LONDON FINANCE & INVESTMENT GROUP P.L.C.

Preliminary announcement of unaudited results for the year ended 30th June 2007

London Finance is an investment company whose assets primarily consist of three

Strategic Investments and a General Portfolio. Strategic Investments are

significant investments in smaller UK quoted companies and these are balanced

by a General Portfolio, which consists mainly of investments in major U.K. and

European equities.

At 30th June 2007, the three Strategic Investments, in which we have board

representation, were our associated company Western Selection P.L.C.,

Marylebone Warwick Balfour Group Plc and Finsbury Food Group plc. Detailed

comments on our Strategic Investments are given below.

Our objective is to achieve capital growth in real terms over the medium term,

while maintaining a progressive dividend policy.

Results

The Group made a profit before tax for the year of �765,000 (2006 - �309,000).

Our operating profits have increased to �840,000 from �263,000 as a result of

higher profits realised on sales of investments, particularly the disposal of

one third of the Group holding in Marylebone Warwick Balfour, and increased fee

income achieved by City Group, reduced by the costs of establishing an Employee

Benefit Trust. Our profit after tax and minority interest was �489,000 (2006 -

�303,000) giving earnings per share of 1.60p (2006 - 1.06p).

To reflect the improvement in the earnings and our progressive dividend policy,

the Board has decided to increase the dividend for the year to 1.10p per share

(2006 - 1.05p).

Our net assets per share, after provision for deferred taxation, have increased

26% to 66p at 30th June 2007 from 52p last year. Our Strategic Investments have

increased in value by 41% and our General Portfolio by 19% after taking into

account additions and disposals of investments. This compares with the increase

in the FTSE 100 index of 13% and the FTSE Eurotop 300 index of 22% over the

year.

Strategic Investments

Western Selection P.L.C. ("Western")

The Company owns 5,287,221 shares, being 41.23% of the issued share capital of

Western, having purchased 74,721 shares for �47,821 during the year. On 10th

September 2007, Western announced a profit before associates and exceptional

items of �355,000 for its year to 30th June 2007 (2006 - �316,000). Including

associates and after exceptional items and tax, earnings per share were 0.51p

(2006 - 2.79p). The company announced a 4% increase in dividend to 2.55p (2006

- 2.45p). Western's net assets at market value were �12,783,000, equivalent to

100p per share, an 11% increase from 90p last year. The increase in value

reflected in the performance of both its strategic investments and General

Portfolio.

The market value of the Company's investment in Western at 30th June 2007 was �

3,490,000 and the book value was �4,567,000. At market value this represents

17% of the net assets of Lonfin. The underlying value of the Company's

investment in Western, valuing Western's investments at market value, was �5.27

million (2006 - �4.68 million).

On 16th July 2007 Western invited its shareholders to subscribe for warrants.

The funds raised from this subscription and from the exercise of the warrants

will be used to increase the assets under management, improving the ratio of

assets invested to operating expenses.

The offer was structured to raise �872,000 in September 2007, assuming that all

Warrants are issued. If all Warrants are exercised �1,693,000 will be raised in

December 2007 and a further �3,848,000 in the period 2008-2010. The offer was

oversubscribed and closed on 17th August 2007. The Group took up all of its

entitlement under the offer and was allocated 204,496 Warrant Units for its

excess application. The �429,000 cost to the Group of this investment was

financed under a specific new facility with the Group's bankers.

Mr. Marshall is the Chairman of Western and Mr. Robotham is a non-executive

director. Western has strategic investments in Creston plc, Swallowfield plc,

Northbridge Industrial Services plc and Industrial & Commercial Holdings PLC.

An extract from Western's announcement of its strategic investments is set out

below:

Creston plc

Creston is a marketing services group whose strategy is to grow within its

sector both by organic growth and through selective acquisition to become

a substantial, diversified international marketing services group. Creston

made a further three acquisitions during its financial year, ICM in

research, TMW in direct and digital marketing and PAN, in healthcare

advertising and communications, being some of the larger UK groups in

their sectors. The results for the year to 31st March 2007, show a profit

after tax of �4,931,000 (2006 - �2,927,000), equivalent to earnings of

9.43p per share (2006 - 8.04p).

