London Finance & Investment Group P.L.C.

Directors Registered office

D.C. Marshall, Chairman 30 City Road,

F.W.A. Lucas, PhD London, EC1Y 2AG

J.H. Maxwell, CA, CCMI, FRSA

J.M. Robotham, OBE, FCA, MSI 27th February 2006

TO THE MEMBERS

The Directors are pleased to present the unaudited interim results of the

Company for the six months ended 31st December 2005

Introduction

As an investment company our target is to achieve growth in shareholder value

in real terms over the long term. In the short term our results are influenced

by overall stock market performance. We continue to believe that a combination

of Strategic Investments and a General Portfolio is the most prudent way of

achieving our aims. Strategic Investments are significant investments in

smaller UK quoted companies where we have expectations of above average growth

over the longer term and these are balanced by a General Portfolio which mainly

consists of investments in major U.K. and European equities.

At 31st December 2005, we held three Strategic Investments in which we have

board representation: our associated company Western Selection P.L.C.,

Marylebone Warwick Balfour Group Plc and Finsbury Food Group plc. Detailed

comments on our Strategic Investments are given below.

Results

The Group made a profit before tax for the half year of �85,000 compared with a

profit of �121,000 last year. Our profit after tax and minority interest was �

101,000 (2004 -�130,000) giving earnings per share of 0.38p (2004 - 0.50p).

The exceptional item of �40,000 included in administration expenses is the cost

of the move in July, after more than thirty years, of the administrative

offices together with the costs related to the termination of the lease on the

previous offices.

Our net assets per share have increased 36% to 50p at 31st December 2005 from

44p at 30th June 2005. Our Strategic Investments have increased in value by 42%

and our General Portfolio has increased by 10%. This compares with the rise in

the FTSE 100 index of 10% over the half year. At the close of business on 15th

February 2006, our net asset value had further increased to 51.96p.

The last time that warrant holders had the right to exercise their warrants was

October 2005 and I am pleased to report that all of the outstanding warrants

were exercised at that time. This resulted in an inflow of �953,000. The Board

decided to exercise the warrants held in Western Selection at a cost of �

518,000 and to increase the investment in Finsbury Food. The cost of these two

purchases was �664,000.

Strategic Investments

Western Selection P.L.C. ("Western")

During the period Western carried out a four for one consolidation of its share

register and the Company's holding is now held in 40p shares, compared with 10p

shares previously. Additionally, on 26th October 2005, the Company exercised

all of the warrants held in Western. As a result the Company now holds

5,212,000 shares, being 44.6% of Western's issued share capital. On 31st

January 2006, Western announced a profit after tax of �126,000 for its half

year to 31st December 2005 and earnings per share of 1.14p (2004 - 1.04p).

Western's net assets at market value were �11,382,000, equivalent to 97.4p per

share, an increase of 12.6% from 86.5p at 30th June 2005.

The market value of the Company's investment in Western at 31st December 2005

was �3.3 million against a book value of �4.6 million. At market value this

represents 22% of the net assets of Lonfin. The underlying value of the

Company's investment in Western, valuing Western's own investments at market

value, was �5.1m (30th June 2005 - �3.9m).

I am the Chairman of Western and Mr. Robotham is a non-executive director.

Western has strategic investments in Creston plc and Swallowfield plc. Extracts

from Western's announcement on its strategic investments are set out below:

Creston plc

Creston is a marketing services group, operating in the U.K., with

significant international clients, whose strategy is to grow within its

sector both by organic growth and acquisition.

Creston's results for the half year to 30th September 2005 show a profit

after tax under IFRS of �765,000 (2004 - �729,000), equivalent to earnings

of 2.14p per share (2004 - 3.17p). Creston's headline earnings per share

have increased 54% to 6.70p from 4.34p.

Western owns 2,873,998 shares in Creston (8.2%) with a market value at 31st

December 2005 of �5,849,000 (30th June 2005 - �4,455,000), being 51% of

Western's net assets.

