TIDMRAI

RNS Number : 9071K

RA International Group PLC

07 September 2021

This announcement contains inside information

RA INTERNATIONAL GROUP PLC

("RA International" or the "Company")

Interim Results for the six months to 30 June 2021

RA International Group plc (AIM: RAI), a specialist provider of

complex and integrated remote site services to Humanitarian,

Governmental and Commercial organisations globally, is pleased to

announce its interim results in respect of the six months ended 30

June 2021.

HIGHLIGHTS

-- Revenue of USD 26.2m (H2 20: USD 29.1m, H1 20: USD 35.4m) and underlying

EBITDA of USD 5.0m (H2 20: USD 6.2m, H1 20: USD 8.1m), in line with expectations

for the first half of 2021.

-- IFM revenue of USD 15.4m (H2 20: USD 15.3m, H1 20: USD 15.9m) highlights

the continued resilience of this service channel as supply chain and construction

activity remained impacted by COVID-19 in the first half of the year.

-- Given the ongoing uncertainty in Cabo Delgado province, Mozambique, we

have excluded the USD 60.5m contract to provide IFM services in this region

and reset the order book to USD 129m as at 30 June 2021.

-- The revised order book of USD 129m as at 30 June 2021 reflects new contracts,

contract uplifts and extensions of USD 29m in the period, highlighting

very encouraging new contract momentum; we expect awards with a higher

aggregate value in the second half of the year.

-- Significant contract awards within the first half of the year include a

USD 21.5m contract with USAID and two UN construction contracts in Central

Africa, with a combined value of USD 5.8m.

-- Subsequent to the end of the Period we commenced a construction contract

with Cherokee Nation Mechanical, LLC for works in East Africa with a value

of USD 4.2m. We have also made significant progress in finalizing the two

contracts announced in March to provide construction related support services

for the U.S. Department of State in the Middle East and in East Asia. Both

contracts are expected to be significant in value.

-- In addition to the above, during the period we agreed commercial terms

with Danakali Limited for the construction of a 1,200 person camp facility

and to provide IFM services.

-- Cash as at 30 June 2021 of USD 10.1m, reflecting a USD 7.5m decrease from

December 2020 year-end, primarily attributable to working capital movements

which are expected to begin to reverse in the second half of the year.

6 months 6 months 6 months

ended ended ended

30 June 31 December 30 June

2021 2020 2020

USD'm USD'm USD'm

Revenue 26.2 29.1 35.4

Gross profit 7.7 8.5 10.3

Gross profit margin 29.2% 29.2% 29.1%

Underlying EBITDA(1) 5.0 6.2 8.1

Underlying EBITDA margin 19.2% 21.2% 22.8%

Profit before tax 0.8 1.6 5.1

Profit before tax margin 3.2% 5.4% 14.3%

Basic EPS (cents) 0.6 0.9 2.9

Net cash (end of period) (2) 3.6 11.2 20.3

Soraya Narfeldt, CEO of RA International, commented:

"Our financial performance for the first half of the year, with

revenue and profitability in line with market expectations, is a

resilient performance given COVID-19 uncertainty has remained

across our markets. We are cautiously optimistic and starting to

see encouraging signs that the business environment is improving;

depending on timing, this could boost our second half performance,

but in any event should bridge to a stronger 2022.

What is less apparent in the numbers we are reporting today is

the progress we are making in building a stronger business year on

year. This becomes clear when you consider the significant projects

we are winning including Danakali, Cherokee Nation, and USAID. We

also have visibility on future contract wins which we see as highly

likely we will secure. By the end of this financial year, based on

current contract pipeline, we could more than offset the reduction

in our order book which we have made in light of the ongoing

situation in Mozambique. To not only replace a contract of this

scale but to deliver growth would be a real barometer of the

success of our strategy, our business development activity across

all our customer segments and our reputation as a trusted partner

for global, blue-chip organisations. We look forward to updating

investors on our progress throughout the second half of the

year."

Notes to summary table of financial results:

(1) Underlying EBITDA is calculated by adding depreciation, non-underlying

items, and share based payment expense to operating profit

(2) Net cash represents cash less overdraft balances, term loans

and notes outstanding.

