For Immediate Release

Chicago, IL – March 20, 2012 – Zacks Equity Research highlights

Hilltop Holdings, Inc. ( HTH) as the Bull of the

Day and Guess? Inc.'s ( GES) as the Bear of the

Day. In addition, Zacks Equity Research provides analysis on

JPMorgan Chase & Co. ( JPM), Bank of

America Corporation ( BAC) and Citigroup

Inc. ( C).

Full analysis of all these stocks is available at

http://at.zacks.com/?id=2678.

Here is a synopsis of all five stocks:

Bull of the Day:

We are upgrading our recommendation on Hilltop Holdings,

Inc. ( HTH) to Outperform based on its fourth quarter

earnings that modestly surpassed the Zacks Consensus Estimate,

based on a higher-than-expected top line that benefited from

improved premiums, investment income and net realized gain coupled

with lower-than-expected expenses.

Hilltop's capital position remains sound along with a risk-free

balance sheet that lays scope for efficient capital deployment.

This is also evident from the new share buyback program, fostering

shareholders' confidence in the stock.

Overall, Hilltop should continue to tread ahead with its

strategic approach in order to capitalize on the opportunities that

the markets provide on stabilization. Our six-month price target is

$10.00 per share, reflecting about 0.8x our book value estimate of

$12.33 per share at September 30, 2012. This target price implies

an expected total return of 15.9% over that period.

Bear of the Day:

Guess? Inc.'s ( GES) fourth quarter and fiscal

2012 earnings missed year-ago earnings by 5.4% and 1.9%,

respectively. Severe austerity measures taken by the European

government to combat the debt crisis in the region resulted in

reduced spending by consumers there.

Though this was offset by the slight increase in per capita

income of the North American region, operating margin shrank, owing

to higher SG&A as well as promotional activities. Same-store

sales also declined in the quarter. In the wholesale segment,

reorders for the fall collections as well as spring/summer orders

also missed the mark.

Though the valuation on a price-to-book basis looks attractive

(trailing 12-month ROE of 25.9%, well above the industry average),

our six-month target price of $30.00 per share equates to about

10.0x our earnings estimate for 2012. We retain our Underperform

recommendation.

Latest Posts on the Zacks Analyst Blog:

Foreclosures Plunge, Will Rise

Soon

Last week, RealtyTrac, the leading online marketplace of

foreclosure properties, released its foreclosure market report for

February 2012. According to the report, foreclosure filings for the

month dipped 2% from the prior month and 8% from the prior-year

month, with a total of 206,900 properties receiving default,

auction or repossession notices.

This was the lowest annual decline in foreclosure activity since

October 2010. Actually, the drop in foreclosure activities in

larger states was chiefly responsible for the fall in its results,

though 21 states reported a rise in the foreclosure activities in

February 2012.

Though there was a drop in overall foreclosure activity for the

month under review, they are bound to increase in the upcoming

months due to the $25 billion settlement deal that took place

between mortgage servicers – JPMorgan Chase &

Co. ( JPM), Bank of America Corporation (

BAC), Citigroup Inc. ( C), among others – 49

states’ attorneys general and the regulators. The deal will speed

up the rate of the foreclosure activities, which was almost frozen

until now.

The major indicator, which confirmed that the foreclosures will

surge over the next several months, is the rise in the new default

notices issued. Issuance of default notice, the first step in the

foreclosure process, inched up 1% on a month-over-month basis, but

dipped 7% year over year to 58,886. Moreover, issuance of default

notices increased nearly 20% year-over-year in those states where

court orders are required before the foreclosure procedure

begins.

Conversely, in February 2012, foreclosure auctions fell 2% from

January 2012 and 13% from February 2011 to 84,180 properties.

Likewise, the final stage -- i.e. bank repossessions -- slipped 4%

from the previous month and 1% from the year-ago month to 63,834

properties. The top 10 states with the highest foreclosure

activities were Nevada, California, Arizona, Georgia, Florida,

Illinois, Michigan, South Carolina, Ohio and Wisconsin.