Swallowfield plc

Swallowfield formulates, manufactures and packages high quality household

goods, toiletries and cosmetics across the whole spectrum of consumer

markets for own label and brand names. Swallowfield announced in December

that as it only expected to break even for the year (before restructuring

costs), it would not be paying an interim dividend, and it would shortly

finalise a comprehensive reorganisation and rationalisation programme across

the entire business.

Swallowfield's latest published results for the year to 30th June 2005

showed a profit after tax, but before exceptional restructuring costs, of �

76,000 (2004 - �816,000). The value of this business is underpinned by net

assets in excess of 85p per share, compared to the current price of 45p.

We own 1,000,000 shares in Swallowfield (8.88% of their issued share

capital). The market value of the Company's holding in Swallowfield on 31st

December 2005 was �455,000 (30th June 2005 - �765,000) representing 4% of

Western's net assets.

Marylebone Warwick Balfour Group Plc ("MWB")

The Company owns 3,000,000 shares in MWB, representing 2.73% of its issued

share capital. The book value at 31st December, 2005 was �2.5 million compared

with a market value of �4.5 million, which represents 30% of the net assets of

Lonfin.

MWB is in the process of a realisation program through the controlled sale of

assets with the objective of returning cash or cash equivalents to shareholders

by end of December 2007. We expect the repayment to be above the current market

price of MWB's shares.

I am a non-executive director of MWB.

Finsbury Food Group plc ("Finsbury Food")

During the period the Company purchased 200,000 shares in Finsbury Food at a

cost of �145,900 and at 31st December 2005, it owned 5,000,000 shares in

Finsbury Food and 3,000,000 warrants, representing 21.85% of their share

capital and 47.03% of their warrants. The market value of our holding was �4.8

million on 31st December 2005 compared to a cost of �1 million; this represents

32% of the net assets of Lonfin.

Finsbury Food is a supplier of boxed ambient cakes to most of the UK's major

supermarket chains and speciality breads to Waitrose. In November 2005 Finsbury

acquired 3 businesses in Scotland supplying supermarkets with specialist cakes

and breads, including gluten-free and low fat products.

I am the deputy chairman of Finsbury Food.

General Portfolio

The General Portfolio is dominated by holdings in oils & natural resources,

pharmaceuticals, foods & beverages and banking. These sectors accounted for 76%

of the portfolio by value at 31st December 2005 and 73% at 30th June 2005.

The year ahead

The share prices of our Strategic Investments in smaller quoted companies will

remain volatile, nevertheless we expect these investments to provide superior

returns over the long term. We are nervous of the imbalance of the World

economy, in particular the delicate balance within the global energy markets.

As is our practice, we only declare one dividend a year which was paid in

October 2005 for the year ended 30th June 2005. It is our intention, subject to

unforeseen circumstances, to maintain that policy.

David C. Marshall

Chairman

Unaudited Consolidated Profit & Loss Account

Half year ended Year ended

31st December 30th June

2005 2004 2005

Restated Restated

�000 �000 �000

Operating Income

Dividends received 99 96 179

Interest and sundry income 15 14 28

Profit on sales of investments 179 180 365

---------- ---------- ----------

293 290 572

Management services income 285 234 501

---------- ---------- ----------

578 524 1,073

---------- ---------- ----------

Administrative expenses

Investment operations (163) (150) (294)

Management services (295) (256) (551)

Exceptional item (40) - -

---------- ---------- ----------

Total administrative expenses (498) (406) (845)

---------- ---------- ----------

Operating profit 80 118 228

Share of result of associated undertaking 68 55 90

Interest payable (63) (52) (116)

---------- ---------- ----------

Profit on ordinary activities before taxation 85 121 202

Tax on result of ordinary activities (1) (1) (12)

---------- ---------- ----------

Profit on ordinary activities after taxation 84 120 190

Minority interest 17 10 22

---------- ---------- ----------

Profit attributable to members of the holding 101 130 212

company

---------- ---------- ----------

Earnings per share 0.38p 0.50p 0.81p

Headline earnings per share 0.38p 0.50p 0.81p

Fully diluted earnings per share 0.38p 0.50p 0.80p

Dividend per share Nil Nil 1.00p

Consolidated Statement of Recognised Gains and Losses

Unrealised gains on investments held as :-

Fixed assets 3,080 1,332 2,131

Current assets 449 104 130

Deferred taxation on unrealised gains (1,036) (68) (176)

