TIDMMCM

RNS Number : 7305H

MC Mining Limited

31 July 2023

ANNOUNCEMENT 31 July 2023

ACTIVITIES REPORT FOR THE QUARTERED 30 JUNE 2023

FOR

MC Mining Limited ( MC Mining or the Company)

and its subsidiary companies

HIGHLIGHTS

Operations

-- Health and safety remains a priority and we continue to make

progress despite two lost-time injuries (LTIs) recorded during the

quarter (FY2023 Q3: one LTI);

-- Run-of-mine (ROM) coal production at the Uitkomst

metallurgical and thermal coal mine (Uitkomst Colliery or Uitkomst)

was 1% lower than the June 2022 quarter at 118,469 tonnes (t)

(FY2022 Q4: 119,005t). Production was impacted by difficult

geological conditions and regular electricity blackouts interrupt

ing operations at the colliery;

o Uitkomst recorded 53,489t of coal sales during the quarter

(FY2022 Q4: 34,126t), comprising 51,036t (FY2022 Q4: 28,360t) of

high-grade domestic coal sales and 2,453t (FY2022 Q4: 5,766t) of

lower grade middlings coal;

o Uitkomst had 50,491t (FY2022 Q4: 15,534t) of high-grade coal

at the colliery and 4,872t (FY2022 Q4: 22,169t) at port at the end

of the quarter;

-- Updated Life of Mine (LOM) plan and Coal Reserve estimate for

the fully-licensed and shovel-ready Makhado steelmaking hard coking

coal (HCC) project (Makhado Project or Makhado), significantly

increasing the LOM and improving the project's economics ;

o Compared to the 30 August 2022 announcement of pre-feasibility

studies, Coal Reserves[1] increased 53%, saleable steelmaking HCC

increased 64% and saleable thermal coal increased by 57%;

o The updated LOM plan resulted in a 25% higher annual mine

production rate with a 21.2% yield of saleable steelmaking HCC and

17.6% yield of 5,500kcal thermal coal (previously 19.8% and 17.2%

respectively), delivering improved project financial returns;

o Commencement of managed tender processes to select the

outsourced mining, plant and laboratory operators, which are

expected to be completed during Q3 CY2023;

o Steady progress during the quarter on critical early works

activities; and

-- Continued ramp-up of mining and processing at the outsourced

Vele Aluwani Colliery (Vele Colliery or Vele) following the

recommissioning of the mine in December 2022; the outsourced agent

produced 48,092t (FY2022 Q4: nil t) of thermal coal during the

quarter .

Corporate

-- Benchmark API4 export thermal coal prices continued to

decline, averaging US $115/t in the quarter compared to US$146/t in

Q3 FY2023 and US$273/t in H1 of FY2022. Steelmaking HCC prices

remained elevated, with the index-price averaging US$250/t for the

quarter.

-- Available cash and facilities of US$8.8 million comprising

cash of US$7.5 million and facilities of US$1.3 million at

quarter-end (net cash balance of US$14.1 million at 31 March 2023)

and restricted cash of US$0.02 million (US$0.02 million at 31 March

2023).

Events post June 2023

-- Extension of the repayment date for the R160 million loan

(US$8.9 million), plus interest thereon, by the Industrial

Development Corporation of South Africa Limited (the IDC), to 30

September 2023. The IDC withdrew the conditional, undrawn R245

million (US$13.6 million) loan facility, which had been available

since July 2019, subject to completion of due diligence and credit

approval. The change of the project scope resulting in Makhado's

peak funding increasing to R1.8 billion, made this facility

redundant.

Godfrey Gomwe, Managing Director & Chief Executive Officer,

commented:

"MC Mining has made significant progress on the Makhado Project

during the quarter. The completion of a five-year Makhado

Implementation Plan was augmented by the substantial increase in

Coal Reserves and mine life at much-improved annual production

rates. This progress bodes well for moving operations down the cost

curve while aiming to take advantage of the favourable near-term

steelmaking HCC coal prices.