Further, for the month under review, foreclosure activity in 26

states with a judicial foreclosure process declined 2% from January

2012 but rose 24% from February 2011. However, in 24 states where a

non-judicial foreclosure process is followed, there was 5% fall

from the prior month and 23% decline on year-over-year basis.

Still a Long Way to Go

With nearly all the problems related to flawed paper work

getting resolved, the downtrend in foreclosures will get reversed

very soon. Moreover, the settlement deal clearly describes the

procedures to be followed while foreclosing a property. This will

allow the mortgage servicers to step up the foreclosure activities.

Moreover, RealtyTrac expects foreclosures to rise 25% this year to

1 million homes, compared with 804,000 homes that were foreclosed

in 2011.

Also, there will be additional pressure on the home prices

across the nation as many properties are expected to come to the

market due to increased foreclosure activities. We hope that there

would be enough number of buyers for these properties; otherwise

the housing market will have little chance of regaining a solid

foothold. As for now, we should gear up to see an exceptional rise

in foreclosure activities.

Get the full analysis of all these stocks by going to

http://at.zacks.com/?id=2649.

About the Bull and Bear of the Day

Every day, the analysts at Zacks Equity Research select two

stocks that are likely to outperform (Bull) or underperform (Bear)

the markets over the next 3-6 months.

About the Analyst Blog

Updated throughout every trading day, the Analyst Blog provides

analysis from Zacks Equity Research about the latest news and

events impacting stocks and the financial markets.

About Zacks Equity Research

Zacks Equity Research provides the best of quantitative and

qualitative analysis to help investors know what stocks to buy and

which to sell for the long-term.

Continuous analyst coverage is provided for a universe of 1,150

publicly traded stocks. Our analysts are organized by industry

which gives them keen insights to developments that affect company

profits and stock performance. Recommendations and target prices

are six-month time horizons.

Zacks "Profit from the Pros" e-mail newsletter provides

highlights of the latest analysis from Zacks Equity Research.

Subscribe to this free newsletter today by visiting

http://at.zacks.com/?id=7158.

About Zacks

Zacks.com is a property of Zacks Investment Research, Inc.,

which was formed in 1978 by Leonard Zacks. As a PhD from MIT Len

knew he could find patterns in stock market data that would lead to

superior investment results. Amongst his many accomplishments was

the formation of his proprietary stock picking system; the Zacks

Rank, which continues to outperform the market by nearly a 3 to 1

margin. The best way to unlock the profitable stock recommendations

and market insights of Zacks Investment

Research is through our free daily email newsletter; Profit from

the Pros. In short, it's your steady flow of Profitable ideas

GUARANTEED to be worth your time! Register for your free

subscription to Profit from the Pros at

http://at.zacks.com/?id=4582.

Visit http://www.zacks.com/performance for information about the

performance numbers displayed in this press release.

Follow us on Twitter: http://twitter.com/zacksresearch

Join us on Facebook:

http://www.facebook.com/home.php#/pages/Zacks-Investment-Research/57553657748?ref=ts

Disclaimer: Past performance does not guarantee future results.

Investors should always research companies and securities before

making any investments. Nothing herein should be construed as an

offer or solicitation to buy or sell any security.

Media Contact

Zacks Investment Research

800-767-3771 ext. 9339

support@zacks.com

http://www.zacks.com

BANK OF AMER CP (BAC): Free Stock Analysis Report

CITIGROUP INC (C): Free Stock Analysis Report

GUESS INC (GES): Free Stock Analysis Report

HILLTOP HLDGS (HTH): Free Stock Analysis Report

JPMORGAN CHASE (JPM): Free Stock Analysis Report

To read this article on Zacks.com click here.

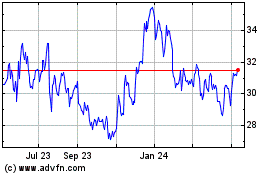

Hilltop (NYSE:HTH)

Historical Stock Chart

From Apr 2024 to May 2024

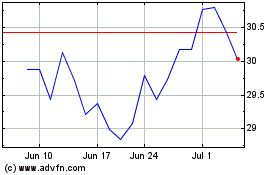

Hilltop (NYSE:HTH)

Historical Stock Chart

From May 2023 to May 2024