---------- ---------- ----------

2,493 1,368 2,085

Profit attributable to members 101 130 212

Share capital issued 953 79 -

Dividend paid in respect of the previous year (262) (233) (233)

---------- ---------- ----------

Total recognised gains and losses for the year 3,285 1,343 2,064

---------- ---------- ----------

Unaudited Consolidated Balance Sheet

31st December 30th June

2005 2004 2005

Restated Restated

�000 �000 �000

Fixed assets

Tangible assets 436 432 431

Investments 12,473 7,962 8,776

---------- ---------- ----------

12,909 8,394 9,207

Current assets

Listed investments 4,687 3,924 4,265

Debtors 239 121 178

Cash, bank balances and deposits 93 79 48

---------- ---------- ----------

5,019 4,124 4,491

Creditors falling due within one year (1,753) (1,540) (1,827)

---------- ---------- ----------

Net Current Assets 3,266 2,584 2,664

Deferred taxation (1,212) (68) (176)

---------- ---------- ----------

14,963 10,910 11,695

====== ====== ======

Capital and Reserves

Called up share capital 1,501 1,311 1,310

Share premium account 1,859 1,096 1,095

Reserves 4,729 1,521 2,237

Profit and loss account 6,831 6,910 6,992

---------- ---------- ----------

Shareholders funds 14,920 10,838 11,634

Minority equity interest 43 72 61

---------- ---------- ----------

14,963 10,910 11,695

====== ====== ======

Consolidated Cash Flow Statement

Half year ended Year ended

31st December 30th June

2005 2004 2005

�000 �000 �000

Cash (outflow)/inflow on operating (57) 5 (244)

activities

---------- ---------- ----------

Returns on investments and servicing of

finance

Dividend received 201 193 277

Interest paid (64) (43) (89)

---------- ---------- ----------

Net cash inflow from returns on investments 137 150 188

and servicing

of finance

---------- ---------- ----------

Taxation paid (1) (1) (15)

---------- ---------- ----------

Investing activities

Tangible assets purchased (11) - (4)

Fixed assets investments purchases (664) (100) (101)

---------- ---------- ----------

Net cash outflow from investment activities (675) (100) (105)

---------- ---------- ----------

Equity dividend paid - Company (262) (233) (233)

---------- ---------- ----------

Financing

Share capital issued 953 78 77

Net (repayment)/drawdown of loan facility (50) 150 350

---------- ---------- ----------

Net cash inflow from financing 903 228 427

---------- ---------- ----------

Increase in cash 45 49 18

====== ====== ======

(a) Reconciliation of operating profit to net cash flow from operating

activities

31st 30th June

December

2005 2005

�000 �000

Operating profit 80 228

Dividends receivable (99) (180)

Depreciation charges 5 10

(Increase)/Decrease in debtors (59) 100

(Decrease)/increase in creditors (28) 55

Decrease in current asset investments 44 (457)

---------- ----------

(57) (244)

---------- ----------

(b) Reconciliation of net cash flow to movement in net debt

At start Cash At end of

of period flow period

�000 �000 �000

Cash at bank 48 45 93

Bank loan (1,600) (50) (1,550)

---------- ---------- ----------

(1,552) (5) (1,457)

---------- ---------- ----------

2004/2005

Cash at bank 30 49 79

Bank loan (1,250) (150) (1,400)

---------- ---------- ----------

(1,220) (101) (1,321)

---------- ---------- ----------

Balance Sheet Analysis taking investments at market value

31st December 30th June

2005 2004 2005

�000 �000 �000

Principal investments at market value:

Marylebone Warwick Balfour Group Plc 4,455 2,580 3,180

Finsbury Food Group plc 4,760 2,847 3,195

Western Selection P.L.C. 3,258 2,535 2,401

---------- ---------- ----------

12,473 7,962 8,776

General equity portfolio - (see analysis 4,687 3,924 4,265

attached)