Enquiries:

RA International Group PLC Via Bamburgh Capital

Soraya Narfeldt, Chief Executive Officer

Lars Narfeldt, Chief Operating Officer

Andrew Bolter, Chief Financial Officer

Canaccord Genuity Limited (Nominated Adviser

and Broker)

Bobbie Hilliam

Alex Aylen +44 (0) 207 523

Georgina McCooke 8000

Bamburgh Capital Limited (Financial PR & Investor +44 (0) 191 249

Relations) 7442

Murdo Montgomery investors@raints.com

Background to the Company

RA International is a leading provider of services to remote

locations. The Company offers its services through three channels:

construction, integrated facilities management and supply chain,

and services three main client groups: humanitarian and aid

agencies, governments and commercial customers, predominantly in

the oil and gas and mining sectors. It has a strong customer base,

largely comprising UN agencies, western governments and global

corporations.

The Company provides comprehensive, flexible, mission critical

support to its clients enabling them to focus on the delivery of

their respective businesses and services. Focusing on integrity and

values alongside making on-going investment in its people,

locations and operations has over time created a reliable and

trusted brand within its sector.

CHIEF EXECUTIVE'S REVIEW

Overview

I am pleased to update the Company's shareholders on our

performance for the six months ended 30 June 2021 (the "Period" or

"First Half"). The main themes for the First Half have been

consistent with the views and outlook we detailed in our full year

results update at the end of March. In March, we highlighted our

confidence in the level and nature of our business development

activity, which is aligned with our customer led growth strategy.

The contracts we have secured in the First Half, including the

landmark contracts with Cherokee Nation Mechanical, LLC

("Cherokee") and the United States Agency for International

Development ("USAID") highlight an increase in business momentum.

We are growing our customer base and winning larger, more valuable

long-term contracts, expanding into new geographies and

demonstrating the value of our relationship-based approach and "one

supplier" model.

We are greatly encouraged by this momentum, which will drive

long-term business growth, however we remain cautious in the

near-term as COVID-19 continues to be a constraint on new business

activity and as a result of the unfolding situation in Mozambique.

Despite these challenges, we have delivered a stable performance

for the First Half, and, as we look ahead, are cautiously

optimistic the impact of COVID-19 is receding, and new business

activity is picking up.

We delivered a resilient performance in the First Half, in-line

with expectations

We highlighted in March the continued impact of the pandemic as

a health crisis and that of government enforced restrictions and

lock-down provisions which remained in place across the world.

Whilst we were encouraged by the level of bid activity we were

seeing and our ability to continue to win high quality contracts,

delays in both awarding and commencing new contracts remained a

material factor. This uncertainty informed our approach of adopting

a cautious view on our financial performance in the near-term,

including for the first half of 2021. The financial performance we

are reporting today, with revenue of USD 26.2m and underlying

EBITDA of USD 5.0m, is in line with expectations and we see these

results as a credible performance as we continue to work in an

operating environment where COVID-19 remains a significant factor.

As we think about the near-term outlook, we are encouraged both by

the continued resilience of our IFM service channel and by the

awards of new construction contracts; an important indicator that

activity levels are starting to return to more normal levels. We

expect to see heightened levels of project starts by existing and

new customers and, depending on timing, this could lead to a

materially stronger performance in the second half of the year but,

in any event, should bridge to a stronger performance in 2022.

We are responding to the evolving situation in Mozambique

Clearly the situation in Mozambique has been a key area of focus

for us since the tragic events unfolded in Cabo Delgado province in

March 2021. It is not appropriate to provide commentary on this

from a people perspective in this report, but it is important we

provide shareholders with an update from a commercial perspective.

Given the continued uncertainty in the region, which has seen Total

suspend activity in the area, we have excluded the USD 60.5m

contract from our order book and have reset the order book at USD

129m as at 30 June 2021. We highlighted in March that we expected

the situation in Mozambique to have a USD 10.0m impact on revenue

in 2021; this remains our expectation. Looking further ahead, in

spite of the ongoing instability in the region, we remain confident

that by virtue of the considerable multinational commercial

investment and the significance to both Mozambique and the

international community, the project will come into fruition and we

remain well positioned to provide the originally planned services

as and when they are required.

We continue to drive long-term value by executing on our

customer-led growth strategy

As we have grown over the years, we have relentlessly and

successfully focused on the diversification of our business in

terms of geography, customer concentration, and service channel.

Our customers rely on us and trust us to deliver in the most

challenging of circumstances and our track record of delivering

large and complex projects, often through our "one-supplier" model,

and supporting our customers and their changing requirements is

central to our ethos of growing with our customers. We believe our

relationship driven approach continues to set us apart and will

drive sustainable growth through further expansion into our very

significant addressable markets.

