UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-4/A-3

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

AMERICAN SIERRA GOLD CORP.

(Exact name of registrant as specified in its charter)

Nevada

(State or other jurisdiction of incorporation or organization)

5960

(Primary Standard Industrial Classification Code Number)

98-0528416

(I.R.S. Employer Identification Number)

9555 SW Allen Blvd., #36, Beaverton, Oregon 97005

(951) 287-9593

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

1218 Third Avenue, Suite 505, Seattle, WA 98101

(Former address)

|

Larry Regis

President

American Sierra Gold Corp.

9555 SW Allen Blvd., #36

Beaverton, Oregon 97005

(951) 287-9593

|

with copy to:

Michele Rasmussen

The Apex Law Group, LLP

1218 Third Avenue, Suite 505

Seattle, Washington 98101

(206) 448-7000

|

Approximate date of commencement of proposed sale of the securities to the public: From time to time after the Registration Statement becomes effective.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box

o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large Accelerated Filer

o

|

Accelerated Filer

o

|

|

|

|

|

Non-accelerated filer

o

(Do not check if a smaller reporting company)

|

Smaller Reporting Filer

x

|

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer)

o

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer)

o

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

CALCULATION OF REGISTRATION FEE

|

Title of each class of

securities to be registered

|

|

Amount to be

Registered

|

|

|

Proposed Maximum

Offering Price Per Share (1)

|

|

|

Proposed Maximum

Aggregate Offering Price

|

|

|

Amount of

Registration Fee (2)

|

|

Common Stock, par value $0.001

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

Estimated solely for purposes of calculating the registration fee under the Securities Act of 1933, based on the average high and low price on the OTCQB as of December 10, 2012 ($0.12 per share), in accordance with Rule 457(f)(2).

|

|

(2)

|

The Company is offsetting previously paid filing fees of $1,398.07 relating to Form S-4 filed October 31, 2012, file number 333-184668.

|

American Sierra Gold Corp’s common stock is listed on the Over the Counter Bulletin Board with the trading symbol “AMNP.”

Note

: Specific details relating to the fee calculation shall be furnished in notes to the table, including references to provisions of Rule 457 (§230.457 of this chapter) relied upon, if the basis of the calculation is not otherwise evident from the information presented in the table.

The information in this prospectus is not complete and may be changed. We may not offer these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion

Preliminary Prospectus Dated May __, 2013

63,941,540 Shares

AMERICAN SIERRA GOLD CORP.

Common Stock

______________________________________

This Prospectus provides a general description of securities we may offer and sell in accordance with the exchange offer with Medinah Gold, Inc. We are offering you one share of our common stock in exchange for each share of Medinah Gold, Inc. you own. This exchange offer will be open for 30 days from the mailing date of the letter of transmittal. You should read this Prospectus and the applicable prospectus supplement carefully before you invest in any securities. This Prospectus may not be used to consummate a sale of securities unless accompanied by the applicable prospectus supplement.

Our common stock is quoted on the Over-the-Counter Bulletin Board under the symbol “AMNP.OB.” On May 31, 2013, the last sales price for our common stock as reported on the OTC Bulletin Board was $0.14 per share.

You should read this Prospectus and each applicable prospectus supplement carefully before you invest in any securities. An investment in our securities involves certain risks. See the “

Risk Factors

” section on page 16 below and in each applicable prospectus supplement to read about the risks you should consider before buying our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this Prospectus is May ___, 2013.

|

|

Page

|

|

|

6

|

|

|

7

|

|

|

7

|

|

|

7

|

|

|

8

|

|

|

8

|

|

|

9

|

|

|

9

|

|

|

9

|

|

|

10

|

|

|

11

|

|

|

16

|

|

Risks Related to our Business Combination

|

16

|

|

|

18

|

|

|

19

|

|

|

21

|

|

|

21

|

|

|

23

|

|

|

23

|

|

|

23

|

|

|

23

|

|

|

23

|

|

|

23

|

|

|

24

|

|

|

24

|

|

|

24

|

|

|

24

|

|

|

24

|

|

|

24

|

|

|

25

|

|

|

25

|

|

|

27

|

|

|

27

|

|

|

28

|

|

|

33

|

|

|

44

|

|

|

44

|

|

|

47

|

|

|

48

|

|

|

55

|

|

|

55

|

|

|

56

|

|

|

57

|

|

|

57

|

|

|

59

|

|

|

59

|

|

|

64

|

|

|

65

|

|

|

66

|

|

|

67

|

|

|

67

|

|

|

67

|

|

|

67

|

|

|

68

|

|

|

69

|

|

|

69

|

|

|

69

|

|

|

69

|

|

|

69

|

|

|

69

|

REFERENCES TO ADDITIONAL INFORMATION

This prospectus incorporates important business and financial information about ASGC from other documents that are not included in or delivered with this prospectus. This information is available for you to review at the Securities and Exchange Commission’s, or SEC’s, public reference room located at 100 F Street, N.E., Room 1580, Washington, DC 20549, and through the SEC’s website, www.sec.gov. You can also obtain those documents incorporated by reference in this prospectus by requesting them in writing or by telephone at the following address and telephone number:

|

AMERICAN SIERRA GOLD CORP.

|

MEDINAH GOLD INC.

|

|

9555 SW Allen Blvd., #36

|

9555 SW Allen Blvd., #36

|

|

Beaverton, Oregon 97005

|

Beaverton, Oregon 97005

|

|

(951) 287-9593

|

(951) 287-9593

|

|

Attention: Larry Regis

|

Attention: Larry Regis

|

In addition, if you have questions about the transactions described herein, or if you need to obtain copies of the accompanying prospectus or other documents incorporated by reference in the prospectus, you may contact the appropriate contact listed above. You will not be charged for any of the documents you request. You may request this information at any time prior to the end of the exchange offer.

For a more detailed description of the information incorporated by reference in the accompanying prospectus and how you may obtain it, see “Where You Can Find More Information” beginning on page 69 of the accompanying prospectus.

