TIDMLFI

London Finance & Investment Group PLC

('Lonfin' or the 'Company')

Unaudited Condensed Interim Financial statements for the six months ended 31

December 2021

and dividend declaration

The Company today announces its unaudited interim results and interim dividend

declaration for the six months ended 31 December 2021 (the 'Interim

Statement').

Chairman's Statement

Introduction

As an investment company our target is to achieve growth in shareholder value

in real terms over the medium to long term while maintaining a progressive

dividend policy. In the short term, our results can be influenced by overall

stock market performance, particularly the valuation of our Strategic

Investments. We continue to believe that a combination of Strategic Investments

and a General Portfolio is the most effective way of achieving our aims.

Strategic Investments are significant investments in smaller UK quoted

companies where we have expectations of above average growth over the medium to

longer term and these are balanced by a General Portfolio which consists of

investments in major U.S., U.K. and European equities. The Company acknowledges

the increased focus on Environmental, Social and Governance (ESG) issues in

recent years and the benefits of socially responsible long-term investment.

At 31 December 2021, we held two Strategic Investments: Western Selection PLC

and Finsbury Food Group Plc. Detailed comments on our Strategic Investments are

given below.

Results

Our net assets per share increased by 4.5% to 63.2p at 31 December 2021 from

60.5p at 30 June 2021. We sold 1,500,000 Finsbury Food shares in the period and

made some changes to the General Portfolio Investments, realising cash of £

2,842,000 and net profits of £1,536,000 compared to the cost of these

investments. The value of our General Portfolio increased by 6.3% compared with

increases of 4.6% and 6.0% in the FTSE 100 index and the FTSEurofirst 300 Index

respectively, over the half year. At the close of business on 31 January 2022,

our net asset value was 61.8p per share.

The Group profit before tax for the half year was £561,000 including

revaluation of General Portfolio investments only (2020 - £848,000). Our total

comprehensive profit after tax and minority interest was £1,024,000 (2020: £

1,689,000) including revaluation of all investments, resulting in earnings per

share of 1.2p (2020: earnings per share 2.1p).

Strategic Investments

Finsbury Food Group Plc ("Finsbury")

Finsbury is one of the largest producers and suppliers of premium cakes, bread

and morning goods in the UK and currently supplies most of the UK's major

supermarket chains. Further information about Finsbury, which is admitted to

trading on AIM, is available on its website: www.finsburyfoods.co.uk

During the period we sold 1,500,000 Finsbury Food shares and at 31 December

2021, Lonfin held 4,500,000 Finsbury shares, representing 3.45% of Finsbury's

issued share capital. The market value of the holding was £4,500,000 at 31

December 2021 (2020 - £4,560,000) and represented approximately 23% (2020 -

26%) of Lonfin's net assets. In January 2022, we sold a further 200,000

Finsbury shares.

On 20 September 2021, Finsbury announced profits on continuing operations after

tax of £13,645,000 for the 52 weeks ended 26 June 2021 (2020: profits on

continuing operations after tax of £107,000).

A dividend of £120,000 was received from Finsbury on 21 December 2021.

Western Selection PLC ("Western")

The Group owns 7,860,515 Western shares, representing 43.8% of Western's issued

share capital.

On 17 February 2022, Western announced profit before tax of £117,000 for the

half year to 31 December 2021 (2020: loss before tax of £261,000) and earnings

per share of 0.64p (2020: loss per share of 1.5p). Western also announced that

it was not recommending the payment of an interim dividend (2020: £Nil).

The market value of the Company's investment in Western at 31 December 2021 was

£2,987,000 representing 15% of the net assets of Lonfin (30 June 2021: £

2,712,000). Our share of the net assets of Western, including the value of

Western's investments at market value, was £5,310,000 (30 June 2021 - £

4,396,000).

I am the Chairman of Western and Edward Beale is a non-executive director.

Western's main Core Holdings are Northbridge Industrial Services Plc and Kinovo

Plc.

An extract from Western's interim results announcement relating to its main

Core Holdings is set out below:

Core Holdings

Northbridge Industrial Service Plc ("Northbridge")

Northbridge hires and sells specialist industrial equipment to a non-cyclical

customer base. With offices or agents in the UK, USA, Dubai, Germany, Belgium,

France, Australia, New Zealand, Singapore, Brazil, Korea and Azerbaijan,

Northbridge has a global customer base. This includes utility companies, the

oil and gas sector, shipping, construction and the public sector. The product

range includes load banks, transformers and oil tools. Further information

about Northbridge, which is admitted to trading on AIM, is available on its

website: www.northbridgegroup.co.uk

Northbridge's latest results, for the half year to 30 June 2021, showed a

profit after tax of £77,000 for the period (2020: loss after tax of £

7,295,000). No interim dividend payment was recommended (2020: £Nil).

