TIDMTHRU

RNS Number : 1071D

Thruvision Group PLC

24 June 2019

Thruvision Group plc

("Thruvision" or the "Group")

Results for the Year ended 31 March 2019

Highlights

-- Strong revenue growth to GBP6.0 million (2018: GBP3.1

million) with operating loss before tax reduced to GBP2.1 million

(2018: GBP2.5 million);

-- Adjusted loss before tax* of GBP1.7 million (2018: GBP2.9 million)

-- Strong growth in the number of Thruvision units sold to 109

(2018: 57) with eleven new customers acquired, including US State

Department's Bureau of International Narcotics and Law Enforcement

(INL);

-- Further unit sales to seven existing customers in Loss

Prevention and Transport who expanded the deployment of Thruvision

units across a larger number of sites;

-- Thruvision approved for operational use by US Government's

Transportation Security Administration (TSA) in the mass transport

market;

-- Orders that were delayed by the US Government shut-down in

early calendar 2019 have been received since the period end and are

in the process of being delivered;

-- Completed formal process of separating Digital Barriers from

the Group, resulting in GBP0.2 million of one-off costs incurred

and subsequent return of GBP3.3 million to shareholders through a

Tender Offer in August 2018;

-- Cash at 31 March 2019 of GBP9.4 million (31 March 2018: GBP17.6 million).

*Adjusted loss before tax is defined as loss before tax from

continuing operations, adding back share-based payments, share

buyback costs and financing set up fees.

Commenting on the results, Colin Evans, Chief Executive,

said:

"This has been a year of important transformation - we have

nearly doubled our revenues, significantly increased our

manufacturing capacity, and strengthened our sales leadership.

During the year we won orders from new customers and saw further

sales to existing customers in the Loss Prevention and

Transportation markets. While we experienced some delays following

the US Government shut-down in early 2019, those orders have been

received since the period end.

Looking forward, market interest continues to grow as brand

awareness builds and sales momentum into the new financial year has

been maintained. The Board remains confident about the company's

prospects for the future, and its ability to exploit a significant

new niche in the international security market."

For further information please contact:

Thruvision Group plc +44 (0)1235 436180

Tom Black, Executive Chairman

Colin Evans, Chief Executive

Investec Bank plc (NOMAD & Broker) +44 (0)20 7597 5970

Andrew Pinder / Sebastian Lawrence

/ Patrick Robb

FTI Consulting LLP +44 (0)20 3727 1000

Matt Dixon / Harry Staight/ Shamma

Kelly

About Thruvision

Thruvision is the leading provider of next-generation

people-screening technology. Using patented passive terahertz

technology, Thruvision is uniquely capable of detecting metallic

and non-metallic threats including weapons, explosives and

contraband items that are hidden under clothing, at distances up to

10m.

Addressing the growing need for fast, safe and effective

security, Thruvision has been vetted and approved by the US

Transportation Security Administration. More than 250 units have

been deployed worldwide over the last five years for applications

including mass transit and aviation security, facilities and public

area protection, customs and border control and supply chain loss

prevention. Thruvision has offices near Oxford and in Washington

DC.

www.thruvision.com

Chairman's statement

In our first full year of trading since the disposal of the

Digital Barriers business, we made good progress in firmly

establishing Thruvision in the international security market.

Focusing all our resources on the people security screening market

resulted in a near doubling of revenues and good sales traction

across all our market segments. Critically, Thruvision was vetted

and approved by the US Government's Transportation Security

Administration (TSA) which led to growing momentum in the US in the

second half of the year and provides an invaluable international

reference point for future sales.

Markets

The macro demand environment for Thruvision remains very strong.

Terrorism continues to spread globally, and governments around the

world are continuing to invest accordingly in protecting

transportation, public areas and critical infrastructure. In

parallel, mass migration and the smuggling of drugs and other

contraband across borders remains a headline issue, especially in

the US. Closer to home, the rapid growth of online sales is

changing the underlying structure of retailing and creating

significant opportunities for theft in retailers' distribution

infrastructure. Taken together, these factors reinforced our

decision to focus on the four key market segments we first

identified in our 2018 Annual Report and have since refined (see

below) namely, Transportation, Customs, Entrance Protection, and

Loss Prevention.

Focusing on these market segments allowed us to build sales

momentum, with eleven new customers placing orders for Thruvision

equipment during the year. New international government customers

in the second half of the year were the US State Department's

Bureau of International Narcotics and Law Enforcement (INL) and the

Czech Government, adding to the TSA's Innovation Task Force, Los

Angeles Metro and a major Asian government which purchased units in

H1. In H2, we also added Matalan to Next and Sony, as new

commercial customers. Some two-thirds of our orders in the year

were received from existing customers who purchased second or even

third batches of equipment, giving us confidence about the

likelihood of repeat orders from newly acquired customers.

We have seen good progress in the US throughout the year

although the US Government shut-down in early 2019 delayed orders

until after year-end, meaning revenue growth was below our initial

expectations. The opening of our showcase demonstration centre in

Washington DC in the spring of 2018, followed by approval for mass

transit from the TSA in August, and initiating manufacturing of our

screening units in Florida in the autumn has now positioned us as a

key new security technology vendor with the US Government. We

received two orders early in the new financial year, the first of

which was from the US State Department's INL, bringing the number

of national Customs agencies now using Thruvision to six. The

second order came in from Los Angeles International Airport who

will be using Thruvision units to screen employees. Aviation

security in the US is a key opportunity for us both with employee

screening and passenger screening in main airport security

checkpoints. For passenger screening, we are currently working with

the TSA's Innovation Task Force and are going through approval

processes.

Similarly, we saw very good growth in Asia over the year with

notable demand for Thruvision across our Customs, Transportation

and Entrance Protection segments. As a result of this, we opened an

Asia Pacific office in Sydney at the start of the current financial

year and we have now appointed an experienced regional sales leader

to build on this momentum.

In our Loss Prevention business, we added five new customers and

had follow-on orders from two existing customers in the year. This,

combined with some very positive customer publicity from Next, has

given us the confidence to significantly strengthen our sales

leadership and team in this area.

Through the second half of the year, we successfully scaled our

manufacturing capacity to allow us to build up to 20 units per

month and, in the coming year, we expect to launch several new

product variants, each designed to meet specific market needs.