The Makhado early works activities continued during the quarter

with funding activities expected to be concluded in H2 CY2023. The

managed tender processes to select the outsourced mining, plant and

laboratory operators also commenced during the quarter. We are

excited to have strong contenders to be our partners and these

processes are expected to be completed during Q3 CY2023.

The Uitkomst colliery continues to be impacted by the increased

incidents of electricity blackouts implemented by Eskom, the state

power utility. Production at the colliery requires extended travel

time to the underground mining areas and a revised shift system to

increase mining time was implemented during June 2023. I am pleased

to report that initial results of the new shift system recorded

favourable improvements in daily ROM coal production. Uitkomst is

assessing potential additional international and domestic customers

to optimise prices for the colliery's premium product.

The ramp-up of operations at the outsourced Vele Colliery

continued during the quarter and the contractor is expected to be

at full production during H2 CY2023. "

DETAILED QUARTERLY OPERATIONS REPORTS

Uitkomst Colliery - Utrecht Coalfields (84% owned)

One LTI was recorded during the quarter (FY2023 Q3: one LTI) and

the mine has enhanced its focus on leading indicators to deliver

improvements in safety with the goal of zero harm.

The Uitkomst Colliery generated 118,469t of ROM coal during the

quarter (FY2022 Q4: 119,005t) with production adversely affected by

challenging geological conditions and lower seam heights. The

implementation of daily electricity blackouts by Eskom also

impacted operations at the colliery. Uitkomst does have back-up

diesel generators but these are only sufficient for underground

mining operations and the switch from Eskom to internally generated

power affects both underground and surface operations. The

continued use of the generators for the underground mining

activities and high cost of diesel is impacting mining costs. A

revised underground operating shift system was implemented at

Uitkomst during June 2023. This is designed to increase mining

time, yielding additional ROM coal production leading to improved

volumes of saleable coal.

Uitkomst sold 51,036t (FY2022 Q4: 28,360t) of high-grade pea and

duff-sized coal during the three months to domestic customers. Due

to the low API4 export prices, no coal was exported (FY2022 Q4: nil

t). The average API4 coal price during the quarter was US$115/t,

64% lower than FY2022 Q4 (US$315/t). Uitkomst sold 2,453t (FY2022

Q4: 5,766t) of high ash, lower value middlings coal under fixed

price arrangements. The colliery had 4,872t (FY2022 Q4: 22,169t) of

high-grade coal at port and 50,491t (FY2022 Q4: 15,534t) on site at

the end of the quarter. The export marketing agreement with

Overlooked Collieries (Pty) Ltd expired at the end of June 2023 and

the Company continues to assess potential domestic and

international customers.

The weaker ZAR:US$ exchange rate and higher coal sales volumes

contributed to a 17% decline in production costs per saleable tonne

(FY2023 Q4: US$90/t vs. FY2022 Q4: US$108/t). The ZAR denominated

production costs continued to experience inflationary pressures as

well as higher energy costs due to the increased diesel consumption

to maintain underground operations during blackout periods.

Processing costs were higher due to increased overtime and

operating inefficiencies caused by the power outages.

Quarter to end-Jun 2023 Quarter to end-Jun 2022 %

Production volumes

Uitkomst ROM (t) 118,469 119,005 (1%)

Inventory volumes

High quality duff and peas at site (t) 50,491 15,534 >100%

High quality duff and peas at port (t) 4,872 22,169 (78%)

55,363 37,703 46%

Sales tonnages

Domestic high-quality duff and peas (t) 51,036 28,360 80%

Middlings sales (t) 2,453 5,766 (58%)

53,489 34,126 57%

Quarter financial metrics

Net revenue/t (US$) 104 80 31%

Net revenue/t (ZAR) 1,946 1,238 57%

Production cost/saleable tonne (US$)^ 90 108 (17%)

----------------------------------------- ------------------------- ------------------------- -------

^ costs are all South African Rand (ZAR) based

Makhado Hard Coking Coal Project - Soutpansberg Coalfield (67%

owned)

The development of the Company's flagship fully licensed and

shovel-ready Makhado Project is expected to position MC Mining as

South Africa's pre-eminent steelmaking HCC producer. Makhado

recorded no LTIs (FY2023 Q3: nil) during the quarter.