During the period we sold 495,500 Northbridge shares and subsequent to the

period end we sold a further 1,427,500 Northbridge shares. At 28 January 2022,

Western owned 1,377,000 Northbridge shares which represented 4.74% of

Northbridge's issued share capital. At 31 December 2021, the market value of

this investment was £4,712,000 (30 June 2021: £3,828,000), representing 38.8%

of Western's net assets.

Kinovo Plc ("Kinovo")

Kinovo is an award-winning provider of gas and electrical installation,

maintenance and general building services to local authority and housing

associations predominantly in London and South East England. It has a strategy

of growing organically and by acquisition. Further information about Kinovo,

which is admitted to trading on AIM, is available on its website:

www.kinovoplc.com.

Kinovo announced its interim results for the six-month period to 30 September

2021 on 7 December 2021 showing a profit after tax of £834,000 (2020: loss

after tax - £361,000). Western received a final dividend of £37,500 on 22

September 2021. No interim dividend has been recommended by Kinovo during the

current financial year.

Western owns 7,500,000 Kinovo shares, which represents 12.1% of Kinovo's issued

share capital. The market value of this investment at 31 December 2021 was £

3,075,000 (30 June 2021: £2,775,000) representing 25.3% of Western's net

assets.

General Portfolio

Lonfin's general portfolio is diverse with material interests in Food and

Beverages, Natural Resources, Chemicals and Tobacco. We believe that the

portfolio of quality companies we hold has the potential to outperform the

market in the medium to long term.

At 31 December 2021, the number of holdings in the General Portfolio was 38

(2020: 33).

The Company repaid the full amount owed under its loan facility and therefore

had unused borrowing facilities of £1,900,000 at 31 December 2021 which can be

drawn on to fund additional investment.

Outlook

We expect to see a rotation out of growth and tech stocks and into value stocks

which should benefit our portfolio positioning. We remain exposed to general

market movements and the overall direction of the market in the short term

remains unclear. We are ungeared and have the opportunity to take advantage of

any weaknesses in the share prices of quality international stocks.

Accordingly, the Board remains cautious at this time and shall continue to

monitor equity and currency markets for potential future volatility that has

the potential to impact further on the value of our investments.

The Board has declared an interim dividend of 0.55p per share (2020: 0.55p).

18 February 2022

D.C. MARSHALL

Chairman

Interim Dividend

The Board recommends an interim gross dividend of 0.55p per share (11.25620 SA

cents) (2020: 0.55p) which will be paid on Thursday 24 March 2022 to those

members registered at the close of business on Friday 11 March 2022 (SA and

UK). Shareholders on the South African register will receive their dividend in

SA Rand converted from sterling at the closing rate of exchange on Monday 14

February 2022, being GBP 1 = SA Rand 20.4658.

JSE Disclosure Requirements

In respect of the normal gross cash dividend, and in terms of the South African

Tax Act, the following dividend tax ruling only applies to those shareholders

who are registered on the South African register on Friday, 11 March 2021. All

other shareholders are exempt.

* The number of shares in issue now and as at the interim dividend

declaration date is 31,207,479;

* The interim gross dividend is 11.25620 SA cents;

* The interim net dividend is 9.00496 SA cents;

* The dividend has been declared from income reserves, which funds are

sourced from the Company's main bank account in London and is regarded as a

foreign dividend by South African shareholders; and

* The Company's UK Income Tax reference number is 948/L32120.

Dividend dates:

Last day to trade (SA) Tuesday 8 March 2022

Shares trade ex-dividend (SA) Wednesday 9 March 2022

Shares trade ex-dividend (UK) Thursday 10 March 2022

Record date (SA and UK) Friday 11 March 2022

Dividend Payment date Thursday 24 March 2022

The JSE Listing Requirements require disclosure of additional information in

relation to any dividend payments.

Shareholders registered on the South African register are advised that the

dividend withholding tax will be withheld from the gross final dividend amount

of 11.25620 SA cents per share at a rate of 20% unless a shareholder qualifies

for an exemption; shareholders registered on the South African register who do

not qualify for an exemption will therefore receive a net dividend of 9.00496

SA cents per share. The dividend withholding tax and the information contained

in this paragraph is only of direct application to shareholders registered on

the South African register, who should direct any questions about the

application of the dividend withholding tax to Computershare Investor Services

(Pty) Limited in South Africa. Tel: +27 11 370 5000.