This prospectus and the documents that are incorporated into this prospectus by reference may contain or incorporate by reference statements that do not directly or exclusively relate to historical facts. You can typically identify forward-looking statements by the use of forward-looking words, such as “may,” “will,” “could,” “project,” “believe,” “anticipate,” “expect,” “estimate,” “continue,” “potential,” “plan,” “forecast” and other similar words. These include, but are not limited to, statements relating to the synergies and the benefits that we expect to achieve in the transactions discussed herein, including future financial and operating results, the combined Company’s plans, objectives, expectations and intentions and other statements that are not historical facts. Those statements represent the intentions, plans, expectations, assumptions and beliefs of ASGC and Medinah about future events and are subject to risks, uncertainties and other factors. Many of those factors are outside the control of ASGC and Medinah, and could cause actual results to differ materially from the results expressed or implied by those forward-looking statements. In addition to the risk factors described under “Risk Factors” beginning on page 16, those factors include:

|

·

|

possible delays in the exchange offer due to the inability to obtain regulatory approval;

|

|

·

|

the ability to integrate ASGC’s and Medinah’s businesses and operations;

|

|

·

|

the benefits of Medinah, including the prospects of the combined businesses, anticipated synergies and cost savings;

|

|

·

|

anticipated growth and growth strategies;

|

|

·

|

the need for additional capital and the availability of financing;

|

|

·

|

the ability to successfully manage relationships with customers, distributors and other important relationships;

|

|

·

|

the ability to integrate the management team and employees;

|

|

·

|

the loss of key personnel or expenditure of a greater amount of resources attracting, retaining and motivating key personnel than in the past;

|

|

·

|

the compatibility of business cultures;

|

|

·

|

pricing and availability of products and services;

|

|

·

|

demand for the combined companies products and services;

|

|

·

|

the deterioration of general economic conditions, either nationally or in the local markets in which we operate;

|

|

·

|

legislative or regulatory changes that may adversely affect ASGC’s business after the exchange; and

|

|

·

|

costs related to the exchange that may reduce the entity’s working capital.

|

The forward-looking statements are based on current expectations about future events. Although ASGC believes that the expectations reflected in the forward-looking statements are reasonable, these expectations may not be achieved. ASGC is under no duty to update any of the forward-looking statements after the date of this prospectus to conform those statements to actual results. In evaluating these statements, you should consider various factors, including the risks outlined in the section entitled “Risk Factors” beginning on page 16 .

The following summary highlights only selected information contained elsewhere in this prospectus and may not contain all the information that may be important to you. Accordingly, you are encouraged to read this prospectus carefully and in its entirety, including the documents incorporated by reference in this prospectus. See the section entitled “Where You Can Find More Information” beginning on page 69 .

American Sierra Gold Corp.

We are a precious metal mineral acquisition, exploration and development company, formed in Nevada on January 30, 2007. At the time of our incorporation, we were incorporated under the name “C.E. Entertainment, Inc.,” and our original business plan was to engage in the sales and marketing of Ukrainian classical music. On May 19, 2009, we changed our name to American Sierra Gold Corp. by way of a merger with our wholly-owned subsidiary, American Sierra Gold Corp., which was formed solely for the purpose of changing our name. In addition to the name change, we changed our intended business purpose to that of precious metal mineral exploration, development and production.

On May 30, 2012, the State of Nevada declared effective the one (1) new for fifteen (15) old reverse stock split of our issued and outstanding shares of common stock on the Over-the-Counter Bulletin Board. The reverse stock split was approved on May 22, 2012, by way of a written consent resolution by the Board of Directors and it was declared effective with FINRA on June 15, 2012. As a result, our authorized capital decreased from 2,000,000,000 shares of common stock to 133,333,334 shares of common stock and the issued and outstanding decreased from 91,253,626 shares of common stock to 6,083,576 shares of common stock, all with a par value of $0.001. The record date for the reverse stock split was May 22, 2012.

ASGC’s principal executive offices are located at 9555 SW Allen Blvd., #36, Beaverton, Oregon 97005 and our phone number is (951) 287-9593.

Medinah Gold Inc.

Medinah is a property holding and mining company with its assets in the country of Chile. Medinah has been operating in that capacity since 1999 under the direction of its president, Larry Regis, Jr. There are no federal or state regulatory requirements that must be complied with and no approval must be obtained in connection with this exchange transaction.

Medinah’s address is 9555 SW Allen Blvd., #36, Beaverton, Oregon 97005 and its telephone number (951) 287-9593.

ASGC is proposing for Medinah to become a majority owned subsidiary pursuant to an exchange offer. Upon the exchange, Medinah shareholders can elect to have their shares converted into common shares of ASGC on a one-for-one basis, which is expected to be approximately 63,941,540 shares of common stock. Medinah shareholders will not receive any fractional shares of ASGC common stock. As a result of the exchange, former Medinah shareholders will own ASGC common stock. A description of the ASGC common stock to be issued as part of the exchange offer is set forth under the section entitled “Description of ASGC Securities” beginning on page 67 .

Mandatory surrender of certificates is required by Medinah stockholders in connection with participating in the exchange offer. Upon which time this registration statement has been deemed effective, ASGC shall then cause its transfer agent, American Registrar & Transfer Co. (the “Exchange Agent”), to mail to each Medinah shareholder (i) a letter of transmittal (the “Letter of Transmittal”) to the Exchange Agent and (ii) instructions for use in surrendering Medinah stock certificates in exchange for ASGC common stock . New certificates will be mailed to participating stockholders. Medinah stockholders are not required to participate in this exchange offer. The expiration date for Medinah stockholders to exchange their certificates in exchange for ASGC common stock shall be 30 calendar days from the day this prospectus and the letter of transmittal have been mailed. Medinah stockholders may elect to retain their shares of Medinah. The consequence of them doing so is that their Medinah shares will not be able to be sold on an exchange. Please see “The Exchange Offer - Procedures for Tendering” beginning on page 61 for information on how to exchange your shares of Medinah for shares of ASGC.

For additional information on the business combination, see “The Business Combination” beginning on page 55.

On May 31, 2013, ASGC had 15,791,740 issued and outstanding shares of common stock. Since ASGC is looking to acquire stock of Medinah through the exchange offer, it is not required to obtain shareholder consent.

For additional information on the Security Ownership of Certain Beneficial Owners and Management, see “Security Ownership of Certain Beneficial Owners and Management and Related Stock Matters” on page 25.

