|

|

|

|

|

|

|

|

|

|

|

100,900

|

|

Henderson Land Development Co. Ltd.

|

|

628,419

|

|

|

|

35,000

|

|

Hongkong Land Holdings Ltd.

|

|

236,950

|

|

|

|

28,500

|

|

Kerry Properties Ltd.

|

|

117,160

|

|

|

|

64,000

|

|

New World China Land Ltd.

|

|

26,541

|

|

|

|

290,400

|

|

Sino Land Co. Ltd.

|

|

409,683

|

|

|

|

101,000

|

|

Sun Hung Kai Properties Ltd.

|

|

1,346,384

|

|

|

|

60,000

|

|

Wharf Holdings Ltd. (The)

|

|

515,531

|

|

|

|

15,000

|

|

Wheelock & Co. Ltd.

|

|

78,007

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,688,862

|

|

|

|

|

|

|

|

|

|

Japan — 29.2%

|

|

|

|

18

|

|

Activia Properties, Inc., REIT

|

|

128,633

|

|

|

|

11,550

|

|

AEON Mall Co. Ltd.

|

|

287,228

|

|

|

|

600

|

|

Daito Trust Construction Co. Ltd.

|

|

54,824

|

|

|

|

6,000

|

|

Daiwa House Industry Co. Ltd.

|

|

110,195

|

|

|

|

123

|

|

GLP J-REIT, REIT

|

|

120,518

|

|

|

|

30

|

|

Japan Real Estate Investment Corp., REIT

|

|

316,353

|

|

|

|

67,000

|

|

Mitsubishi Estate Co. Ltd.

|

|

1,698,376

|

|

|

|

57,000

|

|

Mitsui Fudosan Co. Ltd.

|

|

1,718,111

|

|

|

|

26

|

|

Nippon Building Fund, Inc., REIT

|

|

282,604

|

|

|

|

18

|

|

Nippon Prologis REIT, Inc., REIT

|

|

156,092

|

|

|

|

13,200

|

|

Nomura Real Estate Holdings, Inc.

|

|

307,009

|

|

|

|

159

|

|

NTT Urban Development Corp.

|

|

191,670

|

|

|

|

17,000

|

|

Sumitomo Realty & Development Co. Ltd.

|

|

710,280

|

|

|

|

16,000

|

|

Tokyu Land Corp.

|

|

152,304

|

|

|

|

41

|

|

United Urban Investment Corp., REIT

|

|

50,919

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6,285,116

|

|

|

|

|

|

|

|

|

|

Netherlands — 8.4%

|

|

|

|

3,367

|

|

Corio NV, REIT

|

|

146,812

|

|

|

|

6,454

|

|

Eurocommercial Properties NV, REIT

|

|

245,592

|

|

|

|

3,755

|

|

Unibail-Rodamco SE, REIT

|

|

912,341

|

|

|

|

7,110

|

|

Wereldhave NV, REIT

|

|

502,685

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,807,430

|

|

|

|

|

|

|

|

|

|

Norway — 0.5%

|

|

|

|

82,891

|

|

Norwegian Property ASA

|

|

115,944

|

|

|

|

|

|

|

|

|

|

Singapore — 5.1%

|

|

|

|

65,000

|

|

Ascendas Real Estate Investment Trust, REIT

|

|

117,486

|

|

|

|

61,000

|

|

Cache Logistics Trust, REIT

|

|

57,793

|

|

|

|

125,000

|

|

Capitaland Ltd.

|

|

317,100

|

|

|

|

86,000

|

|

CapitaMalls Asia Ltd.

|

|

134,752

|

|

|

|

21,000

|

|

CDL Hospitality Trusts, REIT

|

|

27,479

|

|

|

|

85,000

|

|

Global Logistic Properties Ltd.