Implementation Plan

The Company continued to make steady progress and during April

2023 announced the Makhado Project Implementation Plan. A primary

goal of the Implementation Plan was to improve the accuracy of the

August 2022 pre-feasibility studies from +/-30% accuracy to an

estimated accuracy of +/-10%. In addition, the Implementation Plan

included a detailed execution plan for the construction of the East

Pit, Makhado coal handling and processing plant (CHPP) and related

infrastructure and a detailed mine plan for the first five years of

operations.

Updated LOM Plan and Coal Reserve

Subsequent to the Implementation Plan, MC Mining prepared an

updated LOM plan and Coal Reserve estimate for the Makhado

steelmaking HCC Project. The LOM plan builds on the five-year

Implementation Plan and incorporates the exploitation of all

portions of the East, Central and West Pit coal deposits that are

mineable by surface mining methods. The updated Coal Reserve

estimate was derived from the updated LOM plan using updated costs,

macroeconomic and coal price assumptions.

The updated LOM plan extended the Makhado LOM from 22 years to

28 years (27% increase), despite the 25% higher annual ROM coal

production rate and improved production metrics, as demonstrated

below:

-- 25% increase in the targeted mining rate from 3.2 to 4.0

million tonnes per annum (Mtpa) of ROM coal;

-- 100% increase in CHPP capacity, from 2.0 to 4.0 Mtpa;

-- 30% increase in planned annual sales of 64 Mid Volatile (Vol) steelmaking HCC to 0.81 Mtpa;

-- 15% increase in planned annual sales of 5,500 kcal thermal coal to 0.62 Mtpa;

-- 60% increase of total saleable coal products from 26 to 41 million tonnes over the mine life;

-- time to first production increasing from 12 to 18 months due

to the construction of the new CHPP whilst keeping the payback

period materially unchanged at 3.5 years from the start of

construction; and

-- 11% increase in the estimated project peak funding

requirements to US$100 million (ZAR1.8 billion).

Engineering and operational tenders

Erudite (Pty) Ltd (Erudite) completed the detailed designs for

the Makhado mine infrastructure and CHPP during the quarter.

Erudite also commenced obtaining detailed execution quotes for the

construction of the CHPP. This process is expected to be finished

in Q3 CY2023 and will also cater for the enlarged mining and

processing footprint. The Makhado Project will be

contractor-operated and during the quarter the Company commenced

managed tender processes to select a mining contractor, CHPP

operating contractor and the analytical laboratory operator. These

processes are expected to be completed in Q3 CY2023. First coal

production is expected 18 months from commencement of construction,

which is expected during H2 CY2023.

Early works

The Company continued to progress the critical Makhado early

works during the quarter, including:

-- commencement with detailed design, procurement and

construction of the power supply overhead transmission line, with

construction team mobilised onsite - a critical path activity;

-- refurbishment of onsite accommodation to house project construction crews;

-- placement of orders for key long-lead time items, including

the payment of a deposit of ZAR19.0 million (US$1.0 million);

-- mobilisation of contractors for the construction of the main

access road, main bridge and civil works for bulk water

reticulation; and

-- progress with erection of fencing to secure the project site.

Makhado Project Funding

The Company continued the Makhado Project composite funding

initiatives during the quarter and anticipates that the funding

will be concluded in H2 CY2023. The various initiatives underway

include amongst others, build, own, operate, transfer (BOOT)

funding arrangements, additional senior debt as well as debt/equity

instruments and coal prepayments. During the quarter, the Company

signed a Memorandum of Agreement (MOA) with Enprotec (Pty) Ltd

(Enprotec) to design and procure the flotation and filtration

plant, a key part of the CHPP required to extract the steelmaking

HCC. The flotation and filtration plant is expected to cost ZAR155

million (US$8.6 million) and in terms of the MOA, a significant

portion of this plant will be constructed on a BOOT basis.

Vele Aluwani Semi-Soft Coking and Thermal Coal Colliery -

Limpopo (Tuli) Coalfield (100% owned)

Vele recorded one LTI (FY2023 Q3: nil) during the quarter and a

safety awareness campaign was launched at the colliery during the

period.

