TIDMUOG

RNS Number : 5131W

United Oil & Gas PLC

26 April 2021

26 April 2021

United Oil & Gas PLC ("United" or the "Company")

Final audited results for the year ended 31 December 2020,

Shareholder call and Notice of AGM

United Oil & Gas PLC (AIM: "UOG"), the growing oil and gas

company with a portfolio of production, development, exploration

and appraisal assets, is pleased to announce its audited results

for the year ended 31 December 2020.

A shareholder call hosted by management will take place at

12.00pm BST today. Should investors wish to participate in the

event, please click this link to register https://bit.ly/2S9mfow .

A confirmation email with details of the dialling in process will

be sent to your email address. A presentation and the 2020 Annual

Report will be made available today on www.uogplc.com

Brian Larkin, Chief Executive Officer commented:

"2020 was a landmark year for United Oil and Gas, building on

strong foundations to position ourselves as a full-cycle oil and

gas company with strong production, diverse assets, an exceptional

board and clearly defined avenues to deliver further material

growth. These were significant achievements despite one of the

toughest years for our sector and wider markets caused by the

COVID-19 pandemic."

"Building on this success is key for all at United Oil and Gas

and we look forward to driving further activity and material growth

in 2021 and beyond."

2020 Highlights:

Strategic - Completion of transformational acquisition,

strengthening the Board and shareholder base

-- Rockhopper Egypt acquisition completed following Egyptian

Government approval including successful equity placing and

re-admission of the enlarged Group to AIM

-- Significant strengthening of the Board with the appointment

of Ms Iman Hill and Tom Hickey as non-executive directors

-- Establishment of Environmental, Social and Governance (ESG)

Board Committee in September 2020 to drive forward the Group's

commitment to operating responsibly

-- Welcomed new institutional investors as a result of the

successful placing of Rockhopper Exploration plc's 18.3%

shareholding

Operational - Sustained low-cost production and reserves growth

across portfolio

-- Strong operational performance of Egyptian assets

o Group working interest production averaged 2,195 boepd *

o Success at the ASH-2 and ES-5 Development Wells increased

working interest production from 1,709 boepd on 1(st) March 2020 to

2,389 boepd on 31(st) December 2020

o Independent reserves report by Gaffney, Cline & Associates

from the end of 2020 indicates a 24 % increase in Abu Sennan Gross

2P Reserves to 16.8 Mmboe, representing a 198 % reserves

replacement ratio.

o Completion of ASH and Al Jahraa gas pipelines increasing

environmental efficiency of the Abu Sennan licence and contributing

an additional 312 boepd to United

-- High impact Jamaican exploration assets secured and progressed during the period

o 100% equity stake and operatorship of the Walton Morant

Licence in Jamaica along with 18- month extension secured.

o Prospective resources report on Jamaica by Gaffney Cline &

Associates showing unrisked mean prospective resource potential of

over 2.4 billion barrels assigned across 11 prospects and

leads(1)

-- New licence awards in the UK North Sea with of Blocks 15/18e

and 15/19c containing the Maria, Brochel and Maol Discoveries in

the UK's 32(nd) offshore licensing round.

Financial -Revenues delivering positive operating cashflow and

profits

-- Group Revenues of $9.1m*(2)

-- Profit for the year of $0.85m

-- Average realised oil price of $37.76/bbl and average realised gas price of $2.63/mmbtu(*2)

-- Cash operating cost $5.77/boe(2)

-- Cash capital expenditure $2.5m

-- Cash generated from operation activities $4.8m

-- Cash balance at 31 December 2020 $2.2m

* From completion of the Rockhopper Egypt acquisition to period

end, 28(th) February 2020 to 31 (st) December 2020

(1) Summation made by UOG management based on the GaffneyCline

analysis

(2) 22% interest net of government take

Post Year-end:

-- Significant success at the ASH-3 Development Well which

encountered 27.5m of net pay and tested at 7,720 boepd on 64/64

choke and 4,140 boepd on 30/64 choke

-- Discovery at the ASD-1X Exploration well, which encountered a

total of at least 22m net pay interpreted across a number of

reservoirs

2021 Guidance:

-- Group working interest production year to date ahead of

expectations; full year guidance raised to 2,500 to 2,700

boepd.

-- Success of the ASH-3 and ASD-1X wells in early 2021 is likely to lead to a reserves uplift

-- Group Capital Expenditure is forecast to be $6.0m, fully funded from existing assets

o c. $5.4m to be invested in Egypt with three firm wells

following the addition of the AJ-8 well to the programme offset by

savings on ASH-3 and AD1-X, five workovers, and facilities

upgrades

o c. $0.6m to be invested in our Jamaican, Italian and UK

assets

Outlook:

-- Cash generation is expected to continue strongly throughout

2021 in line with increased production and pricing, particularly in

the second half of the year as the capital expenditure associated

with the drilling campaign is phased almost entirely in the first

half

-- The formal farm-out campaign for the Walton Morant licence in

Jamaica commenced earlier this month and, following on from the

Prospective resources report on Jamaica by Gaffney Cline &

Associates, management look forward to discussing this opportunity

with prospective partners.

-- The Crown disposal milestone payment of $2.85m from Hibiscus,

payable on approval of the Marigold development plan by the by the

UK's Oil and Gas Authority, is currently expected to be received in

the second quarter of 2021.

-- Our portfolio provides a platform for organic growth but also

a base from which we can consider further growth opportunities in

2021 and beyond.

Annual General Meeting

In light of the Coronavirus (COVID-19) pandemic and the UK

Government's measures to restrict travel and public gatherings of

more than two people who do not live together, it will not be

possible to hold the AGM in its usual format. The meeting will be

held at 128 Lower Baggot Street, Dublin 02 A430, Ireland at 12:00

a.m. on 28 May 2021. This year's AGM will be organised as a closed

meeting. Shareholders must not attend the AGM in person and anyone

seeking to attend in person will be refused entry. The AGM Notice

and Form or Proxy will be posted to Shareholders and will be

available from today on www.uogplc.com . The Company will make

arrangements for a quorum to be present to transact the formal

business of the meeting as set out in the notice of the AGM.

Extracts from the Annual Report are set out below. The financial

information set out below does not constitute the Company's

statutory accounts for the periods ended 31 December 2020 or 31

December 2019 but it is derived from those accounts. Statutory

accounts for 31 December 2019 have been delivered to the Registrar

of Companies and those for 31 December 2020 will be delivered

following the Company's Annual General Meeting. The auditors have

reported on those accounts, their reports were unqualified and did

not contain statements under section 498(2) or (3) of the Companies

Act 2006.

The Company encourages shareholders to vote on the resolutions

or to appoint the Chairman of the AGM as a proxy to vote on their

behalf. Shareholders can vote on the resolutions using an online

portal, following the procedure below.

-- Visiting www.shareregistrars.uk.com and following the online

instructions. Through the website shareholders will be able to

access the Registrars' Portal, on which they will be able to

register to be able to vote. For security reasons, registration is

a two-stage authentication process. Once registered, shareholders

will be able to vote online via the platform.