People

Following Ian Lindsay's decision to relocate to Australia with

his family, Adrian Crockett joined the company as Finance Director

on 1 May 2019. Adrian brings significant AIM and technology

business experience to the Board and I am delighted to welcome him

to the team. Our headcount increased during the year and we now

employ over 30 people. We remain a small business with a very

strong culture and high morale and I would like to take this

opportunity to thank all of our people for their exceptional

dedication to the Company.

The Board is acutely aware that, as I cannot be regarded as

independent due to my long association with Thruvision, we have

only one independent director. It is the Board's intention to add

another independent director to the Board in due course, but we do

not regard this as an urgent priority as we have a full-time

Company Secretary and operate to very high levels of governance for

a business of our size.

Finally, following the divestment of Digital Barriers to Volpi

Capital in October 2017, we successfully completed the return of

GBP3.3 million of cash to shareholders through a Tender Offer

process that completed in August 2018. During the year, we also

completed the formal process of separating Digital Barriers from

the Group, incurring one-off costs of GBP0.2 million relating to

warranties on the sale and a reassessment of the likely amount due

in deferred consideration.

Outlook

With positive market drivers, a strong technology base and

proven manufacturing capability, our focus now is on driving sales

growth in our key market segments. We have strengthened our sales

leadership and are experiencing growing international brand

recognition, based on progress in the US and an increasing number

of referenceable customers. We believe that Thruvision's growing

sales pipeline shows that we are capable of exploiting a

significant new niche in the international security market and the

Board therefore remains confident about the company's prospects for

the future.

Update on strategy

Thruvision addresses the growing international need to quickly

and comprehensively security screen individuals for either weapons

or contraband that might be concealed in their clothing, in a safe

and respectful manner. The two most widely deployed existing

technologies, walk-through metal detectors and active millimeter

wave body scanners, do not meet this need as they either fail to

detect non-metallic threats or are very slow for high throughput

requirements. In both cases, possible alarms can only be resolved

by physical searches that are both slow and invasive. These

shortcomings create a significant market opportunity for

people-screening, which cannot be met by existing technology, but

which is achievable using Thruvision people-screening units.

Given this competitive positioning, we have focused on four

distinct market segments, each offering a significant level of

solution repeatability across a broad range of international

markets:

-- Customs - screening for prohibited items such as cash and

drugs at all types of border checkpoints including airports, land

crossings, seaports, cruise-liner terminals, bridges and railway

stations. Customers are national government agencies resulting in

total order quantities that could be substantial although sales

cycles are extended by government procurement procedures. Key

customers here include Hong Kong Customs and the US State

Department's INL.

-- Entrance Protection - screening for weapons at entrances to

high profile or high security buildings, sports and entertainment

venues and other public areas. Covering both public and private

sector sites, the aim here is to ensure sites are protected from

non-metallic threat items and to speed up the process of screening

visitors. A key customer here is the Farnborough International

Airshow.

-- Loss Prevention - screening for items being stolen from

distribution centres or factories. The market here consists of a

potentially very large number of on-line retail and other

customers. With a clear financial return on investment driving

purchasing, relatively short sales cycles have been demonstrated.

Flagship customers include Matalan, Next,Sony, and more recently

Morrisons.

-- Transportation - screening for suicide vests and large guns

at railways, subways and airport concourses, and screening of

employees for smaller weapons in airport checkpoints. Following a

purchase by TSA's Innovation Task Force, Thruvision is now being

evaluated for use with aviation passengers, and this could lead to

further TSA approval to operate in aviation checkpoints in due

course. Customers in this segment include governments, airport

operators and a combination of city or regional public sector

organisations. In addition to the TSA, key customers here include

Los Angeles Metro, Los Angeles World Airports and the Philippino

Government.

With internationally recognised 'flagship' customers secured in

each of these market segments, we are seeing increasing interest

from a range of organisations looking for effective, higher

throughput, people security screening solutions.

Moving forward, we aim to exploit this growing interest and

awareness to increase sales of Thruvision units into these market

segments across the world. We are confident we can grow revenues

and gross margins more quickly than we need to increase costs and

so deliver profitability for shareholders.

Business Review

Sales

We recorded strong sales growth with a total of 109 units

delivered in the year. While performance was somewhat impacted by

the delays in unit orders caused by the US Government shutdown

early in calendar 2019, orders have been received after the period

end and are in the process of being delivered. Sales into

Transportation were particularly strong (accounting for a little

over 50% of units delivered), with Customs and Loss Prevention

showing good progress. In Entrance Protection, we secured one

significant project in Asia and provided very high-profile visitor

screening for the Farnborough International Airshow, which resulted

in excellent feedback on convenience and speed of throughput.

We received orders from eleven new customers in the year,

accounting for around a third of the units delivered. The balance

was delivered to existing customers as second or even third batches

of units, giving us confidence that, once organisations start using

Thruvision, they are much more likely to buy again in the future.

Based on this, we are shaping our sales team to ensure we are

successful in both acquiring new customers and upselling existing

customers through excellent post-sales support.

Regional updates

-- Americas: We continued to focus heavily on the Transportation

and Customs segments. We secured headline orders in the year from

Los Angeles Metro, TSA's Innovation Task Force, State Department's

INL, and since year-end, Los Angeles International Airport and a

further INL order under a new framework purchasing agreement. We

expect continued uptake across these Federal Agencies and within

the US aviation security market for both airport employee screening

and, subject to further TSA approvals, passenger screening. More

broadly, on the back of the INL initiative we are seeing growing

interest across Central and South America. Separately, we are

working in North America with a specialist Loss Prevention sales

partner and expect progress in this segment in the coming year.

-- Asia Pacific: As with the US, we focused mainly on the

Transportation and Customs segments. We deployed a fourth batch of

units with our Hong Kong customer and made further progress in

China around Customs and Entrance Protection, albeit with

considerable care around protecting our IP. We received a third

order from our Philippines-based partner for Transportation

security and expect further orders in the future. We are seeing

strong, growing interest across the region and in particular in

Japan, Singapore and Australia. With new sales leadership in place,

we expect to be able to accelerate progress in the coming

months.

-- UK and Europe: we made excellent progress on our primary

focus of building our Loss Prevention business. We secured five new

customers during the year including Next, Sony, JD Sports and

Matalan, and received further orders from two existing customers.

Morrisons was secured post year end. With Next publicly reporting a

59% reduction in one of its proxy measures for theft reduction from

its distribution centres, we are very confident about the positive

return on investment that our products provide for such customers.