Share certificates may not be de-materialised or re-materialised between

Wednesday 9 March 2021 and Friday 11 March 2021, both dates inclusive. Shares

may not be transferred between the registers in London and South Africa during

this period either.

Statement of Directors' responsibility

The Directors confirm that, to the best of their knowledge:

* the unaudited interim results for the six months ended 31 December 2021,

have been prepared in accordance with IAS 34, 'Interim financial

reporting', as adopted by the EU; and

* the Interim Statement includes a fair review of the information required by

DTR 4.2.7R and DTR 4.2.8R of the Disclosure and Transparency Rules.

Neither this Interim Statement nor any future interim statements of the Company

will be posted to shareholders. The Interim Statement is available as follows:

* on the Company's website at www.city-group.com/

london-finance-investment-group-plc/; and

* by writing to City Group PLC, the Company Secretary, at 1 Ely Place, London

EC1N 6RY

This announcement contains information that was previously classified as inside

information for the

purposes of the UK Market Abuse Regulation. Upon the publication of this

announcement, this information

is considered to be in the public domain.

The directors of the Company accept responsibility for the contents of this

announcement.

For further information, please contact:

London Finance & Investment Group PLC +44(0) 20 7796 9060

JSE Sponsor to the Company:

Questco Corporate Advisory Proprietary

Limited

Condensed Consolidated Statement of Total Comprehensive Income

Half year Year

Notes ended Ended

31 30 June

December

2021 2020 2021

£000 £000 £000

Operating Income

Dividends receivable 290 119 326

Rental and other income 75 75 154

(Loss)/Profit on sales of General 6 (97) 61 245

Portfolio investments

Management service fees 169 159 304

437 414 1,029

Administrative expenses

Investment operations (223) (203) (392)

Management services (192) (196) (412)

Total administrative expenses (415) (399) (804)

Operating profit 22 15 225

Unrealised changes in the carrying value 543 855

of General Portfolio investments 6 1,651

Other income - - 36

Interest payable (4) (22) (39)

Profit before taxation 561 848 1,873

Tax expense (159) (167) (337)

Profit after taxation 402 681 1,536

Non-controlling interest (23) (12) (26)

Profit attributable to shareholders 379 669 1,510

Other comprehensive income -

Profit on sales of Strategic Investments 38 - -

Unrealised changes in the carrying value 658 1,020 1,911

of Strategic Investments

Corporation tax expense on these items (51) - -

Total other comprehensive income 645 1,020 1,911

Total comprehensive income attributable to 1,024 1,689 3,421

shareholders

Basic, Diluted and Headline earnings per 1.2p 2.1p 4.8p

share

Interim dividend 0.55p 0.55p 0.55p

Final dividend 0.60p

- -

Total in respect of the period 0.55p 0.55p 1.15p

Condensed Consolidated Statement of Changes in Shareholders' Equity

Ordinary Share Unrealised Share of Retained Total Non-Controlling Total

Share Premium Profits and Retained Realised Interests Equity

Capital Account Losses on profits and Profits

Investments losses of &

Subsidiaries Losses

£000 £000 £000 £000 £000 £000 £000 £000

Period ended 31 Dec

2021

Balances at 1 July

2021 1,560 2,320 4,530 4,734 5,749 18,893 129 19,022

Profit for the Period - - (253) 142 490 379 23 402

Other Comprehensive - - 658 (13) - 645 - 645

Income

Transfer of gain on - - (942) 942 - - - -

disposal of

investments at fair

value through other

comprehensive income

to retained earnings

Total comprehensive

income - - (537) 1,071 490 1,024 23 1,047

Dividends paid to - - - - (187) (187) - (187)

shareholders

Balances at 31 Dec

2021 1,560 2,320 3,993 5,805 6,052 19,730 152 19,882

Ordinary Share Unrealised Share of Retained Total Non-Controlling Total

Share Premium Profits and Retained Realised Interests Equity

Capital Account Losses on profits and Profits

Investments losses of &

Subsidiaries Losses

£000 £000 £000 £000 £000 £000 £000 £000

Period ended 31 Dec

2020

Balances at 1 July

2020 1,560 2,320 1,708 4,712 5,498 15,798 103 15,901

Profit for the Period - - 492 10 167 669 12 681

Other Comprehensive - - 1,020 - - 1,020 - 1,020

Income

Total comprehensive

income - - 167 1,689 12 1,701

1,512 10

Dividends paid and - - - - (187) (187) - (187)