-- Shareholders can submit their completed Form of Proxy electronically by emailing the same to voting@shareregistrars.uk.com

-- Completing and returning the Form of Proxy to the Company's

Registrars, Share Registrars Limited, The Courtyard, 17 West

Street, Farnham, Surrey GU9 7DR no later than 48 hours before the

Annual General Meeting

In the event that further disruption to the AGM becomes

unavoidable or there are any changes to the current AGM

arrangements, the Company will announce any changes to the meeting

(such as timing or venue) as soon as reasonably practicably through

a Regulatory Information Service and the Company's website.

Pursuant to Rule 20 of the AIM Rules for Companies, copies of

both the Annual Report and the Notice will shortly be available for

inspection at www.uogplc.com .

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014 as it forms part of UK

Domestic Law by virtue of the European Union (Withdrawal) Act 2018

("UK MAR").

CHAIRMAN'S STATEMENT

FOR THE YEARED 31 DECEMBER 2020

Dear Shareholders,

Introduction

I am very pleased to report that

2020 was one of the most important

and transformational years for the

Group. United is now a full cycle

oil and gas company with a portfolio

of production, development, exploration

and appraisal assets that underpin

our growth ambitions.

Our performance during an extremely

challenging year has been exemplary

and gives the Board and I great confidence

about the capability of our team,

our assets and our planned strategy

for future growth.

Key activities in 2020

The year began with completion of

the Rockhopper Egypt acquisition,

including a successful equity placing,

and the re-admission of the enlarged

group to AIM. The drilling success

that was achieved at ASH-2 at the

end of 2019, was followed by further

success at ES-5, increasing our production

and reserves, validating our original

assessment of the significant upside

potential of the assets. Our technical

team continue to play a very important

role in working closely with the

operator in maximising the returns

from these assets and their potential.

As part of the transaction, the seller

Rockhopper Exploration plc acquired

an 18.3% interest in the Group which

was then very successfully placed

later in the year with new institutional

investors.

In August, as a result of determined

efforts on the part of our executives,

the Group was awarded operatorship

and 100% ownership of the high impact

Walton Morant exploration licence

in Jamaica and secured an extension

to the exploration phase, allowing

more time to evaluate the prospectivity

of the licence and to seek potential

joint venture partners.

The Group was also awarded further

blocks containing discoveries in

the UK's latest offshore licensing

round.

Business development opportunities

across the full cycle continued to

be offered to and assessed by the

team in the course of 2020, and a

number of such opportunities are

still under consideration. However,

only the most attractive ones consistent

with our strategy will be taken forward.

Strengthening of our Board and governance

As the Company has grown, we have

recognised the need for an increased

range of skills, experience and diversity

among the non-executive directors

to support and challenge management

in the execution of United's strategy.

We believe we have more than achieved

this as a result of the appointments

during the period of Iman Hill and

Tom Hickey, both bring considerable

additional technical, operational,

financial and commercial experience

to the Board.

Further, to drive forward our commitment

to operating sustainably, the Board

established an Environmental, Social

and Governance Committee, chaired

by Iman, and also appointed Tom to

chair the Audit Committee whilst

I remain chair of the Remuneration

Committee and the AIM Rules Compliance

Committee.

In addition to these changes, we

approved a Remuneration Policy for

executive remuneration (which is

summarised later in this Report)

and made other changes to Board committee

composition to improve Board governance

and oversight.

Finally, Alberto Cattaruzza, who

had been a director of United since

our re-listing in 2017 and Stewart

MacDonald, who joined the board following

completion of the Rockhopper Egypt

acquisition, stepped down from their

roles in the Company. I would like

to thank them both again for their

valuable service as directors.

Strategy

Our strategy remains clear; continue

to grow our full cycle portfolio

of low-risk production, development

and exploration assets (as we have

in Egypt, Italy and the UK) complemented

by a few higher risk, low-cost and

high impact exploration opportunities.

In addition, we see opportunity to

deliver value to shareholders through

timely portfolio management as well

as through our technical expertise

and our drilling operations.

Financial Results for 2020

2020 was the first year in which

we received revenues, leading I am

very pleased to report to a profit

after tax of $0.85m. With our production

and revenues continuing strongly,

and with cash operating costs in

2020 of $5.77 per boe, we entered

2021 with an asset base resilient

to low oil prices and with a strong

balance sheet.

Post Year End

There has been further drilling success

since the year end with the ASH-3

wellbeing successfully drilled, tested

and brought into production and the

announcement of an exploration discovery

on the ASD-1X exploration well. The

ASH Field continues to outperform

our estimates, further demonstrating

the significant growth potential

of our Egyptian assets.

Impact to the Company of COVID-19

The human and economic impact of

the COVID-19 pandemic continues to

be very significant. The priority

of the Group remains the health and

wellbeing of our employees and wider

stakeholders and we are glad to report

that all of our employees are safe

and well.

In common with every company in the

oil and gas industry, and indeed

in all other areas of business, the

Company's activities have been affected

by COVID-19 uncertainty. However,

there has been no impact on our operations

in Egypt and the production and transport

of oil and gas has continued uninterrupted.

Dialogue with shareholders

Shareholders views on the Company,

its strategy, remuneration policy

and indeed all aspects of our business

and operations are very important

to the Board and we welcome every

opportunity to engage. However, appreciating

that physical meetings are not possible

at the moment we would be very happy

to hear from you in whatever manner

suits you best. I can be reached

via the Company Secretary at info@uogplc.com

Conclusion

2020 was another very successful

year for the company in the development

and pursuit of our strategy and I

would like to record my thanks to

our executives and staff for their

continued commitment and energy throughout

the year, which was an especially

challenging period, given the COVID

-19 pandemic and commodity price

fluctuations.

We look forward very positively to

the year ahead. We have a balanced

full cycle portfolio, the cash flow

to fund our business and exciting

new opportunities under review.

Graham Martin

Chairman

CONSOLIDATED INCOME STATEMENT

FOR THE YEARED 31 DECEMBER 2020

Notes Year to 31 December Year to 31 December 2019

2020

$ $

Revenue 1 9,053,657 -

Cost of sales 2 (6,505,011) -

Gross profit / (loss) 2,548,646 -

Administrative expenses:

------------------------- ------ ------------------------ -------------------------

Other administrative

expenses (1,707,168) (1,516,035)

Exploration expenses

written off (37,161) (2,111,319)

Gain on disposal of

intangible assets 4 - 2,881,976

Acquisition and AIM

expenses - (1,202,586)

------------------------- ------ ------------------------ -------------------------

Total administrative

expenses (1,744,329) (1,947,964)

Operating profit /

(loss) 3 804,317 (1,947,964)

Finance income 6 1,572,706 -

Finance expense 6 (1,580,842) (4,841)

Profit / (loss) before

taxation 796,181 (1,952,805)

Taxation 7 56,480 (186,270)

Profit / (loss) for the

financial year

attributable to the

Company's equity

shareholders 852,661 (2,139,075)

Earnings / (loss) per

share from continuing

operations

expressed in pence per

share: 8

Basic 0.15 (0.62)

======================== =========================

Diluted 0.14 (0.62)

======================== =========================

Consolidated Statement of Comprehensive

Income 2020 2019

$ $

Profit / (loss) for the financial year 852,661 (2,139,075)

Foreign exchange (losses)/ gains (337,713) 405,954

Total comprehensive income / (loss) for the

financial year attributable to the Company's

equity shareholders 514,948 (1,733,121)