The mining and processing operations at the opencast Vele

Colliery were outsourced to Hlalethembeni Outsourcing Services

(Pty) Ltd (HOS) and recommissioned in late December 2022. The

recommissioning of Vele adds a further cash generating unit to MC

Mining's portfolio with limited financial or human capital

contributions and by the end of the period, had created 333

permanent jobs. HOS is responsible for all mining and processing

costs and the Company remains responsible for the colliery's

regulatory compliance, rehabilitation guarantees, relationships

with authorities and communities as well as the supply of

electricity and water. The construction of the overhead electricity

line was completed in April 2023 and connected to the national

power grid in May 2023. As a result, the generator at the Vele CHPP

will be used as a back-up source of power, with Eskom being the

primary source of electricity at the colliery. This satisfies the

Company's commitment with regards to electricity

infrastructure.

HOS completed the de-watering of the Vele Colliery open cast pit

during the period and produced 48,092t (FY2022 Q4: nil t) of

thermal coal during the quarter. Ramp-up to full production is

expected to occur in H2 CY2023 with HOS targeting monthly

production of 60,000t of saleable thermal coal from Vele.

Greater Soutpansberg Project (GSP) - Soutpansberg Coalfield (74%

owned)

The Greater Soutpansberg Projects recorded no LTIs (FY2023 Q3:

nil) during the quarter and no reportable activities occurred

during the period.

Appendix 5B - Quarterly Cash Flow Report

The Company's cash balance as at 30 June 2023 was US$7.5 million

with available facilities of US$1.3 million. The aggregate amount

of payments to related parties and their associates, as disclosed

as item 6.1 of the June 2023 quarter Appendix 5B was US$107k,

comprising executive and non-executive director remuneration.

Godfrey Gomwe

Managing Director and Chief Executive Officer

This announcement has been approved by the Company's Disclosure

Committee.

All figures are in South African rand or United States dollars

unless otherwise stated.

For more information

contact:

Endeavour Corporate

Tony Bevan Company Secretary Services +61 8 9316 9100

Company advisors:

James Harris / James

Dance Nominated Adviser Strand Hanson Limited +44 20 7409 3494

Rory Scott Broker (AIM) Tennyson Securities +44 20 7186 9031

R&A Strategic

Marion Brower Financial PR (South Africa) Communications +27 11 880 3924

BSM Sponsors Proprietary Limited is the nominated JSE Sponsor

About MC Mining Limited:

MC Mining is an AIM/ASX/JSE-listed coal exploration, development

and mining company operating in South Africa. MC Mining's key

projects include the Uitkomst Colliery (metallurgical and thermal

coal), Makhado Project (hard coking coal), Vele Colliery (semi-soft

coking and thermal coal), and the Greater Soutpansberg Projects

(coking and thermal coal).

All figures are denominated in United States dollars unless

otherwise stated. Safety metrics are compared to the preceding

quarter while financial and operational metrics are measured

against the comparable period in the previous financial year. A

copy of this report is available on the Company's website,

www.mcmining.co.za .

Forward-looking statements

This Announcement, including information included or

incorporated by reference in this Announcement, may contain

"forward-looking statements" concerning MC Mining that are subject

to risks and uncertainties. Generally, the words "will", "may",

"should", "continue", "believes", "expects", "intends",

"anticipates" or similar expressions identify forward-looking

statements. These forward-looking statements involve risks and

uncertainties that could cause actual results to differ materially

from those expressed in the forward-looking statements. Many of

these risks and uncertainties relate to factors that are beyond MC

Mining's ability to control or estimate precisely, such as future

market conditions, changes in regulatory environment and the

behaviour of other market participants. MC Mining cannot give any

assurance that such forward-looking statements will prove to have

been correct. The reader is cautioned not to place undue reliance

on these forward-looking statements. MC Mining assumes no

obligation and does not undertake any obligation to update or

revise publicly any of the forward-looking statements set out

herein, whether as a result of new information, future events or

otherwise, except to the extent legally required.

Statements of intention

Statements of intention are statements of current intentions

only, which may change as new information becomes available or

circumstances change.