During the Period we announced contracts which highlight the

strategy in action. In March 2021, we announced our appointment as

teaming partner on two contracts with Cherokee, providing

construction related services for the U.S. Department of State in

the Middle East and East Asia. These significant contracts build on

our initial work with Cherokee in East Africa and highlight how by

partnering with large US corporations of Cherokee's standing, we

can deliver large and complex projects for the US government and

extend our footprint to new geographies. We look forward to further

collaboration with Cherokee on new projects and growing this very

successful partnership.

We highlighted in our March results the high level of business

development activity we are involved in, with new bid activity on

contracts ranging from USD 10m to USD 50m being particularly

notable. We also highlighted our discussions with large US

corporations and governmental institutions as a primary area of

focus for our business development activity. The Cherokee contracts

referenced above demonstrate the effectiveness of this approach as

does our contract with USAID, which we announced in June 2021. This

contract sees us working directly with USAID to provide

comprehensive life support and maintenance services in one of their

compounds in East Africa. The contract is for an initial two-year

base period, with the option for two one-year extensions, with a

contract value in aggregate of USD 21.5m. Our reputation for

delivering integrated services to international standards was

instrumental in securing this contract.

We continue to make good progress on our business development

activity with respect to the commercial sector, another primary

area of focus for us. We announced in June 2021 that we had agreed

commercial terms with Danakali. This will be a major milestone

contract for RA in that it is a globally significant project and

highlights the value of our integrated approach, constructing and

providing ongoing IFM support for a 1,200 person camp for the

Colluli Mining Share Company ("CMSC") development in Eritrea, East

Africa. We were appointed as preferred contractor in 2020 and have

worked closely with Danakali and its partners as they have

developed their plans, with the updated scope of work and contract

terms highlighting the value of this relationship driven approach.

We look forward to providing shareholders with further information

on the key commercial terms when all approvals have been obtained,

which include the CMSC board.

Overall, we have demonstrated our ability to win large contracts

across our humanitarian, governmental and commercial customer base

and the work we have been doing to build relationships with

customers across these categories supports a healthy pipeline with

a number of similar sized opportunities which are in various stages

of adjudication.

Contracts

We were awarded new contracts, uplifts, and extensions to

existing contracts of USD 29m in the First Half and expect awards

with a higher aggregate value in the second half of 2021.

Contract order book:

USD'm

Opening order book 187

New contracts, contract uplifts

and extensions 29

Removal of Mozambique contract (61)

Contracted revenue delivered (26)

----------------

Closing order book as at 30 June

2021 129

At 30 June 2021, 57% of the order book composition was comprised

of high value IFM work. The scale of our order book, combined with

the contracts at advanced stage negotiation and proven resilience

of IFM revenue, provides confidence to continue to make long-term

investment decisions, even in these dynamic times.

Current Trading and Outlook

Our financial performance for the first half of the year, with

revenue and profitability in line with market expectations, is a

resilient performance given COVID-19 uncertainty has remained

across our markets. We are cautiously optimistic and starting to

see encouraging signs that the business environment is improving -

depending on timing, this could boost our second half performance,

but in any event should bridge to a stronger 2022.

What is less apparent in the numbers we are reporting today is

the progress we are making in building a stronger business year on

year. This becomes clear when you consider the significant projects

we are winning - including Danakali, Cherokee Nation, and USAID. We

also have visibility on future contract wins which we see as highly

likely we'll secure. By the end of this financial year, based on

current contract pipeline, we could more than offset the reduction

in our order book which we have made in light of the ongoing

situation in Mozambique. To not only replace a contract of this

scale but to deliver growth would be a real barometer of the

success of our strategy, our business development activity across

all our customer segments and our reputation as a trusted partner

for global, blue-chip organisations. We look forward to updating

investors on our progress throughout the second half of the

year.

Soraya Narfeldt

Chief Executive Officer

07 September 2021

FINANCIAL REVIEW

Overview

Revenue of USD 26.2m and underlying EBITDA of USD 5.0m highlight

our financial performance for the Period, in line with external

expectations. We see this as a resilient performance, with the

stability of our IFM service channel remaining a key feature of our

business. While Construction and Supply Chain revenue continues to

be impacted by COVID-19, we are seeing encouraging signs that the

business environment is improving. The most promising is that we

have commenced works on all newly awarded construction contracts.