Separately, we secured initial small Customs sales with both the UK

and Czech authorities.

-- Middle East and Africa: Given demand elsewhere, we spent

little time focusing on this region through most of the year.

Following TSA approval however, we have seen interest levels

increasing and we have set aside dedicated sales resource in this

region for the coming period.

Routes to market

Our routes to market vary depending on region and market sector.

For Loss Prevention in the UK and Europe, we sell directly to

end-customers. As a company, we have built up a significant

understanding of how best to use Thruvision in the context of

distribution centre security, and customers value the advice we

offer as well as the technology we supply. Given the niche nature

of the market, we also benefit significantly from customer

referrals. Our intention is to use the growing list of

international retailers who use Thruvision to secure Loss

Prevention customers in North America and Australasia as our next

steps.

We operate directly with end customers in the US where we have

built strong relationships with a number of key senior figures

across TSA, CBP, State Department and the Defense Department. We

install and support all our systems with our own staff to ensure

the highest levels of service, and we intend on strengthening our

account management in these areas to secure further sales.

Our model in Asia Pacific, Latin America and Middle East and

Africa is different. We adopt a 'sell with' partner model, meaning

we engage with end customers directly wherever possible alongside

local partners. This means we can bring the very latest sales news

and expertise to each opportunity and train the smaller number of

partners we use to sell, install and then support our

technology.

Manufacturing

We made good progress through the course of the year

strengthening and multi-skilling our manufacturing team. We

upgraded our manufacturing facilities in Didcot to increase both

capacity and resilience and brought our Florida-based manufacturing

partner fully on stream during the second half of the year.

Collectively, we demonstrated we can sustain production at 20 units

per month, with an ability to surge production above this to meet

larger orders in a timely manner. We believe we now have a

manufacturing platform which can produce around 240 units per year

with little further investment.

New product development

We launched the new Thruvision TAC product in the summer of

2018. Developed with and approved by the TSA for the mass transit

market, the Thruvision TAC is now our flagship product. It has also

sparked significant international interest, especially for mass

transit security given the publicity generated by Los Angeles

Metro.

Based on the modular design of the Thruvision TAC product, we

are now planning the launch of several new TAC variants,

principally based on varying software functionality. Each new

product will be optimised to meet the specific needs of its target

market segment. We also expect to launch a completely new military

specification, outdoor screening model as a result of funding from

the TSA.

As well as making significant improvements to our hardware, we

also increased investment in our Artificial Intelligence-based

image processing software during the year. We expect this to form

the basis of further improvements in detection performance over

time.

Competition

We are seeing a number of smaller, early stage technology

companies in the market, aiming also to provide high-throughput

people security screening. These are largely based on active

millimeter-wave technology, meaning they often require

country-by-country Radio Frequency approval in order to be operated

legally. None have yet entered any form of formal TSA testing and

we do not believe any have yet reached volume production and sales.

One has been acquired by a larger player, indicating growing

corporate interest in our niche. We maintain a careful watching

brief.

IP protection

We have an ongoing programme to look at our patent portfolio and

to identify the most appropriate ways to protect the new

innovations resulting from our R&D work. Included in this

programme is an assessment of enforceability in certain high-risk

countries and how best to mitigate such risks.

Facilities

Over the course of the year we invested in new sales facilities

in the Washington DC area, upgraded our head office and main

manufacturing centre in Didcot, England and early in the new

financial year, opened a new sales office in Australia to cover the

Asia Pacific region. No significant further investment in our

facilities is planned in the coming year.

Staff

We increased headcount from 23 to 34 staff through the year.

These increases were predominantly in Sales and Sales Support

(specifically the US), and Engineering. Through the financial

year-end period, we also strengthened sales leadership in the Asia

Pacific and Loss Prevention areas and expect to further strengthen

our Loss Prevention and US sales teams in FY20. Voluntary staff

attrition was nil.

Financial Review

Summary

For the year ended 31 March 2019, Thruvision revenues grew

significantly by 93% to GBP6.0 million (2018: GBP3.1 million) which

resulted in a reduced operating loss of GBP2.1 million (2018 loss:

GBP2.5 million).

The Directors believe that adjusted loss before tax is currently

an important measure of the performance of the business.

The Group recorded an adjusted loss of GBP1.7 million (2018:

GBP2.9 million) This was arrived at as follows:

Adjusted loss: 2019 2018

GBP'000 GBP'000

Loss before tax from continuing operations (2,060) (3,212)

Share-based payment 207 52

Share buyback costs 119 -

Financing set up fees - 263

Adjusted loss before tax for the year

from continuing operations (1,734) (2,897)

---------

Further details on the above are provided in note 4 below.

A significant increase in sales of Thruvision units resulted in

109 units delivered in 2019 (2018: 57). This included eleven new

customers and repeat business with seven others. The introduction

of the higher priced new TSA-approved Thruvision TAC unit and a

planned reduction in Customer development revenues helped increase

Gross Margin to 39% (2018: 35%). Unit sales were spread evenly

across all regions, showing balanced growth. Average revenue per

unit increased to GBP54k (2018: GBP51k) year-on-year as a result of

being able to achieve higher pricing on existing models as the

business became more established and starting to sell higher priced

TAC models in the US.

Continued focus on the reduction of non-productive overheads

generated savings that were used to partially offset our investment

in the Sales and Marketing resource required to drive growth, and

to expand our manufacturing capacity. The manufacturing expansion

allowed us to increase production capability and resulted in an

average of 20 units produced per month in Q4 and has ensured we can

continue to scale production moving forward.

Eleven employees joined the company during the year. Three of

these joined in sales, marketing and pre-sales roles, two in

post-sales support, one in Finance and five in the engineering team

to increase both manufacturing capacity and strengthen our software

capability.

The cash balance at the year-end was GBP9.4 million (2018:

GBP17.6 million) The US Government shutdown in early calendar 2019

delayed several opportunities, for which we had been building up

stock levels of our US-manufactured TAC model, as a result the cash

receipt was delayed. As orders were received post year-end we now

expect to see these stock levels reduce as units are delivered. We

also completed a major order to the Philippines in Q4 resulting in

a debtor over the period-end of GBP1.6 million. It is expected that

this cash will be received in H1. In August 2018, the Group

returned GBP3.3 million cash to shareholders via a Tender Offer,

reducing the number of Ordinary Shares in issue to 145,454,118.