|

|

189,552

|

|

|

|

173,250

|

|

Keppel REIT, REIT

|

|

173,224

|

|

|

|

77,880

|

|

Mapletree Industrial Trust, REIT

|

|

82,623

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,100,009

|

|

|

|

|

|

|

|

|

|

Sweden — 0.5%

|

|

|

|

8,700

|

|

Hufvudstaden AB (Class A Stock)

|

|

110,460

|

|

|

|

|

|

|

|

|

|

United Kingdom — 9.4%

|

|

|

|

13,233

|

|

Big Yellow Group PLC, REIT

|

|

87,825

|

|

|

|

45,550

|

|

British Land Co. PLC, REIT

|

|

414,122

|

|

|

|

20,874

|

|

Great Portland Estates PLC, REIT

|

|

176,041

|

|

|

|

|

|

|

|

|

|

|

|

HEALTHCARE — 14.1%

|

|

|

|

|

|

|

|

|

|

Biotechnology — 3.4%

|

|

|

|

|

|

|

|

|

|

Alexion Pharmaceuticals, Inc.*

|

|

|

2,000

|

|

|

|

232,460

|

|

|

Amgen, Inc.

|

|

|

16,700

|

|

|

|

1,808,443

|

|

|

Biogen Idec, Inc.*

|

|

|

6,400

|

|

|

|

1,396,032

|

|

|

Celgene Corp.*

|

|

|

12,400

|

|

|

|

1,821,064

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5,257,999

|

|

|

|

|

|

|

|

|

|

|

|

|

Healthcare Equipment & Supplies — 2.1%

|

|

|

|

|

|

|

|

|

|

Abbott Laboratories

|

|

|

36,400

|

|

|

|

1,333,332

|

|

|

Becton Dickinson and Co.(a)

|

|

|

800

|

|

|

|

82,976

|

|

|

CareFusion Corp.*

|

|

|

1,700

|

|

|

|

65,569

|

|

|

Covidien PLC (Ireland)

|

|

|

19,600

|

|

|

|

1,207,948

|

|

|

Medtronic, Inc.

|

|

|

1,800

|

|

|

|

99,432

|

|

|

STERIS Corp.

|

|

|

1,400

|

|

|

|

63,028

|

|

|

Stryker Corp.

|

|

|

5,000

|

|

|

|

352,300

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,204,585

|

|

|

|

|

|

|

|

|

|

|

|

|

Healthcare Providers & Services — 2.6%

|

|

|

|

|

|

|

|

|

|

Aetna, Inc.

|

|

|

19,000

|

|

|

|

1,219,230

|

|

|

Cigna Corp.

|

|

|

2,900

|

|

|

|

225,707

|

|

|

UnitedHealth Group, Inc.

|

|

|

21,600

|

|

|

|

1,573,560

|

|

|

WellPoint, Inc.

|

|

|

11,700

|

|

|

|

1,001,052

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4,019,549

|

|

|

|

|

|

|

|

|

|

|

|

|

Healthcare Technology

|

|

|

|

|

|

|

|

|

|

MedAssets, Inc.*

|

|

|

3,200

|

|

|

|

69,664

|

|

|

|

|

|

|

|

|

|

|

|

|

Life Sciences Tools & Services — 1.0%

|

|

|

|

|

|

|

|

|

|

Life Technologies Corp.*

|

|

|

6,400

|

|

|

|

477,440

|

|

|

Thermo Fisher Scientific, Inc.(a)

|

|

|

11,700

|

|

|

|

1,065,987

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,543,427

|

|

|

|

|

|

|

|

|

|

|

|

|

Pharmaceuticals — 5.0%

|

|

|

|

|

|

|

|

|

|

AbbVie, Inc.

|

|

|

23,100

|

|

|

|

1,050,588

|

|

|

Eli Lilly & Co.

|

|

|

15,600

|

|

|

|

828,516

|

|

|

Johnson & Johnson

|

|

|

20,399

|

|

|

|

1,907,306

|

|

|

Mallinckrodt PLC*(a)

|

|

|

2,450

|

|

|

|

112,431

|

|

|

Merck & Co., Inc.

|

|

|

14,500

|

|

|

|

698,465

|

|

|

Pfizer, Inc.