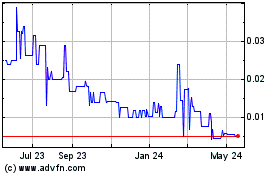

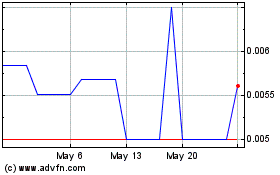

Our common stock has traded on the Over-the-Counter Bulletin Board (“OTCQB”) since October 12, 2009, initially under the symbol “CENI.OB”. Our common stock currently trades under the symbol “AMNP.OB.” On May 31, 2013, the latest practicable date before the printing of prospectus, the last reported sale price of the ASGC ordinary shares on the Over The Counter Bulletin Board was $0.14 per share. The following table represents the range of the high and the low closing prices, as quoted on the OTC Bulletin Board for each fiscal quarter during the fiscal years ended July 31, 2012 and July 31, 2011, respectively. These quotations represent prices between dealers, and may not include retail mark-ups, markdowns or commissions, and may not necessarily represent actual transactions. On May 31, 2013, ASGC had 15,791,740 issued and outstanding shares of common stock. ASGC currently has one class of stock.

|

Fiscal Quarter Ended

|

|

High Bid

|

|

|

Low Bid

|

|

|

April 30, 2013

|

|

$

|

0.15

|

|

|

$

|

0.13

|

|

|

January 31, 2013

|

|

$

|

0.14

|

|

|

$

|

0.12

|

|

|

October 31, 2012

|

|

$

|

0.10

|

|

|

$

|

0.05

|

|

|

July 31, 2012*

|

|

$

|

0.20

|

|

|

$

|

0.02

|

|

|

April 30, 2012

|

|

$

|

0.08

|

|

|

$

|

0.03

|

|

|

January 31, 2012

|

|

$

|

0.19

|

|

|

$

|

0.04

|

|

|

October 31, 2011

|

|

$

|

0.38

|

|

|

$

|

0.23

|

|

|

July 31, 2011

|

|

$

|

0.20

|

|

|

$

|

0.16

|

|

|

April 30, 2011

|

|

$

|

0.41

|

|

|

$

|

0.34

|

|

|

January 31, 2011

|

|

$

|

0.76

|

|

|

$

|

0.65

|

|

|

October 31, 2010

|

|

$

|

0.14

|

|

|

$

|

0.05

|

|

*On May 30, 2012, the State of Nevada declared effective ASGC’s 1:15 stock split. The stock split was declared effective with FINRA on June 15, 2012.

We have no equity incentive plan and accordingly have not granted stock options or stock awards pursuant to any equity incentive plan.

See also, the “Security Ownership of Certain Beneficial Owners and Management and Related Stock Matters” table starting on page 25 for director, officer and affiliate holding information.

Dividends

.

We have neither declared nor paid any cash dividends on our capital stock and do not anticipate paying cash dividends in the foreseeable future. Our current policy is to retain any earnings in order to finance our operations. Our Board of Directors will determine future declaration and payment of dividends, if any, in light of our then-current financial condition.

Securities Authorized for Issuance under Equity Compensation Plans

As of May 1, 2013, we have not granted any stock options or authorized securities for issuance under an equity compensation plan.

Recent Sales of Unregistered Securities

There were no sales of unregistered securities during the year ending July 31, 2012 or during the nine months ending March 31, 2013.

Interests

of Officers and Directors in the Business Combination

The current directors and officers of ASGC will continue to be the officers and directors of the expected resulting combined entity of the exchange offer. ASGC shareholders who are shareholders prior to the exchange offer will continue to be shareholders in the same manner and extent as all other shareholders. However, existing shareholders will be diluted upon consummation of the exchange since ASGC will be issuing approximately 63,941,540 shares of common stock to the shareholders of Medinah. Aside from common stock ownership, none of the directors and officers of Medinah and ASGC have an interest in the business combination.

These interests are described in more detail in the sections of this document entitled “The Business Combination — Interests of Officers and Directors in the Business Combination” beginning on page 57 .

Material

U.S. Federal Income Tax Consequences

Material U.S. Federal Income Tax Consequences of the Exchange Offer and Excepted Business Combination

The board of directors and management of ASGC and Medinah believe that the exchange will be treated as a “tax-free reorganization” under Section 368 (a) of the Internal Revenue Code and has received a tax opinion from Thomas Harris, CPA, to this effect.

Tax matters are very complicated, and the tax consequences of the expected business combination to a particular shareholder will depend on such shareholder’s circumstances. Accordingly, Medinah and ASGC urge you to consult your tax advisor for a full understanding of the tax consequences of the expected business combination to you, including the applicability and effect of U.S. federal, state, local and foreign income and other tax laws.

The Exchange

Following the exchange of a majority of the Medinah shares; (i) the current shareholders of Medinah will hold a majority of the issued and outstanding shares of ASGC common stock, on a fully diluted basis, and, therefore, will have voting control of ASGC; and (ii) Medinah’s operations will become the core business of the combined entity.

Based on the above facts, the respective management of Medinah and ASGC believe that Medinah is considered as the accounting acquiror, currently referred to as a reverse merger. No intangible assets or goodwill will be recognized as a result of the exchange.

Rights of dissenting shareholders

NRS 78.3793 provides that, unless otherwise provided for in Articles or Bylaws, a shareholder who did not vote in favor of authorizing the voting rights to the acquiring person, has dissenter's rights and may obtain payment for a fair value of his/her shares. ASGC’s articles of incorporation or bylaws do not provide for rights of dissenting shareholders. Additionally, ASGC is not required to and did not solicit or obtain shareholder consent before making the exchange offer with Medinah. Only Board of Director approval was required and it was obtained via unanimous written consent in lieu of a special meeting on January 22, 2013.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

On April 5, 2013, the ASGC’s board of directors voted to approve the appointment of the below individuals as directors and officers of ASGC. These appointments were deemed effective on April 5, 2013. Simultaneously with these appointments, James Vandeberg, ASGC’s sole officer and director resigned. His resignation from the Board and as Sole Director does not arise from any disagreement on any matter relating to ASGC’s operations, policies or practices, nor regarding the general direction of ASGC. A current report on Form 8-K regarding these events was filed on April 10, 2013. If a majority of Medinah shareholders do not elect to have their shares converted into ASGC common stock, Medinah will not become or be recognized as a majority owned subsidiary of ASGC.

|

Name

|

|

Office

|

|

Larry Regis

|

|

President and Chief Executive Officer

|

|

|

|

|

|

Gary Goodin

|

|

Chief Operating Officer, Chief Accounting Officer, Vice President Marketing and Sales

|

|

|

|

|

|

Vittal Karra

|

|

Secretary, Treasurer, Head of Marketing

|

Note that Larry Regis currently serves as President and Director of Medinah, Gary Goodin serves as Secretary, Treasurer and Director of Medinah and Vittal Karra serves as Director of Medinah. Jim Vandeberg and Les Price serve as advisors without compensation to the Board of Directors.

For more information on the new directors and management of ASGC, see “Post-Exchange ASGC Executive Officers and Directors” beginning on page 65 .

Material Interests of Affiliates of ASGC and Medinah.

As noted in the “Security Ownership of Certain Beneficial Owners and Management and Related Stock Matters” table starting on page 25, Les Price has a controlling interest in MMC Mines, Inc. and G.X.K. Ventures, Inc. These entities own a combined total of 3,400,000 shares of ASGC common stock, representing 21.6% of the total issued and outstanding shares of ASGC. Mr. Price was appointed as an advisor to the Board of Directors on April 5, 2013.