Key Performance Indicators ("KPIs")

The Group consider the following to be our KPIs which track the

trading performance and position of the business.

KPIs

2019 2018

GBP'000 GBP'000

-------------------------------------- -------- --------

Revenue 5,981 3,103

Number of units shipped 109 57

Average revenue per unit 54 51

Gross Profit 2,327 1,079

Gross Margin 39% 35%

Overheads* (4,204) (3,461)

Operating loss (2,108) (2,524)

Number of employees at 31 March 2019 34 23

-------------------------------------- -------- --------

* Overheads exclude for the period share buyback costs of GBP0.1

million (2018;: nil), and Foreign exchange gains of GBP0.2 million

(2018;: GBP0.1m), Finance set-up fees of GBP0.2million in 2018 and

Share based payment charge GBP0.2million (2018 : GBP52,000)

Revenue

Thruvision revenues grew significantly by 93% to GBP6.0 million

(2018: GBP3.1 million). Revenues from unit sales contributed GBP5.9

million (2018: GBP2.9 million), and development revenue was GBP0.1

million (2018: GBP0.2 million).

The growth in revenues over the prior year reflects strong

organic unit sales in our main markets, with unit volumes

increasing to 109 (2018: 57 units). We received orders from eleven

new customers in the year with seven existing customers ordering

for a second or third time showing increasing confidence in, and

adoption of, Thruvision technology. Unit deliveries were impacted

by procurement delays caused by the US Government shutdown and

these orders have now been received.

In the US and Asia Pacific, our Transportation and Customs

market segments grew strongly while in the UK and Europe, our

primary focus was on Loss Prevention where strong progress has been

made with customers including Next and Sony.

After a number of initial sales in the Middle East and Africa in

2018, high demand elsewhere resulted in a reduced focus on this

region and it will continue to be a secondary priority moving

forwards.

2019 2018

Revenue GBP'000 GBP'000

---------------- -------- --------

Units 5,901 2,895

Development 80 208

---------------- -------- --------

Total 5,981 3,103

---------------- -------- --------

Revenue by Geography 2019 2018

GBP'000 GBP'000

---------------------- --------- ---------

UK & Europe 1,338 384

Middle East and

Africa 28 902

Americas 975 413

Asia-Pacific 3,640 1,404

---------------------- --------- ---------

5,981 3,103

---------------------- --------- ---------

Gross Profit

Gross Profit increased to GBP2.3 million in the period (2018:

GBP1.1 million). Gross margin increased to 39% in the year (2018:

35%). The Gross margin increase was due to a higher mix of the TAC

unit sales, improved Average Revenue Per Unit and manufacturing

cost reduction work compared to the prior year, offset by lower

development revenues. Development revenues represented 1% of

revenue in 2019 (2018: 7%) demonstrating a move to a scalable unit

sales-driven business model. The gross margin attributable to unit

revenues increased to 40% (2018: 34%).

Gross Margin 2019 2018

GBP'000 GBP'000

-------------------------- ------- -------

Unit Revenue 5,901 2,895

Unit Gross Profit 2,337 991

-------------------------- ------- -------

Gross margin % 40% 34%

Development Revenue 80 208

Development Gross Profit (10) 88

-------------------------- ------- -------

Gross margin % (13)% 42%

Overall Revenue 5,981 3,103

Overall Gross Profit 2,327 1,079

-------------------------- ------- -------

Gross margin % 39% 35%

-------------------------- ------- -------

Overheads

Overheads increased by 21% to GBP4.2 million (2018: GBP3.5

million). Sales & Marketing expenditure increased by GBP0.6

million to deliver strategic investment in our US and Asia Pacific

markets. This additional investment was made to capitalise on our

'flagship' customer deployments in these regions and was used to

increase direct marketing and provide enhanced pre-sales

capability. Manufacturing and R&D costs increased by GBP0.6

million which was focused on increasing production capacity and

strengthening our software capability. These investments were

offset by lower PLC costs following the sale of the Video Business

and lower administration costs in the period.

Overheads 2019 2018

GBP'000 GBP'000

---------------------------- -------- --------

Sales & Marketing 1,701 1,102

Manufacturing and

R&D 1,289 708

Property and administration 432 658

PLC costs 782 993

Total Overheads* 4,204 3,461

----------------------------- -------- --------

*Overheads exclude for the period share buyback costs of GBP0.1

million (2018 : nil), and Foreign exchange gains of GBP0.2 million

(2018 : GBP0.1m), Finance set-up fees of GBP0.2million in 2018 and

Share based payment charge GBP0.2million (2018 : GBP52

thousand)

Looking forward, we expect to see further investment,

principally in Sales & Marketing, but at a rate below the

headline growth rate of the business. We do not expect to

materially increase management and administration or PLC costs in

the near-term.

Operating loss

Operating Loss from operations before tax including deprecation,

share based payments, FX and Interest narrowed to GBP2.1 million

(2018 loss: GBP2.5 million). Of this, GBP0.2 million relates to

one-off, non-recurring costs associated with the sale of the

Digital Barriers business in November 2017. This loss would have

been further reduced had orders not been delayed by the US

Government shut-down in early calendar 2019.

Discontinued costs

Costs this year of GBP0.2m were allocated as discontinued on the

basis that these costs were incurred as a result of one-off events

related to the disposal of Digital Barriers. These were amounts due

from warranties on the sale (GBP0.1 million) as well as a

reassessment of the likely amount due in deferred consideration

(GBP0.1 million).

Taxation

As a result of brought-forward tax losses we do not expect to

pay the full rate of UK corporation tax in the next financial year.

The Income Statement tax credit for the year of GBP23k (2018:

GBP90k) relates to the expected R&D tax credit reclaim, with

the decrease this year primarily due to a GBP34k prior year

adjustment in respect of 2018.

At 31 March 2019, the Group had unutilised tax losses carried

forward of approximately GBP10.5 million (2018: GBP9.1 million).

Given the varying degrees of uncertainty as to the timescale of

utilisation of these losses, the Group has not recognised GBP10.8

million (2018: GBP9.1 million) of potential deferred tax assets

associated with these losses. At 31 March 2019, the Group's net

deferred tax liability stood at GBPnil (2018: GBPnil).

Cash

The Group cash and cash equivalents at 31 March 2019 were GBP9.4

million (2018: GBP17.6 million).

