Company of 584,927

Compugen ordinary shares at an average price of $9.23 per share

pursuant to a registration statement filed January 11, 2011 and a

subsequent sales agreement entered into with Cantor Fitzgerald

& Co. Such September 30, 2013 cash and cash accounts balance

does not include the market value of Compugen’s holdings of Evogene

Ltd.'s shares at such time.

Conference Call and Webcast Information

Compugen will hold a conference call to discuss its third

quarter 2013 results today, October 29, 2013 at 10:00 a.m. EST. To

access the conference call, please dial 1-888-668-9141 from the US

or +972-3-918-0609 internationally. The call will also be available

via live webcast through Compugen’s website, located at the

following link. A replay of the conference call will be

available approximately two hours after the completion of the live

conference call. To access the replay, please dial 1-888-782-4291

from the US or +972-3-925-5921 internationally. The replay will be

available through November 1, 2013.

About Compugen

Compugen is a leading drug discovery company focused on

therapeutic proteins and monoclonal antibodies to address important

unmet needs in the fields of immunology and oncology. The Company

utilizes a broad and continuously growing integrated infrastructure

of proprietary scientific understandings and predictive platforms,

algorithms, machine learning systems and other computational

biology capabilities for the in silico (by computer) prediction and

selection of product candidates, which are then advanced in its

Pipeline Program. The Company's business model includes

collaborations covering the further development and

commercialization of selected product candidates from its Pipeline

Program and various forms of research and discovery agreements, in

both cases providing Compugen with potential milestone payments and

royalties on product sales or other forms of revenue sharing. In

2012, Compugen established operations in California for the

development of oncology and immunology monoclonal antibody

therapeutic candidates against Compugen drug targets. For

additional information, please visit Compugen's corporate website

at www.cgen.com.

This press release contains “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995. These statements, include words such as “may,” “expects,”

“anticipates,” “potential,” “believes,” and “intends,” and describe

opinions about future events. Forward-looking statements in this

press release include, but are not limited to, statements that

Compugen's achievements in the field of immune checkpoint based

therapies are providing the potential to establish Compugen as a

significant contributor in the in the worldwide fight against

cancer and the treatment of autoimmune diseases through therapies

based on immune checkpoints. These forward-looking statements

involve known and unknown risks and uncertainties that may cause

the actual results, performance or achievements of Compugen to be

materially different from any future results, performance or

achievements expressed or implied by such forward-looking

statements. Some of these risks and other factors are discussed in

the "Risk Factors" section of Compugen’s Annual Report on Form 20-F

for the year ended December 31, 2012 as filed with the Securities

and Exchange Commission. In addition, any forward-looking

statements represent Compugen’s views only as of the date of this

release and should not be relied upon as representing its views as

of any subsequent date. Compugen does not assume any obligation to

update any forward-looking statements unless required by law.

COMPUGEN LTD CONDENSED CONSOLIDATED STATEMENTS OF

COMPREHENSIVE INCOME U.S. dollars in thousands, (except for

share and per-share amounts) Three

Months Ended

September 30,

Nine Months Ended

September 30,

2013

Unaudited

2012

Unaudited

2013

Unaudited

2012

Unaudited

Revenues 1,590 108 1,774 108 Cost of revenues

1,465

33

1,699

33

Gross profit 125 75

75 75 Operating

expenses Research and development expenses, net 2,842 2,787

9,018 6,834 Marketing and business development expenses 415 147 767

498 General and administrative expenses

1,270

765 3,375 2,444 Total

operating expenses * 4,527

3,699 13,160

9,776 Operating loss

(4,402) (3,624) (13,085) (9,701)

Financing income (loss), net **

(185) 114

2,085 1,446 Net loss before taxes

(4,587) (3,510) (11,000) (8,255) Taxes

on income

155 - 155

- Net loss (4,742)

(3,510) (11,155)

(8,255) Basic net loss per

ordinary share (0.12) (0.10) (0.29) (0.23) Weighted average number

of Ordinary shares used in computing basic net loss per share

39,145,119 35,991,398 38,217,843 35,750,276 Diluted net loss per

ordinary share (0.12) (0.10) (0.29) (0.30) Weighted average number

of Ordinary shares used in computing diluted net loss per share

39,145,119 36,797,405 38,217,843 36,406,301

* Includes non-cash stock based compensation.

** Includes non-cash expenses related to the Baize research and

development funding arrangements.

COMPUGEN LTD. CONDENSED CONSOLIDATED BALANCE

SHEETS DATA (U.S. dollars, in thousands)

September 30,

2013

Unaudited

December 31,

2012

Audited

ASSETS Current assets Cash, cash equivalents and

short-term bank deposits $ 43,837 $ 19,589 Restricted cash 101 96

Investment in Evogene 3,985 5,196 Other accounts receivable and

prepaid expenses 1,917 690 Receivables on account of shares

2,011 - Total current

assets 51,851 25,571

Non-current investments Severance pay fund

2,007 1,728 Total non-current

investments 2,007 1,728

Long-term prepaid expenses 185

360 Deferred tax asset

201 - Property and

equipment, net 1,143

1,250 Total assets $

55,387 $ 28,909

LIABILITIES AND SHAREHOLDERS’ EQUITY Current

liabilities Other accounts payable, accrued expenses and trade

payables $ 3,425 $ 1,384 Deferred revenue

5,781

- Total current liabilities

9,206 1,384 Long-term

liabilities Research and development funding arrangements

14,102 7,872 Deferred revenue 2,720 - Accrued severance pay

2,329 1,981 Total long-term

liabilities 19,151

9,853 Total shareholders’ equity

27,030 17,672 Total liabilities

and shareholders’ equity $ 55,387

$ 28,909

Compugen Ltd.Tsipi HaitovskyGlobal Media LiaisonEmail:

tsipih@netvision.net.ilTel: +972-52-598-9892

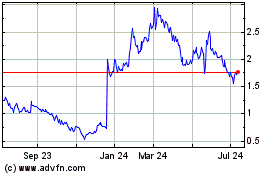

Compugen (NASDAQ:CGEN)

Historical Stock Chart

From Aug 2024 to Sep 2024

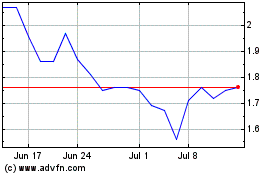

Compugen (NASDAQ:CGEN)

Historical Stock Chart

From Sep 2023 to Sep 2024