Western maintained its holding of 3,000,000 shares in Creston during the

year which is 5.4% of Creston's issued share capital. The market value of

the Company's holding in Creston on 30th June 2007 was �4,890,000 (2006 -

�4,845,000), being 33% (2006 - 40%) of Western's net assets.

Swallowfield plc

Swallowfield has a long history of developing and producing aerosol,

cosmetic and toiletry products stretching back to 1950. As one of Europe's

premier contract manufacturers of toiletries and cosmetics it offers an

unrivalled breadth of product capabilities. Its skill in design,

developing and producing gift packs and themed product ranges complements

its production capability.

Swallowfield's latest published results were for the 28 weeks to 13th

January 2007 and showed a profit of �255,000 (2006 - loss of 695,000 after

reorganisation costs of �677,000)

Western owns 1,000,000 shares in Swallowfield which is 8.9% of the issued

share capital. The market value of the Company's holding in Swallowfield

on 30th June 2007 was �795,000 (2006 - �455,000), being 5% (2006 - 4%) of

Western's net assets.

Northbridge Industrial Services PLC

Northbridge announced profits of �731,000 for the year ended 31st December

2006 and declared a maiden dividend of 2p per share. Western maintained

its holding of 1,500,000 shares in Northbridge, being 19.7% of the

company. The value of the investment at 30th June 2007 was �2,768,000

(2006 - �1,598,000) being 19% (2006 - 13%) of Western's assets.

Northbridge was formed for the purpose of acquiring companies that hire

and sell specialist industrial equipment such as generators, load banks,

pumps, air compressors, heaters and chillers. Northbridge is seeking to

acquire specialist niche businesses to give it the potential for expansion

into outsourcing providers, capable of supplying a non-cyclical customer

base. Northbridge's first acquisition was Crestchic Limited, one of the

largest electrical load bank equipment manufacturers in the world; selling

and hiring to leading national and international customers.

Industrial & Commercial Holdings PLC

ICH is a small unlisted PLC in which Western holds 29.9%. It owns land

with potential to receive planning permission for housing at Milngavie,

adjacent to Dougalston golf course, just north east of Glasgow. ICH is

currently making representations for inclusion in the local authority's

next five year plan, but it may take some time for the permission to be

received. We are in discussion with the board of ICH to consider an

acquisition of an active business.

Marylebone Warwick Balfour Group Plc ("MWB")

The Company accepted a tender offer for 1 million shares in MWB during the

year, realising a profit of �1.2 million, and at 30th June 2007 holds its

remaining 2 million shares representing 2.48% of MWB's issued share capital.

The market value at 30th June 2007 was �5.5 million, compared with the book

value of �1.7 million, and represents 27% of the net assets of Lonfin.

MWB is in the process of maturing and realising its assets for the benefit of

all stakeholders through an orderly disposal programme, and appointed Bank of

America to find a buyer for its Malmaison and Hotel du Vin property assets on

2nd July 2007. Mr. Marshall is a non-executive director of MWB and the board

constantly reviews the programme of disposal.

Finsbury Food Group plc ("Finsbury")

During the year we exercised the remaining holding of warrants, acquiring a

further 3,000,000 shares in Finsbury at a cost of �900,000 to bring our holding

to 8,000,000 shares, representing 15.66% of their share capital. The market

value of our holding was �9.3 million on 30th June 2007 (cost - �1,893,000) and

represents 45% of the net assets of Lonfin.

Finsbury Food's main subsidiary, Memory Lane Cakes in Cardiff, is a supplier of

boxed ambient cakes to most of the UK's major supermarket chains, which include

Asda, Morrisons, Sainsbury, Somerfield, Tesco and Waitrose. Ambient cakes are

baked cakes that have not been frozen and are generally retailed at room

temperature.