The cash outflow as a result of operating activities was GBP4.4

million as increased revenues were offset by the Operating Loss,

investment in inventory levels for delayed US Government orders and

increased receivables driven principally by a large order delivered

to the Philippines in Q4. Stock value at 31 March 2019 was GBP3.3

million (2018: GBP1.8 million)

In August 2018, the Group returned GBP3.3 million cash to

shareholders by way of a Tender Offer process reducing the number

of Ordinary Shares in issue to 145,454,118.

Currency Impact

The Group generated foreign currency exchange gains during the

period of GBP0.2 million (2018: GBP0.1 million), due to the

depreciation of GBP versus USD.

Consolidated income statement

for the year ended 31 March 2019

Year ended Year ended

31 March 31 March

2019 2018

Note GBP'000 GBP'000

----------------------------------------- ----- ---------------- ----------------

Continuing operations

Revenue 2 5,981 3,103

Cost of sales (3,654) (2,024)

------------------------------------------ ----- ---------------- ----------------

Gross profit 2,327 1,079

Administration costs (4,440) (3,654)

Other income 5 51

Operating loss 3 (2,108) (2,524)

Finance revenue 78 70

Finance costs (30) (758)

------------------------------------------ ----- ---------------- ----------------

Loss before tax (2,060) (3,212)

Income tax 23 90

------------------------------------------ ----- ---------------- ----------------

Loss for the year from continuing

operations (2,037) (3,122)

------------------------------------------ ----- ---------------- ----------------

Discontinued operations

Loss from discontinued operation

after tax (233) (16,429)

Loss for the year (2,270) (19,551)

Adjusted loss: 4

Loss before tax from continuing

operations (2,060) (3,212)

Share-based payment 4 207 52

Share buyback costs 119 -

Financing set up fees - 263

Adjusted loss before tax for

the year from continuing operations (1,734) (2,897)

----- ----------------

Loss per share - continuing

operations

Loss per share - basic 5 (1.33p) (1.89p)

Loss per share - diluted 5 (1.33p) (1.89p)

Loss per share - continuing and discontinued

operations

Loss per share - basic 5 (1.49p) (11.84p)

Loss per share - diluted 5 (1.49p) (11.84p)

------------------------------------------ ----- ---------------- ----------------

Consolidated statement of comprehensive income

for the year ended 31 March 2019

Year ended Year ended

31 March 31 March

2019 2018

GBP'000 GBP'000

------------------------------------------------------- ----------- -----------

Loss for the year from continuing operations (2,037) (3,122)

Loss for the year from discontinued operations (233) (16,429)

--------------------------------------------------------- ----------- -----------

Loss for the year attributable to owners

of the parent (2,270) (19,551)

--------------------------------------------------------- ----------- -----------

Other comprehensive income / (loss) from

continuing operations

--------------------------------------------------------- ----------- -----------

Other comprehensive income that may be subsequently reclassified

to profit and loss:

Exchange differences on retranslation of

foreign operations - continuing 6 3

Exchange differences on retranslation of

foreign operations - discontinued - (694)

Reclassification to profit and loss - discontinued - 698

Net other comprehensive income to be reclassified

to profit or

loss in subsequent periods 6 7

--------------------------------------------------------- ----------- -----------

Total comprehensive loss attributable to

owners of the parent (2,264) (19,544)

--------------------------------------------------------- ----------- -----------

Consolidated statement of financial position

at 31 March 2019

31 March 31 March

2019 2018

Note GBP'000 GBP'000

------------------------------ ----- --------- ---------

Assets

Non current assets

Property, plant and

equipment 760 278

Other intangible assets 7 2

-------------------------------- ----- --------- ---------

280

Current assets

Inventories 3,349 1,813

Trade and other receivables 6 2,690 1,229

Current tax recoverable 114 90

Cash and cash equivalents 9,375 17,587

-------------------------------- ----- --------- ---------

15,528 20,719

------------------------------ ----- --------- ---------

Total assets 16,295 20,999

Equity and liabilities

Attributable to owners of

the parent

Equity share capital 8 1,618 1,814

Share premium - 109,078

Capital redemption

reserve - 4,786

Translation reserve 14 8

Retained earnings 12,445 (96,207)

-------------------------------- ----- --------- ---------

Total equity 14,077 19,479

Non current liabilities

Provisions 38 36

-------------------------------- ----- --------- ---------

36

Current liabilities

Trade and other payables 7 2,180 1,455

Provisions - 29

-------------------------------- ----- --------- ---------

2,180 1,484

------------------------------ ----- --------- ---------

Total liabilities 2,218 1,520

-------------------------------- ----- --------- ---------

Total equity and liabilities 16,295 20,999

-------------------------------- ----- --------- ---------

Consolidated statement of changes in equity

for the year ended 31 March 2019

Ordinary Share Capital Merger Translation Other Total

share premium redemption reserve reserve reserves Retained equity

capital account reserve earnings

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- --------- ---------- ----------- ---------- ------------- --------------- --------- -------------

At 31 March

2017 1,814 109,078 4,786 454 1 (307) (76,912) 38,914

--------------- --------- ---------- ----------- ---------- ------------- --------------- --------- -------------

Share-based

payment

credit - - - - - - 109 109

--------------- --------- ---------- ----------- ---------- ------------- --------------- --------- -------------

Transactions

with

shareholders - - - - - - 109 109

Loss for the

year - - - - 701 - (19,551) (18,850)

Other

comprehensive

income - - - - (694) - - (694)

--------------- --------- ---------- ----------- ---------- ------------- --------------- --------- -------------

Total

comprehensive

gain/(loss) - - - - 7 - (19,551) (19,544)

On disposal of

Video

Business - - - (454) - 307 147 -

At 31 March

2018 1,814 109,078 4,786 - 8 - (96,207) 19,479

--------------- --------- ---------- ----------- ---------- ------------- --------------- --------- -------------

Capital

redemption - (109,078) (4,786) - - - 113,864 -

Share buyback (196) - - - - - (3,149) (3,345)

Share-based

payment

credit - - - - - - 207 207

--------------- --------- ---------- ----------- ---------- ------------- --------------- --------- -------------

Transactions

with

shareholders (196) (109,078) (4,786) - - - 110,922 (3,138)

--------------- --------- ---------- ----------- ---------- ------------- --------------- --------- -------------

Gain/(loss)

for the

year - - - - - - (2,270) (2,270)