As a result of the exchange offer, the holders of Medinah common stock will become holders of ASGC common stock. Following the exchange, the rights of Medinah shareholders will be governed by the ASGC Articles of Incorporation. Both companies are incorporated in Nevada and no material differences exist between the governing documents of each entity aside from the par value of their respective authorized amounts of capital stock. ASGC capital stock has a $0.001 par value and Medinah capital stock has a $0.001 par value.

UNAUDITED

PRO FORMA CONDENSED COMBINED CONSOLIDATED FINANCIAL STATEMENTS

The following unaudited pro forma condensed combined consolidated financial statements give effect to the transaction between our company, ASGC, and Medinah (MGI) using the acquisition method of accounting for the business combination on the basis that MGI is the acquirer for financial reporting purposes. Because this business combination is accounted for in a manner similar to that of a reverse capitalization, no intangible assets or goodwill are recognized.

The merger has not been consummated as of the date of the preparation of this unaudited pro forma condensed combined consolidated financial information and there can be no assurances that the merger transaction will be consummated. In addition to the impact of ongoing integration activities, the timing of completion of the transaction and other changes in net tangible and intangible assets that occur prior to completion of the transaction could cause differences in the information presented.

The unaudited pro forma condensed combined consolidated financial information does not include any adjustments related to restructuring or one-time charges, potential profit improvements, potential cost savings or other costs which may result from the merger, or the result of final valuations of intangible assets and liabilities, which will not be determined until after the consummation of the merger.

The unaudited pro forma condensed combined consolidated financial statements are presented for illustrative purposes only and are not necessarily indicative of the combined financial position or results of operations of future periods or the results that actually would have been realized had the entities been a single entity during these periods. The pro forma statements of operations give effect to the exchange as if it occurred January 1, 2012, the beginning of MGI’s fiscal year ended December 31, 2012. The pro forma net loss per share is computed by dividing the pro forma net loss by the pro forma weighted average number of shares outstanding. The pro forma per share data are not necessarily indicative of the results that would have occurred, your financial interest in such results, or the future results that will occur after the exchange.

The unaudited pro forma condensed combined consolidated financial statements, which have been prepared by ASGC have been derived from historical financial statements of ASGC and historical financial statements of MGI that are included elsewhere in this Prospectus, and should be read in conjunction with the financial statements and related notes.

UNAUDITED PRO FORMA CONDENSED COMBINED CONSOLIDATED

BALANCE SHEET

As of March 31, 2013

(in thousands)

|

|

|

January 31,

|

|

|

March 31,

|

|

|

|

|

|

|

Pro Forma

|

|

|

|

|

2013

|

|

|

2013

|

|

|

Pro Forma

|

|

|

|

Post-Merger

|

|

|

|

|

ASGC

|

|

|

MGI

|

|

|

Adjustments

|

|

|

|

Combined

|

|

|

|

|

(historical)

|

|

|

(historical)

|

|

|

|

|

|

|

|

|

|

Current assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

-

|

|

|

$

|

382

|

|

|

|

|

|

|

$

|

382

|

|

|

Investments

|

|

|

|

|

|

|

100

|

|

|

|

|

|

|

|

100

|

|

|

Prepaid expenses and other current assets

|

|

|

|

|

|

|

4

|

|

|

|

|

|

|

|

4

|

|

|

Total current assets

|

|

|

-

|

|

|

|

486

|

|

|

|

-

|

|

|

|

|

486

|

|

|

Mineral properties

|

|

|

|

|

|

|

2,656

|

|

|

|

|

|

|

|

|

2,656

|

|

|

Other assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets

|

|

$

|

-

|

|

|

$

|

3,142

|

|

|

$

|

-

|

|

|

|

$

|

3,142

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts payable and accrued expenses

|

|

$

|

4

|

|

|

|

|

|

|

|

|

|

|

|

$

|

4

|

|

|

Due to related parties

|

|

|

4

|

|

|

$

|

284

|

|

|

|

|

|

|

|

|

288

|

|

|

Notes payable

|

|

|

145

|

|

|

|

|

|

|

|

|

|

|

|

|

145

|

|

|

Total current liabilities

|

|

|

153

|

|

|

|

284

|

|

|

|

-

|

|

|

|

|

437

|

|

|

Accrued and other non-current liabilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-

|

|

|

Total liabilities

|

|

|

153

|

|

|

|

284

|

|

|

|

-

|

|

|

|

|

437

|

|

|

Stockholders' equity (deficit)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock and additional paid-in-capital

|

|

|

5,201

|

|

|

|

4,327

|

|

|

|

(4,327

|

)

|

(A)

|

|

|

4,173

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1,028

|

)

|

(C)

|

|

|

|

|

|

Accumulated deficit

|

|

|

(5,354

|

)

|

|

|

(1,469

|

)

|

|

|

5,355

|

|

(B)

|

|

|

(1,468

|

)

|

|

Total stockholders' equity (deficit)

|

|

|

(153

|

)

|

|

|

2,858

|

|

|

|

-

|

|

|

|

|

2,705

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders' equity (deficit)

|

|

$

|

-

|

|

|

$

|

3,142

|

|

|

$

|

-

|

|

|

|

$

|

3,142

|

|

See accompanying notes to unaudited pro forma condensed combined consolidated financial statements.

UNAUDITED PRO FORMA CONDENSED COMBINED CONSOLIDATED

STATEMENTS OF OPERATIONS

(in thousands, except per share information)

|

|

|

ASGC

|

|

|

MGI

|

|

|

|

|

|

|

|

|

|

|

year ended

|

|

|

|

|

|

|

|

|

|

|

January 31,

|

|

|

December 31,

|

|

|

Pro Forma

|

|

|

Post-Merger

|

|

|

|

|

2013

|

|

|

2012

|

|

|

Adjustments

|

|

|

Combined

|

|

|

|

|

(historical)

|

|

|

(historical)

|

|

|

|

|

|

(pro forma)

|

|

|

Revenue

|

|

$

|

-

|

|

|

$

|

22

|

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exploration and development costs

|

|

|

-

|

|

|

|

15

|

|

|

|

|

|

|

15

|

|

|

General and administrative

|

|

|

148

|

|

|

|

72

|

|

|

|

|

|

|

220

|

|

|

Total operating expenses

|

|

|

148

|

|

|

|

87

|

|

|

|

-

|

|

|

|

235

|

|

|

Loss from operations

|

|

|

(148

|

)

|

|

|

(65

|

)

|

|

|

-

|

|

|

|

(235

|

)

|

|

Interest expense

|

|

|

(5

|

)

|

|

|

-

|

|

|

|

|

|

|

|

(5

|

)

|

|

Net loss

|

|

$

|

(153

|

)

|

|

$

|

(65

|

)