Consolidated Balance Sheet as at

31 December 2020 Notes 2020 2019

Assets $ $

Non-current assets

Intangible assets 10 7,891,743 5,580,864

Property, plant and equipment 11 13,607,167 26,722

21,498,910 5,607,586

Current assets

Inventory 13 35,729 -

Trade and other receivables 14 5,454,307 3,524,655

Cash and cash equivalents 15 2,188,902 1,275,537

7,678,938 4,800,192

Current liabilities:

Trade and other payables 18 (2,996,115) (1,085,701)

Derivative financial instruments 21 (992,681) -

Borrowings 21 (2,133,655) -

Lease liabilities 20 (94,050) (26,030)

Current tax payable (135,388) (190,446)

------------ ------------

(6,351,889) (1,302,177)

Non-current liabilities:

Borrowings 21 (2,422,146) -

Derivative financial instruments 21 (647,376) -

Lease liabilities 20 (96,787) -

------------ ------------

(3,166,309) -

Net assets 19,659,650 9,105,601

============ ============

Equity and liabilities

Capital and reserves

Share capital 16 8,138,619 4,564,787

Share premium 16 16,047,975 9,912,988

Share-based payment reserve 17 1,922,090 1,591,808

Merger reserve (2,697,357) (2,697,357)

Translation reserve (348,940) (11,227)

Retained earnings (3,402,737) (4,255,398)

Shareholders' funds 19,659,650 9,105,601

============ ============

The financial statements were approved

by the Board of Directors and authorised

for their issue on 23 April 2021

and were signed on its behalf by:

Brian Larkin

Chief Executive Officer

Consolidated Statement of Changes

in Equity

Share-based

Share Share payments Retained Translation Merger

capital premium reserve earnings reserve reserve Total

$ $ $ $ $ $ $

For the year

ended 31

December 2020

Balance at 1

January 2020 4,564,787 9,912,988 1,591,808 (4,255,398) (11,227) (2,697,357) 9,105,601

Loss for the

year - - - 852,661 - - 852,661

Foreign

exchange

difference - - - - (337,713) - (337,713)

Total

comprehensive

income - - - 852,661 (337,713) - 514,948

Shares issued 3,573,832 6,640,081 - - - - 10,213,913

Share issue

expenses - (505,094) 62,516 - - - (442,578)

Share-based

payments - - 267,766 - - - 267,766

Balance at 31

December 2020 8,138,619 16,047,975 1,922,090 (3,402,737) (348,940) (2,697,357) 19,659,650

---------- ----------- ------------ ------------ ------------ ------------ ------------

For the year

ended 31

December 2019

Balance at 1

January 2019 4,564,787 9,912,988 1,465,036 (2,116,323) (417,181) (2,697,357) 10,711,950

Loss for the

year - - - (2,139,075) - - (2,139,075)

Foreign

exchange

difference - - - - 405,954 - 405,954

Total

comprehensive

income - - - (2,139,075) 405,954 - (1,733,121)

Share-based

payments - - 126,772 - - - 126,772

Balance at 31

December 2019 4,564,787 9,912,988 1,591,808 (4,255,398) (11,227) (2,697,357) 9,105,601

---------- ----------- ------------ ------------ ------------ ------------ ------------

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE YEARED 31 DECEMBER

2020 2019

$ $

Cash flow from operating activities

Loss for the financial year before tax 796,181 (1,952,805)

Share-based payments 267,766 126,772

Depreciation 2,628,990 94,026

Amortisation 3,862 -

Fair value gain on derivatives (1,572,706) -

Impairment of intangible assets 37,161 2,111,319

Gain on disposal of intangible assets 31,307 (2,881,976)

Gain on disposal of property, plant and equipment 42,318 -

Interest expense 1,580,842 4,841

Foreign exchange movements (189,918) 268,159

------------- ------------

3,625,803 (2,229,664)

Changes in working capital

Decrease in inventory 64,433 -

Decrease / (increase) in trade and other receivables 2,530,065 (61,527)

(Decrease) / increase in trade and other payables (1,390,182) 677,689

------------- ------------

Cash inflow/(outflow) from operating activities 4,830,119 (1,613,502)

Cash outflow from investing activities

Cash outflows on business combination (11,200,000) -

Cash acquired in business combination 46,543 -

Disposal of intangible assets - 950,000

Purchase of property, plant & equipment (2,816,460) (1,637)

Spend on exploration activities (1,457,307) (3,097,401)

Net cash used in investing activities (15,427,224) (2,149,038)

Cash flow from financing activities

Issue of ordinary shares net of expenses 5,835,834 -

Proceeds on issue of oil swap financing arrangement 7,760,288 -

Repayments on oil swap financing arrangement (1,666,116) -

Payments on oil price derivatives (70,431) -

Capital payments on lease (73,183) (88,387)

Interest paid on lease (5,753) (4,841)

Net cash generated/ (used in) from financing

activities 11,780,639 (93,228)

Net increase/(decrease) in cash and cash equivalents 1,183,534 (3,855,768)

Cash and cash equivalents at beginning of financial

year 1,275,537 5,149,907

Effects of exchange rate changes (270,169) (18,602)

Cash and cash equivalents at end of financial year 2,188,902 1,275,537

Notes to the Consolidated Financial

Statements

1. Segmental reporting

Operating segments

Operating segments are reported in

a manner consistent with the internal

reporting provided to the chief operating

decision maker. The chief operating

decision maker, who is responsible

for allocating resources, assessing

the performance of the operating

segment and making strategic decision,

has been identified as the Board

of Directors.

The Group operates in four geographic

areas - the UK, Europe and greater

Mediterranean, Latin America and

Egypt. The Group's revenue from external

customers and information about its

non-current assets (other than financial

instruments, investments accounted

for using the equity method, deferred

tax assets and post-employment benefit

assets) by geographical location

are detailed below.

2020

Latin

$ UK Other EU America Egypt Total

Revenue - - - 9,053,657 9,053,657

-------- ---------- ---------- ----------- -----------

Non-current assets 779,323 2,833,287 3,602,178 14,284,122 21,498,910

-------- ---------- ---------- ----------- -----------

2019

Latin

$ UK Other EU America Total

Revenue - - - -

-------- ---------- ---------- ----------

Non-current assets 511,009 2,336,837 2,759,740 5,607,586

-------- ---------- ---------- ----------

2. Cost of sales

2020 2019

$ $

Production costs 3,941,743 -

Depreciation, depletion & amortisation 2,563,268 -

========== =====

6,505,011 -

========== =====

3. Operating Profit/(loss)

2020 2019

$ $

Operating loss is stated after charging/(crediting):

Fees payable to the Company's auditors for the audit of the

annual financial statements 60,000 40,000

Fees payable to the Company's auditors and its associates for

other services to the Group:

* Reporting accountant services - 90,000

4. Disposal of Crown asset in prior

period

On 12 December 2019, United announced

the completion of the sale of its

95% share in the North Sea Blocks

12/18d and 15/19b (licence P2366)

to Anasuria Hibiscus UK limited.

The disposal was of the aforementioned

licence only, and the UOG Crown Limited

subsidiary company is retained in

the group.

Under the deal for this disposal

of the Crown licence, United received

$950,000 in 2019 on completion, with

a further receivable of $2,850,000

which is contingent upon approval

of an FDP, the latter amount being

reflected in current receivables

in the balance sheet. In the event

of non-payment of the latter amount,

the Group would retain ownership

of the licence asset.