Other

comprehensive

gain/(loss) - - - - 6 - - 6

--------------- --------- ---------- ----------- ---------- ------------- --------------- --------- -------------

Total

comprehensive

gain/(loss) - - - - 6 - (2,270) (2,264)

--------------- --------- ---------- ----------- ---------- ------------- --------------- --------- -------------

At 31 March

2019 1,618 - - - 14 - 12,445 14,077

--------------- --------- ---------- ----------- ---------- ------------- --------------- --------- -------------

Consolidated statement of cash flows

for the year ended 31 March 2019

Year ended Year ended

31 March 31 March

2019 2018

Note GBP'000 GBP'000

------------------------------------------ ----- ----------- -----------

Operating activities

Loss before tax from continuing

operations (2,060) (3,212)

Loss before tax from discontinued

operations (233) (16,337)

------------------------------------------ ----- ----------- -----------

Loss before tax (2,293) (19,549)

Non-cash adjustment to reconcile loss before

tax to net cash flows

Depreciation of property,

plant and equipment 179 400

Amortisation of intangible

assets 2 716

Impairment of goodwill - 4,291

Share-based payment transaction

expense 207 109

Unrealised gains on foreign

exchange (25) 62

Realisation of foreign exchange

losses on disposal of Video

Business - 708

Disposal of fixed assets 28 (5)

Loss on disposal of Video

Business - 2,085

Recovery of purchase consideration - (1,126)

Finance income (78) (70)

Finance costs 30 1,227

Non-cash consideration - 7,635

Non-cash settlement of borrowings

- repayment of loan out of

disposal proceeds - (7,635)

Working capital adjustments:

Increase in trade and other

receivables (1,724) (109)

Increase in inventories (1,536) (108)

Increase in trade and other

payables 545 370

Increase in deferred revenue 156 762

Decrease in provisions (27) (54)

----------------------------------------- ----- ----------- -----------

Cash utilised in operations (4,536) (10,291)

Interest paid - -

Tax received - 762

------------------------------------------ ----- ----------- -----------

Net cash flow from operating

activities (4,536) (9,529)

------------------------------------------ ----- ----------- -----------

Investing activities

Purchase of property, plant &

equipment (579) (196)

Expenditure on intangible assets (7) (2)

Interest received 78 70

Deferred consideration from disposal 182 -

of Video Business

Cash proceeds from disposal of

Video Business - 19,187

Cash balance in Video Business

at disposal - (928)

Recovery of purchase consideration - 1,126

------------------------------------------ ----- ----------- -----------

Net cash flow from investing

activities (326) 19,257

------------------------------------------ ----- ----------- -----------

Financing activities

Share buyback - reduction in

share capital 8 (3,345) -

Proceeds from borrowings - 7,635

Finance costs - (741)

Net cash flow from financing

activities (3,345) 6,894

------------------------------------------ ----- ----------- -----------

Net (decrease) / increase in

cash and cash equivalents (8,207) 16,622

Cash and cash equivalents at

the beginning of the year 17,587 1,002

Effect of foreign exchange rate changes on

cash and cash equivalents (5) (37)

------------------------------------------------- ----------- -----------

Cash and cash equivalents at

end of year 9,375 17,587

------------------------------------------ ----- ----------- -----------

Notes to the financial information

1. Accounting Policies

Basis of preparation

The principal accounting policies of the Group are set out in

the Group's 2018 annual report and financial statements. A number

of new or amended standards became effective from the 1 April

2018:

-- IFRS 9 'Financial Instruments'

-- IFRS 15 'Revenue from Contracts with Customers'

Full disclosure of the transition will be included in the 2019

Financial Statements, but the Company has not identified any

changes to its accounting policies that require retrospective

adjustment.

2. Segmental information

The directors do not split the business into segments in order

to internally analyse the business performance and as a result the

results of the business are only presented below as continuing and

discontinuing. The directors believe that allocating overheads by

department provides a suitable level of business insight. The

overhead department cost centers comprise of sales and marketing,

manufacturing and R&D, property and administration, and Plc

costs, with the split of costs as shown on page 7.

Year ended 31 March 2019

Video Business Thruvision

Discontinued Continuing Total

GBP'000 GBP'000 GBP'000

--------------------------------------------------- --------------- ------------ ------------

Revenue - 5,981 5,981

Depreciation and amortisation - 181 181

Segment adjusted operating (loss) (233) (1,901) (2,134)

Share based payment charge - (207) (207)

--------------------------------------------------- --------------- ------------ ------------

Segment operating (loss) (233) (2,108) (2,341)

--------------------------------------------------- --------------- ------------ ------------

Finance income - 78 78

Finance costs - (30) (30)

--------------------------------------------------- --------------- ------------ ------------

Segment (loss) before tax (233) (2,060) (2,293)

--------------------------------------------------- --------------- ------------ ------------

Income tax (charge) / credit - 23 23

--------------------------------------------------- --------------- ------------ ------------

Loss for the year from continuing

operations (233) (2,037) (2,270)

--------------------------------------------------- --------------- ------------ ------------

Year Ended 31 March 2018

Video Business Thruvision

Discontinued Continuing Total

GBP'000 GBP'000 GBP'000

--------------------------------------------------- --------------- ------------ ------------

Total segment revenue 13,129 3,103 16,232

Depreciation and amortisation 218 182 400

Segmented adjusted operating (loss) (7,472) (2,472) (9,944)

--------------------------------------------------- --------------- ------------ ------------

Amortisation of intangibles initially recognised

on acquisition (716) - (716)

Share based payment charge (57) (52) (109)

Acquisition related income 1,126 - 1,126

Loss on disposal and related costs (4,458) - (4,458)

Impairment of goodwill and intangibles (4,291) - (4,291)

--------------------------------------------------- --------------- ------------ ------------

Segment operating (loss) (15,868) (2,524) (18,392)

--------------------------------------------------- --------------- ------------ ------------

Finance income - 70 70

Finance costs (469) (758) (1,227)

--------------------------------------------------- --------------- ------------ ------------

Segment (loss) before tax (16,337) (3,212) (19,549)

--------------------------------------------------- --------------- ------------ ------------

Income tax (charge) / credit (92) 90 (2)

Loss for the year (16,429) (3,122) (19,551)

--------------------------------------------------- --------------- ------------ ------------

Following its disposal on 31 October 2017 the Video Business is

now reported as a discontinued operation. The costs incurred this

year within discontinued operations include amounts due under

warranty provisions with regards to the sale of the Video Business,

as well as a reassessment of the recoverable amount due on deferred

consideration due as a result of the sale of the Video

Business.