|

|

$

|

-

|

|

|

$

|

(240

|

)

|

|

Basic pro forma net loss per share

|

|

$

|

(0.02

|

)

|

|

$

|

(0.00

|

)

|

|

|

|

|

|

$

|

(0.00

|

)

|

Shares used in computing net loss

per share - basic and diluted

|

|

|

6,391,730

|

|

|

|

50,973,500

|

|

|

|

|

|

|

|

57,365,230

|

|

|

|

|

ASGC

|

|

|

MGI

|

|

|

|

|

|

|

|

|

|

|

|

|

three months ended

|

|

|

|

|

|

|

|

|

|

|

|

January 31,

|

|

|

March 31,

|

|

|

Pro Forma

|

|

|

Post-Merger

|

|

|

|

|

2013

|

|

|

2013

|

|

|

Adjustments

|

|

|

Combined

|

|

|

|

|

(historical)

|

|

|

(historical)

|

|

|

|

|

|

|

(pro forma)

|

|

|

Revenue

|

|

$

|

-

|

|

|

$

|

-

|

|

|

|

|

|

|

$

|

-

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exploration costs

|

|

|

-

|

|

|

|

13

|

|

|

|

|

|

|

|

13

|

|

|

General and administrative

|

|

|

94

|

|

|

|

8

|

|

|

|

|

|

|

|

102

|

|

|

Total operating expenses

|

|

|

94

|

|

|

|

21

|

|

|

|

-

|

|

|

|

115

|

|

|

Loss from operations

|

|

|

(94

|

)

|

|

|

(21

|

)

|

|

|

-

|

|

|

|

(115

|

)

|

|

Interest expense

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-

|

|

|

Net loss

|

|

$

|

(94

|

)

|

|

$

|

(21

|

)

|

|

$

|

-

|

|

|

$

|

(115

|

)

|

|

Basic pro forma net loss per share

|

|

$

|

(0.01

|

)

|

|

$

|

(0.00

|

)

|

|

|

|

|

|

$

|

(0.00

|

)

|

Shares used in computing net loss

per share - basic and diluted

|

|

|

6,391,730

|

|

|

|

63,987,770

|

|

|

|

|

|

|

|

70,379,500

|

|

See accompanying notes to unaudited pro forma condensed combined consolidated financial statements.

NOTES TO UNAUDITED PRO FORMA CONDENSED COMBINED CONSOLIDATED

FINANCIAL STATEMENTS

|

1.

|

Description of Transaction

|

We, American Sierra Gold Corp. (“ASGC”), are a publicly-owned precious metal mineral acquisition, exploration and development company, formed in Nevada in 2007. Medinah Gold Inc. (“MGI”) is a privately-owned property holding and mining company with mineral property mining claims in the country of Chile, formed in Nevada in 1999.

We are proposing to exchange 63,914,540 shares of our common stock to holders of all of the outstanding common stock of MGI (the “Exchange”). As of May 31, 2013, there are 15,791,740 shares of ASGC common stock outstanding. Giving effect to the Exchange, shareholders previously owning shares of MGI would own approximately 80% of total shares outstanding, and MGI would become a wholly-owned subsidiary of ASCG. In April 2013, our Board of Directors approved the appointment of three directors and executive officers, who were directors and executive officers of MGI, and ASGC’s former sole officer and director resigned. Following the exchange, MGI’s operations will become the core business of the combined entity. We have also changed our primary business address from Seattle, Washington to that of MGI in Beaverton, Oregon. These relative security holdings and the composition of our Board of Directors and Executive Officers, the proposed structure, the size of the combining entities and the terms of the exchange of equity interests were considered in determining the accounting acquirer. Based on the weight of these factors, it was concluded that MGI is the accounting acquirer and its historical financial statements will become those of the registrant after the exchange.

The unaudited pro forma condensed combined consolidated financial statements, which have been prepared by ASGC, have been derived from historical financial statements of ASGC and historical financial statements of MGI.

The unaudited pro forma condensed combined consolidated financial statements were prepared in accordance with Securities and Exchange Commission Regulation S-X Article 11, using the acquisition method of accounting based on Accounting Standards Codification (ASC) 805, Business Combinations, and are based on the historical financial statements of MGI and the acquired assets and liabilities of ASGC after giving effect to the stock to be issued by ASGC to consummate the acquisition, as well as pro forma adjustments.

ASC 805 requires, among other things, that most assets acquired and liabilities assumed be recognized at their fair values, determined in accordance with ASC 820, Fair Value Measurements, as of the acquisition date. In addition, ASC 805 establishes that the consideration transferred be measured at the closing date of the asset acquisition at the then-current market price, which may be different than the amount of consideration assumed in these unaudited pro forma condensed combined consolidated financial statements.

ASC 820, as amended, defines the term “fair value” and sets forth the valuation requirements for any asset or liabilities measured at fair value. Fair value is defined as “the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. This is an exit price concept for the valuation of the asset or liability. In addition, market participants are assumed to be buyers and sellers in the principal (or the most advantageous) market for the asset or liability. Fair value measurements for an asset assume the highest and best use by these market participants. As a result of these standards, we may be required to record assets which are not intended to be used or sold and/or to value assets at fair value measures that do not reflect our intended use of those assets. Many of these fair value measurements can be highly subjective and it is also possible that other professionals, applying reasonable judgment to the same facts and circumstances, could develop and support a range of alternative estimated amounts.

Because MGI is considered the accounting acquirer, under the acquisition method of accounting, ASGC assets acquired and liabilities assumed will be recorded as of the completion of the exchange at their respective fair values and added to those of MGI. This accounting treatment is sometimes referred as that of a reverse merger or reverse capitalization. Our financial statements and reported results of operations issued after completion of the exchange will reflect these values, but will not be retroactively restated to reflect the historical financial position or results of operations of ASGC. Prior to the exchange, the fiscal year-end of ASGC was July 31 and of MGI was December 31. Inasmuch as MGI is considered the acquirer for accounting purposes, the accompanying pro forma financial information has been prepared on the basis of MGI’s December 31 fiscal year-end. Pro forma results of operations are presented on the basis to give effect to the merger as if it had been completed on December 1, 2011, the beginning of MGI’s fiscal year ended December 31, 2012.

Upon consummation of the exchange, accounting policies of ASGC will be reviewed, and as a result of that review, it may become necessary to conform the combined company’s accounting policies to be consistent to those accounting policies that are determined to be more appropriate for the combined company. The unaudited pro forma condensed combined consolidated financial statements do not assume any differences in accounting policies.

|

4.

|

Preliminary Purchase Price Determination

|

The value of shares to be issued to MGI shareholders in the exchange, if all 63,914,540 shares are exchanged, approximates $9.6 million, based on the closing share price of ASGC at March 31, 2013. Based on the closing share price on May 28, 2013, the value of shares to be issued would approximate $8.9 million.

|

5.

|

Preliminary Allocation of Consideration Transferred

|

The carrying value of ASGC’s assets and liabilities are considered by Company management to approximate fair values. Because this business combination is accounted for in a manner similar to that of a reverse capitalization, no intangible assets or goodwill are recognized.