|

|

|

104,134

|

|

|

|

3,043,837

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7,641,143

|

|

|

|

|

|

|

|

|

|

|

|

|

INDUSTRIALS — 11.5%

|

|

|

|

|

|

|

|

|

|

Aerospace & Defense — 2.4%

|

|

|

|

|

|

|

|

|

|

Alliant Techsystems, Inc.

|

|

|

3,800

|

|

|

|

353,780

|

|

|

General Dynamics Corp.

|

|

|

14,500

|

|

|

|

1,237,430

|

|

|

Huntington Ingalls Industries, Inc.

|

|

|

1,000

|

|

|

|

62,180

|

|

|

Lockheed Martin Corp.

|

|

|

3,300

|

|

|

|

396,396

|

|

|

Northrop Grumman Corp.(a)

|

|

|

10,600

|

|

|

|

975,836

|

|

|

Raytheon Co.

|

|

|

9,900

|

|

|

|

711,216

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,736,838

|

|

|

|

|

|

|

|

|

|

|

|

|

Air Freight & Logistics — 1.4%

|

|

|

|

|

|

|

|

|

|

FedEx Corp.

|

|

|

7,500

|

|

|

|

795,000

|

|

|

United Parcel Service, Inc. (Class B Stock)

|

|

|

15,300

|

|

|

|

1,328,040

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,123,040

|

|

|

|

|

|

|

|

|

|

|

|

|

Airlines — 0.1%

|

|

|

|

|

|

|

|

|

|

Spirit Airlines, Inc.*

|

|

|

4,400

|

|

|

|

145,420

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Building Products — 0.3%

|

|

|

|

|

|

|

|

|

|

AO Smith Corp.

|

|

|

4,400

|

|

|

|

181,808

|

|

|

Lennox International, Inc.

|

|

|

3,100

|

|

|

|

222,642

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

404,450

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial Services & Supplies — 0.1%

|

|

|

|

|

|

|

|

|

|

UniFirst Corp.

|

|

|

1,400

|

|

|

|

137,228

|

|

|

|

|

|

|

|

|

|

|

|

|

Construction & Engineering — 0.5%

|

|

|

|

|

|

|

|

|

|

AECOM Technology Corp.*

|

|

|

5,000

|

|

|

|

169,500

|

|

|

EMCOR Group, Inc.

|

|

|

1,100

|

|

|

|

45,408

|

|

|

KBR, Inc.

|

|

|

13,700

|

|

|

|

428,536

|

|

|

Quanta Services, Inc.*

|

|

|

1,700

|

|

|

|

45,577

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

689,021

|

|

|

|

|

|

|

|

|

|

|

|

|

Electrical Equipment — 0.8%

|

|

|

|

|

|

|

|

|

|

Babcock & Wilcox Co. (The)

|

|

|

4,700

|

|

|

|

143,538

|

|

|

Emerson Electric Co.

|

|

|

18,200

|

|

|

|

1,116,934

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,260,472

|

|

|

|

|

|

|

|

|

|

|

|

|

Industrial Conglomerates — 1.2%

|

|

|

|

|

|

|

|

|

|

General Electric Co.

|

|

|

71,900

|

|

|

|

1,752,203

|

|

|

|

|

|

|

|

|

|

|

|

|

Machinery — 2.2%

|

|

|

|

|

|

|

|

|

|

AGCO Corp.

|

|

|

1,200

|

|

|

|

67,500

|

|

|

Deere & Co.

|

|

|

14,400

|

|

|

|

1,196,208

|

|

|

Hyster-Yale Materials Handling, Inc.

|

|

|

1,000

|

|

|

|

65,010

|

|

|

Ingersoll-Rand PLC

|

|

|

8,200

|

|

|

|

500,610

|

|

|

Lincoln Electric Holdings, Inc.

|

|

|

2,600

|

|

|

|

153,504

|

|

|

Oshkosh Corp.*

|

|

|

19,700

|

|

|

|

882,954

|

|

|

Parker Hannifin Corp.

|

|

|

1,100

|

|

|

|

113,608

|

|

|

Toro Co. (The)

|

|

|

700

|

|

|

|

34,496

|

|

|

Valmont Industries, Inc.