In accordance with IFRS 8, the Group has derived the information

for its operating segments using the information used by the Chief

Operating Decision Maker and supplemented this with additional

analysis to assist readers of the Annual Report to better

understand the impact of the proposed divestment. The Group has

identified the Board of Directors as the Chief Operating Decision

Maker as it is responsible for the allocation of resources to

operating segments and assessing their performance.

Analysis of revenue by customer

There have been two (2018: three) individually material

customers (comprising over 10% of total revenue) in the year. These

customers individually represented GBP2,310,000 and GBP808,000 of

revenue for the year (2018: GBP779,000, GBP639,000 and

GBP576,000).

Other segment information

The following tables provides disclosure of the Group's

continuing and discontinued revenue analysed by geographical market

based on the location of the customer.

Continuing revenue

2019 2018

GBP'000 GBP'000

------------------------ --------- ---------

UK and Europe 1,338 384

Middle East and Africa 28 902

Americas 975 413

Asia-Pacific 3,640 1,404

------------------------ --------- ---------

5,981 3,103

------------------------ --------- ---------

The Group's non-current assets by geography are detailed

below:

2019 2018

GBP'000 GBP'000

-------------------------- --------- ---------

United Kingdom 737 258

United States of America 30 22

-------------------------- --------- ---------

767 280

-------------------------- --------- ---------

3. Group operating loss

The Group operating loss attributable to continuing operations

is stated after charging/(crediting):

2019 2018

GBP'000 GBP'000

-------------------------------------------------------- --------- ---------

Operating lease rentals - land and buildings 152 106

Research and development costs 429 505

Bad debt expense 12 17

Depreciation of property, plant and equipment 179 189

Amortisation of intangible assets initially recognised

on acquisition 2 -

Exchange differences (163) (92)

-------------------------------------------------------- --------- ---------

Note: as the above table is continuing operations only,

deprecation and intangibles won't reconcile to their respective

notes for the comparative period.

3. Group operating loss (continued)

Auditors' remuneration

The following table shows an analysis of all fees payable to

Grant Thornton UK LLP, the Group's auditors:

2019 2018

GBP'000 GBP'000

-------------------------------------------------------- ----------- ---------

Audit services

Fees payable to the Company's auditor for the audit of

the financial statements 42 50

The audit of the Company's subsidiaries 17 20

-------------------------------------------------------- ----------- ---------

59 70

-------------------------------------------------------- ----------- ---------

Non-audit services

Tax advisory services 61 -

Other non-audit services 9 23

-------------------------------------------------------- ----------- ---------

70 23

-------------------------------------------------------- ----------- ---------

Fees relate to all activities undertaken by Grant Thornton UK

LLP (2018: Grant Thornton UK LLP) in the period, covering

continuing and discontinued operations.

4. Adjusted loss before tax

An adjusted loss before tax measure has been presented as the

Directors believe that this is a better measure of the Group's

underlying performance. Adjusted loss is not defined under IFRS and

has been shown as the Directors consider this to be helpful for a

better understanding of the performance of the Group's underlying

business. It may not be comparable with similarly titled

measurements reported by other companies and is not intended to be

a substitute for, or superior to, IFRS measures of profit. The net

adjustments to loss before tax from continuing operations are

summarised below:

2019 2018

GBP'000 GBP'000

------------------------------ --------- ---------

Share based payment (i) 207 52

Share buyback costs (ii) 119 -

Financing set up costs (iii) - 263

------------------------------ --------- ---------

Total adjustments 326 315

------------------------------ --------- ---------

(i) The performance condition associated with LTIP awards made

in July 2015 and January 2019 are subject to a non-market based

performance measure. Accordingly, should these LTIP awards fail to

vest, the share based payment charge will be added back to the

income statement. Prior to July 2015 LTIP awards were made with a

market based performance measure which in the event that LTIPs fail

to vest the share based payment charge is not added back to the

income statement. To date the majority of historic LTIP awards have

failed to vest. The inclusion provides consistency over time

allowing a better understanding of the financial position of the

Group.

(ii) Share buyback costs incurred represent additional legal and

professional fees incurred as a result of the share buyback carried

out in August 2018.

(iii) During the year end 31 March 2018 the Group obtained a new

facility, incurring legal and set up fees.

5. Loss per share

Unadjusted loss per share

Year ended Year ended

31 March 31 March

2019 2018

GBP'000 GBP'000

---------------------------------------- ------------ ----------------

Loss from continuing operations

attributable to ordinary shareholders (2,037) (3,122)

----------------------------------------- ------------ ----------------

Loss from continuing and discontinued

operations attributable to ordinary

shareholders (2,270) (19,551)

Weighted average number of shares 152,839,321 165,130,024

----------------------------------------- ------------ ----------------

Basic and diluted loss per share

- continuing operations (1.33p) (1.89p)

----------------------------------------- ------------ ----------------

Basic and diluted loss per share

- continuing and discontinued

operations (1.49p) (11.84p)

----------------------------------------- ------------ ----------------

Adjusted loss per share

Year ended Year ended

31 March 31 March

2019 2018

GBP'000 GBP'000

Loss from continuing operations

attributable to ordinary shareholders (2,037) (3,122)

Amortisation of intangibles - -

Share-based payment 207 52

Share buyback costs 119 -

Financing set up fees - 263

Adjusted loss after tax (1,711) (2,807)

----------------------------------------- ------------ ----------------

Weighted average number of shares 152,839,321 165,130,024

----------------------------------------- ------------ ----------------

Basic and diluted loss per share (1.33p) (1.89p)

----------------------------------------- ------------ ----------------

Basic and diluted adjusted loss

per share (1.12p) (1.70p)

----------------------------------------- ------------ ----------------

The inclusion of potential Ordinary Shares arising from LTIPs,

EMI Options and Incentive Shares would be anti-dilutive. Basic and

diluted loss per share has therefore been calculated using the same

weighted number of shares.