Gross margin for the Period was stable at 29.2% (H2 20 29.2%, H1 20

29.1%) with improvements expected once the operating environment

normalises. Cash generation for the Period was lower than

comparative periods reflecting an adverse USD 8.3m movement in

working capital. This primarily resulted from an increase in

inventory balances caused by the suspension of works in Mozambique

in March. These movements are seen as temporary and are expected to

begin to reverse in the next six months as inventory is reallocated

to new and ongoing projects.

6 months 6 months 6 months

ended ended ended

30 June 31 December 30 June

2021 2020 2020

USD'm USD'm USD'm

Revenue 26.2 29.1 35.4

Gross profit 7.7 8.5 10.3

Gross profit margin 29.2% 29.2% 29.1%

Underlying EBITDA 5.0 6.2 8.1

Underlying EBITDA margin 19.2% 21.2% 22.8%

Profit before tax 0.8 1.6 5.1

Profit before tax margin 3.2% 5.4% 14.3%

Basic EPS (cents) 0.6 0.9 2.9

Net cash (end of period) 3.6 11.2 20.3

Revenue

Reported revenue for H1 21 was USD 26.2m (H2 20: USD 29.1m, H1

20: USD 35.4m). The decrease from prior period comparators reflects

lower revenues from our Construction and Supply Chain channels

whilst IFM revenue remained stable. We are encouraged by a recent

uptick in construction contracts being awarded, which although

relatively small in terms of contract value, are an important

indicator of returning to a more normal operating environment,

which if it persists, should lead to significant growth in

Construction revenue in the short term.

The weighting of revenue by customer type remained stable. At

52%, Commercial and Government work represents approximately half

of our revenue (H2 20: 53%, H1 20: 51%). Our strategic goal is to

diversify our customer base and revenue streams over time.

Revenue by service channel:

6 months 6 months 6 months

ended ended ended

30 June 31 December 30 June

2021 2020 2020

USD'm USD'm USD'm

Integrated facilities management 15.4 15.3 15.9

Construction 6.2 8.4 10.7

Supply chain 4.6 5.3 8.8

---------------- ---------------- ----------------

26.2 29.1 35.4

Profit Margin

Gross margin in H1 21 was 29.2% (H2 20: 29.2%, H1 20: 29.1%),

reflecting stable profit margins compared with prior period

comparators. The stability in gross margins reflects an increase in

the percentage of IFM revenue, offset by the addition of certain

new contracts which have lower margin in the initial phase of

deployment but are expected to increase over time, and also lower

occupancy in our hotel facility in Somalia. Gross margin is not

expected to return to pre-COVID levels until such time as more

normal levels of customer activity resume and operational

inefficiencies caused by COVID-19 ease.

Reconciliation of profit to Underlying EBITDA:

6 months 6 months 6 months

ended ended ended

30 June 31 December 30 June

2021 2020 2020

USD'm USD'm USD'm

Profit 1.0 1.5 5.0

Tax expense (0.2) - -

---------------- ---------------- ----------------

Profit before tax 0.8 1.6 5.1

Finance costs 0.6 0.5 0.5

Investment income - (0.1) (0.1)

---------------- ---------------- ----------------

Operating profit 1.4 1.9 5.4

Non-underlying items 1.2 2.2 0.8

---------------- ---------------- ----------------

Underlying operating profit 2.6 4.2 6.2

Share based payments 0.3 0.1 -

Depreciation 2.1 1.9 1.8

---------------- ---------------- ----------------

Underlying EBITDA 5.0 6.2 8.1

Underlying EBITDA margin in H1 21 was 19.2% (H2 20: 21.2%, H1

20: 22.8%) reflecting the variance in revenue and an increase in

administrative expenses. Administrative expenses increased modestly

in the Period to USD 5.0m from USD 4.3m in the prior period,

resulting from investment in our project management and support

functions to underpin anticipated future growth of the business.

Excluding this investment, underling EBITDA margin would have been

comparable to the prior period.

During the Period, the Company incurred non-underlying costs of

USD 1.2m (H2 20: USD 2.2m, H1 20: USD 0.8m). This balance includes

an impairment charge of USD 0.8m relating to assets that were

damaged as a result of the hostile activity in Mozambique. We are

actively working with our insurance providers to identify the value

of a possible recovery and taking all practical steps to safeguard

assets still in the Palma area, including relocating assets from

the region.