Tangible fixed assets 436 432 431

Cash, bank balances and deposits 93 79 48

Bank loan (1,550) (1,400) (1,600)

Other net (liabilities)/assets 36 (19) (48)

Deferred taxation (1,212) (68) (176)

(Minority interests (43) (72) (61)

---------- ---------- ----------

Net assets 14,920 10,838 11,635

---------- ---------- ----------

Net Assets per share 49.73p 41.23p 44.38p

Net Assets per share at 15th February 2006 51.96p

Notes:-

1. The results are presented under International Financial Reporting

Standards and comparative amounts have been restated onto the same basis.

There is no effect on the results in the comparative periods, other than

the non-provision for the proposed dividend in the year ended 30 June

2005. The reconciliations to explain the effect of the transition on the

comparative equity amounts is as follows:-

31st 30th June

December

2005 2005

�000 �000

UK GAAP reported equity 9,678 9,496

Fair value adjustments to investments under IAS (208) (208)

39 - for years prior to 1 July 2004

Fair value adjustments to investments under IAS 1,368 2,085

39 (detailed in the statement of recognised

gains and losses)

Dividend proposed not provided for under IAS 10 - 262

- Events after the balance sheet date

---------- ----------

IFRS restated 10,838 11,635

---------- ----------

2. The results for the half-year are unaudited and have been otherwise

prepared on the basis of the accounting policies adopted in the accounts

for the year ended 30th June 2005. The financial information in this

interim report does not constitute statutory accounts within the meaning

of Section 240(5) of the Companies Act 1985. The audited accounts of the

Group for the year ended 30th June 2005 have been reported on by the

Group's auditors and have been delivered to the Registrar of Companies.

The report of the auditors was unqualified and did not contain a statement

under Section 237(2) or 272(3) of the Companies Act 1985.

3. Earnings per share are based on the profit after taxation and minorities,

and on the average number of shares 26,785,377 (December 2004 - 25,960,112

and June 2005 - 26,113,943), in issue during the period.

Market Value of General Portfolio

31st December 2005

�000 %

ING Groep 167 3.5

BOC Group 144 3.1

UBS 144 3.1

Hilton Group 138 3.0

Reckitt Benckiser 134 2.9

Pernod-Ricard 132 2.8

Land Securities Group 131 2.8

Roche Holdings 131 2.8

Nestl� 130 2.8

British American Tobacco 130 2.8

Standard Chartered 130 2.7

Beiersdorf 129 2.7

Diageo 126 2.7

Associated British Foods 126 2.7

BP 124 2.6

Novartis 122 2.6

Imperial Tobacco Group 122 2.6

HSBC Holding 121 2.6

Royal Dutch Shell 120 2.6

Rio Tinto 119 2.5

Anglo American 119 2.5

Cadbury Schweppes 118 2.5

GlaxoSmithKline 117 2.5

Total 117 2.5

Tesco 116 2.5

Schindler-Holdings 115 2.4

Johnson Matthey 113 2.4

Heineken 110 2.3

L'Oreal 108 2.3

Smith & Nephew 107 2.3

BHP Billiton 104 2.2

Rexam 102 2.2

Barclays 98 2.1

Carlsberg 94 2.0

Smiths Group 94 2.0

Vodafone Group 88 1.9

Koninklijke 83 1.8

Schering 78 1.7

Credit Suisse Group 70 1.5

ABN AMRO 68 1.5

Eni 48 1.0

---------- ----------

4,687 100.0

====== ======

END

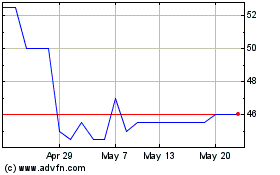

London Finance & Investm... (LSE:LFI)

Historical Stock Chart

From May 2024 to Jun 2024

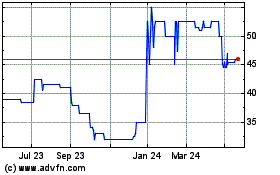

London Finance & Investm... (LSE:LFI)

Historical Stock Chart

From Jun 2023 to Jun 2024