Having acquired the licence in 2018

and incurred costs on a work programme,

some in-house technical work, and

the costs of disposal the Group reported

a profit on disposal before tax in

its 2019 Income Statement of $2,881,976.

5. Directors and employees

The aggregate payroll costs of the

employees, including Executive Directors

and Non-Executive directors, were

as follows:

2020 2019

$ $

Staff costs

Wages and salaries 1,700,487 675,928

Share-based payments 267,766 126,772

Pension 135,059 -

Social security 60,640 31,958

========== ========

2,163,952 834,658

========== ========

Average monthly number of persons

employed by the Group during the

year was as follows:

2020 2019

Number Number

By activity:

Administrative 6 3

Directors 6 5

======= =======

12 8

======= =======

2020 2019

$ $

Remuneration of Directors

Emoluments and fees for qualifying services 1,149,729 450,450

Share-based payments 229,040 112,015

Pension 53,251 -

Social security 21,743 13,881

---------- --------

1,453,763 576,346

========== ========

Key management personnel are identified

as the Executive Directors.

No share warrants have been exercised

by any of the directors.

6. Finance income and expense

Finance income 2020 2019

$ $

Fair value gain on derivatives 1,572,706 -

---------

1,572,706 -

========= ====

Finance expense 2020 2019

$ $

Effective interest on borrowings 1,576,607 -

Interest expense on lease liabilities 4,235 4,841

---------

1,580,842 4,841

========= =====

7. Taxation

2020 2019

$ $

Profit/(Loss) before tax 796,181 (1,952,805)

--------- -----------

Loss on ordinary activities multiplied by standard

rate of corporation tax in the UK of 19% (2019:

19%) 151,274 (371,033)

Tax effects of:

Utilisation of tax losses (151,274) -

Adjustment to previous period (56,480) -

Unrelieved tax losses carried forward - 557,303

---------

Corporation tax (credit)/charge (56,480) 186,270

========= ===========

The Group has accumulated tax losses

of approximately $8m (2019: $4m).

No deferred tax asset was recognised

in respect of these accumulated tax

losses as there is insufficient evidence

that the amount will be recovered

in future years.

8. Earnings / (loss) per share

The Group has issued share warrants

and options over Ordinary shares

which could potentially dilute basic

earnings per share in the future.

Further details are given in note

17.

Basic earnings / (loss) per share

is calculated by dividing the profit

/ (loss) attributable to ordinary

shareholders by the weighted average

number of ordinary shares outstanding

during the year.

Due to the losses incurred during

the prior year, a diluted loss per

share has not been calculated as

this would serve to reduce the basic

loss per share. There were 130,510,730

(2019: 93,329,853) share warrants

and options outstanding at the end

of the year that could potentially

dilute basic earnings per share in

the future.

Basic and diluted earnings / (loss)

per share 2020 2019

Cents Cents

Basic earnings / (loss) per share from continuing

operations 0.15 (0.62)

----- ------

Diluted earnings / (loss) per share from continuing

operations 0.14 (0.62)

----- ------

The profit / (loss) and weighted

average number of ordinary shares

used in the calculation of basic

earnings / (loss) per share are as

follows: 2020 2019

$ $

Profit / (loss) used in the calculation of total

basic and diluted loss per share 852,661 (2,139,075)

------- -----------

Number of shares 2020 2019

Number Number

Weighted average number of ordinary shares for the

purposes of basic earnings / (loss) per share 578,248,726 345,613,985

Dilutive shares 23,207,377 -

----------- -----------

Weighted average number of ordinary shares for the

purposes of diluted earnings / (loss) per share 601,456,103 345,613,985

----------- -----------

9. Subsidiaries

Details of the Group's subsidiaries

in 2020 are as follows:

Name & Principal activity Class Place of % ownership

address of of shares incorporation held by the

subsidiary and operation Group

2020 2019

UOG

Holdings

plc

200

Strand,

London, Intermediate England and

WC2R 1DJ holding company Ordinary Wales 100 100

UOG Ireland

Limited*

9 Upper

Pembroke

Street,

Dublin Intermediate

2, Ireland holding company Ordinary Ireland 100 100

UOG PL090

Ltd*

200

Strand,

London, Oil and gas England and

WC2R 1DJ exploration Ordinary Wales 100 100

UOG Italia

Srl*

Viale

Gioacchino

Rossini 9,

00198,

Rome, Oil and gas

Italy exploration Ordinary Italy 100 100

UOG Jamaica

Ltd*

200

Strand,

London, Oil and gas England and

WC2R 1DJ exploration Ordinary Wales 100 100

UOG Crown

Ltd*

200

Strand,

London, Oil and gas England and

WC2R 1DJ exploration Ordinary Wales 100 100

UOG Colter

Ltd*

200

Strand,

London, Oil and gas England and

WC2R 1DJ exploration Ordinary Wales 100 100

UOG Egypt Oil and gas Ordinary Australia 100 -

Pty exploration

Sydney

2000, New

South

Wales,

Australia

*held indirectly by United Oil &

Gas Plc

10. Intangible assets Exploration and Computer software

Evaluation assets $ Total

$ $

Cost

At 1 January 2019 5,226,219 - 5,226,219

Additions 3,086,027 11,374 3,097,401

Disposals (792,033) - (792,033)

Foreign exchange

differences 207,925 - 207,925

------------------ ------------

At 31 December 2019 7,728,138 11,374 7,739,512

Acquired in

business

combinations 3,181,362 - 3,181,362

Additions 1,457,307 - 1,457,307

Transfer to

production assets (2,538,981) - (2,538,981)

Disposals (31,307) - (31,307)

Foreign exchange

differences 335,459 1,070 336,529

------------------ ------------

At 31 December 2020 10,131,978 12,444 10,144,422

------------------ ------------

Amortisation and

impairment

At 1 January 2019 - - -

Charge for the - - -

year

Impairment 2,111,319 - 2,111,319

Foreign exchange

differences 47,329 - 47,329

At 31 December 2019 2,158,648 - 2,158,648

Charge for the year - 3,862 3,862

Impairment 37,161 - 37,161

Foreign exchange

differences 52,722 286 53,008

------------------ ------------

At 31 December 2020 2,248,531 4,148 2,252,679

------------------ ------------

Net book value

At 31 December 2020 7,883,447 8,296 7,891,743

======================== ================== ============

At 31 December 2019 5,569,490 11,374 5,580,864

======================== ================== ============

At 31 December 2020 the Group's E&E

carrying values of $7.9m related

to our exploration prospects in Abu

Sennan in Egypt, gas development

Selva asset in Italy, our high impact

exploration activity in Jamaica,

and the UK North Sea and Wessex basin

exploration/development work programmes.

During the year we completed the

acquisition of Rockhopper Egypt Pty

which came with a portfolio of exploration

prospects and commitments, successfully

applied and were awarded the Maria

field in the OGA 32(nd) North Sea

licencing round, gained full 100%

operatorship of our Jamaican high

impact exploration licence after

Tullow Jamaica Limited relinquished

their 80% share, and have made the

decision to write down remaining

expenditure on the Colter wells after

they were relinquished in January

2021.