Non-underlying items

6 months 6 months 6 months

ended ended ended

30 June 31 December 30 June

2021 2020 2020

USD'm USD'm USD'm

Acquisition costs - 0.2 -

COVID-19 costs 0.4 0.6 0.8

Restructuring costs - 0.3 -

Other share based payments - 1.2 -

Asset impairment 0.8 - -

---------------- ---------------- ----------------

1.2 2.2 0.8

Earnings Per Share

Basic earnings per share was 0.6 cents in the current period (H2

20: 0.9 cents, H1 20: 2.9 cents) and is equal to diluted earnings

per share.

Cashflow

Net cash outflows from operating activities of USD 3.6m in the

Period reflects a marked decrease from the comparators with net

inflows of USD 12.0m and USD 9.1m respectively. The decrease is

primarily attributable to temporary working capital movements which

impacted cash negatively by USD 8.3m. This compares with a USD 7.1m

working capital cash benefit in H2 20. The negative working capital

movements for the Period primarily relate to the addition of USD

4.0m of inventory which was in transit to Mozambique at the time of

the attack and increased accounts receivable and decreased accounts

payable balances. The inventory relating to Mozambique is being

reallocated to new and existing projects which is expected to

result in working capital beginning to reverse in the next six

months.

Capital expenditure ("capex") for the period of USD 3.3m

primarily relates to investment in Mozambique. As previously

highlighted, overall capex for the current financial year is

expected to be markedly lower than prior years (2020: USD 24.5m,

2019: USD 12.4m), with 2020 in particular reflecting significant

investment in our Mozambique project. Given our current portfolio

of projects we anticipate 2021 capex to be approximately USD

5-7m.

Balance Sheet and Liquidity

Cash as at 30 June 2021 of USD 10.1m reflects a USD 7.5m

decrease from year-end. The decrease in cash is attributable to the

working capital movements outlined above, which are expected to

begin to reverse in the next six months.

Net assets at 30 June 2021 were USD 70.2m (H2 20: USD 72.1m, H1

20: USD 71.8m), with fixed assets comprising the majority of the

total balance sheet following significant capital expenditure in

2020.

Breakup of net assets:

As at As at As at

30 June 31 December 30 June

2021 2020 2020

USD'm USD'm USD'm

Cash and cash equivalents 10.1 17.6 20.3

Loan notes (6.5) (6.5) -

---------------- ---------------- ----------------

Net cash 3.6 11.2 20.3

Net working capital 18.8 14.4 18.5

Non-current assets 54.5 51.0 36.3

Tangible owned assets 48.6 47.4 33.7

Right-to-use assets 5.8 3.5 2.4

Goodwill 0.1 0.1 0.1

Lease liabilities and end of service

benefit (6.8) (4.6) (3.2)

---------------- ---------------- ----------------

Net assets 70.2 72.1 71.8

Within non-current assets is USD 16.7m of buildings,

infrastructure, and equipment in Palma, Mozambique. We are

currently working to relocate high value items to ensure their

continued security and upkeep. A full review of the value of these

assets is planned for the second half of 2021.

Dividend

A dividend of 1.35p per share totalling USD 3.2m was declared

and authorised during H1 21 (H2 20: nil, H1 20: USD 2.7m) and was

subsequently paid on 8 July 2021.

The Board's intention continues to be to adopt a progressive

dividend policy and to increase the dividend in future years while

retaining sufficient working capital to meet the needs of the

business and to fund continued growth. The Board believes the

continued growth in our customer base and the pursuit of a

one-supplier model will provide a basis for continued earnings

growth in the future

Shares in Issue and Treasury Shares

In the First Half, 157,493 ordinary shares were transferred out

of treasury in settlement of certain employee share options. As at

30 June 2021, the total number of ordinary shares in issue and

admitted to trading on AIM was 173,575,741, comprising 1,870,058

ordinary shares held in treasury and 171,705,683 ordinary shares

with voting rights.