Glossary

Term Definition

BOOT Build, own, operate, transfer

CHPP Coal handling & processing plant

Enprotec Enprotec (Pty) Ltd

Erudite Erudite (Pty) Ltd

GSP Greater Soutpansberg Projects

HCC Hard coking coal

HOS Hlalethembeni Outsource Services (Pty) Ltd

IDC Industrial Development Corporation of South Africa Limited

LOM Life of mine

LTI Lost time injury

Makhado Project/ Makhado Makhado steelmaking hard coking coal project

MC Mining/ the Company MC Mining Limited

MOA Memorandum of Agreement

Mtpa Million tonnes per annum

ROM Run of mine

t tonnes

Uitkomst Colliery/ Uitkomst Uitkomst metallurgical and thermal coal mine

Vele Colliery/Vele Vele Aluwani Colliery

Tenements held by MC Mining and its Controlled Entities

Project Name Tenement Number Location Interest Change during quarter

------------------------------ ------------------------------ ---------------- ---------- ----------------------

Chapudi Project* Albert 686 MS Limpopo 74%

Bergwater 712 MS 74%

Remaining Extent and Portion

2 of Bergwater 697 MS 74%

Blackstone Edge 705 MS 74%

Remaining Extent & Portion 1

of Bluebell 480 MS 74%

Remaining Extent & Portion 1

of Bushy Rise 702 MS 74%

Castle Koppies 652 MS 74%

Chapudi 752 MS 74%

Remaining Extent, Portions 1,

3 & 4 of Coniston 699 MS 74%

Driehoek 631 MS 74%

Remaining Extent of

Dorps-rivier 696 MS 74%

Enfield 512 MS (consolidation

of Remaining Extent of

Enfield 474 MS, Brosdoorn

682 MS & Remaining

Extent of Grootvlei 684 MS) 74%

Remaining Extent and Portion

1 of 74%

Grootboomen 476 MS 74%

Grootvlei 684 MS 74%

Kalkbult 709 MS 74%

Remaining Extent, Remaining

Extent of Portion 2,

Remaining Extent of Portion

3, Portions 1,

4, 5, 6, 7 & 8 of Kliprivier

692 MS 74%

Remaining Extent of

Koodoobult 664 MS 74%

Koschade 657 MS (Was Mapani

Kop 656 MS) 74%

Malapchani 659 MS 74%

Mapani Ridge 660 MS 74%

Melrose 469 MS 74%

Middelfontein 683 MS 74%

Mountain View 706 MS 74%

M'tamba Vlei 654 MS 74%

Remaining Extent & Portion 1

of Pienaar 635 MS 74%

Remaining Extent & Portion 1

of Prince's Hill 704 MS 74%

Qualipan 655 MS 74%

Queensdale 707 MS 74%

Remaining Extent & Portion 1

of Ridge End 662 MS 74%

Remaining Extent & Portion 1

of Rochdale 700 MS 74%

Sandilands 708 MS 74%

Portions 1 & 2 of Sandpan 687

MS 74%

Sandstone Edge 658 MS 74%

Remaining Extent of Portions

2 & 3 of Sterkstroom 689 MS 74%

Sutherland 693 MS 74%

Remaining Extent & Portion 1

of Varkfontein 671 MS 74%

Remaining Extent, Portion 2,

Remaining Extent of Portion

1 of Vastval 477 MS 74%

Vleifontein 691 MS 74%

Ptn 3, 4, 5 & 6 of Waterpoort

695 MS 74%

Wildebeesthoek 661 MS 74%

Woodlands 701 MS 74%

------------------------------ ----------------------------------------------- ---------- ----------------------

Kanowna West & Kalbara M27/41 Coolgardie^ Royalty<>

----------------

M27/47 Royalty<>

----------------

M27/59 Royalty<>

M27/72,27/73 Royalty<>

M27/114 Royalty<>

M27/196 Royalty<>

M27/181 5.99%

M27/414,27/415 Royalty<>

P27/1826-1829 Royalty<>

P27/1830-1842 Royalty<>

P27/1887 Royalty<>

------------------------------ ------------------------------ ---------------- ---------- ----------------------