Our Italian development at the Selva

field continued to make progress

in 2020. Factoring in the impact

of Covid-19, we are now targeting

first production by mid- 2022. Formal

technical environmental approval

from the Italian Environmental Ministry

was granted in January 2020 and preliminary

work has commenced on the development

programme preparing for first gas.

Testing has previously indicated

rates of 150,000scm/day with UOG's

economic interest being 20%. At the

Balance Sheet date $2,659,922 had

been capitalised for our Italian

asset.

In August 2020, the Group was assigned

Tullow Jamaica Ltd.'s 80% equity

in the Walton Morant licence meaning

United now operate 100%. The initial

exploration period was extended until

31 January 2022 when an initial drill-or-drop

decision is required. The Group has

commenced a work programme to further

de-risk the high-graded Colibri prospect

and perform detailed interpretation

of the numerous follow-on targets.

This work will have an impact on

the continuing farm-down process.

As at 31 December 2020 the Group

are carrying $3,602,178 for Jamaica

in its Intangibles assets.

In the UK North Sea, Licence P2519,

containing two blocks including the

Palaeocene Maria discovery, was acquired

in the OGA's 32(nd) licensing round

which is only 10KM from our previously

awarded acreage in the 31(st) licencing

round. Together with the awards in

the 31(st) round United has an exciting

work programme in place and costs

to date on the balance sheet of $214,082

are capitalised. The work programme

continues on the Waddock Cross development

with current capitalised costs at

yearend of $565,241. In the Wessex

Basin United decided with its partners

to relinquish the PEDL licences,

effective 31 January 2021. As a result,

costs remaining capitalised of $37,161

were written down.

A key achievement in 2020 was the

completion of the acquisition of

Rockhopper Egypt Pty Limited which

came with valuable exploration licences.

Several exploration opportunities

and prospects exist within the Abu

Sennan licence and an exploration

commitment ASD 1X well was drilled

during early 2021 leading to a discovery.

As at the Balance Sheet date United

had $842,024 capitalised as E&E in

UOG Egypt Pty Limited.

Management reviews the intangible

exploration assets for indications

of impairment at each balance sheet

date based on IFRS 6 criteria. Commercial

reserves have not yet been established

and the evaluation and exploration

work is ongoing. The Directors believe

the only impairment indicators relate

to Colter (as described above) and

have impaired all associated costs

to date accordingly, with all remaining

assets described continuing to be

carried at cost.

11. Property, plant and equipment

Production Computer Fixtures Right of

assets equipment and use asset Total

$ $ fittings $ $

$

Cost

At 1 January

2019 - 6,952 - - 6,952

Transition to

IFRS 16 - - - 72,453 72,453

Additions - 1,637 - 41,860 43,497

Foreign

exchange

differences - - - 462 462

At 31 December

2019 - 8,589 114,775 123,364

Acquired in

business

combinations 10,630,944 - - 61,127 10,692,071

Transfer from

E&E assets 2,538,981 - - 2,538,981

Additions 2,806,734 6,755 2,971 204,763 3,021,223

Disposals - - - (186,700) (186,700)

Foreign

exchange

differences - (1,638) - 10,799 9,161

At 31 December

2020 15,976,659 13,706 2,971 204,764 16,198,100

Depreciation

At 1 January

2019 - 2,235 - - 2,235

Charge for the

year - 3,562 - 90,464 94,026

Foreign

exchange

differences - 15 - 366 381

At 31 December

2019 - 5,812 - 90,830 96,642

Charge for the

year 2,563,268 3,169 231 62,322 2,628,990

Disposals - - - (144,382) (144,382)

Foreign

exchange

differences - (1,665) 17 11,331 9,683

At 31 December

2020 2,563,268 7,316 248 20,101 2,590,933

Net book

value

At 31 December

2020 13,413,391 6,390 2,723 184,663 13,607,167

=========== =========== =========== =========== ===========

At 31 December

2019 - 2,777 - 23,945 26,722

=========== =========== =========== =========== ===========

Depreciation is recognised within

administrative expenses.

12. Business combinations

On 28 February 2020, the Company

announced that it had completed the

acquisition of 100% of the equity

share capital of UOG Egypt Pty Ltd

(formerly Rockhopper Egypt Pty Ltd).

from Rockhopper Exploration plc ("Rockhopper").

The acquisition was transformational

for the Group delivering a solid

production base and transitioning

the company to a full cycle E&P company.

The Acquisition, which had an effective

date of 1 January 2019, included

a 22% non-operating interest in the

producing Abu Sennan concession,

onshore Egypt. The consideration

payable to Rockhopper for the Acquisition

was US$16 million which was funded

by:

* the issue to Rockhopper of 114,503,817 Consideration

Shares at 3 pence per Ordinary Share representing

18.5% of the Company's Enlarged Ordinary Share

Capital,

* a pre-payment financing structure of US$8 million

provided by BP ('the BP Facility') and

* the issue of 150,616,669 Placing Shares at 3 pence

per share with certain existing and new investors and

8,419,498 Subscription Shares also at 3 pence per

share.

No goodwill has been recognised on

the acquisition because the fair

value of the identifiable net assets

was the same as the fair value of

the consideration transferred, as

shown in the table below. $

Fair value of consideration transferred

Cash 11,500,000

Liabilities assumed 3,259,090

Shares issued 3,933,276

18,692,366

Recognised amounts of identifiable

net assets

Intangible assets 3,181,362

Property, plant and equipment 10,692,071

-----------

Total non-current assets 13,873,433

Inventory 100,162

Trade and other receivables 4,759,717

Cash at bank and in hand 46,543

Total current assets 4,906,422

Trade and other payables (25,337)

Lease liabilities (62,152)

-----------

Total current liabilities (87,489)

Fair value of net assets acquired 18,692,366

The fair value of acquired receivables

was equal to the contractual amounts

receivable and all cash flows were

collected.

$

Net cash outflow on acquisition of subsidiary

Consideration paid in cash 11,500,000

Less: cash and cash equivalent balances acquired (46,543)

-----------

Total 11,453,457

===========

Post-acquisition contribution

The acquisition of UOG Egypt contributed

$9,053,657 revenue and $2,136,680

profit to the Group's results for

the year acquired.

If UOG Egypt had been acquired on

1 January 2020, revenue of the Group

for the year would have been $11,192,276

and profit for the year would have

been $5,754,327

13. Inventory

2020 2019

$ $

Oil in tanks 35,729 -

35,729 -

======= =====

14. Trade and other receivables

2020 2019

$ $

Other tax receivables 77,529 334,636

Prepayments 7,984 340,019

Accrued income 2,518,794 -

Crown disposal proceeds due 2,850,000 2,850,000

5,454,307 3,524,655

========== ==========

The Directors consider that the carrying

values of trade and other receivables

are approximate to their fair values.

No expected credit losses exist in

relation to the Group's receivables

as at 31 December 2020 (2019: $nil).

Accrued Income relates to two months

Oil & Gas invoices for the Abu Sennan

producing assets in Egypt under the

receivable terms of the agreement

with EGPC.

Prepayments and deposits relate to

monies paid in advance in relation

to the Rockhopper acquisition completed

after the balance sheet date, and

2 months advance rent on the office.

Crown disposal proceeds due are being

carried at the full value expected

to be received (see note 3).