|

|

|

3,100

|

|

|

|

432,884

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,446,774

|

|

|

|

|

|

|

|

|

|

|

|

|

Marine

|

|

|

|

|

|

|

|

|

|

Matson, Inc.

|

|

|

1,300

|

|

|

|

36,816

|

|

|

|

|

|

|

|

|

|

|

|

|

Road & Rail — 1.9%

|

|

|

|

|

|

|

|

|

|

CSX Corp.

|

|

|

30,500

|

|

|

|

756,705

|

|

|

Norfolk Southern Corp.

|

|

|

6,600

|

|

|

|

482,856

|

|

|

Union Pacific Corp.

|

|

|

11,000

|

|

|

|

1,744,490

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,984,051

|

|

|

|

|

|

|

|

|

|

|

|

|

Trading Companies & Distributors — 0.6%

|

|

|

|

|

|

|

|

|

|

DXP Enterprises, Inc.*

|

|

|

900

|

|

|

|

62,100

|

|

|

W.W. Grainger, Inc.

|

|

|

3,400

|

|

|

|

891,276

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

953,376

|

|

|

|

|

|

|

|

|

|

|

|

|

INFORMATION TECHNOLOGY — 18.0%

|

|

|

|

|

|

|

|

|

|

Communications Equipment — 2.0%

|

|

|

|

|

|

|

|

|

|

Cisco Systems, Inc.

|

|

|

88,450

|

|

|

|

2,259,897

|

|

|

QUALCOMM, Inc.

|

|

|

12,000

|

|

|

|

774,600

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,034,497

|

|

|

|

|

|

|

|

|

|

|

|

|

Computers & Peripherals — 5.0%

|

|

|

|

|

|

|

|

|

|

Apple, Inc.

|

|

|

11,060

|

|

|

|

5,004,650

|

|

|

EMC Corp.

|

|

|

45,600

|

|

|

|

1,192,440

|

|

|

|

|

|

|

|

|

|

|

|

|

Hewlett-Packard Co.

|

|

|

61,100

|

|

|

|

1,569,048

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7,766,138

|

|

|

|

|

|

|

|

|

|

|

|

|

Electronic Equipment, Instruments & Components — 0.1%

|

|

|

|

|

|

|

|

|

|

Ingram Micro, Inc.*

|

|

|

5,500

|

|

|

|

125,565

|

|

|

Littelfuse, Inc.

|

|

|

400

|

|

|

|

31,996

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

157,561

|

|

|

|

|

|

|

|

|

|

|

|

|

Internet Software & Services — 2.3%

|

|

|

|

|

|

|

|

|

|

Akamai Technologies, Inc.*

|

|

|

23,300

|

|

|

|

1,099,760

|

|

|

Google, Inc. (Class A Stock)*

|

|

|

1,480

|

|

|

|

1,313,648

|

|

|

Yahoo!, Inc.*

|

|

|

38,900

|

|

|

|

1,092,701

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,506,109

|

|

|

|

|

|

|

|

|

|

|

|

|

IT Services — 3.6%

|

|

|

|

|

|

|

|

|

|

CoreLogic, Inc.*

|

|

|

12,900

|

|

|

|

359,910

|

|

|

International Business Machines Corp.

|

|

|

7,570

|

|

|

|

1,476,453

|

|

|

MasterCard, Inc. (Class A Stock)

|

|

|

2,800

|

|

|

|

1,709,708

|

|

|

Syntel, Inc.

|

|

|

1,000

|

|

|

|

71,780

|

|

|

Visa, Inc. (Class A Stock)

|

|

|

10,700

|

|

|

|

1,894,007

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5,511,858

|

|

|

|

|

|

|

|

|

|

|

|

|

Semiconductors & Semiconductor Equipment — 1.3%

|

|

|

|

|

|

|

|

|

|

Intel Corp.(a)

|

|

|

35,200

|

|

|

|

820,160

|

|

|

LSI Corp.*

|

|

|

62,300

|

|

|

|

484,694

|

|

|

Marvell Technology Group Ltd.