Abbotshall Royalty ML63/409,410 Norseman^ Royalty

------------------------------ ------------------------------ ---------------- ---------- ----------------------

Kookynie Royalty ML40/061 Leonora^ Royalty

------------------------------

ML40/135,136 Royalty

------------------------------ ------------------------------ ---------------- ---------- ----------------------

Makhado Project Fripp 645 MS Limpopo 67%(#)

Lukin 643 MS 67%(#)

Mutamba 668 MS 67%(#)

Salaita 188 MT 67%(#)

Tanga 849 MS 67%(#)

Daru 889 MS 67%(#)

Windhoek 900 MS 67%(#)

Generaal Project* Beck 568 MS Limpopo 74%

Bekaf 650 MS 74%

Remaining Extent & Portion 1

of Boas 642 MS- 74%

Chase 576 MS 74%

Coen Britz 646 MS 74%

Fanie 578 MS 74%

Portions 1, 2 and Remaining

Extent of Generaal 587 MS 74%

Joffre 584 MS 74%

Juliana 647 MS 74%

Kleinenberg 636 MS 74%

Remaining Extent of Maseri

Pan 520 MS 74%

Remaining Extent and Portion

2 of Mount Stuart 153 MT 100%

Nakab 184 MT 100%

Phantom 640 MS 74%

Riet 182 MT 100%

Rissik 637 MS 100%

Schuitdrift 179 MT 100%

Septimus 156 MT 100%

Solitude 111 MT 74%

Stayt 183 MT 100%

Remaining Extent & Portion 1

of Terblanche 155 MT 100%

Van Deventer 641 MS 74%

Wildgoose 577 MS 74%

------------------------------ ----------------------------------------------- ---------- ----------------------

Mopane Project* Ancaster 501 MS Limpopo 100%

Banff 502 MS 74%

Bierman 599 MS 74%

Cavan 508 MS 100%

Cohen 591 MS 100%

Remaining Extent, Portions 1

& 2 of Delft 499 MS 74%

Dreyer 526 MS 74%

Remaining Extent of Du Toit

563 MS 74%

Faure 562 MS 74%

Remaining Extent and Portion

1 of Goosen 530 MS 74%

Hermanus 533 MS 74%

Jutland 536 MS 100%

Krige 495 MS 74%

Mons 557 MS 100%

Remaining Extent of Otto 560

MS (Now Honeymoon) 74%

Remaining Extent & Portion 1

of Pretorius 531 MS 74%

Schalk 542 MS 74%

Stubbs 558 MS 100%

Ursa Minor 551 MS 74%

Van Heerden 519 MS 74%

Portions 1, 3, 4, 5, 6, 7, 8,

9, Remaining Extent of

Portion 10, Portions 13, 14,

15, 16,

17, 18, 19, 20, 21, 22, 23,

24, 26, 27, 29, 30, 35, 36,

37, 38, 39, 40, 41, 44, 45,

46, 48,

49, 50, 51, 52 & 54 of Vera

815 MS 74%

Remaining Extent of Verdun

535 MS 74%

Voorburg 503 MS 100%

Scheveningen 500 MS 74%

Uitkomst Colliery and Portion 3 (of 2) of

prospects Kweekspruit No. 22 KwaZulu-Natal 84%

Portion 8 (of 1) of

Kweekspruit No. 22 84%

Remainder of Portion 1 of

Uitkomst No. 95 84%

Portion 5 (of 2) of Uitkomst

No. 95 84%

Remainder Portion1 of

Vaalbank No. 103 84%

Portion 4 (of 1) of Vaalbank

No. 103 84%

Portion 5 (of 1) of Vaalbank

No. 103 84%

Remainder of Portion 1 of

Rustverwacht No. 151 84%

Remainder of Portion 2 of

Rustverwacht No. 151 84%

Remainder of Portion 3 (of 1)

of Rustverwacht No. 151 84%

Portion 4 (of 1) Rustverwacht

No.151 84%

Portion 5 (of 1) Rustverwacht

No. 151 84%

Remainder of Portion 6 (of 1)