15. Cash and cash equivalents

2020 2019

$ $

Cash at bank (GBP) 132,913 263,536

Cash at bank (EUR) 25,561 21,465

Cash at bank (USD) 16,980 990,536

Cash at bank (EGP) 2,013,448 -

2,188,902 1,275,537

========== ==========

At 31 December 2020 and 2019 all

significant cash and cash equivalents

were deposited in creditworthy financial

institutions in UK, Ireland and Egypt.

16. Share capital and share premium

Allotted, issued, and fully paid:

2020

Share capital Share premium

No $ $

Ordinary shares of GBP0.01 each

At 1 January 2020 345,613,985 4,564,787 9,912,988

Allotments:

Shares issued in consideration

for business combination 114,503,817 1,463,002 2,470,274

Shares issued for cash 159,036,167 2,031,987 4,051,541

Shares issued for cash (exercise

of warrants) 6,000,000 78,843 118,266

Share issue expenses - - (505,094)

At 31 December 2020 625,153,969 8,138,619 16,047,975

2019

Share capital Share premium

No $ $

Ordinary shares of GBP0.01 each

At 1 January and 31 December 2019 345,613,985 4,564,787 9,912,988

As regards income and capital distributions,

all categories of shares rank pari

passu as if the same constituted

one class of share.

17. Share-based payments

Options

Details of the number of share options

and the weighted average exercise

price (WAEP) outstanding during the

year are as follows:

2020

Number of WAEP

Options GBP

Outstanding at the beginning of the year 11,117,647 0.05

Issued 35,650,043 0.04

Outstanding at the year end 46,767,690 0.04

Number vested and exercisable at 31 December 2020 - -

2019

Number of WAEP

Options GBP

Outstanding at the beginning of the year 11,117,647 0.05

Issued - -

Outstanding at the year end 11,117,647 0.05

Number vested and exercisable at 31 December 2019 - -

The fair values of share options

issued in the current financial year

were calculated using the Black Scholes

model as follows:

Share Share Share Share Share Share

options options options options options options

Date of 27 Oct 29 Sep 1 July 17 June 20 March 24 June

grant 2020 2020 2020 2020 2020 2019

Number

granted 1,481,481 1,565,741 6,107,843 14,767,500 8,060,811 3,666,667

Share price GBP0.03 GBP0.03 GBP0.03 GBP0.03 GBP0.01 GBP0.04

at date of

grant

Exercise GBP0.03 GBP0.03 GBP0.03 GBP0.04 GBP0.04 GBP0.03

price

Expected

volatility 85.31% 85.27% 82.66% 82.01% 65.31% 45.95%

Expected

life from

date of

grant

(years) 6.5 6.5 6.5 6.5 6.5 6.5

Risk free

rate -0.0384% -0.0821% -0.0280% -0.0322% 0.2543% 0.5769%

Expected

dividend

yield 0% 0% 0% 0% 0% 0%

Fair value GBP0.018 GBP0.019 GBP0.018 GBP0.019 GBP0.004 GBP0.021

at date of

grant

Earliest 27 Oct 29 Sep 1 July 17 June 20 March 24 June

vesting 2023 2023 2023 2023 2023 2022

date

Expiry date 27 Oct 29 Sep 1 July 17 June 20 March 24 June

2030 2030 2030 2030 2030 2029

Expected volatility was determined

based on the historic volatility

of the Company's shares for a period

averaging 1 year. The expected life

used in the model has been adjusted,

based on management's best estimate,

for the effects of non-transferability,

exercise restrictions and behavioural

considerations.

The Group recognised total expenses

of $267,766 (2019: $126,772) in the

income statement in relation to share

options accounted for as equity-settled

share-based payment transactions

during the year.

Warrants

Details of the number of share warrants

and the weighted average exercise

price (WAEP) outstanding during the

year are as follows:

2020

Number of WAEP

Warrants GBP

Outstanding at the beginning of the year 82,212,206 0.04

Issued 7,530,834 0.03

Exercised (6,000,000) 0.03

Outstanding at the year end 83,743,040 0.04

Number vested and exercisable at 31 December 2020 83,743,040 0.04

2019

Number of WAEP

Warrants GBP

Outstanding at the beginning of the year 82,212,206 0.04

Outstanding at the year end 82,212,206 0.04

Number vested and exercisable at 31 December 2019 82,212,206 0.04

The fair values of share warrants

issued or extended in the current

financial year were calculated using

the Black Scholes model as follows:

Share warrants

Date of grant 28 Feb 2020

Number granted 7,530,834

Share price at date of grant GBP0.03

Exercise price GBP0.03

Expected volatility 49.57%

Expected life from date of grant (years) 1.5

Risk free rate 0.2813%

Expected dividend yield 0%

Fair value / incremental fair value at date of grant GBP0.0064

Earliest vesting date 28 Feb 2020

Expected volatility was determined

based on the historic volatility

of a comparable company's shares

for a period averaging 1 year. The

expected life used in the model has

been adjusted, based on management's

best estimate, for the effects of

non-transferability, exercise restrictions

and behavioural considerations.

The Group recognised total expenses

of $62,516 (2019: $nil) in relation

to share warrants accounted for as

equity-settled share-based payment

transactions during the year in relation.

These were recognised as follows:

$62,516 (2019: $nil) as a deduction

from share premium related to share

warrants accounted for as equity-settled

share-based payment transactions

during the year.

18. Trade and other payables

2020 2019

$ $

Trade payables 836,759 403,816

Tax and social security - 26,151

Other payables 1,431,078 200,074

Deferred shares (note 19) 40,739 39,804

Accruals 687,539 415,856

2,996,115 1,085,701

========== ==========

19. Deferred shares

On 12 October 2015, the Company issued

30,000 Deferred Shares of GBP1 for

GBP30,000 to the founder, which have

an entitlement to a non-cumulative

annual dividend at a fixed rate of

0.1 per cent of their nominal value.

The Deferred Shares have no voting

rights attached to them and may be

redeemed in their entirety by the

Company for an aggregate redemption

payment of GBP1.

20. Leases

Right of use assets

The Group used leasing arrangements

relating to property, plant and equipment.

As the Group has the right of use

of the asset for the duration of

the lease arrangement, a "right of

use" asset is recognised within property,

plant and equipment.

When a lease begins, a liability

and right of use asset are recognised

based on the present value of future

lease payments.

2020 2019

$ $

Interest expense on lease liabilities 4,235 4,841

Total cash outflow for leases (78,936) (93,228)

Additions to right-of-use assets 265,890 114,313

Disposals from right-of-use assets (42,318) -

Depreciation charge - right of use assets (62,322) (90,464)

Foreign exchange movement on right of use assets (532) 96

Right of use assets - carrying amount at the 23,945 -

beginning

of the year:

-------------- --------------

Carrying amount at the end of the year: 184,663 23,945

============== ==============

Lease liabilities 2020 2019

$ $

Current 94,050 26,030

Non-current 96,787 -

------------- ------------

190,837 26,030

============= ============

21. Borrowings and derivatives

Amounts payable on borrowings held

by the Group falling due within one

year and in more than one year are:

2020 2019

$ $

Secured - at amortised cost

4,555,801 -

* Other loans

Current 2,133,655 -

Non-current 2,422,146 -

4,555,801 -

The assets of the Group are held

as security against the loan. 2020 2019

$ $

Separated embedded derivative

904,702 -

* Loan derivative liability (current)

647,376 -

* Loan derivative liability (non-current)

========== =====

- 1,552,078 -

Other derivative financial instruments

87,979 -

* Hedge derivative liability (current)

Summary of borrowing arrangements:

In February 2020, the Group entered

into a prepaid commodity swap arrangement

for $8 million to part-finance the

acquisition of Rockhopper Egypt Pty

Ltd. The funds will be repaid through

30 monthly repayments which are structured

as a fixed notional amount with variations

based on movements in oil prices.