|

|

|

46,400

|

|

|

|

601,808

|

|

|

Skyworks Solutions, Inc.*(a)

|

|

|

4,800

|

|

|

|

115,296

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,021,958

|

|

|

|

|

|

|

|

|

|

|

|

|

Software — 3.7%

|

|

|

|

|

|

|

|

|

|

Activision Blizzard, Inc.

|

|

|

2,600

|

|

|

|

46,748

|

|

|

CA, Inc.

|

|

|

5,200

|

|

|

|

154,648

|

|

|

Intuit, Inc.

|

|

|

17,600

|

|

|

|

1,124,992

|

|

|

Manhattan Associates, Inc.*

|

|

|

1,700

|

|

|

|

150,178

|

|

|

Microsoft Corp.

|

|

|

50,100

|

|

|

|

1,594,683

|

|

|

Oracle Corp.

|

|

|

64,400

|

|

|

|

2,083,340

|

|

|

Rovi Corp.*

|

|

|

7,000

|

|

|

|

157,710

|

|

|

Solera Holdings, Inc.

|

|

|

3,500

|

|

|

|

199,185

|

|

|

Symantec Corp.

|

|

|

10,000

|

|

|

|

266,800

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5,778,284

|

|

|

|

|

|

|

|

|

|

|

|

|

MATERIALS — 2.1%

|

|

|

|

|

|

|

|

|

|

Chemicals — 2.1%

|

|

|

|

|

|

|

|

|

|

CF Industries Holdings, Inc.

|

|

|

1,900

|

|

|

|

372,419

|

|

|

Eastman Chemical Co.

|

|

|

6,300

|

|

|

|

506,709

|

|

|

FutureFuel Corp.

|

|

|

1,400

|

|

|

|

22,106

|

|

|

Koppers Holdings, Inc.

|

|

|

400

|

|

|

|

15,460

|

|

|

LyondellBasell Industries NV (Class A Stock)

|

|

|

15,800

|

|

|

|

1,085,618

|

|

|

Sherwin-Williams Co. (The)

|

|

|

5,500

|

|

|

|

957,935

|

|

|

Valspar Corp. (The)

|

|

|

2,700

|

|

|

|

183,924

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,144,171

|

|

|

|

|

|

|

|

|

|

|

|

|

Paper & Forest Products

|

|

|

|

|

|

|

|

|

|

Clearwater Paper Corp.*

|

|

|

600

|

|

|

|

29,352

|

|

|

|

|

|

|

|

|

|

|

|

|

TELECOMMUNICATIONS SERVICES — 1.8%

|

|

|

|

|

|

|

|

|

|

Diversified Telecommunication Services — 1.8%

|

|

|

|

|

|

|

|

|

|

AT&T, Inc.

|

|

|

32,368

|

|

|

|

1,141,619

|

|

|

CenturyLink, Inc.

|

|

|

12,000

|

|

|

|

430,200

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Verizon Communications, Inc.

|

|

|

|

|

|

|

|

|

|

|

24,400

|

|

|

|

1,207,312

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,779,131

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

UTILITIES — 1.9%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Electric Utilities — 0.5%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exelon Corp.

|

|

|

|

|

|

|

|

|

|

|

19,400

|

|

|

|

593,446

|

|

|

Xcel Energy, Inc.

|

|

|

|

|

|

|

|

|

|

|

8,600

|

|

|

|

257,570

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

851,016

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gas Utilities — 0.3%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Atmos Energy Corp.

|

|

|

|

|

|

|

|

|

|

|

2,700

|

|

|

|

119,448

|

|

|

UGI Corp.

|

|

|

|

|

|

|

|

|

|

|

6,900

|

|

|

|

289,731

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

409,179

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Independent Power Producers & Energy Traders — 0.3%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AES Corp. (The)

|

|

|

|

|

|

|

|

|

|

|

34,600

|

|

|

|

430,424

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Multi-Utilities — 0.7%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DTE Energy Co.