6. Trade and other receivables

Gross Provision Net carrying Gross Provision Net carrying

carrying for impairment amounts carrying for impairment amounts

amounts amounts

2019 2019 2019 2018 2018 2018

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------ ---------- ---------------- ------------- ---------- ---------------- -------------

Trade receivables 2,262 - 2,262 620 (17) 603

Prepayments 158 - 158 132 - 132

Accrued income 1 - 1 10 - 10

VAT recoverable 87 - 87 41 - 41

Deferred consideration 123 - 123 405 - 405

Other receivables 59 - 182 38 - 38

2,690 - 2,690 1,246 (17) 1,229

------------------------ ---------- ---------------- ------------- ---------- ---------------- -------------

The Group's credit risk on trade and other receivables is

primarily attributable to one receivable. One customer represents

GBP1,608,000 of the Group's trade receivables at 31 March 2019

(2018: two customers GBP513,000). There is no other significant

concentration of credit risk.

The Group believes that the carrying amounts of the Group's

trade receivables by the type of customer gives a fair presentation

of the credit quality of the assets:

2019 2018

GBP'000 GBP'000

---------------------- --------- ---------

Government customers 200 57

Commercial customers 2,062 546

---------------------- --------- ---------

2,262 603

---------------------- --------- ---------

Trade receivables of GBP181,000 (2018: GBP46,000) were past due

but not impaired; trade receivables of GBPnil (2018: GBP36,000) are

past due and stated after reflecting a partial impairment.

The movement in the provision for doubtful debts is as

follows:

GBP'000

---------------------------------------------- --------

At 31 March 2017 376

---------------------------------------------- --------

Provided in period - continuing operations 17

Provided in period - discontinued operations 648

Released - discontinued operations (1,024)

At 31 March 2018 17

---------------------------------------------- --------

Released (17)

---------------------------------------------- --------

At 31 March 2019 -

---------------------------------------------- --------

Trade receivables, net of an allowance of GBPnil (2018:

GBP17,000) for doubtful debts, are aged as follows:

2019 2018

GBP'000 GBP'000

---------------------------------------------------------- --------- ---------

Within credit terms 2,081 539

Not more than three months past due 32 35

More than three months but not more than six months past

due 147 11

More than six months past due 2 18

---------------------------------------------------------- --------- ---------

2,262 603

---------------------------------------------------------- --------- ---------

7. Trade and other payables

2019 2018

GBP'000 GBP'000

--------------------------------- --------- ---------

Current

Trade payables 1,240 732

Accruals 586 549

Deferred income 262 106

Social security and other taxes 72 64

Other payables 20 4

--------------------------------- --------- ---------

2,180 1,455

--------------------------------- --------- ---------

8. Share capital

Number GBP'000

------------------------------------------------ ------------- --------

Authorised, allotted, called-up and fully paid

Ordinary Shares of 1 pence each

------------------------------------------------ ------------- --------

At 1 April 2017 165,130,024 1,651

------------------------------------------------ ------------- --------

Shares issued in the year - -

------------------------------------------------ ------------- --------

At 31 March 2018 165,130,024 1,651

------------------------------------------------ ------------- --------

Share buyback (19,675,906) (196)

------------------------------------------------ ------------- --------

At 31 March 2019 145,454,118 1,455

------------------------------------------------ ------------- --------

Number GBP'000

---------------------------------------------------------- --------

Authorised, allotted, called-up and fully paid

Deferred Shares of GBP1 each

-------- --------

At 31 March 2018 163,124 163

------------------------------------------------- -------- --------

At 31 March 2019 163,124 163

------------------------------------------------- -------- --------

GBP'000

---------------------- --------

Total share capital

---------------------- --------

At 31 March 2018 1,814

---------------------- --------

At 31 March 2019 1,618

---------------------- --------

The Board announced on 12 March 2018 to return up to GBP8

million to shareholders. GBP3.3m was subsequently returned to

shareholders in August 2018 at 17p per share, with 196,675,906

shares being cancelled.

A resolution is included in the notice of Annual General Meeting

to be held in September 2019 to buy back and subsequently cancel

all Deferred Shares later in 2019.

9. Related party transactions

Remuneration

The remuneration of Directors and other members of key

management, recognised in the income statement, is set out below in

aggregate. Key management are defined as the Board of Thruvision

Group plc and other persons classified as 'persons discharging

managerial responsibility' under the rules of the Financial Conduct

Authority. Currently no employees outside of the Directors are

classified as 'persons discharging managerial responsibility'.

2019 2018

GBP'000 GBP'000

------------------------- --------- ---------

Directors' remuneration 480 889

Pension contributions 3 3

483 892

------------------------- --------- ---------

The highest paid Director received GBP235,000 (2018: GBP284,000)

in the year, with GBPnil in pensions contributions (2018:

GBP1,000). Key management compensation comprises short--term

employee benefits (including national insurance) of GBP545,000

(2018: GBP1,012,000), pension contributions of GBP3,000 (2018:

GBP3,000) and share-based payments of GBP84,000 (2018:

GBP66,000).

The Directors shareholding at the year-end are detailed below

(based on the year end share price of GBP0.2865 per share (2018:

GBP0.1125 per share):

2019 2018

No of shares No of 2019 2018

shares GBP'000 GBP'000

Tom Black 11,349,444 11,349,444 3,251,616 1,276,812

Colin Evans 2,423,900 2,423,900 694,447 272,689

Paul Taylor 272,489 272,489 78,068 30,655

------------- -------------- ----------- ---------- ----------

10. Post balance sheet event

The Group has no post balance sheet events.

11. Publication of non-statutory accounts

The above does not constitute statutory accounts within the

meaning of the Companies Act 2006. It is an extract from the full

accounts for the year ended 31 March 2019 on which the auditor has

expressed an unmodified opinion and does not include any statement

under section 498 of the Companies Act 2006. The accounts will be

posted to shareholders on or before 10 July 2019 and subsequently

filed at Companies House.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR FJMJTMBTTBLL

(END) Dow Jones Newswires

June 24, 2019 02:00 ET (06:00 GMT)

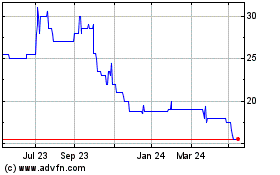

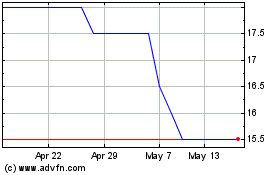

Thruvision (LSE:THRU)

Historical Stock Chart

From May 2024 to Jun 2024

Thruvision (LSE:THRU)

Historical Stock Chart

From Jun 2023 to Jun 2024