Due to the price structure, the arrangement

includes an embedded derivative (a

forward contract). For financial

reporting purposes, this must be

separately accounted for at fair

value at each balance sheet date.

The balance of proceeds that did

not relate to the derivative were

treated as the opening carrying amount

of the loan which will then be measured

at amortised cost over its life,

with finance charges recognised to

give an even return over the loan

life and repayments of capital allocated

appropriately.

As at 31 December 2020, a fair value

gain has been recognised (as finance

income) as a result of oil price

movements in the period and on forward

price rates.

During the year modifications were

agreed to the loan whereby there

was a three-month period where payments

were suspended and the deferred amounts

will be rolled into payments in the

final 12 months of the loan.

Further put option hedging contracts

were entered into in the second half

of the year to manage oil price risk

. Each of these contracts is a standalone

derivative and those that were outstanding

at the end of the year were measured

at fair value, with gains and losses

in the income statement. Some arrangements

are still in place, extending to

June 2021.

The valuations of the host debt and

derivative on initial recognition

and valuation of the remaining embedded

derivative as at 31 December 2020

were undertaken using data provided

by independent third parties.

The fair value of the contracts has

been estimated using a valuation

technique that maximises the use

of observable market inputs. These

are classified as Level 2 in the

fair value hierarchy (see note 22).

Reconciliation of liabilities arising

from financing activities

2020 At 1 At 31

January Cash Interest Repaid Fair value FX December

2020 received accrued in cash movements movements 2020

$ $ $ $ $ $ $

Loan - 4,853,381 1,576,607 (1,866,712) - (7,475) 4,555,801

Embedded

derivative - 2,906,907 - 200,596 (1,731,116) 175,691 1,552,078

Derivative - - - (70,431) 158,410 - 87,979

- 7,760,288 1,576,607 (1,736,547) (1,572,706) 168,216 6,195,858

============================ ========== ---------- ------------ ------------ ---------- ==========

Fair value movements are recognised

in finance income (see note 6).

22. Financial instruments

Classification of financial instruments

The fair value hierarchy groups financial

assets and liabilities into three

levels based on the significance

of inputs used in measuring the fair

value of the financial assets and

liabilities.

The fair value hierarchy has the

following levels:

Level 1: quoted prices (unadjusted)

in active markets for identical assets

or liabilities;

Level 2: inputs other than quoted

prices included within Level 1 that

are observable for the asset or liability,

either directly (i.e. as prices)

or indirectly (i.e. derived from

prices); and

Level 3: inputs for the asset or

liability that are not based on observable

market data (unobservable inputs).

The level within which the financial

asset or liability is classified

is determined based on the lowest

level of significant input to the

fair value measurement.

The only financial instruments measured

at fair value in the balance sheet

are the embedded derivatives and

standalone derivatives which are

classified as Level 2 according to

the above definitions. There were

no transfers in or out of Level 2

in the year.

There are no financial instruments

classified at Level 1 or Level 3

in the years presented.

The tables below set out the Group's

accounting classification of each

class of its financial assets and

liabilities.

Financial assets measured at amortised cost 2020 2019

$ $

Accrued income (note 14) 2,518,794 -

Crown disposal proceeds due (note 14) 2,850,000 2,850,000

Cash and cash equivalents (note 15) 2,188,902 1,275,537

---------- ----------

7,557,696 4,125,537

========== ==========

All of the above financial assets'

carrying values are approximate to

their fair values, as at 31 December

2020 and 2019.

Financial liabilities

Measured at amortised cost

2020 2019

$ $

Trade payables (note 18) 836,759 403,816

Other payables (note 18) 1,431,078 200,074

Lease liabilities (note 20) 190,837 26,030

Borrowings (note 21) 4,555,801 -

Accruals (note 18) 687,539 415,856

7,702,014 1,045,776

In the view of management, all of

the above financial liabilities'

carrying values approximate to their

fair values as at 31 December 2020

and 2019.

Measured at fair value through profit or loss

2020 2019

$ $

Derivative financial 1,640,057 -

instruments (note 21)

1,640,057 -

Fair value measurements

This note provides information about

how the Group determines fair values

of various financial assets and financial

liabilities.

Fair value of financial assets and

financial liabilities that are not

measured at fair value on a recurring

basis

The directors consider that the carrying

amounts of financial assets and financial

liabilities recognised in the consolidated

financial statements approximate

their fair values (due to their nature

and short times to maturity).

Fair value of financial liabilities

that are measured at fair value on

a recurring basis

The fair value of derivative financial

instruments has been estimated using

a valuation technique that maximises

the use of observable market inputs.

.

23. Financial instrument risk exposure

and management

The Group's operations expose it

to degrees of financial risk that

include liquidity risk, credit risk,

interest rate risk.

This note describes the Group's objectives,

policies and process for managing

those risks and the methods used

to measure them. Further quantitative

information in respect of these risks

is presented in notes 14,15,18,20,21,22

and 24

Liquidity risk

Liquidity risk is dealt with in note

24 of these financial statements.

Credit risk

The Group's credit risk is primarily

attributable to its cash balances.

The credit risk on liquid funds is

limited because the third parties

are large international banks with

a minimum investment grade credit

rating.

The Group's total credit risk amounts

to the total of other receivables

and cash and cash equivalents. Credit

assessments are routinely reviewed

on all of the Group's joint venture

partners and other counterparties.

Interest rate risk

The Group's only exposure to interest

rate risk is the interest received

on the cash held on deposit, which

is immaterial. The Group's borrowings

outstanding at 31 December 2020 are

structured in such a way that the

notional interest charge is fixed

and therefore there is no interest

rate risk. There were no borrowings

as at 31 December 2019.

Price risk

The Group manages its exposure to

commodity price risk on an ongoing

basis. As described in note 12, the

loan for the acquisition of Rockhopper

Egypt also involved a derivative

arrangement to manage the exposure

arising from having the loan payments

based on oil quantities rather than

a fixed cash price. Further arrangements

were initiated and closed during

the reporting period, and others

remain outstanding and will be settled

based on contract timing into 2021.

The combined put and call arrangements

provide the Group with protection

against price movements on either

side of a protected corridor.

Foreign exchange risk

The Group is exposed to foreign exchange

movements on monetary assets and

liabilities denominated in currencies

other than USD. The Group's transactions

are carried out in GBP, EUR and USD.

Equity funding transactions are carried

out in GBP. Operational transactions

are carried out predominantly in

USD but also in GBP and EUR.

The monetary assets and liabilities

denominated in currencies other than

USD are relatively immaterial (see

notes 14 and 15) and transactional

risk is considered manageable.

The Group does not hold material

non-domestic balances and currently

does not consider it necessary to

take any action to mitigate foreign

exchange risk due to the immateriality

of that risk.

24. Liquidity risk

Prudent liquidity risk management

includes maintaining sufficient cash

balances to ensure the Group can

meet liabilities as they fall due.