|

|

|

|

|

|

|

|

|

|

|

4,900

|

|

|

|

346,430

|

|

|

SCANA Corp.

|

|

|

|

|

|

|

|

|

|

|

15,400

|

|

|

|

799,414

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,145,844

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Water Utilities — 0.1%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

American States Water Co.

|

|

|

|

|

|

|

|

|

|

|

600

|

|

|

|

38,532

|

|

|

American Water Works Co., Inc.

|

|

|

|

|

|

|

|

|

|

|

2,400

|

|

|

|

102,432

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

140,964

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL LONG-TERM INVESTMENTS

(cost $96,396,715)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

150,684,999

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SHORT-TERM INVESTMENTS — 5.5%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AFFILIATED MONEY MARKET MUTUAL FUND — 5.4%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Prudential Investment Portfolios 2 — Prudential Core Taxable Money Market Fund

(cost

$8,278,504; includes $4,874,961 of cash collateral for

securities on loan)(b)(c)

|

|

|

|

|

|

|

|

8,278,504

|

|

|

|

8,278,504

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest

Rate

|

|

|

Maturity

Date

|

|

|

Principal

Amount

(000)

|

|

|

|

|

|

U.S. TREASURY OBLIGATION — 0.1%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. Treasury Bill(d)(e)

(cost $159,991)

|

|

|

0.043

|

%

|

|

|

09/19/13

|

|

|

|

160

|

|

|

|

159,994

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL SHORT-TERM INVESTMENTS

(cost $8,438,495)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8,438,498

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL INVESTMENTS — 103.2%

(cost $104,835,210)(f)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

159,123,497

|

|

|

Liabilities in excess of other assets(g) — (3.2)%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(4,989,084

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET ASSETS — 100.0%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$

|

154,134,413

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

Non-income producing security.

|

|

(a)

|

All or a portion of security is on loan. The aggregate market value of such securities, including those sold and pending settlement, is $4,769,992; cash collateral of

$4,874,961 (included with liabilities) was received with which the Fund purchased highly liquid short-term investments.

|

|

(b)

|

Represents security, or a portion thereof, purchased with cash collateral received for securities on loan.

|

|

(c)

|

Prudential Investments LLC, the manager of the Fund, also serves as manager of the Prudential Investment Portfolios 2 — Prudential Core Taxable Money Market Fund.

|

|

(d)

|

Represents security, or a portion thereof, segregated as collateral for futures contracts.

|

|

(e)

|

Rate quoted represents yield-to-maturity as of purchase date.

|

|

(f)

|

The United States federal income tax basis of the Fund investment was $104,967,063; accordingly, net unrealized appreciation on investments for federal income tax

purposes was $54,156,434 (gross unrealized appreciation $54,259,700; gross unrealized depreciation $103,266). The difference between book and tax basis is primarily attributable to deferred losses on wash sales and other book to tax differences as

of the most recent fiscal year end.

|

|

(g)

|

Includes net unrealized appreciation (depreciation) on the following derivative contracts held at reporting period end:

|

Open futures contracts outstanding at July 31, 2013:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number of

Contracts

|

|

Type

|

|

Expiration

Date

|

|

Value at

Trade Date

|

|

|

Value at

July 31, 2013

|

|

|

Unrealized

Appreciation(1)

|

|

|

|

|

Long Position:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

43

|

|

E-mini S&P 500 Futures

|

|

Sep. 2013

|

|

$

|

3,506,017

|

|

|

$

|

3,613,075

|

|

|

$

|

107,058

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

The amount represents fair value of derivative instruments subject to equity contracts risk exposure as of July 31, 2013.

|

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

Level 1 - quoted prices generally in active markets for identical securities.

Level 2 - other significant observable inputs including, but not limited to, quoted prices for similar securities, interest rates and

yield curves, prepayment speeds, foreign currency exchange rates, and amortized cost.

Level 3 - significant unobservable

inputs for securities valued in accordance with Board approved fair valuation procedures.