Andrew Bolter

Chief Financial Officer

07 September 2021

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the six months ended 30 June 2021

6 months 6 months 6 months

ended ended ended

30 June 31 December 30 June

2021 2020 2020

Notes USD'000 USD'000 USD'000

Revenue 26,240 29,076 35,365

Direct costs (18,580) (20,577) (25,070)

---------------- ---------------- ----------------

Gross profit 7,660 8,499 10,295

Administrative expenses (5,042) (4,338) (4,091)

---------------- ---------------- ----------------

Underlying operating profit 2,618 4,161 6,204

Non-underlying items 4 (1,243) (2,249) (797)

---------------- ---------------- ----------------

Operating profit 1,375 1,912 5,407

Investment revenue 22 139 139

Finance costs (560) (491) (479)

---------------- ---------------- ----------------

Profit before tax 837 1,560 5,067

Tax expense 164 (20) (41)

---------------- ---------------- ----------------

Profit and total comprehensive

income for the period 1,001 1,540 5,026

Basic and diluted earnings per

share (cents) 5 0.6 0.9 2.9

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at 30 June 2021

30 June 31 December 30 June

2021 2020 2020

Notes USD'000 USD'000 USD'000

Assets

Non-current assets

Property, plant, and equipment 54,365 50,886 36,114

Goodwill 138 138 138

---------------- ---------------- ----------------

54,503 51,024 36,252

---------------- ---------------- ----------------

Current assets

Inventories 13,267 9,142 8,971

Trade and other receivables 14,201 12,666 19,078

Cash and cash equivalents 10,102 17,632 20,266

---------------- ---------------- ----------------

37,570 39,440 48,315

---------------- ---------------- ----------------

Total assets 92,073 90,464 84,567

Equity and liabilities

Equity

Share capital 24,300 24,300 24,300

Share premium 18,254 18,254 18,254

Merger reserve (17,803) (17,803) (17,803)

Treasury shares (1,257) (1,363) (51)

Share based payment reserve 383 177 62

Retained earnings 46,304 48,509 47,037

---------------- ---------------- ----------------

Total equity 70,181 72,074 71,799

---------------- ---------------- ----------------

Non-current liabilities

Loan notes 6,471 6,471 -

Lease liabilities 5,698 3,720 2,579

Employees' end of service benefits 562 517 477

---------------- ---------------- ----------------

12,731 10,708 3,056

---------------- ---------------- ----------------

Current liabilities

Lease liabilities 502 318 163

Trade and other payables 8,659 7,364 9,549

---------------- ---------------- ----------------

9,161 7,682 9,712

---------------- ---------------- ----------------

Total liabilities 21,892 18,390 12,768

---------------- ---------------- ----------------

Total equity and liabilities 92,073 90,464 84,567

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the six months ended 30 June 2021

Share Based

Share Share Merger Treasury Payment Retained

Capital Premium Reserve Shares Reserve Earnings Total

Notes USD'000 USD'000 USD'000 USD'000 USD'000 USD'000 USD'000

As at 1

January 2020 24,300 18,254 (17,803) - 47 44,685 69,483

Total

comprehensive

income for

the period - - - - - 5,026 5,026

Share based

payments - - - - 15 - 15

Dividends

declared and

authorised 6 - - - - - (2,674) (2,674)

Purchase of

treasury

shares - - - (51) - - (51)

---------------- ---------------- ---------------- ---------------- ---------------- ---------------- ----------------

As at 30 June

2020 24,300 18,254 (17,803) (51) 62 47,037 71,799

Total

comprehensive

income for

the period - - - - - 1,540 1,540

Share based

payments - - - - 115 - 115

Purchase of

treasury

shares - - - (2,549) - - (2,549)

Issuance of

treasury

shares - - - 1,237 - (68) 1,169

---------------- ---------------- ---------------- ---------------- ---------------- ---------------- ----------------

As at 31

December 2020 24,300 18,254 (17,803) (1,363) 177 48,509 72,074

Total

comprehensive

income for

the period - - - - - 1,001 1,001

Share based

payments - - - - 288 - 288

Dividends

declared and

authorised 6 - - - - - (3,206) (3,206)

Issuance of

treasury

shares - - - 106 (82) - 24

---------------- ---------------- ---------------- ---------------- ---------------- ---------------- ----------------

As at 30 June

2021 24,300 18,254 (17,803) (1,257) 383 46,304 70,181

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

For the six months ended 30 June 2021

6 months 6 months 6 months

ended ended ended

30 June 31 December 30 June

2021 2020 2020

Notes USD'000 USD'000 USD'000

Operating activities

Operating profit 1,375 1,912 5,407

Adjustments for non-cash and other items:

Depreciation on property, plant, and equipment 2,127 1,885 1,846

Loss on disposal of property, plant, and equipment 51 83 10

Unrealised differences on translation of foreign

balances 15 (330) 335

Provision for employees' end of service benefits 208 110 99

Share based payments 288 1,284 15

Non-underlying items - asset impairment 4 817 - -

---------------- ---------------- ----------------

4,881 4,944 7,712

Working capital adjustments:

Inventories (4,643) (171) (2,793)

Accounts receivable, deposits, and other

receivables (1,921) 6,798 5,442

Accounts payable and accruals (1,731) 508 (1,124)

---------------- ---------------- ----------------

Cash flows generated from operations (3,414) 12,079 9,237

Tax paid (16) (38) (79)

Employees' end of service benefits paid (163) (70) (13)

---------------- ---------------- ----------------

Net cash flows from operating activities (3,593) 11,971 9,145

---------------- ---------------- ----------------

Investing activities

Investment revenue received 22 139 139

Purchase of property, plant, and equipment (3,287) (15,270) (9,180)

Proceeds from disposal of property, plant, and

equipment 35 20 4

---------------- ---------------- ----------------

Net cash flows used in investing activities (3,230) (15,111) (9,037)

---------------- ---------------- ----------------

Financing activities

Proceeds from borrowings 387 6,084 -

Payment of lease liabilities (543) (194) (370)

Finance costs paid (560) (491) (479)

Dividends paid 6 - (2,674) -

Purchase of treasury shares - (2,549) (51)

Proceeds from share options exercised 24 - -

---------------- ---------------- ----------------

Net cash flows used in financing activities (692) 176 (900)

---------------- ---------------- ----------------

Net decrease in cash and cash equivalents (7,515) (2,964) (792)

Cash and cash equivalents as at start of the period 17,632 20,266 21,393

Effect of foreign exchange on cash and cash

equivalents (15) 330 (335)

---------------- ---------------- ----------------

Cash and cash equivalents as at end of the period 10,102 17,632 20,266

The attached notes 1 to 7 form part of the Condensed

Consolidated Interim Financial Statements.

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL

STATEMENTS

For the six months ended 30 June 2021

1 CORPORATE INFORMATION

The principal activity of RA International Group plc ("RAI" or

the "Company") and its subsidiaries (together the "Group") is

providing services in demanding and remote areas. These services

include construction, integrated facilities management, and supply

chain services. RAI was incorporated on 13 March 2018 as a public

company in England and Wales under registration number 11252957.

The address of its registered office is One Fleet Place, London,

EC4M 7WS.

2 BASIS OF PREPARATION

The financial information set out in these condensed

consolidated interim financial statements does not constitute the

Group's statutory accounts within the meaning of section 434 of the

Companies Act 2006.

The unaudited condensed consolidated interim financial

statements for the six months ended 30 June 2021 have been prepared

in accordance with IAS 34, 'Interim Financial Reporting'. They do

not include all the information required for full annual financial

statements and should be read in conjunction with the consolidated

financial statements of RAI for the year ended 31 December 2020.

The unaudited financial information has been prepared using the

same accounting policies and methods of computation as the Annual

Report for the year ended 31 December 2020. The same accounting

policies and methods of computation will be used to prepare the

Annual Report for the year ended 31 December 2021. The financial

statements of the Group are prepared in accordance with IFRS.

3 SEGMENT INFORMATION

For management purposes, the Group is organised into one segment

based on its products and services, which is the provision of

services in demanding and remote areas. Accordingly, the Group only

has one reportable segment. The Group's Chief Operating Decision

Maker ("CODM") monitors the operating results of the business as a

single unit for the purpose of making decisions about resource

allocation and assessing performance. The CODM is considered to be

the Board of Directors.

Operating segments

Revenue, operating results, assets and liabilities presented in

the financial statements relate to the provision of services in

demanding and remote areas.

Revenue by service channel:

6 months 6 months 6 months

ended ended ended

30 June 31 December 30 June

2021 2020 2020

USD'000 USD'000 USD'000

Integrated facilities management 15,415 15,349 15,916

Construction 6,187 8,420 10,665

Supply chain 4,638 5,307 8,784

---------------- ---------------- ----------------

26,240 29,076 35,365

Revenue by recognition timing:

6 months 6 months 6 months

ended ended ended

30 June 31 December 30 June

2021 2020 2020

USD'000 USD'000 USD'000

Revenue recognised over time 19,318 19,940 20,178

Revenue recognised at a point

in time 6,922 9,136 15,187

---------------- ---------------- ----------------

26,240 29,076 35,365

Geographic segment

The Group primarily operates in Africa and the CODM considers

Africa and Other to be the only geographic segments of the Group.