Pro forma adjustments reflect those matters that are a direct result of the exchange, which are factually supportable and, for pro forma adjustments to the pro forma condensed combined consolidated statements of operations, are expected to have continuing impact. The pro forma adjustments are based on preliminary estimates which may change as additional information is obtained.

Adjustments included in the column under the heading “Pro Forma Adjustments” represent the following:

(A) To eliminate MGI stockholders’ equity.

(B) To eliminate ASGC’s accumulated deficit.

(C) To record shares issued.

In addition to the other information contained in or incorporated by reference into this prospectus, you should carefully consider the following risk factors in deciding whether to participate in the proposals described in this prospectus.

RISK FACTORS

RELATING

TO OUR BUSINESS COMBINATION

If the exchange offer’s expected resulting business combination does not qualify as a reorganization under Section 368(a) of the Code, the shareholders of Medinah may be required to pay substantial U.S. federal income taxes.

Although each of ASGC and Medinah believes that the business combination qualifies as a tax-free reorganization under the Code, it is possible that the IRS may assert that the business combination fails to qualify as such. If the IRS were successful in any such contention, or if for any other reason the business combination were to fail to qualify as a tax-free reorganization, then (i) each Medinah shareholder that elected to exchange their shares under this exchange offer would recognize gain or loss with respect to all such shareholder’s shares of Medinah common stock based on the difference between (A) the fair market value of ASGC Common Stock received in the exchange and (B) such shareholder’s tax basis in the Medinah common stock surrendered in the exchange; and (ii) Medinah would recognize gain or loss with respect to all of its assets based on the difference between (A) the sum of the fair market value of the ASGC common stock transferred pursuant to the exchange and the liabilities deemed assumed by ASGC for U.S. federal income tax purposes and (B) Medinah’s aggregate tax basis in all of its assets.

Medinah shareholders cannot be sure of the market value of the shares of ASGC common stock to be issued upon completion of the business combination.

Medinah shareholders that elect to exchange their shares pursuant to this offer will receive a fixed number of shares of ASGC common stock

rather than a number of shares with a particular fixed market value. The market values of ASGC common stock and the Medinah common stock at the time this prospectus may vary significantly from their prices on the date the shares are actually exchanged. Because the Exchange Ratio will not be adjusted to reflect any changes in the market prices of ASGC common stock, the market value of the ASGC common stock issued pursuant to the exchange and the Medinah common stock surrendered in the exchange may be higher or lower than the values of these shares on earlier dates.

Following the expected consummation of the business combination resulting from the exchange offer, the market price of ASGC’s securities may be influenced by many factors, some of which are beyond its control, including those described above and the following:

|

·

|

changes in financial estimates by analysts;

|

|

·

|

announcements by it or its competitors of significant contracts, productions, acquisitions or capital commitments;

|

|

·

|

fluctuations in its quarterly financial results or the quarterly financial results of companies perceived to be similar to it;

|

|

·

|

general economic conditions;

|

|

·

|

changes in market valuations of similar companies;

|

|

·

|

changes in its capital structure, such as future issuances of securities or the incurrence of additional debt;

|

|

·

|

future sales of ASGC common stock;

|

|

·

|

regulatory developments in the United States, foreign countries or both;

|

|

·

|

litigation involving ASGC, its subsidiaries or its general industry; and

|

|

·

|

additions or departures of key personnel.

|

You are urged to obtain up-to-date prices for ASGC common stock. There is no assurance that a majority of the exchange offer will be completed, that there will not be a delay in the completion of the business combination or that all or any of the anticipated benefits of the business combination will be obtained.

Failure to successfully combine and integrate the businesses of ASGC and Medinah in the expected time frame may adversely affect ASGC’s future results.

The success of the expected resulting business combination of the exchange offer will depend, in part, on ASGC’s ability to realize the anticipated benefits from the combined businesses of ASGC and Medinah, as further described in the section titled “ “The Business Combination — Recommendation of the Medinah Board; Medinah’s Reasons for the Business Combination” beginning on page 56 . To realize these anticipated benefits, the businesses of ASGC and Medinah must be successfully integrated and combined. ASGC and Medinah have been independent companies, and they will continue to be operated as such until the completion of the business combination. The management of ASGC may face significant challenges in integrating the technologies, organizations, procedures, policies and operations, as well as addressing the different business cultures at the two companies, and retaining key personnel. If the combined Medinah is not successfully integrated, the anticipated benefits of the business combination may not be realized fully or at all or may take longer to realize than expected. The integration process and other disruptions resulting from the business combination may also disrupt Medinah’s ongoing businesses and/or adversely affect its relationships with employees, customary regulators and others with whom it has business or other dealings.

Failure to complete the exchange offer’s resulting business combination could negatively affect the stock prices, businesses and financial results of ASGC and Medinah, respectively.

If the expected resulting business combination is not completed, the ongoing businesses of ASGC and Medinah may be adversely affected and ASGC and Medinah will be subject to several risks and consequences, including the following:

|

·

|

ASGC and Medinah will be required to pay certain costs relating to the exchange offer, whether or not the business combination is completed, such as significant fees and expenses relating to financing arrangements and legal, accounting and printing fees; and

|

|

·

|

matters relating to the business combination may require substantial commitments of time and resources by ASGC and Medinah management, which could otherwise have been devoted to other opportunities that may have been beneficial to ASGC and Medinah as independent companies, as the case may be.

|

In addition, if the expected business combination is not completed, ASGC and/or Medinah may experience negative reactions from the financial markets and from Medinah’s customers and employees. If the business combination is not consummated, ASGC and Medinah cannot assure their respective shareholders that the risks described will not materially affect the business, financial results and stock prices of ASGC and/or Medinah.

ASGC

and Medinah

will incur significant transaction and business combination transition costs in connection with the exchange offer’s expected resulting business combination.

ASGC and Medinah expect that they will incur significant, non-recurring costs in connection with consummating the expected business combination and integrating the operations of ASGC and Medinah. ASGC and Medinah will also incur significant fees and expenses relating to financing arrangements and legal, accounting and other transaction fees and costs associated with the business combination.

The unaudited condensed combined consolidated pro forma financial information included elsewhere in this prospectus may not be indicative of what the combined companies actual financial position or results of operations would have been.