The following is a summary of the inputs used as of

July 31, 2013 in valuing such portfolio securities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Level 1

|

|

|

Level 2

|

|

|

Level 3

|

|

|

Investments in Securities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stocks

|

|

$

|

150,684,999

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

Affiliated Money Market Mutual Fund

|

|

|

8,278,504

|

|

|

|

—

|

|

|

|

—

|

|

|

U.S. Treasury Obligation

|

|

|

—

|

|

|

|

159,994

|

|

|

|

—

|

|

|

Other Financial Instruments*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Futures

|

|

|

107,058

|

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

$

|

159,070,561

|

|

|

$

|

159,994

|

|

|

$

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

Other financial instruments are derivative instruments not reflected in the Schedule of Investments, such as futures, forwards and swaps contracts, which are recorded

at the unrealized appreciation/depreciation on the instrument.

|

Notes to Schedules of Investments (Unaudited)

Securities Valuation:

The Funds hold portfolio securities and other assets that are fair valued at the close of each day the New York Stock

Exchange (“NYSE”) is open for trading. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. The Board of Trustees

(the “Board”) has delegated fair valuation responsibilities to Prudential Investments LLC (“PI”) through the adoption of Valuation Procedures for valuation of the Funds’ securities. Under the current Valuation Procedures, a

Valuation Committee is established and responsible for supervising the valuation of portfolio securities and other assets. The Valuation Procedures allow the Funds to utilize independent pricing vendor services, quotations from market makers and

other valuation methods in events when market quotations are not readily available or not representative of the fair value of the securities. A record of the Valuation Committee’s actions is subject to review, approval and ratification by the

Board at its next regularly scheduled quarterly meeting.

Various inputs are used in determining the value of the Funds’ investments,

which are summarized in the three broad level hierarchies based on any observable inputs used as described in the table following the Schedule of Investments. The valuation methodologies and significant inputs used in determining the fair value of

securities and other assets classified as Level 1, Level 2 and Level 3 of the hierarchy are as follows:

Common stocks, exchange-traded funds

and financial derivative instruments (including futures contracts and certain options and swap contracts on securities), that are traded on a national securities exchange are valued at the last sale price as of the close of trading on the applicable

exchange. Securities traded via NASDAQ are valued at the NASDAQ official closing price. To the extent these securities are valued at the last sale price or NASDAQ official closing price, they are classified as Level 1 of the fair value hierarchy.

In the event there is no sale or official closing price on such day, these securities are valued at the mean between the last reported bid

and asked prices, or at the last bid price in absence of an asked price. These securities are classified as Level 2 of the fair value hierarchy as these inputs are considered as significant other observable inputs to the valuation.

For common stocks traded on foreign securities exchanges, certain valuation adjustments will be applied when events occur after the close of the

security’s foreign market and before the Funds’ normal pricing time. These securities are valued using pricing vendor services that provide model prices derived using adjustment factors based on information such as local closing price,

relevant general and sector indices, currency fluctuations, depositary receipts, and futures, as applicable. Securities valued using such model prices are classified as Level 2 of the fair value hierarchy as the adjustment factors are considered as

significant other observable inputs to the valuation.

Investments in open-end,

non-exchange-traded

mutual funds are valued at their net asset values as of the close of the NYSE on the date of valuation. These securities are classified as Level 1 as they have the ability to be purchased or sold at their net asset values on the date of valuation.

Fixed income securities traded in the

over-the-counter

market, such as corporate bonds, municipal bonds, U.S. Government agencies issues and guaranteed obligations, U.S. Treasury obligations and sovereign issues are usually valued at prices provided by approved independent pricing vendors. The pricing

vendors provide these prices usually after evaluating observable inputs including yield curves, credit rating, yield spreads, default rates, cash flows as well as broker/dealer quotations and reported trades. Securities valued using such vendor

prices are classified as Level 2 of the fair value hierarchy.

Asset-backed and mortgage-related securities are usually valued by approved

independent pricing vendors. The pricing vendors provide the prices using their internal pricing models with inputs from deal terms, tranche level attributes, yield curves, prepayment speeds, default rates and broker/dealer quotes. Securities valued

using such vendor prices are classified as Level 2 of the fair value hierarchy.