The below geography split is based on the location of project

implementation.

Revenue by geographic area of project implementation:

6 months 6 months 6 months

ended ended ended

30 June 31 December 30 June

2021 2020 2020

USD'000 USD'000 USD'000

Africa 25,427 28,741 32,420

Other 813 335 2,945

---------------- ---------------- ----------------

26,240 29,076 35,365

Non-current assets by geographic area:

As at As at As at

30 June 31 December 30 June

2021 2020 2020

USD'000 USD'000 USD'000

Africa 51,249 47,687 35,003

Other 3,254 3,337 1,249

---------------- ---------------- ----------------

54,503 51,024 36,252

Revenue split by customer:

6 months 6 months 6 months

ended ended ended

30 June 31 December 30 June

2021 2020 2020

% % %

Customer A 29 24 24

Customer E 18 16 6

Customer F 12 14 7

Customer D 10 12 7

Customer G 10 9 9

Customer I 3 3 2

Customer H 2 5 5

Customer B 1 5 9

Customer C - 1 6

Other 15 11 25

---------------- ---------------- ----------------

100 100 100

4 NON-UNDERLYING ITEMS

6 months 6 months 6 months

ended ended ended

30 June 31 December 30 June

2021 2020 2020

USD'000 USD'000 USD'000

Acquisition costs - 175 -

COVID-19 costs 426 636 797

Restructuring costs - 269 -

Other share based payments - 1,169 -

Asset impairment 817 - -

---------------- ---------------- ----------------

1,243 2,249 797

Asset impairment

These costs relate to the write off of inventory and fixed

assets stolen or damaged beyond repair following the widescale

attack in Palma District, Mozambique in March 2021.

5 EARNINGS PER SHARE

The Group presents basic earnings per share ("EPS") data for its

ordinary shares. Basic EPS is calculated by dividing the profit

attributable to ordinary shareholders of the Group by the weighted

average number of ordinary shares outstanding during the period.

Diluted earnings per share is calculated by dividing the profit

attributable to ordinary shareholders of the Group by the weighted

average number of ordinary shares outstanding during the period

plus the weighted average number of ordinary shares that would be

issued on conversion of all the dilutive potential ordinary shares

into ordinary shares.

6 months 6 months 6 months

ended ended ended

30 June 31 December 30 June

2021 2020 2020

Profit for the period (USD'000) 1,001 1,540 5,026

Basic weighted average number

of ordinary shares 171,576,465 171,347,432 173,566,950

Effect of employee share options 1,560,394 1,407,232 -

---------------- ---------------- ----------------

Diluted weighted average number

of shares 173,136,859 172,754,664 173,566,950

Basic earnings per share (cents) 0.6 0.9 2.9

Diluted earnings per share (cents) 0.6 0.9 2.9

6 DIVIDENDS

During the interim period, a dividend of 1.35 pence (USD 0.02)

per share (171,662,973 shares) totalling GBP 2,317,000 (USD

3,206,000) was declared and authorised (H2 20: nil, H1 20: 1.25

pence (USD 0.02) per share (173,575,741 shares) totalling GBP

2,170,000 (USD 2,674,000)). The dividend declared and authorised

during the interim period was paid to ordinary shareholders on 8

July 2021.

7 APPROVAL OF CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

The condensed consolidated interim financial statements were

approved by the Board of Directors on 6 September 2021.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR UPUGCBUPGGBQ

(END) Dow Jones Newswires

September 07, 2021 02:00 ET (06:00 GMT)

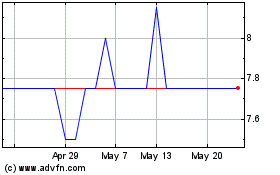

Ra (LSE:RAI)

Historical Stock Chart

From May 2024 to Jun 2024

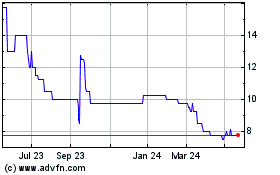

Ra (LSE:RAI)

Historical Stock Chart

From Jun 2023 to Jun 2024