In managing liquidity risk, the main

objective of the Group is therefore

to ensure that it has the ability

to pay all of its liabilities as

they fall due. The Group monitors

its levels of working capital to

ensure that it can meet its debt

repayments as they fall due. The

table below shows the undiscounted

cash flows on the Company's / Group's

financial liabilities as at 31 December

2020 and 2019, on the basis of their

earliest possible contractual maturity.

Within Within Within Within

Payable Within 2 2 -6 6 - 12 1-2 2-5

Total on demand months months months years years

$ $ $ $ $ $ $

At 31

December

2020

Trade

payables 836,759 - 836,759 - - - -

Other

payables 1,431,078 1,431,078 - - - - -

Lease

liabilities 210,007 - 22,081 31,937 54,630 93,963 7,396

Borrowings 6,288,305 - 533,346 1,066,692 1,918,320 2,769,947 -

Derivative

financial

instruments 87,980 - - - 87,980 - -

Accruals 687,539 - - 687,539 - - -

---------- ---------- ---------- ---------- ---------- ---------- -------

9,541,668 1,431,078 1,392,186 1,786,168 2,060,930 2,863,910 7,396

At 31

December

2019

Trade

payables 403,816 - 403,816 - - -

Other

payables 200,074 200,074 - - - -

Lease

liabilities 26,446 - 17,631 8,815 - -

Accruals 415,856 - - 415,856 - -

1,046,192 200,074 421,447 424,671 - -

25. Capital management

The Group's capital management objectives

are:

* To provide long-term returns to shareholders

* To ensure the Group's ability to continue as a going

concern

The Group defines and monitors capital

on the basis of the carrying amount

of equity plus borrowings less cash

and cash equivalents as presented

on the face of the balance sheet

and as follows:

2020 2019

$ $

Equity 19,659,650 9,105,601

Borrowings 4,555,801 -

Cash and cash equivalents (2,188,902) (1,275,537)

------------ ------------

22,026,549 7,830,064

============ ============

The Board of Directors monitors the

level of capital as compared to the

Group's commitments and adjusts the

level of capital as is determined

to be necessary by issuing new shares.

The Group is not subject to any externally

imposed capital requirements.

These policies have not changed in

the year. The Directors believe that

they have been able to meet their

objectives in managing the capital

of the Group.

26. Related party transactions

Key management personnel are identified

as the Executive Directors, and their

remuneration is disclosed in note

5.

27. Financial commitments

As at 31 December 2020, the Group's

commitments comprise their producing

assets and exploration expenditure

in Egypt, exploration expenditure

interests in Waddock Cross, Crown,

and the Walton-Morant licence, and

development expenditure in Italy.

These commitments have been summarised

below:

Exploration/Production Year Year

licence ending 31 ending 31

December December

2020 2021

$ $

Abu Sennan - 4,629,900

Crown 9,952 140,000

Colter 6,774 -

Walton-Morant licence 103,407 402,500

Selva Malvezzi 177,883 82,564

Waddock Cross 47,314 47,198

345,330 5,302,162

----------------- -----------------

28. Ultimate controlling party

The directors do not consider there

to be an ultimate controlling party.

29. Events after the balance sheet

date - to complete closer to sign

off

1. ASH 3 Well Test Update

On the 23 of February 2021 the company

announced an update on the testing

of the ASH-3 development well in

the Abu Sennan concession, onshore

Egypt. The ASH-3 well was spudded

on 4 of January 2021, reached a total

depth of 4.087 metres on the 8 February

2021 which was ahead of schedule

and under budget. Gross hydrocarbons

indicates a column of 59m in the

primary AEB reservoir target, 27.5m

of which is estimated to be net pay.

The well was immediately brought

onstream through the existing ASH

facilities and is producing at an

average of over 4,000 boepd (880

boepd net) since coming onstream

on 5 March 2021, of which United

holds a 22% non-operating interest.

2. Discovery at ASD-1X Well, Abu

Sennan Concession, Egypt

On the 6 of April United announced

the preliminary results of the ASD

1X exploration well discovery, which

encountered a total of at least 22m

net oil pay across a number of reservoirs.

Well testing is ongoing, and if successful,

will be followed by an application

to Egyptian General Petroleum Company

('EGPC') for a development lease

over this new discovery. The ASD-1X

exploration well, located 12KM to

the north-east of the producing Al

Jahraa Field, safely reached Total

Depth (TD) of 3,750 MD on 30 March

2021, several days ahead of schedule

and under-budget.

Glossary

Non-IFRS measures

The Group uses certain measures of

performance that are not specifically

defined under IFRS or other generally

accepted accounting principles.

Cash-operating costs per barrel

Cash operating costs are defined

as cost of sales less depreciation,

depletion and amortisation, production

based taxes, movements in inventories

and certain other immaterial cost

of sales.

Cash operating costs are then divided

by barrels of oil equivalent produced

to demonstrate the cash cost incurred

to producing oil and gas from the

Group's producing assets. Year

ended

31 December

2020

Audited

$

Cost of Sales 6,505,011

Less

Depreciation, depletion and amortisation -2,563,268

Inventories -64,433

Cash operating costs 3,877,310

Production

(BOEPD) 2,195

Cash Operating Cost

BOE ($) 5.77

EBITDAX

EBITDAX is earnings from continuing

activities before interest, tax,

depreciation, amortisation, reversal

of impairment, and exploration expenditure

and exceptional items in the current

year.

Year

ended

31 December

2020

Audited

$

Operating Income (Loss) 804,318

Depreciation, Depletion

& Amortisation 2,628,990

Exploration Expense 37,161

3,470,469

=============

For more information, please visit

the Company's website at www.uogplc.com

or contact:

United Oil & Gas Plc (Company)

Brian Larkin, CEO brian.larkin@uogplc.com

Beaumont Cornish Limited (Nominated

Adviser)

Roland Cornish and Felicity Geidt +44 (0) 20 7628 3396

Optiva Securities Limited (Broker)

Christian Dennis +44 (0) 20 3137 1902

Murray (PR Advisor) +353 (0) 87 6909735

Joe Heron jheron@murrayconsultants.ie

Camarco (Financial PR/IR)

Billy Clegg +44 (0) 20 3757 4983

James Crothers uog@camarco.co.uk

Notes to Editors

United Oil & Gas is a high growth oil and gas company with a

portfolio of low-risk, cash generative production and development

assets across Egypt, UK, Italy and a high impact exploration

licence in Jamaica.

The Company is led by an experienced management team with a

strong track record of growing full cycle businesses and partnered

with established industry players and well positioned to deliver

future growth through portfolio optimisation and targeted

acquisitions.

United Oil & Gas is listed on the AIM market of the London

Stock Exchange. For further information on United Oil and Gas

please visit https://www.uogplc.com/

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR PPUPUCUPGPGA

(END) Dow Jones Newswires

April 26, 2021 02:00 ET (06:00 GMT)

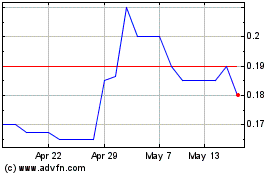

United Oil & Gas (LSE:UOG)

Historical Stock Chart

From May 2024 to Jun 2024

United Oil & Gas (LSE:UOG)

Historical Stock Chart

From Jun 2023 to Jun 2024