Over-the-counter

financial

derivative instruments, such as option contracts, foreign currency contracts and swaps agreements, are usually valued using pricing vendor services, which derive the valuation based on underlying asset prices, indices, spreads, interest rates,

exchange rates and other inputs. These instruments are categorized as Level 2 of the fair value hierarchy.

Securities and other assets that

cannot be priced using the methods described above are valued with pricing methodologies approved by the Valuation Committee. In the event there are unobservable inputs used when determining such valuations, the securities will be classified as

Level 3 of the fair value hierarchy.

When determining the fair value of securities, some of the factors influencing the valuation include:

the nature of any restrictions on disposition of the securities; assessment of the general liquidity of the securities; the issuer’s financial condition and the markets in which it does business; the cost of the investment; the size of the

holding and the capitalization of the issuer; the prices of any recent transactions or bids/offers for such securities or any comparable securities; any available analyst media or other reports or information deemed reliable by the investment

adviser regarding the issuer or the markets or industry in which it operates. Using fair value to price securities may result in a value that is different from a security’s most recent closing price and from the price used by other mutual funds

to calculate their net asset values.

The Funds invest in the Prudential Core Taxable Money Market Fund, a portfolio of the Prudential

Investment Portfolios 2, registered under the Investment Company Act of 1940, as amended, and managed by PI.

Other information regarding

the Funds is available in the Funds’ most recent Report to Shareholders. This information is available on the Securities and Exchange Commission’s website (www.sec.gov).

|

Item 2.

|

Controls and Procedures

|

|

|

(a)

|

It is the conclusion of the registrant’s principal executive officer and principal financial officer that the effectiveness of the registrant’s current disclosure controls and procedures (such disclosure

controls and procedures having been evaluated within 90 days of the date of this filing) provide reasonable assurance that the information required to be disclosed by the registrant has been recorded, processed, summarized and reported within the

time period specified in the Commission’s rules and forms and that the information required to be disclosed by the registrant has been accumulated and communicated to the registrant’s principal executive officer and principal financial

officer in order to allow timely decisions regarding required disclosure.

|

|

|

(b)

|

There have been no significant changes in the registrant’s internal controls or in other factors that could significantly affect these controls subsequent to the date of their evaluation, including any corrective

actions with regard to significant deficiencies and material weaknesses.

|

Certifications pursuant to Rule 30a-2(a) under the Investment Company Act of

1940 – Attached hereto.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused

this report to be signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant)

Prudential Investment Portfolios 9

|

|

|

|

|

|

|

By (Signature and Title)*

|

|

/s/ Deborah A. Docs

|

|

|

|

|

|

Deborah A. Docs

|

|

|

|

|

|

Secretary of the Fund

|

|

|

Date September 23, 2013

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below

by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

|

|

|

|

|

|

|

By (Signature and Title)*

|

|

/s/ Stuart S. Parker

|

|

|

|

|

|

Stuart S. Parker

|

|

|

|

|

|

President and Principal Executive Officer

|

|

|

Date September 23, 2013

|

|

|

|

|

|

|

By (Signature and Title)*

|

|

/s/ Grace C. Torres

|

|

|

|

|

|

Grace C. Torres

|

|

|

|

|

|

Treasurer and Principal Financial Officer

|

|

|

Date September 23, 2013

|

*

|

Print the name and title of each signing officer under his or her signature.

|

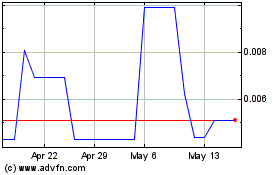

Searchlight Minerals (PK) (USOTC:SRCH)

Historical Stock Chart

From Mar 2024 to Apr 2024

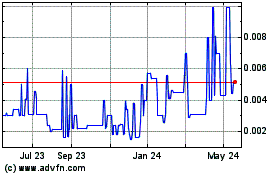

Searchlight Minerals (PK) (USOTC:SRCH)

Historical Stock Chart

From Apr 2023 to Apr 2024