After acquiring three bakeries in Scotland last year Finsbury continued its

expansion programme with the acquisition of the Lightbody Group in Hamilton,

Scotland in February 2007. The results are ahead of expectations and many

synergies are now being pursued within the substantially expanded group. Mr.

Marshall is a non-executive director of Finsbury.

General Portfolio

The General Portfolio has material interests in Oil, Natural Resources,

Pharmaceuticals and Healthcare, Food and Beverages and Banking. These sectors

accounted for 64% of the portfolio by value at 30th June 2007 (69% at 30th June

2006). We believe that the companies in these sectors in which we have invested

have the potential to outperform the market in the medium to long term.

The number of holdings in the General Portfolio has decreased from 43 to 39. We

have invested �694,000 (2006: �238,000) in this portfolio over the year and the

average value of each holding has increased from �114,000 to �168,000.

We have a �2 million bank facility and at 30th June 2007 had drawn down �

1,247,000. This leaves �753,000 available for further investment when the Board

feels appropriate.

Dividend

The recommended dividend is 1.10p per share (2006 - 1.05p). Subject to member's

approval, the dividend will be paid on 12th October 2007 to those members

registered at the close of business on 21st September 2007. Shareholders on the

South African register will receive their dividend in South African Rand

converted from sterling at the closing rate of exchange on 12th September 2007.

Outlook

In spite of the current volatility in the market, we believe that we will again

be able to produce satisfactory results in the current year.

D.C. MARSHALL

Chairman

14th September 2007

Consolidated Income Statement

For the year ended 30th June 2007 2006

�000 �000

Operating Income

Investment operations 1,713 610

Management services 662 587

Administrative expenses

Investment operations - normal (344) (350)

Management services - normal (594) (584)

Exceptional (597) -

---------- ----------

Operating profit 840 263

Share of result of associated undertaking - normal 206 169

Share of result of associated undertaking - exceptional (131) -

Interest payable (150) (123)

---------- ----------

Profit on ordinary activities before taxation 765 309

Tax on result of ordinary activities (245) (4)

---------- ----------

Profit on ordinary activities after taxation 520 305

Equity minority interest (31) (2)

---------- ----------

Profit for the financial year attributable to members of 489 303

the holding company

====== ======

Basic earnings per share 1.60p 1.06p

Headline earnings per share 3.97p 1.06p

Consolidated Statement of Changes in Equity

Ordinary Share Fair

share premium Revaluation value Retained Total

capital account reserve reserve earnings

Year ended 30thJune �000 �000 �000 �000 �000 �000

2006

Balances at 1st July 1,310 1,095 330 1,907 6,992 11,634

2005

Profit attributable to - - - - 303 303

shareholders

Fair value adjustment - - - 3,007 - 3,007

on listed

undertakings, net of

profits realised

during the year and

reflected in the

income statement

---------- ---------- ---------- ---------- ---------- ----------

Total income and - - - 3,007 303 3,310

expense for the year

---------- ---------- ---------- ---------- ---------- ----------

New shares issued 2 10 - - - 12

New shares issued in 188 749 - - - 937

respect of warrants

exercised

Dividends paid in - - - - (262) (262)

respect of the

previous year

---------- ---------- ---------- ---------- ---------- ----------

Total transactions 190 759 - - (262) 687

with shareholders for

the year

---------- ---------- ---------- ---------- ---------- ----------

Balances at 30th June 1,500 1,854 330 4,914 7,033 15,631

2006

---------- ---------- ---------- ---------- ---------- ----------

Year ended 30thJune

2007

Balances at 1st July 1,500 1,854 330 4,914 7,033 15,631

2006

---------- ---------- ---------- ---------- ---------- ----------

Profit attributable to - - - - 489 489

shareholders

Fair value adjustment - - - 4,181 - 4,181

on listed

undertakings, net of

profits realised

during the year and

reflected in the

income statement

---------- ---------- ---------- ---------- ---------- ----------

Total income and - - - 4,181 489 4,670

expense for the period

---------- ---------- ---------- ---------- ---------- ----------

New shares issued 60 474 - - - 534

Dividends paid in - - - - (315) (315)