The unaudited pro forma condensed combined consolidated financial information in this prospectus is presented for illustrative purposes only, has been prepared based on a number of assumptions and is not necessarily indicative of what the combined companies actual financial position or results of operations would have been had the business combination been completed on the dates indicated. The unaudited pro forma condensed combined consolidated financial information does not reflect any cost savings, operating synergies or revenue enhancements that the combined companies may achieve as a result of the business combination or the costs to combine the operations of ASGC and Medinah or the costs necessary to achieve these cost savings, operating synergies and revenue enhancements. See “Selected Unaudited Pro Forma Consolidated Combined Financial Information” beginning on page 11 for more information.

Our Common Stock Is Quoted on the OTCQB, Which May Have an Unfavorable Impact on Our Stock Price and Liquidity.

Our common stock is quoted on the Over-the-Counter Bulletin Board (“OTCQB”). The OTCQB is a significantly more limited market than the New York Stock Exchange or NASDAQ system. The OTCQB market is an inter-dealer market much less regulated than the major exchanges and, therefore, our traded shares of common stock are subject to abuses, volatility and shorting. Thus, there is currently no broadly followed and established trading market for our common stock. An established trading market may never develop or be maintained. Active trading markets generally result in lower price volatility and more efficient execution of buy and sell orders. Absence of an active trading market reduces the liquidity of the shares traded there, which may make it difficult to sell your shares of our common stock within any particular time period, for an acceptable price, or at all. Our common stock is considered highly speculative and there is no certainty that our common stock will continue to be listed for trading on the OTCQB or on any other form of quotation system or stock exchange.

The Market Price of Our Common Stock is Highly Volatile, Which Could Hinder Our

Ability to Raise Additional Capital.

The market price of our common stock has been and is expected to continue to be highly volatile. Factors, including regulatory matters, concerns about our financial condition, operating results, litigation, government regulation, developments or disputes relating to agreements, title to our properties or proprietary rights, may have a significant impact on the market price of our stock. In addition, potential dilutive effects of future sales of shares of common stock by shareholders and by us, and subsequent sale of common stock by the holders of warrants and options could have an adverse effect on the price of our securities, which could hinder our ability to raise additional capital to fully implement our business, operating and development plans.

Penny Stock Regulations Affect Our Stock Price, Which May Make It More

Difficult For Investors to Sell Their Stock.

Broker-dealer practices in connection with transactions in “penny stocks” are regulated by certain penny stock rules adopted by the SEC. Penny stocks generally are equity securities with a price per share of less than $5.00 (other than securities registered on certain national securities exchanges or quoted on the NASDAQ Stock Market, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system). The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the risks in the penny stock market. The broker-dealer must also provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer’s account. In addition, the penny stock rules generally require that prior to a transaction in a penny stock the broker-dealer make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for a stock that becomes subject to the penny stock rules. Our securities are subject to the penny stock rules, and investors may find it more difficult to sell their securities.

The Existence of Indemnification Rights to Our Directors and Officers May Result in Substantial Expenditures by the Company and May Discourage Lawsuits Against Our Directors and Officers.

Our organizational documents contain provisions that limit the liability of our Directors for monetary damages and provide for indemnification of our executive officers and Directors. These provisions may discourage shareholders from bringing a lawsuit against our Directors and officers for breaches of fiduciary duty and may also reduce the likelihood of derivative litigation against our Directors and officers even though such action, if successful, might otherwise have benefited the shareholders. In addition, a shareholder’s investment in the company may be adversely affected to the extent that costs of settlement and damage awards against our officers or Directors are paid by the company pursuant to the indemnification provisions in the company’s governing documents. The impact on a shareholder’s investment in terms of the cost of defending a lawsuit may deter the shareholder from bringing suit against one of our officers or directors. We have been advised that the United States Securities and Exchange Commission (“SEC”) takes the position that these provisions do not affect the liability of any officer or director under applicable federal and state securities laws.

ASGC may sell equity securities in the future, which would cause dilution.

ASGC may sell equity securities in the future to obtain funds for general corporate or other purposes. ASGC may sell these securities at a discount to the market price. Any future sales of equity securities will dilute the holdings of existing holders of ASGC common stock, possibly reducing the value of their investment.

RISKS

ASSOCIATED WITH OUR INDUSTRY

Environmental Controls Could Curtail or Delay Exploration and, If Mineral Reserves are Found, Development of

Our Mines and Impose Significant Costs on Us.

We are required to comply with numerous environmental laws and regulations imposed and enforced by foreign, federal, provincial, state and local authorities. At the federal level, legislation such as the Clean Water Act, the Clean Air Act, the Resource Conservation and Recovery Act, the Comprehensive Environmental Response Compensation Liability Act and the National Environmental Policy Act impose effluent and waste standards, performance standards, air quality and emissions standards and other design or operational requirements for various components of mining and mineral processing, including gold and silver mining and processing. In addition, insurance companies are now requiring additional cash collateral from mining companies in order for the insurance companies to issue a surety bond. This addition of cash collateral for a bond could have a significant impact on our ability to bring properties into production.

Many states have also adopted regulations that establish design, operation, monitoring, and closing requirements for mining operations. Under these regulations, mining companies are required to provide a reclamation plan and financial assurance to ensure that the reclamation plan is implemented upon completion of mining operations. Additionally, Nevada and other states require mining operations to obtain and comply with environmental permits, including permits regarding air emissions and the protection of surface water and groundwater. Although we believe that the mining properties we currently have an interest in are in compliance with applicable federal and state environmental laws, changes in those laws and regulations may necessitate significant capital outlays or delays, may materially and adversely affect the economics of a given property, or may cause material changes or delays in our intended exploration, and if we find mineral reserves, development and production activities. Any of these results could force us to curtail or cease our business operations.

Development and Operation of Mining Projects Involve Numerous

Uncertainties.

Mine development projects typically require a number of years and significant expenditures during the development phase before production is possible.

Mining development projects are subject to the completion of successful feasibility studies, issuance of necessary governmental permits and receipt of adequate financing. The economic feasibility of development projects is based on many factors such as:

|

·

|

estimation of reserves;

|

|

·

|

anticipated metallurgical recoveries;

|

|

·

|

future gold and silver prices; and

|

|

·

|

anticipated capital and operating costs of such projects.

|

If mineral reserves are found, our mine development projects may have limited relevant operating history upon which to base estimates of future operating costs and capital requirements. Estimates of proven and probable reserves and operating costs determined in feasibility studies are based on geologic and engineering analyses.