of Rustverwacht No. 151 84%

Portion 7 (of 1) of

Rustverwacht No. 151 84%

Portion 8 (of 2) of

Rustverwacht No. 151 84%

Remainder of Portion 9 (of 2)

of Rustverwacht No. 151 84%

Portion 11 (of 6) of

Rustverwacht No. 151 84%

Portion 12 (of 9) of

Rustverwacht No. 151 84%

Portion 13 (of 2) of

Rustverwacht No. 151 84%

Portion 14 (of 2) of

Rustverwacht No. 151 84%

Portion 15 (of 3) of

Rustverwacht No. 151 84%

Portion 16 (of 3) of

Rustverwacht No. 151 84%

Portion 17 (of 2) of

Rustverwacht No. 151 84%

Portion 18 (of 3) of Waterval

No. 157 84%

Remainder of Portion 1 of

Klipspruit No. 178 84%

Remainder of Portion 4 of

Klipspruit No. 178 84%

Remainder of Portion 5 of

Klipspruit No. 178 84%

Portion 6 of Klipspruit No.

178 84%

Portion 7 (of 1) of

Klipspruit No. 178 84%

Portion 8 (of 1 )of

Klipspruit No. 178 84%

Portion 9 of Klipspruit No.

178 84%

Remainder of Portion 10 (of

5) of Klipspruit No. 178 84%

Portion 11 (of 5) of

Klipspruit No. 178 84%

Portion 13 (of 4) of

Klipspruit No. 178 84%

Remainder of Portion 14 of

Klipspruit No. 178 84%

Portion 16 (of 14) of

Klipspruit No. 178 84%

Portion 18 of Klipspruit No.

178 84%

Portion 23 of Klipspruit No.

178 84%

Remainder of Portion 1 of

Jackalsdraai No. 299 84%

Remainder of Jericho B No.

400 84%

Portion 1 of Jericho B No.

400 84%

Portion 2 of Jericho B No.

400 84%

Portion 3 of Jericho B No.

400 84%

Remainder of Jericho C No.

413 84%

Portion 1 of Jericho C No.

413 84%

Remainder of Portion 1 of

Jericho A No. 414 84%

Remainder of Portion 2 (of 1)

of Jericho A No. 414 84%

Portion 3 (of 1) of Jericho A

No. 414 84%

Portion 4 (of 1) of Jericho A

No. 414 84%

Portion 5 (of 2) of Jericho A

No. 414 84%

Portion 6 (of 1) of Jericho A

No. 414 84%

Margin No. 420 84%

Portions of Overvlakte 125 MS

Vele Colliery and (Remaining Extent, 3, 4, 5,

prospects 6, 13, 14) Limpopo 100%

Bergen Op Zoom 124 MS 100%

Semple 155 MS 100%

Voorspoed 836 MS 100%

Alyth 837 MS 100%

------------------------------ ----------------------------------------------- ---------- ----------------------

* Form part of the Greater Soutpansberg Projects

Tenement located in the Republic of South Africa

^ Tenement located in Australia

(#) MC Mining's interest will reduce to 67% on completion of the

26% Broad Based Black Economic Empowerment (BBBEE) transaction

<> net smelter royalty of 0.5%

[1] As announced on 30 June 2023. The increased Coal Reserves in

the East Pit have resulted in increased saleable tonnes. This was

confirmed by the most recent drilling programme.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDGIGDRGXXDGXB

(END) Dow Jones Newswires

July 31, 2023 04:33 ET (08:33 GMT)

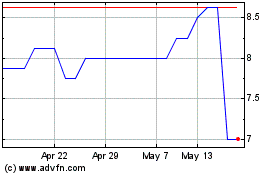

Mc Mining (LSE:MCM)

Historical Stock Chart

From May 2024 to Jun 2024

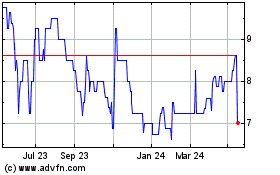

Mc Mining (LSE:MCM)

Historical Stock Chart

From Jun 2023 to Jun 2024