total transactions

with shareholders

Balances at 31 Dec

2020 - - - - -

33 33 33

Condensed Consolidated Statement of Financial Position

31 December 30 June

Notes 2021 2020 2021

£000 £000 £000

Non-current assets

Property, plant and equipment 17 26 22

Right of use of leased offices 113 481 145

Investments at fair value through other 7,487 7,311 8,202

comprehensive income

7,617 7,818 8,369

Current assets

Listed investments at fair value through 6 12,849 10,898 12,081

profit or loss

Trade and other receivables 183 128 125

Cash and cash equivalents 517 423 309

13,549 11,449 12,515

Current liabilities

Trade and other payables falling due within (141) (157) (228)

one year

Lease liability (70) (53) (71)

Corporation tax liability (51) - -

(262) (210) (299)

Net Current Assets 13,287 11,239 12,216

Non-current liabilities

Lease liability (73) (491) (107)

Borrowings 5 - (450) (650)

Deferred taxation (949) (668) (806)

Total Assets less Total Liabilities 19,882 17,448 19,022

Capital and Reserves

Called up share capital 1,560 1,560 1,560

Share premium account 2,320 2,320 2,320

Unrealised profits and losses on 3,993 3,220 4,530

investments

Share of retained profits and losses of 5,805 4,722 4,734

subsidiaries

Company's retained realised profits and 6,052 5,511 5,749

losses

Total Capital and Reserves attributable to 19,730 17,333 18,893

owners

Non-controlling equity interest 152 115 129

19,882 17,448 19,022

Net assets per share 63.2 55.5p 60.5p

Number of shares in issue 31,207,479 31,207,479 31,207,479

Condensed Consolidated Statement of Cash Flows

Half year ended Year

ended

31 December 30 June

2021 2020 2021

£000 £000 £000

Cash flows from operating activities

Profit before tax 561 848 1,873

Adjustments for non-cash items-

Finance expense 4 22 39

Depreciation charges 5 5 10

Depreciation on right of use of asset 32 31 62

Lease adjustment - - (36)

Unrealised changes in the fair value of General (543) (855) (1,651)

Portfolio investments

Loss/(Profit) on sales of General Portfolio 97 (61) (245)

investments

(Increase)/Decrease in trade and other (58) 38 41

receivables

(Decrease)/Increase in trade and other payables (74) (67) 10

Taxes paid (16) (20) (51)

Net cash inflow/(outflow) from operating 8 (59) 52

activities

Cash flows from investment activity

Acquisition of current investments (1,753) (856) (1,706)

Proceeds from disposal of current investments 1,431 821 1,469

Proceeds from disposal of strategic investments 1,411 - -

Net cash inflow/(outflow) from investment 1,089 (35) (237)

activity

Cash flows from financing

Interest paid (12) (8) (19)

Interest paid on lease liabilities (4) (14) (28)

Repayment of lease liabilities (36) (26) (52)

Equity dividends paid (187) (187) (326)

Unclaimed dividends - 33 -

Net (repayment)/drawdown of loan facilities (650) 450 650

Net cash (outflow)/inflow from financing (889) 248 225

Increase in cash and cash equivalents 208 154 40

Cash and cash equivalents at the beginning of the 309 269 269

period/year

Cash and cash equivalents at end of the period/ 517 423 309

year

Notes to the condensed financial statements

1.Basis of preparation

The results for the half-year are unaudited. The information contained in this

report does not constitute statutory accounts within the meaning of the

Companies Act 2006. The statutory accounts of the Group for the year ended 30

June 2021 have been reported on by the Company's auditors and have been

delivered to the Registrar of Companies. The report of the auditors was

unqualified.

This report has been prepared in accordance with the accounting policies

contained in the Group's 2021 Annual Report and Accounts and International

Financial Reporting Standards, and complies with IAS 34, 'Interim financial

reporting' as adopted by the EU. The financial information contained in this

report has not been audited or reviewed by the Company's auditors.

The Group has only one operating lease and the right of use of asset and lease

liability have been estimated based on 5% discount factor and the cash flow

predicted over 5-year lease life. The Income statement has also been affected

with additional depreciation and interest charges which replace the rent costs.

2.Earnings per share

Earnings per share are based on the profit on ordinary activities after

taxation and non-controlling interests of £379,000 (2020: £669,000) and on

31,207,479 shares (2020: 31,207,479 shares) being the weighted average of

number of shares in issue during the period. There are options outstanding over

80,000 shares.