Any of the following events, among others, could affect the profitability or economic feasibility of a project:

|

·

|

unanticipated changes in grade and tonnage of material to be mined and processed;

|

|

·

|

unanticipated adverse geotechnical conditions;

|

|

·

|

incorrect data on which engineering assumptions are made;

|

|

·

|

costs of constructing and operating a mine in a specific environment;

|

|

·

|

availability and cost of processing and refining facilities;

|

|

·

|

availability of economic sources of power;

|

|

·

|

adequacy of water supply;

|

|

·

|

adequate access to the site;

|

|

·

|

unanticipated transportation costs;

|

|

·

|

government regulations (including regulations relating to prices, royalties, duties, taxes, restrictions on production, quotas on exportation of minerals, as well as the costs of protection of the environment and agricultural lands);

|

|

·

|

fluctuations in metal prices; and

|

|

·

|

accidents, labor actions and force majeure events.

|

Any of the above referenced events may necessitate significant capital outlays or delays, may materially and adversely affect the economics of a given property, or may cause material changes or delays in our intended exploration, development and production activities. Any of these results could force us to curtail or cease our business operations.

Mineral Exploration is Highly Speculative, Involves Substantial Expenditures,

and is Frequently Non-Productive.

Mineral exploration involves a high degree of risk and exploration projects are frequently unsuccessful. Few prospects that are explored end up being ultimately developed into producing mines. To the extent that we continue to be involved in mineral exploration, the long-term success of our operations will be related to the cost and success of our exploration programs. We cannot assure you that our mineral exploration efforts will be successful. The risks associated with mineral exploration include:

|

·

|

the identification of potential economic mineralization based on superficial analysis;

|

|

·

|

the quality of our management and our geological and technical expertise; and

|

|

·

|

the capital available for exploration and development.

|

Substantial expenditures are required to determine if a project has economically mineable mineralization. It may take several years to establish proven and probable reserves and to develop and construct mining and processing facilities. Because of these uncertainties, our current and future exploration programs may not result in the discovery of reserves, the expansion of our existing reserves or the further development of our mines.

The Prices of Gold and Silver are Highly Volatile And a Decrease in the

Price of Gold or Silver Would Have A Material Adverse Effect on Our Business.

The profitability of mining operations is directly related to the market prices of metals. The market prices of metals fluctuate significantly and are affected by a number of factors beyond our control, including, but not limited to, the rate of inflation, the exchange rate of the dollar to other currencies, interest rates, and global economic and political conditions. Price fluctuations of metals from the time development of a mine is undertaken to the time production can commence can significantly affect the profitability of a mine. Accordingly, we may begin to develop one or more of our mining properties at a time when the price of metals makes such exploration economically feasible and, subsequently, incur losses because the price of metals decreases. Adverse fluctuations of the market prices of metals may force us to curtail or cease our business operations.

Insurance Costs Could Have an Adverse Effect on Our Profitability.

Our operations are subject to all of the operating hazards and risks normally incident to exploring for and developing mineral properties, such as unusual or unexpected geological formations, environmental pollution, personal injuries, flooding, cave-ins, changes in technology or mining techniques, periodic interruptions because of inclement weather and industrial accidents. Although maintenance of insurance to ameliorate some of these risks is part of our proposed exploration program associated with those mining properties we have an interest in, such insurance may not be available at economically feasible rates or in the future be adequate to cover the risks and potential liabilities associated with exploring, owning and operating our properties. Either of these events could cause us to curtail or cease our business operations.

Due to the Uncertain Nature of Exploration, There is a Substantial Risk That We May Not Find Economically Exploitable Reserves of Gold and/or Silver.

The search for valuable minerals is an extremely risky business. We do not know whether the claims and properties that we have optioned contain commercially exploitable reserves of gold and/or silver. The likelihood of success must be considered in light of the costs, difficulties, complications, problems and delays encountered in connection with the exploration of mineral properties. These potential problems include, but are not limited to, additional costs and unanticipated delays and expenses that may exceed current estimates.

Even if we do eventually discover a mineral reserve on one or more of our properties, there can be no assurance that we will be able to develop the property into a producing mine and extract those resources. Both mineral exploration and development involve a high degree of risk and few properties which are explored are ultimately developed into producing mines.

The commercial viability of an established mineral deposit will depend on a number of factors including, by way of example, the size, grade and other attributes of the mineral deposit, the proximity of the resource to infrastructure such as a smelter, roads and a point for shipping, government regulation and market prices. Most of these factors will be beyond our control, and any of them could increase costs and make extraction of any identified mineral resource unprofitable.

We Face Significant Competition in the Mineral Exploration Industry.

We compete with other mining and exploration companies possessing greater financial resources and technical facilities than we do in connection with the acquisition of exploration properties and leases on prospects and properties and in connection with the recruitment and retention of qualified personnel. Such competition may result in our being unable to acquire interests in economically viable gold and silver exploration properties or qualified personnel.

We are a precious metal mineral acquisition, exploration and development company, formed in Nevada on January 30, 2007. At the time of our incorporation, we were incorporated under the name “C.E. Entertainment, Inc.,” and our original business plan was to engage in the sales and marketing of Ukrainian classical music. On May 19, 2009, we changed our name to American Sierra Gold Corp. by way of a merger with our wholly-owned subsidiary, American Sierra Gold Corp., which was formed solely for the purpose of changing our name. In addition to the name change, we changed our intended business purpose to that of precious metal mineral exploration, development and production.

Further, effective May 19, 2009, we conducted a 40:1 forward stock split of our issued and outstanding common stock. As a result, our authorized capital stock increased from 50,000,000 shares of common stock, $0.001 par value per share, to 2,000,000,000 shares of common stock, $0.001 par value per share. Effective with the State of Nevada, on May 30, 2012, the State of Nevada declared effective the one (1) new for fifteen (15) old reverse stock split of our issued and outstanding shares of common stock on the Over-the-Counter Bulletin Board. The reverse stock split was approved on May 22, 2012, by way of a written consent resolution by the Board of Directors and it was declared effective with FINRA on June 15, 2012. As a result, our authorized capital decreased from 2,000,000,000 shares of common stock to 133,333,334 shares of common stock and the issued and outstanding decreased from 91,253,626 shares of common stock to 6,083,576 shares of common stock, all with a par value of $0.001. The record date for the reverse stock split was May 22, 2012. Unless specifically stated otherwise, all share amounts referenced herein, refer to post-reverse stock split share amounts.

Mining Properties and Projects

Our primary business focus is to evaluate, acquire, explore and develop gold properties in North America. In November 2010, we acquired and began work on one project that consists of six mineral claims in the Adams Ridge area of British Columbia, Canada (the “Adams Ridge Claims”). We are in the exploration stage with respect to the Adams Ridge Claims. Despite exploration work on the Adams Ridge Claims, we have not established that there are any mineral reserves, nor can there be any assurance that we will be able to do so.