- Current report filing (8-K)

May 25 2010 - 3:37PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported)

|

May 19,

2010

|

|

ROCKY BRANDS, INC.

|

|

(Exact name

of registrant as specifıed in its

charter)

|

|

Ohio

|

|

0-21026

|

|

31-1364046

|

|

(State

or other jurisdiction

|

|

(Commission

|

|

(IRS

Employer

|

|

of

incorporation)

|

|

File

Number)

|

|

Identifıcation

No.)

|

|

39 East Canal Street, Nelsonville,

Ohio

|

|

45764

|

|

(Address

of principal executive offıces)

|

|

(Zip

Code)

|

|

Registrant's telephone number, including area code

|

(740)

753-1951

|

|

Not Applicable

|

|

(Former

name or former address, if changed since last

report.)

|

Check the

appropriate box below if the Form 8-K fıling is intended to simultaneously

satisfy the fıling obligation of the registrant

under any of the following

provisions (see General Instruction A.2. below):

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

(17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

(17 CFR 240.13e-4(c))

|

Item

1.01.

|

Entry

Into a Material Definitive

Agreement.

|

On May 19, 2010, Rocky Brands, Inc.

(the “Company”) and certain of its subsidiaries (together with the Company, the

“Borrowers”) entered into Amendment No. 3 to the Amended and Restated Loan and

Security Agreement (the “Amendment”) with GMAC Commercial Finance LLC, as

administrative agent and sole lead arranger for the Lenders (“GMAC CF”), Bank of

America, N.A., as syndication agent, and Charter One Bank, N.A., as

documentation agent. A copy of the Amended and Restated Loan and

Security Agreement between the Borrowers and GMAC CF (the “Loan Agreement”) was

filed as Exhibit 10.2 to the Company’s Current Report on Form 8-K, dated May 25,

2007, filed with the Securities and Exchange Commission on May 30, 2007, and is

incorporated herein by reference. A copy of Amendment No. 2 to the

Loan and Security Agreement was filed as Exhibit 10.1 to the Company’s Current

Report on Form 8-K, dated March 31, 2009, filed with the Commission on April 3,

2009, and is incorporated herein by reference. (All capitalized terms

not otherwise defined herein shall have the meanings given to them in the Loan

Agreement.)

The Amendment reflects Borrowers desire

to prepay all or a portion of the outstanding Second Priority Senior Secured

Notes within the period commencing on May 19, 2010 and continuing through

December 31, 2010 (the “Prepayment Period”). In addition to

provisions under the existing Amended and Restated Loan and Security Agreement,

as amended, that authorize the prepayment of all or any portion of the Second

Priority Senior Secured Notes, the Amendment provides that Borrowers may at any

time during the Prepayment Period utilize up to $15,225,000 in additional Loans

to prepay a portion of the Second Priority Senior Secured Notes, subject to

certain conditions. The Amendment further reduces Borrower’s Undrawn

Availability requirement from $5,000,000 to $4,000,000.

The foregoing description of the

Amendment and the transactions contemplated thereby does not purport to be

complete and is qualified in its entirety by reference to the complete text of

the Amendment. A copy of the Amendment is attached hereto as Exhibit

10.1 and is incorporated herein by reference.

|

Item

5.02.

|

Departure

of Directors or Certain Officers; Election of Directors; Appointment of

Certain Officers; Compensatory Arrangements of Certain

Officers.

|

On May 20, 2010, the board of directors

of the Company increased the number of authorized directors to nine and elected

David Sharp, the Company’s President and Chief Operating Officer, as a Class II

director.

|

Item

5.07.

|

Submission

of Matters to a Vote of Security

Holders.

|

On May 19, 2010, the Company held its

annual meeting of shareholders. The following directors were elected

at the meeting according to the vote tabulation described below:

|

Director

|

|

Votes For

|

|

Votes Withheld

|

|

Non Votes

|

|

|

J.

Patrick Campbell

|

|

1,072,336

|

|

1,656,730

|

|

2,279,340

|

|

|

Michael

L. Finn

|

|

1,072,152

|

|

1,656,914

|

|

2,279,340

|

|

|

G.

Courtney Haning

|

|

1,072,336

|

|

1,656,730

|

|

2,279,340

|

|

|

Curtis

A. Loveland

|

|

977,301

|

|

1,751,765

|

|

2,279,340

|

|

Also at the annual meeting of

shareholders, the shareholders ratified the selection of Schneider Downs &

Co., Inc. as the Company’s independent registered public accounting firm for the

fiscal year ending December 31, 2010 according to the vote tabulation described

below:

|

|

|

Votes For

|

|

Votes Against

|

|

Abstain

|

|

Non Votes

|

|

|

Ratification

of Selection of Accounting Firm

|

|

4,968,878

|

|

21,030

|

|

18,498

|

|

0

|

|

Item

9.01. Financial Statements and

Exhibits.

(d) Exhibits.

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

10.1

|

|

Amendment

No. 3 to Amended and Restated Loan and Security Agreement, dated as of May

19, 2010, by and among Rocky Brands, Inc., Lifestyle Footwear, Inc., Rocky

Brands Wholesale LLC, Lehigh Outfitters, LLC, and Rocky Brands

International, LLC, as Borrowers, GMAC Commercial Finance LLC, as

administrative agent and sole lead arranger for the Lenders, Bank of

America, N.A., as syndication agent, and Charter One Bank, N.A., as

documentation

agent

|

SIGNATURES

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to

be signed on its behalf by the undersigned hereunto duly

authorized.

|

|

Rocky

Brands, Inc.

|

|

|

|

|

|

Date: May

25, 2010

|

By:

|

/s/ James E. McDonald

|

|

|

|

James

E. McDonald, Executive Vice

|

|

|

|

President

and Chief Financial Officer

|

EXHIBIT

INDEX

|

Exhibit

No.

|

|

Description

|

|

|

|

|

|

10.1

|

|

Amendment

No. 3 to Amended and Restated Loan and Security Agreement, dated as of May

19, 2010, by and among Rocky Brands, Inc., Lifestyle Footwear, Inc., Rocky

Brands Wholesale LLC, Lehigh Outfitters, LLC, and Rocky Brands

International, LLC, as Borrowers, GMAC Commercial Finance LLC, as

administrative agent and sole lead arranger for the Lenders, Bank of

America, N.A., as syndication agent, and Charter One Bank, N.A., as

documentation agent

|

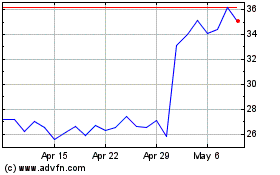

Rocky Brands (NASDAQ:RCKY)

Historical Stock Chart

From Aug 2024 to Sep 2024

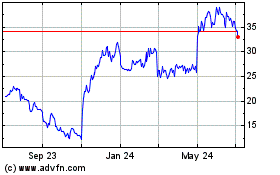

Rocky Brands (NASDAQ:RCKY)

Historical Stock Chart

From Sep 2023 to Sep 2024