Reconciliation of headline earnings

Headline earnings are required to be disclosed by the JSE. Headline earnings

per share are based on the profit attributable to the shareholders after tax

and non-controlling interests of £379,000 (2020: £669,000) and on 31,207,479

shares (2020: 31,207,479 shares) being the weighted average of number of shares

in issue during the period.

3.Going Concern

After making enquiries, the Board is satisfied that the Group will be able to

operate within the level of its facilities for the foreseeable future. For this

reason, the Board considers it appropriate for the Group to adopt the going

concern basis in preparing its financial statements.

4.Principal risks and uncertainties

The principal risks and uncertainties which could impact the Group's long-term

performance and its performance over the remaining six months of the financial

year are disclosed on pages 8-9 of the Group's 2021 Annual Report and Accounts.

The key risks and mitigating activities have not changed from these:

* Stock market volatility, and economic uncertainty;

* Possible volatility of share prices of Strategic Investments and General

Portfolio investments;

* Dividend income;

* Ability to make strategic investments; and

* Liquidity of equity investments in strategic investments

5.Reconciliation of net cash flow to movement in net debt

At start Cash Non-cash At end of

of Period Flow Movement Period

Half year ended £000 £000 £000 £000

31 December 2021

Cash at bank 309 208 - 517

Borrowings (650) 650 - -

Lease liability (178) 40 (5) (143)

Net cash and cash equivalents (519) 898 (5) 374

31 December 2020

Cash at bank 269 154 - 423

Borrowings - (450) - (450)

Lease liability (571) 40 (13) (544)

Net cash and cash equivalents (302) (256) (13) (571)

30 June 2021

Cash at bank 269 40 - 309

Borrowings - (650) - (650)

Lease liability (571) 80 313 (178)

Net cash and cash equivalents (302) (530) 313 (519)

6.Listed investments at fair value through profit and loss ("General

Portfolio")

Half year ended Year ended

31 December 30 June

2021 2020 2021

£000 £000 £000

Cost 6,975 6,038 6,038

Opening unrealised gains 5,106 3,910 3,910

Balance brought forward 12,081 9,948 9,948

Purchases 1,753 856 1,706

Sales proceeds (1,431) (821) (1,469)

Realised gain on disposal 556 277 700

Net unrealised gains transferred to realised gain (653) (216) (455)

on disposal

Unrealised fair value gains in the period 543 855 1,651

Balance carried forward 12,849 10,898 12,081

Composition of General Portfolio

Value

£000 %

Procter & Gamble 4.2

546

Nestle 4.0

519

Diageo 4.0

515

Pernod Ricard 4.0

511

AP Moeller-Maersk 3.9

503

L'Oreal 3.7

473

Givaudan 3.6

467

Compagnie Financiere Richemont 3.6

461

LVMH Moet Hennessey 3.5

449

Heineken Holding 3.5

448

Schindler-Holdings 3.3

428

Unilever 3.1

398

BHP Group 2.9

374

Phillip Morris International 2.8

359

Deutsche Post 2.8

356

Linde 2.6

334

Reckitt Benckiser Group 2.4

311

Antofagasta 2.4

308

Rio Tinto 2.3

302

Exxon Mobil Corp 2.3

299

Royal Dutch Shell B 2.3

292

3M 2.3

290

BAE Systems 2.1

275

British American Tobacco 2.1

268

Becton Dickinson 2.0

261

Chemours 2.0

259

PayPal 2.0

256

FedEx 2.0

254

Caterpillar 2.0

253

Credit Agricole 1.9

250

Holcim 1.9

249

Bank of America 1.9

249

Otis Worldwide Corp 1.9

246

Legal & General 1.8

229

Imperial Brands 1.8

226

BASF 1.7

218

Anheuser Busch Inbev 1.7

213

M&G 1.6

200

12,849 100

END

(END) Dow Jones Newswires

February 18, 2022 09:30 ET (14:30 GMT)

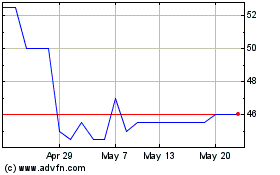

London Finance & Investm... (LSE:LFI)

Historical Stock Chart

From May 2024 to Jun 2024

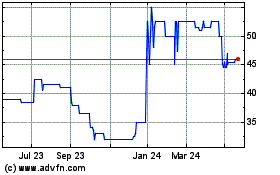

London Finance & Investm... (LSE:LFI)

Historical Stock Chart

From Jun 2023 to Jun 2024