respect of the

previous year

---------- ---------- ---------- ---------- ---------- ----------

Total transactions 60 474 - - (315) 219

with shareholders for

the year

---------- ---------- ---------- ---------- ---------- ----------

Balances at 30thJune 1,560 2,328 330 9,095 7,207 20,520

2007

---------- ---------- ---------- ---------- ---------- ----------

Consolidated Balance Sheet

at 30th June 2007 2006

�000 �000

Non-current Assets

Tangible assets 416 430

Investments 18,305 13,247

---------- ----------

18,721 13,677

---------- ----------

Current Assets

Listed investments 6,564 4,907

Accounts receivable 184 196

Bank balance and deposits 87 171

---------- ----------

6,835 5,274

Current Liabilities

Accounts payable: falling due within one year (1,777) (1,893)

---------- ----------

Net Current Assets 5,058 3,381

---------- ----------

Total Assets less Current Liabilities 23,779 17,058

Deferred taxation (3,164) (1,363)

---------- ----------

Total Assets less Current Liabilities 20,615 15,695

====== ======

Capital and Reserves

Called up share capital 1,560 1,500

Share premium account 2,328 1,854

Reserves 9,425 5,244

Profit and loss account 7,207 7,033

---------- ----------

Equity shareholders' funds 20,520 15,631

Minority equity interests 95 64

---------- ----------

20,615 15,695

====== ======

Consolidated Cash Flow Statement

For the year ended 30th June 2007 2006

�000 �000

Cash outflow on operating activities

Cash absorbed by operations, including General Portfolio (1,311) (140)

investments

Dividends receivable 380 281

Interest paid (100) (95)

Interest received 12 20

Taxation paid (13) (4)

---------- ----------

Net cash (absorbed)/generated by operations (1,032) 62

Investing activities

Purchase of tangible fixed assets - (12)

Proceeds on sale of non-current asset investments 2,080 -

Non-current asset investments - purchased (948) (664)

---------- ----------

Net cash inflow/(outflow) from investment activities 1,132 (676)

---------- ----------

Financing

Share capital issued 534 949

Equity dividend paid (315) (262)

Net repayment of loan facility (403) 50

---------- ----------

Net cash (outflow)/inflow from financing (184) 737

---------- ----------

(Decrease)/Increase in cash (84) 123

====== ======

Notes

1. The dividend for the year of 1.10p per share (2006 - 1.05p) will be paid

on 5th October 2007 to shareholders on the register on 14th September

2007.

2. Earnings per share are based on the profit on ordinary activities after

taxation and minority interests and on 30,631,233 shares (2006 -

28,672,672) being the weighted average of the number of shares in issue

during the year.

3. The net assets attributable to shareholders, taking investments at market

value, are before providing for any tax that may arise on realisation.

4. The financial information in this preliminary announcement of unaudited

group results, which has been reviewed and agreed by the auditors, does

not constitute statutory accounts within the meaning of section 240(5) of

the Companies Act 1985. The accounts have been prepared in accordance with

the Accounting Standards of the Auditing Practices Board of the United

Kingdom and are consistent with those applied in the previous financial

year. The audited accounts of the group for the year ended 30th June 2006

have been reported on with an unqualified audit report in accordance with

section 235 of the Companies Act 1985 and have been delivered to the

Registrar of Companies.

END

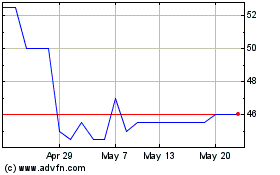

London Finance & Investm... (LSE:LFI)

Historical Stock Chart

From May 2024 to Jun 2024

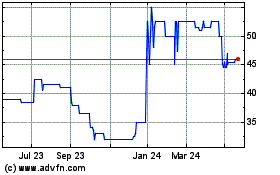

London Finance & Investm... (LSE:LFI)

Historical Stock Chart

From Jun 2023 to Jun 2024